AM/FM Radio Is The #1 Mass Reach Medium – But By How Much?

Why is reach crucial to driving sales impact? Erwin Ephron, the father of modern media planning, said it best: “Most advertising usually works by reminding people about brands they know, when they happen to need that product. Ads work best when the consumer is ready to buy. Reminding the many is better than lecturing the few.”

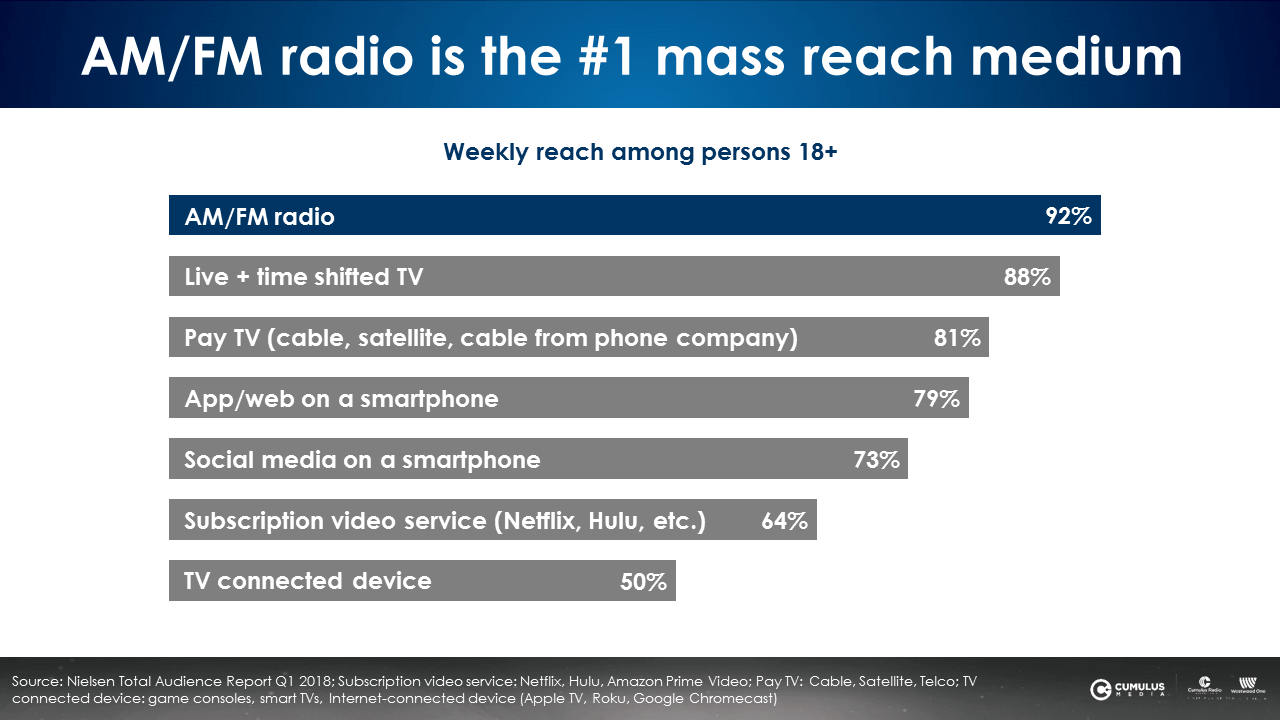

How does AM/FM radio’s reach stack up against other media?

The gold standard of cross media reach measurement is Nielsen’s “Total Audience Report.” It quantifies television, online, mobile, and AM/FM radio audiences so that they can be compared on an even weekly playing field.

Here’s what Nielsen’s latest Q1 2018 Total Audience Report reveals:

Among persons 18+, AM/FM radio is #1 with a massive 92% weekly reach

AM/FM radio reaches nearly all persons 18+ on a weekly basis, as it continues its reign as America’s #1 mass reach medium. Coming in second is TV (live and time shifted) at an 88% weekly reach. Pay TV rounds out the top three with an 81% reach. Nearly one in five Americans are not reached by cable TV ads. Smartphone weekly reach (apps and web) comes in at 79%, and social media is 73%.

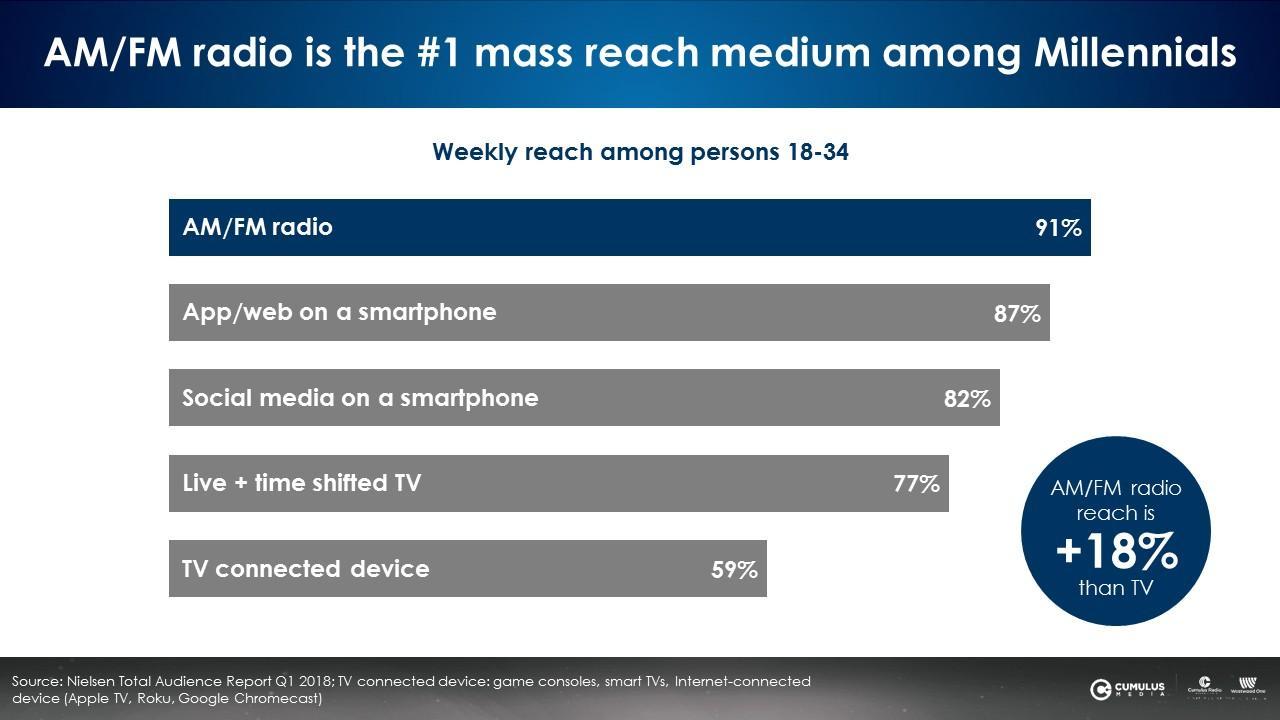

Among Millennials 18-34, AM/FM radio reigns supreme with the highest reach

18-34 Millennials are a coveted demographic. AM/FM radio reaches 91% of Millennials weekly. Smartphone obsessed they may be, but the weekly reach of apps/web on a smartphone taps out at 87% and social media at 82%.

AM/FM radio’s reach is 18% greater than the weekly reach of TV (77%). One in four American 18-34s are not reached weekly by live and time shifted TV.

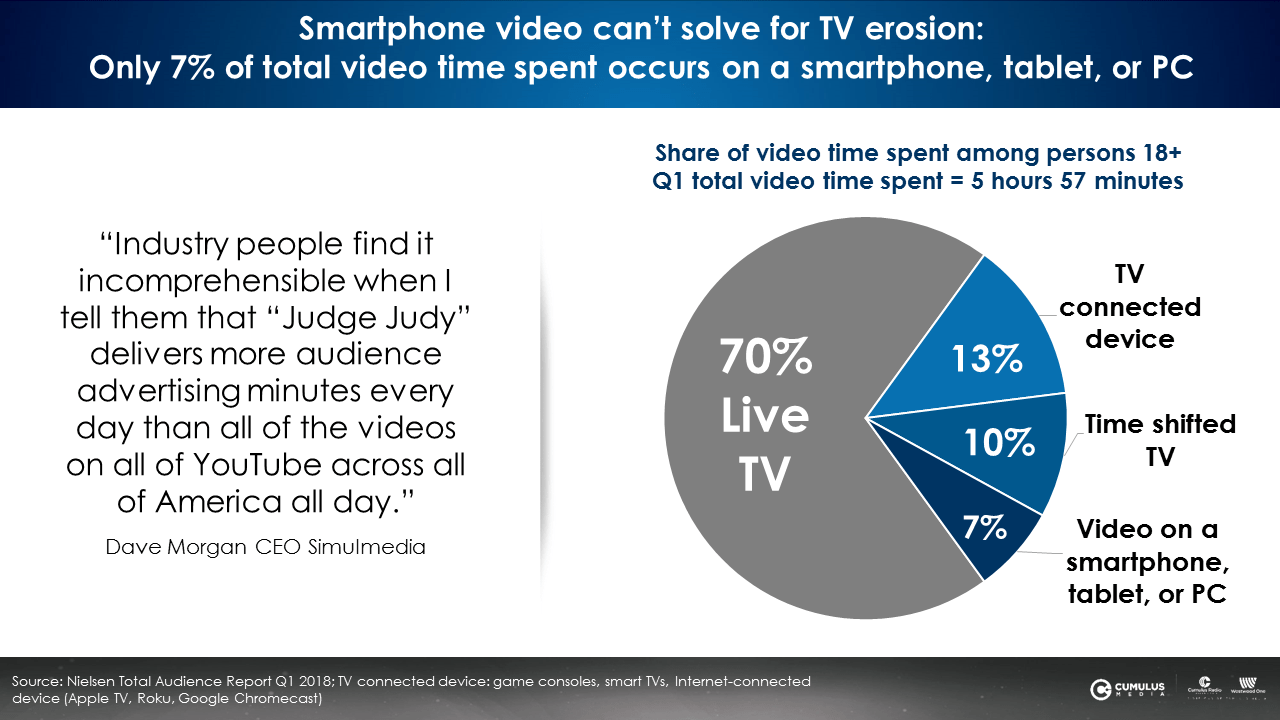

YouTube and smartphone video cannot be the only solution to TV ratings erosion

Earlier this year, MoffettNathanson released an assessment of the television audience that showed its decline was not slowing down any time soon. MoffettNathanson reports August 2018 viewing was down -15% for network cable and off -13% for broadcast compared to August of 2017.

Some assume turning to YouTube could help overcome TV’s audience shortfalls. Dave Morgan, CEO of Advanced TV firm Simulmedia, says, “Industry people find it incomprehensible when I tell them that Judge Judy delivers more audience advertising minutes every day than all of the videos on all of YouTube across all of America all day.”

Smartphone video will not make up for all of TV audience shortfalls either. Smartphone video’s share is only 7% of all video time, less than time shifted TV and TV connected devices.

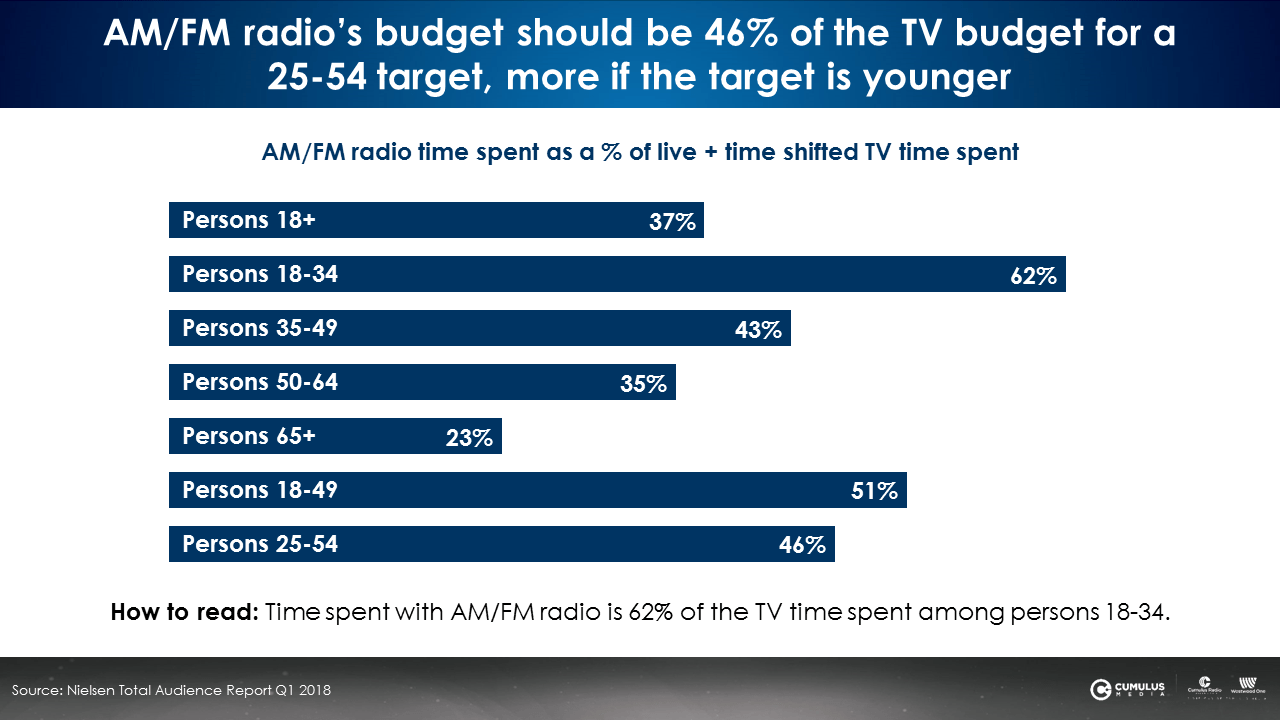

Determining AM/FM radio budgets via time spent analysis

Via Nielsen’s Total Audience Report, AM/FM radio’s time spent can be compared to that of television. Millennial AM/FM radio time spent is 62% of TV. For persons 25-54, AM/FM radio time spent is nearly half of TV time spent.

The younger the consumer, the greater AM/FM radio’s time spent as a share of TV viewing. These time spent comparisons can be utilized as an approach for determining media allocations for AM/FM radio.

If a brand is targeting 18-34s, the AM/FM radio media investment should be 62% of the TV spend. If the target is 25-54, AM/FM radio spend can be pegged at 46% of the TV investment. If the brand target is focused on older 50-64 consumers, the AM/FM radio budget can be 35% of that of television.

AM/FM radio continues to dominate as America’s #1 mass reach medium. Brands looking to grow sales can shift some of the TV budget to AM/FM radio to make up for TV’s time spent erosion.

Key takeaways:

- Among persons 18+, AM/FM radio is #1 with a massive 92% weekly reach

- Among Millennials 18-34, AM/FM radio reigns supreme with the highest reach

- YouTube and smartphone video cannot be the only solution to TV ratings erosion

- AM/FM radio budgets can be determined as a proportion of TV spend using AM/FM radio/TV time spent comparisons

Lauren Vetrano is Director of Content Marketing at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.