The Q4 2017 TV Ratings: Still “Worse Than We Thought”

When MoffettNathanson, Wall Street media research and analysis firm, reported on the poor state of television ratings in November, they titled their report “Worse Than We Thought.” Now that the Q4 2017 analyses have been released, MoffettNathanson’s assessment is television’s audience decline doesn’t seem to be slowing down any time soon.

Here are some highlights on the state of television from the MoffettNathanson report:

Cable networks are down -10% as pay television universe shrinks

With the exception of Disney, viewership numbers for parent cable companies all dropped in Q4 2017: A&E (-5%), Time Warner (-8%), Viacom (-8%), Discovery Communications (-10%), Scripps Networks (-11%), NBCUniversal (-13%), Twenty-First Century Fox (-19%), and AMC Networks (-25%).

The TV landscape remains bleak as MoffettNathanson projects pay television subscriber declines at -3.6%. Fewer people are watching cable and fewer people are buying cable subscriptions.

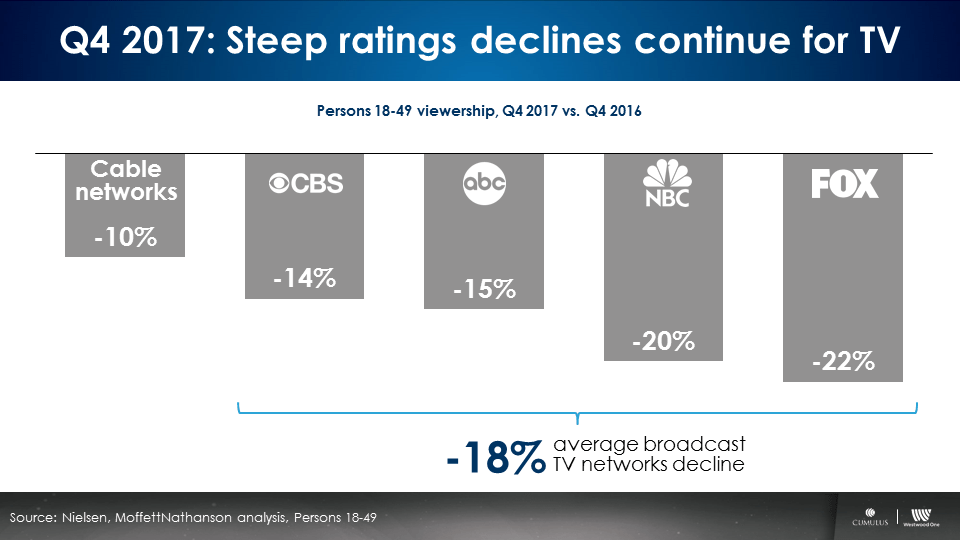

Broadcast television networks are down by -18%

In Q4 2017, all of the major broadcasting networks (ABC, CBS, NBC, and FOX) were down by double digits when compared to Q4 2016 viewership. NBC was down -14%, followed by ABC with -15%, then NBC at -20%, and finally FOX taking a -22% hit. The erosion across these major broadcast networks resulted in an average decline of -18%.

What’s a media planner to do? Turn to AM/FM radio

AM/FM radio is a reliable mass reach machine. It amplifies media plans by replacing lost reach and diminishing impressions caused by TV’s decline. Allocating only 20% of a TV buy to AM/FM radio can grow campaign reach by 40%.

The addition of AM/FM radio into the media plan also boosts advertiser awareness, consideration, purchase, and brand advocacy. Together, TV and AM/FM radio work.

With television’s viewership sinking deeper each quarter, advertisers and media buyers have to be realistic about their budgets and plans. The key for future advertising success is creating an optimal media mix, not simply continuing with TV-only media plans out of habit.

AM/FM radio can save your media plan and make your TV better!

Key takeaways:

- Cable networks are down -10% as pay television universe shrinks

- Broadcast television networks are down by -18%

- Allocating 20% of a TV budget to AM/FM radio increases reach by 40% and boosts advertiser awareness, consideration, purchase, and brand advocacy

Brittany Faison is a Research Analyst at Cumulus | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.