Case Study: Pharmaceutical Brand AM/FM Radio Campaign Generates Growth In Familiarity, Brand Consideration, And Usage; While TV Spend Is 7X AM/FM Radio, Brand Equity Among Heavy TV Viewers Erodes

Click here to view a 15-minute video of the key findings.

Click here to download a PDF of the slides.

A new study from the Harris Poll Brand Tracker reveals an over-the-counter (OTC) brand from a major pharmaceutical marketer experienced strong results from their 2025 AM/FM radio campaign. Among heavy AM/FM radio listeners, the brand experienced significant growth in awareness, brand favorability, consideration, and usage.

Oddly, while the brand spent seven times more on linear TV, brand equity among heavy TV viewers saw erosion over the same period. Among those who were heavily exposed to the TV campaign, the brand suffered major drops in familiarity, consideration, trial, and usage.

Key findings:

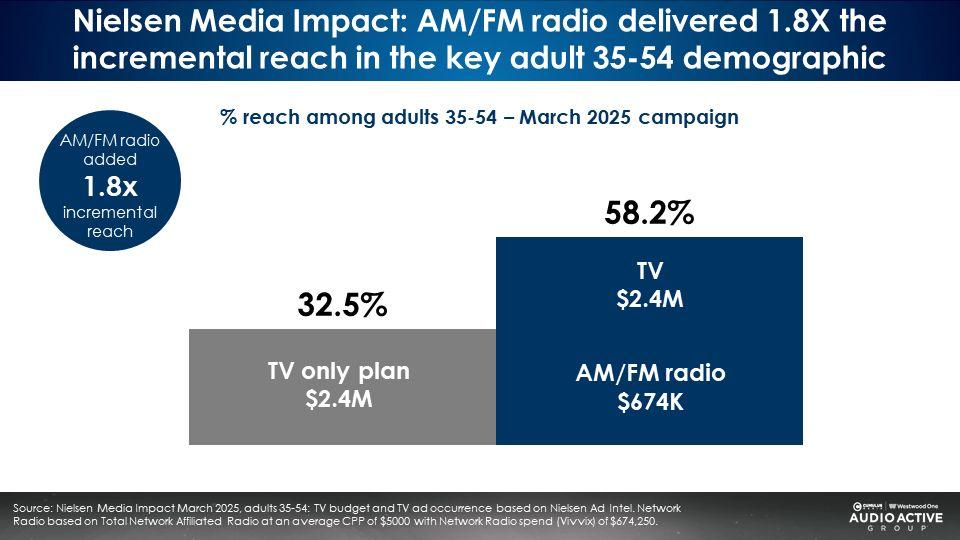

- The addition of AM/FM radio grew 35-54 monthly reach for the OTC brand from 33% to 58%, an +80% increase in campaign reach, according to Nielsen Media Impact.

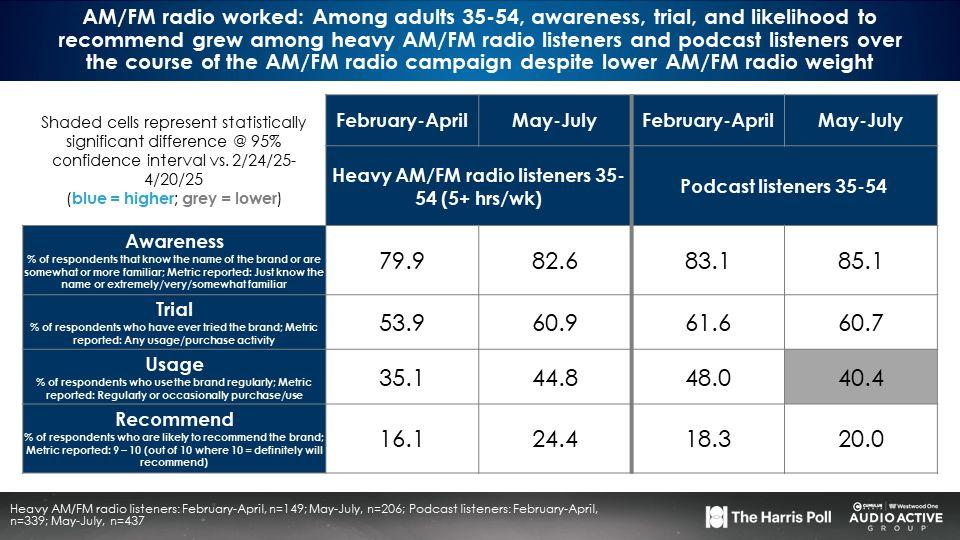

- AM/FM radio worked: Among adults 35-54, awareness, trial, and likelihood to recommend grew among heavy AM/FM radio listeners.

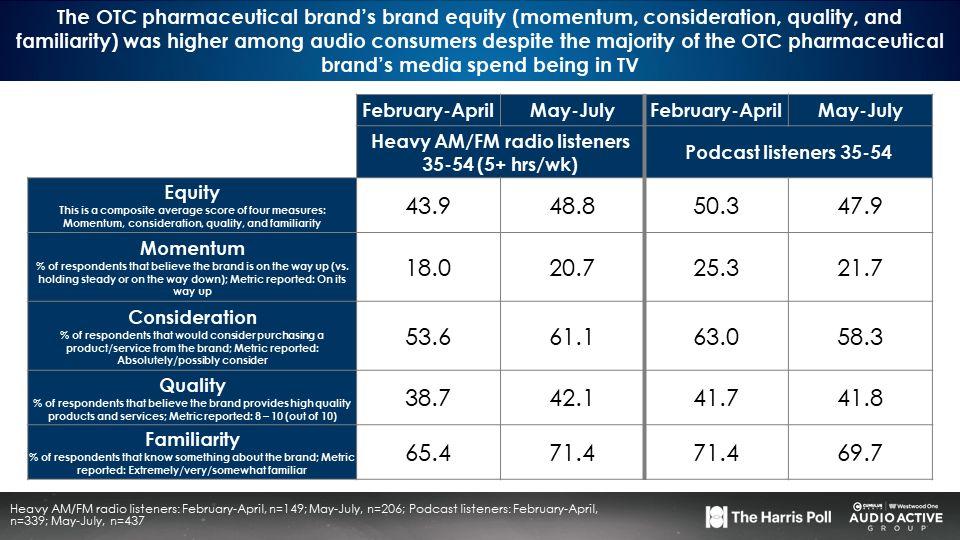

- Surprisingly, despite very small AM/FM radio investments, the OTC pharmaceutical brand’s equity measures are comparable among heavy TV viewers and heavy AM/FM radio listeners

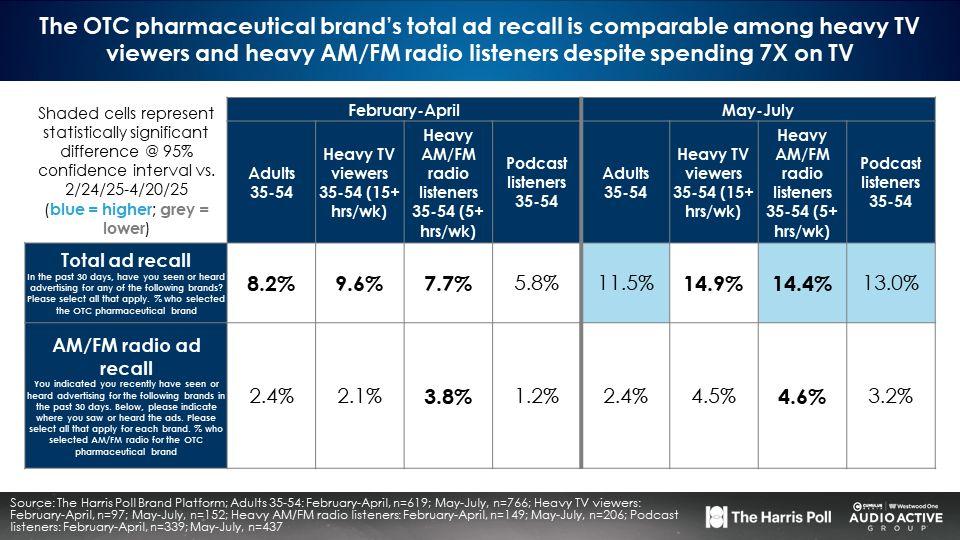

- The OTC pharmaceutical brand’s total ad recall is comparable among heavy TV viewers and heavy AM/FM radio listeners despite spending 7X on TV.

2025 pharmaceutical spend is up +9.3% on network radio

Miller Kaplan, the firm that tracks network radio ad spend, reports year-to-date August 2025 pharmaceutical spend on network radio is up +9.3% compared to the same period a year ago.

Major pharmaceutical marketers using network radio include Pfizer, AbbVie, Bayer, Astellas, Quincy Bioscience, Novo Nordisk, and Johnson & Johnson.

Strong body of evidence: Nearly a dozen network radio pharmaceutical case studies

Over the last seven years, the Cumulus Media | Westwood One Audio Active Group® has commissioned a series of pharmaceutical of network radio case studies. Each of these case studies measured the entire radio campaign, not just the Westwood One buy.

- Veritone One And Signal Hill Insights Pharma Study: Facial Aesthetics Category Skews Young And AM/FM Radio And Podcasts Offer Exceptional Reach Among Patients And Prospects/Considerers

- Signal Hill Insights Four-Year Pharmaceutical Brand Tracking Study: Despite Being Outspent 3:1 By TV, AM/FM Radio Outperforms For A Digestion Ailment Medication

- Two New Pharmaceutical Studies: Swoop Reveals AM/FM Radio Delivers Significant Reach And Time Spent Among The Digestion Aliment Segment And ABX Report Reveals AM/FM Radio Pharmaceutical Ads Are 94% As Effective As TV Ads At One-Fourth The CPM

- AM/FM Radio Drives Results For Pharmaceutical Brands: Multiple Case Studies Reveal AM/FM Radio Drives Incremental Reach And Action, Grows Share Of Voice, And Delivers High Creative Scores At A Fraction of TV’s CPM

- Case Study: AM/FM Radio Campaign For A Pharmaceutical Brand Generates Strong Lift In Brand Equity And Actions Taken With No Negative Reaction To Disclaimer

- AM/FM Radio Powers Through The Pandemic To Launch A New Pharmaceutical Brand

- Pharmaceutical Case Study: AM/FM Radio Campaign Lifts Awareness And Drives Surge In Likelihood To Take Action

OTC pharmaceutical brand: March-June 2025 campaign

A major pharmaceutical brand that is a heavy user of TV launched a first ever network radio in Spring 2025. The four-month campaign utilized nearly 300 GRPs against the brand target of adults 25-54.

Campaign weight was heaviest in March and April, achieving a 35-54 U.S. monthly reach of 40%. The May/June portion of the campaign generated a 25% monthly reach.

The campaign optimized for reach using a broad array of AM/FM radio programming formats including Adult Contemporary, Top 40/Contemporary Hit Radio, Country, Classic Hits, Rock, Urban, Classic Rock, News/Talk, and Sports.

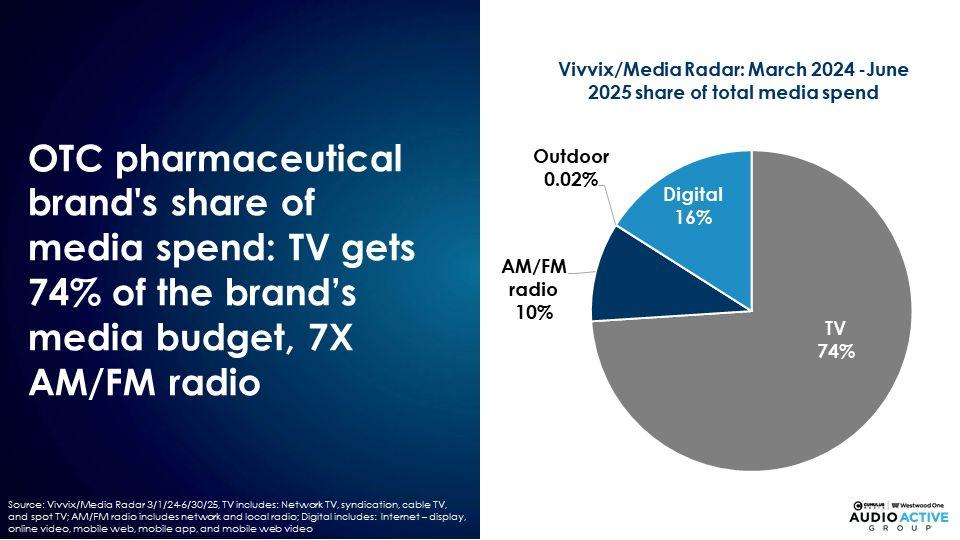

The OTC pharmaceutical brand spent 7X more on TV than AM/FM radio

From March 2024 to June 2025, Media Radar reports the largest proportion of the OTC brand’s media plan was devoted to linear TV.

Putting AM/FM radio into the media plan lifted TV reach by +80%

AM/FM radio’s superpower is the ability to make your TV better with a nearly 2X increase in reach. Nielsen Media Impact, the media planning and optimization platform, reveals in March 2025, the addition of AM/FM radio grew 35-54 reach for the OTC brand from 33% to 58%, an +80% increase in campaign reach.

Harris Poll Brand Tracker measures brand health on a continuous basis

To measure the impact of the network radio campaign, the Cumulus Media | Westwood One Audio Active Group® commissioned the Harris Poll Brand Tracker to track the brand equity (awareness, consideration, brand favorability, and usage) of the OTC brand.

Over the course of five months, Harris conducted a national study of 1,385 persons 35-54, the target demographic of the OTC brand. To track performance, the early portion of the AM/FM radio campaign (February-April) was compared to the later period (May-July).

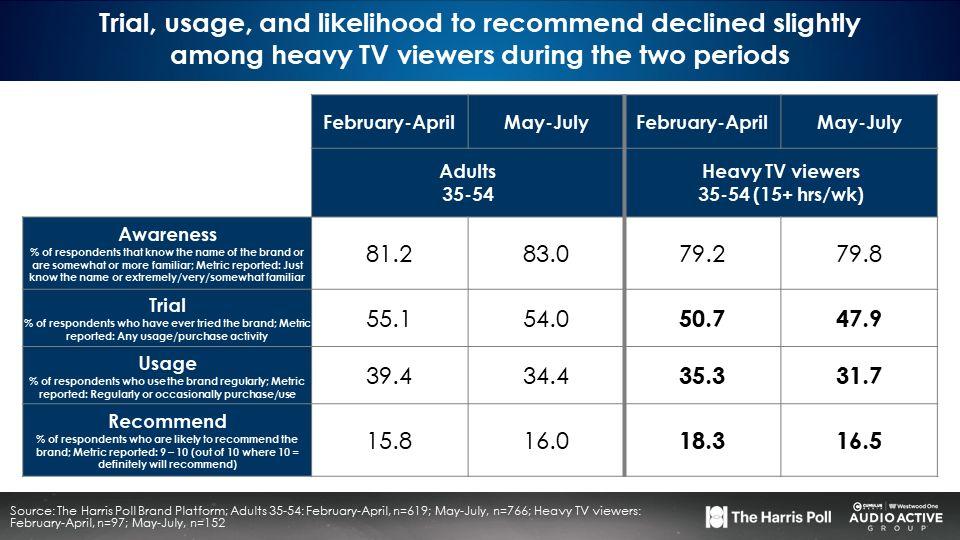

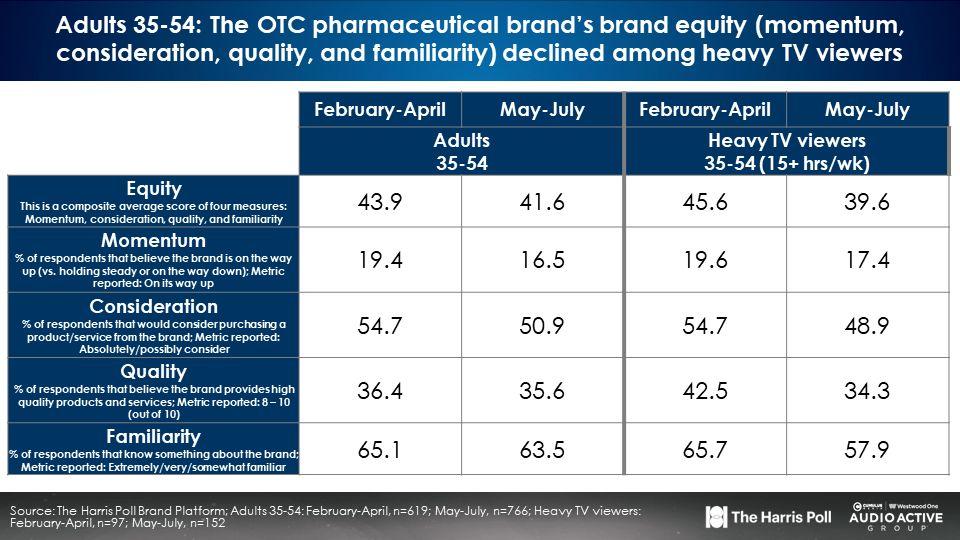

Despite significant TV spend, brand metrics eroded among heavy TV viewers, those with the greatest opportunity to be exposed to the OTC brand TV ads

Comparing May-July 2025 to February-April 2025, among heavy TV viewers, trial, usage, and recommendation dropped. In addition, overall brand equity among heavy TV viewers is actually lower than in the total U.S.

Why is awareness, trial, usage, and brand recommendation lower among heavy TV viewers than in the total U.S.?

This is bizarre given the size of the linear TV budget. There are two potential reasons brand health is weaker among heavy TV viewers.

First, it might be the heavy TV viewer is not really interested in the OTC product category or the brand. In that case, no matter how much TV budget is spent, the consumer has little interest and the ads go “in one ear and out the other.”

Second, despite spending $2.4M in the month, two thirds of U.S. 35-54s were never exposed to the campaign. With such weak campaign reach, it’s hard to make positive movements in brand equity.

During the same period, brand momentum, brand consideration, quality, and familiarity all dropped among heavy TV viewers.

AM/FM radio worked: Among heavy AM/FM radio listeners, the OTC brand equity improves

Awareness is up. So is trial, usage, and recommendation.

AM/FM radio worked as the OTC brand’s equity, momentum, consideration, quality, and familiarity were up across the board among heavy AM/FM radio listeners.

Why are all brand equity measures stronger among total AM/FM radio listeners than in the total U.S.?

Heavy AM/FM radio listeners could be more interested in the OTC product category and the brand. AM/FM radio adverting works because the OTC brand is “fishing where the fish are.” The OTC brand’s AM/FM radio campaign reaches people who are already more invested in the OTC category and brand.

The second reason why the AM/FM radio campaign is working is due to AM/FM radio’s much higher 35-54 campaign reach. While TV missed most of the 35-54 demo, the AM/FM radio campaign reached the vast majority of the OTC brand’s 35-54 demographic.

Despite spending 7X more on TV, ad recall is the same among heavy AM/FM radio listeners and heavy TV viewers

During February-April, ad recall was only a few points higher among TV viewers (9.6%) than among AM/FM radio listeners (7.7%). During May-June, ad recall was virtually tied at 14% among the two AM/FM radio and TV segments.

This is further proof that AM/FM radio is more effective than TV for this OTC brand. AM/FM radio ads punch above their weight, achieving the same ad recall as TV, despite spending 7X more on TV. It is also clear than heavy AM/FM radio listeners are far more engaged with the brand and the category than heavy TV viewers.

Key findings:

- The addition of AM/FM radio grew 35-54 monthly reach for the OTC brand from 33% to 58%, an +80% increase in campaign reach, according to Nielsen Media Impact.

- AM/FM radio worked: Among adults 35-54, awareness, trial, and likelihood to recommend grew among heavy AM/FM radio listeners.

- Surprisingly, despite very small AM/FM radio investments, the OTC pharmaceutical brand’s equity measures are comparable among heavy TV viewers and heavy AM/FM radio listeners

- The OTC pharmaceutical brand’s total ad recall is comparable among heavy TV viewers and heavy AM/FM radio listeners despite spending 7X on TV.

Recommendations:

- The OTC pharmaceutical brand should increase audio’s share of the media plan from 10% to 25% given that the brand equity is stronger among heavy AM/FM radio and podcast listeners.

- The OTC pharmaceutical brand should significantly increase the proportion of their media plan devoted to podcasts. In many cases, its brand equity is strongest among podcast listeners.

- Increasing the OTC pharmaceutical brand’s commitment to audio will result in incremental reach growth. Currently the overlay of AM/FM radio generates 1.8X incremental reach to the OTC pharmaceutical brand’s TV reach.

Click here to view a 15-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.