Signal Hill Insights Four-Year Pharmaceutical Brand Tracking Study: Despite Being Outspent 3:1 By TV, AM/FM Radio Outperforms For A Digestion Ailment Medication

Click here to view a 16-minute video of the key findings.

Click here to download a PDF of the slides.

Since 2018, pharmaceutical and drug store spend on AM/FM radio has soared +59%, according to Miller Kaplan. AbbVie, Pfizer, Johnson and Johnson, and P&G are running AM/FM radio campaigns for multiple brands. For the second year in a row, pharma/drug store is now the number one advertising category on U.S. network radio.

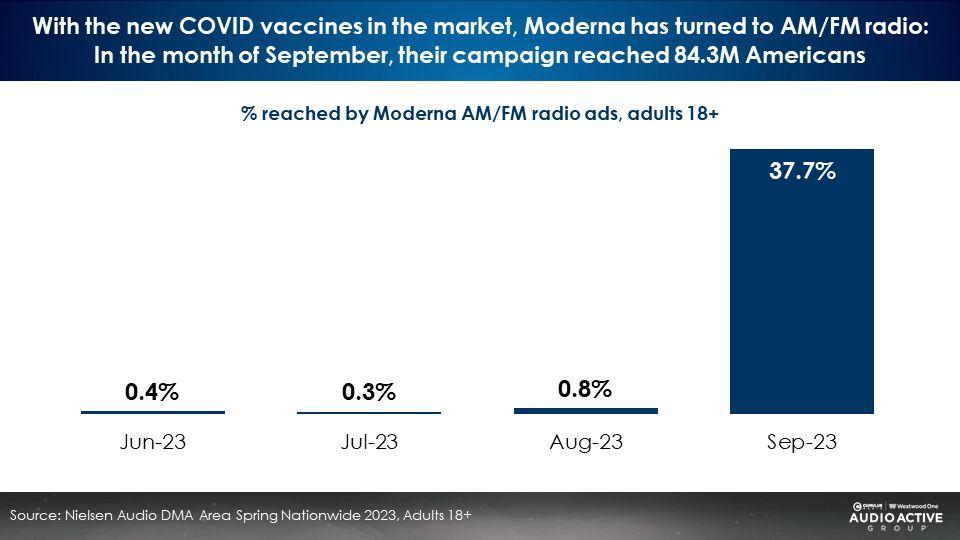

Moderna, one of the major pharmaceutical companies in the U.S., is using AM/FM radio in a significant way. With new COVID vaccines in the market, Moderna has used AM/FM radio to raise their brand awareness. In the month of September alone, they used AM/FM radio to reach over 83 million Americans.

In 2018, long before the pharma industry considered AM/FM radio a viable media platform, a major pharma brand began using AM/FM radio in a meaningful way. The brand wanted to measure the impact of its audio investment. The Cumulus Media | Westwood One Audio Active Group® retained Signal Hill Insights to conduct seven brand tracking studies over a four-year period. In total, 10,609 respondents were surveyed.

The most recent study examined 1,508 adults 18+ with health insurance in May 2023. 3,069 respondents were surveyed in 2020, 3,027 in 2021, and 3,005 in 2022. (In 2020, 2021 and 2022, two studies were conducted each year.)

Key findings:

- Heavy AM/FM radio listeners are more likely to be sufferers of the digestion ailment than heavy TV viewers, which makes AM/FM radio an ideal media platform.

- Those with the digestion ailment skew younger, which explains why TV under-indexes for the disease states.

- AM/FM radio has worked for the brand. Among heavy AM/FM radio listeners, there was strong upper funnel growth (awareness and ad recall).

- Among those who have the digestion ailment, the medication has seen growth in key brand metrics since 2020.

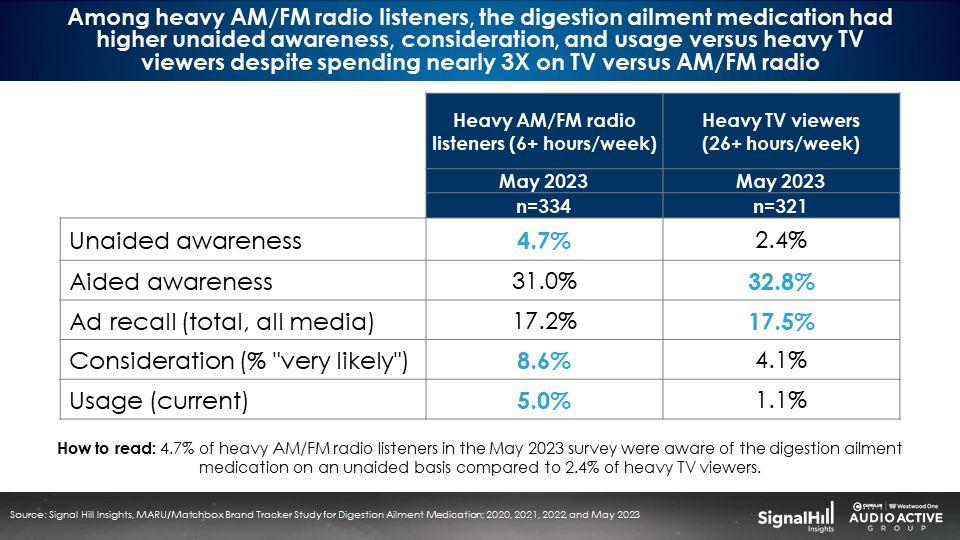

- Compared to TV viewers, heavy AM/FM radio listeners had higher unaided awareness, consideration, and usage versus heavy TV viewers despite spending nearly 3X on TV versus AM/FM radio.

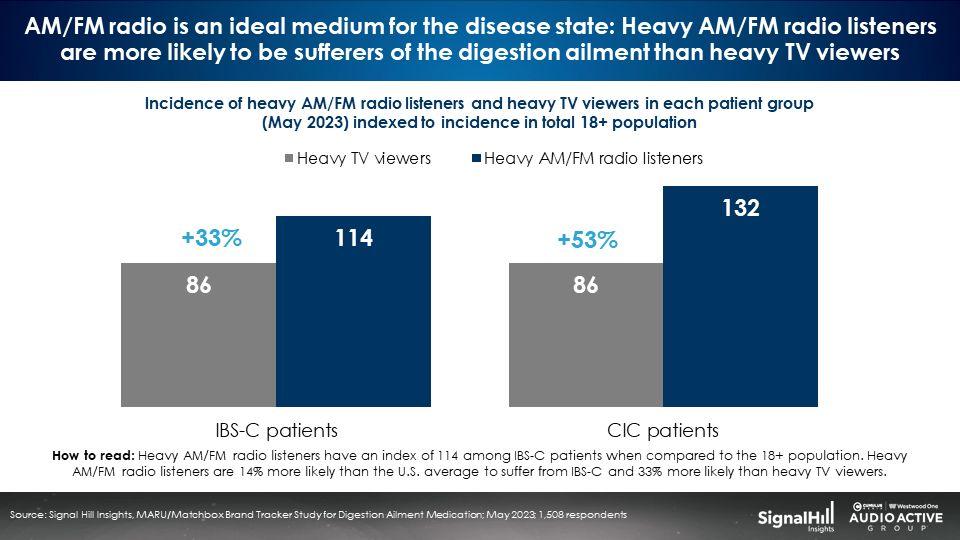

AM/FM radio is an ideal medium for the disease state: Heavy AM/FM radio listeners are more likely to be sufferers of the digestion ailment than heavy TV viewers

A consistent finding over the four years was that heavy AM/FM radio listeners had a far greater incidence of having the digestive symptoms IBS-C (irritable bowel syndrome with constipation) or CIC (chronic idiopathic constipation) compared to TV viewers. Heavy AM/FM radio listeners are +33% more likely to be IBS-C patients and +53% more likely to be CIC patients.

One of the reasons AM/FM radio outperforms TV is that the AM/FM radio audience is significantly more likely to be in the patient population.

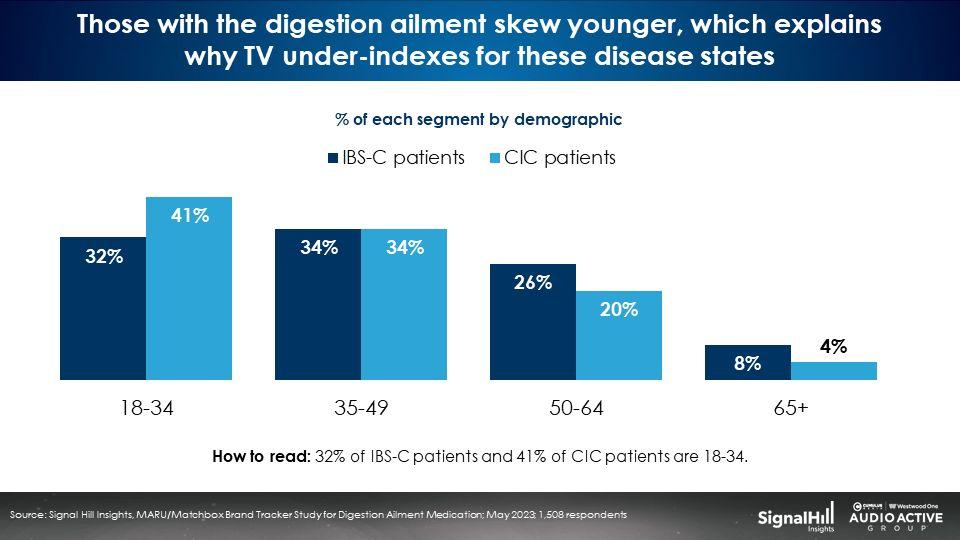

Those with the disease states skew younger, which explains why TV under-indexes

The disease states skew 18-49, a demographic where television has seen significant audience losses. Two-thirds of IBS-C sufferers are 18-49 and 75% of those with CIC are 18-49.

Nielsen reports AM/FM radio significantly outreaches TV among 18-49s:

Nielsen Total Audience Report: Reach by demographic

| Weekly reach | 18-34 | 35-49 | 50-64 | 65+ |

| Live + time-shifted TV | 52% | 71% | 85% | 91% |

| AM/FM radio | 78% | 86% | 89% | 84% |

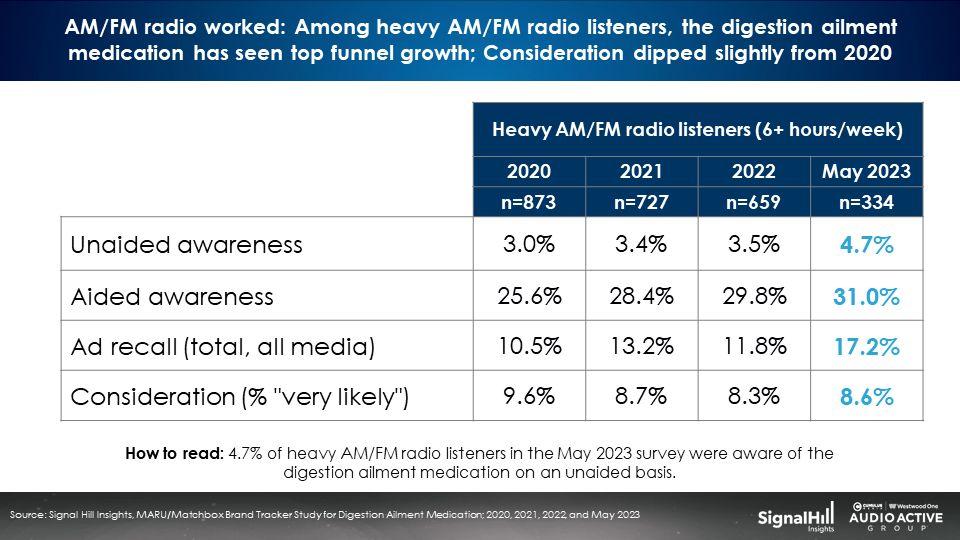

AM/FM radio worked: Over four years, brand awareness and consideration grow

Among heavy AM/FM radio listeners, those with the greatest opportunity to be exposed to the AM/FM radio brand campaign, 2023 unaided awareness and aided awareness hit a four-year high. Advertising recall also experienced a four-year high. Consideration was stable.

Pharma brands must “be known before they are needed”: Among those in the disease state, brand awareness and advertising recall have grown strongly

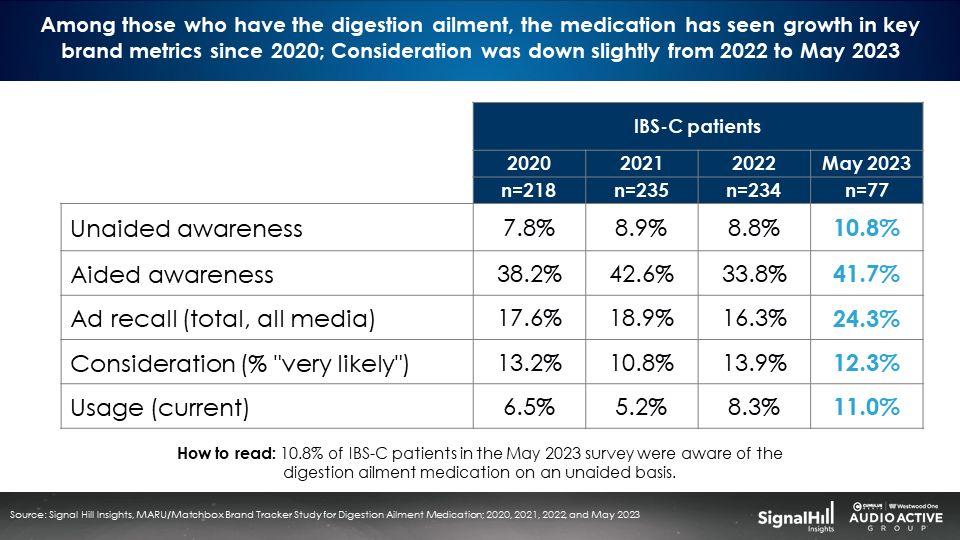

Among IBS-C patients unaided and aided awareness, along with advertising recall, are up strongly. Consideration has moved across the years, while usage hit new highs in 2023.

Despite being outspent 3:1 by TV, AM/FM radio listeners have 2X unaided awareness for the brand, 2X the consideration, and 5X the usage

TV has a slight advantage in aided awareness and general advertising recall.

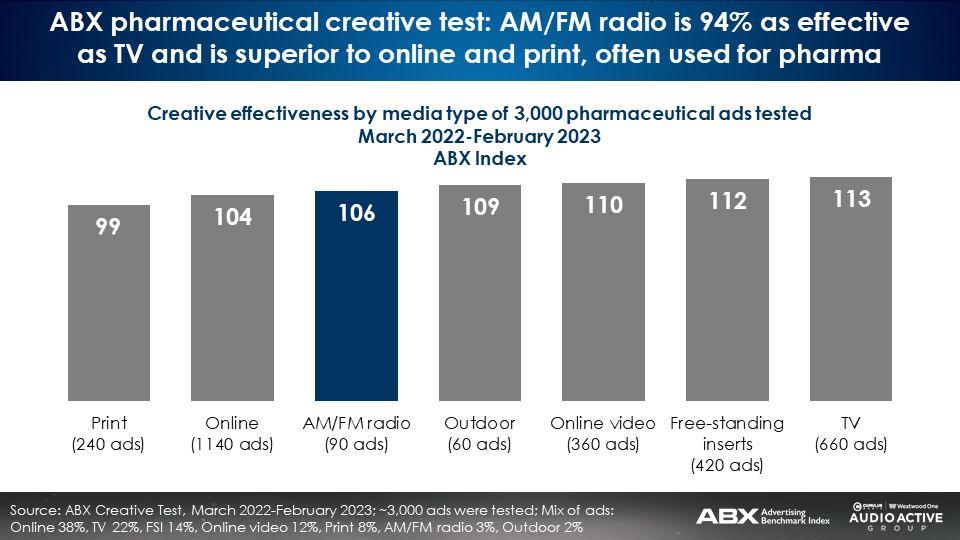

There is a growing body of evidence on AM/FM radio’s effectiveness for pharma brands. However, some pharma brands suggest without offering evidence that “sight, sound, and motion” are inherently superior to audio. To explore this industry myth, ABX conducted the largest ever creative study of pharma ads that includes assets from all media forms.

“Sight, sound, and motion” superiority over pharma audio ads is a myth: ABX creative study of nearly 3,000 pharma ads reveals AM/FM radio is 94% as effective as TV at one-fourth the CPM

A recent study from ABX, a leading creative effectiveness measurement firm, examined 2,970 pharmaceutical ads that ran from March 2022 to February 2023.

The pharma ads ran across TV, print, digital, outdoor, online video, free standing print inserts, and AM/FM radio. 660 pharma TV ads were tested. 90 pharma AM/FM radio ads were tested.

Pharma AM/FM radio ads test virtually the same as TV at a fraction of the CPM. The average creative effectiveness score for the AM/FM radio ads was 106. AM/FM radio’s performance is 94% that of TV (113). AM/FM radio pharmaceutical creative effectiveness scores beat online and print, both highly visual media.

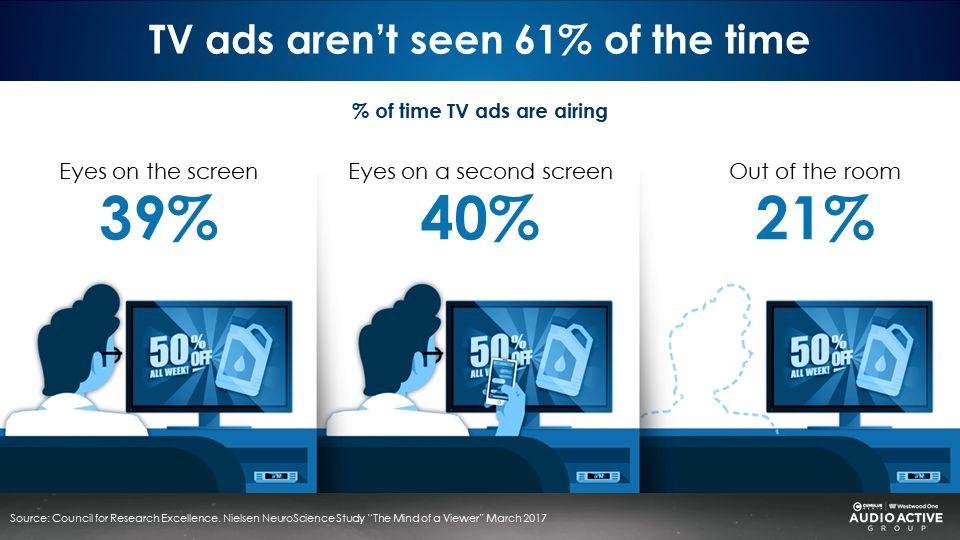

Why don’t “sight, sound, and motion” TV ads significantly outperform AM/FM radio ads in creative effectiveness?

Part of the reason is TV ads are not seen 61% of the time. A Nielsen study finds when TV ads play, 40% of the time, people are looking at a second screen and not the TV.

So, 40% of TV ad impressions are AM/FM radio ads – just sound, no sight/motion. 21% of the time TV ads play to an empty room.

Gary Getto, President of ABX, says, “Moving some TV funds to AM/FM radio produces significantly higher reach. Often the excuse for not doing this is the need for sight, sound, and motion that TV provides and, in many cases, the lack of confidence in AM/FM radio creative’s ability to move the needle. But extensive ABX data shows that AM/FM radio can be nearly as effective as television when best practices in audio creative are followed.”

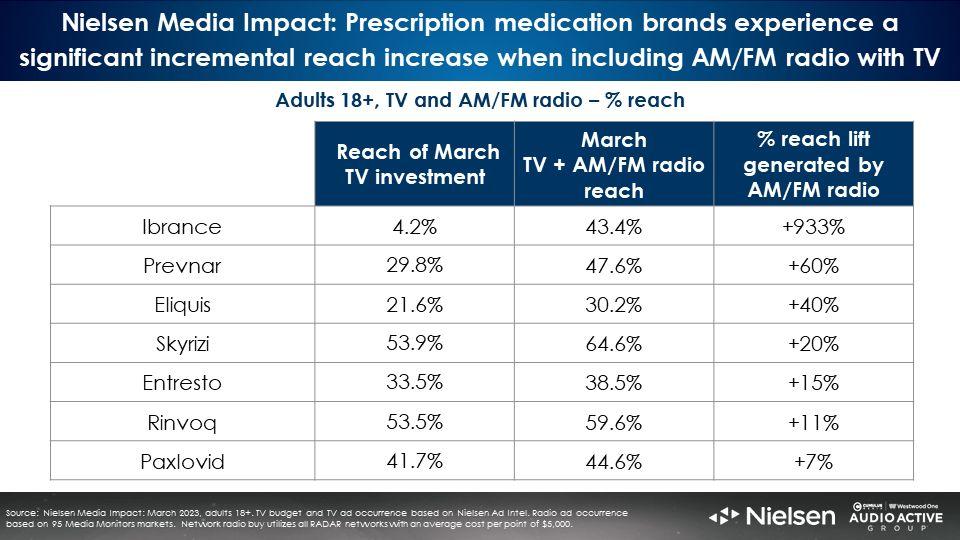

AM/FM radio is the reach accelerator for pharma brands: Pharma brands see significant lifts in incremental reach with the addition of AM/FM radio

Via Nielsen Media Impact, the media planning platform, the reach lift generated by AM/FM radio to a brand’s TV buy can be quickly determined.

Across 7 prescription medication brands, AM/FM radio added incremental reach gains when added to the TV plan. The network radio overlay causes reach to soar. AM/FM radio makes TV plans better.

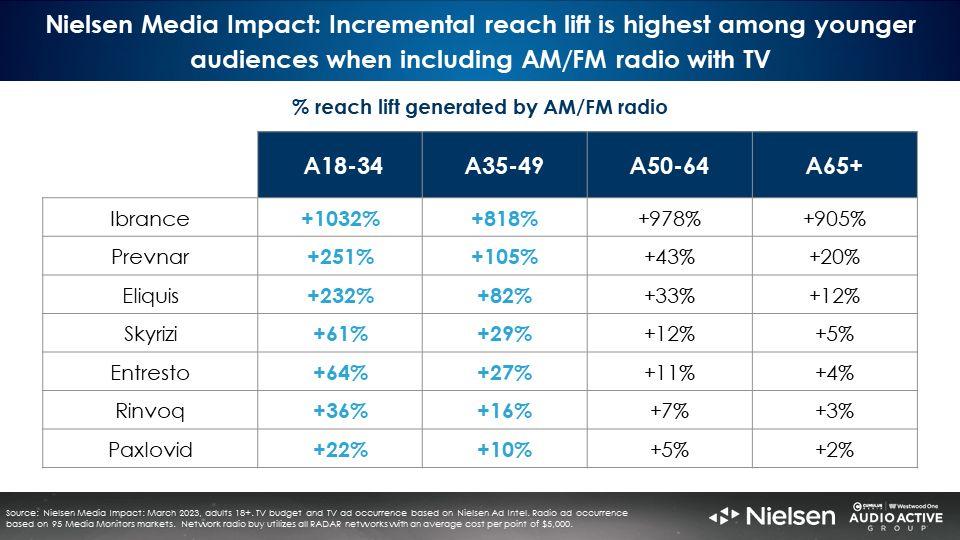

AM/FM radio’s superpower is generating astonishing reach lift among younger demographics

Looking at March 2023 pharmaceutical TV campaigns across 7 medication brands, the younger the demographic, the greater the incremental reach generated by AM/FM radio.

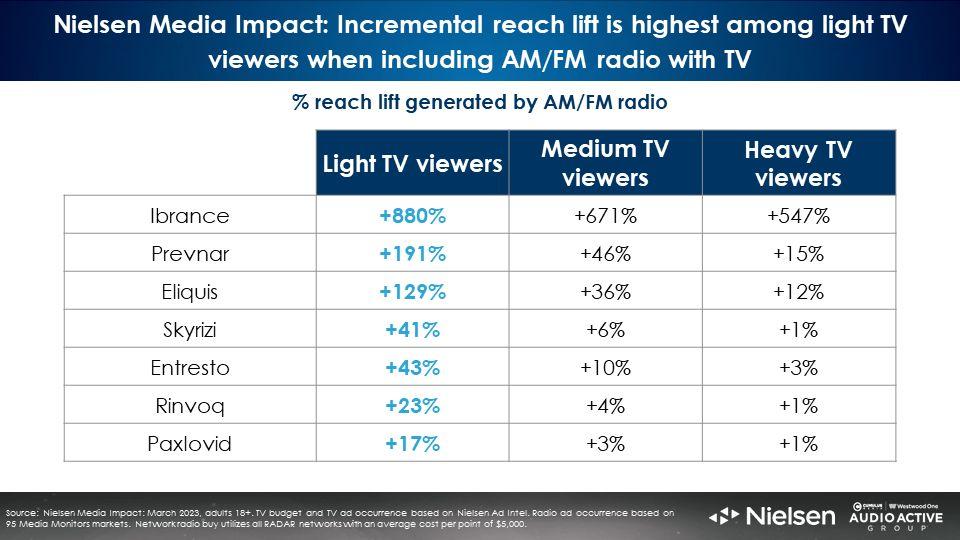

Fix the light TV viewing problem with AM/FM radio

A wise media planner once said, “You cannot fix your light TV viewing problem by buying more TV.” In the case of the 7 pharma brands, their AM/FM radio investments generate a massive reach increase among light TV viewers and strong growth in medium TV viewers.

Key findings:

- Two years running, pharma is the number one advertising category on network radio.

- On behalf of a digestive ailment pharmaceutical brand, the Cumulus Media | Westwood One Audio Active Group® commissioned Signal Hill Insights to conduct 7 brand studies over a four-year period.

- Heavy AM/FM radio listeners are more likely to be sufferers of the digestion ailment than heavy TV viewers, which makes AM/FM radio an ideal media platform.

- AM/FM radio has worked for the brand: Among heavy AM/FM radio listeners, the digestion ailment medication has seen strong top funnel growth.

- Among those who have the digestion ailment, the medication has seen growth in key brand metrics since 2020.

- Among heavy AM/FM radio listeners, the digestion ailment medication had higher unaided awareness, consideration, and usage versus heavy TV viewers despite spending nearly 3X on TV versus AM/FM radio.

- Brand new ABX creative study of nearly 3,000 pharma ads: AM/FM radio is 94% as effective as TV at one-fourth the CPM proving that “sight, sound, and motion” superiority over audio ads is a myth.

- AM/FM radio is the reach accelerator for pharma brands: Pharma brands see significant lifts in incremental reach with the addition of AM/FM radio.

- You cannot solve your light TV viewing problem by buying more TV: AM/FM radio generates massive growth in campaign reach among light TV viewers.

- The younger the demo, the larger the reach gains when including AM/FM radio with TV.

Click here to view a 16-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.