Amazon Prime Day 2025 Purchasing Was Powered By AM/FM Radio, Podcasts, and Streaming Music; Retailers Should Give Audio A Starring Role In Media Plans

Click here to download a PDF of the slides.

Ad-supported audio listeners led all other media in purchases during Amazon’s July 8-11, 2025 four-day Prime Day event, according to a national study of 925 Americans by Quantilope.

Key takeaways:

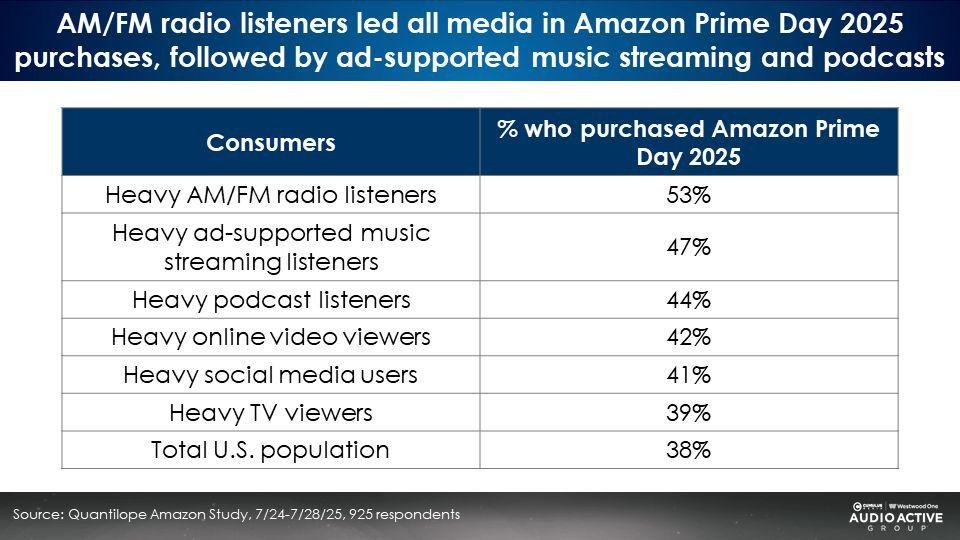

- Leading all media in Amazon Prime Day 2025 purchases were AM/FM radio listeners (53%), followed by ad-supported music streaming (47%) and podcast (44%) consumers: Ad-supported audio listeners were more likely to shop Amazon Prime Day than the online video audience, social media users, and linear TV viewers. Ad-supported audio listeners are more likely to be Amazon Prime members, spend more, and were more aware of Amazon Prime Day 2025.

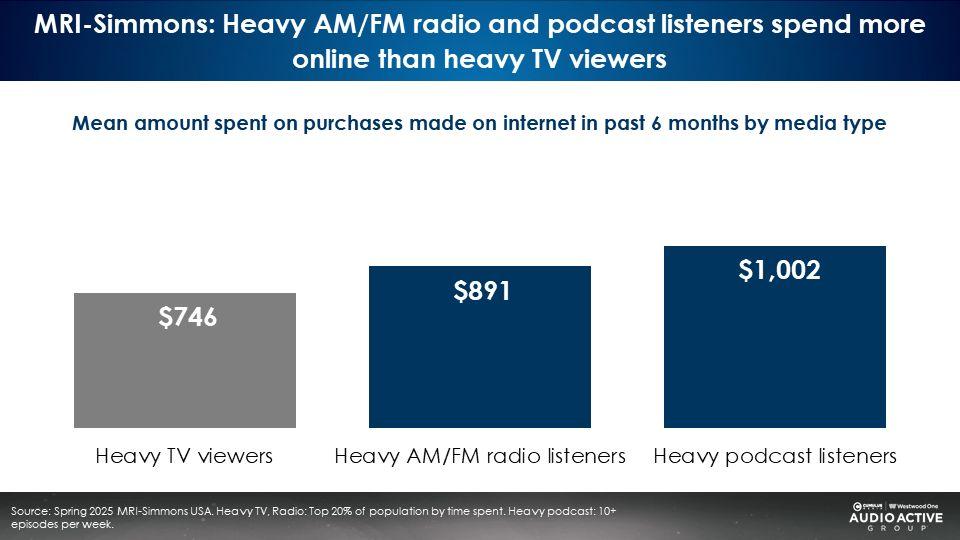

- Ad-supported audio (AM/FM radio, music streaming, and podcasts) are ideal media platforms for retailers and e-commerce brands: Heavy audio listeners are more likely to shop online. Heavy AM/FM radio and podcast listeners spend more online than TV viewers.

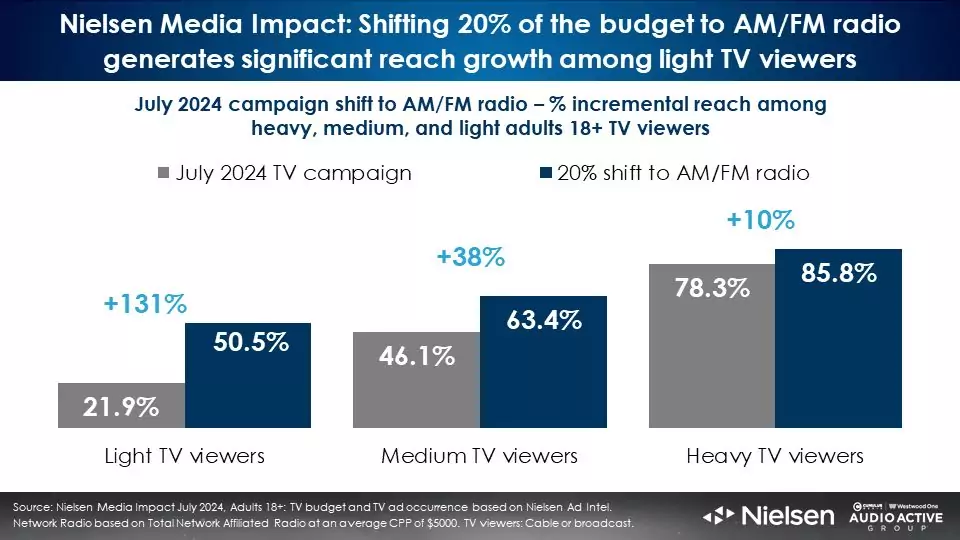

- AM/FM radio makes your TV better – “20 gets you 50”: A 20% shift of a TV media budget to AM/FM radio generates a +50% increase in campaign reach. Nielsen Media Impact campaign optimizations reveal shifting media weight to AM/FM radio generates significantly more reach, especially among younger 18-49 demographics. AM/FM radio does an extraordinary job in increasing campaign reach among light TV viewers who will not see retailer TV ads.

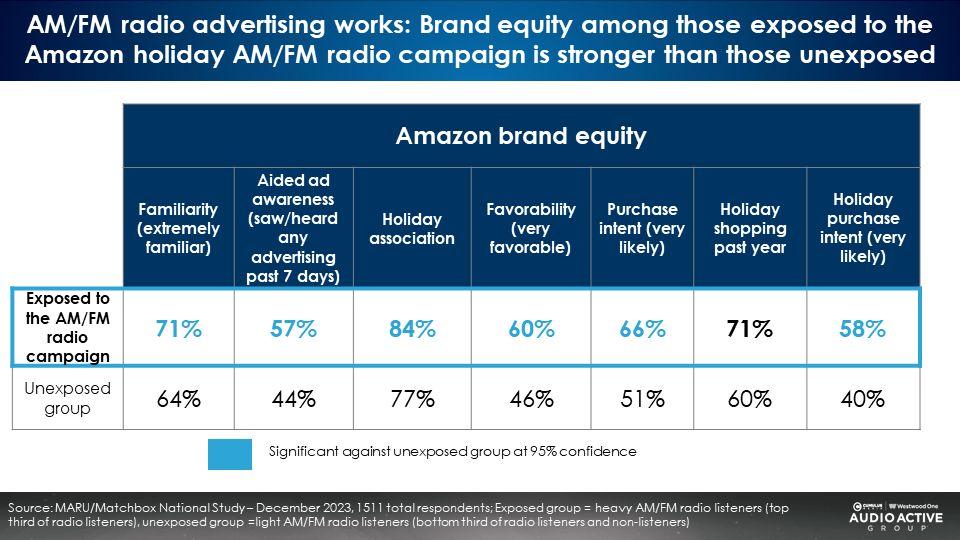

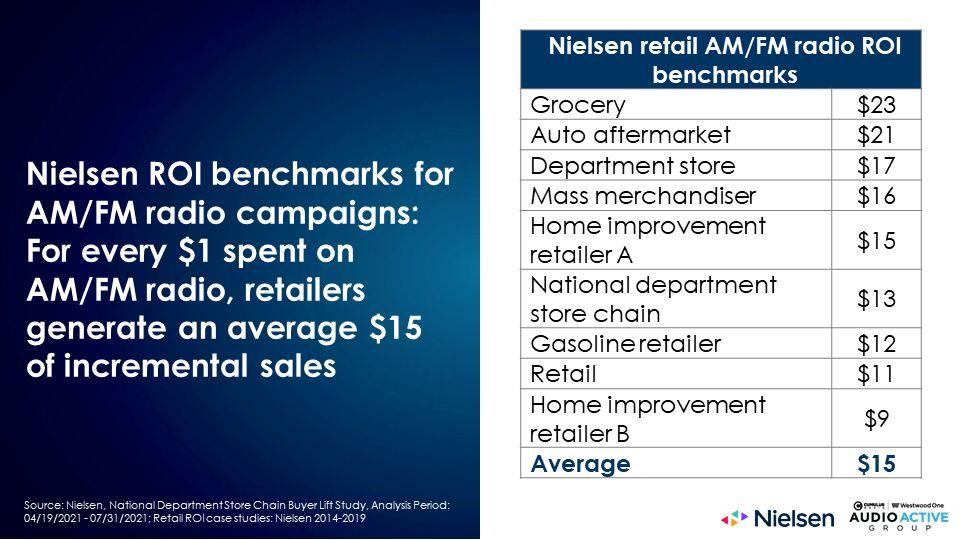

- Audio holiday AM/FM radio campaigns work: Consumers exposed to an Amazon holiday AM/FM radio campaign have higher brand equity (awareness, ad recall, prior purchase, and purchase intent). Nielsen sales effect studies reveal AM/FM radio campaigns for retailers generate significant return on advertising spend: $15 dollars of incremental sales for every dollar of AM/FM radio advertising.

AM/FM radio listeners led all media in Amazon Prime Day 2025 purchases, followed by ad-supported music streaming and podcasts

Why did ad-supported audio lead all other media in Prime Day 2025 purchases?

Ad-supported audio listeners are more likely to be Amazon Prime members, spend more, and were aware of Amazon Prime Day 2025

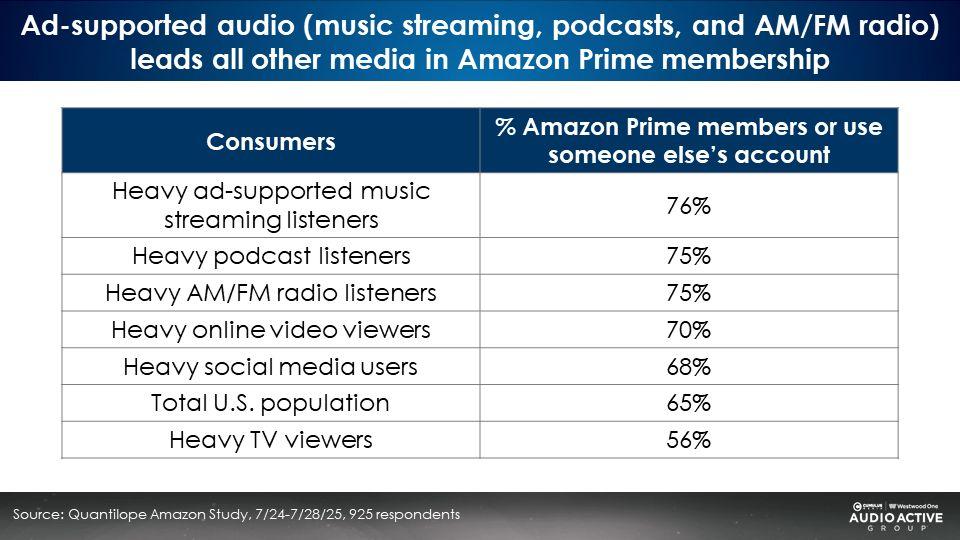

Ad-supported audio (music streaming, podcasts and AM/FM radio) lead all other media in Amazon Prime membership

Heavy ad-supported audio listeners are 15% to 17% more likely to be Amazon Prime members. Heavy TV viewers are 14% less likely than the U.S. average to be Prime members.

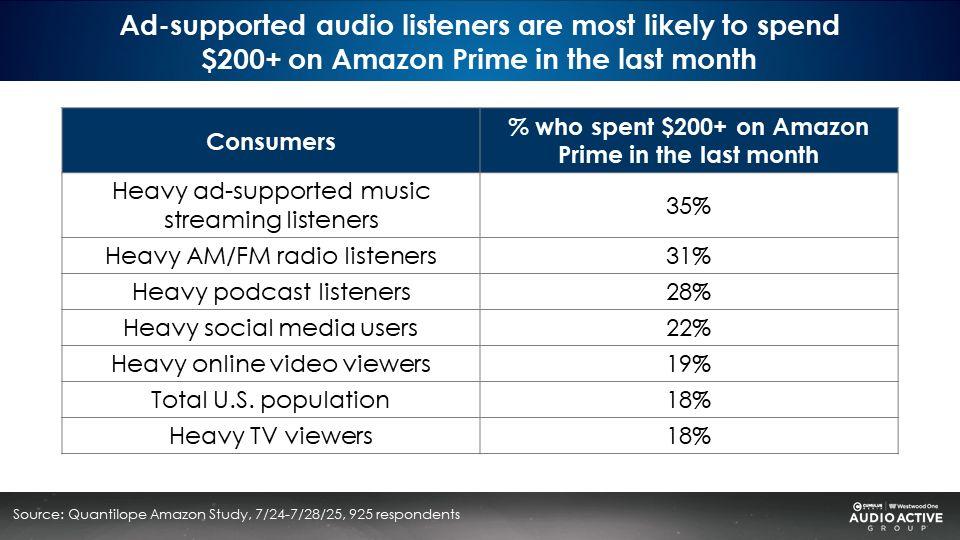

Ad-supported audio listeners most likely to spend $200+ on Amazon Prime in the last month

MRI-Simmons reveals the AM/FM radio and podcast audience spent more online that TV audience in last six months

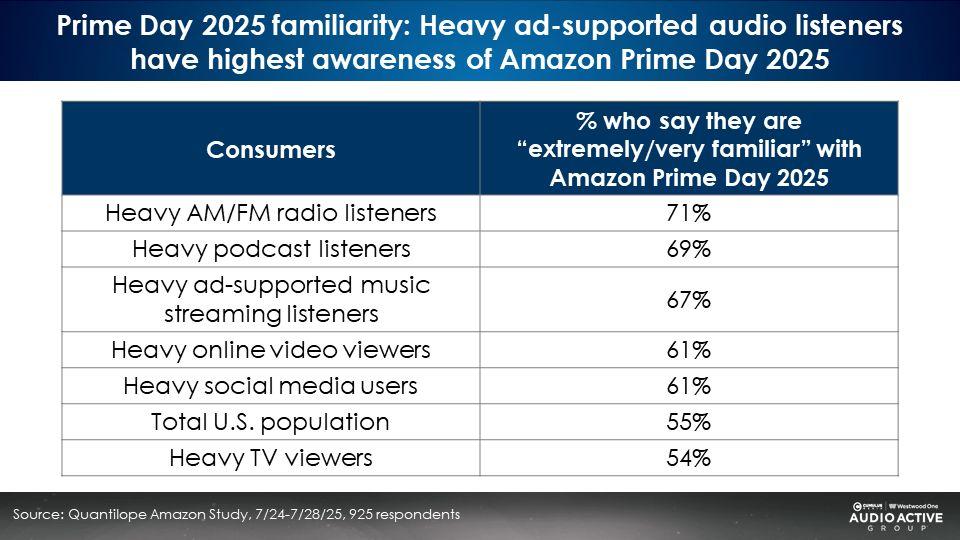

Heavy ad-supported audio listeners were most likely to be aware of Amazon Prime Day 2025

Consumers were probed on their familiarity with Amazon Prime Day 2025 and asked to indicate if they were “extremely familiar, very familiar, somewhat familiar, heard of but not familiar, or never heard of.”

Prime Day 2025 familiarity: Heavy ad-supported audio listeners have the highest awareness of Amazon Prime Day 2025

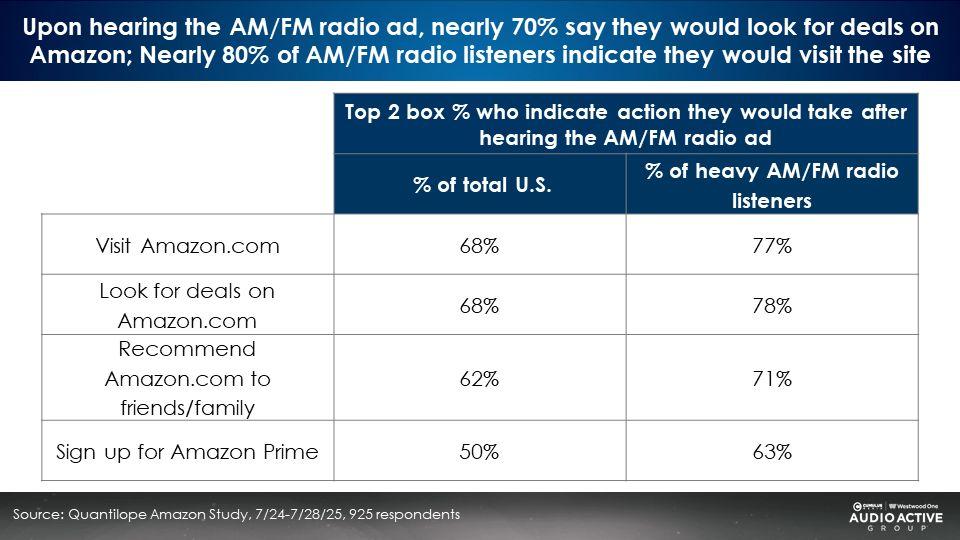

When played a 2025 Amazon Prime Day AM/FM radio ad, 46% of Americans say they recall hearing the ad; In response to the Amazon Prime Day ad, nearly 70% say they would visit Amazon or look for deals on Amazon

Over the last decade, numerous studies have proven that AM/FM radio is the engine of American e-commerce and a key media driver of Prime Day.

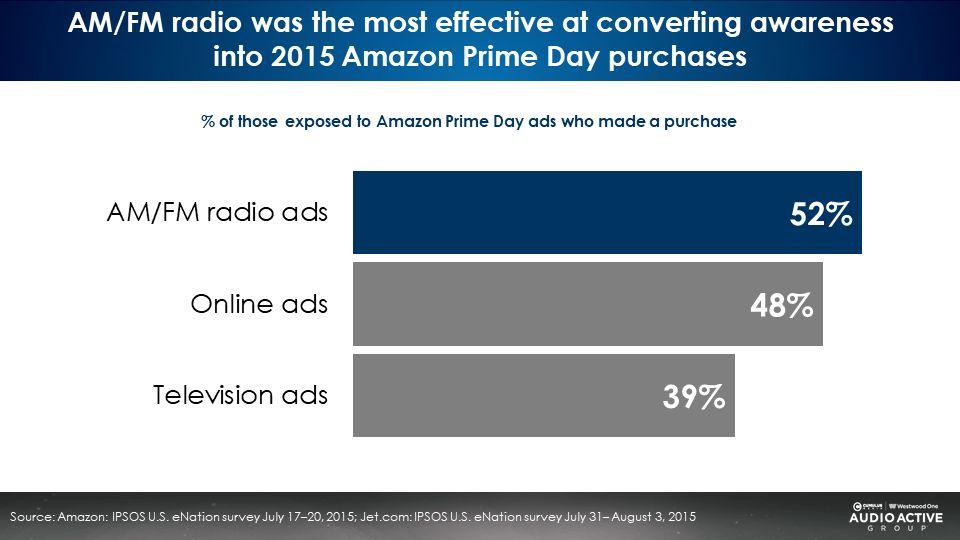

In 2015, AM/FM radio ads drove the strongest purchase conversion for the very first Amazon Prime Day

In 2015, an IPSOS study commissioned by the Cumulus Media | Westwood One Audio Active Group® revealed AM/FM radio ads were the most effective at converting awareness into Prime Day purchases. Of those exposed to AM/FM radio ads, 52% made a purchase versus TV (39%) and online (48%).

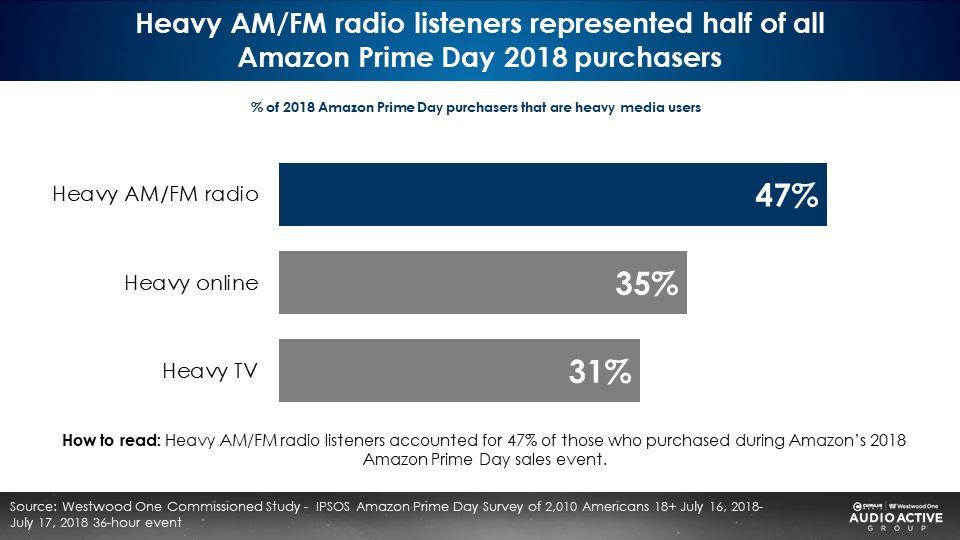

A 2018 IPSOS study revealed heavy AM/FM radio listeners represented half of all Amazon Prime Day purchasers

AM/FM radio was the engine of Amazon Prime Day in 2018. Far more heavy AM/FM radio listeners were purchasers (47%) compared to heavy online users (35%) and heavy TV viewers (31%). Heavy AM/FM radio listeners were 51% more likely to be Amazon Prime Day 2018 purchasers compared to heavy TV viewers.

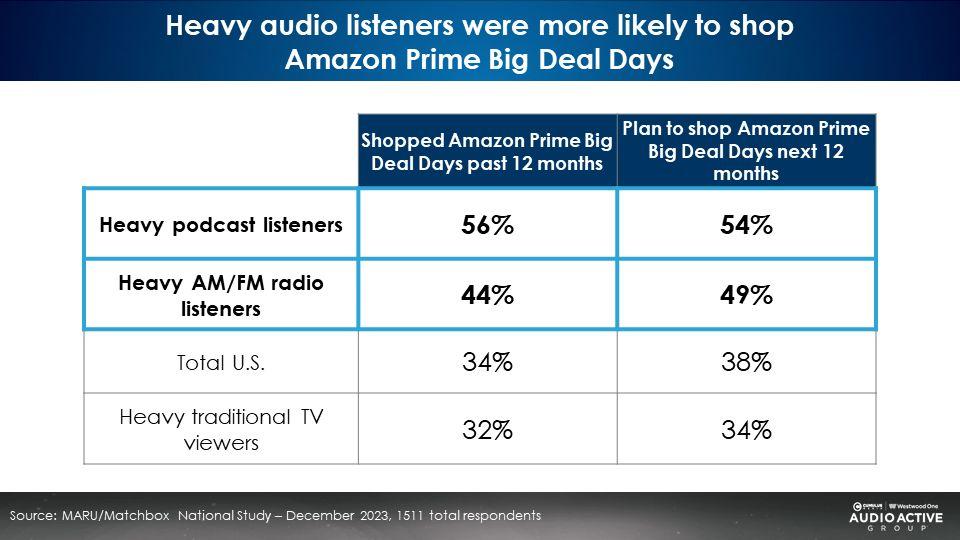

Heavy podcast and heavy AM/FM radio listeners are more likely to purchase at Amazon sales events

A December 2023 MARU/Matchbox study found heavy podcast and heavy AM/FM radio listeners were more likely to have purchased at the October 10-11, 2023 Amazon Prime Big Deal Days event. The study also found heavy audio listeners are more likely to shop at future Amazon shopping events. Heavy TV viewers are far less likely to shop Amazon sales events.

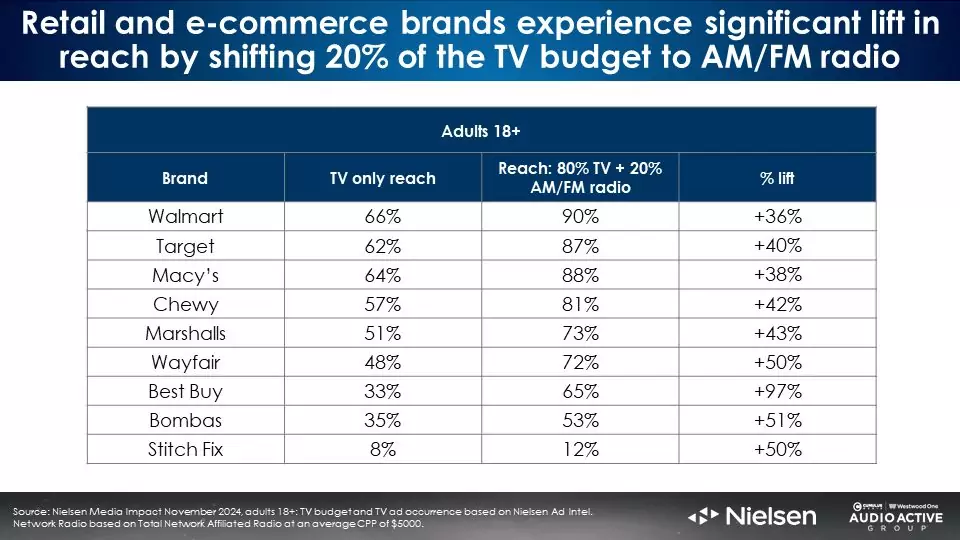

“20 gets you 50”: Retailers can generate +50% incremental reach increase to their TV investment by shifting just 20% of their holiday media plan to AM/FM radio

An analysis conducted via Nielsen Media Impact, the media planning and optimization platform, reveals shifting just 20% of a linear television buy to AM/FM radio can generate a +50% increase in campaign reach. The November 2024 television holiday campaigns from a variety of retailers are detailed below.

Shifting 20% of holiday TV investment to AM/FM radio grows reach by an average of +50%. The smaller the retailer’s TV investment, the greater the incremental reach lift achieved with the addition of AM/FM radio.

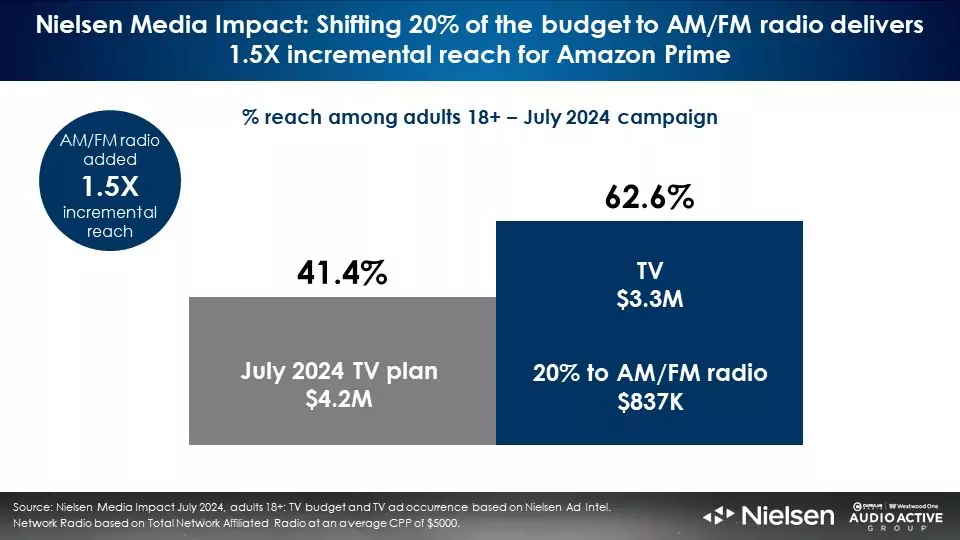

Nielsen Media Impact: AM/FM radio elevates the Amazon media plan; Amazon experiences a +50% increase in reach with a 20% reallocation to AM/FM radio

In June of 2024, Amazon Prime spent $4.2M on network television and reached 41% of adults 18+, according to Nielsen Media Impact, the media planning and optimization platform. Shifting just 20% of the TV budget to AM/FM radio generates a +51% increase in reach (41% to 63%). A reach lift of +51% for the same budget!

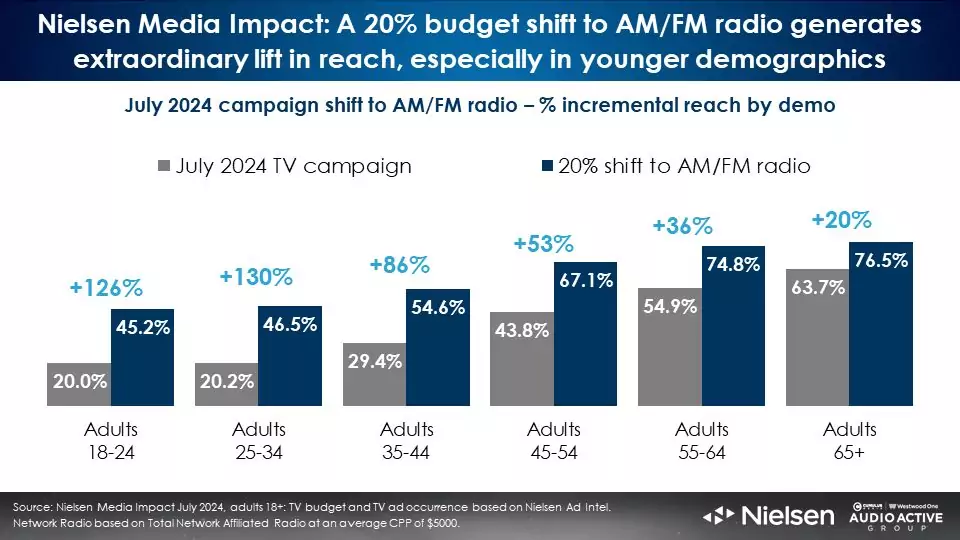

Adding AM/FM radio to the Amazon TV media plan generates significant younger demo incremental reach growth

The grey bars below represent the monthly reach of the Amazon Prime Day 2024 TV buy. The Amazon buy reached nearly half of persons 65+ but lacked reach in the younger demos.

The blue bars represent the combined reach of the 80% TV and 20% AM/FM radio media plan. The 20% share shift to AM/FM radio generates astonishing lifts in reach in younger demographics:

- 18-24: +126%

- 25-34: +130%

- 35-44: +86%

- 45-54: +53%

Adding AM/FM radio to the Amazon Prime media plan generates massive reach growth among light and medium TV viewers

A wise media planner once said, “You cannot solve your light TV viewing problem by buying more TV!”

The 20% reallocation of the Amazon media plan to AM/FM radio results in significant incremental reach increases among light (+131%) and medium (+38%) TV viewers. Younger demographics are very light users of linear television, while older demographics are heavy users of TV.

An Amazon holiday AM/FM radio campaign generates strong brand equity and purchase intent

MARU/Matchbox conducted a campaign effect study of the December 2023 Amazon holiday campaign. Comparing those exposed to the AM/FM radio campaign versus those not exposed reveals stronger brand familiarity, advertising recall, holiday association, favorability, purchase intent, and prior purchase.

Nielsen: AM/FM radio campaigns generate extraordinary return on retail advertising spend; For every dollar spent, $15 dollars of incremental sales are generated

Key takeaways:

- Leading all media in Amazon Prime Day 2025 purchases were AM/FM radio listeners (53%), followed by ad-supported music streaming (47%) and podcast (44%) consumers: Ad-supported audio listeners were more likely to shop Amazon Prime Day than the online video audience, social media users, and linear TV viewers. Ad-supported audio listeners are more likely to be Amazon Prime members, spend more, and were more aware of Amazon Prime Day 2025.

- Ad-supported audio (AM/FM radio, music streaming, and podcasts) are ideal media platforms for retailers and e-commerce brands: Heavy audio listeners are more likely to shop online. Heavy AM/FM radio and podcast listeners spend more online than TV viewers.

- AM/FM radio makes your TV better – “20 gets you 50”: A 20% shift of a TV media budget to AM/FM radio generates a +50% increase in campaign reach. Nielsen Media Impact campaign optimizations reveal shifting media weight to AM/FM radio generates significantly more reach, especially among younger 18-49 demographics. AM/FM radio does an extraordinary job in increasing campaign reach among light TV viewers who will not see retailer TV ads.

- Audio holiday AM/FM radio campaigns work: Consumers exposed to an Amazon holiday AM/FM radio campaign have higher brand equity (awareness, ad recall, prior purchase, and purchase intent). Nielsen sales effect studies reveal AM/FM radio campaigns for retailers generate significant return on advertising spend: $15 dollars of incremental sales for every dollar of AM/FM radio advertising.

Download a PDF of the slides:

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.