Nielsen: AM/FM Radio Elevates The Media Plan With Dramatic Lifts In Incremental Reach Among Light TV Viewers And Younger Demographics

Click here to view a 13-minute video of the key findings.

Click here to download a PDF of the slides.

Nielsen Media Impact: Expect a 12% audience loss running last year’s media plan this year

A new Nielsen analysis reveals buying the same media plan as the prior year reaches 12% fewer consumers. Via Nielsen Media Impact, the media optimization and planning platform, Nielsen examined a frequently utilized media plan consisting of 65% linear TV, 10% CTV, and 25% digital.

The same media plan repeated a year later reaches 12% fewer people. Given that reach is the foundation of media effectiveness, this means lower brand impact and a reduction in potential sales effect.

Can increasing connected TV and digital media allocations fix all of linear TV’s woes? Unfortunately, no

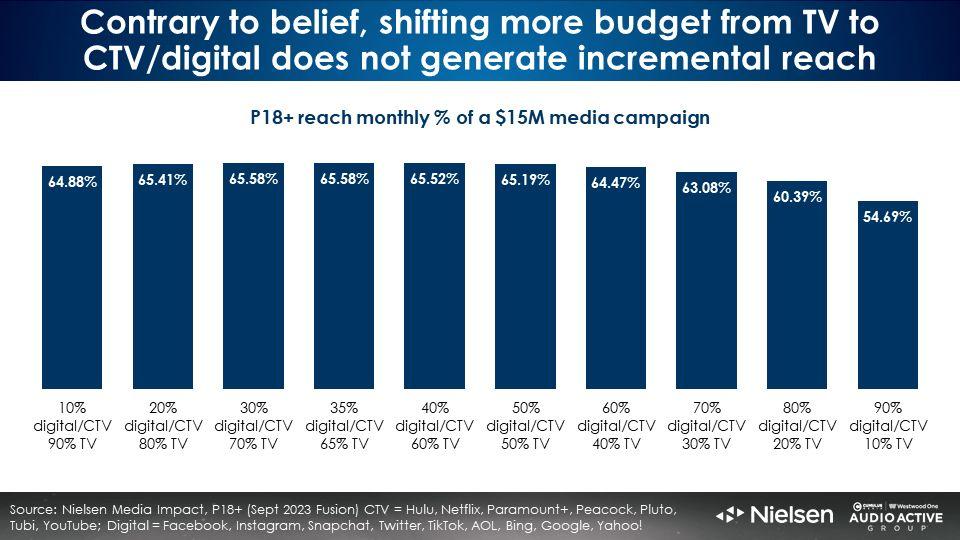

It is commonly accepted that increasing connected TV’s portion of the media plan can solve for linear TV’s audience erosion. Nielsen conducted an analysis to test this theory.

Nielsen examined a buy consisting of 90% linear TV and 10% CTV and digital. The monthly reach achieved was 65%. Then the mix of linear TV was reduced and the CTV and digital allocation was increased by 10% increments.

Dialing up CTV and digital does not grow reach! Shifting the mix of CTV and digital all the way up to 60% and reducing the linear TV allocation down to 40% did not achieve any reach lift. Monthly campaign reach remains at 65%.

Increasing the allocation of CTV and digital to 70%, 80%, or even 90% actually causes reach to drop.

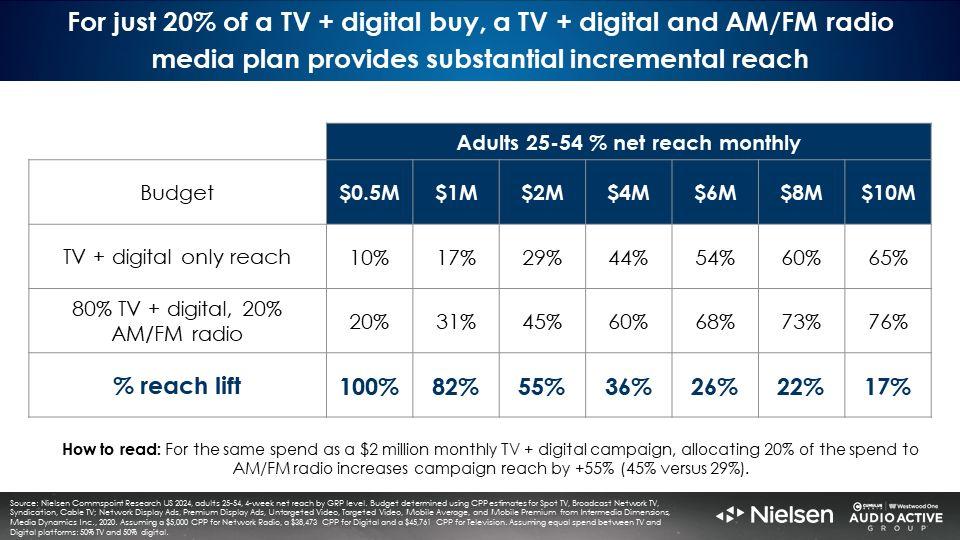

Regardless of the size of your media budget, adding AM/FM radio to a digital/TV plan sharply builds reach

Via Nielsen Commspoint, the media allocation planning tool, a wide range of monthly digital/TV media plans were examined. Very small, light, medium, and heavy campaigns were examined. The lightest digital/TV campaign reached 10% of the market. The heaviest reached 60%.

Then a 20% allocation of AM/FM radio was introduced. The results were stunning.

Across the seven monthly campaigns, from the lightest to the heaviest, the addition of AM/FM radio generated significant lifts in reach. Shifting 20% of the lightest TV/digital campaign to AM/FM radio caused reach to double.

Introducing the 20% allocation of AM/FM radio to medium-sized campaigns causes reach to soar by 36% to 55%. Even the heaviest TV and digital campaign saw reach grow 20% with the addition of AM/FM radio to the plan.

Why is AM/FM radio such a powerful addition to the media plan? AM/FM radio ratings are bigger than TV

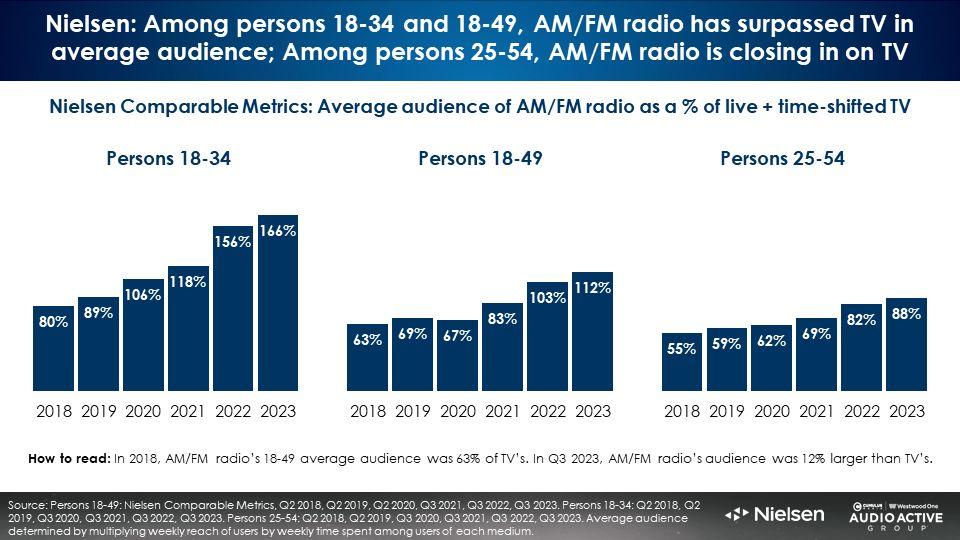

The just released Q3 2023 Nielsen Comparable Metrics reveals startling news.

AM/FM radio beats TV by 66% among 18-34s ratings and by 12% among 18-49. Based on current trends, AM/FM radio will soon overtake TV among 25-54s.

The relationship between TV and AM/FM radio average audiences has shifted dramatically in the last five years. In 2018, TV’s average audience was significantly greater than AM/FM radio across all major buying and selling demographics. Today it is a different story.

When you put AM/FM radio in the plan, you introduce a medium with larger reach and more GRPs than TV.

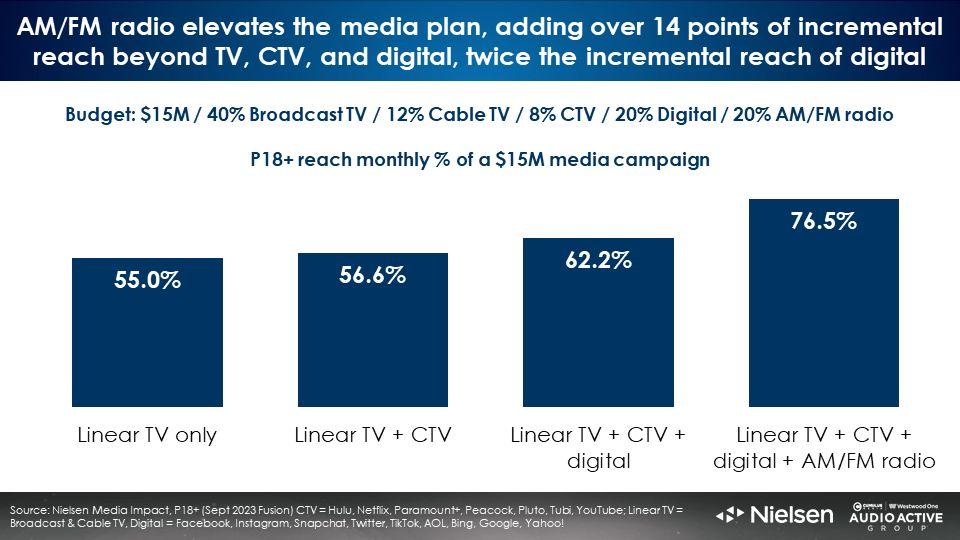

Deconstructing a media plan: AM/FM radio generates the most incremental reach, twice that of digital, followed by digital; CTV adds very little reach

Nielsen Media Impact can pull apart a media buy to understand the incremental reach contribution of each element of the plan.

The addition of CTV to the base linear TV buy only adds one point of reach. The digital overlay does better, adding six reach points.

The addition of AM/FM radio caused reach to surge by 14 points. AM/FM radio generates more than twice the incremental reach of digital.

AM/FM radio (not CTV) is the secret to reaching America’s light TV viewers

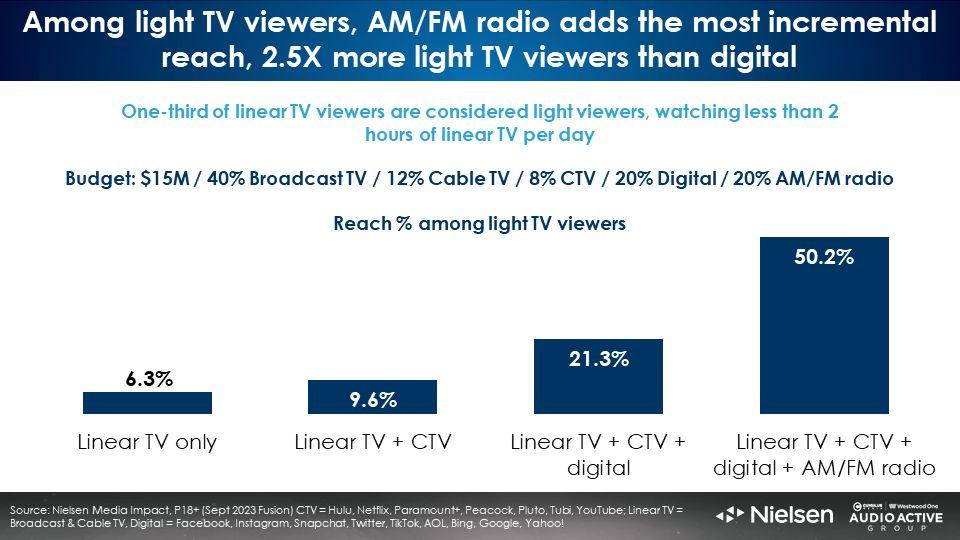

According to Nielsen Comparable Metrics, 40% of 18-49 Americans are not reached by live and time-shifted TV in a week. To examine the best way to reach light/non-TV viewers, Nielsen Media Impact examined the reach accumulation of a standard media plan. Nielsen defines light TV viewers as the one-third of America who spend less than two hours a day with TV.

A wise media planner one said, “You cannot solve your light TV viewer problem by buying more TV.” TV is highly ineffective at reaching light TV viewers.

- The TV portion of a media plan with a 52% TV allocation only reaches 6% of the U.S. light TV viewers.

- The addition of connected TV only adds three incremental reach points.

- The digital overlay generates twelve points of addition reach among light TV viewers.

- The addition of AM/FM radio generates an astounding 29 points of incremental reach among light TV viewers! AM/FM radio generates 2.5X more reach than digital.

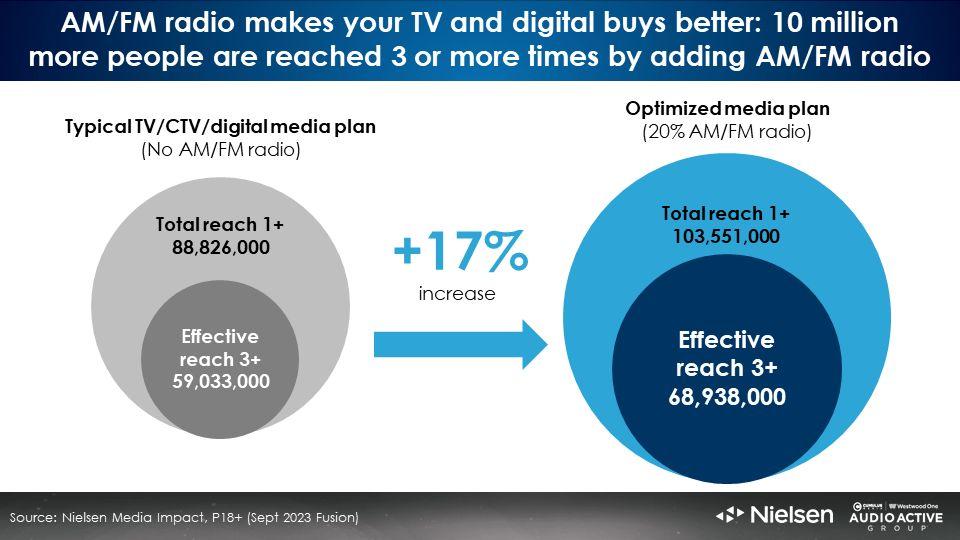

The addition of AM/FM radio generates a 17% increase in 3+ reach

Marketing effectiveness gurus tout the value of reach, exposing a consumer at least once with an ad campaign. There is evidence that exposing consumers three or more times is even more effective. 3+ exposures has been dubbed “effective reach.”

Steve Marx, the legendary media sales trainer, created a concept called the Optimum Effective Schedule (O.E.S.), which generates large numbers of consumers reached three or more times by AM/FM radio campaigns.

Nielsen examined the effective reach of a TV, CTV, and digital media plan. They then studied the 3+ effective reach delivery of the same media budget with a 20% allocation to AM/FM radio.

The outcome? Shifting 20% of the media plan to AM/FM radio generates an eye-popping +17% increase in 3+ effective reach for the same budget.

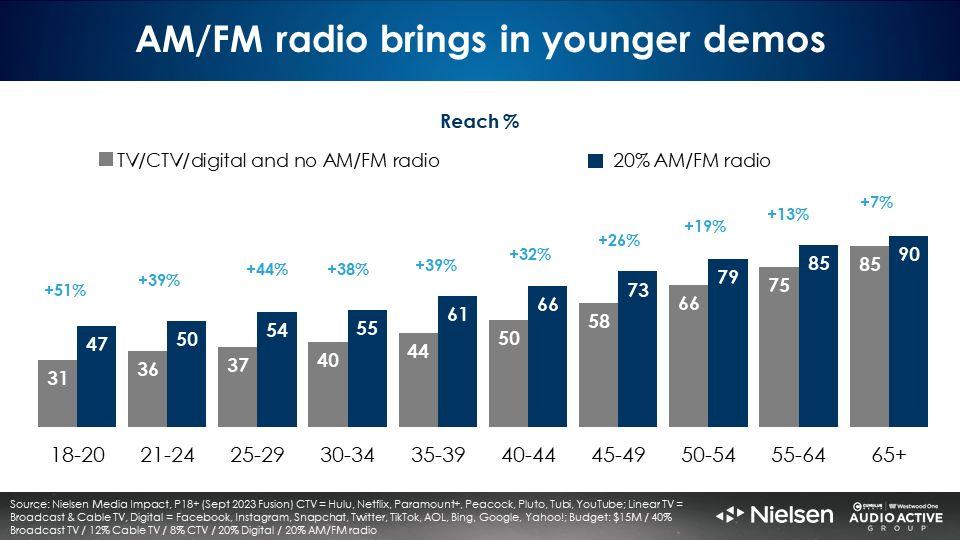

Adding AM/FM radio to the plan generates reach lift in younger demographics

One of AM/FM radio’s superpowers is generating massive reach lift among light TV viewers. AM/FM radio’s other superpower is generating impressive reach growth among younger demographics.

The grey bars below represent the reach of the TV/CTV/digital media plan among ten discrete age groups. Plans with a heavy concentration of linear TV skew old. The grey bars do not include any AM/FM radio.

The blue bars represent the demographic reach of the media plan that includes a 20% allocation to AM/FM radio with the same budget. The younger the demographic, the greater the reach lift generated by AM/FM radio.

On average, AM/FM radio generates:

- +45% reach lift among 18-24s

- +42% reach increase with 25-34s

- +35% reach growth among 35-44s

- +29% reach lift with 45-54s

Key takeaways:

- The same TV/CTV/digital buy from the prior year delivers 12% less reach.

- Contrary to belief, shifting more budget from TV to CTV/digital does not generate incremental reach.

- With just a 20% share shift, AM/FM radio elevates the digital/TV media plan with significant incremental reach growth.

- Nielsen: Among persons 18-34 and 18-49, AM/FM radio has surpassed TV in average audience. Among persons 25-54, AM/FM radio is closing in on TV.

- The addition of AM/FM radio to the media plan generates massive incremental reach among light TV viewers and young demos.

Recommendations:

- Don’t be fooled – “CTV hope” is not a strategy: Assuming CTV can solve for all of your linear TV woes is a fool’s errand. CTV adds surprisingly small amounts of incremental reach to the base linear TV buy, especially among light TV viewers.

- Be real – Digital adds modest amount of reach: A 20% allocation of digital generates six points of incremental reach to the base linear TV/CTV buy.

- Shift 20% of the media plan to AM/FM radio and watch campaign reach soar: AM/FM generates 14 points of incremental reach, 2X that of digital. The addition of AM/FM radio to the media plan generates a significant reach lift among light TV viewers and younger demographics.

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.