Auto Aftermarket Retailers: New Study Reveals AM/FM Radio And Podcasts Are Ideal To Reach Auto Parts Shoppers

Click here to view an 18-minute video of the key findings.

Click here to download a PDF of the full deck.

The Cumulus Media | Westwood One Audio Active Group® commissioned MARU/Matchbox to conduct the sixth installment of a comprehensive auto aftermarket category study to determine the current state of America’s auto parts retailers. 805 auto parts shoppers were surveyed in August 2023.

Key segments: Do-it-yourselfers and ultra-heavy auto parts shoppers

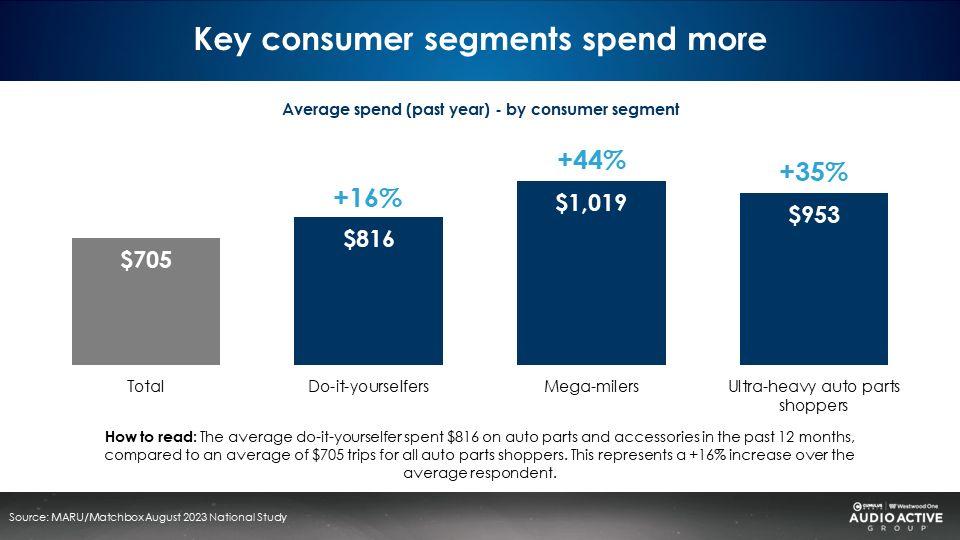

In the last year, Americans who shop at auto aftermarket retailers spent an average of $705. Do-it-yourselfers spend +16% more than the average. Mega-milers who clock 200+ miles in their vehicles a week spend +44% more on auto parts than the average.

Ultra-heavy auto parts shoppers have made 10+ shopping trips in the past two years. At $953, they spend +35% more than the norm.

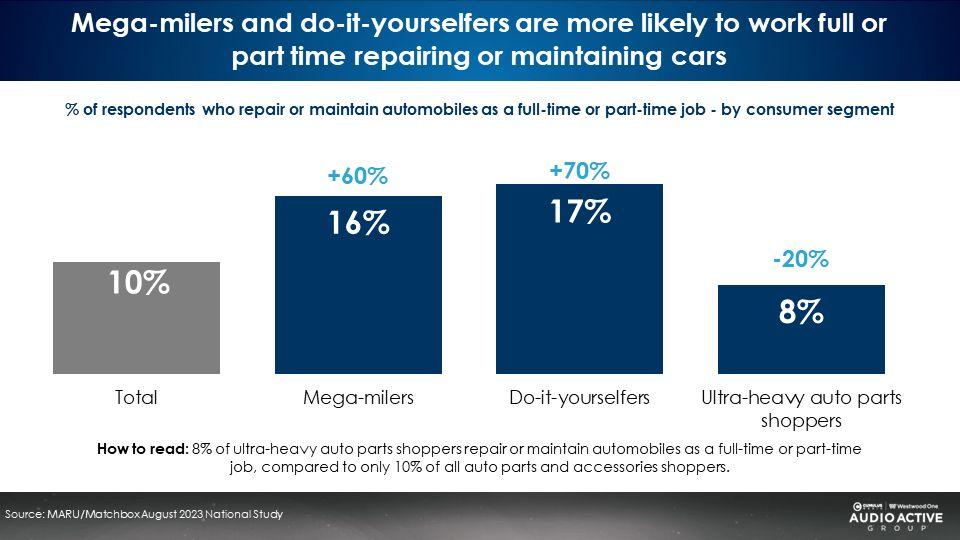

Pros represent 16% of mega-milers and 17% of do-it-yourselfers

Among those who shop in the auto aftermarket category, 10% say they repair cars full time or part time. Those who repair or maintain cars full time or part time represent one out of six of do-it-yourselfers and one out of six mega-milers. Pros would be an ideal media target.

Media scorecard: AM/FM radio and podcasts are the ideal platforms to advertise auto aftermarket

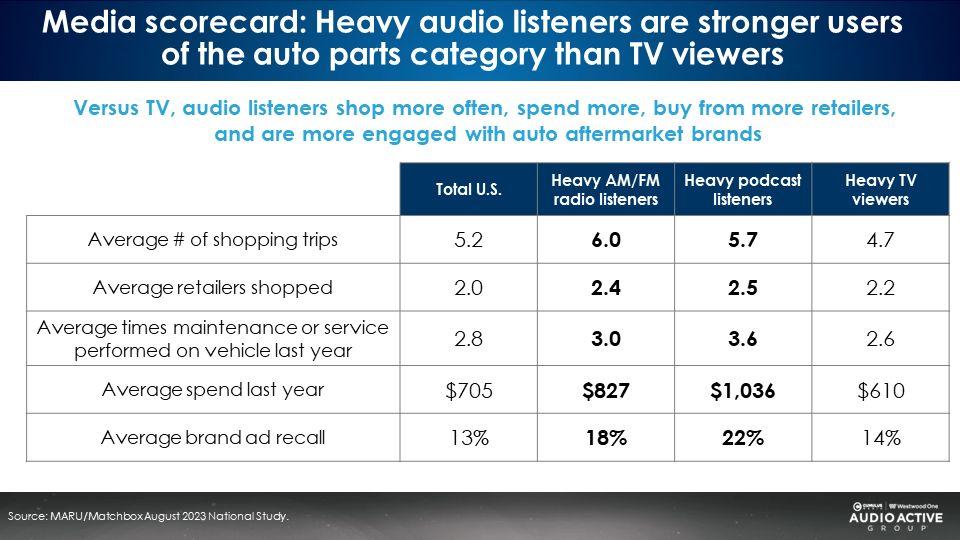

Heavy AM/FM radio listeners and podcast listeners visit more retailers, make more shopping trips, and spend more annually in the auto parts category.

Compared to heavy TV viewers, audio listeners:

- Shop more often

- Shop more auto parts retailers

- Have maintenance or service performed more frequently

- Spend more each year

- Exhibit higher retailer ad recall

AM/FM radio and podcasts are the soundtrack of the American worker. Heavy audio users over index on children and working full time. As such, they spend far more on auto parts than TV viewers. Conversely, TV is the soundtrack of America’s retirees, or as one observer wryly noted, “TV is what’s playing in God’s waiting room.”

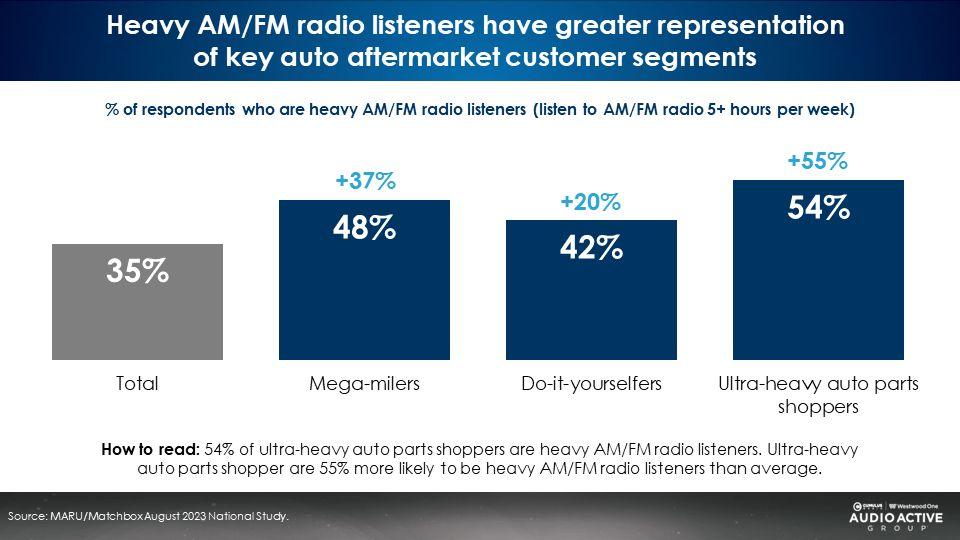

The biggest auto parts customers are far more likely to be heavy AM/FM radio listeners

The three key consumer segments (mega-milers, do-it-yourselfers, and ultra-heavy auto parts shoppers) are more likely to be heavy AM/FM radio listeners:

- Ultra-heavy auto parts shoppers, those who made 10+ shopping trips in the past two years, are +55% more likely to be heavy AM/FM radio listeners

- Do-it-yourselfers are +20% more likely to be heavy AM/FM radio listeners

- Mega-milers are +37% more likely to be heavy AM/FM radio listeners

Time spent in the car powers AM/FM radio listening and the need for auto parts

As time spent in the car grows, so does the need for car maintenance and auto parts. As such, the heaviest AM/FM radio listeners are the biggest auto parts shoppers. AM/FM radio is endemic to the auto parts category.

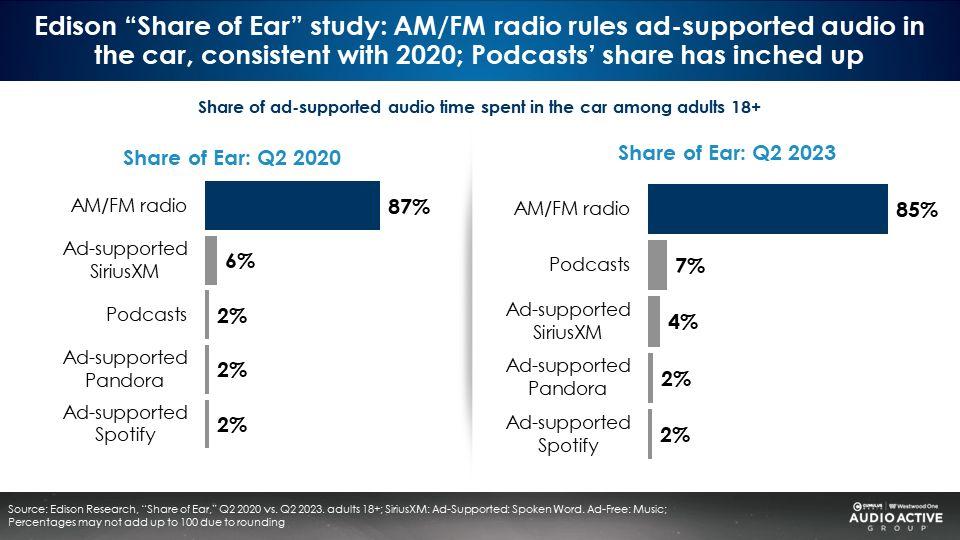

In the car, AM/FM radio is the “queen of the road” with a stunning 85% share of ad-supported audio

Edison Research’s Q2 2023 “Share of Ear” report reveals AM/FM radio has a dominant share of in-car ad-supported audio, unchanged from Q2 2020. AM/FM radio is the perfect platform to reach heavy auto parts purchasers when they are in the car and their thoughts turn to car maintenance.

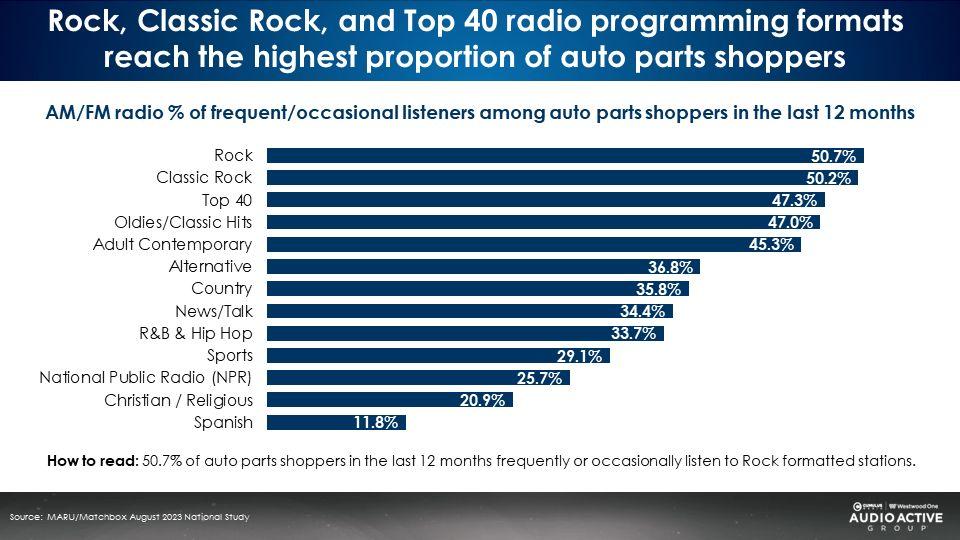

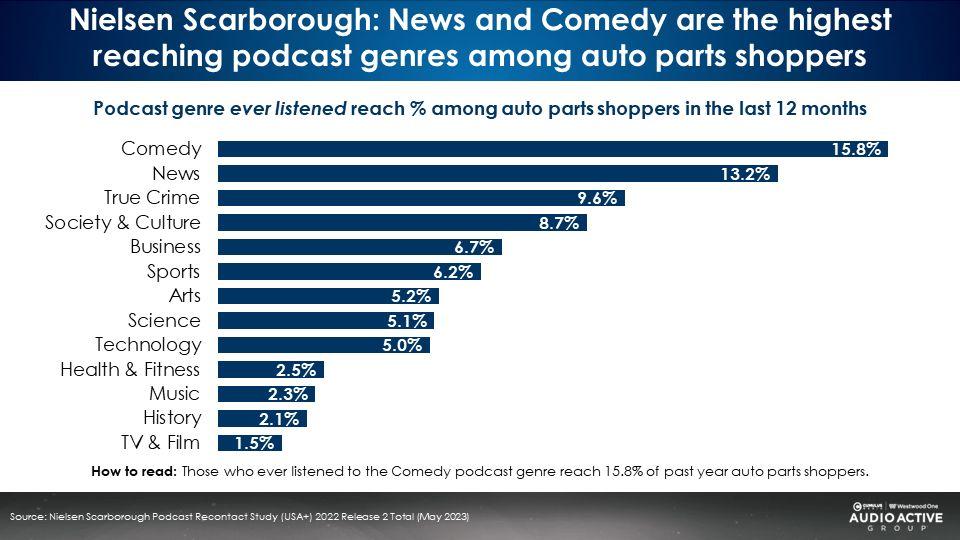

A wide variety of AM/FM radio programming formats and podcast genres generate strong reach with auto parts purchasers

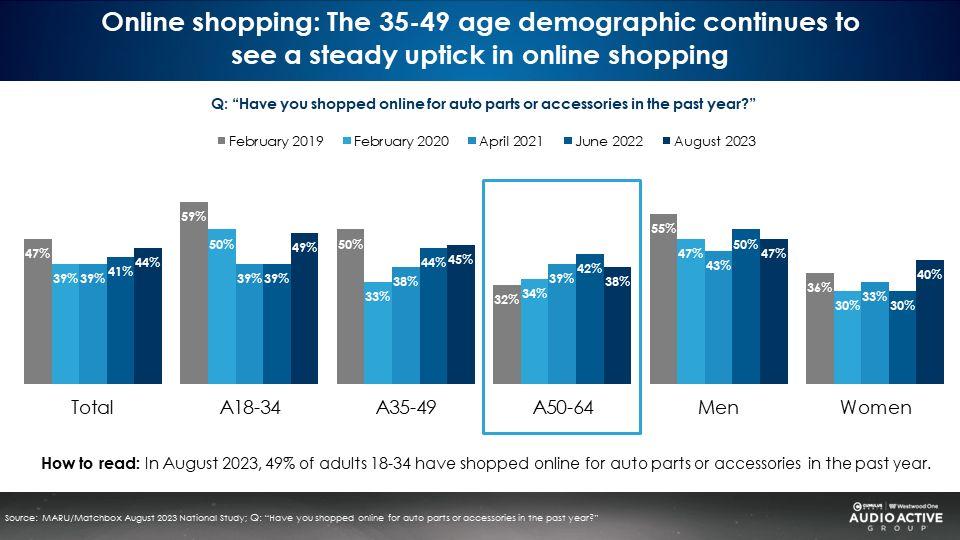

The pandemic disruption in online auto parts shopping is receding

Among 18-49s, the proportion who shop online for auto parts in the last year almost recovered to pre-pandemic levels. Among 50-64s, online shopping has been steadily growing over the last five years.

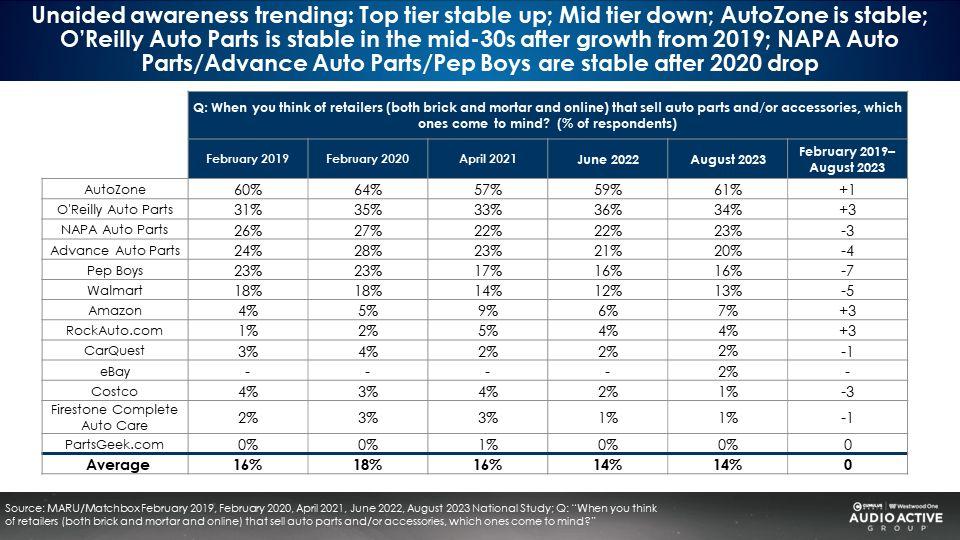

Unaided awareness trends: The top tier brands are stable to up; Mid-tier brands are down

Unaided awareness is captured by asking consumers to name all the brands in a category they can think of without any help. This is the most difficult brand measure to build. It is also the most important measure for a brand.

Jeremy Bullmore, former Chairman of J. Walter Thompson London and Non-Executive Director of WPP says, “Of all the properties that a strong brand needs, simple familiarity must top the list. Familiarity implies trust, reassurance – even affection. Familiarity is acquired and maintained directly through experience and remotely through communications.”

Over the last five years, AutoZone has led the auto parts sector in unaided awareness. Year in and year out, six out of ten auto parts shoppers are able to name AutoZone unprompted.

Next is O’Reilly Auto Parts, who has grown its unaided awareness three points over the last five years to 34%. The next three brands – NAPA Auto Parts, Advance Auto Parts, and Pep Boys – have seen unaided awareness losses since 2019.

Unaided awareness is also referred to as “mental availability.” Marketing effectiveness czarina Karen Nelsen-Field says, “Mental availability measures the likelihood of your brand coming to mind, compared to competitors, when a purchase occasion arises. It is a metric that is closely related to market share change, both growth and decline, and is widely accepted by marketers as an indicator of brand strength.”

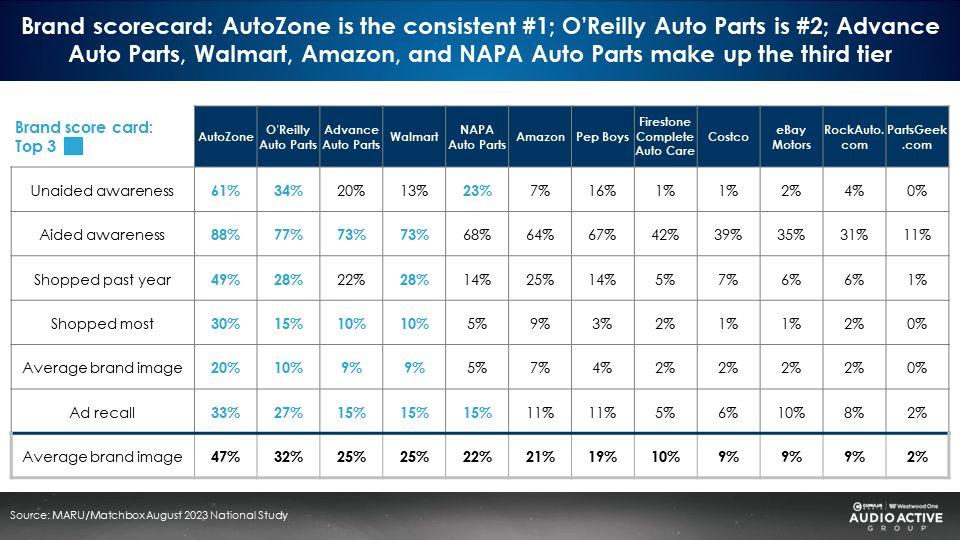

Auto aftermarket brand score card

The scorecard below details key 2023 brand equity metrics (awareness, purchase, brand image, ad recall) down the left. Auto parts retailers are indicated left to right across the top.

The magnitude of a brand’s unaided awareness is a key driver for brand images and shopping behavior.

Ty Heath from the B2B Institute says, “The brand that’s remembered is the brand that is bought. The goal is not to create a lead, the goal is create a memory. Lead generation is short term. Memory generation is long term. Win the mind to win the market. Mind share = market share.”

Key findings:

- Consistent trends: Across the last four years, brand equity and shopping patterns for the top two performers (AutoZone and O’Reilly Auto Parts) are stable to up. Mid-tier players have seen erosion since 2020. Ad spend pull backs have long term effects.

- AM/FM radio and podcasts are the ideal platforms to advertise auto aftermarket. TV underperforms with category usage and brand equity: Heavy AM/FM radio and podcast listeners visit more retailers in the category, make more shopping trips, and spend far more than the average. Two key consumer segments, do-it-yourselfers and ultra-heavy shoppers, are more likely to be heavy AM/FM radio listeners. TV viewers are weak category users.

- Brand metrics among online retailers have remained relevant but have stalled: In early incarnations of the study, the brand equity growth of online retailers implied they would continue to expand and would impact traditional retailers. In reality, AutoZone and O’Reilly Auto Parts have maintained their stronghold at the top of the category.

- Brand opportunity: 20% of category shoppers cannot attribute top brand perceptions to any retailer.

- Services motivate younger demographics: 62% of adults 18-34 say maintenance or service offerings (oil changes, fluid changes, battery testing, etc.) are extremely or very influential on which auto parts and/or accessories retailer in which they choose to shop. People who take advantage of service offerings are more likely to be ultra-heavy shoppers, so this can be an effective category entry point strategy for younger demos.

Recommendations:

- Build brands too: Historically, the auto aftermarket sector heavily marketed vendor special offers. There is a significant body of marketing research that indicates “a succession of short-term response-focused (offer) campaigns will not succeed as strongly over the longer term as a single brand-building campaign designed to achieve year-on-year improvement to business success.” (Binet & Field)

- Online shopping should be promoted: Consumers have transitioned to a blend of retail and online shopping for their auto parts needs, with 41% of consumers using both traditional and online retailers. Legacy brands must continue to market their online platforms to consumers.

- Market service offerings: 62% of adults 18-34 say service offerings are extremely or very likely to influence where they choose to shop. Promotions centered around service offerings can entice younger demographics to come into the store and be converted into long-term customers.

- Maintain AM/FM radio as the centerpiece of the media plan. Podcasts show promise: AM/FM radio is the “engine” of auto aftermarket sales. Nielsen determined AM/FM radio generates $21 of return in advertising spend for every dollar invested in AM/FM radio ads. Key auto aftermarket segments (mega-milers, do-it-yourselfers, and ultra-heavy auto parts shoppers) are heavy users of AM/FM radio. A reallocation of TV budgets to audio is a smart strategy to target heavy category users.

Creative recommendations:

- Emotion-based creative drives the strongest business outcomes: Research by the two godfathers of marketing effectiveness, Les Binet and Peter Field, finds that sales and profit growth are generated by emotion-based ads that “create positive feelings and associations” that are “interesting and enjoyable.”

- Shift creative to become more entertaining and emotion based: Les Binet says, “In order to really build strong brands, you’ve got to start preparing consumers long before they even start thinking about the product or the purchase. That means engaging them when they’re not interested in what you have to say, when they are not thinking about the product, when they have no need to be satisfied. So you can only do that by engaging them with things that are intrinsically interesting at a human level and that will be remembered for a very long time. So emotion is the most powerful selling tool we have.”

- “Entertain for business gain” urges Orlando Wood from System 1: In his book, Why Does The Pedlar Sing? What Creativity Really Means In Advertising, Paul Feldwick says: “I would like to encourage all those who work in advertising and brand management to suspend their “delicate feelings” about what really creates popularity and fame, and to embrace the idea that advertising is at least as much showmanship as it is salesmanship. It is time to rediscover the fact that advertising builds brands best when it is entertaining, popular, and memorable, when it is not just a pitch, but a performance.”

Click here to view an 18-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.