Upwave Brand Effect Case Study: Cumulus AM/FM Radio Station Stream Takeover Grows Awareness, Ad Recall, And Purchase Intent For A Shoe Brand

Click here to view an 8-minute video of the key findings.

Since 2016, AM/FM radio audio streaming has grown to be a major media channel available for marketers and brands. Two recent studies from Edison Research both reveal streaming’s strength in reach and time spent listening.

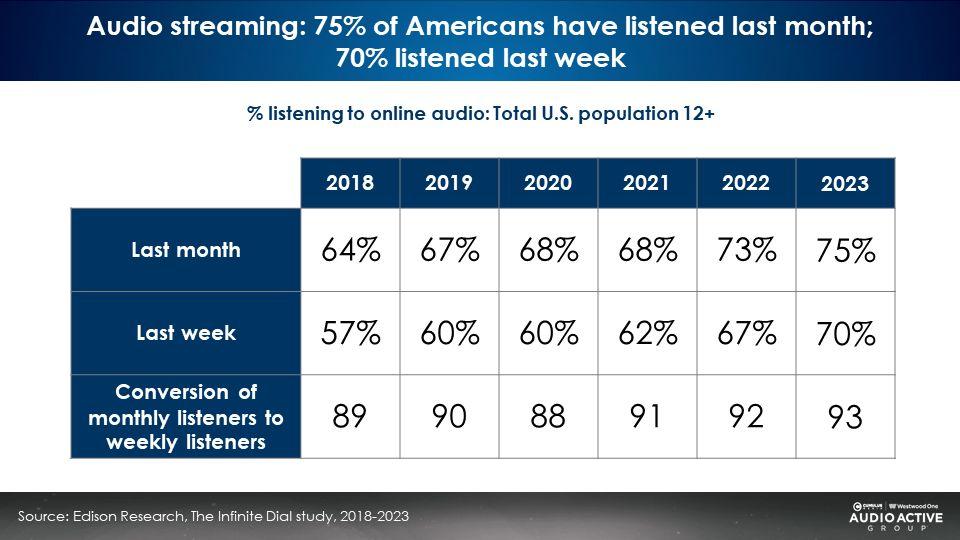

Edison Research’s Infinite Dial study: Advertisers can use audio streaming to reach a growing audience of habituated users

Compared to 2021, monthly and weekly online audio audiences have leapt forward. 75% of Americans have listened to audio streaming in the last month. 70% have listened in the last week, up from 2022’s 67%.

Edison Research’s “Share of Ear” study reveals AM/FM radio streaming has soared to 20% of all 25-54 AM/FM radio listening. This is a dramatic increase from 2016 when streaming only represented 8% of total AM/FM radio listening.

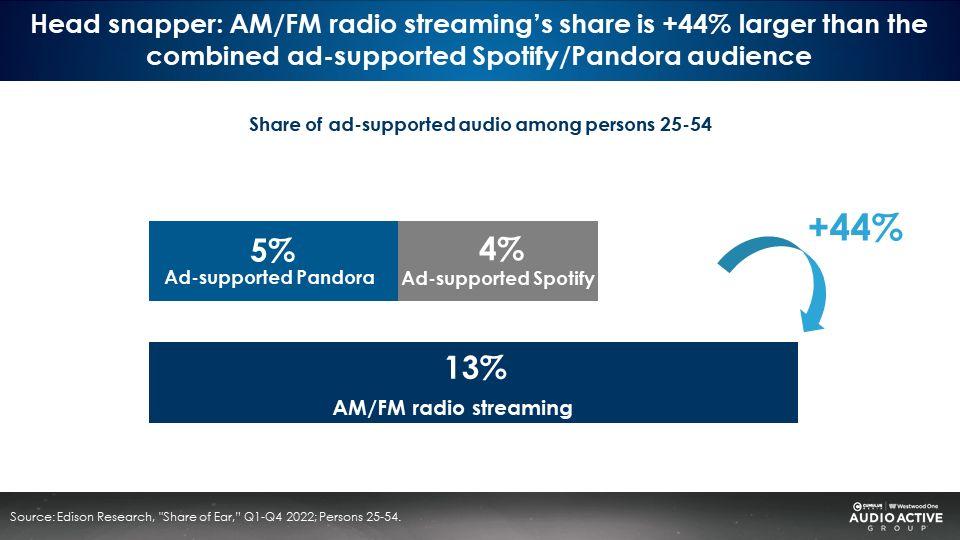

Head snapper: AM/FM radio’s 25-54 streaming audiences are +44% larger than ad-supported Spotify and Pandora combined

Edison’s Q4 2022 “Share of Ear” study reveals a surprising finding about the magnitude of AM/FM radio streaming. Among 25-54s, the ad-supported audiences of Pandora (5%) and Spotify (4%) are quite small. AM/FM radio’s streaming share of 13% is +44% larger than Pandora and Spotify combined.

Case study: Cumulus AM/FM radio station stream takeover works for a shoe brand

A popular shoe company that targets men ran an AM/FM radio streaming takeover of nearly 400 Cumulus AM/FM radio stations in December 2022. Takeovers are high intensity campaigns which feature the shoe brand as the exclusive pre-roll for every occasion of listening on all Cumulus AM/FM radio station streams. The shoe brand’s campaign garnered 8.5 million impressions across 398 AM/FM radio station streams.

The Cumulus Media | Westwood One Audio Active Group® commissioned brand lift measurement leader Upwave to conduct a study in order to understand the brand effect of the campaign. Upwave placed a pixel on the shoe brand’s streaming audio ad via the Triton ad sever. Responses among those exposed to the ad were compared to those consumers not exposed to the campaign. Lift in key brand equity measures represent the difference between those exposed and those not exposed.

Here are the key findings:

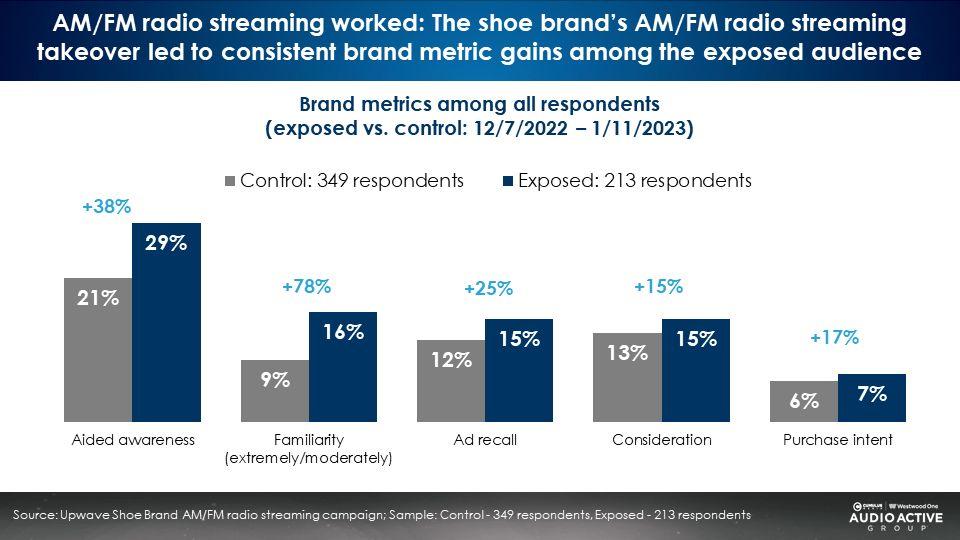

AM/FM radio streaming worked: The shoe brand’s AM/FM radio streaming takeover led to consistent brand metric gains among the exposed audience

Those who were exposed to the shoe brand’s AM/FM radio streaming takeover saw +38% greater aided awareness, +78% greater familiarity, +25% greater ad recall, +15% greater consideration, and +17% higher purchase intent compared to those who did not hear the campaign.

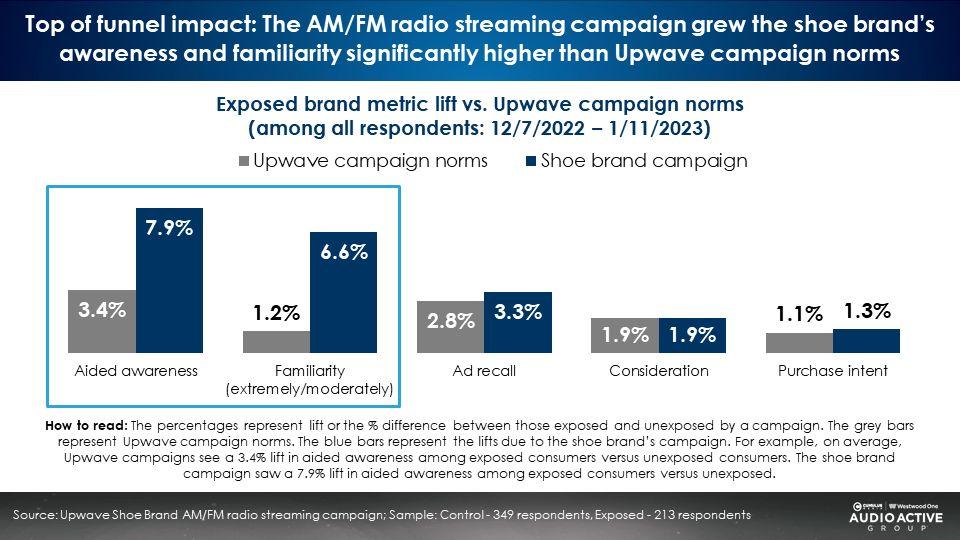

Compared to Upwave campaign norms, the shoe brand’s AM/FM radio streaming campaign drove significantly higher lift in top of funnel metrics

The shoe brand’s AM/FM radio streaming campaign worked. Lift, or the percentage difference between those exposed and unexposed by a campaign, was higher with the shoe brand’s campaign.

The lift in aided awareness (7.9%) and familiarity (6.6%) in particular saw spikes far greater than the average Upwave campaign.

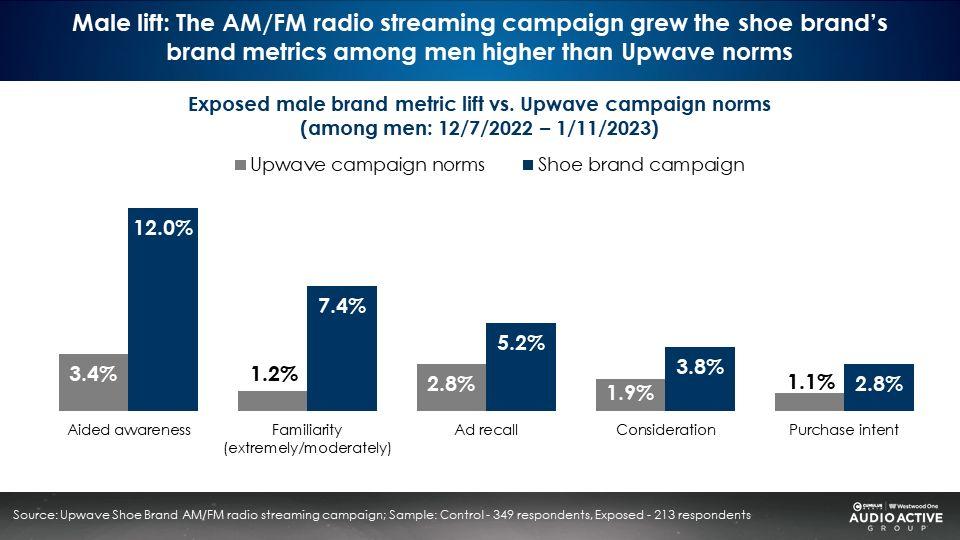

The shoe brand’s campaign was successful among their male target demographic with greater lift levels across all brand metrics versus Upwave campaign norms

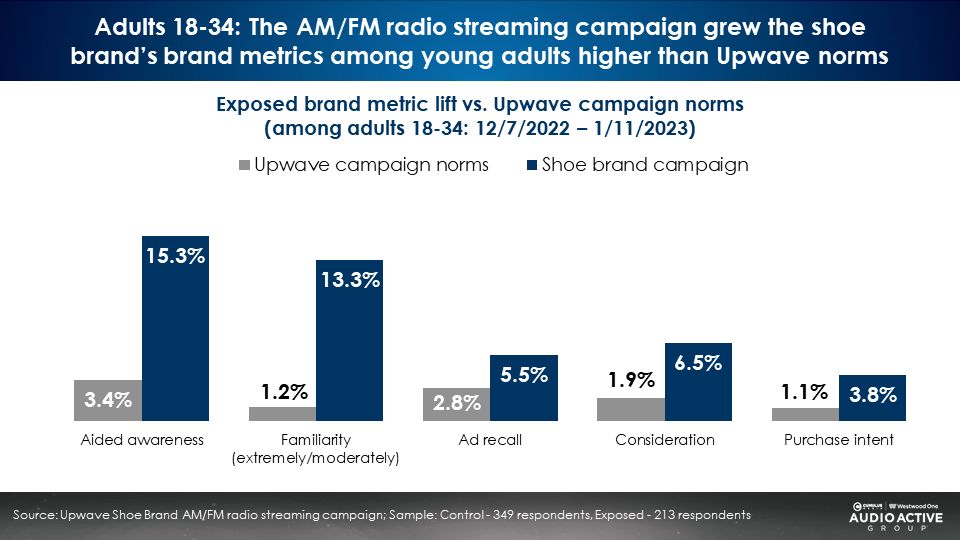

Millennial 18-34s saw higher levels of brand metric lifts versus Upwave campaign norms for the shoe brand

Younger consumers experienced higher levels of aided awareness (15.3%), familiarity (13.3%), ad recall (5.5%), consideration (6.5%), and purchase intent lift (3.8%) compared to the typical campaign.

The shoe brand’s campaign utilized effective creative and was well targeted as the brand metric growth among men 18-34 aligned with the intended consumer demographic.

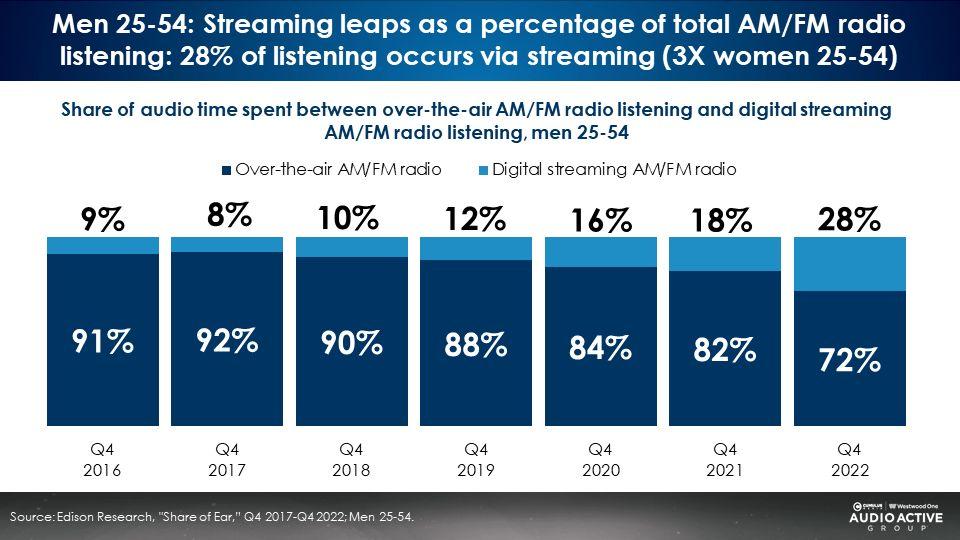

Edison: A whopping 28% of men 25-54 AM/FM radio listening occurs via the stream, nearly three times the proportion of women 25-54

For the shoe brand, AM/FM radio streaming was a particularly well-suited media channel. Edison’s “Share of Ear” finds men 25-54 are driving all of the growth in AM/FM radio streaming.

Since 2019, the share of men 25-54 AM/FM radio time spent going to the stream has jumped from 12% to 28%. Comparatively, women 25-54 only spend 10% of total AM/FM radio listening time with AM/FM radio streaming. This number has remained stable, hovering around 10% for the past few years.

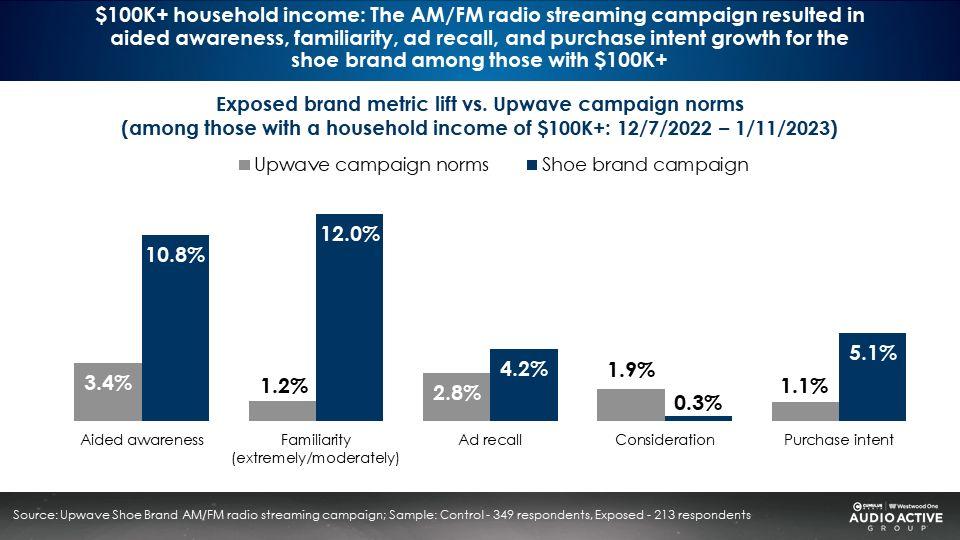

Affluent consumers (those with a household income of $100K+) saw higher lifts in aided awareness, familiarity, ad recall, and purchase intent for the shoe brand versus Upwave campaign norms

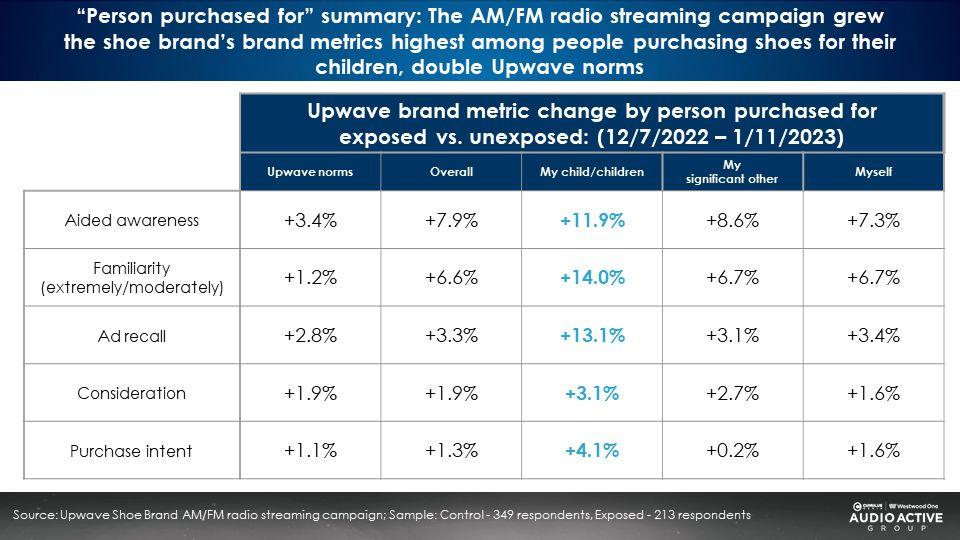

Those who were purchasing the shoe brand for their child or children saw the highest levels of brand metric lift versus Upwave norms and those purchasing for their significant others or themselves

While men 18-34 was a primary target of the campaign, the growth in brand metric lift among the “with children” group could serve as a new valuable consumer segment for the brand.

Key takeaways:

- Edison Research’s “Share of Ear” study: AM/FM radio streaming has soared to 20% of all 25-54 AM/FM radio listening

- Head snapper: AM/FM radio’s 25-54 streaming audiences are +44% larger than ad-supported Spotify and Pandora combined

- AM/FM radio streaming worked: The shoe brand’s AM/FM radio streaming takeover led to consistent brand lift gains among the exposed audience

- Compared to Upwave campaign norms, the shoe brand’s AM/FM radio streaming campaign drove significantly higher lift in top of funnel metrics

- The shoe brand’s campaign was successful among their male target demographic with greater lift levels across all brand metrics versus Upwave campaign norms

- Millennial 18-34s saw higher levels of brand metric lifts versus Upwave campaign norms for the shoe brand

- Edison: A whopping 28% of men 25-54 AM/FM radio listening occurs via the stream, nearly three times the proportion of women 25-54

- Affluent consumers (those with a household income of $100K+) saw higher lifts in aided awareness, familiarity, ad recall, and purchase intent for the shoe brand versus Upwave campaign norms

- Those who were purchasing the shoe brand for their child or children saw the highest levels of brand metric lift versus Upwave norms and those purchasing for their significant others or themselves

Click here to view an 8-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.