59 Tier One Automotive Brand Case Studies: AM/FM Radio Generates Significant Brand Awareness, Consideration, And Purchase Intent

Click here to view a 14-minute video of the key findings.

Independent data analysis agency Colourtext and Radiocentre, the UK commercial AM/FM radio industry group, recently released the largest and most comprehensive AM/FM radio ad effectiveness report ever conducted. Big Audio Datamine encompasses 1,002 campaigns for 463 brands covering 14 sectors.

As part of this massive study, 59 tier one auto campaigns were measured for brands like Toyota, Honda, Land Rover, BMW, VW, Nissan, Volvo, Lexus, and Jaguar. These studies represent the world’s largest collection of AM/FM radio campaign effect measurement for tier one auto brands.

Tier one auto advertising describes the ads auto manufacturers air on national media, usually TV, to raise awareness and purchase consideration for their car brands. TV is often thought of first for these ads because of the assumption that people need to experience the “sight, sound, and motion” of the car.

Five key findings from the Big Audio Datamine report:

Summarizing the key takeaways from the 1,002 campaign effect studies, Colourtext and Radiocentre conclude:

- “Radio helps create future demand, increasing awareness by an average of around 50%, and building positive brand sentiment by an average of up to 32% (depending on the specific measure).

- Radio helps convert existing demand, increasing purchase consideration by 18% and stimulating online search among 21% of those who recall hearing the radio ad.

- Radio helps increase efficiency of media plans. The additional impact that radio delivers for advertisers far exceeds its average share of total media spend, enhancing efficiency of media plans, reinforcing its claim to the title of The Multiplier Medium.

- The best-performing campaigns place an emphasis on creative consistency. Campaigns that feature distinctive audio elements strongly associated with the brand – such as music, voices, straplines [slogans], brand characters, or a sonic brand device – and use them consistently within different radio executions and across media (where relevant) achieve greater effects.

- Campaigns that focus on building higher weekly reach deliver stronger effects. The most influential planning variable is weekly reach. The average uplift rate in effectiveness outcomes is significantly greater for higher-reach campaigns than for lower-reach campaigns.”

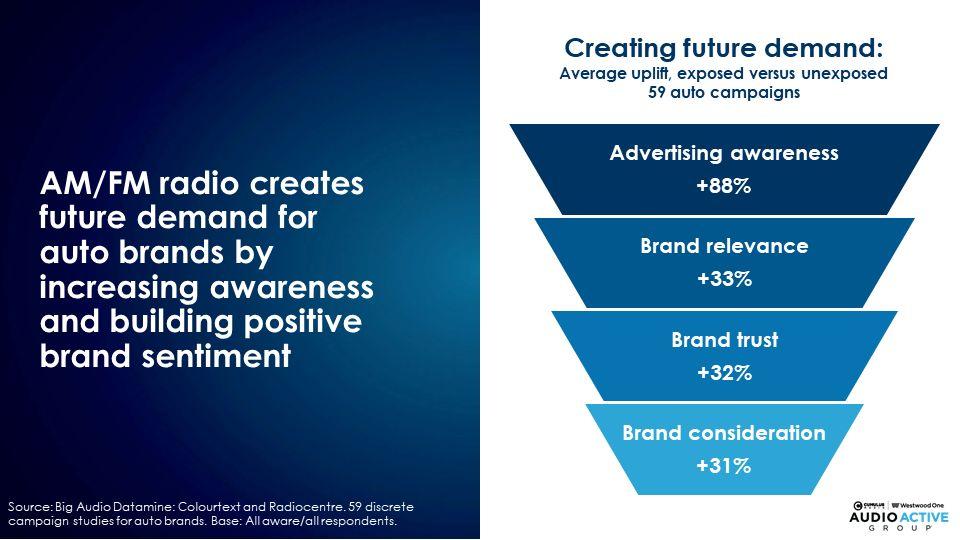

Tier one automotive brand effect: AM/FM radio advertising generates significant increases in advertising awareness, brand relevance, brand trust, and brand consideration

Across the 59 campaigns, Colourtext found AM/FM radio ads generated major impact for automotive brands:

- +88% increase in advertising awareness

- +33% lift in brand relevance

- +32% greater brand trust

- +31% growth in brand consideration

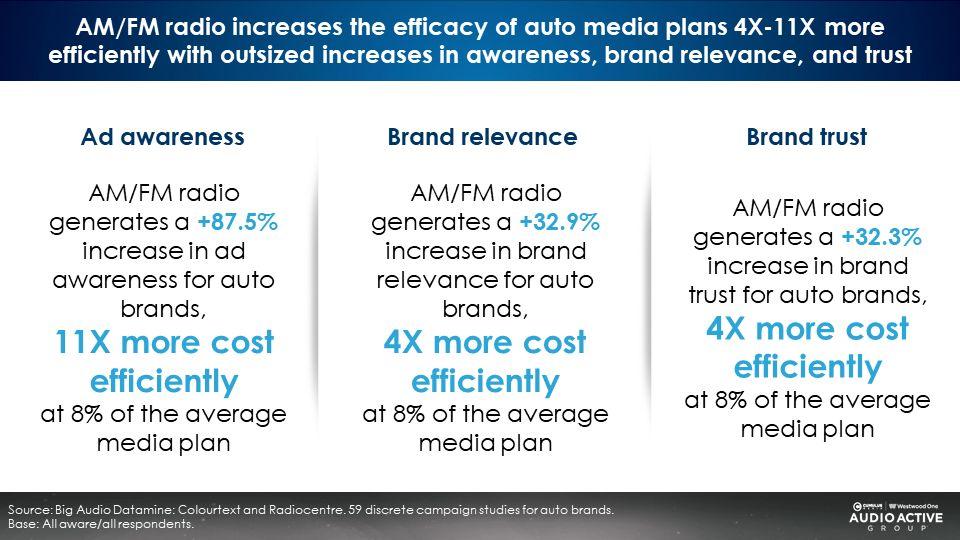

AM/FM radio increases the efficiency of automotive media plans

Colourtext and Radiocentre compared AM/FM radio’s average share of total media spend to the increase in advertising awareness, brand relevance, and brand trust generated by AM/FM radio campaigns. In each case, the auto brand lift is four to eleven times greater than AM/FM radio’s share of media spend.

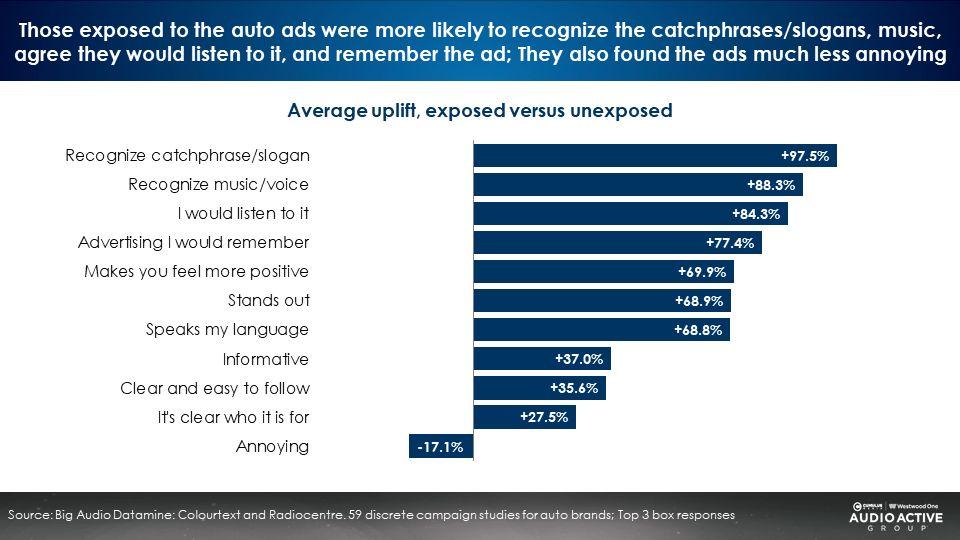

The best performing auto campaigns place an emphasis on creative consistency

Colourtext and Radiocentre looked at the difference in average ad recall, or uplift percentage, for each top creative attribute. Ad recall from campaigns with the creative attribute was compared to those that did not feature the creative attribute.

Most of the top creative attributes of auto AM/FM radio campaigns relate to consistent audio elements such as music, slogan, brand characters, or sonic brand.

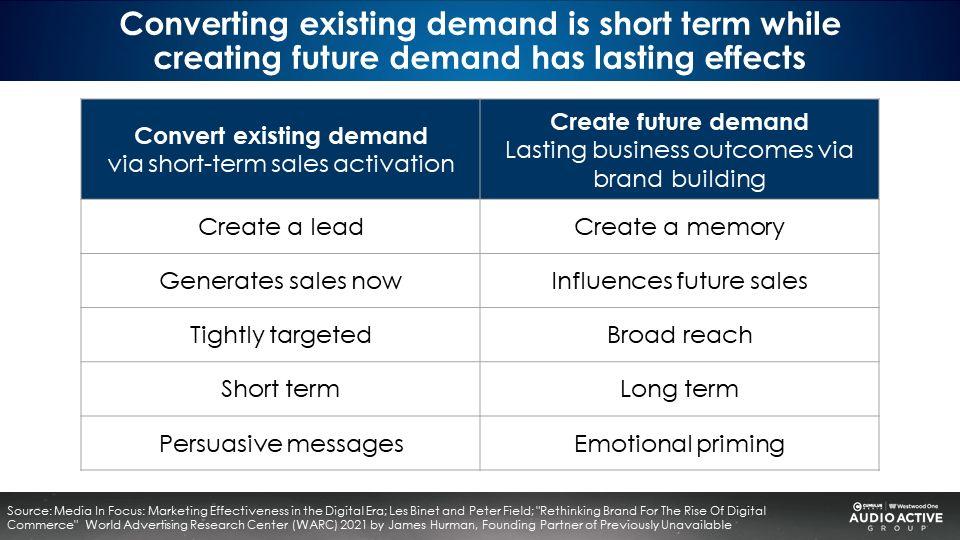

AM/FM radio creates future demand for automotive brands

Rethinking Brand for the Rise of Digital Commerce, a major new marketing effectiveness study from James Hurman, Founding Partner of Previously Unavailable, and WARC, the World Advertising Research Center, reveals marketers need to convert existing demand and create future demand. James Hurman also recently published a wonderful new book on how to create future demand entitled Future Demand: Why Building Your Brand Among Tomorrow’s Customers Is The Key To Start-Up Success.

Hurman explains creating future demand as “advertising to that much larger group of consumers who are not ready to buy now, but will be in [the] future, and making them feel familiar with and positively toward us, so that they gravitate to us when they enter the category.”

According to Hurman, the best way to create future demand is through targeting broad audiences with emotional messaging. This type of creative is meant to stand out and “create positive memories of [a] brand that will influence future purchase decisions.” AM/FM radio’s massive reach and ability to deliver emotion-based, memorable brand creative provide an ideal media platform for tier one auto brands.

Why don’t U.S. auto manufacturers use AM/FM radio to build their brands?

AM/FM radio is miscast solely as a sales activation media platform. Auto makers tell AM/FM radio broadcasters, “Our dealers love you,” implying AM/FM radio’s only use case is local dealer sales events.

AM/FM radio can also be used to build auto brands. Subaru used emotion-based storytelling brand building AM/FM radio ads very successfully, per this case study.

Les Binet and Peter Field, the godfathers of marketing effectiveness, say AM/FM radio has the necessary reach and time spent for brand building

In their seminal book, The Long and The Short of It: Balancing Short and Long-Term Marketing Strategies, Binet and Field conclude, “Radio ought to be able to generate quite strong brand effects, but in practice appears not to. This may be due to the way radio is often used in practice: as an activation channel. Radio appears to be undervalued as a potential brand-building medium.”

There is strong evidence that AM/FM radio is the ideal place for auto manufacturers to build their brands.

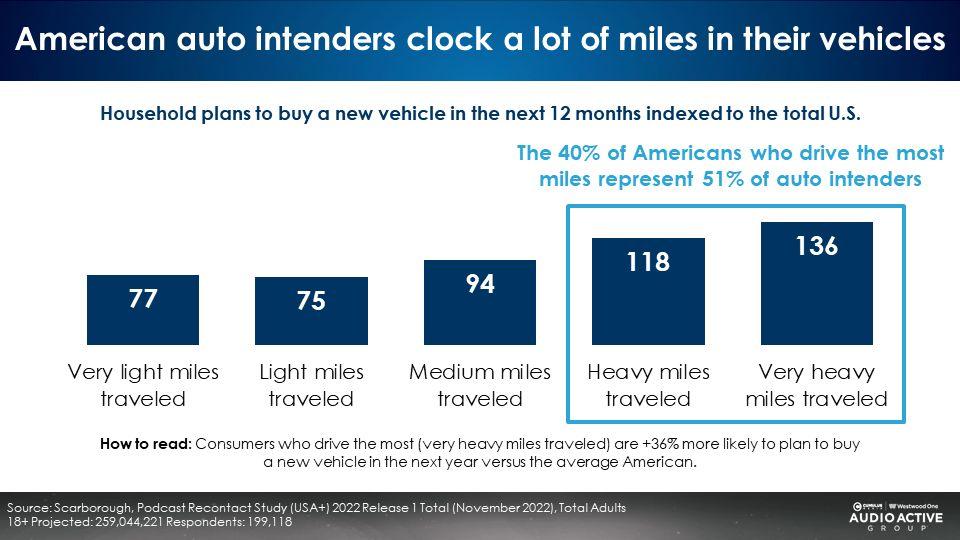

Nielsen Scarborough: American auto intenders clock a lot of miles in their vehicles

A Nielsen Scarborough study of 199,118 Americans finds new car buying intentions increase as miles traveled grows:

- Consumers who drive the most are +36% more likely to plan to buy a new vehicle in the next year.

- The next highest miles driven group is +18% more likely to purchase a new vehicle in the next year.

- Medium miles driven consumers are -6% less likely to buy a new vehicle in the next year.

- Those with light miles traveled are -25% less likely to purchase a new vehicle in the next year.

- Consumers with the very lightest miles driven are -23% less likely to make a new auto purchase in the next year.

It makes sense that people who drive a lot are much more likely to be in the market for a new vehicle. In fact, the 40% of Americans who clock the most miles represent 51% of new auto purchasers.

Which media platform attracts those who drive a lot of miles? Unsurprisingly, heavy AM/FM radio listeners clock a lot of miles in their cars and are +19% more likely to be in the market for a new vehicle in the next year!

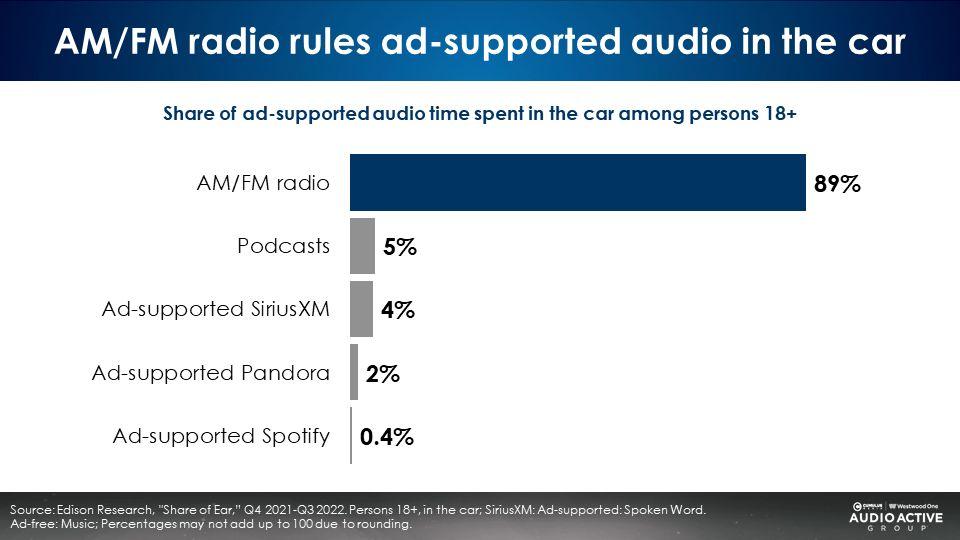

Among ad-supported audio, AM/FM radio has a dominating 89% share of in-car time spent, per Edison’s “Share of Ear” study

When it comes to trying to reach consumers in the car, AM/FM radio offers marketers a stunning 89% share of ad-supported audio in the car.

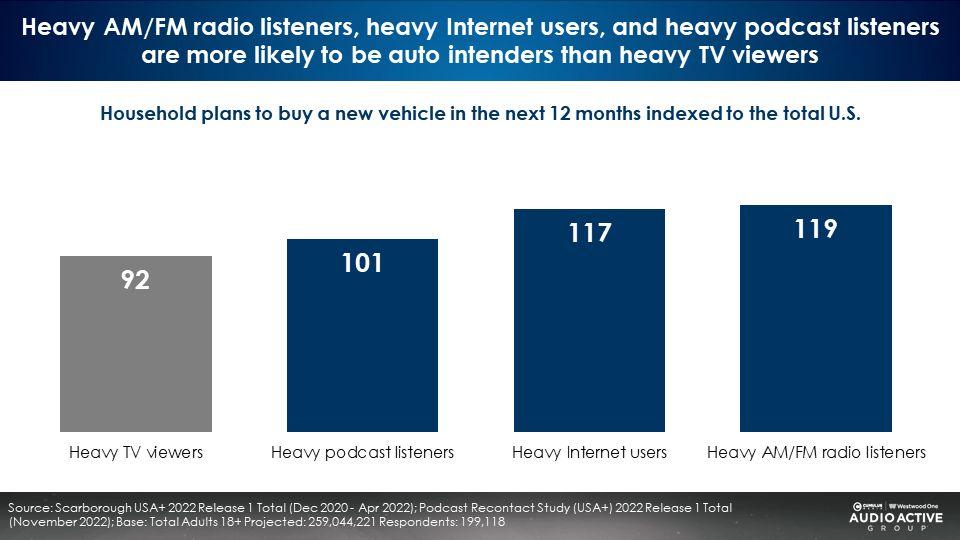

Nielsen Scarborough: Heavy AM/FM radio and digital consumers are way above the norm for auto purchase intention

Nielsen Scarborough reports that new vehicle purchase intention is highest among heavy AM/FM radio and digital users.

- Heavy AM/FM radio listeners are +19% more likely to be in the market for a new vehicle in the next year.

- Heavy Internet users are +17% more likely to be new vehicle auto intenders.

- Heavy podcast listeners’ auto purchase intentions mirror the average U.S. purchase intention.

- Heavy TV viewers are -8% less likely to be in the market for a new vehicle in the next year.

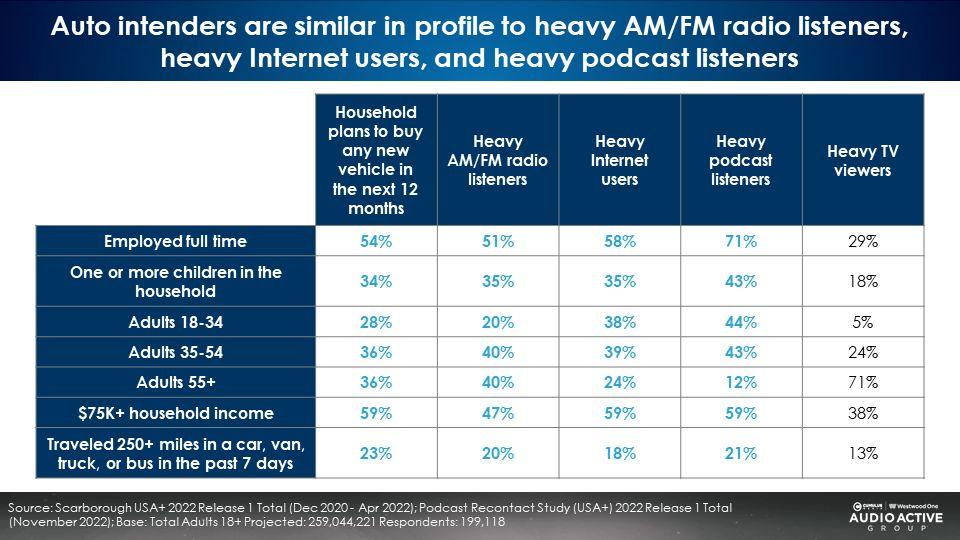

New vehicle purchasers are similar in profile to heavy AM/FM radio listeners, heavy Internet users, and podcast listeners

Nielsen Scarborough reveals the socioeconomic profile of new auto intenders mirrors the profile of heavy AM/FM radio listeners, heavy Internet users, and podcast listeners. While linear TV has a significant role in auto media plans, the TV audience profile is vastly different from auto intenders.

“But wait”, auto brands say, “TV can show the sight, sound, and motion of my car but audio cannot”

Marketers often dismiss audio advertising by noting solemnly, “We need sight, sound, and motion.” The implication: video ads generate substantially greater creative effectiveness, increased brand equity lift, and larger sales effect than an audio ad.

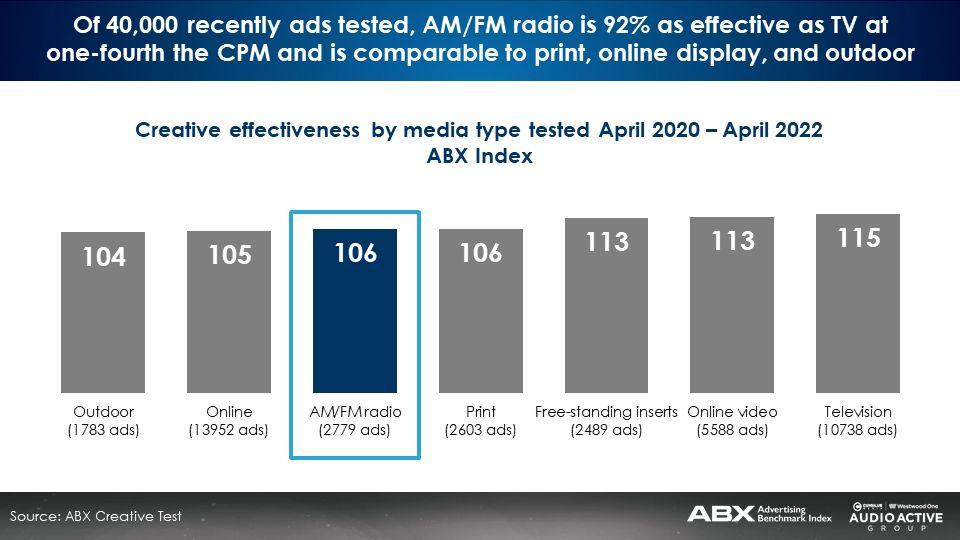

Audio vs. video: Largest ever creative effectiveness study conducted by ABX with 10,738 TV ads and 2,779 AM/FM radio ads

To determine whether “sight, sound, and motion” trumps audio ads, ABX, the leader in syndicated advertising effectiveness, examined the largest head-to-head creative study of audio and video ads. ABX has a large normative database of 365,000+ measured ads globally, from the U.S. and 13 other countries, representing 90% of global ad spend.

ABX: AM/FM radio creative effectiveness is 92% of TV at one-fourth of the CPM

If “sight, sound, and motion” are so impactful, one would think the TV ad creative effectiveness would be double that of AM/FM radio. In reality, TV advertising effectiveness is only 8% better than AM/FM radio at 4X the CPM. The findings are clear. “Sight, sound, and motion” do not represent a significantly greater creative effectiveness.

Gary Getto, President of ABX, says, “Moving some TV funds to AM/FM radio produces significantly higher reach. Often the excuse for not doing this is the need for sight, sound, and motion that TV provides and, in many cases, the lack of confidence in AM/FM radio creative’s ability to move the needle. But extensive ABX data shows that AM/FM radio can be nearly as effective as television when best practices in audio creative are followed.”

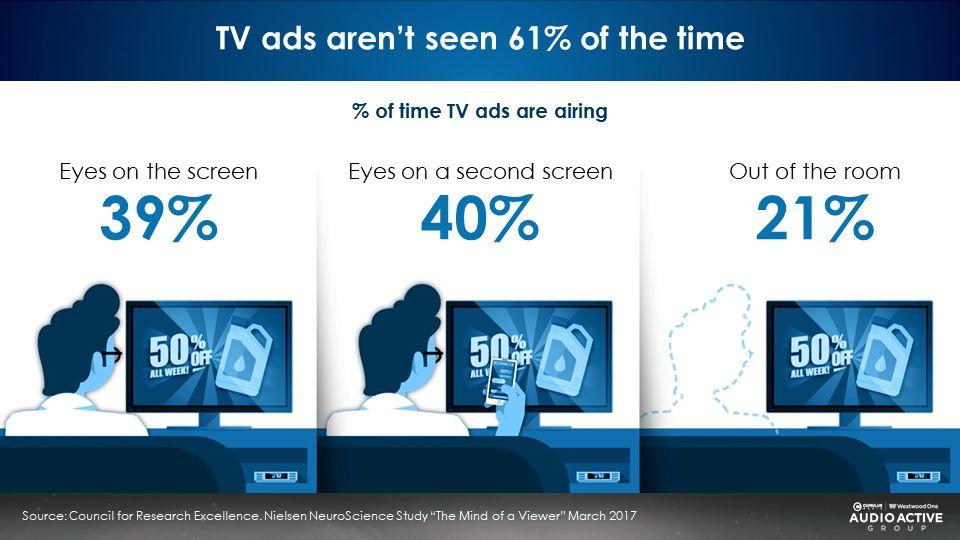

Nielsen: 61% of TV ads are not seen

Why don’t “sight, sound, and motion” TV ads significantly outperform AM/FM radio ads in creative effectiveness? A major study by Nielsen reveals a minority of TV ad impressions are “eyes on glass.” Sight, sound, and motion are rarely achieved. When TV ads are playing:

- 39% of the time the audience’s eyes are on the screen

- 40% of the time people are looking at their phone or a second screen

- 21% of the time people are out of the room

Interestingly, just as many people (40%) only hear a TV ad as those who see the ad (39%). Thus, half the time, that “sight, sound, and motion” TV ad is just an AM/FM radio ad! People can look away but they cannot shut their ears.

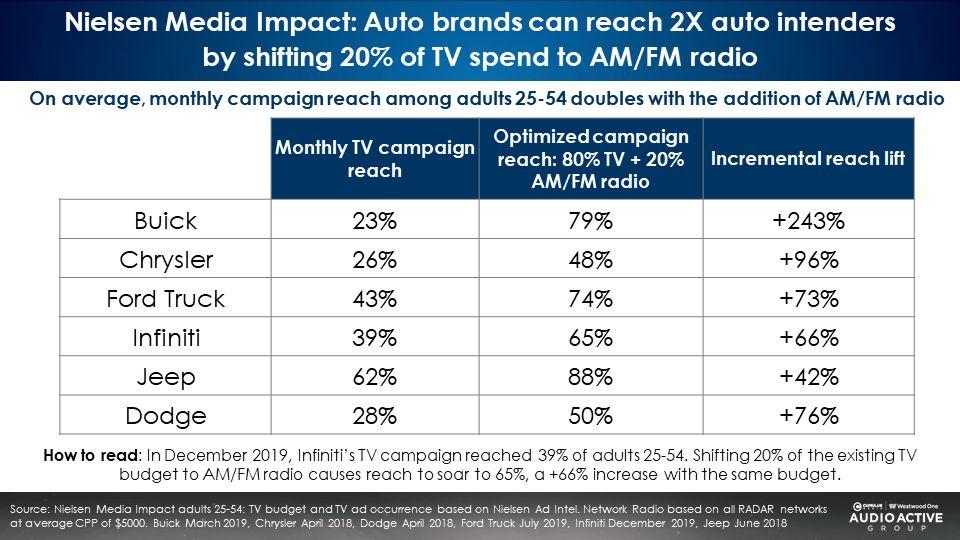

Nielsen Media Impact: Auto brands can reach 2X auto intenders by shifting 20% of TV spend to AM/FM radio

Auto brands can see a sizeable impact by reallocating a small portion of their TV budget to AM/FM radio. Using Nielsen Media Impact, the media optimization platform, reach is determined for the actual TV deliveries of auto brand campaigns among adults 25-54. When 20% of the TV investment is moved to AM/FM radio, reach soars. Across six major auto brands, on average, the addition of AM/FM radio doubles audio intender reach.

For example, Ford Truck’s TV campaign had a 43% monthly reach among adults 25-54. When 20% of the TV plan was reallocated to AM/FM radio, reach grew to 74%, a +73% increase in monthly reach for the same media spend.

Key takeaways:

- Tier one automotive brand effect: AM/FM radio advertising generates significant increases in advertising awareness, brand relevance, brand trust, and brand consideration

- AM/FM radio increases the efficiency of automotive media plans

- The best performing auto campaigns place an emphasis on creative consistency

- AM/FM radio creates future demand for automotive brands

- Nielsen Scarborough: American auto intenders clock a lot of miles in their vehicles

- Among ad-supported audio, AM/FM radio has a dominating 89% share of in-car time spent, per Edison’s “Share of Ear” study

- Nielsen Scarborough: Heavy AM/FM radio and digital consumers are way above the norm for auto purchase intention

- New vehicle purchasers are similar in profile to heavy AM/FM radio listeners, heavy Internet users, and podcast listeners

- ABX: AM/FM radio creative effectiveness is 92% of TV at one-fourth of the CPM

- Nielsen Media Impact: Auto brands can reach 2X auto intenders by shifting 20% of TV spend to AM/FM radio

Click here to view a 14-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.