Auto Aftermarket Retailers: Fifth Installment Of Category Study Reveals AM/FM Radio And Podcast Listeners, Do-It-Yourselfers, And Mega-Milers Are The Ideal Audiences To Target

Click here to view a 12-minute video of the key findings.

The Cumulus Media | Westwood One Audio Active Group® commissioned MARU/Matchbox to conduct the fifth installment of a comprehensive auto aftermarket category study to determine the current state of America’s auto parts retailers. 810 auto parts shoppers were surveyed in June 2022.

Key segments: Do-it-yourselfers and ultra-heavy auto parts shoppers

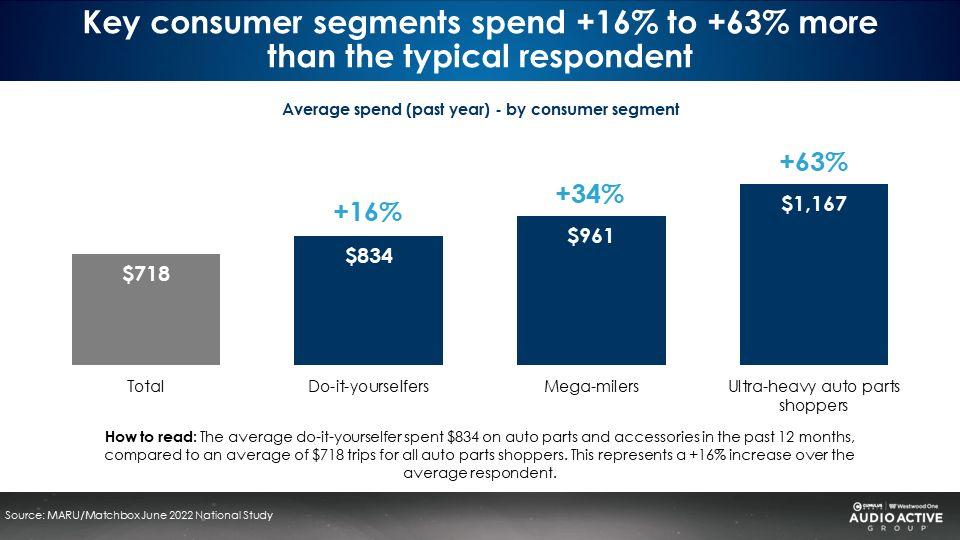

In the last year, Americans who shop at auto aftermarket retailers spent an average of $718. Do-it-yourselfers spend +16% more than the average. Mega-milers clock 200+ miles in their vehicles a week and spend +34% more on auto parts than the average.

Ultra-heavy auto parts shoppers have made 10+ shopping trips in the past two years. They spend +63% more than the average, a whopping $1,167 in the last year.

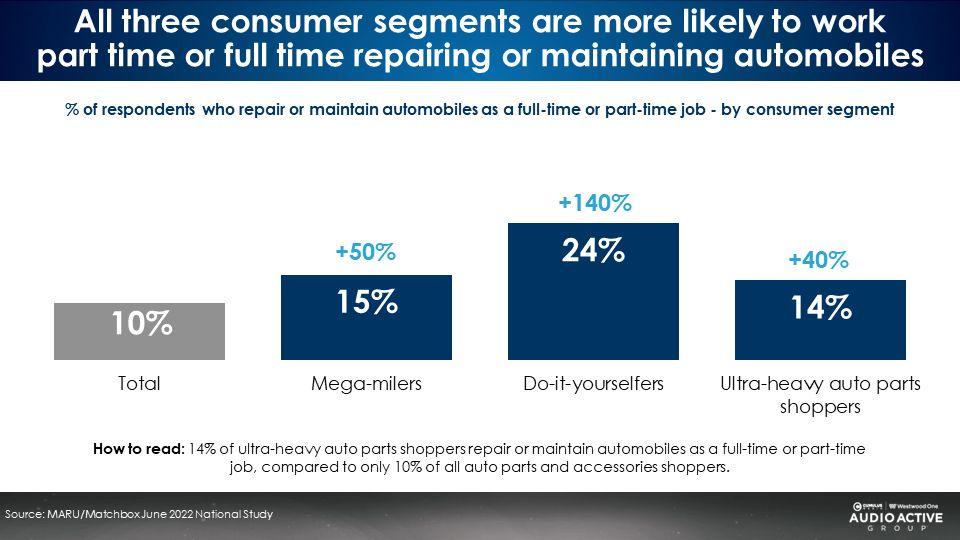

Pros represent 14% ultra-heavy shoppers, 15% of mega-milers, and nearly one out of four do-it-yourselfers

Among those who shop in the auto aftermarket category, 10% say they repair cars full time or part time. Those who repair or maintain cars full time or part time represent 24% of do-it-yourselfers and 14% of ultra-heavy auto parts shoppers. Pros would be an ideal media target.

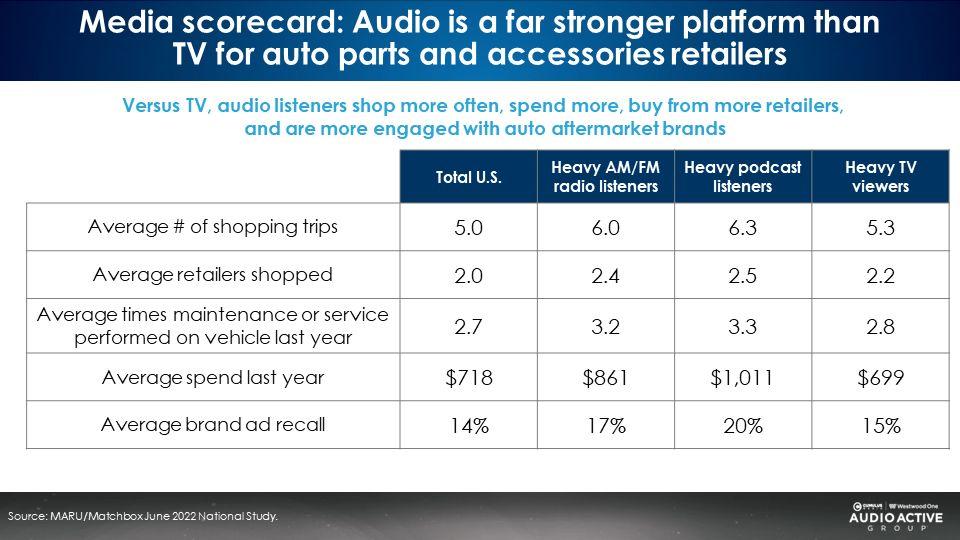

Media scorecard: AM/FM radio and podcasts are the ideal platforms to advertise auto aftermarket

Heavy AM/FM radio listeners and podcast listeners visit more retailers, make more shopping trips, and spend more annually in the auto parts category.

Compared to heavy TV viewers, audio listeners:

- Shop more often

- Shop more auto parts retailers

- Have maintenance or service performed more frequently

- Spend more each year

- Exhibit higher retailer ad recall

AM/FM radio and podcasts are the soundtrack of the American worker. Heavy audio users over index on children and working full time. As such, they spend far more on auto parts than TV viewers. Conversely, TV is the soundtrack of America’s retirees.

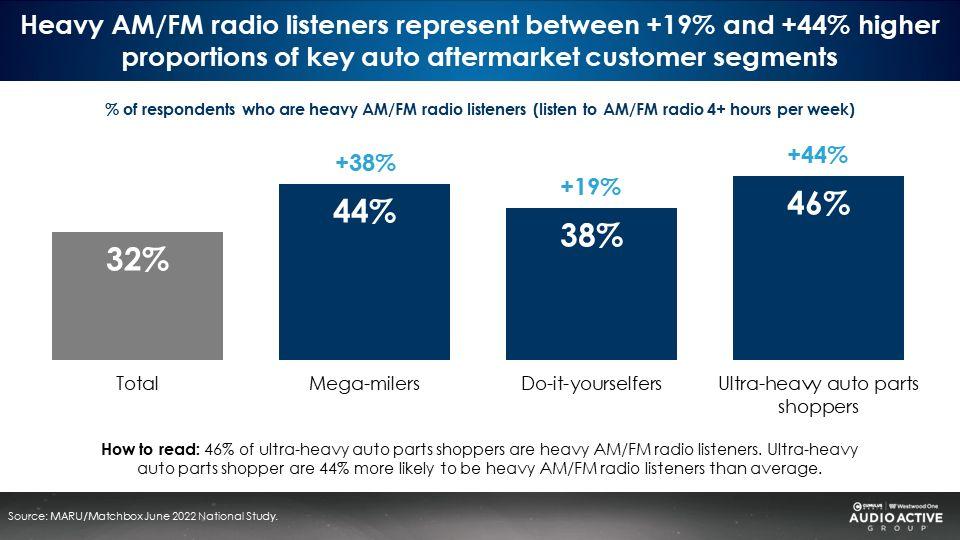

The biggest customers for auto parts retailers are far more likely to be heavy AM/FM radio listeners

The three key consumer segments (mega-milers, do-it-yourselfers, and ultra-heavy auto parts shoppers) are more likely to be heavy AM/FM radio listeners:

- Ultra-heavy auto parts shoppers, those who made 10+ shopping trips in the past two years, are +44% more likely to be heavy AM/FM radio listeners

- Do-it-yourselfers are +19% more likely to be heavy AM/FM radio listeners

- Mega-milers are +38% more likely to be heavy AM/FM radio listeners

Time spent in the car powers AM/FM radio listening and the need for auto parts

As time spent in the car grows, so does the need for car maintenance and auto parts. As such, the heaviest AM/FM radio listeners are the biggest auto parts shoppers. AM/FM radio is endemic to the auto parts category.

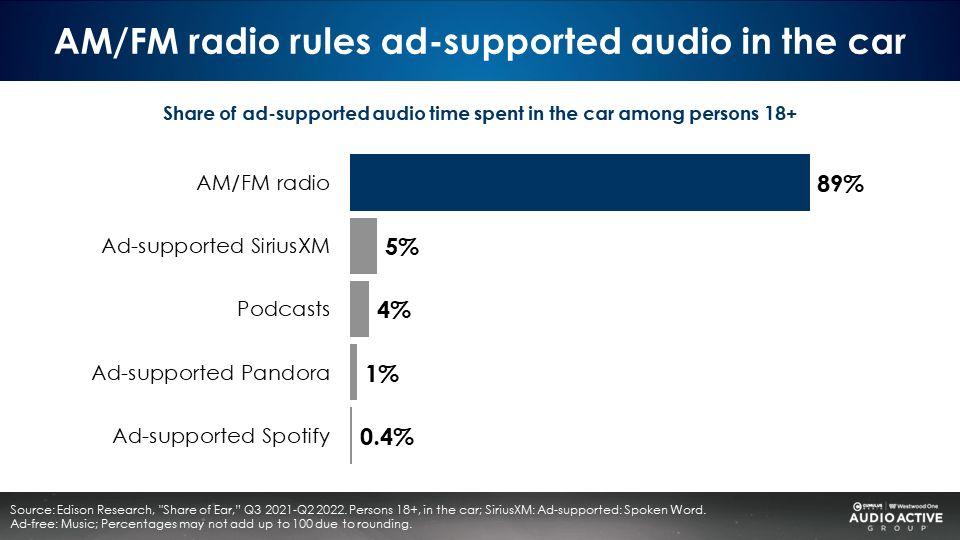

In the car, AM/FM radio is the “queen of the road” with a stunning 89% share of ad-supported audio

Edison Research’s Q2 2022 “Share of Ear” report reveals AM/FM radio has a dominant share of in-car ad-supported audio. AM/FM radio is the perfect platform to reach heavy auto parts purchasers when they are in the car and their thoughts turn to car maintenance.

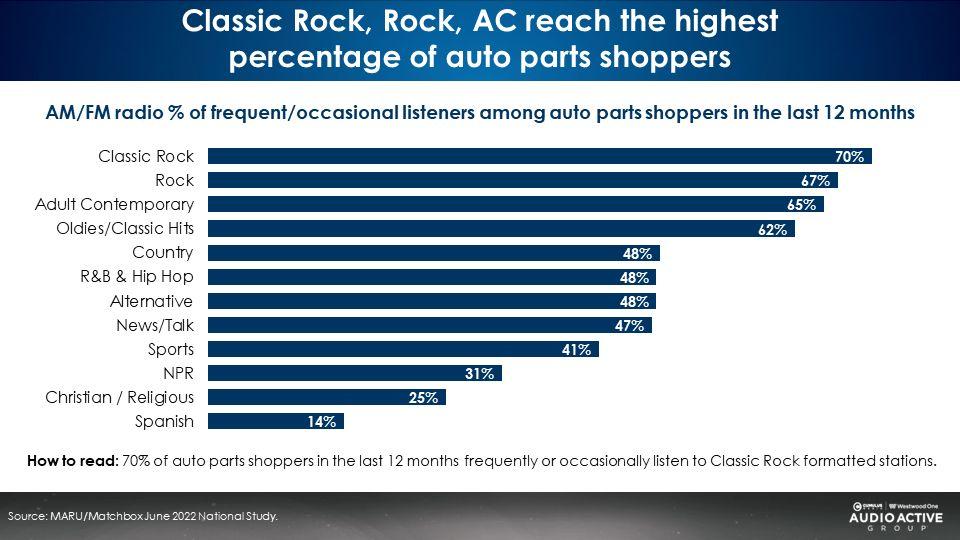

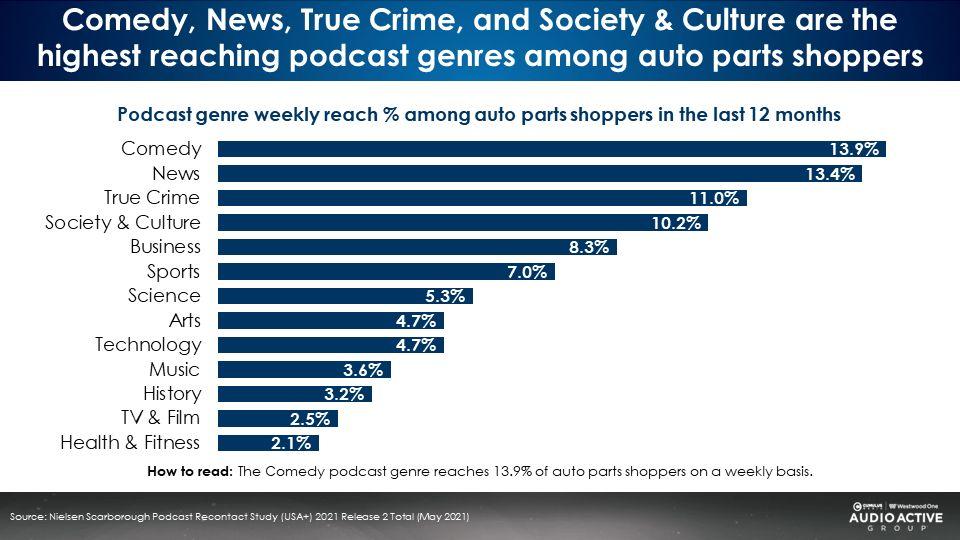

A wide variety of AM/FM radio programming formats and podcast genres generate strong reach with auto parts purchasers

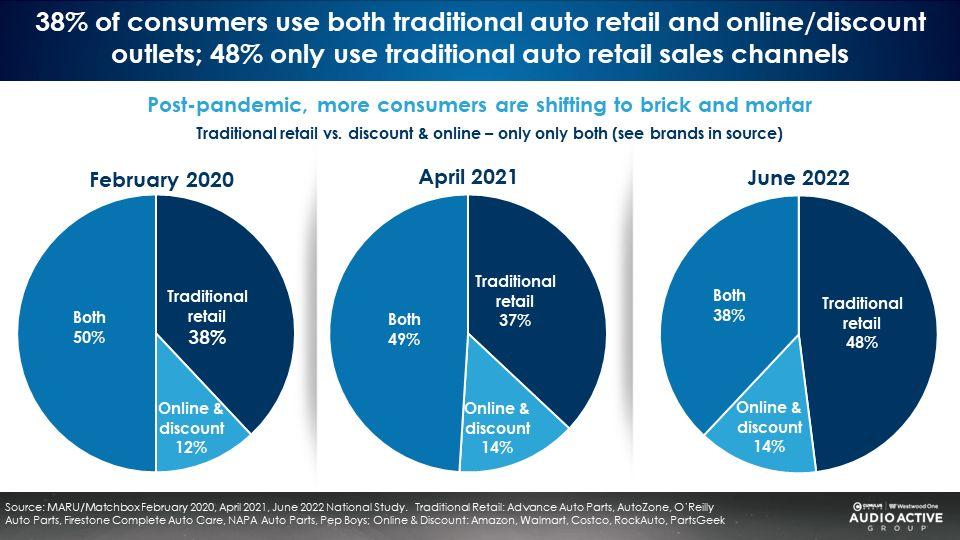

38% of auto parts shoppers use both online/discount outlets and traditional retailers

Traditional retailers include Advance Auto Parts, AutoZone, O’Reilly Auto Parts, Firestone Complete Auto Care, NAPA Auto Parts, and Pep Boys. Online and discount retailers consist of Amazon, Walmart, Costco, RockAuto, and PartsGeek.

48% shop only in the traditional retail channel, up from 37% in April 2021. As pandemic concerns wane, this year-over-year growth could be Americans returning to normal with in-store shopping habits. 14% only shop via online and discount outlets, stable from last year. 38% shop both online and in-store retail channels.

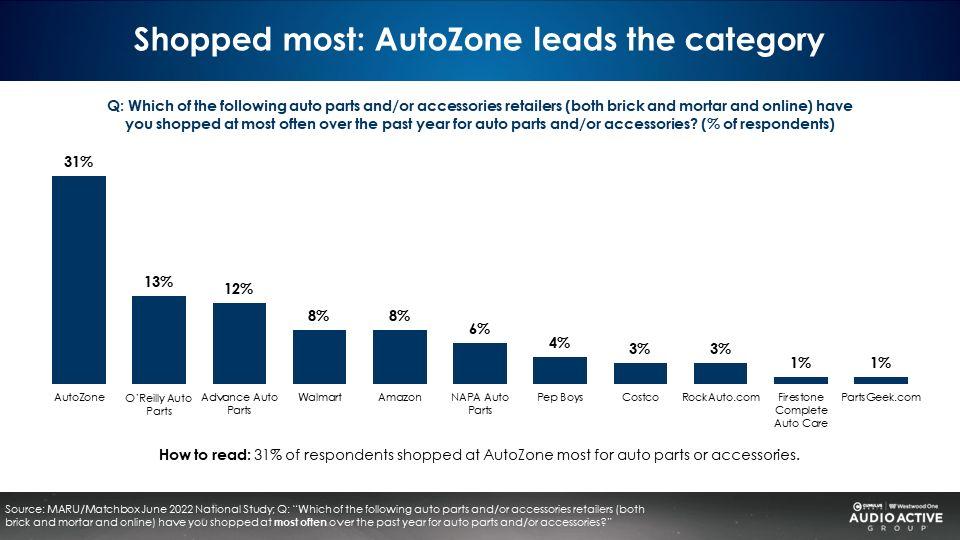

Shopping preference: AutoZone leads followed by O’Reilly Auto Parts and Advance Auto Parts

31% of consumers say they shopped most in the past year at AutoZone, one of the first major national auto parts retailers, followed by O’Reilly Auto Parts (13%) and Advance Auto Parts (12%). Next are Walmart (8%), Amazon (8%), and then NAPA Auto Parts (6%).

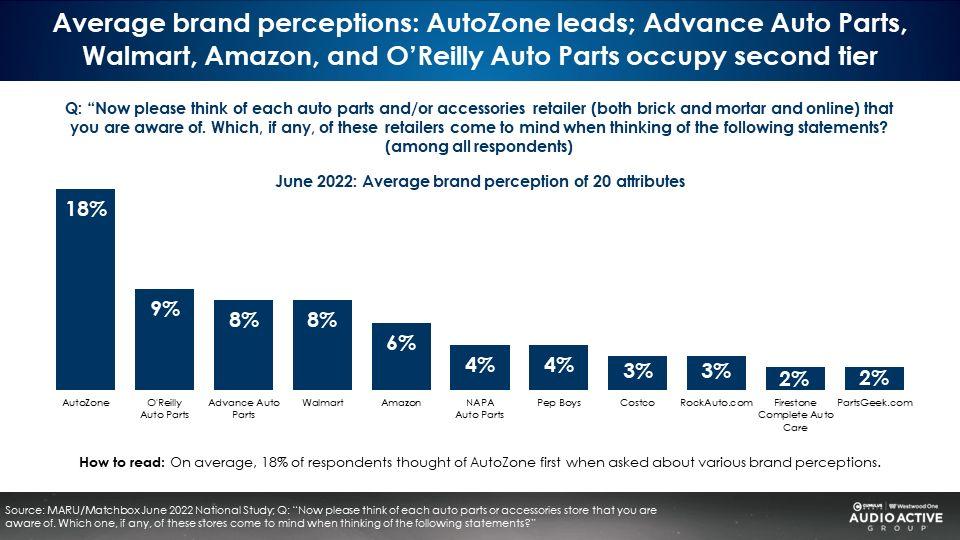

Brand equity: AutoZone leads, followed by O’Reilly Auto Parts, Advance Auto Parts, Walmart, Amazon, NAPA Auto Parts, and Pep Boys

Twenty different brand attributes were measured such as ‘has the most convenient locations,’ ‘has the most knowledgeable and helpful staff,’ etc. Consumers were asked to name the retailer that first came to mind for each attribute. The average of these twenty retailer associations creates the average brand perception.

26% of category shoppers cannot attribute top brand perceptions to any retailer. There is an opportunity for auto aftermarket retailers to increase their branding efforts and capture consumer attention.

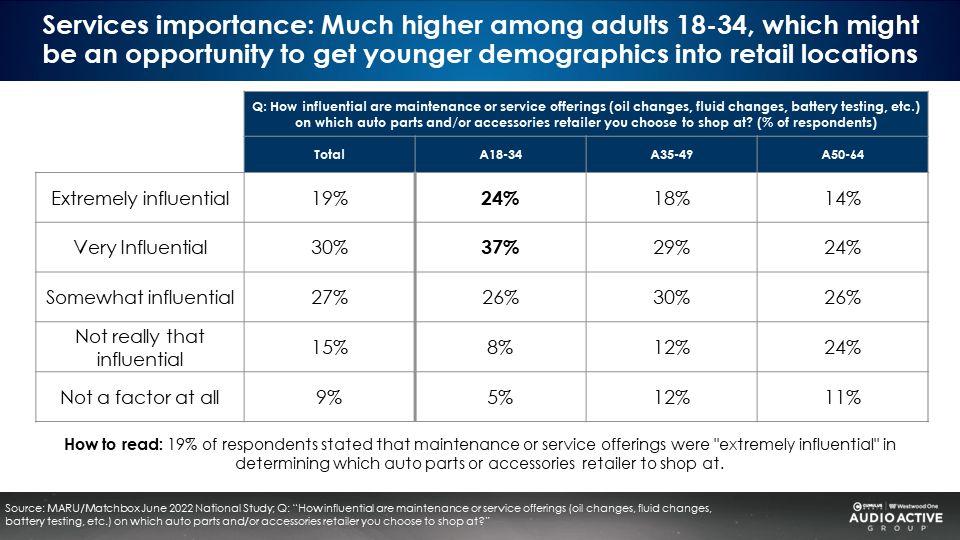

Service offerings: Younger demographics and audio listeners say maintenance (oil, fluid changes, battery testing, etc.) are very influential as to which auto parts retailer they choose

For adults 18-34, maintenance or service offerings are influential in the selection of an auto parts retailer.

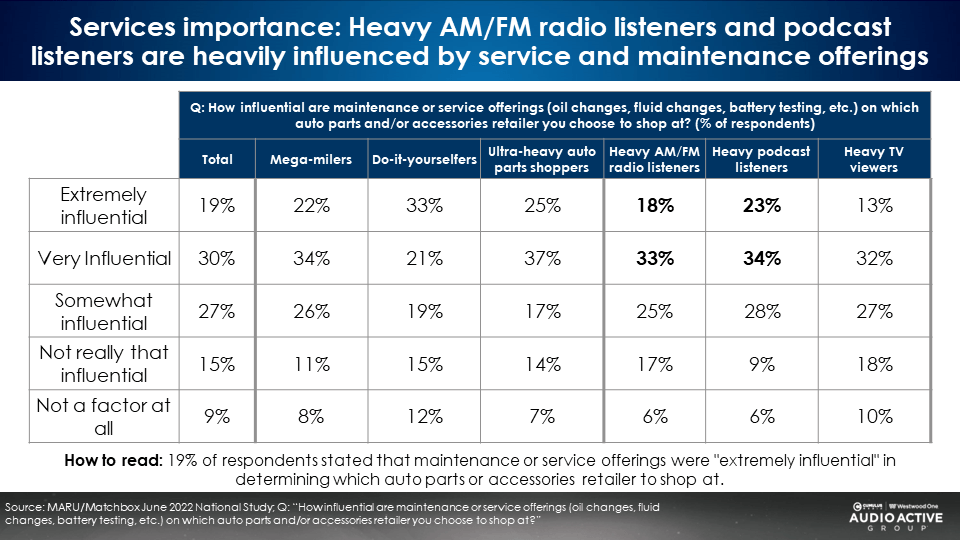

Compared to heavy TV viewers, a greater proportion of heavy AM/FM radio and podcast listeners say service offerings are extremely/very influential on their decision for which auto parts retailer they shop. Interestingly, mega-milers, do-it-yourselfers, and ultra-heavy auto parts shoppers indicate services have a strong impact on their choice of auto parts retailer.

Key findings:

- Consistent trends: Across the last three years, brand equity and shopping patterns have been generally consistent.

- AM/FM radio and podcasts are the ideal platforms to advertise auto aftermarket: Heavy AM/FM radio and podcast listeners visit more retailers in the category, make more shopping trips, and spend far more than the average. Two key consumer segments, do-it-yourselfers and ultra-heavy shoppers, are far more likely to be heavy AM/FM radio listeners. TV viewers are very low category users.

- Brand opportunity: 26% of category shoppers cannot attribute top brand perceptions to any retailer.

- Services motivate younger demographics: 61% of adults 18-34 say maintenance or service offerings (oil changes, fluid changes, battery testing, etc.) are extremely or very influential on which auto parts and/or accessories retailer they choose to shop at. People who take advantage of service offerings are more likely to be ultra-heavy shoppers, so this can be an effective strategy to bring in heavy shoppers and younger demos.

Recommendations:

- Build brands too: Historically, the auto aftermarket sector heavily markets vendor oil special offers. There is a significant body of marketing research that indicates “a succession of short-term response-focused (offer) campaigns will not succeed as strongly over the longer term as a single brand-building campaign designed to achieve year-on-year improvement to business success.” (Binet & Field)

- Market online shopping: Consumers are transitioning to a blend of retail and online shopping for their auto parts needs. Legacy brands need to adapt to changing shopping habits and market their online platforms to consumers.

- Market your service offerings: 61% of adults aged 18-34 say service offerings are extremely or very likely to influence where they choose to shop. Promotions centered around service offerings can entice younger demographics to come into the store and be converted into long-term customers.

- AM/FM radio should be the centerpiece of the auto aftermarket media plan: AM/FM radio is the engine of auto aftermarket sales. Nielsen determined AM/FM radio generates $21 of return in advertising spend for every dollar invested in AM/FM radio ads. Key auto aftermarket segments (mega-milers, do-it-yourselfers, and ultra-heavy auto parts shoppers) are heavy users of AM/FM radio. Reallocation of TV budgets to audio is a smart strategy to target heavy category users and grow reach.

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is the Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.