Financial Case Study: AM/FM Radio Is The Ideal Medium To Reach In-Market High Investable Asset Individuals

A major financial services brand sought to profile individuals with high investable assets of $500K+. The brand wanted to quantify linear television viewing and AM/FM radio listening within the $500K+ investable asset segment and among individuals who were likely to be in the market for a new or additional financial services firm in the next 12 months.

CUMULUS MEDIA | Westwood One retained market researcher MESH Experience to survey 300 U.S. high investable asset individuals in April 2021. MESH Experience is a data, analytics, and insight consultancy working with Fortune 500 companies like Delta Air Lines and LG Electronics.

Persons 35+, not persons 25-54, is the best demographic to target individuals with $500K+ of investable assets

Persons 25-54 seems to be the magical buying demographic for most media buys. However, it is the wrong demographic for the high investable assets target. Half of those with $500K+ of investable assets are persons 35-64. The other half are 65+.

A quarter of the high investable asset segment are likely to be in the market for a new or additional financial firm

23% of the $500K+ investable assets consumer group say they are very or somewhat likely to be in the market for a new or additional financial advisory firm. What is the profile of the in-market segment?

- 73% are aged 35-64

- 90% are employed

- 16% are heavy TV viewers

- 52% are heavy AM/FM radio listeners

Compared to the overall category, those in the market for a new financial services firm are younger, more employed, and less likely to be heavy TV viewers.

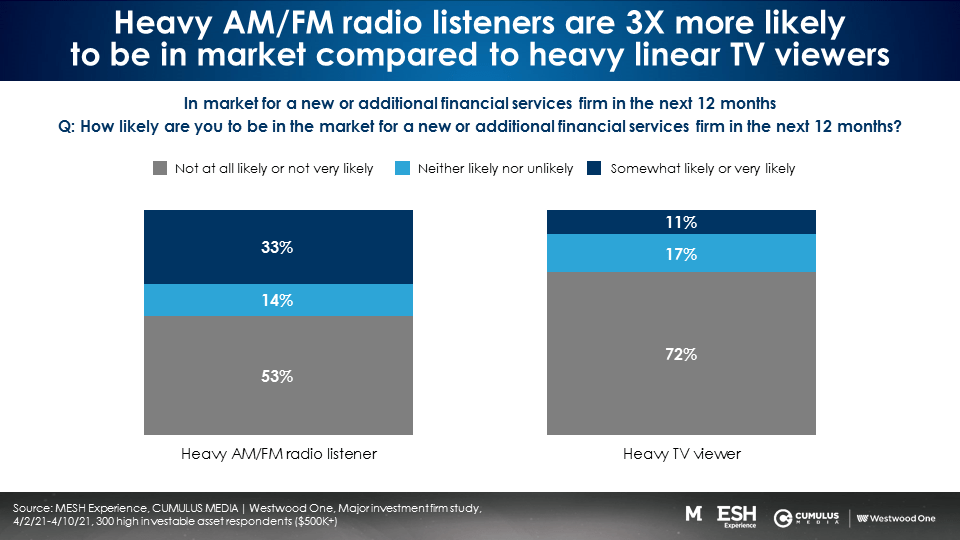

Heavy AM/FM radio listeners are three times more likely to be in the market for a new or additional financial advisory firm compared to heavy linear TV viewers

Among the $500K+ investable assets consumers, MESH Experience found that 33% of heavy AM/FM radio listeners are in the market for a new or additional firm. Only 11% of heavy TV viewers are in the market for a new or additional financial services firm. AM/FM radio listeners are three times as likely to be in the market compared to TV viewers.

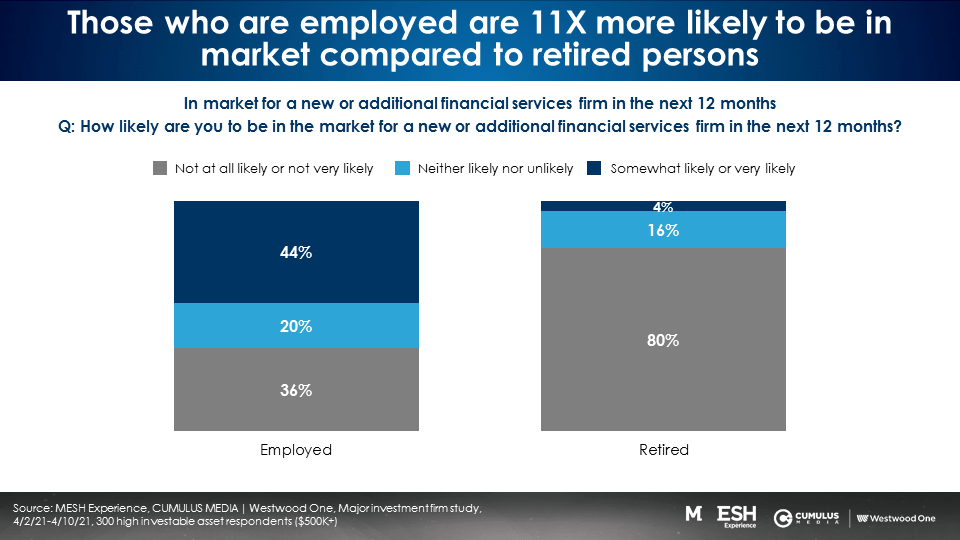

Those who are employed are eleven times more likely to be in the market for a new financial services firm compared to retired persons

MESH Experience found retired persons are no longer in the market for a new financial services firm. They might already be beginning to use their retirement. Those who are employed, on the other hand, are open to making a change in their advisory firm or bringing on an additional financial services firm.

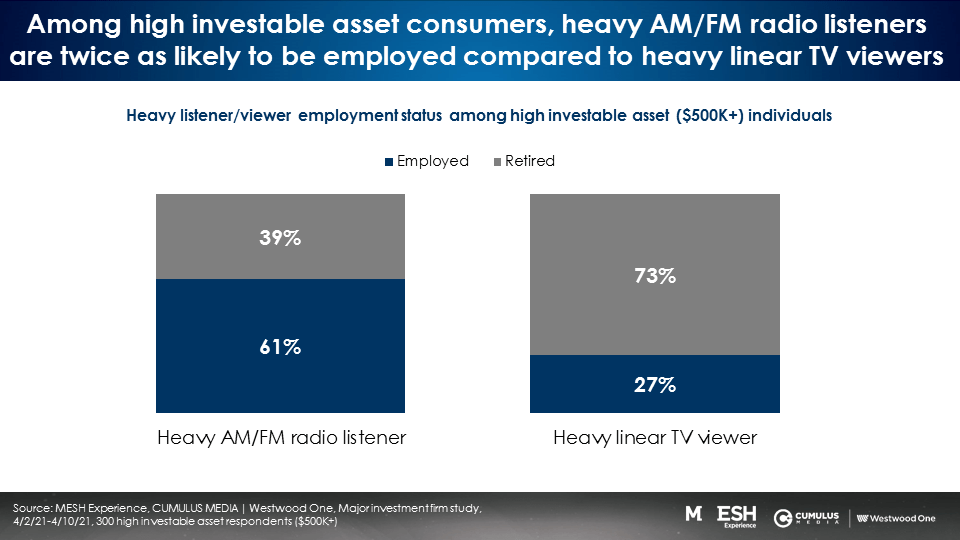

AM/FM radio is the soundtrack of the American worker; TV is the soundtrack of retired Americans

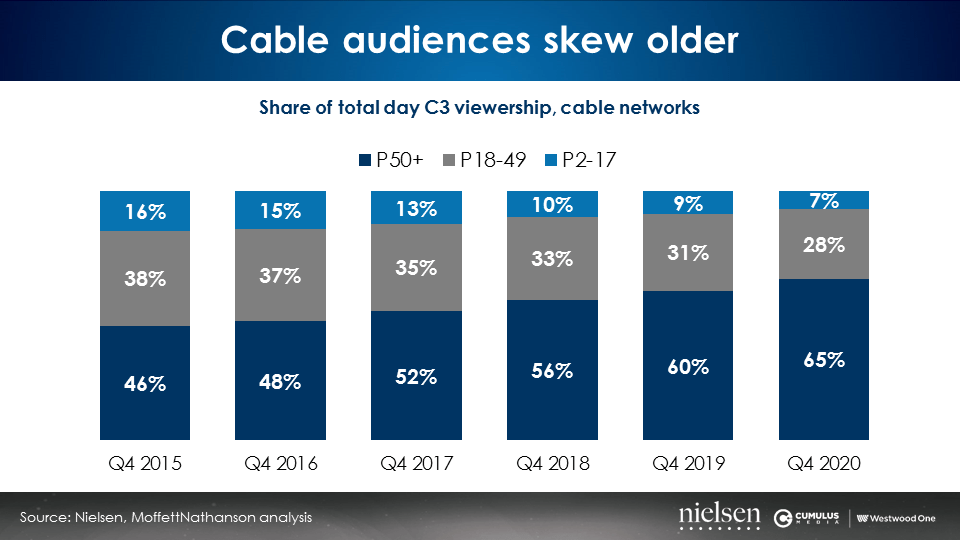

According to a MoffettNathanson analysis, the age profile of network cable audiences has been sharply skewing older.

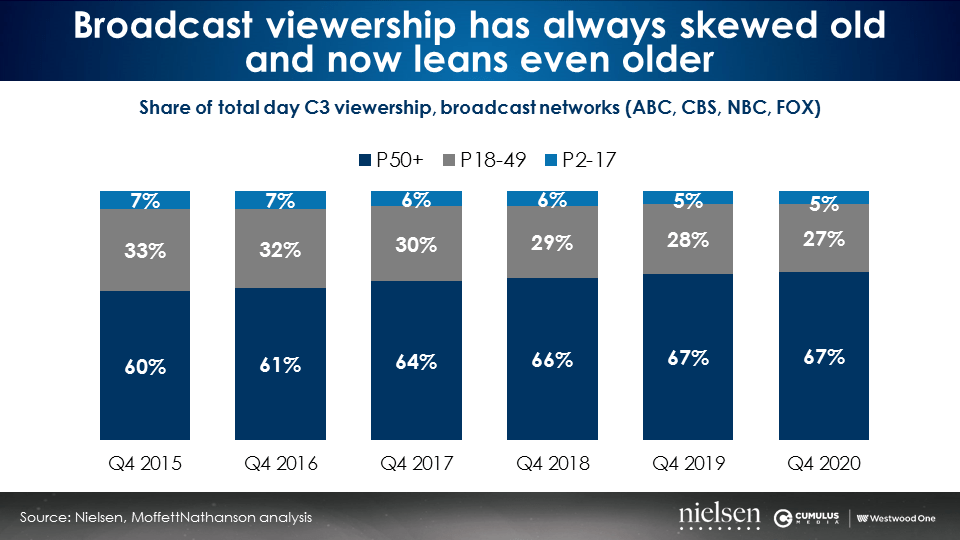

The broadcast network audience profile has always skewed older and is getting even older.

Among the high investable assets consumer segment, heavy AM/FM radio listeners are twice as likely to be employed versus heavy TV viewers.

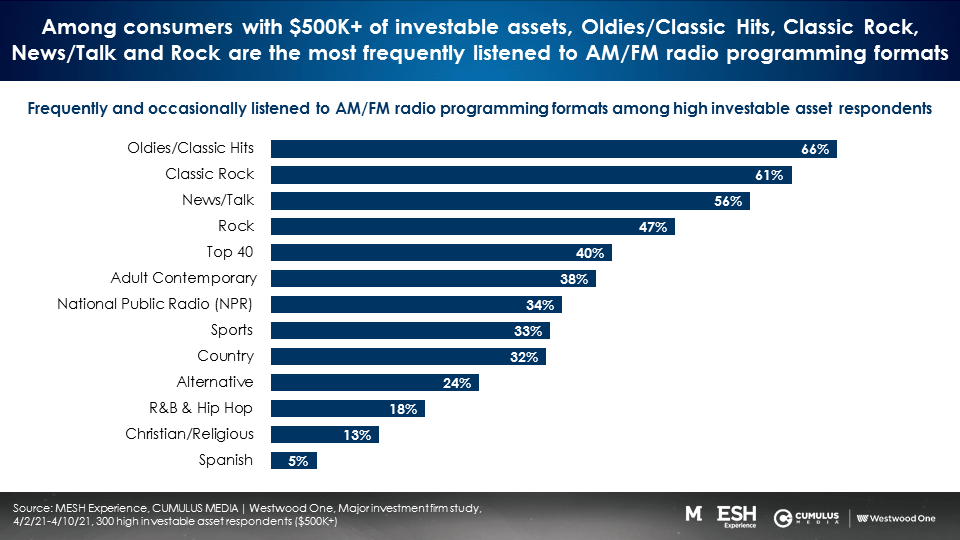

The best AM/FM radio formats to target those with $500K+ of investable assets? Oldies/Classic Hits, Classic Rock, News/Talk, Rock, and Top 40

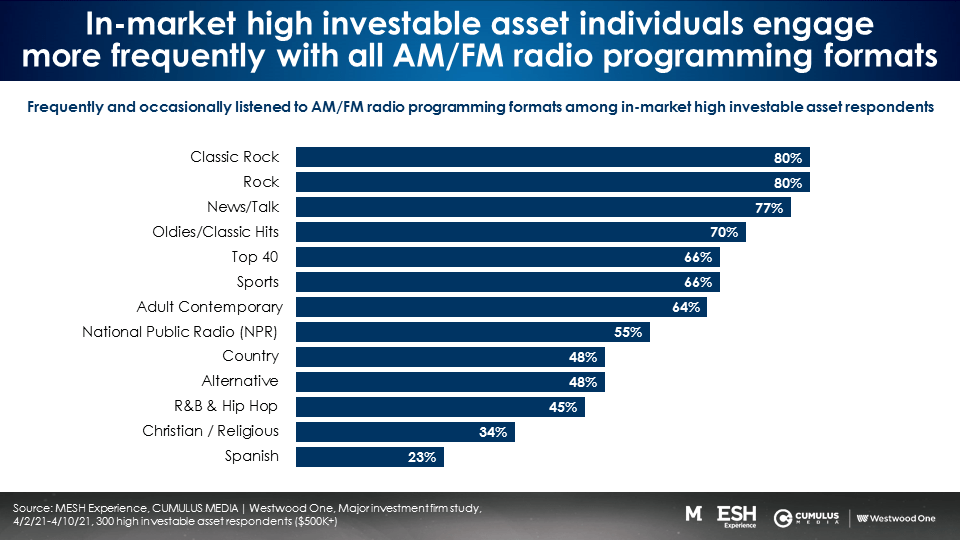

The best AM/FM radio formats to target those in the market for a new financial firm? Classic Rock, Rock, News/Talk, Oldies/Classic Hits, Top 40, Sports, Adult Contemporary, and NPR

Listenership to all AM/FM radio formats is much stronger among those in the market for a new financial services firm. Rock formats perform extremely well.

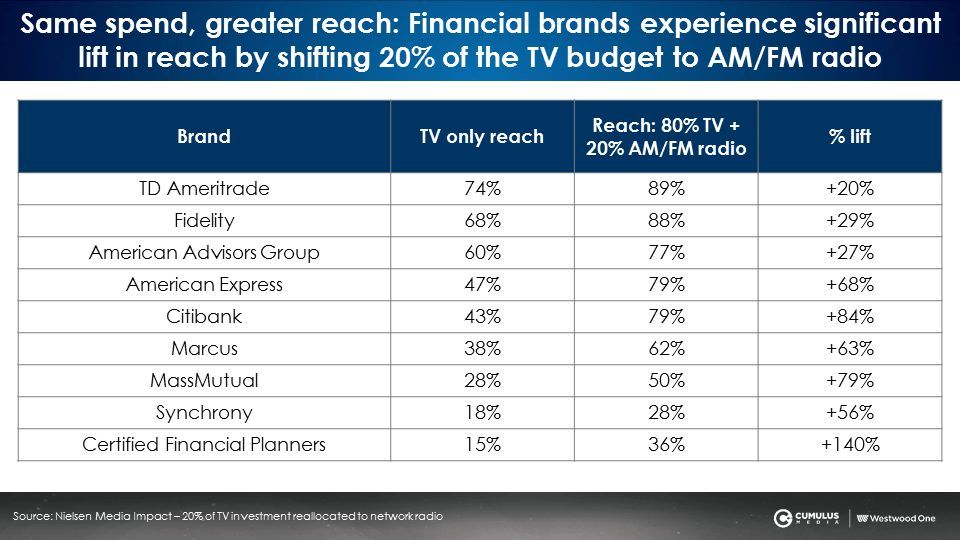

AM/FM radio makes your TV better: Financial brands can experience a significant lift in reach with the addition of AM/FM radio to the media plan at the same spend

Nielsen Media Impact, the media planning and optimization platform, can analyze a brand’s existing television campaign and determine the lift in reach that would occur with the addition of AM/FM radio to the media plan.

The table below depicts the actual reach of nine financial brands’ television campaigns and the reach in the scenario where 20% of the television investment was reallocated to AM/FM radio with no increase in budget. Regardless of the TV spend, the addition of AM/FM radio lifts reach.

The analysis revealed the average financial services brand would experience a +63% increase in reach with the addition of AM/FM radio to the plan and no increase in budget

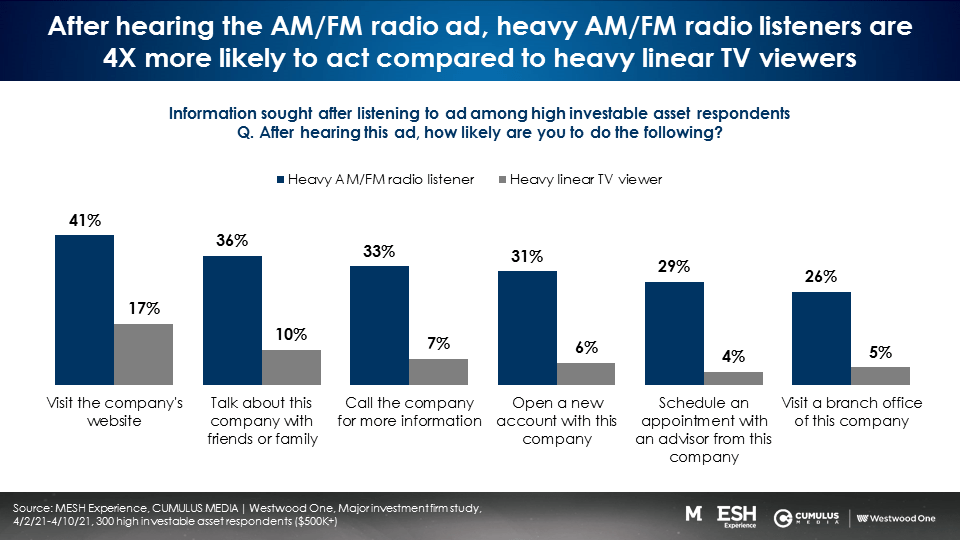

AM/FM radio listeners are more than four times likelier to act upon hearing a financial services brand ad

MESH Experience played an AM/FM radio ad for a financial services brand and asked a series of questions about what action the high investable asset individuals would take based on the ad. Whether the action was contacting the company, visiting the website, visiting a brand office, or opening an account, AM/FM radio listeners were four times as likely as TV viewers to take action.

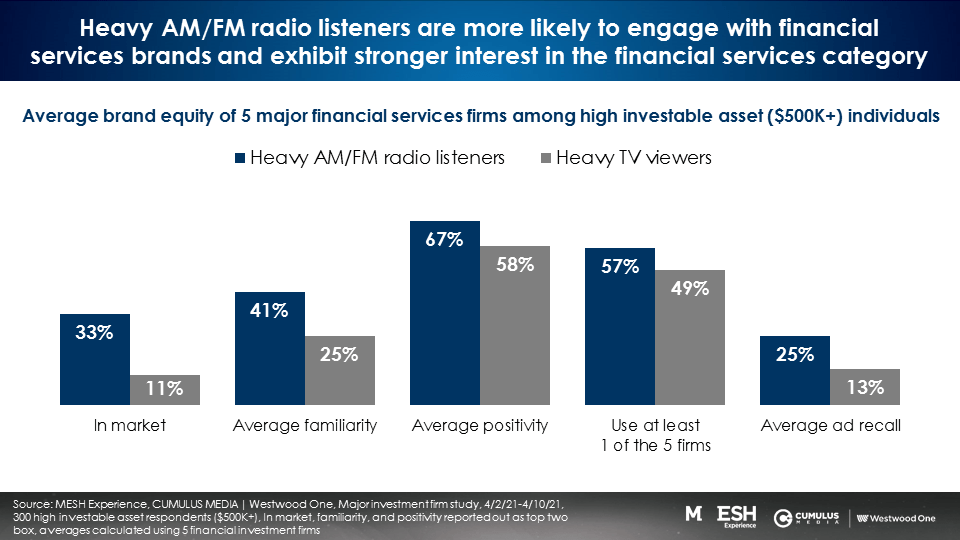

AM/FM radio listeners are far more engaged with the financial services category

MESH Experience found that compared to TV viewers, AM/FM radio listeners:

- Were more likely to be in market

- Exhibit high familiarity with financial services brands

- Have high brand favorability for financial firms

- Are more likely to be customers

- Show higher ad recall for category marketing

MESH Experience: Key findings and recommendations

- Focus on the employed segment of the high investable asset group ($500K+). They are far more likely to be in the market and far more likely to engage with brands. This will set up financial investment brands for long-term benefits as retired consumers are unlikely to switch their firms and show much less interest in the category.

- AM/FM radio should have a much greater role in the overall media plan targeting high investable asset individuals since AM/FM radio plays such a large role among the employed segment. Heavy AM/FM radio listeners are three times more likely to be in the market to make a change to a new advisory firm or to add a new financial services firm versus heavy TV viewers.

- Create interest-based AM/FM radio ads for this high investable asset group for their most frequently used AM/FM radio programming formats – Oldies/Classic Hits, Classic Rock, News/Talk, and Rock – to increase relevancy and engagement.

Click here to view a 9-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.