CUMULUS MEDIA and Signal Hill Insights’ Podcast Download – Spring 2021 Report: Podcast Listening Bolstered By Pandemic, Subscription Services And Clubhouse Cause A Stir, And Listeners Continue To Appreciate Ads In Brand New Podcast Listeners Study

This week, a sea of advertisers, agencies, entertainment companies, and content providers, including our own Cumulus Podcast Network, have been glued to their video screens for the seventh annual Interactive Advertising Bureau (IAB) Podcast Upfront. Record-breaking attendance and an impressive union of great minds and content are a testament to the power and strength of podcast advertising.

This major event in the podcast industry also marks the publication of CUMULUS MEDIA and Signal Hill Insights’ Podcast Download – Spring 2021 Report.

CUMULUS MEDIA | Westwood One and Signal Hill Insights retained MARU/Matchbox to conduct an in-depth study in March 2021 of 600 weekly podcast listeners. This sixth chapter in the Podcast Download series highlights trends from prior studies as well as new developments such as Clubhouse and podcast subscription models.

Here are the key findings:

Podcast accelerant: Podcast listening grew during the pandemic

Throughout the study, there was evidence that the COVID-19 crisis was a boon for podcasting. Audiences soared as listeners experimented with a broader array of content genres and used more distribution platforms than ever before to listen to their podcasts.

While men outpace women in time spent with podcasts, women are catching up, exhibiting a faster audience growth rate.

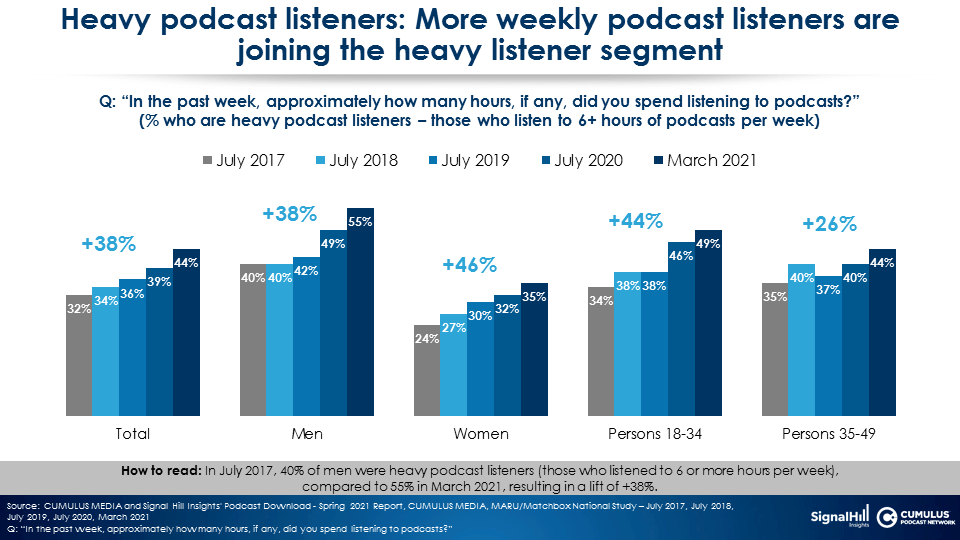

Heavy podcast listeners, those who spend 6+ hours a week listening, have grown +38% since 2017. Women experienced a sharp +46% growth in heavy podcast listening (6+ hour per week) versus men (+38%).

From 2017 to 2020, the proportion of the weekly podcast audience who became heavy podcast listeners grew at a mid-single-digit annual growth rate. However, from 2020 to 2021, right in the heart of COVID-19, the heavy podcast listening segment soared by +13%.

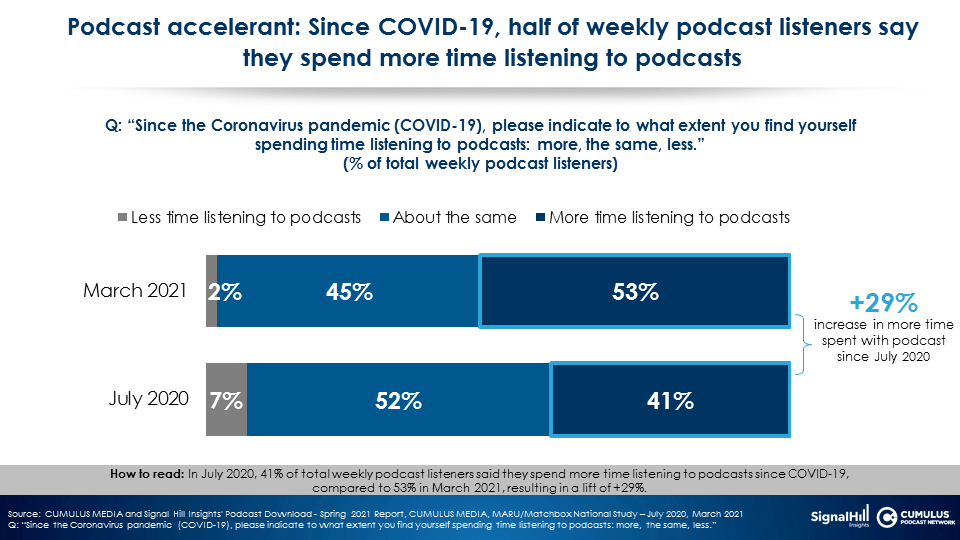

Over half of weekly podcast listeners say they are listening more to podcasts. Barely any respondents say they are listening less.

In July 2020, four months into the pandemic, 41% of weekly podcast listeners said they were listening more to podcasts. By March 2021, the “listen more” segment grew to an impressive 53%. The Infinite Dial 2021, recently released by Edison Research and Triton Digital, also revealed that weekly podcast audiences have surged +17% from 2020 to 2021, from 24% to 28% among 12+ Americans.

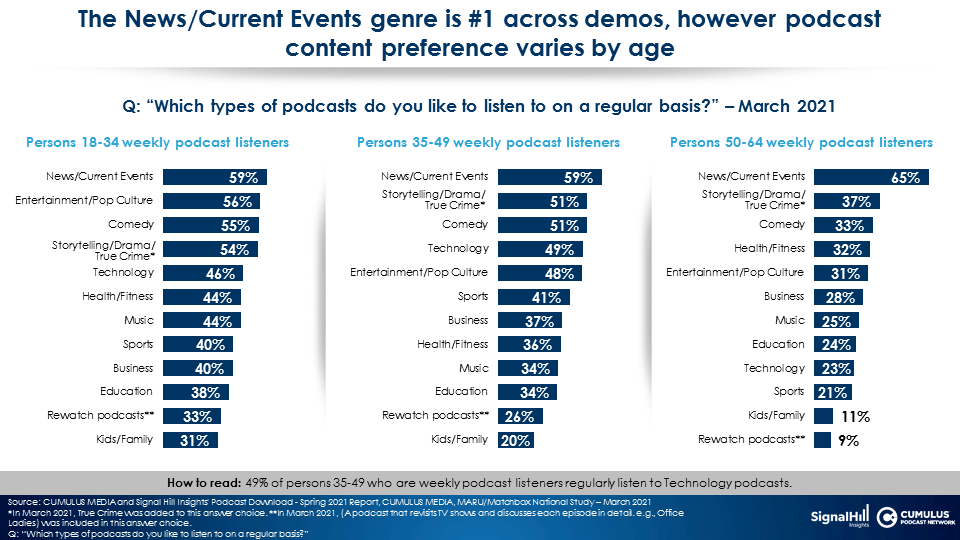

Genre exploration: Podcast audiences are listening to new genres

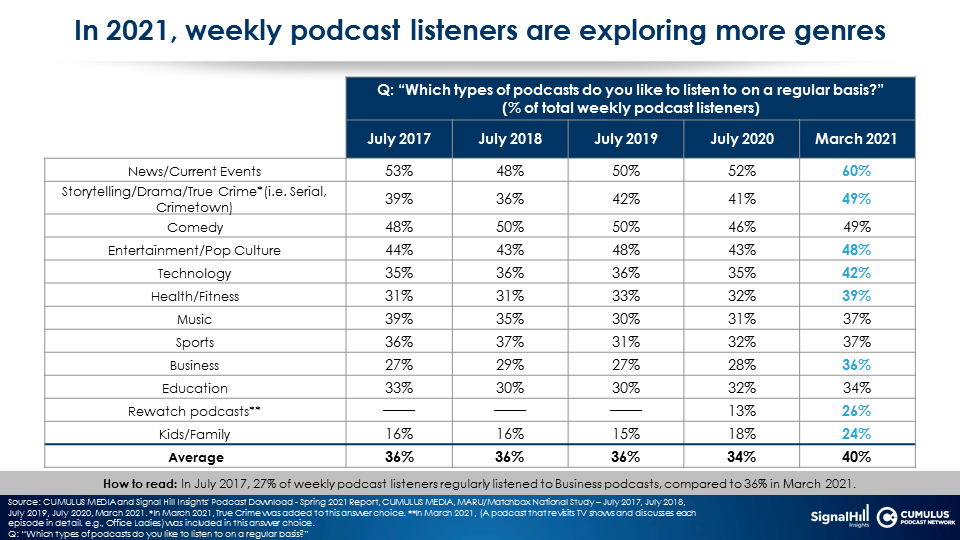

In 2020, the average podcast genre was listened to by 34% of the weekly podcast audience. This year, the average podcast listenership has jumped to 40% as audiences became more adventurous.

Most podcast genres saw a jump in audience. A strong news cycle propelled the News/Current Events category to five-year highs and Rewatch podcasts (podcasts that revisit TV shows and discuss each episode in detail) experienced the biggest growth in listenership, +100% from July 2020 to March 2021.

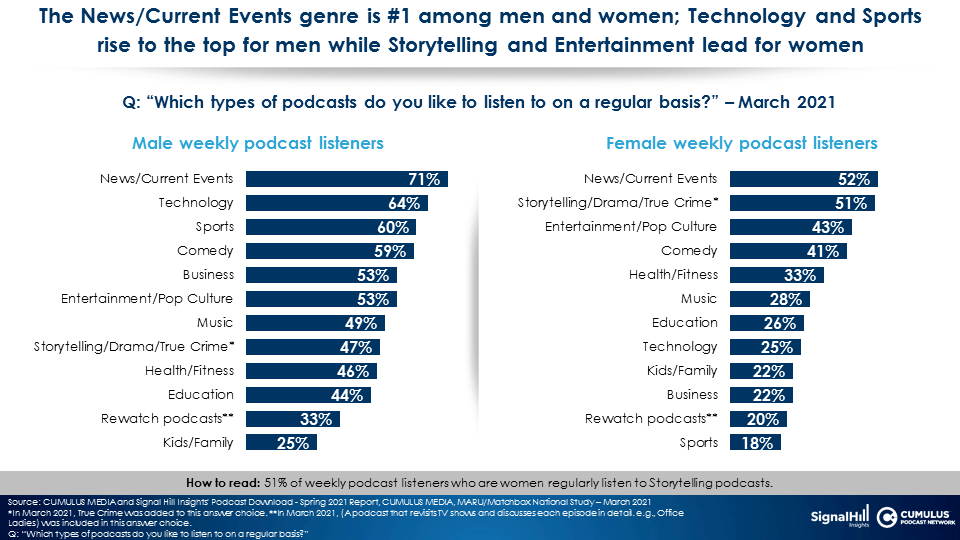

Genre audiences differ markedly by gender.

There are also distinct genre usage patterns by demographic.

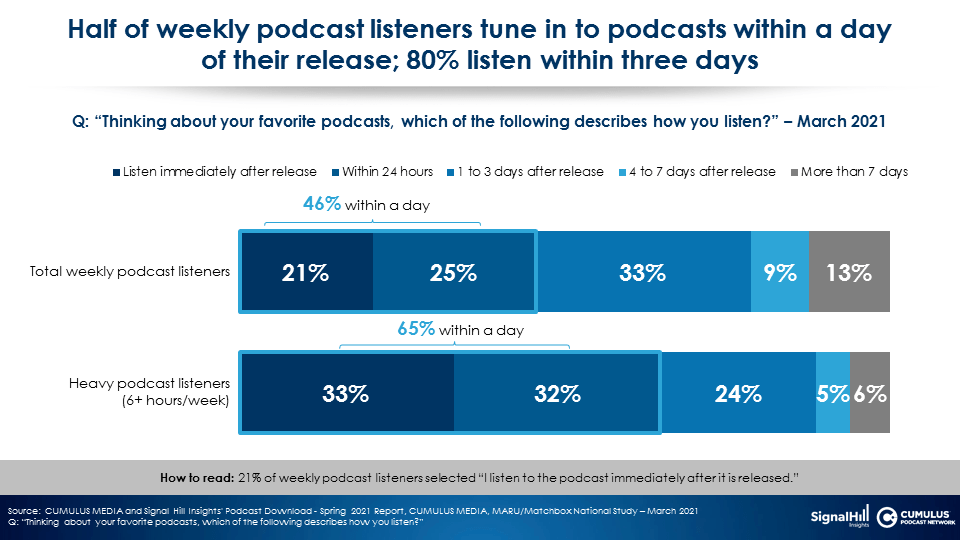

Day and date: Half of podcast fans listen to episodes the day they are released while 80% listen within three days

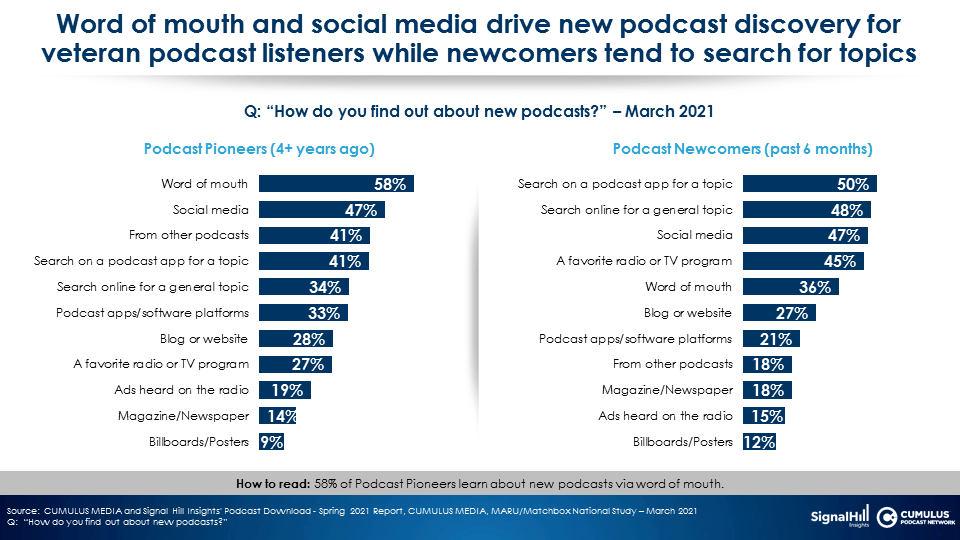

Podcast discovery: Podcast Pioneers who have been listening for 4+ years find new shows via word of mouth and social media while Podcast Newcomers, those who started listening in the past six months, search by topic

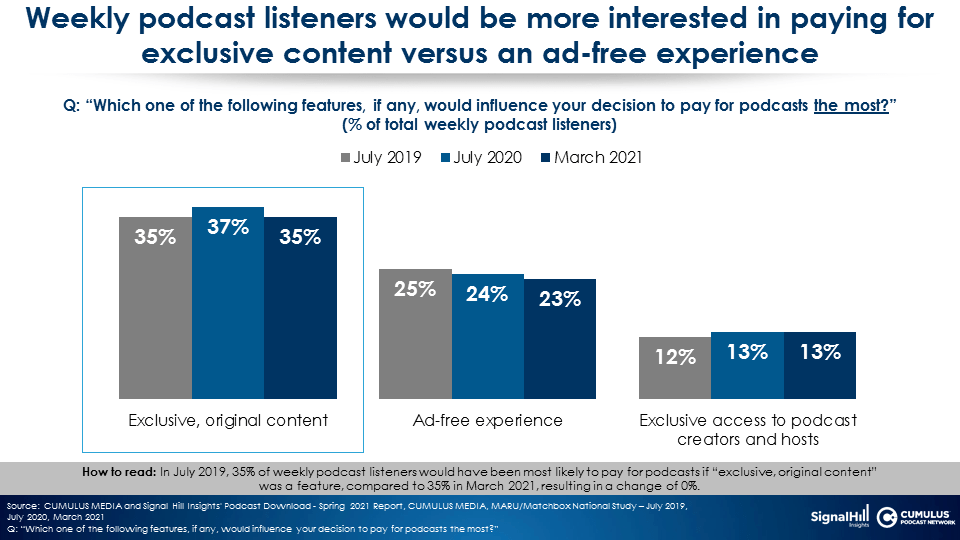

Podcast subscription models: Exclusive content is the driver, not a lack of ads

Apple’s rollout of tools and solutions to permit podcasts to introduce subscription models has caused a stir. Which elements would be most compelling for a consumer subscription model? Surprisingly, it is not the lack of ads, but exclusive content.

For the third year in a row, podcast listeners say exclusive, original content is the most compelling aspect of a subscription model. Far fewer say an ad-free experience would most influence their decision to pay for a podcast. In fact, the importance of an ad-free experience to a subscription offering has been waning, from 25% in 2019 to 23% this year.

Consumers dislike digital media and video ads. In video subscription models, an ad-free environment is a major draw. In contrast, podcast ads are welcomed, enjoyed, and appreciated for making shows possible. It is conceivable that a podcast subscription model could thrive with plentiful exclusive, original content along with advertising!

Clubhouse’s arrival: Social audio is a natural marketing brand platform for podcast hosts and shows

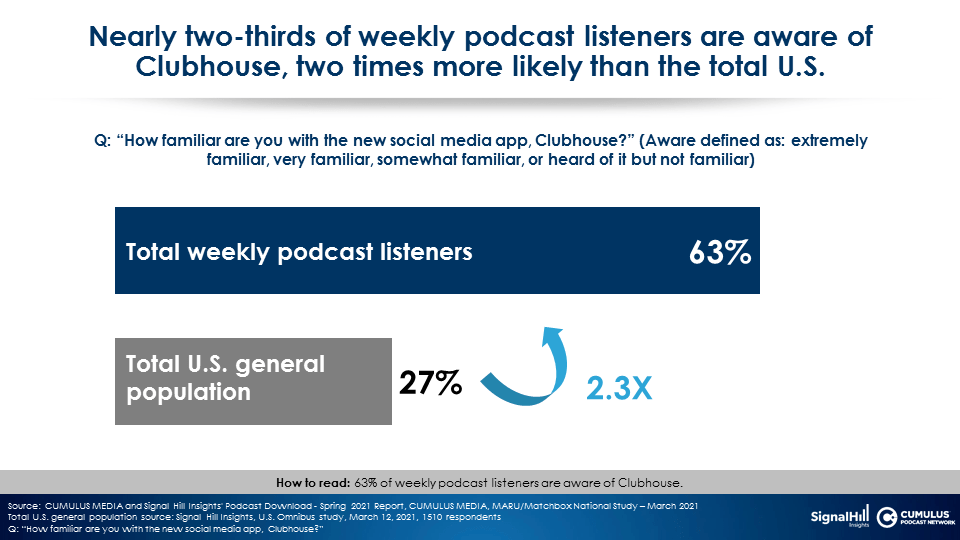

The social audio app Clubhouse has made a splash, especially among podcast listeners. Among weekly podcast listeners, awareness and usage of Clubhouse is far greater than in the general population.

A study of the total U.S. population conducted by Signal Hill Insights found 27% of all Americans had some awareness of Clubhouse. Twice as many weekly podcast listeners have heard of Clubhouse.

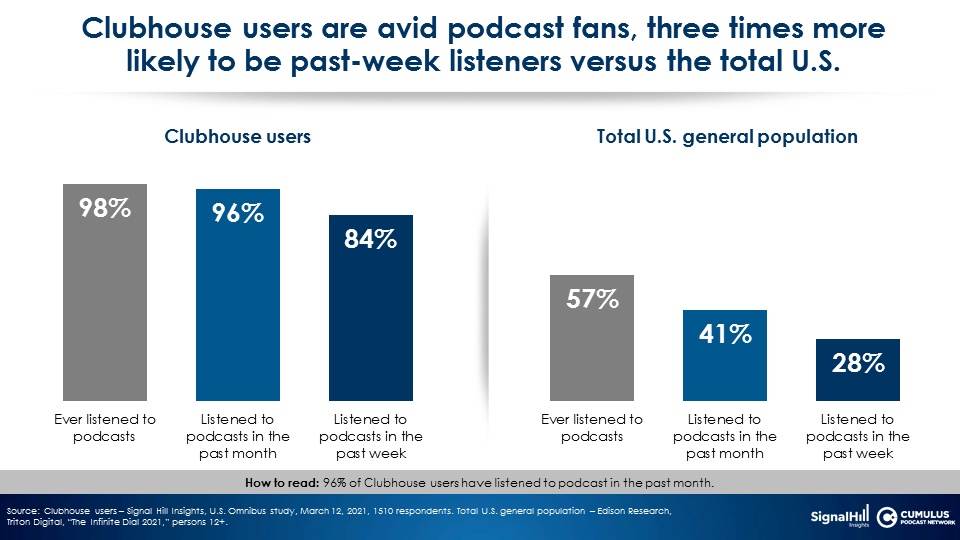

Signal Hill Insights’ study of all Americans found virtually all Clubhouse users are regular podcast listeners.

Among weekly podcast listeners who are aware of Clubhouse, a vast majority agree that Clubhouse would be a “good fit for my favorite podcast host and show.” In prior iterations of the Podcast Download Report, there was strong interest in events where listeners could experience the talent live and ask them questions. Social audio provides that immersive podcast experience right on a fan’s smartphone.

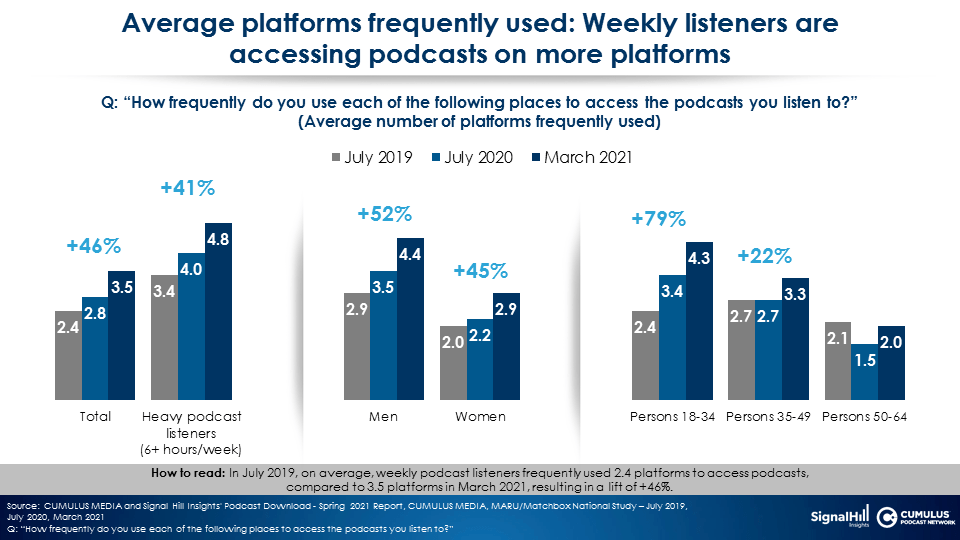

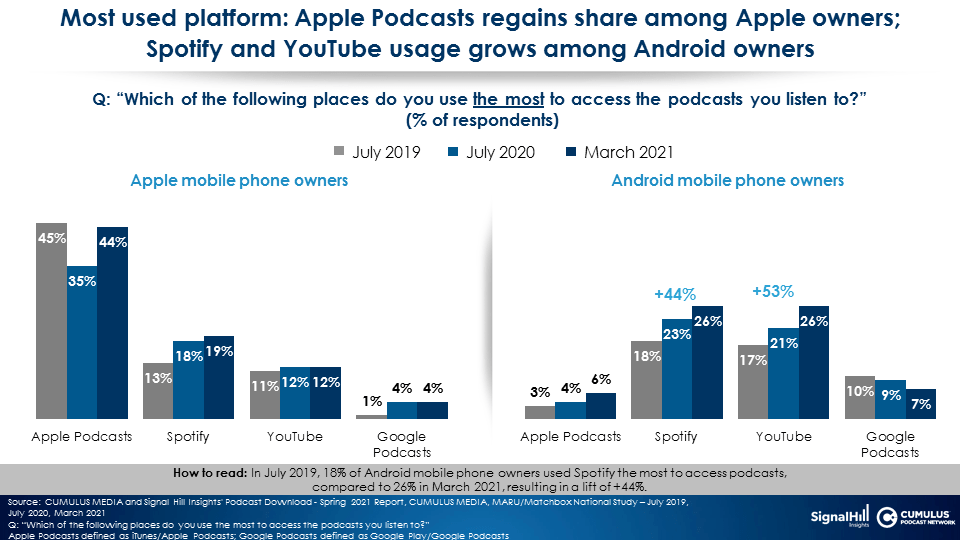

The Big Three Podcast Oligarchy: The number of distribution platforms used to listen to podcasts increased dramatically as Apple, Spotify, and YouTube expand their dominance

Since 2019, there has been a +46% jump in the number of platforms used to access podcasts. The younger the listener, the greater the number of methods used to listen to podcasts.

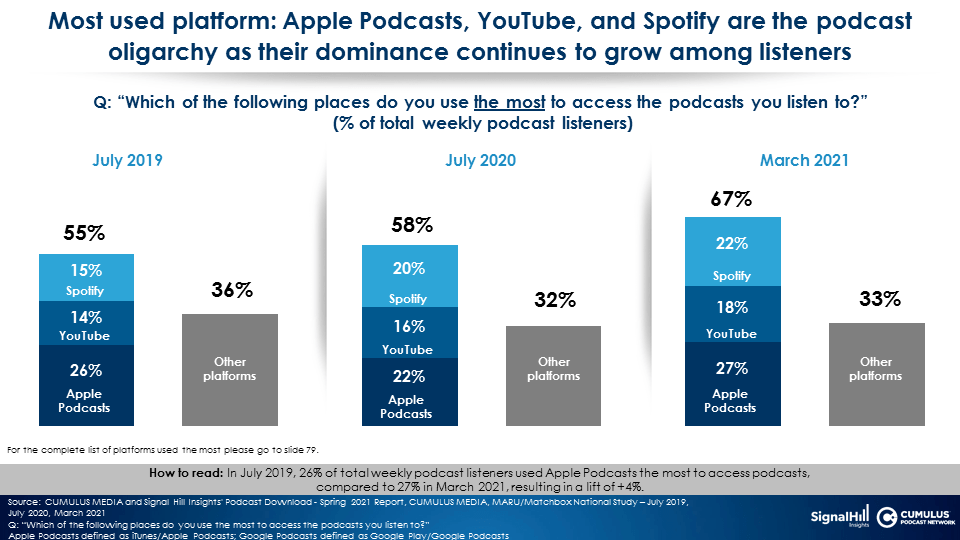

The Apple/Spotify/YouTube listening oligarchy has grown from 55% as the most used platform in 2019 to 67% this year.

While YouTube is surging as a podcast distribution platform, Google podcast apps are rarely used even among consumers who have an Android phone. Among iPhone owners, the Apple podcast app reigns supreme but Spotify is number two and slowly growing.

Ads aren’t bad: Podcast listeners appreciate podcast advertising

In the world of ad-supported media, consumers have a decided aversion to ads. Digital media infuriates consumers with excessive banners, pop-ups, and targeting. The big lure of Netflix, Amazon Prime Video, and HBOMax is the ad-free environment.

Podcast advertising is an altered reality where ads are appreciated by the audience and understood to be necessary support for the shows.

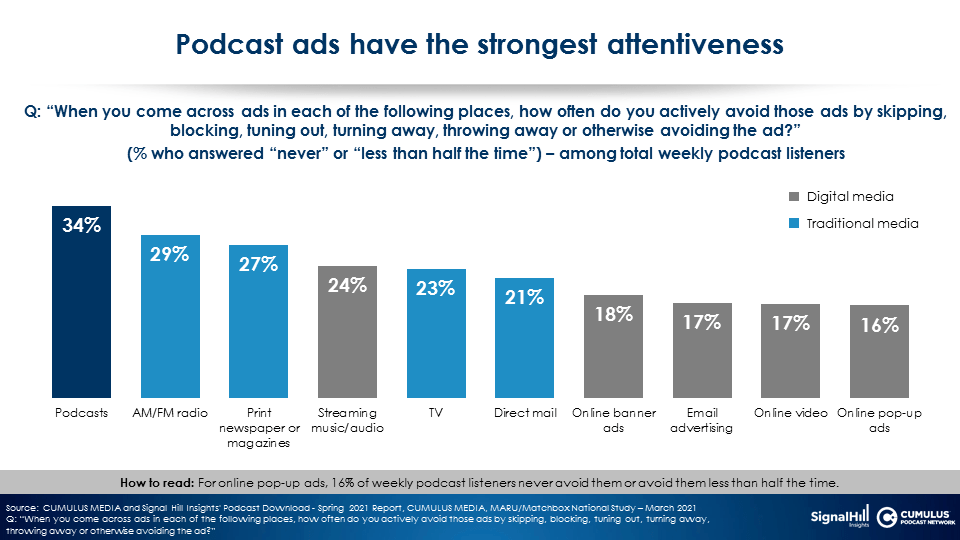

When consumers are asked to indicate how often they avoid ads, audio stands out as the advertising that holds the greatest attention. Podcasts and AM/FM radio have the greatest ad attentiveness.

Traditional media (depicted in the bright blue below) tend to have higher ad attentiveness compared to digital media.

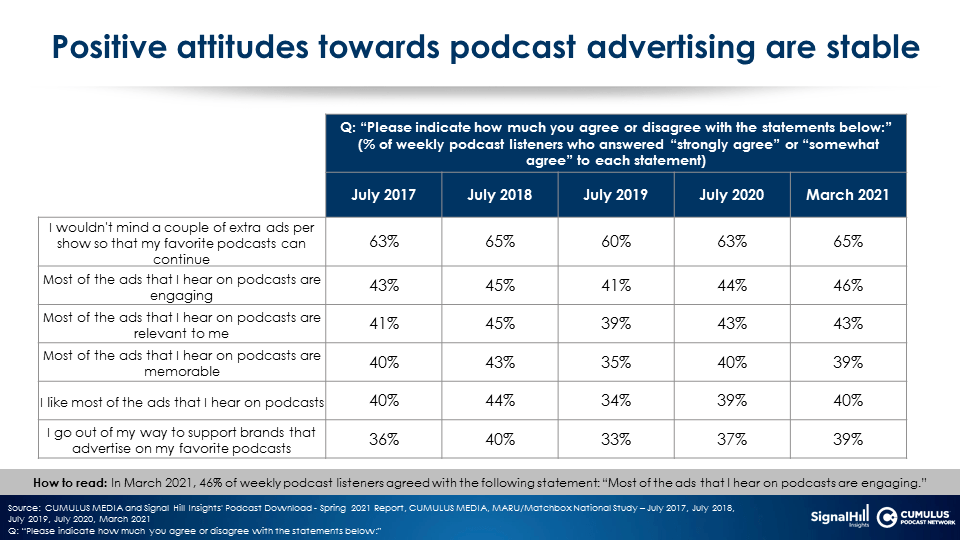

Appreciation of podcast advertising has not eroded despite the growth in podcast audience and podcast ad spend. Over the last five years, positive attitudes towards podcast advertising are remarkably stable.

Astoundingly, 65% of weekly podcast listeners say they would not mind more ads per show so that their favorite podcast can continue. Podcast ads continue to be seen as relevant, likeable, memorable, and engaging. Two out of five weekly podcast listeners say they go out of their way to support sponsors on their favorite podcasts.

Podcast advertising effectiveness: Ads drive action among podcast listeners

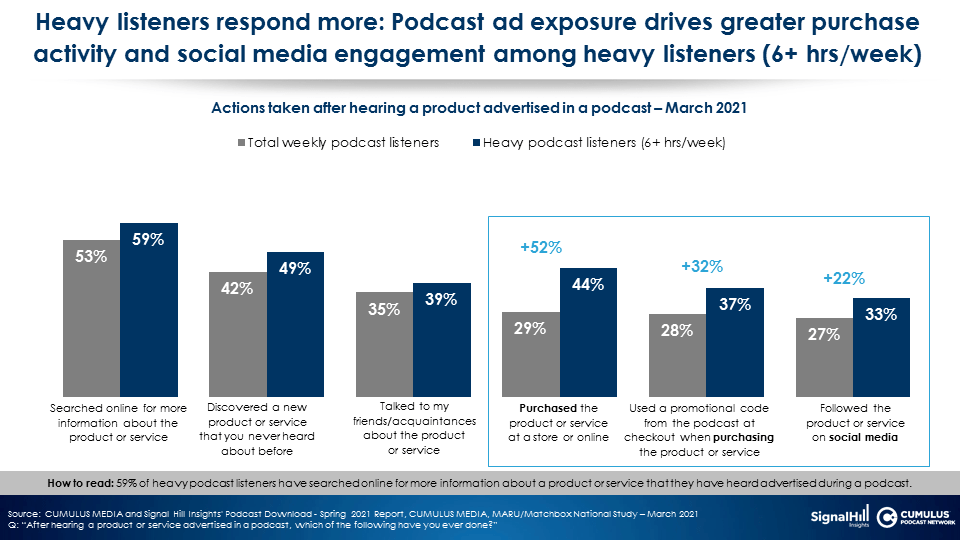

Podcast ads are noticed and create strong response. Three out of four listeners say have taken action after hearing a podcast ad. The remarkable levels of podcast ad engagement and appreciation translates into extraordinary levels of product research and purchase activity.

Compared to the weekly audiences, heavy podcast listeners (6+ hours per week) are +52% more likely to have made a purchase due to an ad, +32% more likely to have used a promo code, and +22% more likely to have followed a service or product on social media.

Podcasts are under-commercialized: Ad tolerance is strong among podcast listeners

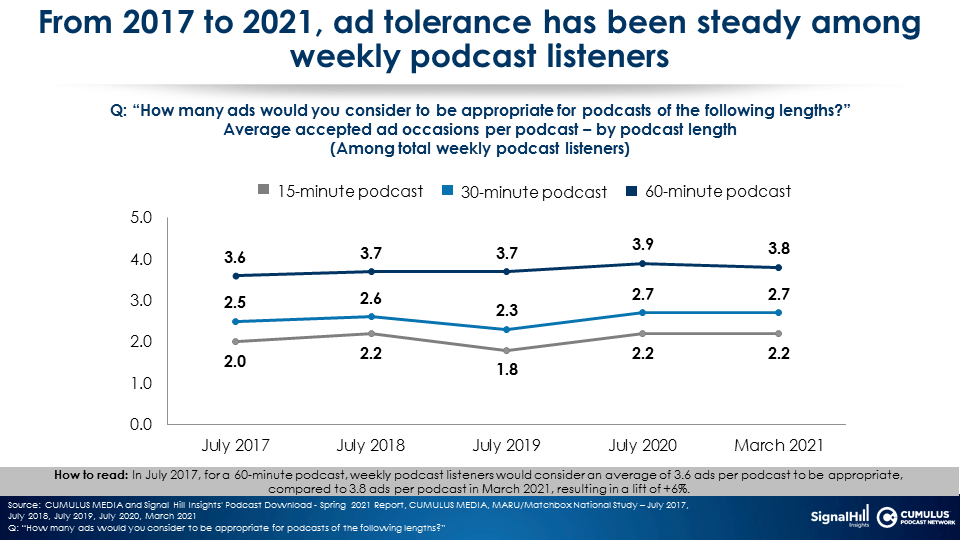

For the last five years, we have asked podcast listeners how many ads they would consider appropriate in podcasts. Each year, the number of ads deemed acceptable far exceeds actual podcast ad loads.

According to Magellan AI, the firm that tracks ads in podcasts, only 5.1% of the average podcast is dedicated to advertising. This pales in comparison to the 25% ad composition for the typical hour of linear television.

Host-read ads connect: Host-read ads continue to be a powerful attribute among podcast listeners

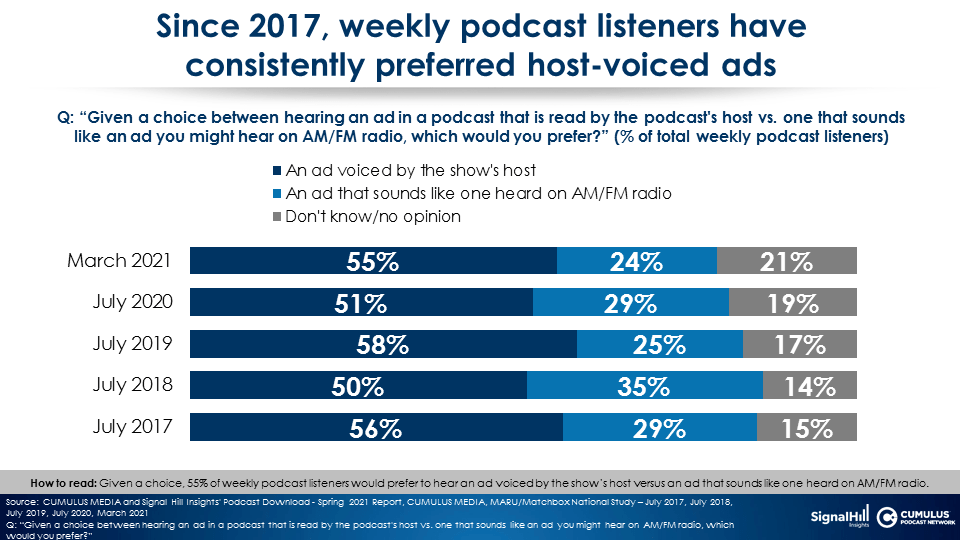

For five years, the majority of the podcast audience has said they prefer ads read by the podcast host.

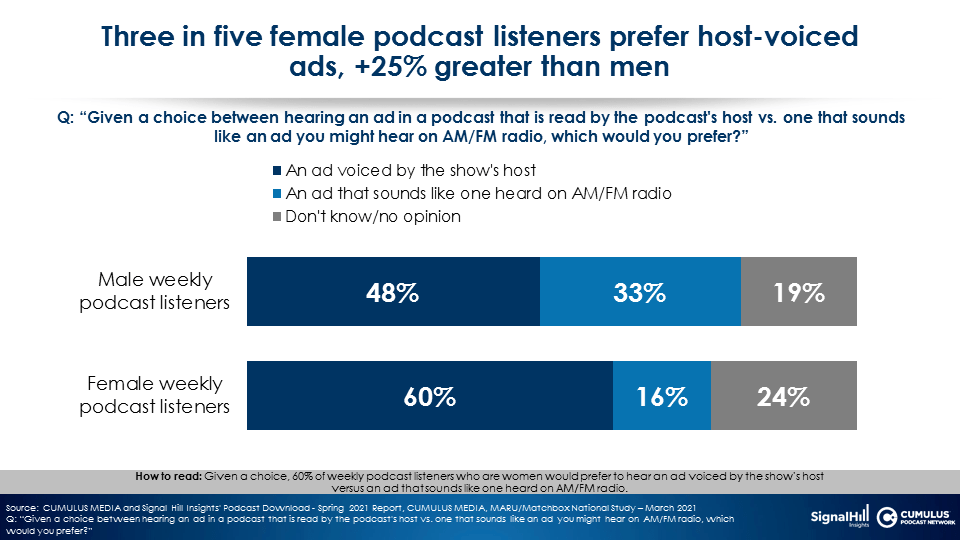

Host-read ads are especially compelling among women, with 60% preferring host-voiced ads.

Key takeaways:

- Podcast accelerant: Podcast listening grew during the pandemic

- Genre exploration: Podcast audiences are listening to new genres

- Day and date: Half of podcast fans listen to episodes the day they are released while 80% listen within three days

- Podcast discovery: Podcast Pioneers who have been listening for 4+ years find new shows via word of mouth and social media while Podcast Newcomers, those who started listening in the past six months, search by topic

- Podcast subscription models: Exclusive content is the driver, not a lack of ads

- Clubhouse’s arrival: Social audio is a natural marketing brand platform for podcast hosts and shows

- The Big Three Podcast Oligarchy: The number of distribution platforms used to listen to podcasts increased dramatically as Apple, Spotify, and YouTube expand their dominance

- Ads aren’t bad: Podcast listeners appreciate podcast advertising

- Podcast advertising effectiveness: Ads drive action among podcast listeners

- Podcasts are under-commercialized: Ad tolerance is strong among podcast listeners

- Host-read ads connect: Host-read ads continue to be a powerful attribute among podcast listeners

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Jeff Vidler is the President and Founder of Signal Hill Insights.

Contact the Insights team at CorpMarketing@westwoodone.com.