The State Of TV: Cord Cutting, Viewership Declines, And Older Audiences Mean Advertisers Need AM/FM Radio For Incremental Reach And The Light TV Viewer

The television landscape is undergoing massive change as audience viewing habits shift from linear TV to ad-free streaming options. Major players like WarnerMedia, NBCU, ViacomCBS, and Disney are all pouring resources into their video subscription services at the expense of their broadcast TV and cable networks.

What does this mean for advertisers who have historically used TV in their media plans for mass reach? How many people are they actually reaching now?

This is the state of TV:

One out of four persons 25-54 cannot be reached on linear TV

Nielsen’s just-released Total Audience Report reveals linear television’s weekly reach among persons 25-54 has dropped from 85% in Q3 2018 to only 77% in Q3 2020. Just about one out of four 25-54 Americans cannot be reached with linear television. AM/FM radio’s 89% weekly reach among persons 25-54 is much stronger than television’s 77%.

“Worst year ever” for cord cutting: Pay TV lost 5.5 million subscribers in 2020

COVID-19 caused Americans to stay home and look to media outlets for information and entertainment. The ever-increasing number of video streaming services meant a step back from traditional TV for many American households.

According to Protocol, “The five biggest pay TV providers lost a combined 5.5 million subscribers in 2020” with pandemic-related cutbacks hitting the industry hard and leading to high rates of cancellations. Variety declared 2020 the “worst year ever” for cord cutting with “more viewers cut[ing] the cord than any preceding year. Across cable, fiber optic, satellite and online providers, there were 78.4 million pay-TV subscribers at the close of 2020, representing a fall of 3.5 million, or -4.3%, from 2019.”

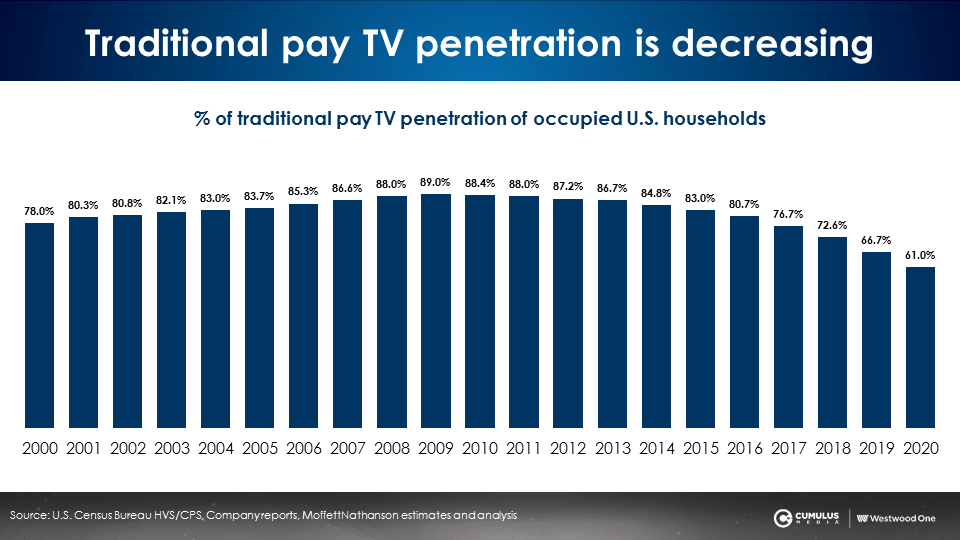

Cable buys miss 40% of America as pay TV penetration collapses

MoffettNathanson reports that residential penetration of traditional pay TV is down to 61% of occupied households. This is sharply reduced from pay TV’s peak 89% penetration in 2009.

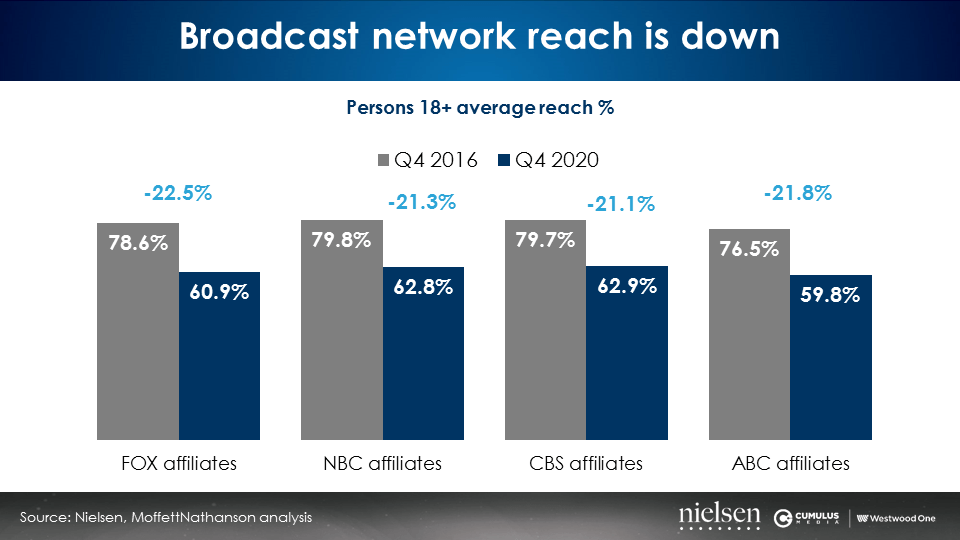

Broadcast TV’s reach is down an average of -22% across FOX, NBC, CBS, and ABC affiliates

According to MoffettNathanson, since 2016, broadcast TV has reached fewer persons 18+ across the four major broadcast network affiliates. In Q4 2020, FOX affiliate reach was down -22.5%, NBC affiliates were reaching -21.3% less adults, CBS affiliates declined -21.1%, and ABC affiliates had dipped -21.8%. In just four years, broadcast TV’s hallmark mass reach saw double-digit declines.

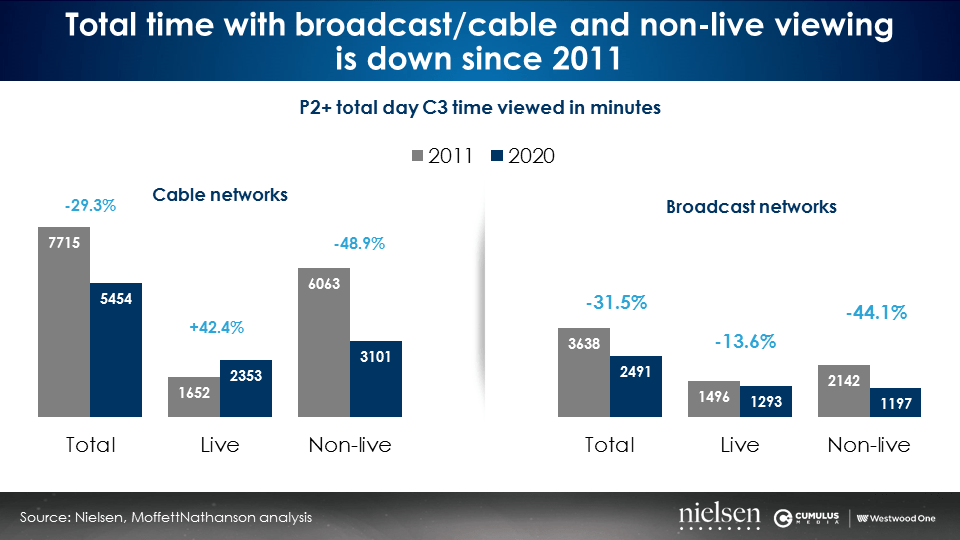

Despite a year with more people at home than ever, time spent with broadcast, cable, and non-live viewing is down

Broadcast and cable networks have seen a decline in time spent. From 2011 to 2020, MoffettNathanson reports a -31.5% decrease in time spent with broadcast networks and a -29.3% decrease in time spent with cable networks.

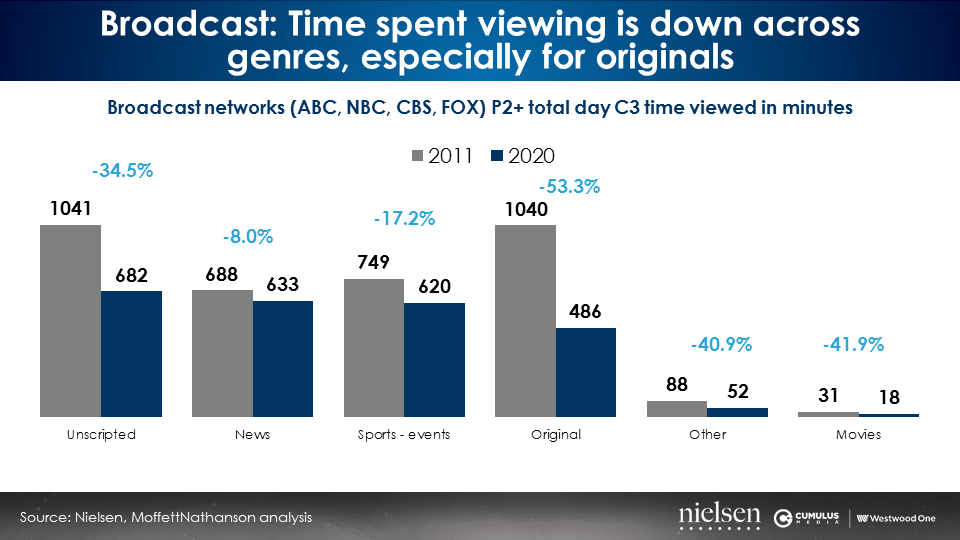

Across all genres, especially original programming, broadcast TV networks see declines in time spent viewing

2020 saw drops in total time spent viewing broadcast TV across all genres. The largest fall was for originals which went from 1,040 minutes per day to 486, a -53% decrease since 2011. Broadcast-aired movies, unscripted programs, and sports events also saw significant drops.

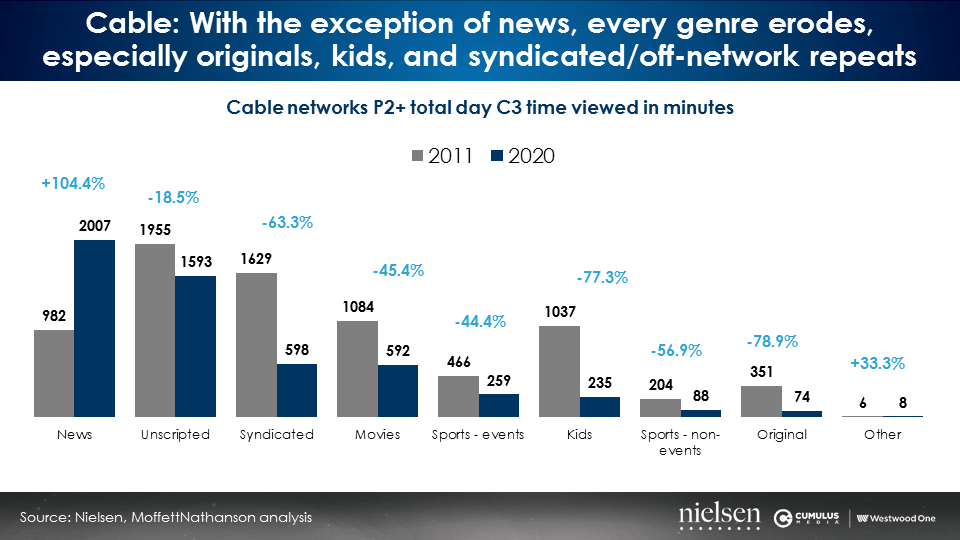

Cable networks see erosion across all genres in 2020 with the exception of news

With the election and pandemic, 2020 was good for cable news networks, resulting in +104.4% growth in total daily time spent. However, across the board, massive erosion occurred for cable genres like originals (-78.9%), kids (-77.3%), and syndicated (-63.3%) programming.

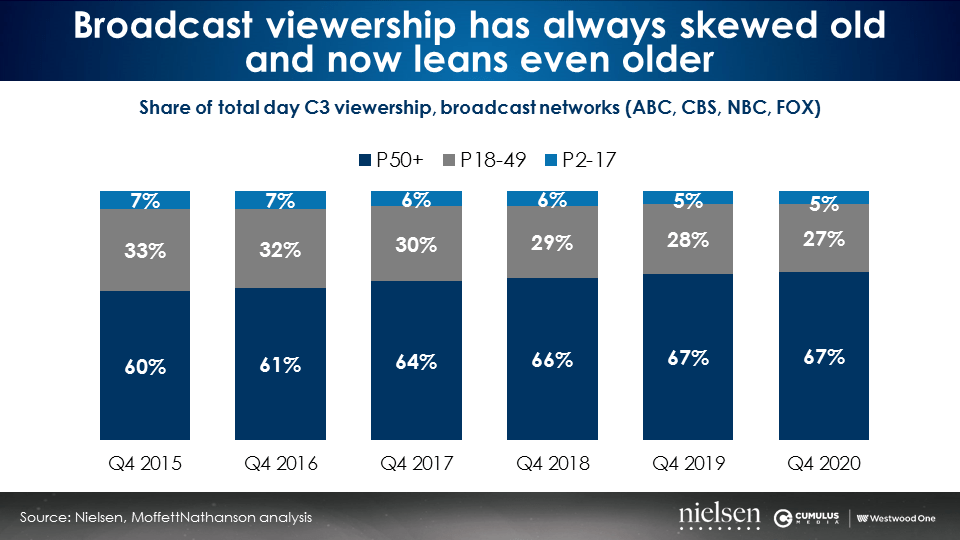

ABC/CBS/NBC/FOX audiences skew increasingly older

According to MoffettNathanson, in Q4 2015, 60% of all total day broadcast network viewership came from persons 50+. By Q4 2020, 67% of all broadcast network viewership was from the 50+ audience.

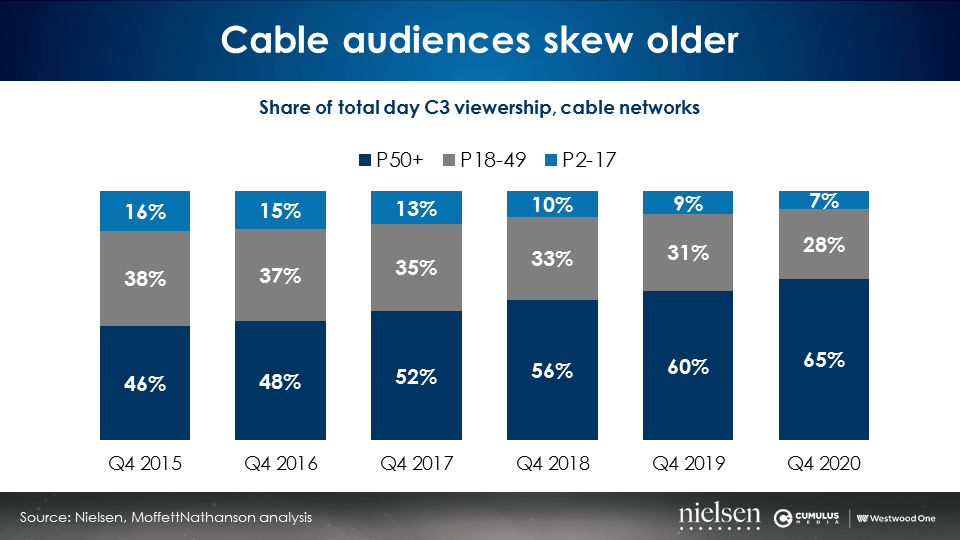

Cable network audiences also grow older

Since Q4 2015, the share of cable network total day viewership by persons 50+ has grown from 46% to a massive 65%. Broadcast and cable advertising is reaching an increasingly older audience.

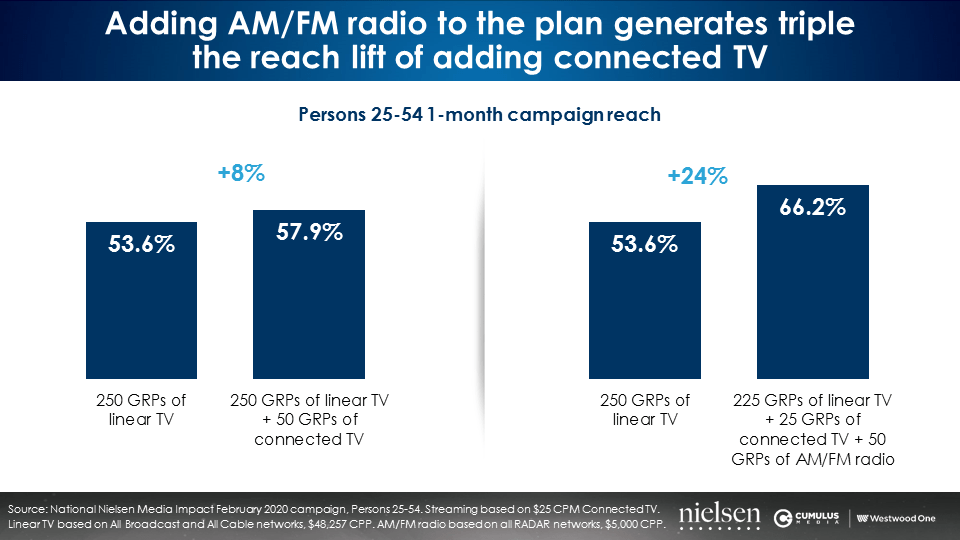

Connected TV can only solve for a small amount of TV’s erosion; Putting AM/FM radio in the plan generates triple the reach of connected TV

Many herald OTT and connected TV, ad-supported streaming TV, as the solution to all of linear TV’s woes. CTV ads are expensive and scarce.

“CTV ad rates for premium publishers are typically priced from two to six times national linear TV ad rates, and the biggest reason is scarcity,” notes Dave Morgan, CEO of Simulmedia, in MediaPost. “Nielsen data and data from smart TVs tell us only 4% of the ad viewing time on TV today is on streamed content.”

Nielsen Media Impact, the optimization and media planning platform, reveals connected TV can only modestly improve reach. In the scenario below, the addition of 50 points of CTV to 250 points of linear TV slightly lifts reach by +8%.

However, adding 50 points of AM/FM radio to 250 points of TV (225 linear TV GRPs and 25 connected TV GRPs) generates a +24% increase in reach, triple the incremental reach lift that connected TV can add alone.

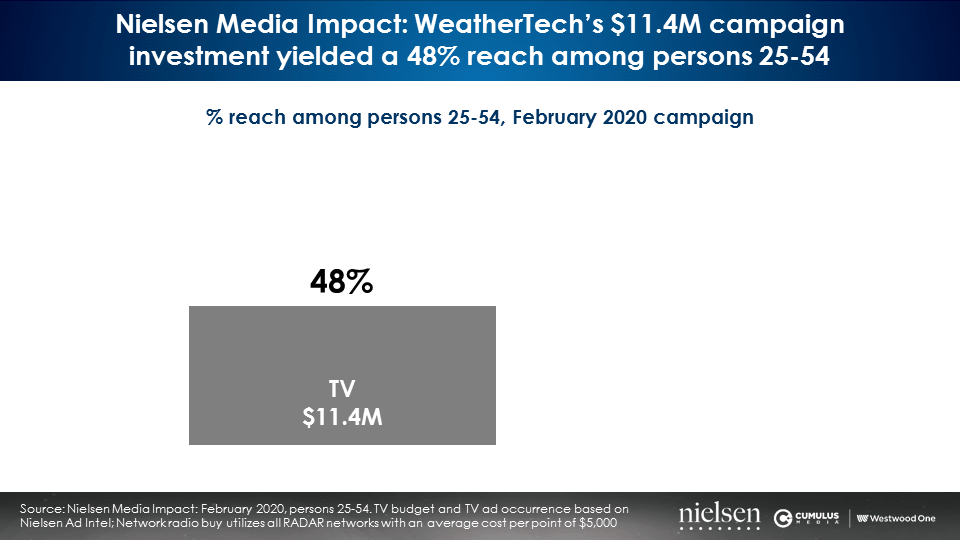

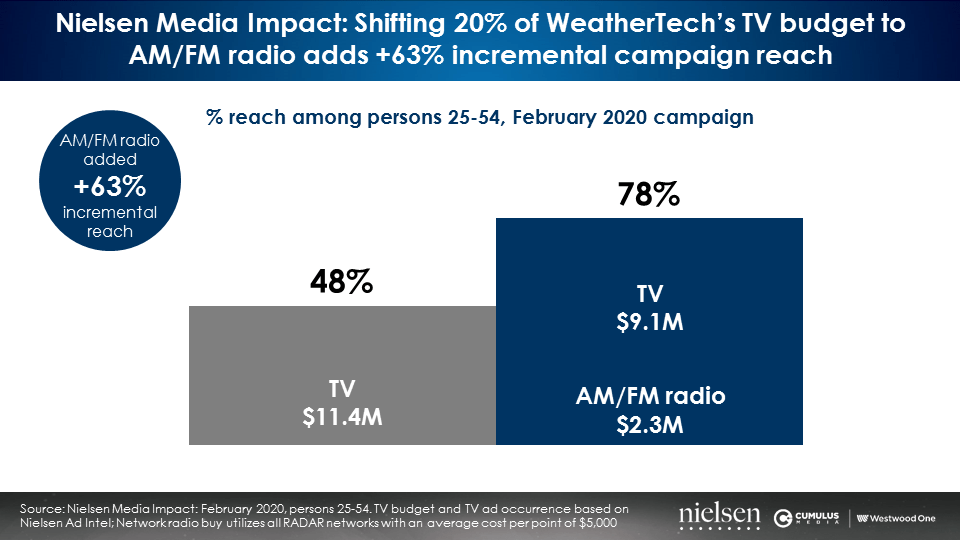

Nielsen Media Impact: Shifting 20% of the TV budget to AM/FM radio adds +63% incremental campaign reach for WeatherTech

WeatherTech is a retailer that sells floor mats, trunk liners, and other products for cars. Despite selling products that are used in the car where AM/FM radio is the number one ad-supported audio source with an 88% share of time spent, WeatherTech advertises on TV, billboards, and digital – not AM/FM radio. In February 2020, they spent $11.4 million in TV, generating a 48% reach among persons 25-54.

What would be the benefit of adding AM/FM radio to WeatherTech’s media plan? Using Nielsen Media Impact, the media optimization and planning tool, the scenario of shifting 20% of the budget to AM/FM radio can be analyzed.

Shifting just 20% of WeatherTech’s TV budget to AM/FM radio massively increases reach from 48% to 78% among persons 25-54. Adding AM/FM radio to WeatherTech’s media plan generates an astonishing +63% increase in campaign reach for the same spend.

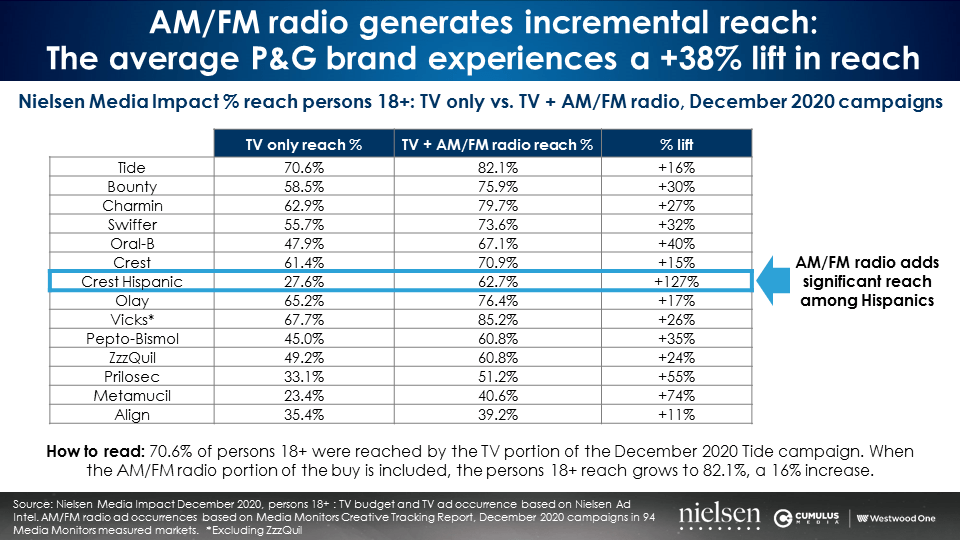

The average P&G brand experiences a +38% increase in reach due to AM/FM radio campaigns

A big story in audio has been Procter and Gamble’s significant return to AM/FM radio. According to Media Monitors, P&G was America’s top AM/FM radio advertiser in 2020.

At a radio conference a few years ago, P&G Executive John Fix said, “P&G wants to reach as much of America as it can, once a week … While TV has been its media cornerstone, it’s a costly investment to use television to reach 72% of the U.S.” He continued, “The brands are looking to get the reach they want and they can’t get it with TV. Knowing that, radio seemed to be an option.”

Nielsen Media Impact reveals the average P&G brand experiences a +38% lift in reach as a result of their AM/FM radio campaigns.

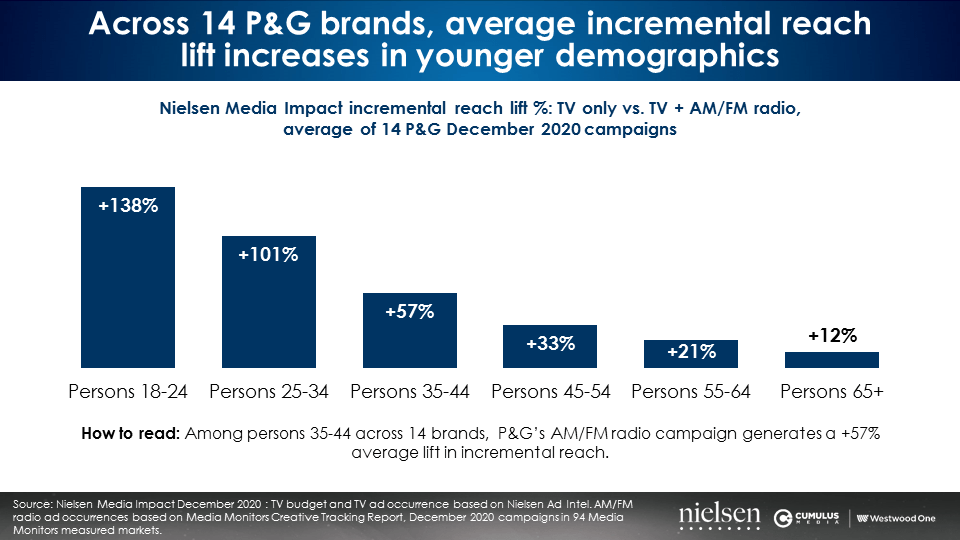

The younger the demographic, the greater the incremental reach lift generated by AM/FM radio

Nielsen Media Impact reports P&G’s lift in incremental reach as a result of their AM/FM radio campaigns grows in younger demographics.

P&G’s December 2020 AM/FM radio campaigns lifted TV reach by +33% among persons 45-54, +57% among persons 35-44, and +101% among persons 25-34. Hundreds of NMI reports for dozens of brands and categories all reveal the same findings. AM/FM radio can supplement the older skew of linear TV with significant reach lift under the age of 60.

AM/FM radio makes your TV better by reaching light TV viewers

Light and non-TV viewers are a challenge for marketers. Advertisers can’t solve the light TV problem by buying more TV.

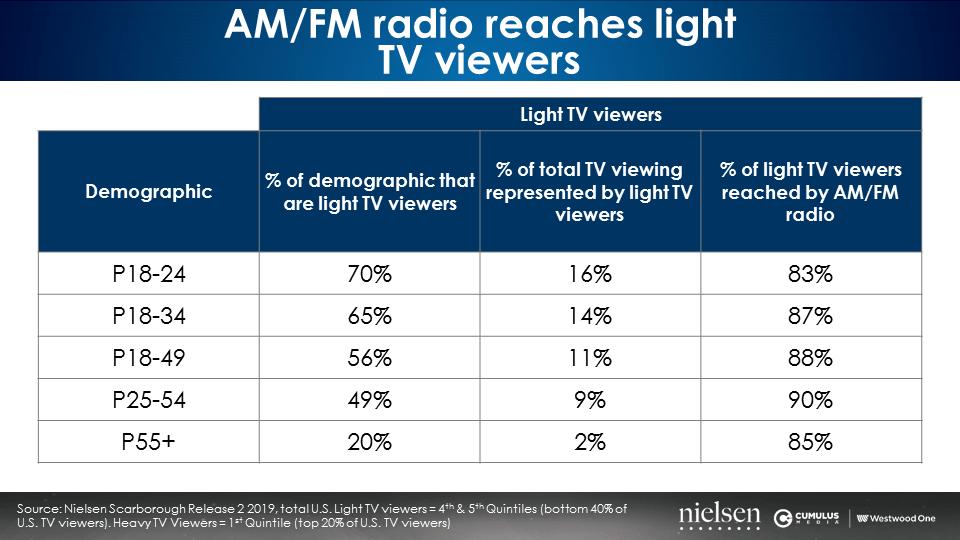

According to Nielsen Scarborough, AM/FM radio reaches 83%+ of the light TV viewer audience across all demographics. In the chart below, Nielsen depicts which percentage of each demo is comprised of light TV viewers and what percentage of that group is reached by AM/FM radio.

As an example, light TV viewers represent 49% of the persons 25-54 demographic, generating only 9% of total TV time spent. AM/FM radio reaches 90% of light TV viewers among persons 25-54.

Key takeaways:

- One out of four persons 25-54 cannot be reached on linear TV

- Cord cutting means 40% of Americans won’t see cable ads

- Despite a year with more people at home than ever, time spent with broadcast, cable, and non-live viewing is down especially for original programming

- Connected TV can only solve for a small amount of TV’s erosion; Putting AM/FM radio in the plan generates triple the reach of connected TV

- Nielsen Media Impact: Shifting 20% of the TV budget to AM/FM radio adds +63% incremental campaign reach for WeatherTech

- The average P&G brand experiences a +38% lift in reach due to their AM/FM radio schedules

- The younger the demographic, the greater the incremental reach lift generated by AM/FM radio

- AM/FM radio makes your TV better by reaching the vast majority of light TV viewers

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.