A Cautionary Tale: What Happens When A Successful AM/FM Radio Advertiser Eliminates AM/FM Radio From The Media Plan

While the pandemic-induced economic impact has caused some advertisers to pull spending, data shows this can be dangerous. According to WARC/Millward Brown, “It can take up to five years to recover from budget-cutting during a recession.”

Similarly, a recent case study commissioned by CUMULUS MEDIA | Westwood One provides strong evidence for why pulling AM/FM radio out of the plan can have negative consequences for the brand. Advertising case studies usually depict brands that find the right audience, optimize their plan, and achieve strong impact. This case study starts that way. From there, things quickly go off the rails.

Our story begins three years ago when a relatively new brand took on two major category players. Knowing that heavy AM/FM radio listeners are massive users in the category, the brand began investing heavily in AM/FM radio and saw immediate impact.

CUMULUS MEDIA | Westwood One retained MARU/Matchbox to track campaign effect during 2017 and 2018. The brand went from an also-ran to a strong performer in the category, gaining parity with the two major players. Brand equity grew. Usage shot up. It was a huge success story.

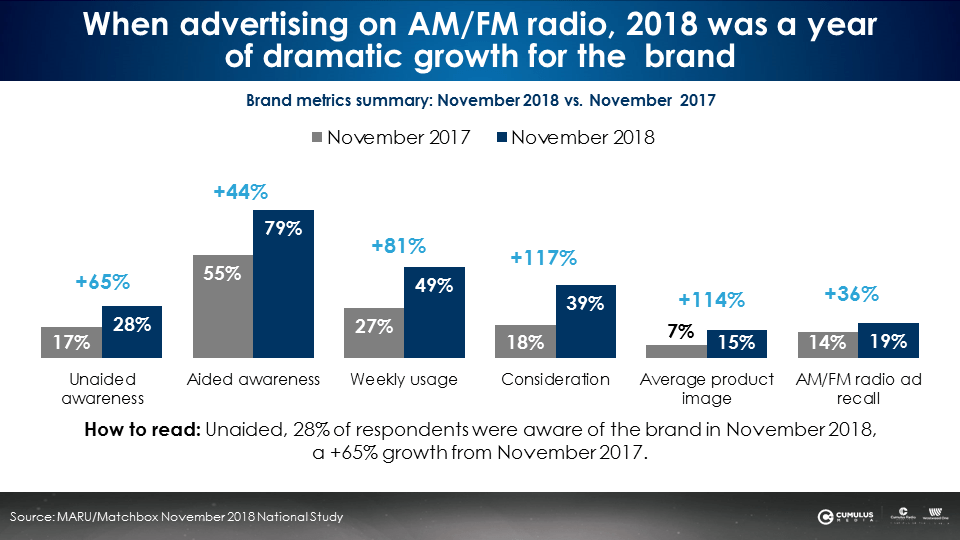

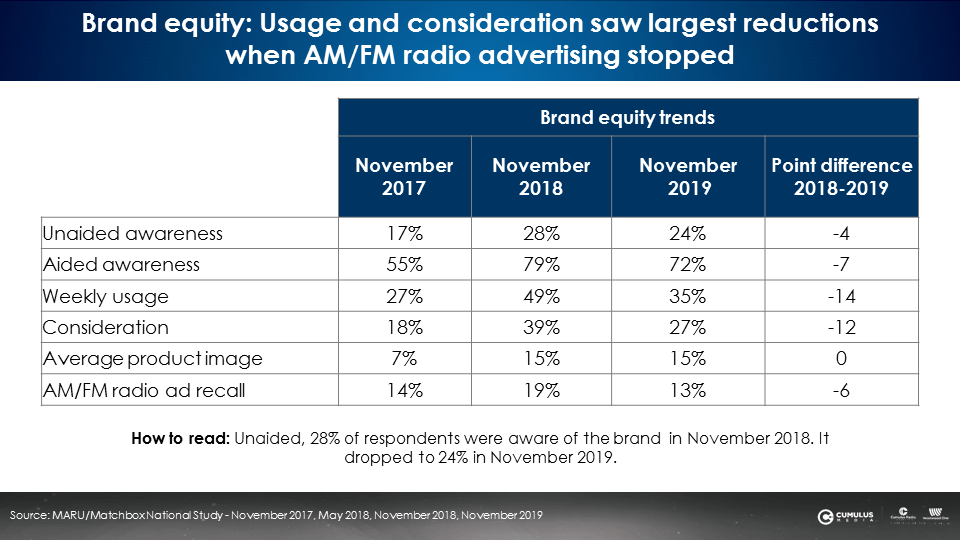

From 2017 to 2018, virtually every measure of brand equity and usage grew dramatically. Awareness, usage, consideration, product images, and AM/FM radio ad recall soared.

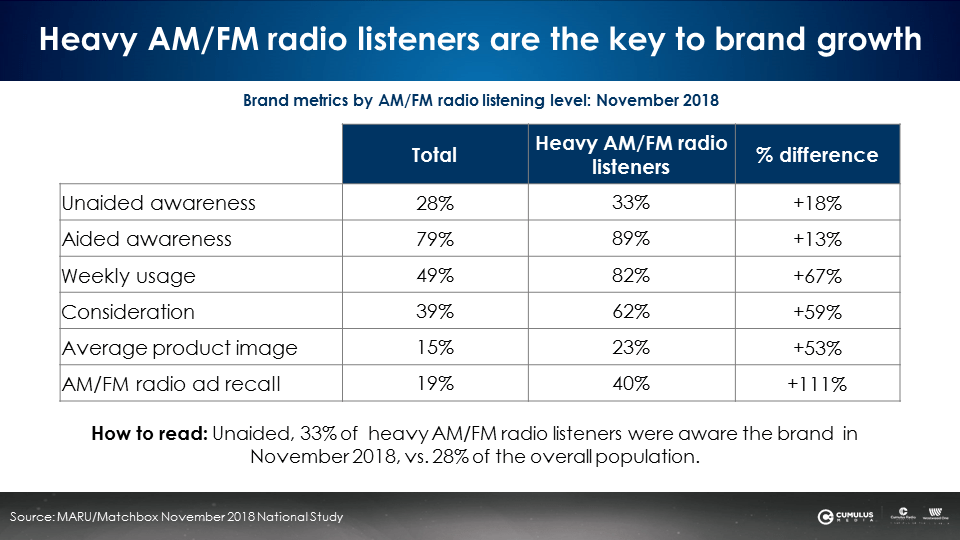

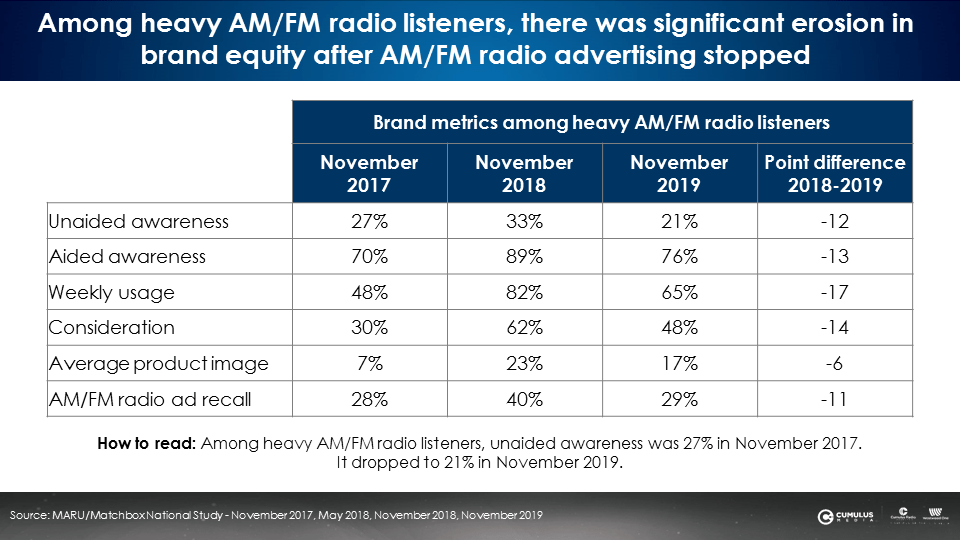

The engine of this growth? Heavy AM/FM radio listeners. Every brand equity and behavior measure was much stronger among heavy AM/FM radio listeners.

Despite this success, and despite data showing that when a brand stops AM/FM radio advertising sales fall, in 2019, the brand decided to shift out of AM/FM radio and double down on TV.

Nielsen analysis: TV skews much too old for the consumer category

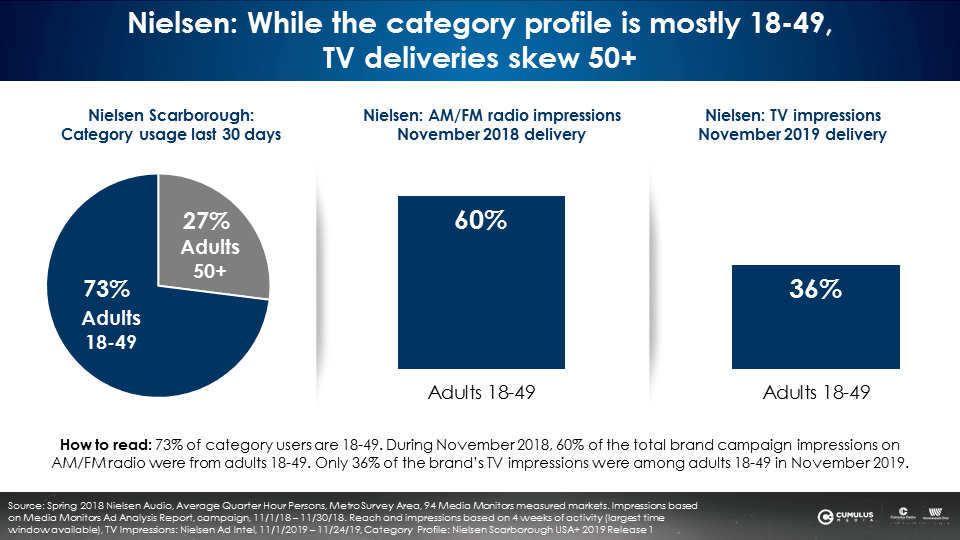

The brand’s category users are mostly made up of adults 18-49 (73%). When the brand was advertising on AM/FM radio, their AM/FM radio campaign impressions skewed 18-49. It was a good fit.

When the brand left AM/FM radio for television, campaign impressions skewed much older. Only 36% of the TV impressions were 18-49. The vast majority of TV deliveries (64%) occurred over the age of 50.

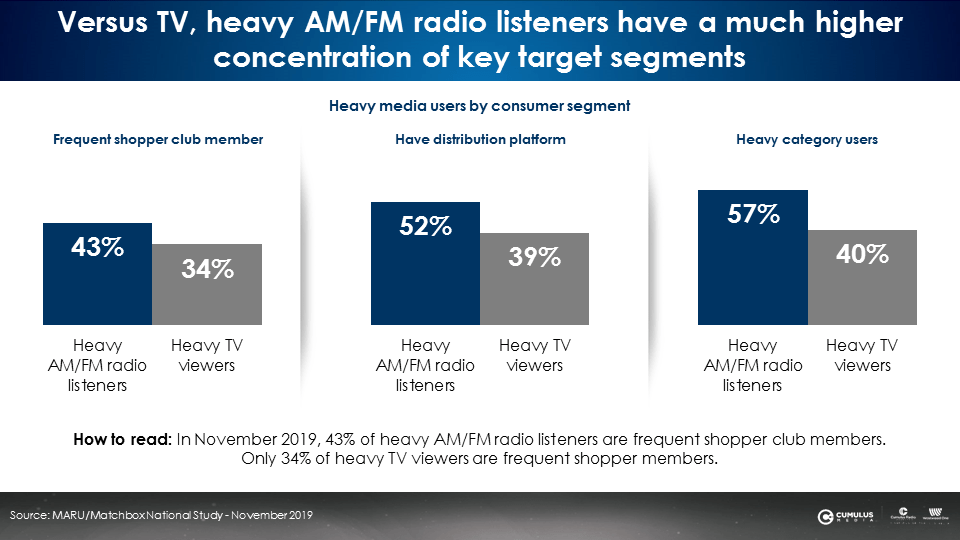

The demographic imbalance of the TV plan also extended to key targets for the brand. Compared to heavy TV viewers, heavy AM/FM radio listeners are far more likely to be members of the brand’s frequent shopper club, have access to their distribution platform, and are much more likely to be heavy category users.

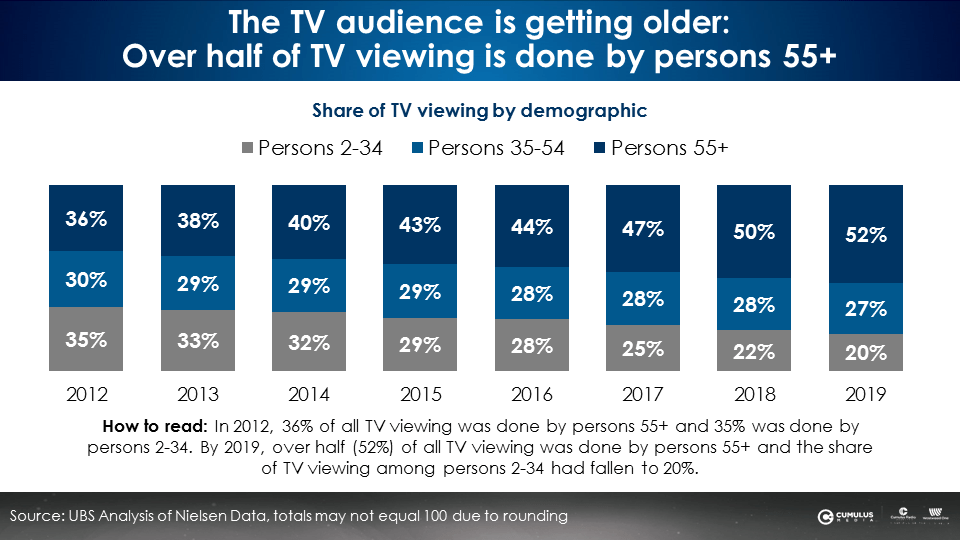

This older skew of the buy, or mis-targeting against key segments, is not the fault of the media agency. This is the state of American linear television today.

Since 2012, the TV audience has aged considerably. Seven years ago, 65% of TV viewing came viewers under 55. Today, only 47% of viewing is from those under 55. The share of viewing among 55+ has ballooned from 36% of 2012 to 52% in 2019.

What happened to the brand after they stopped using AM/FM radio?

Dropping AM/FM radio in 2019 caused erosion in awareness, weekly usage, brand consideration, and AM/FM radio ad recall. As images are like glaciers – slow to form and slow to melt – average brand perceptions were stable. After strong growth from 2017 to 2018, association to brand attributes stagnated from 2018 to 2019.

Dropping AM/FM radio caused major damage among heavy AM/FM radio listeners.

Brand equity suffered greatly down the entire purchase funnel with double-digit losses.

For brands, it is easy to fall victim to misconceptions about AM/FM radio and assume dropping the medium will not incur any negative consequences. However, AM/FM radio is a medium that can be used to reach younger target audiences, build a brand image, and drive usage, consideration, and ad recall.

Key takeaways:

- Advertising with AM/FM radio, a brand saw increases for virtually every measure of brand equity and usage, especially among heavy AM/FM radio listeners.

- AM/FM radio’s strong 18-49 audience composition matched the profile of category and brand users.

- Shifting budget to TV was a major error. Most brand users were under the age of 50 while the vast majority of TV campaign deliveries over the age of 50.

- When the brand cut AM/FM radio, usage and consideration eroded along with decreases in awareness and ad recall.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.