What Agencies Want To Know About Work From Home And AM/FM Radio

With work from home quickly becoming a reality for some Americans, we have fielded questions from agencies and advertisers seeking insight into current listening habits:

What is AM/FM radio’s reach among Americans who work from home?

Nielsen Scarborough USA+ reports that 90.8% of Americans who work from home are reached by AM/FM radio. AM/FM radio is the soundtrack of the American worker regardless of where they sit. Even if more are currently working from home, AM/FM radio is still America’s number one mass reach media.

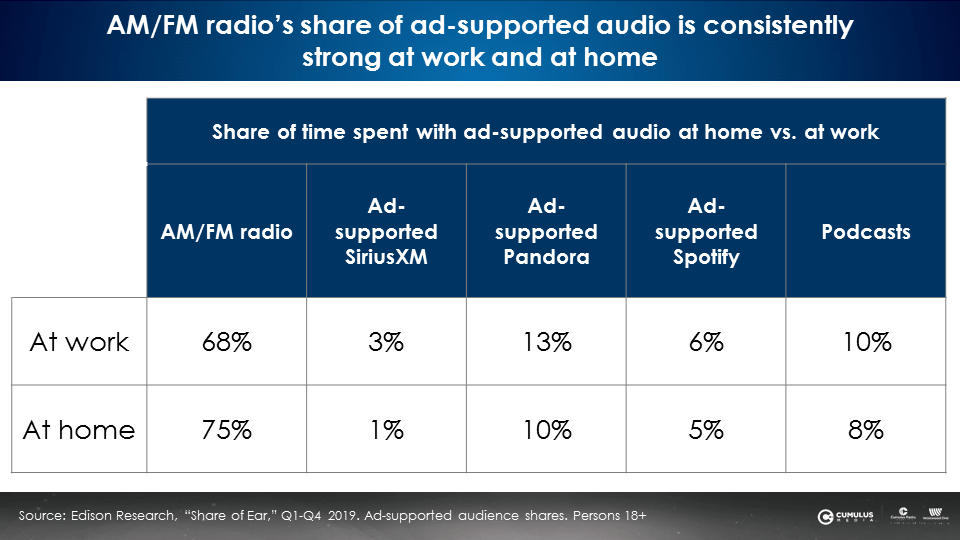

What is AM/FM radio’s share of audio at home and how does it compare to the workplace?

An agency asked, “If more people are working from home, are AM/FM radio shares lower at home versus at work?” Edison Research’s latest Q4 2019 “Share of Ear” study indicates AM/FM radio’s share of ad-supported audio is very strong at home and at work. In fact, AM/FM radio’s at-home share of ad-supported audio is actually a bit stronger at home versus at work. In both locations, AM/FM radio is the dominant audio platform.

What is the propensity to own smart speakers among people that work from home?

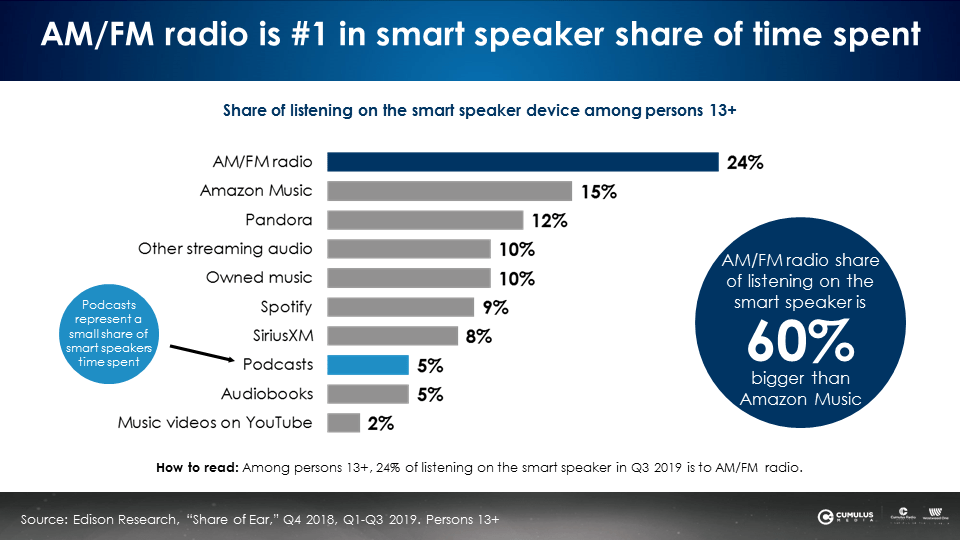

Those that work from home are 43% more likely to own smart speakers according to Nielsen Scarborough USA+. Smart speakers are bringing AM/FM radio back into the home. According to Triton, about 20% of all audio streaming to AM/FM radio comes from smart speakers.

If more people are at home, what are they listening to on their smart speakers?

Per Edison’s “Share of Ear,” AM/FM radio is the number one most listened to audio source on smart speakers.

What is the impact of listening shifts on Nielsen’s “RADAR” network radio audience service?

Nielsen’s network radio audience measurement was designed to smooth out the highs and lows of AM/FM radio listening. Gale Metzger, the father of RADAR, the network radio audience measurement service now owned by Nielsen, built the service to produce stable trends.

RADAR is based on a one-year rolling average of four quarters that smooths out the highs and the lows. Presidential elections and sports events cause listening upticks. Summer vacations and holidays cause listening levels to fall. The four-quarter rolling average stabilizes these events throughout the year.

The most current and just-published RADAR 144 covers the four quarters of 2019. The next RADAR will publish in June and will consist of Q2 2019 through Q1 2020.

When Nielsen introduced enhanced PPM encoding in Fall 2015/Winter 2016, listening levels shot up. The impact of the increase was mitigated by the rolling four quarters. Any disturbance in current listening levels will be smoothed by the one-year rolling average in RADAR.

In the national marketplace, some agencies buy on Nielsen Nationwide, which is produced twice a year measuring Fall and Spring. Nationwide rolls up all U.S. radio markets into one national study. The Fall 2019 survey was just published. Spring 2020 will release in September.

How are audiences reported in Nielsen Audio local markets?

The concept of a rolling average also exists in Nielsen Audio local markets. In the 48 Portable People Meter markets, buyers and sellers generally use an average of the most recent three-month reports. In 44 larger diary radio markets, Nielsen recently introduced Continuous Diary Measurement, which is based on three-month rolling averages.

Are there any early reads on listening from the past week?

Triton, the streaming audio audience service, reports that online audio shares to Public Radio and News/Talk stations have grown in the past week. Makes total sense.

In conclusion:

- AM/FM radio has massive reach among at-home workers and dominant shares at home.

- Those that work at home are 43% more likely to own smart speakers. AM/FM radio is the most listened to audio source on smart speakers.

- Network radio audience measurement services measure audiences on a one-year rolling average, which smooths out the highs and the lows of listening. Changes in listening are mitigated over an extended period.

- Local audience measurement also uses rolling averages to provide stable deliveries.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.