Nielsen: Adding AM/FM Radio To Political TV Buys Generates Dramatic Lift In Reach

How can political campaigns reach more registered voters without increasing their budgets? Nielsen has new answers.

Local Media Impact is Nielsen’s new local market media planning and optimization platform. LMI ingests Nielsen local TV and AM/FM radio people meter audience data along with digital audiences via Scarborough. For the first time, agencies can now determine the lift in reach achieved by adding AM/FM radio to television and digital campaigns.

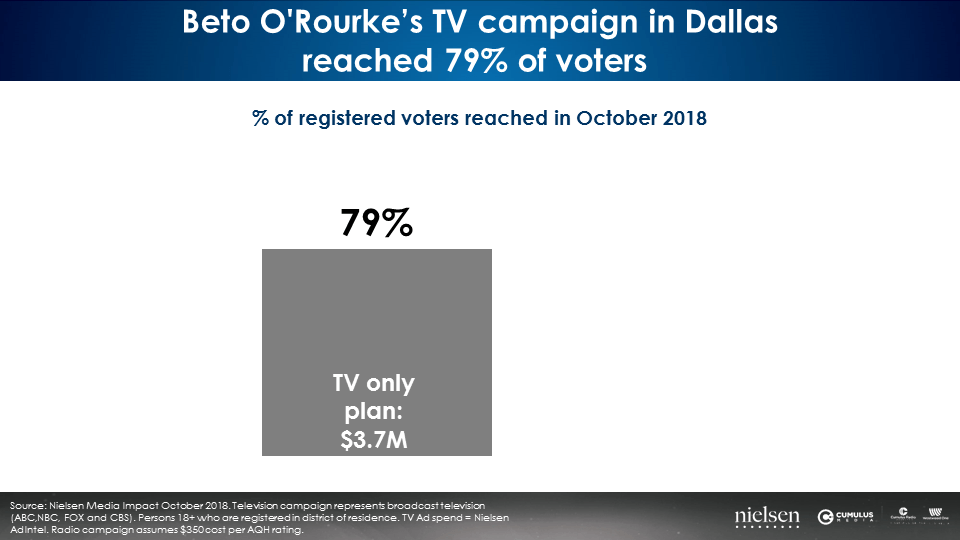

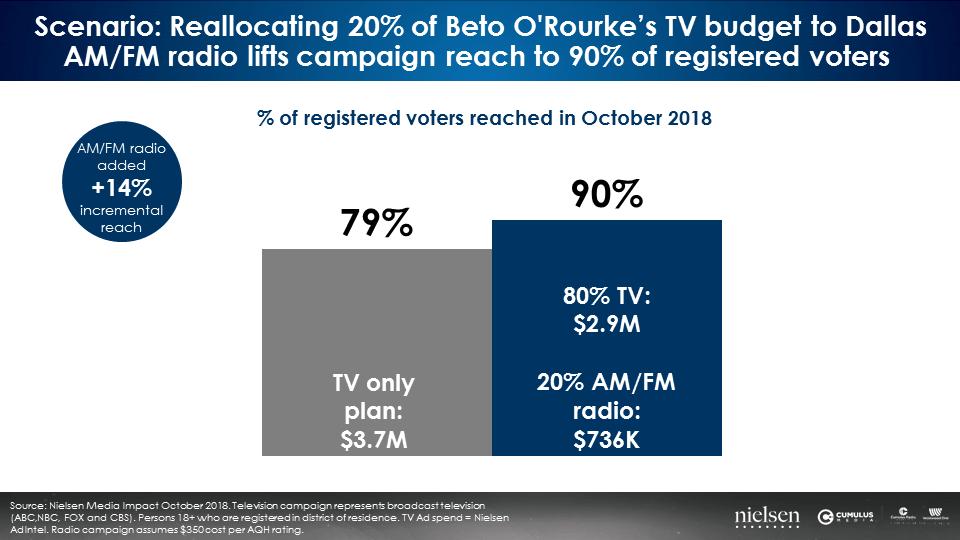

Nielsen case study: Beto O’Rourke’s Dallas TV campaign sees a +14% lift with 20% media allocation to AM/FM radio

In October 2018, Beto O’Rourke’s campaign spent $3.7 million on television in the Dallas market. No AM/FM radio was purchased. The TV campaign reached 79% of registered voters.

Is it possible to enhance this impressive reach? To find out, 20% of the TV budget was reallocated to Dallas AM/FM radio. The result from Nielsen Local Market Impact? Adding AM/FM radio to the plan grows registered voter reach from 79% to 90%, a +14% reach increase!

For the same investment, Nielsen LMI reveals adding AM/FM radio to the media plan causes registered voter reach to surge.

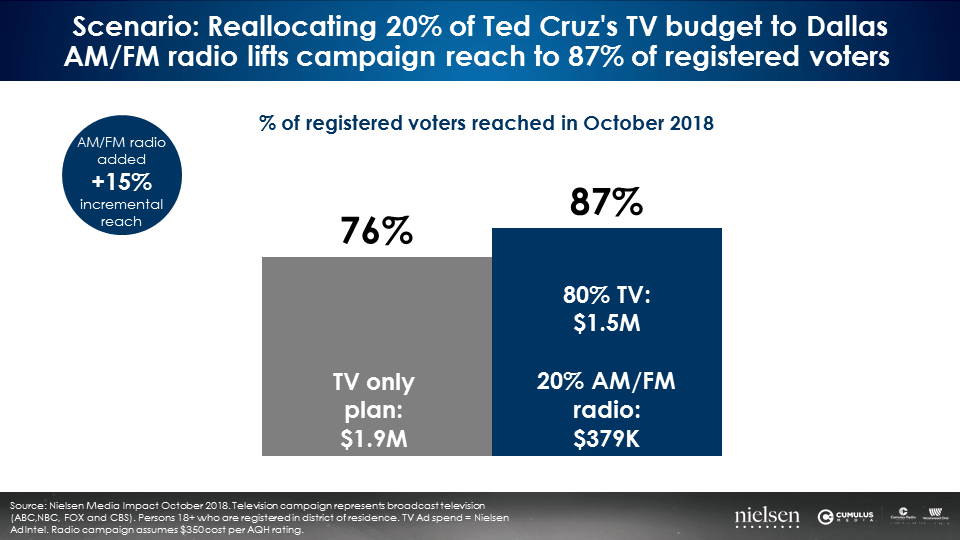

Nielsen case study: Ted Cruz’s Dallas TV campaign sees a +15% lift with 20% media investment allocation to AM/FM radio

Nielsen LMI finds a similar story for the Ted Cruz media buy. During the same month in Dallas, the Cruz campaign spent $1.9 million on TV. No AM/FM radio was utilized.

Using Nielsen LMI to reallocate 20% of the TV campaign to Dallas AM/FM radio, the new media plan generates a +15% increase in registered voter reach (76% to 87%).

AM/FM radio makes your TV better

Regardless of the size of the TV budget, adding AM/FM radio to the media plan generates significant incremental reach. A Nielsen Local Media Impact analysis of a series of local media buys for political campaigns finds a 20% allocation of the monthly TV budget to AM/FM radio consistently generates a major increase in registered voter reach.

Each campaign noted below used television and did not use AM/FM radio. In each case, a 20% reallocation from TV to AM/FM radio resulted in a significant reach lift of registered voters. The Nielsen LMI reallocation resulted in an average +22% increase in reach.

|

Reach |

||||

| Race | Candidate | TV only | AM/FM radio + TV | % change |

| Michigan 8th | Mike Bishop | 72% | 95% | 32% |

| Pennsylvania U.S. Senate | Katie McGinty | 72% | 85% | 18% |

| Florida U.S. Senate | Bill Nelson | 79% | 99% | 25% |

| Ohio Governor | Richard Cordray | 83% | 93% | 12% |

| Wisconsin Governor | Scott Walker | 89% | 97% | 9% |

| California 10th | Jeff Denham | 64% | 83% | 30% |

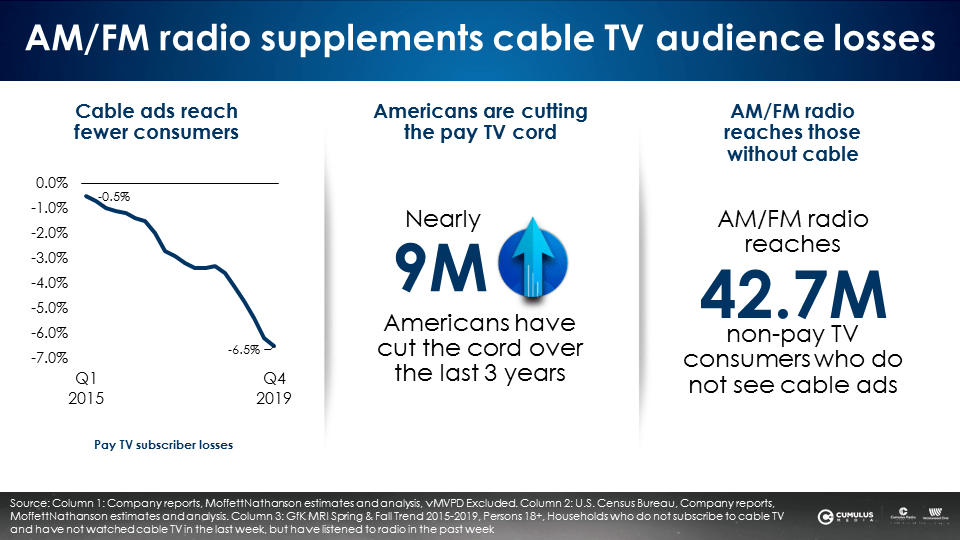

Voters without cable, light TV viewers, and declining TV ratings are why AM/FM radio adds so much incremental reach to TV buys

- Cable ads reach fewer consumers: MoffettNathanson reports Q4 2019 cable subscribers are down -6.5%

- Cord-cutters and cord-nevers: According to the U.S. Census Bureau and MoffettNathanson estimates, nearly 9 million Americans have cut the cord over the last 3 years

- AM/FM radio reaches those without cable: AM/FM radio reaches 42.7 million non-pay TV consumers who do not see ads on channels like CNN, Fox News, and MSNBC

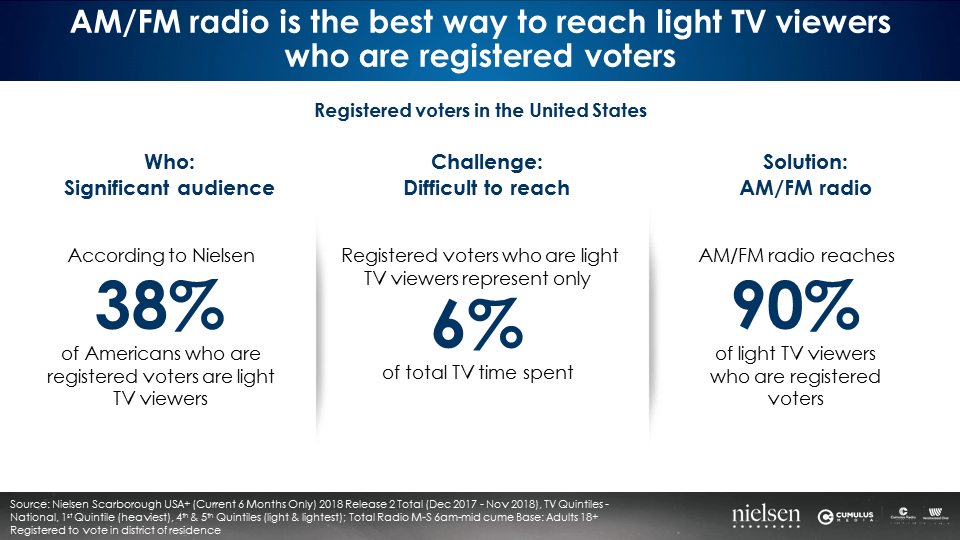

Light TV viewers: According to Nielsen, 38% of registered voters are light or no TV viewers. They generate only 6% of total TV time spent. It’s nearly impossible to reach light TV viewers with TV. The solution: just add AM/FM radio. AM/FM radio reaches 90% of registered voters who are light TV viewers.

Declining TV ratings: According to MoffettNathanson’s analysis of Nielsen TV audiences, in 2019, 18-49 TV ratings declined -15% from the prior year. Older 50+ audiences declined -5%.

With local broadcast affiliate reach now under 70%, it’s hard to reach all registered voters and prospects for any purchaser category with network TV broadcast affiliates.

| Average broadcast affiliate reach % Q4 2019 among persons 18+ | |

| CBS | 68% |

| Fox | 68% |

| NBC | 68% |

| ABC | 63% |

| Source: MoffettNathanson, January 2020 | |

Take it from P&G: AM/FM radio works

After a multi-decade absence from AM/FM radio, P&G is now the fastest growing advertiser on U.S. AM/FM radio. Recently, when asked how their rediscovery of radio is going, Procter & Gamble’s Chief Brand Officer, Marc Pritchard told the Radio Advertising Bureau, “It’s going well. We’re doing a lot more radio, a lot more voice in general, because it’s really something that people are paying attention to. What is old is new again.” He concludes, “Radio is as efficient, if not more efficient in many cases, and has a higher ROI than many other media.”

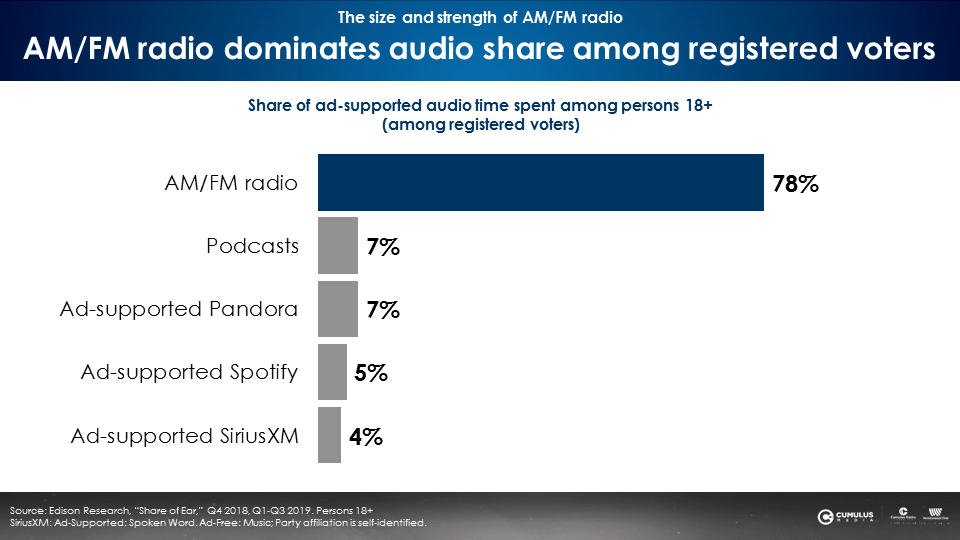

AM/FM radio has a 78% share of ad-supported audio among registered voters

According to the latest “Share of Ear” study from Edison Research, AM/FM radio dominates listening among registered voters. AM/FM radio’s share of ad-supported time spent is over ten times the nearest platform.

Key takeaways:

- Nielsen’s new Local Media Impact media planning platform reveals reallocating 20% of political TV buys to AM/FM radio generates a significant lift in registered voter reach.

- AM/FM radio makes your TV better by reaching hard to reach segments: cord-cutters, cord-nevers, and light or no TV viewers

- Major brands are rediscovering AM/FM radio and seeing strong results

- AM/FM radio has a 78% share of ad-supported audio among registered voters

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.