Your Media Planning Questions Answered: The Audio Planning Guide From The Cumulus Media | Westwood One Audio Active Group®

Click here to view a 13-minute video of the key findings.

Click here to download a PDF of the full deck.

Conversations with marketers and agencies reveal these frequently asked questions about audio media strategy:

- What is the ideal media plan allocation of ad-supported audio platforms?

- If I’m buying music streaming and podcasts, can I “check the box” on audio?

- What are recommended GRP thresholds for light, medium, and heavy AM/FM radio campaigns?

- What is the ideal allocation of AM/FM radio weight by daypart? Is it true that AM/FM radio is a “drive time” medium?

- Are there any seasonality patterns in AM/FM radio listening?

- What is AM/FM radio’s reach during major holiday weeks?

- Can I generate meaningful incremental reach with the addition of AM/FM radio to the media plan?

- If media strategy calls for increased reach among 18-49s, which media can generate the greatest lift?

In response to these questions, the Cumulus Media | Westwood One Audio Active Group® developed the Audio Planning Guide. The data is sourced from Edison Research’s “Share of Ear” Report, Nielsen’s Nationwide, and Nielsen’s Media Impact, the media planning and optimization platform.

What are the ideal audio media plan allocations?

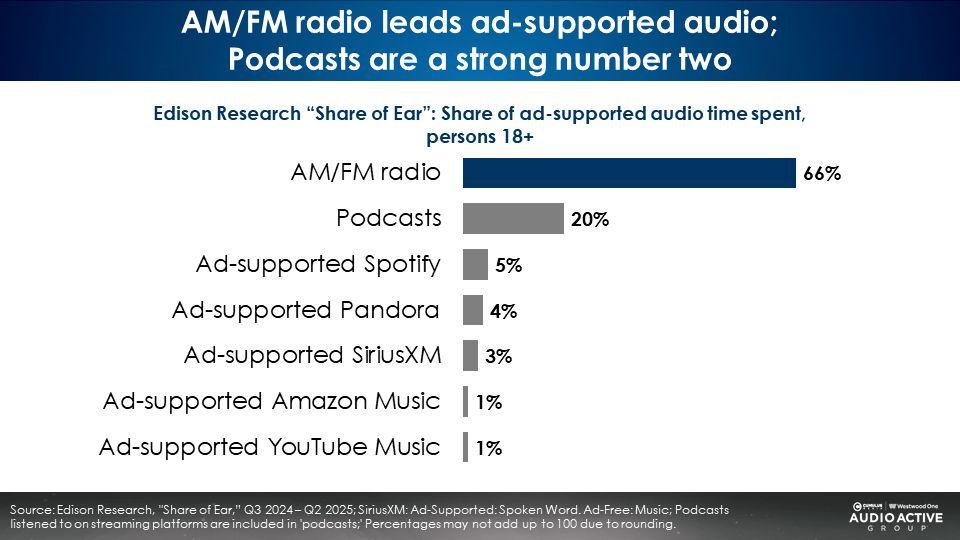

Many media strategists and planners mistakenly believe Pandora and Spotify have the largest share of ad-supported audio listening. Perception is not reality. At a 66% share, Edison Research’s “Share of Ear” reveals AM/FM radio is the dominant ad-supported audio platform. A strong number two is podcasting.

From the Q2 2025 “Share of Ear” study, Edison reports AM/FM radio’s 66% share is 13 times larger than Spotify and 16 times larger than Pandora.

Podcast audiences are substantial, especially among younger demographics.

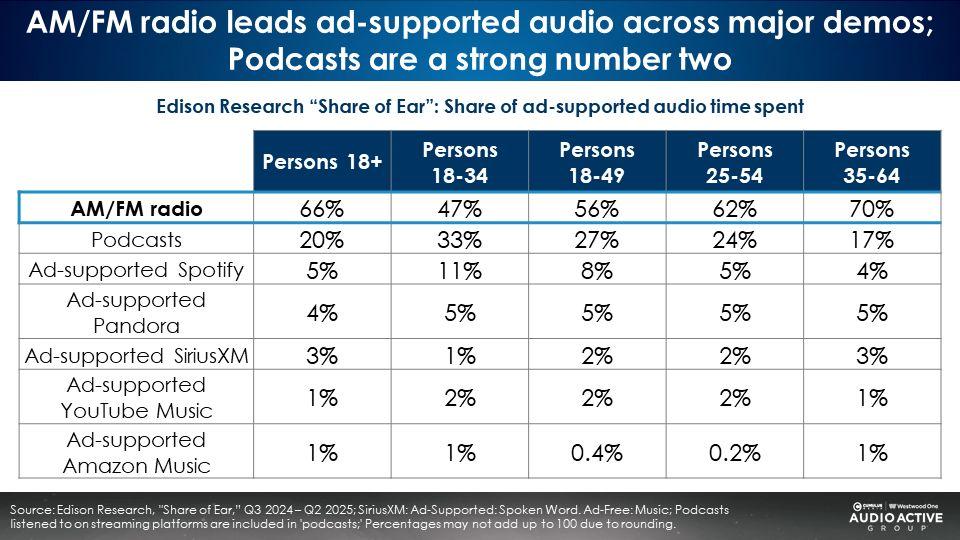

For a series of major buying demographics, here are the shares of ad-supported audio that can be used to allocate audio investments:

If I’m buying music streaming and podcasts, can I “check the box” on audio?

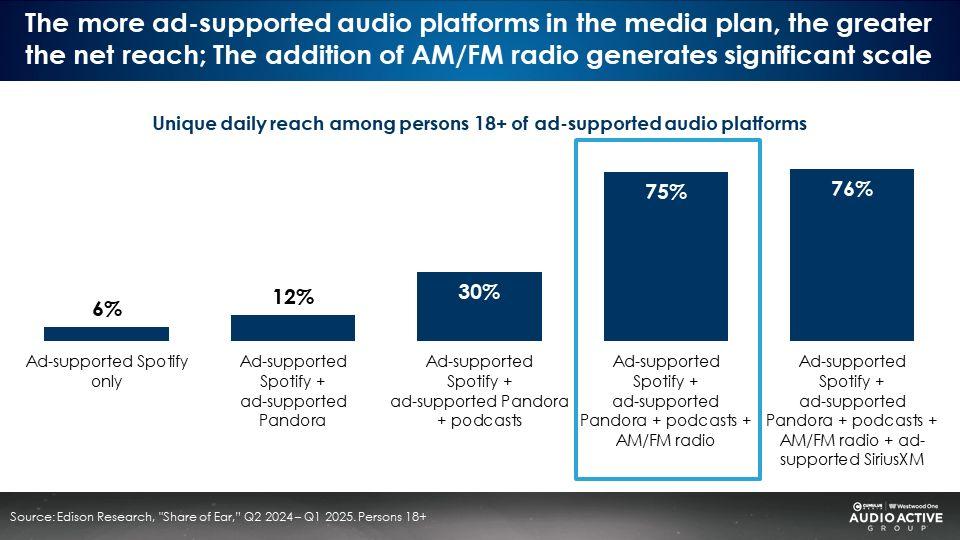

Not so fast! If you only buy digital audio, you’ll miss 70% of America. Edison’s “Share of Ear” reveals that the combination of Spotify, Pandora, and podcasts only reaches 30% of the U.S. in a typical day. The addition of AM/FM radio causes daily reach to soar to 75%.

What are recommended GRP thresholds for light, medium, and heavy AM/FM radio campaigns?

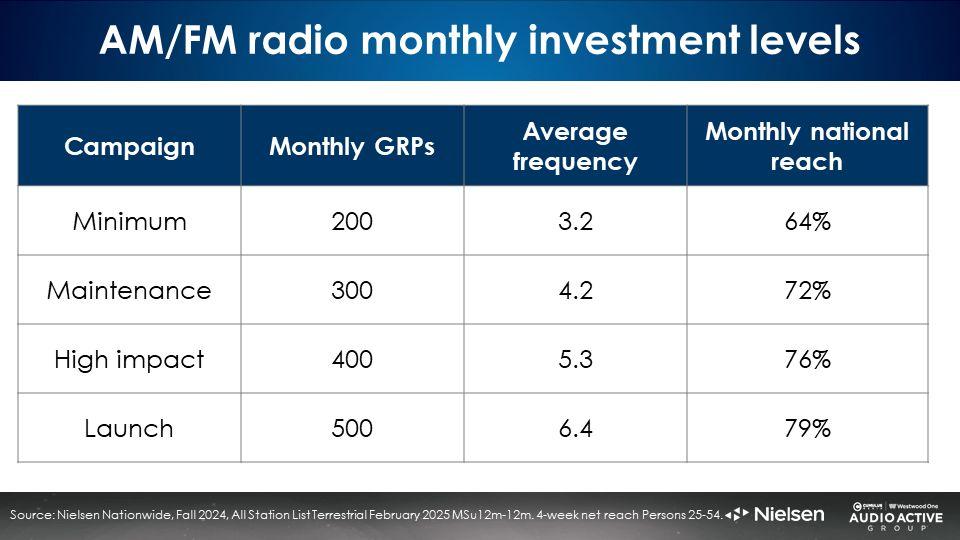

Via Nielsen Nationwide, the service that reports all AM/FM radio listening in America, here are four monthly campaigns of varying GRP weights:

To price out these four investment levels, multiply the GRPs by the cost per point of the local market or the total U.S.

What is the ideal allocation of AM/FM radio weight by daypart? Is it true that radio is a “drive time” medium?

Myth buster. No, AM/FM radio is not a “drive time” medium. 58% of all U.S. AM/FM radio listening occurs outside of morning and afternoon drives! According to Nielsen, here is the ideal daypart allocation based on how Americans listen to AM/FM radio:

- 22% Monday-Friday, 6AM-10AM

- 26% Monday-Friday, 10AM-3PM

- 20% Monday-Friday, 3PM-7PM

- 7% Monday-Friday, 7PM-midnight

- 20% weekends, Saturday-Sunday, 6AM-midnight

- 5% Monday-Sunday, midnight-6AM

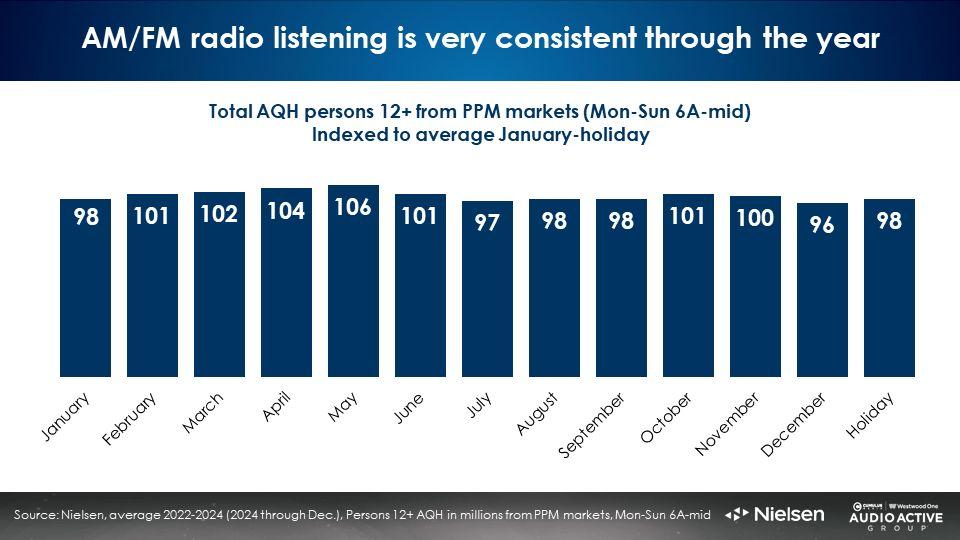

Are there any seasonality patterns in AM/FM radio listening?

In short, no. Indexing aggregated monthly audiences from all Portable People Meter markets reveals exceptionally consistent listening levels throughout the year. Spring months are slightly higher than average while Summer months are ever so slightly below the annual average.

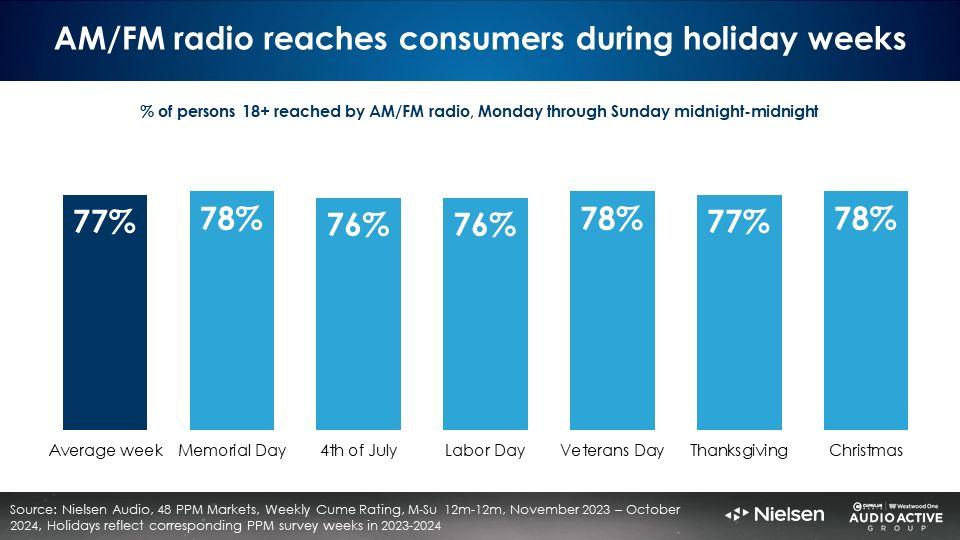

What is AM/FM radio’s reach during major holiday weeks?

Nielsen reveals holiday weekly reach of AM/FM radio is identical to typical weekly reach levels. As such, retailers with major holiday sales can confidently use AM/FM radio to get the word out about seasonal promotions.

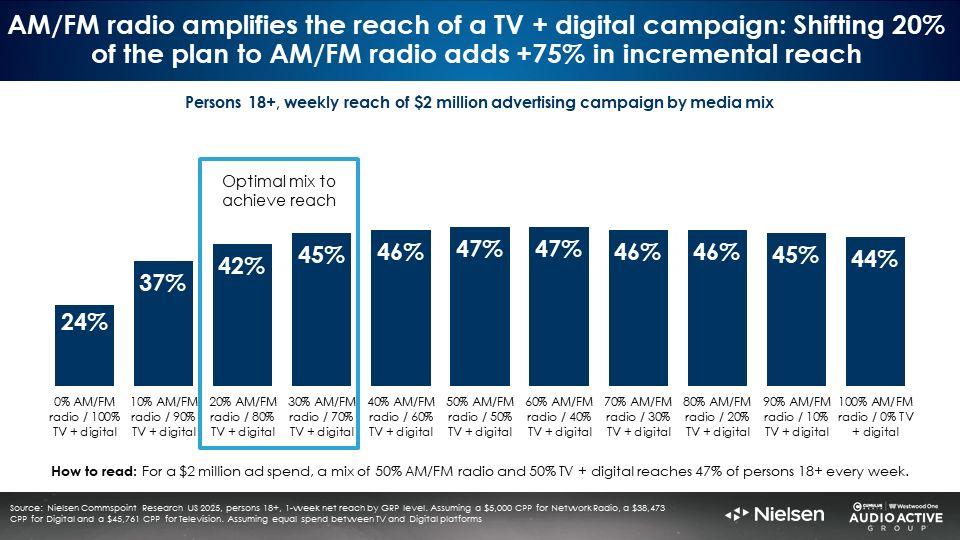

Can I generate meaningful incremental reach with the addition of AM/FM radio to the media plan?

Yes! Major brands find that adding AM/FM radio to media plans can generate a significant lift in campaign reach. According to Nielsen Commspoint, the media planning platform, a reallocation of 20%-30% of the digital/TV budget to AM/FM radio generates significant lifts in incremental reach.

For example, investment in digital and television results in a 27% reach. Shifting 30% of the media budget to AM/FM radio results in campaign reach jumping from 27% to 45%. This 30% reallocation to AM/FM radio generates a stunning +75% increase in reach for the same investment.

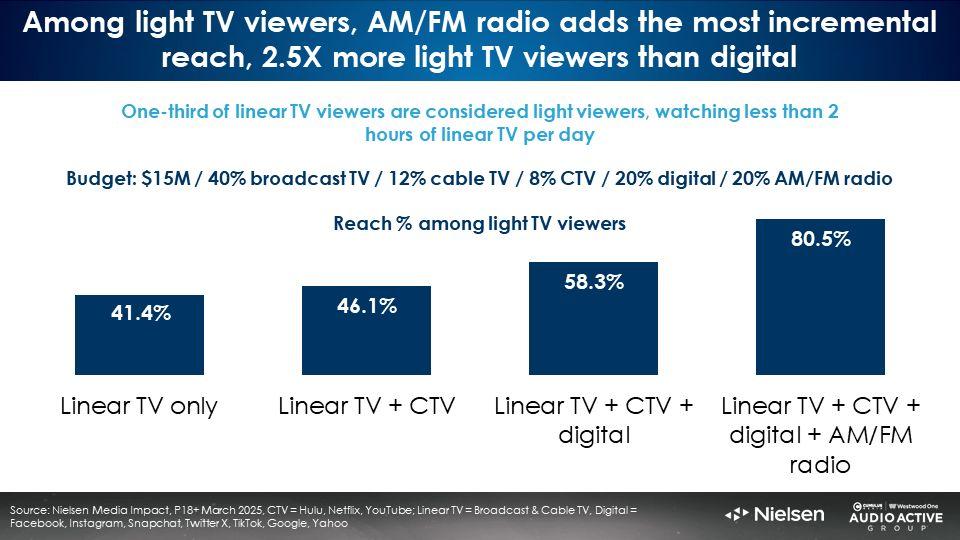

An analysis among light TV viewers from Nielsen Media Impact, the media optimization service, reveals that the addition of AM/FM radio generates the greatest lift in incremental reach.

- Adding CTV to the base TV buy only grows reach by 5 points.

- The addition of digital increases reach by 12 points.

- Layering in AM/FM radio lifts reach by an astonishing 22 points!

AM/FM radio is the queen of incrementality. Over half of the incremental reach of the entire media plan is generated by AM/FM radio.

If media strategy calls for increased reach among 18-49s, which media can generate the greatest lift?

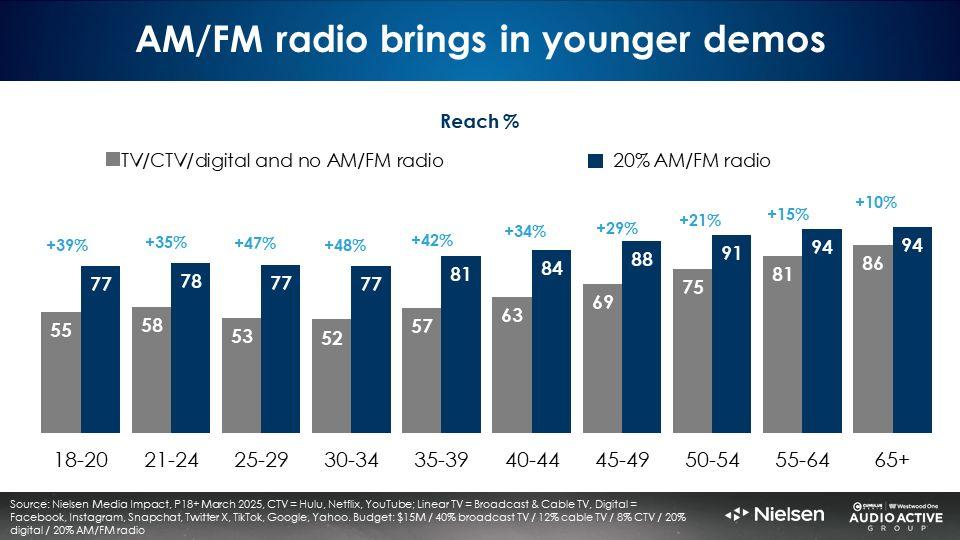

Look no further than AM/FM radio! According to Nielsen Media Impact, the addition of AM/FM radio to a digital/TV plan resulted in significant lift among 18-49-year-olds, ranging from 29% to 48%. This scenario shifted 20% of the digital/TV plan to AM/FM radio with no increase in budget.

Key findings:

- The ideal allocation for a 25-54 audio plan is 62% AM/FM radio, 24% podcasts, 12% music streaming (Pandora, Spotify, Amazon Music, and YouTube Music), and 2% SiriusXM satellite radio.

- You cannot check the box on audio with just a podcast/music streaming media plan. Digital audio only reaches 30% of America in a typical day. Adding AM/FM radio causes reach to soar to 75%.

- Four monthly AM/FM radio media plans (minimum, maintenance, high impact, and launch) require 200 to 500 monthly GRPs, which generate reach from 64% to 79%.

- Most AM/FM radio listening occurs outside “drive times.” The ideal daypart allocation is: 22% Monday-Friday, 6 AM-10 AM; 26% Monday-Friday, 10 AM-3PM; 20% Monday-Friday, 3 PM-7PM; 7% Monday-Friday, 7PM-midnight; 20% weekends; 5% Monday-Sunday, midnight-6AM.

- Retailers can use AM/FM radio with confidence all year long, especially during holidays. Across the year, AM/FM radio listening levels are remarkably consistent. Weekly reach during holiday weeks is identical to a typical week.

- Shifting 20%-30% of digital/TV budgets to AM/FM radio results in extraordinary increases in campaign reach. A 30% reallocation lifts reach by 75% at the same investment.

- AM/FM radio generates the greatest lift in incremental reach of all media, more than CTV and digital.

- AM/FM radio’s super power is generating massive lifts in campaign reach among 18-49s. AM/FM radio is the “soundtrack of the American worker.” Erwin Ephron, the father of modern media planning, wrote, “In today’s planning, reach trumps frequency. It is media’s gift to advertising and … radio … can deliver it by the carload.”

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.