Perception Vs. Reality: Eight Things Brands Get Wrong About AM/FM Radio

Click here to view a 9-minute video of the key findings.

Click here to download a PDF of the full deck.

Ad industry perceptions of media audiences are often completely opposite reality. Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, puts it best: “Why do people think that nobody listens to radio anymore? Because there is a narrative that new media kills old media, so nobody bothers to look at evidence that doesn’t fit the narrative.”

Let’s challenge the narrative and look at some evidence. We’ve collected frequently heard media agency and marketer myths along with a just released August 2025 study from Advertiser Perceptions, the gold standard of advertiser/agency sentiment.

Using data from research leaders Nielsen, LeadsRx, and Edison Research, we disprove eight of the biggest misperceptions brands hold about AM/FM radio.

Misperception #1: “No one listens to AM/FM radio.”

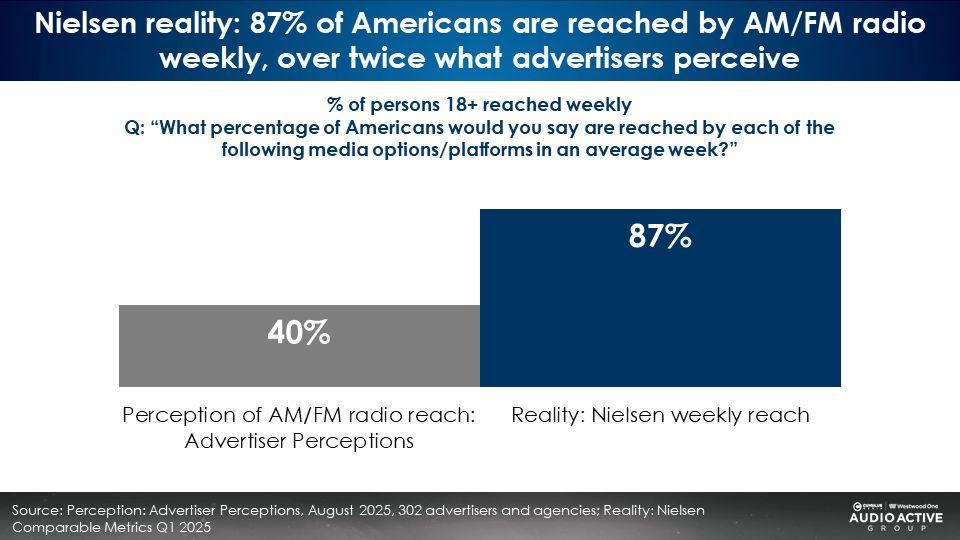

In August 2025, Advertiser Perceptions asked 302 media agencies and advertisers, “What percentage of Americans are reached by AM/FM radio in a typical week?” The perception? 40%! The reality? AM/FM radio’s weekly reach is 87%, over double the perception!

Misperception #2: “No one under 35 listens to AM/FM radio anymore.”

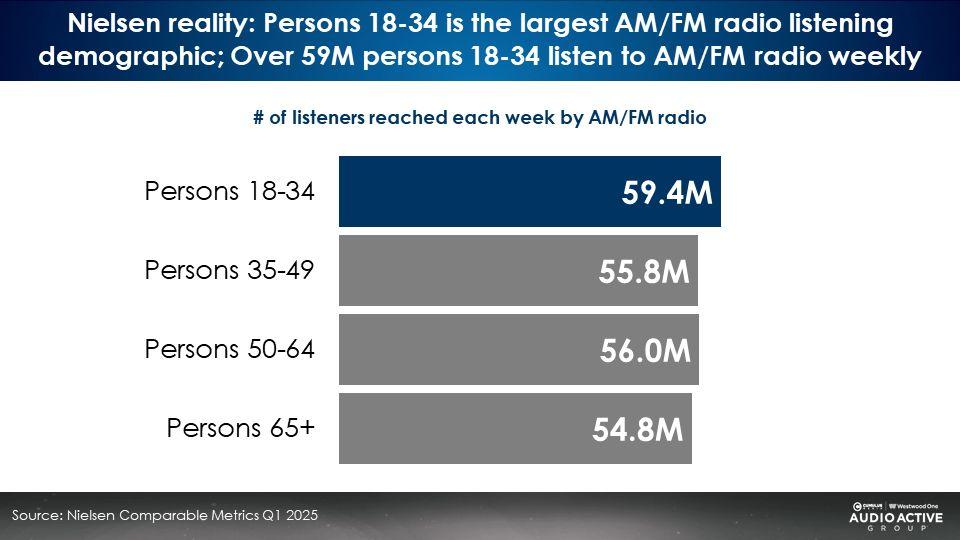

The reality? Nielsen reveals 18-34 is AM/FM radio’s largest listening demographic.

Misperception #3: “Audience shares to Pandora/Spotify are larger than AM/FM radio.”

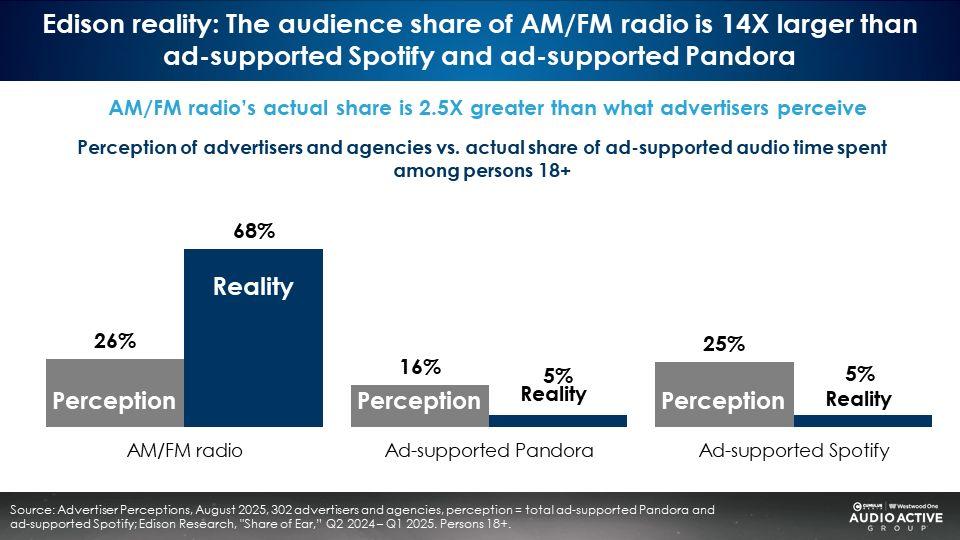

In an August 2025 study, Advertiser Perceptions asked media agencies and marketers for the perceived audience shares of Spotify, Pandora, and AM/FM radio. The perceived audience shares of Pandora/Spotify (41%) are much greater than AM/FM radio (26%).

The reality? Edison’s “Share of Ear” reveals the audience share of AM/FM radio is 14X larger than ad-supported Spotify and ad-supported Pandora.

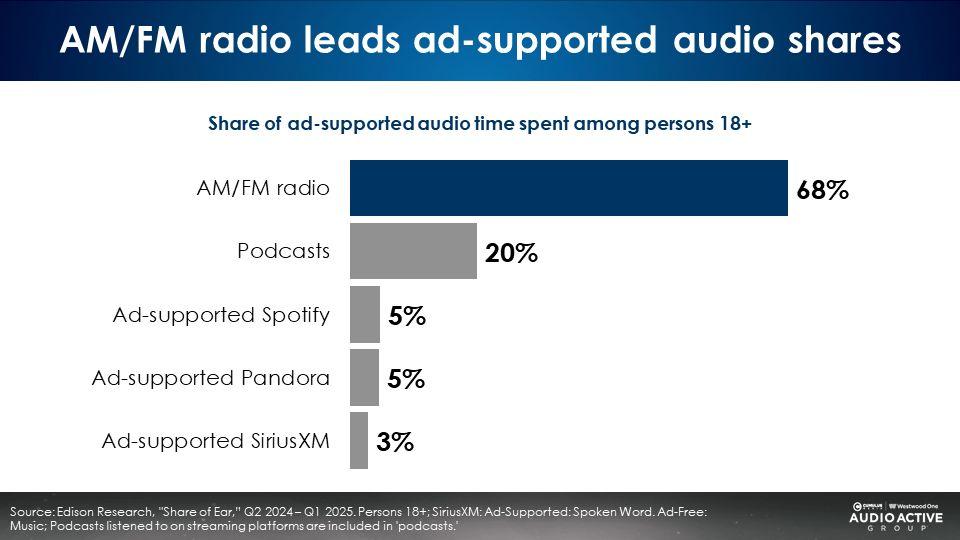

Here is the ranker of U.S. ad-supported audio shares from the Q1 2025 Edison “Share of Ear”:

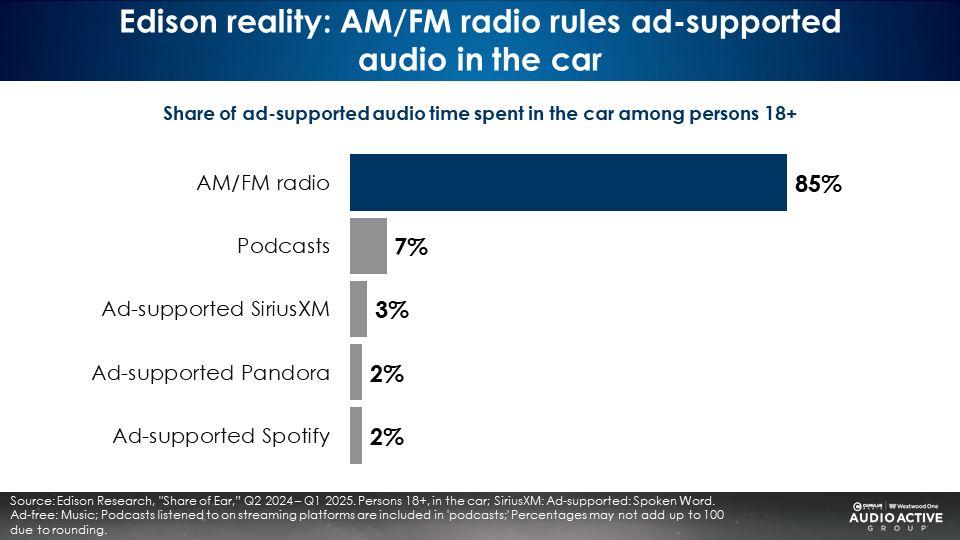

Misperception #4: “In the world of the connected car, the number one thing people do in their car is stream online radio on their smartphones.”

The reality? In the car, AM/FM radio is the “queen of the road” with a stunning 85% share of ad-supported audio, according to Edison’s “Share of Ear.”

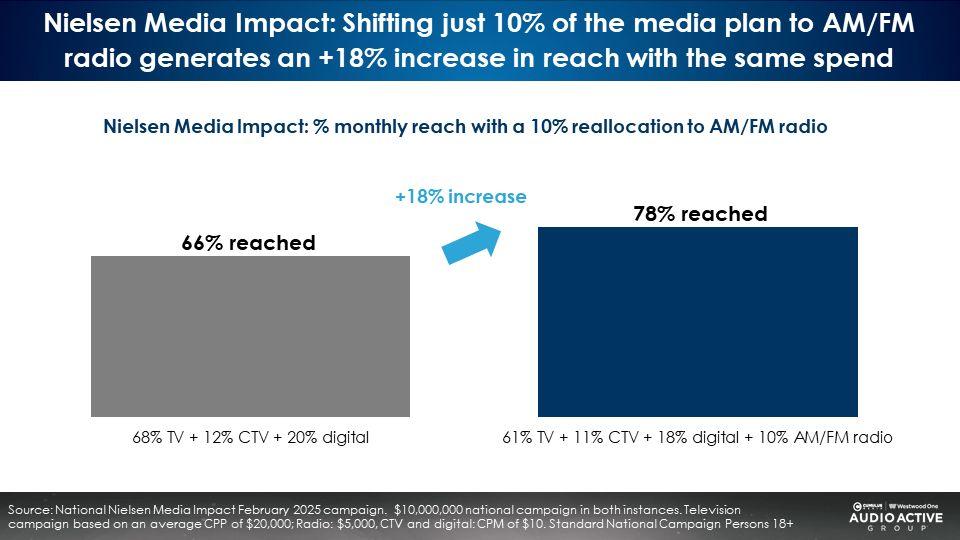

Misperception #5: “Today’s optimal media plan: Put all of your money into connected TV, TV, and social/digital.”

An aggressive media plan with connected TV, digital, and linear TV generates a respectable monthly reach of 66%. A media plan is not complete without AM/FM radio. AM/FM radio always elevates the media plan.

According to Nielsen Media Impact, the media planning and optimization platform, shifting just 10% of the connected TV, digital, and linear TV media plan to AM/FM radio generates an impressive 18% increase in reach for the same investment.

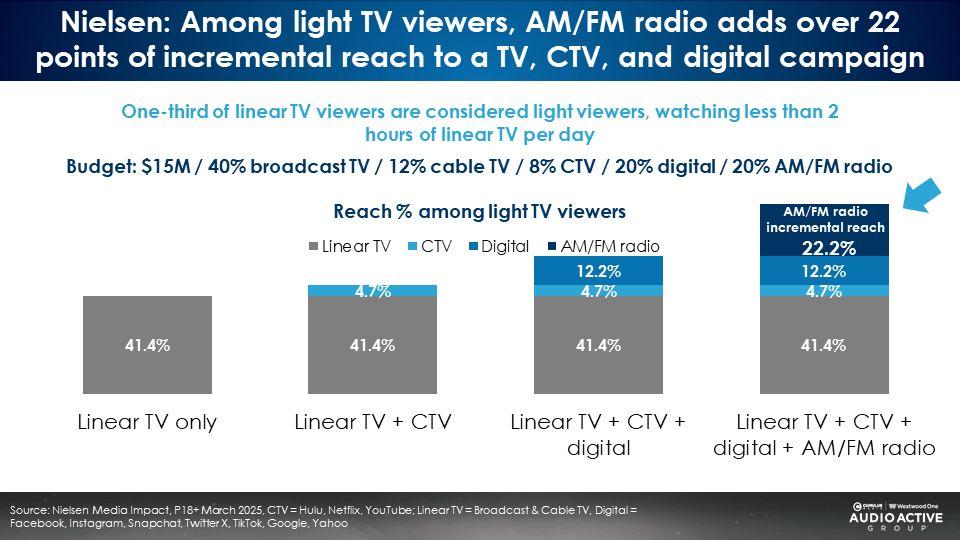

As America’s number one mass reach media, adding AM/FM radio to the media plan always generates large growth in incremental reach. The Nielsen Media Impact campaign analysis below of light TV viewers reveals AM/FM radio generates the largest incremental reach lift from the base TV buy. AM/FM radio’s reach lift (+22 reach points) is nearly 2X that of digital (+12%) and 4X CTV (+5%).

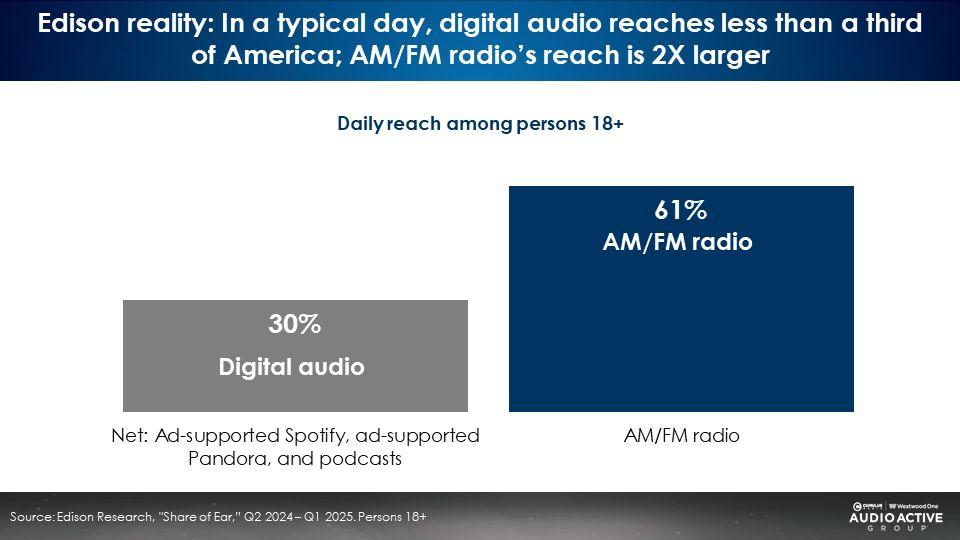

Misperception #6: “The optimal audio buy is Spotify, Pandora, and podcasts.”

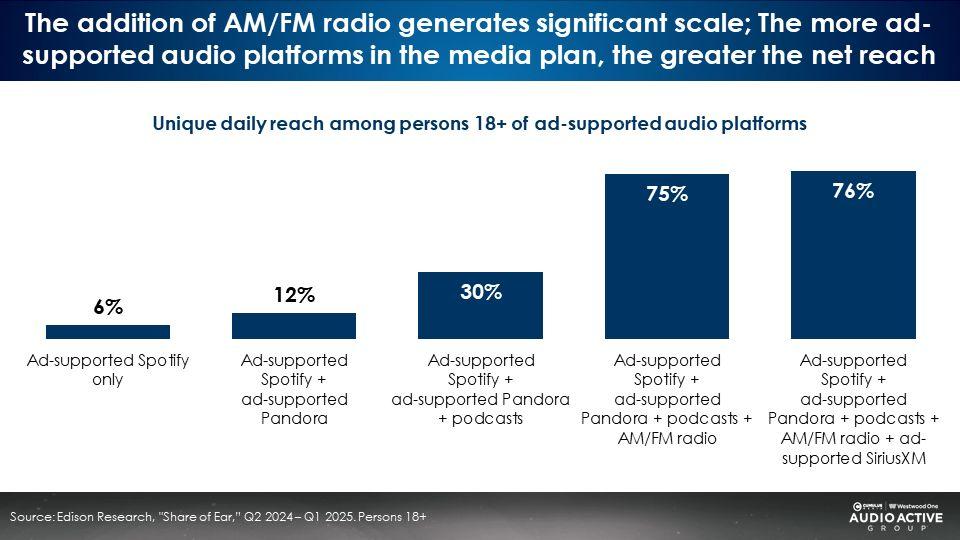

Here’s why you cannot check the box of an audio media plan that only contains digital audio. According to Edison’s “Share of Ear,” the combined ad-supported daily reach of Spotify, podcasts, and Pandora is only 30%, missing 70% of America. AM/FM radio, in contrast, has a daily reach of 61%, 2X digital audio.

The reality is when you put AM/FM radio into a digital audio plan, reach soars. As the “Share of Ear” reach accumulation reveals below, the addition of AM/FM radio causes a massive lift in daily reach.

Misperception #7: “I would love to consider audio. However, there’s a total lack of ROI and sales lift and outcomes evidence for AM/FM radio.”

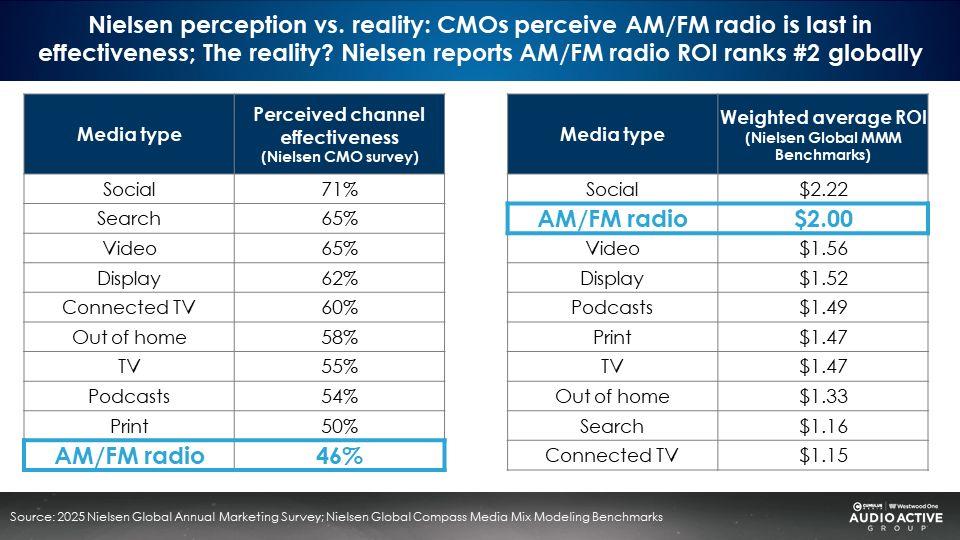

Nielsen recently surveyed CMOs to determine what their perception of the effectiveness of a variety of media types. AM/FM radio ranked dead last.

The reality is a stark difference. According to Nielsen’s Global Media Mix Modeling Benchmarks, AM/FM radio is #2 in ROI, generating $2.00 for every dollar spent.

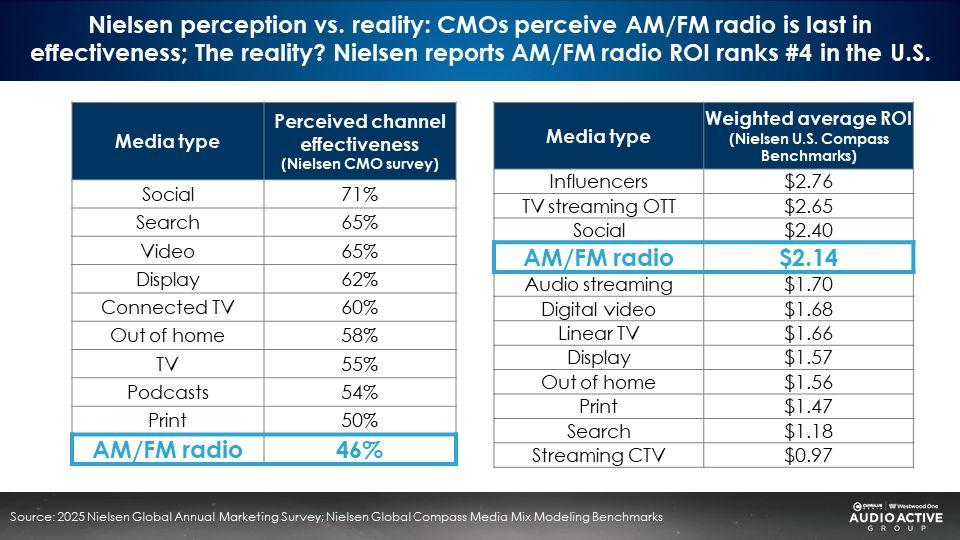

Domestically, the perception is still different from the reality. In the U.S., Nielsen finds AM/FM radio generates $2.14 in ROI for every dollar spent, ranking number four of twelve media.

Can AM/FM radio ads drive search and site traffic? The answer is a resounding yes!

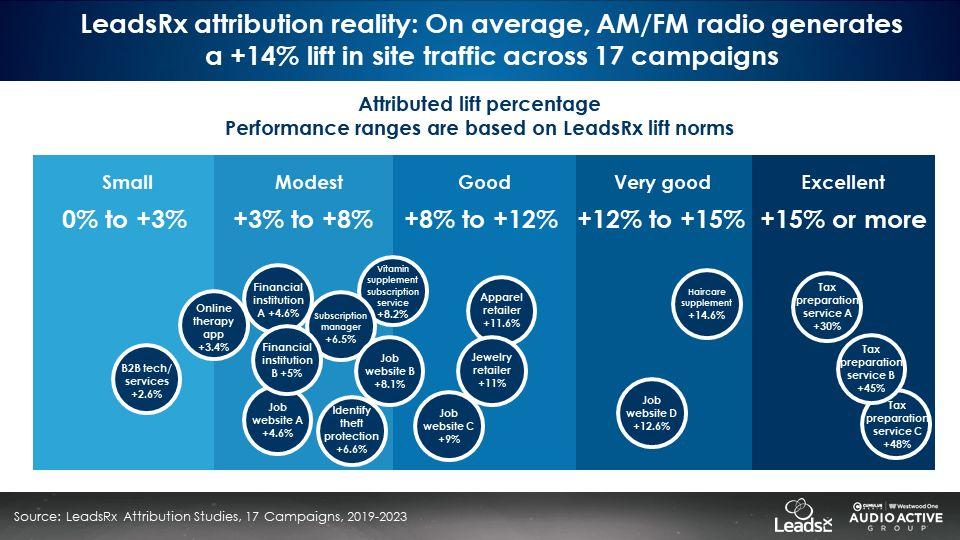

Over the course of five years, the Cumulus Media | Westwood One Audio Active Group® has commissioned LeadsRx, a leader in measuring the impact of advertising on site traffic, to conduct 17 attribution studies for brands spanning a variety of categories.

The key takeaway? On average, AM/FM radio generates an impressive 14% lift in site traffic across the 17 campaigns.

Misperception #8: “AM/FM radio cannot be measured.”

Anything that can measured in TV and digital can be measured in audio! Via this link, see all measurement solutions available to quantify audio impact: “Yes, your audio campaign can be measured!”

The prevailing narratives are wrong. Know the realities:

- 87% of Americans are reached by AM/FM radio weekly, over twice what advertisers perceive.

- Persons 18-34 is the largest AM/FM radio listening demographic. Over 59 million persons 18-34 listen to AM/FM radio weekly.

- The audience share of AM/FM radio is 14X larger than ad-supported Spotify and ad-supported Pandora.

- AM/FM radio rules ad-supported audio in the car with a stunning 85% share.

- AM/FM radio boosts campaign reach among light TV viewers, adding over 22 points of incremental reach (nearly 2X CTV and 4X digital).

- In a typical day, digital audio reaches only 30% of America. AM/FM radio’s reach is 2X larger.

- Despite marketer perceptions, Nielsen global Media Mix Modeling norms reports AM/FM radio ROI ranks #2 of ten media. On average, AM/FM radio generates a +14% lift in site traffic across 17 campaigns.

- Anything that can measured in digital and TV can be measured in audio with Cumulus Media | Westwood One Audio Active Group® measurement solutions.

Click here to view a 9-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.