Auto Dealers: Focus Less On The Competition And More On Auto Intenders Who Cannot Name One Car Retailer

Click here to view a 15-minute video of the key findings.

Click here to download a PDF of the deck.

Michael Katz, Senior Client Solutions Executive, Customer Experience, Nielsen

I spend a fair amount of time mining Nielsen’s massive Scarborough consumer purchase dataset, which captures local and national consumer insights across 2,000+ categories including leisure activities, shopping behaviors, purchasing patterns, and media consumption. Over 330,000 annual surveys reveal consumer buying habits across America. What is the leading auto dealer at which consumers would shop? It’s called, “Don’t know/none”!

Consumers were asked to “select auto dealerships where you or other household members might shop if you were planning to buy or lease a new or used vehicle. (Include in-store and online shopping.)” The Scarborough product booklet then lists dozens of auto dealers including national chains and online retailers. Over one-third of Americans and one out of five auto intenders do not check off any retailers. That’s a lot of “don’t know/none”!

36% of Americans cannot name an auto dealer; 21% of auto intenders are unable to indicate the name of an auto retailer

Our Scarborough data reveals over one out of three Americans cannot name one auto retailer! One out five auto intenders, those who will lease or buy a new or used vehicle in the next year, cannot name one auto dealer! Auto dealers need ads that teach people who they are and build their brands.

The long and the short of it: Retailers have to convert existing demand but they also need to create future demand

Auto dealers excel with their focus on in-market buyers with all manner of ad tech and mar tech. But successful retailers understand a fundamental truth. You have to be known long before you’re needed.

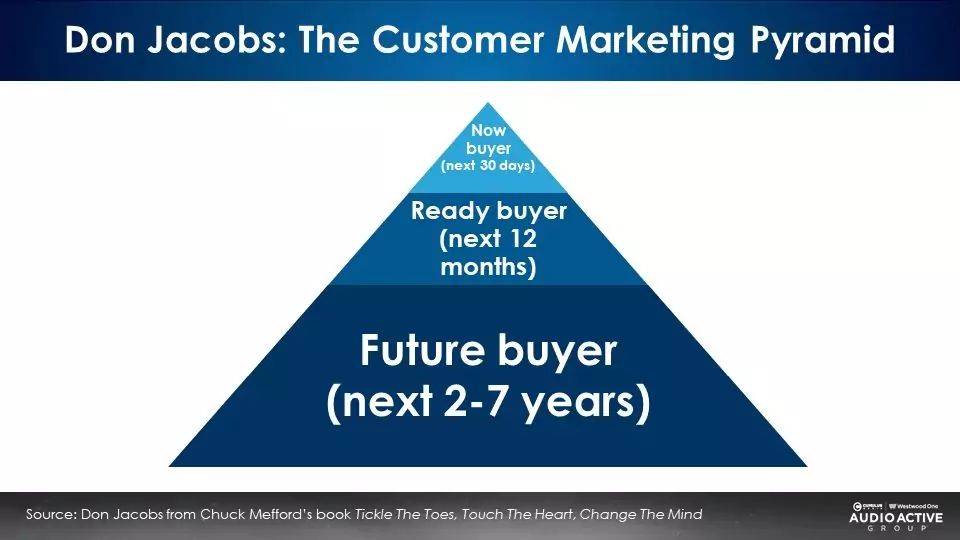

Legendary radio manager Don Jacobs created this Customer Marketing Pyramid:

At any point in time, there are a very small number of consumers who will purchase this month. A somewhat larger number who will buy in the next year. The greatest number of prospects are contained in “future buyer” group, those who will purchase in the next two to seven years.

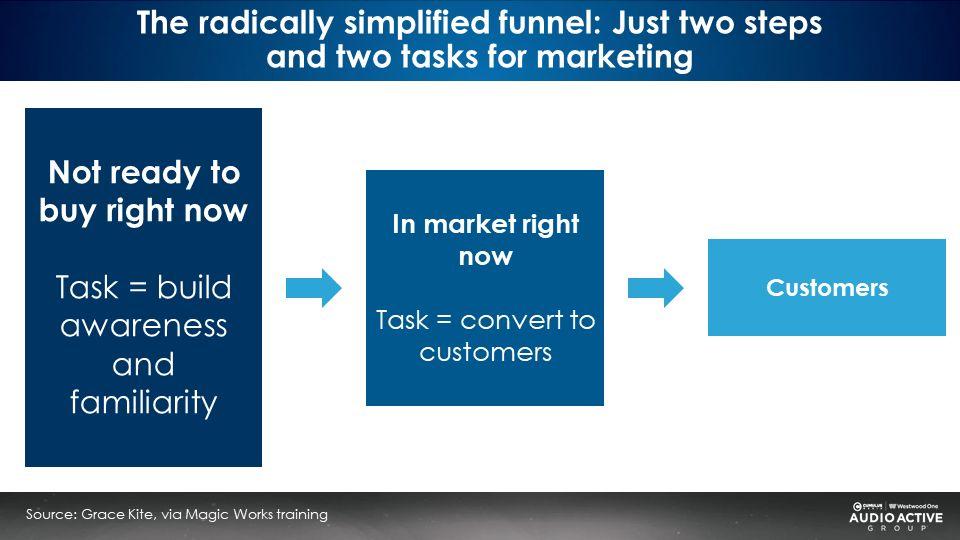

Dr. Grace Kite, founder of marketing effectiveness measurement firm Magic Numbers, created this very simple two-phase purchase funnel:

Dr. Kite says advertisers have two jobs:

- Build awareness and familiarity with the large number of prospects who are not ready to buy right now.

- Convert to consumers those who are in the market now.

The 95/5 rule: Only 5% of consumers are in the market at any time

The prestigious Ehrenberg Bass Institute of Marketing Science developed the “95/5 rule.” They report a very small amount of people are in the market for a product or service at any time. Whether it’s a home repair, an automotive purchase, health care need, or furniture, most people are not in the market.

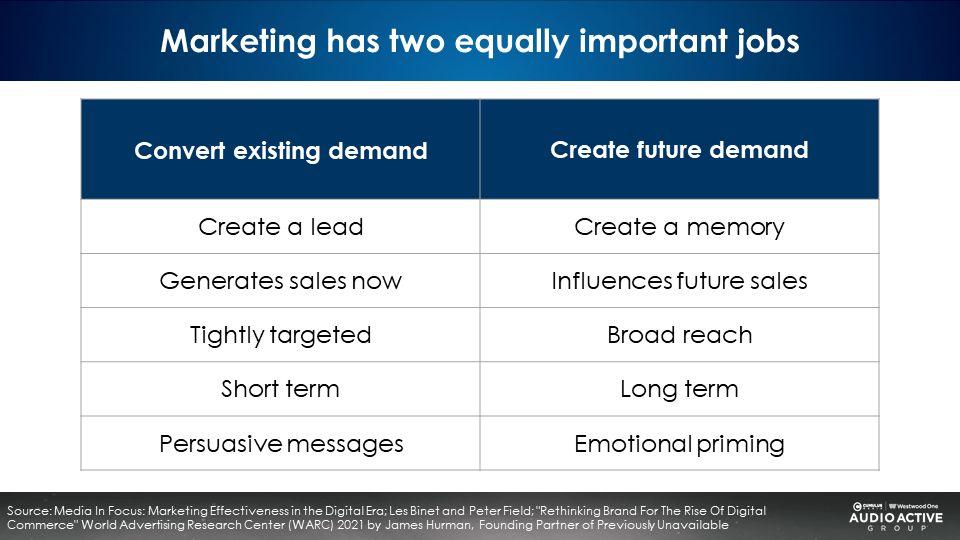

Advertising needs to form around two key strategies. First, convert existing demand by reaching the five percent who are in the market. Usually that takes the form of a sales event.

Second, create future demand. Often this is called brand building. It focuses on the 95% of consumers who are not in the market, not thinking about the category, and not interested in a sales event.

The two jobs of advertising: Converting existing demand (sales events) and creating future demand (brand building) require very different creative and media strategies

James Hurman, a globally recognized expert on brand building and marketing effectiveness, published the Kindle book, Future Demand: Why Building Your Brand Among Tomorrow’s Customers is the Key to Start-Up Success. You can order your copy here.

Hurman explains that creating future demand is advertising to that much larger group of consumers who are not in the market and are not ready to buy now but will be in the future. The goal is making them feel familiar with and positively towards your business in order to get them to gravitate toward you when they enter the category.

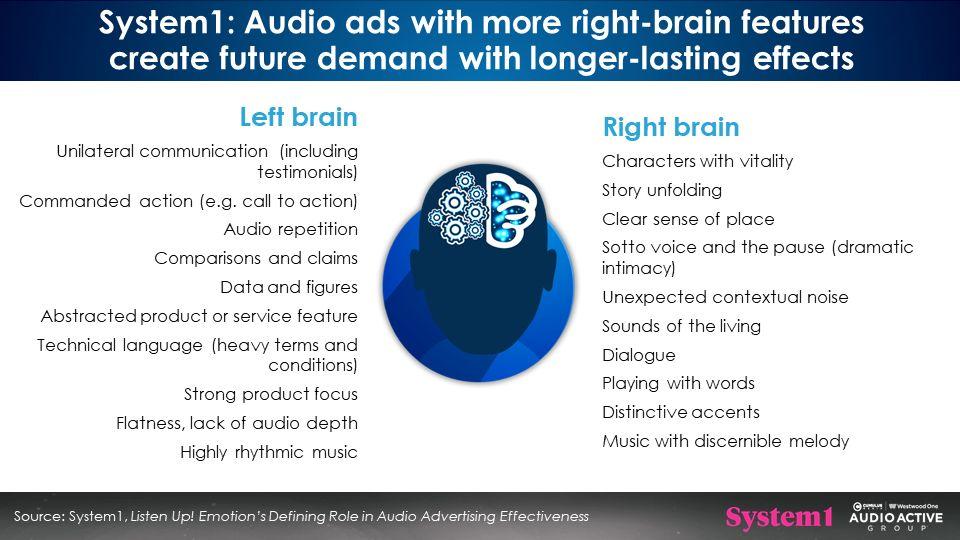

Right brain creative elements drive future demand

To appeal to the 95% who are not in market for a vehicle, a completely different creative strategy has to be utilized. Instead of sales event ads, the creative needs to become decidedly right brained. To build future demand ads, use positive emotions: surprise, a lump in the throat, or happiness.

Entertain for business gain

“Embrace the idea that advertising is at least as much showmanship as it is salesmanship. It is time to rediscover the fact that advertising builds brands best when it is entertaining, popular and memorable, when it is not just a pitch, but a performance,” Paul Feldwick, Why Does The Pedlar Sing? What Creativity Really Means in Advertising.

“The buying of time or space is not the taking out of a hunting license on someone’s private preserve, but it is the renting of a stage on which we may perform,” Howard Luck Gossage, advertising visionary frequently referred to as “The Socrates of San Francisco.”

Brand opportunity: One out of five new car purchase intenders cannot name any auto dealers; 36% of all Americans are unable to name one car dealer

From our Scarborough data, here is the proportion of consumers in local markets who cannot name one auto dealer. While there is some variation by market, you will see that about 36% of consumers overall cannot name one car dealer. Significantly, 21% of those who intend to make an auto transaction in the year are unable to name an auto retailer.

‘Select auto dealerships where you or other household members might shop if you were planning to buy or lease a new or used vehicle. (Include in-store and online shopping.)’, % who said ‘none/don’t know’

| DMA | Among the total U.S. | Among those who plan to buy (new or used) or lease in the next 12 months |

| Total U.S. | 36% | 21% |

| Albany/Schenectady/Troy | 37% | 19% |

| Albuquerque/Santa Fe | 31% | 12% |

| Atlanta | 31% | 20% |

| Austin | 25% | 16% |

| Bakersfield | 38% | 17% |

| Baltimore | 34% | 16% |

| Birmingham | 38% | 22% |

| Boston | 34% | 17% |

| Buffalo | 29% | 17% |

| Charleston/Huntington | 42% | 23% |

| Charlotte | 34% | 17% |

| Chattanooga | 41% | 28% |

| Chicago | 30% | 14% |

| Cincinnati | 36% | 22% |

| Cleveland/Akron | 35% | 18% |

| Colorado Springs/Pueblo | 38% | 19% |

| Columbus | 34% | 23% |

| Dallas/Fort Worth | 28% | 13% |

| Dayton | 34% | 19% |

| Denver | 32% | 22% |

| Des Moines/Ames | 29% | 17% |

| Detroit | 29% | 15% |

| El Paso | 29% | 15% |

| Flint/Saginaw/Bay City | 34% | 20% |

| Fort Myers/Naples | 31% | 26% |

| Fresno/Visalia | 33% | 16% |

| Grand Rapids/Kalamazoo/Battle Creek | 35% | 25% |

| Green Bay/Appleton | 25% | 15% |

| Greensboro/High Point/Winston-Salem | 36% | 22% |

| Greenville/Spartanburg/Asheville/Anderson | 38% | 21% |

| Harlingen/Weslaco/Brownsville/McAllen | 34% | 12% |

| Harrisburg/Lancaster/Lebanon/York | 33% | 20% |

| Hartford/New Haven | 37% | 17% |

| Honolulu | 33% | 14% |

| Houston | 31% | 18% |

| Indianapolis | 35% | 23% |

| Jacksonville | 36% | 16% |

| Kansas City | 35% | 16% |

| Knoxville | 38% | 18% |

| Las Vegas | 36% | 22% |

| Lexington | 38% | 19% |

| Little Rock/Pine Bluff | 36% | 20% |

| Los Angeles | 35% | 17% |

| Louisville | 37% | 21% |

| Memphis | 39% | 21% |

| Miami/Ft. Lauderdale | 35% | 18% |

| Milwaukee | 29% | 19% |

| Minneapolis/St. Paul | 33% | 15% |

| Mobile/Pensacola | 38% | 18% |

| Nashville | 39% | 23% |

| New Orleans | 36% | 13% |

| New York | 42% | 20% |

| Norfolk/Portsmouth/Newport News | 33% | 16% |

| Oklahoma City | 39% | 22% |

| Omaha | 33% | 17% |

| Orlando/Daytona Beach/Melbourne | 30% | 11% |

| Palm Springs | 29% | 18% |

| Philadelphia | 33% | 16% |

| Phoenix | 32% | 19% |

| Pittsburgh | 31% | 15% |

| Portland | 39% | 22% |

| Providence/New Bedford | 36% | 18% |

| Raleigh/Durham | 35% | 19% |

| Richmond/Petersburg | 38% | 19% |

| Roanoke/Lynchburg | 36% | 21% |

| Rochester | 28% | 15% |

| Sacramento/Stockton/Modesto | 33% | 15% |

| Salt Lake City | 35% | 18% |

| San Antonio | 28% | 12% |

| San Diego | 29% | 12% |

| San Francisco/Oakland/San Jose | 35% | 18% |

| Seattle/Tacoma | 42% | 19% |

| Spokane | 39% | 24% |

| St. Louis | 32% | 20% |

| Syracuse | 32% | 10% |

| Tampa/St. Petersburg | 34% | 24% |

| Toledo | 35% | 20% |

| Tucson | 30% | 16% |

| Tulsa | 36% | 22% |

| Washington, D.C. | 31% | 18% |

| West Palm Beach/Fort Pierce | 28% | 12% |

| Wichita/Hutchinson | 39% | 22% |

| Wilkes-Barre/Scranton | 32% | 15% |

Source: Scarborough USA+ 2024 Release 2 & 2023 Release 2 Total (Jun 2022 – Oct 2024) Adults 18+

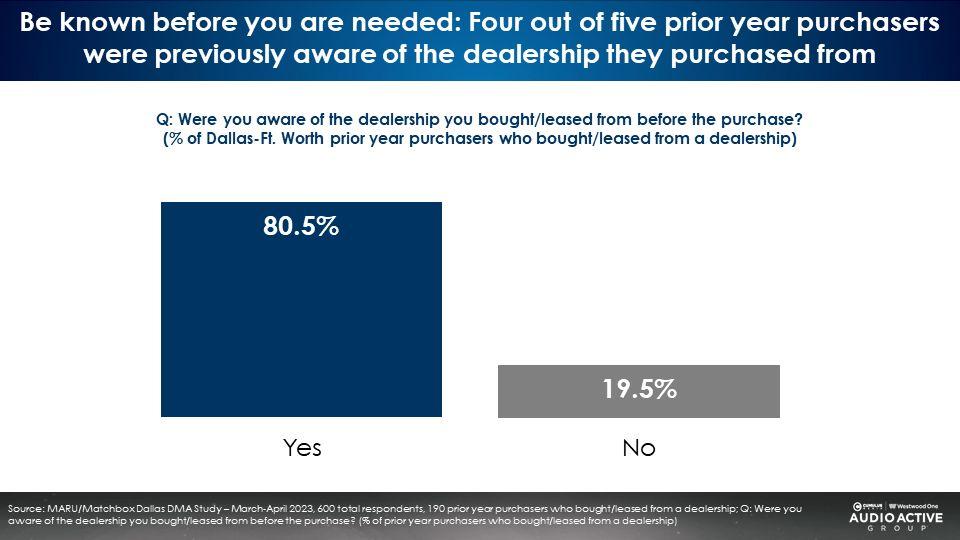

Dealers must “be known before they are needed”: 81% of prior year purchasers were aware of the dealer prior to their purchase

A MARU/Matchbox study of Dallas automotive buyers found the vast majority were already aware of the dealership they purchased from.

Successful auto dealers have something called “mental availability.” Les Binet and Sarah Carter, two of the world’s leading experts on marketing effectiveness, explain, “The single most important factor driving brand preference is ‘mental availability’: how well known a brand is, and how easily it comes to mind. Brands with low mental availability tend to struggle, rejected in favour of more familiar rivals. Or not considered in the first place. Brands with high mental availability don’t have to push so hard to sell, so tend to have higher market shares and better margins.”

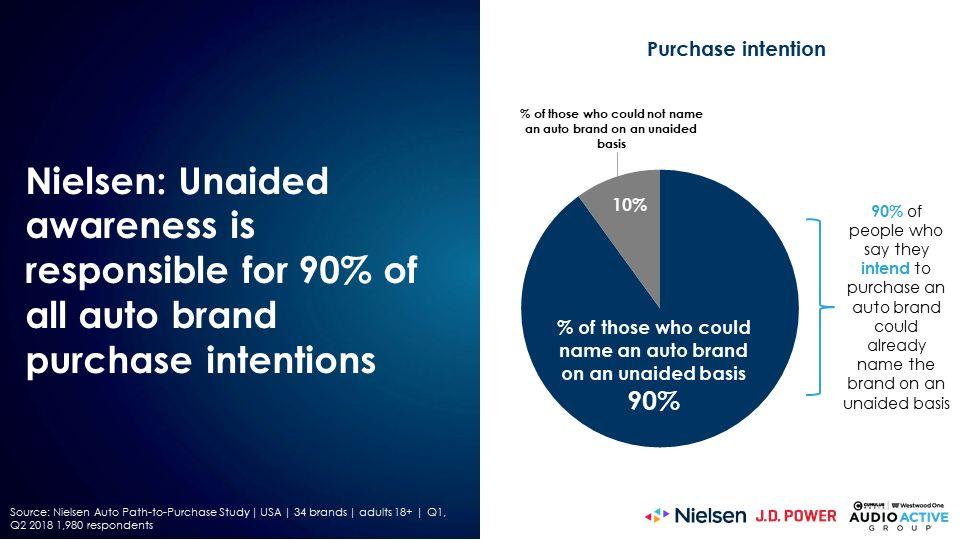

“Easy to mind, easy to find”: Unaided awareness is responsible for 90% of all auto brand purchase intentions

A major national automotive study we conducted at Nielsen found that 90% of those who say they intend to purchase an auto brand could already name the brand on an unaided basis. Both dealers and auto brands must “be known before they are needed.”

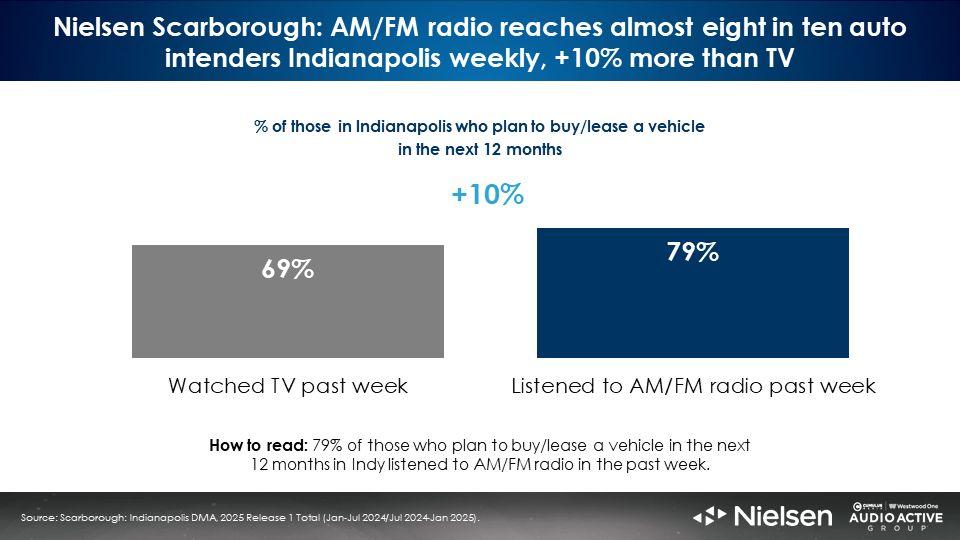

AM/FM radio elevates the auto intender media plan

Here’s an example from Indianapolis. AM/FM radio reaches lots of in-market auto intenders:

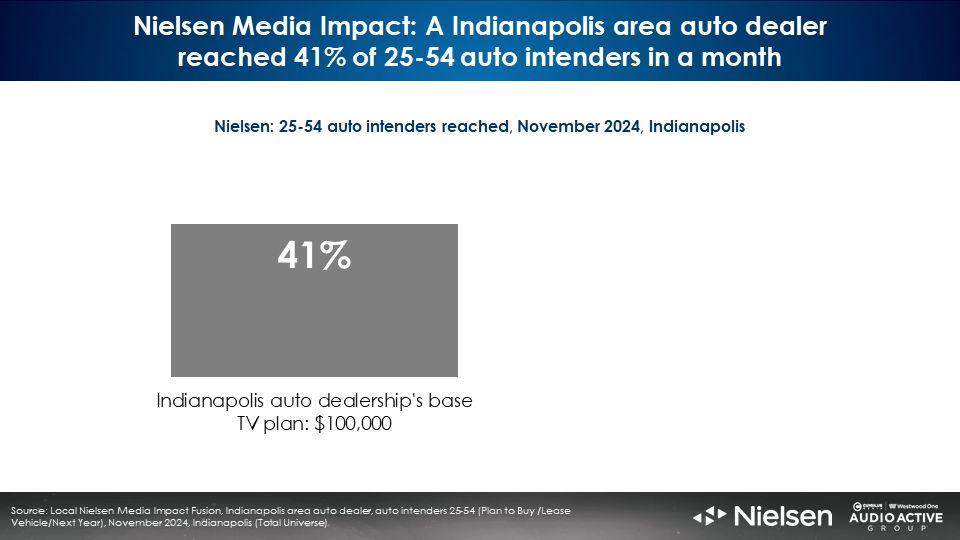

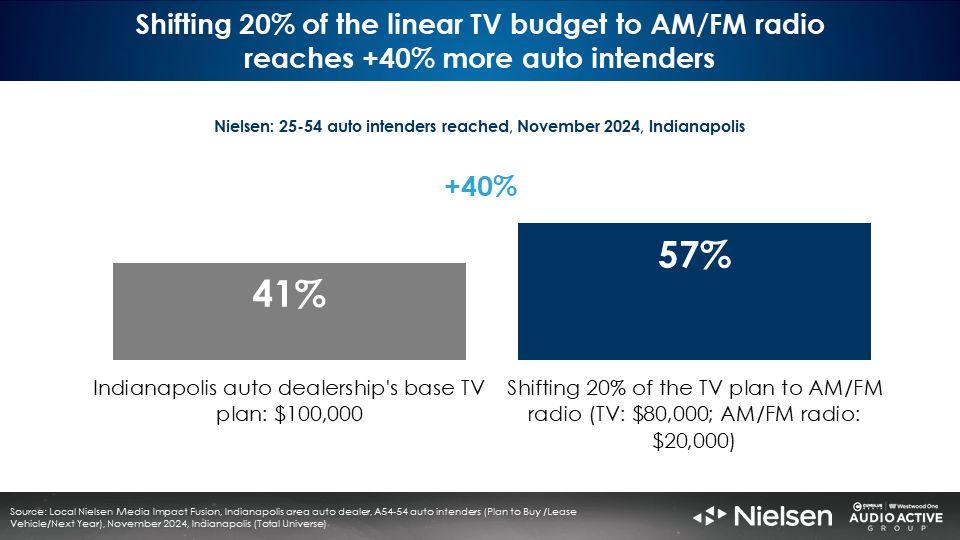

Here’s what happens when AM/FM radio is introduced into an auto dealer media plan. An investment on TV reaches 41% of auto intenders.

When 20% of the TV media plan is shifted to AM/FM radio, auto intender reach soars +40% with the same investment.

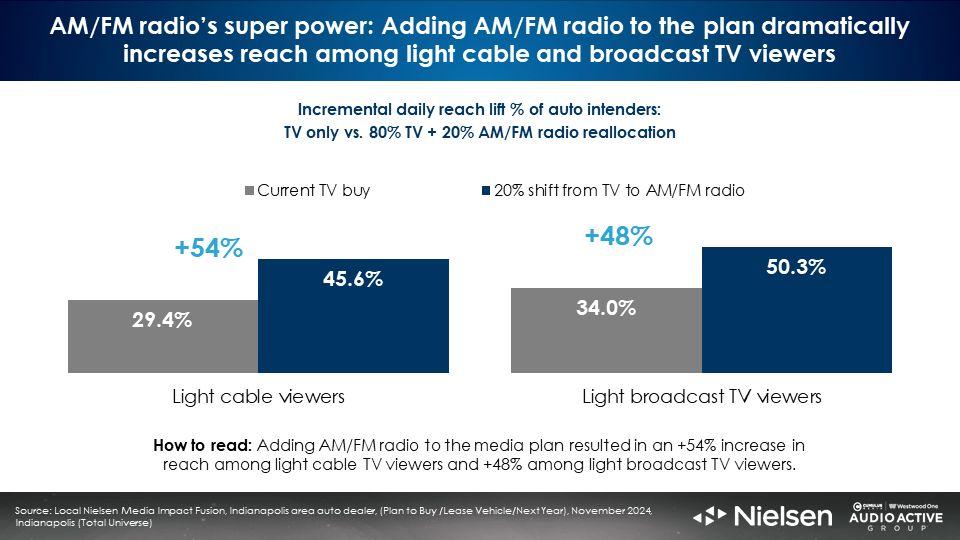

How does AM/FM radio generate all this incremental reach? From light cable and broadcast TV viewers:

Key takeaways:

- Auto dealers must devote more marketing efforts to growing their brands: Over a third of Americans cannot name one auto dealer. One out of five auto intenders are unable to indicate an auto retailer.

- To create future demand, media plans must target broadly with ads that create positive memories via humor, a lump-in-the-throat emotion, or surprise: There is no such thing as waste when creating future demand.

- AM/FM radio elevates the auto intender media plan: Via it’s significant reach, the addition of AM/FM radio to the media plan generates an impressive lift in reach for the same overall investment. AM/FM radio’s superpower lies in its ability to generate significant incremental reach among light cable and broadcast TV viewers.

Click here to view a 15-minute video of the key findings.

Michael Katz is a Senior Client Solutions Executive, Customer Experience, Nielsen.

Contact the Insights team at CorpMarketing@westwoodone.com.