Edison’s “Share Of Ear” Q4 2023: Podcasts And AM/FM Radio Represent The Vast Majority Of Time On The U.S. Ad-Supported Audio Clock; Advertiser Perceptions Of Pandora And Spotify’s Audiences Far Exceed Reality

Click here to view a 15-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison surveys 4,000 Americans annually to measure daily reach and time spent with all forms of audio. This analysis focuses on what advertisers care about – ad-supported audio.

Here are seven key findings from the just released Q4 2023 “Share of Ear” study:

- Advertisers need to “take the me out of media” as they wildly overestimate Spotify and Pandora audiences and dramatically understate AM/FM radio’s shares.

- AM/FM radio represents the dominant ad-supported audio platform with a 68% overall share and a massive 86% in-car share.

- In a typical day in America, 95% of Americans never listen to ad-supported Spotify. 94% never listen to ad-supported Pandora.

- Podcasts’ audiences soar. At a 20% share of ad-supported audio, podcasts now represent one out of every five minutes of U.S. ad-supported audio.

- Among registered voters, AM/FM radio leads in ad-supported audience share (68%) followed by podcasts (21%).

- After a pandemic lull, the proportion of AM/FM radio listening occurring in-car roars back.

- Powered by podcasts, spoken word is on a tear: 40% of all time with ad-supported audio goes to spoken word, up from 27% pre-pandemic.

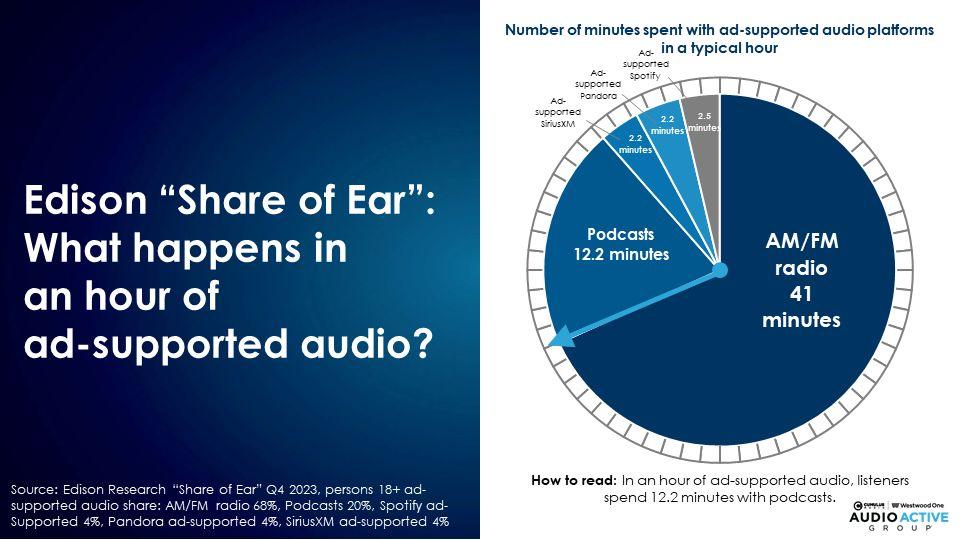

The U.S. ad-supported audio clock: Podcasts and AM/FM radio represent the most tuning minutes

What happens in an hour of U.S. ad-supported audio? The clock below portrays minutes spent in an hour of ad-supported audio. The clock was determined by multiplying “Share of Ear” ad-supported audience shares by 60 minutes.

In an hour of U.S. ad-supported audio:

- AM/FM radio represents 41 minutes of listening

- Podcasts are 12.2 minutes of listening

- Ad-supported Spotify is 2.5 minutes

- Ad-supported Pandora is 2.2 minutes

- Ad-supported SiriusXM is 2.2 minutes

Podcasts and AM/FM radio represent 52.2 minutes in an hour of ad-supported audio in the U.S. 87% of U.S. ad-supported audio consists of podcasts and AM/FM radio.

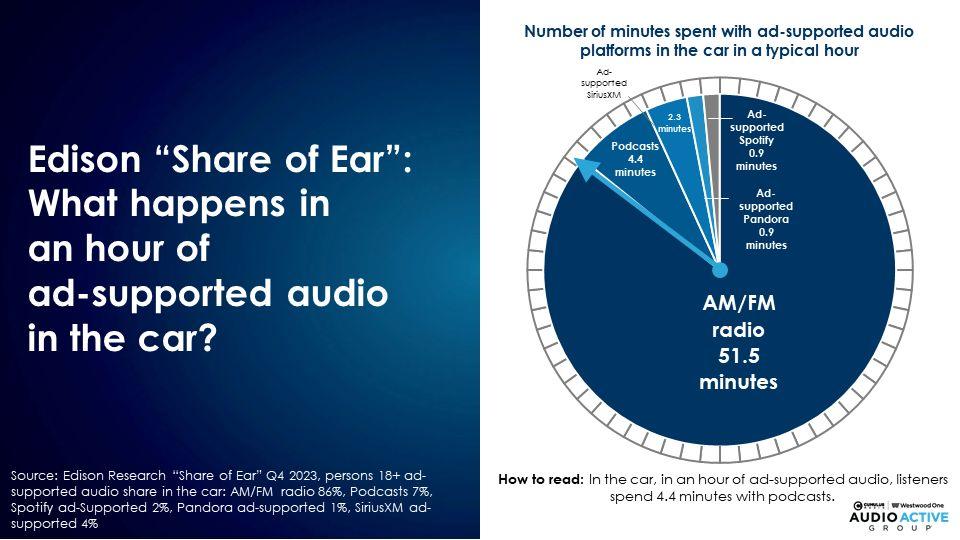

The in-car ad-supported audio clock: AM/FM radio represents the vast majority of tuning minutes in vehicles

What happens in an hour of U.S. ad-supported audio in the car? The clock below was determined by multiplying “Share of Ear” in-car shares of ad-supported audio time spent by 60 minutes.

In an hour of in-car U.S. ad-supported audio:

- AM/FM radio represents 51.5 minutes of listening

- Podcasts are 4.4 minutes of listening

- Ad-supported SiriusXM is 2.3 minutes

- Ad-supported Spotify is 0.9 minutes

- Ad-supported Pandora is 0.9 minutes

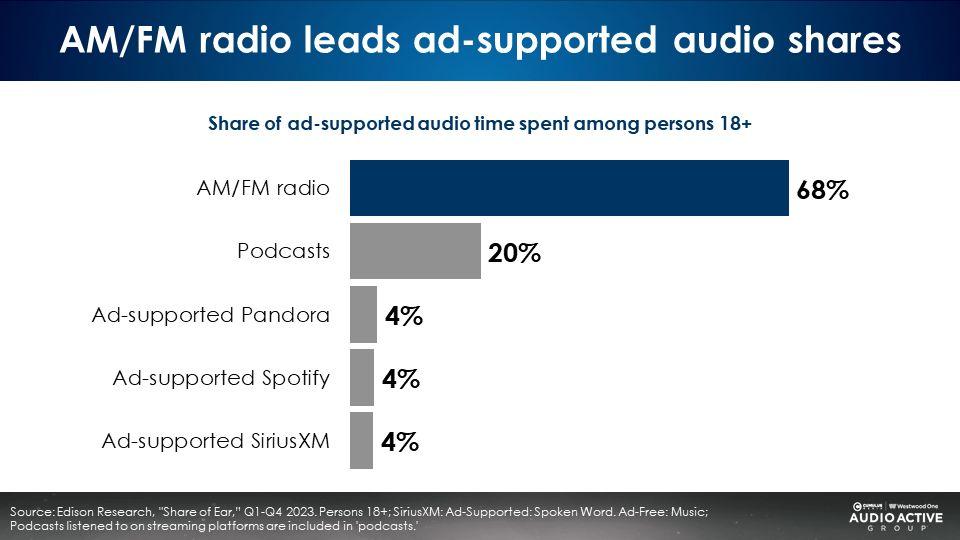

AM/FM radio dominates ad-supported audio shares; Podcasts soar to represent a stunning 20% share

From the Q4 2023 “Share of Ear,” here are the overall 18+ shares of ad-supported audio platforms:

- AM/FM radio: 68%

- Podcasts: 20%

- Ad-supported Pandora, ad-supported SiriusXM, and ad-supported Spotify: all at 4%

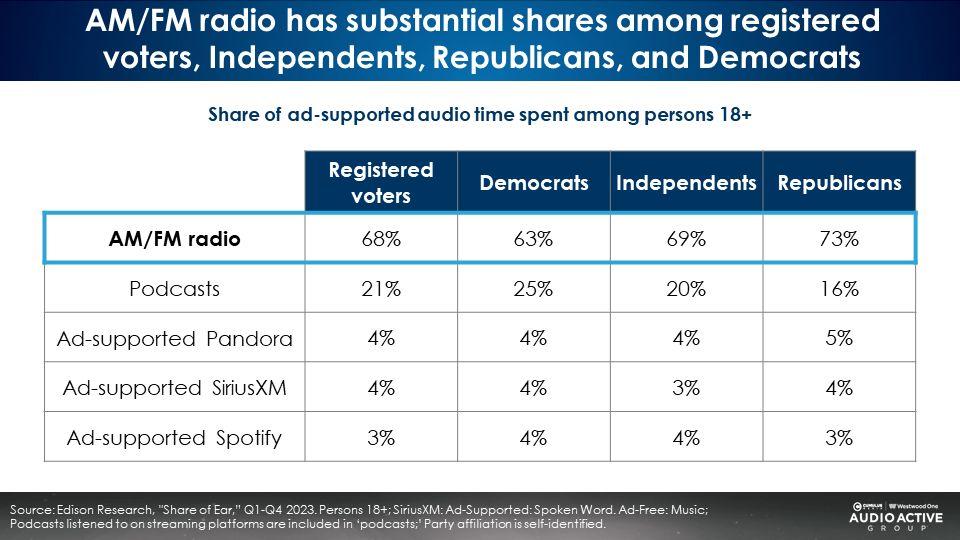

Among registered voters, AM/FM radio leads in ad-supported audience share (68%) followed by podcasts (21%)

Podcasts’ share is highest among Democrats (25%), followed by Independents (20%) and Republicans (16%).

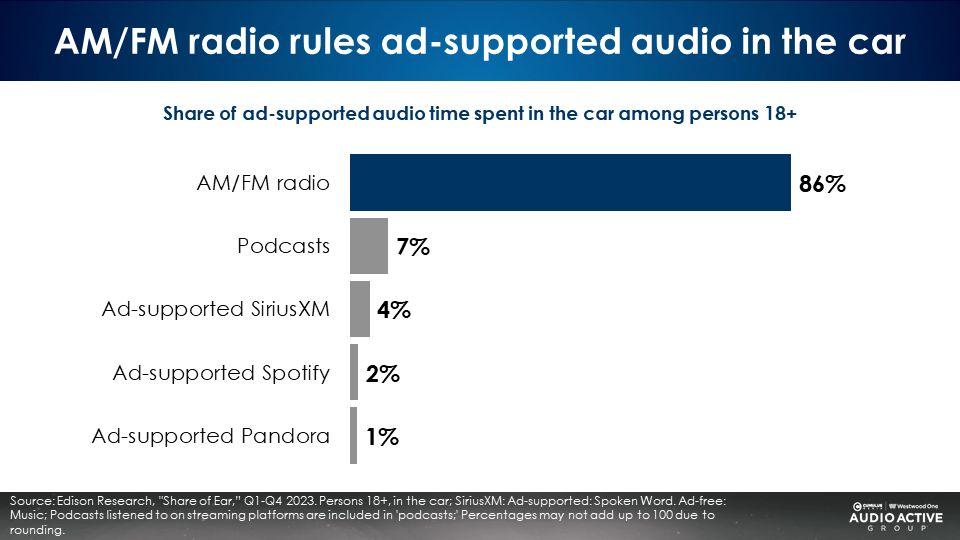

In the car, AM/FM radio is the queen of the road with an 86% share of ad-supported audio

Here are the 18+ shares of in-car ad-supported audio:

- AM/FM radio: 86%

- Podcasts: 7%

- Ad-supported SiriusXM: 4%

- Ad-supported Spotify: 2%

- Ad-supported Pandora: 1%

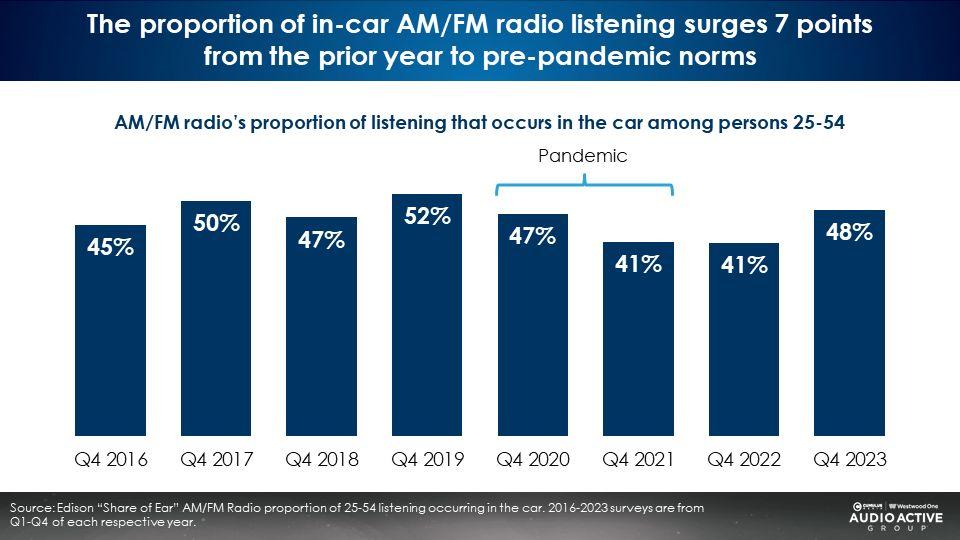

After a pandemic lull, the proportion of in-car listening to AM/FM radio roars back

Pre-pandemic, about half of all AM/FM radio listening occurred in the car. The pandemic saw the amount of AM/FM radio listening in the car sink to only 41%. In the most recent “Share of Ear” report, a stunning 48% of all AM/FM radio listening occurs in the car.

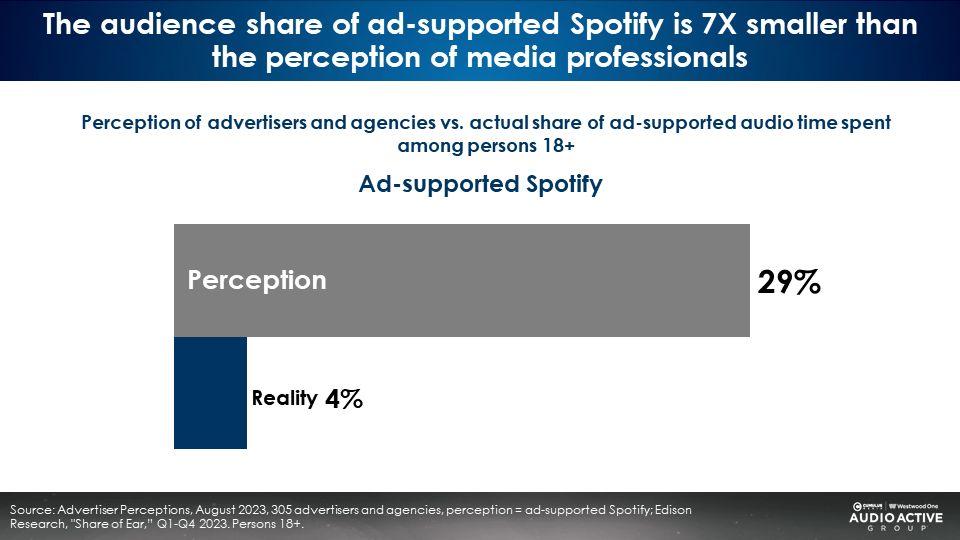

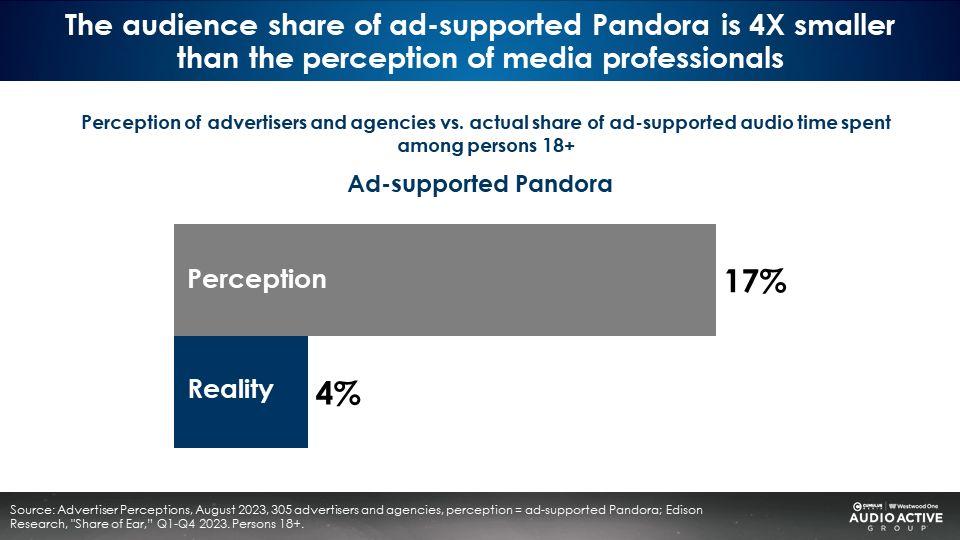

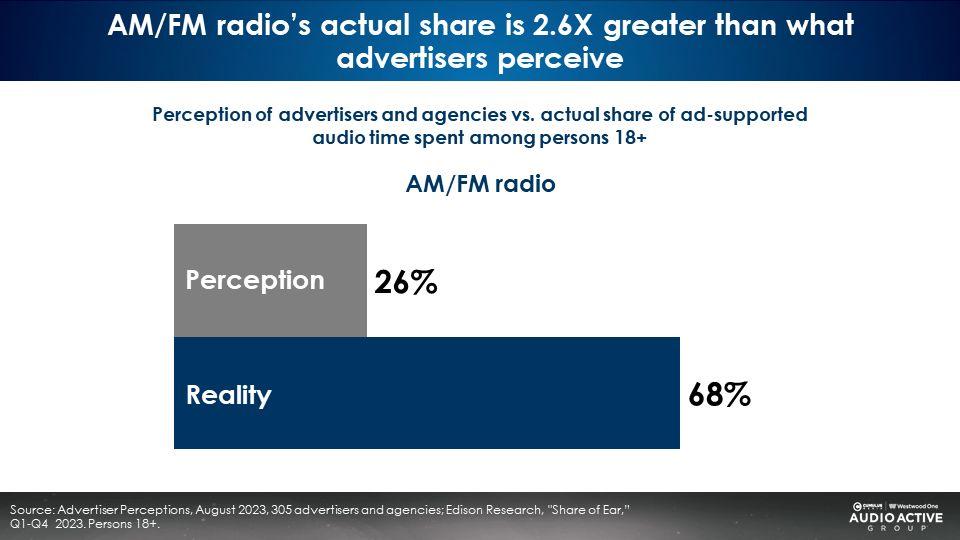

Perception versus reality: Advertisers and agencies wildly overestimate Spotify and Pandora’s audiences and dramatically understate AM/FM radios audiences

In August 2023, Advertiser Perceptions, the leader in measuring brand and media agency sentiment, surveyed 305 agencies and advertisers with media budget decision making responsibility. Marketers and media agencies were asked to estimate the audience shares of Spotify, Pandora and AM/FM radio.

The perceived shares were compared to the reality of audiences from Edison’s Q4 2023 “Share of Ear” study. Perceptions came nowhere close to actual audience shares. In the case of Spotify, the perceived audience share (29%) was seven times larger than Spotify’s actual audience share (4%).

Pandora’s audience share (4%) is four times smaller than its perceived 17% share among agencies and advertisers.

AM/FM radio’s actual audience share (68%) is two and half times larger than perceived (26%).

Marketers and agencies need to take the “me out of media”

Colin Lewis, award-winning CMO, wrote recently that advertisers delude themselves and are “too easily lulled into marketing ‘cults’ that stop us seeing the world as it is.” To create informed planning decisions, marketers and agencies should take the “me” out of “media” and fully understand today’s media behaviors.

Legendary marketing professor Mark Ritson explains, “There is increasing global evidence that marketers are basing their media choices on their own behaviour or that stoked by the digitally obsessed marketing media, rather than actual audience data.”

In their book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter remind agencies and brands, “We’re marketing and communication people, we’re different from the majority. In the US and UK, we’re less than 1% of the population. We tend to be younger. … And we live in a handful of big cities. So it’s all too easy for us overlook how different our lifestyles and perceptions are from the people we talk to.”

Acknowledging this, Colin Kinsella, the former CEO of Havas Media North America concludes, “The biggest risk for AM/FM radio is the 26-year-old planner who lives in New York or Chicago and does not commute by car and does not listen to AM/FM radio and thus does not think anyone else listens to AM/FM radio.”

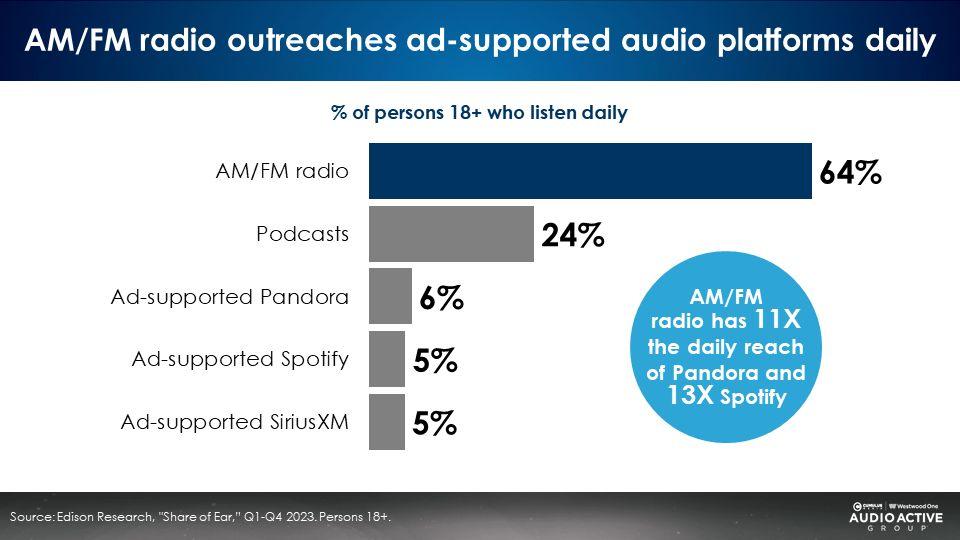

In a typical day in America, 95% of Americans never listen to ad-supported Spotify and 94% never listen to ad-supported Pandora

As a marketer, it’s important to consider media vehicles that can reach a fair amount of people. Edison’s latest “Share of Ear” study reveals only 5% of Americans listen to ad-supported Spotify in a typical day. Only 6% of the U.S. listens to ad-supported Pandora in a day.

In a typical day in America, 64% listen to AM/FM radio, which is 13X more than listen to Spotify and 11 times greater than Pandora. According to Nielsen’s Comparable Metrics, 84% of persons 18+ listen to AM/FM radio in a typical week, placing AM/FM radio as America’s number one mass reach media.

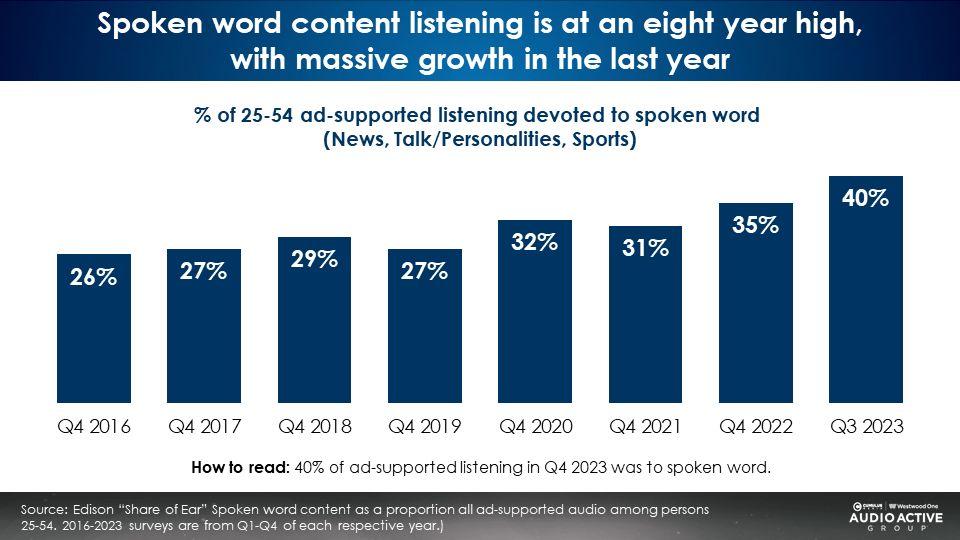

Spoken word, powered by podcasts, is on an absolute tear

From 2016 to 2019, spoken word (news, talk/personalities, and sports) had a 27% share of all ad-supported audio. In 2020 and 2021, spoken word’s share grew to the low thirties.

At present, spoken word has an impressive 40% share of ad-supported audio. This is spoken word’s greatest audience share in the ten-year history of the “Share of Ear” study. Since 2021, spoken word’s share of ad-supported audio has surged 29%, from 31% to 40% of all ad-supported audio.

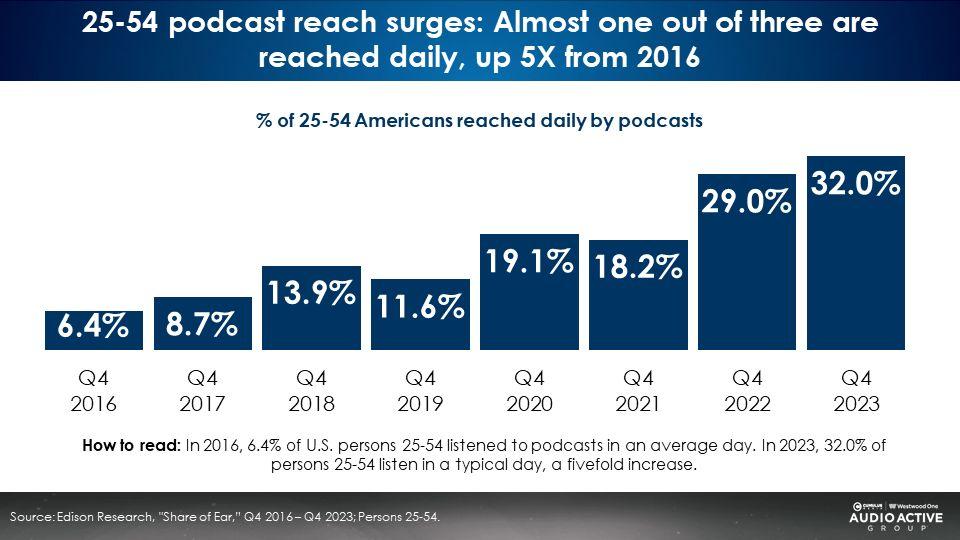

Podcast audiences experience stunning growth: One out of three 25-54s listen daily

Among 25-54s, 32% listen to podcasts daily, a five-fold increase since 2016.

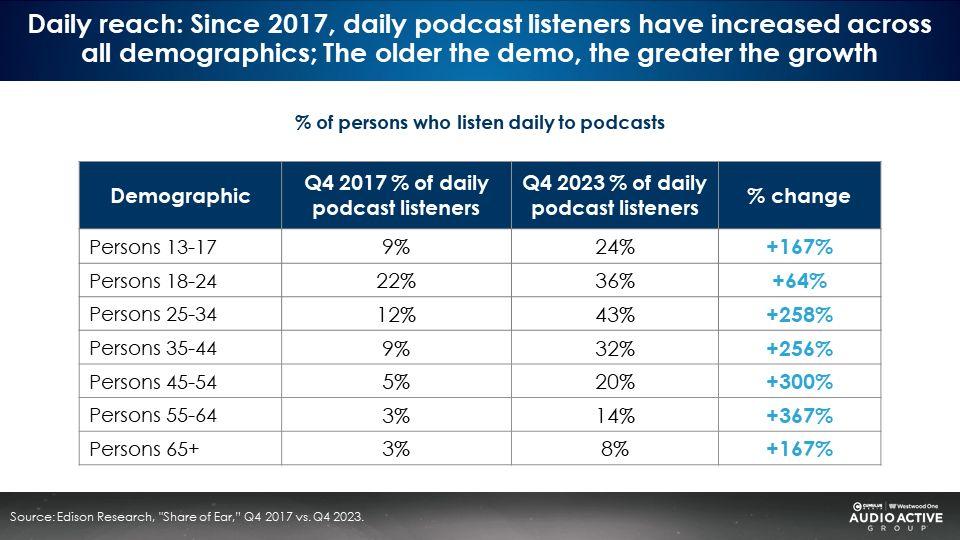

Since 2017, podcasts’ daily reach has surged in every age group.

Key takeaways:

- Advertisers need to “take the me out of media” as they wildly overestimate Spotify and Pandora audiences and dramatically understate AM/FM radio’s shares.

- AM/FM radio represents the dominant ad-supported audio platform with a 68% overall share and a massive 86% in-car share.

- In a typical day in America, 95% of Americans never listen to ad-supported Spotify. 94% never listen to ad-supported Pandora.

- Podcasts’ audiences soar. At a 20% share of ad-supported audio, podcasts now represent one out of every five minutes of U.S. ad-supported audio.

- Among registered voters, AM/FM radio leads in ad-supported audience share (68%) followed by podcasts (21%).

- After a pandemic lull, the proportion of AM/FM radio listening occurring in-car roars back.

- Powered by podcasts, spoken word is on a tear: 40% of all time with ad-supported audio goes to spoken word, up from 27% pre-pandemic.

Click here to view a 15-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.