New Study: AM/FM Radio Advertising Generates Significant Sales And Profit Growth Reports Peter Field, Godfather Of Marketing Effectiveness

Click here to view a 16-minute video of the key findings.

Click here to download a PDF of the report Peter Field presented at the Radiocentre Ireland event.

Click here to download a PDF of the slides.

Peter Field’s latest blockbuster study released in the U.K. is called The Long and the Short of It – 10 Years On: Radio’s Enduring Role in Effectiveness. This consequential new study lays out hard evidence for how AM/FM radio drives significant lifts in market share, pricing power, sales, profits, and ROI. The report was presented by Peter Field at a Radiocentre Ireland event.

Peter Field, along with his writing partner Les Binet, have been dubbed the “godfathers of marketing effectiveness” due to the major marketing studies and books that the duo has published over the last 15 years and their impact on the industry.

Binet and Field have written the most famous and useful books on marketing effectiveness:

- Marketing in the Era of Accountability

- The Long and the Short of It

- Media in Focus

- Effectiveness In Context

Their most popular publication was 2013’s The Long and the Short of It. It revealed two different marketing strategies: converting existing demand/sales activation and creating future demand/brand building.

Converting existing demand is very short term. Creating future demand is long term. Binet and Field reveal that the combined use of the two strategies is the secret to growing advertiser sales and profits.

Les Binet and Peter Field: How marketing drives sales and profits

Les Binet, Group Head of Effectiveness at adam&eveDDB London, and Marketing Consultant Peter Field studied the IPA databank, the world’s largest trove of marketing case studies for their many publications.

Their studies and books are published by London-based IPA, the Institute of Practitioners in Advertising. The IPA maintains a databank of over 1,200 case studies submitted to their Effectiveness Awards Competition. Covering a broad spectrum of marketing categories and budgets, they “represent the most rigorous proofs of the effectiveness of marketing communications in the world.”

Binet and Field marketing effectiveness books are highly respected. Adam Morgan, founder of marketing consultancy eatbigfish, says Les and Peter have written “the most important book ever written about marketing. It should be the foundation of knowledge and practice for everyone working in marketing and communications. Without exception.”

Keith Weed, former Chief Marketing and Communications Officer at Unilever, states, “Les and Peter have made a huge contribution to our understanding of how marketing drives growth and profit for brands.”

Here are Peter Field’s just released key findings on AM/FM radio’s effectiveness:

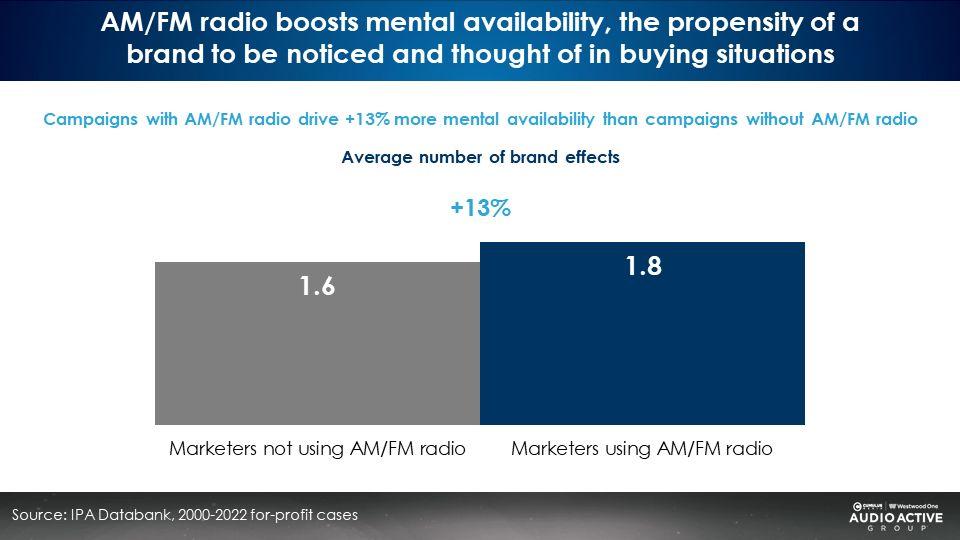

AM/FM radio boosts mental availability (the propensity of a brand to be noticed and thought of in buying situations) by +13%

In their book 66 Ways To Screw It Up: How Not to Plan, Les Binet and Sarah Carter explain:

“The single most important factor driving brand preference is ‘mental availability’: how well known a brand is, and how easily it comes to mind. Brands with low mental availability tend to struggle, rejected in favour of more familiar rivals. Or not considered in the first place. Brands with high mental availability don’t have to push so hard to sell, so tend to have higher market shares and better margins.”

Field’s research found that marketers that used AM/FM radio had +13% greater mental availability than brands that did not use AM/FM radio.

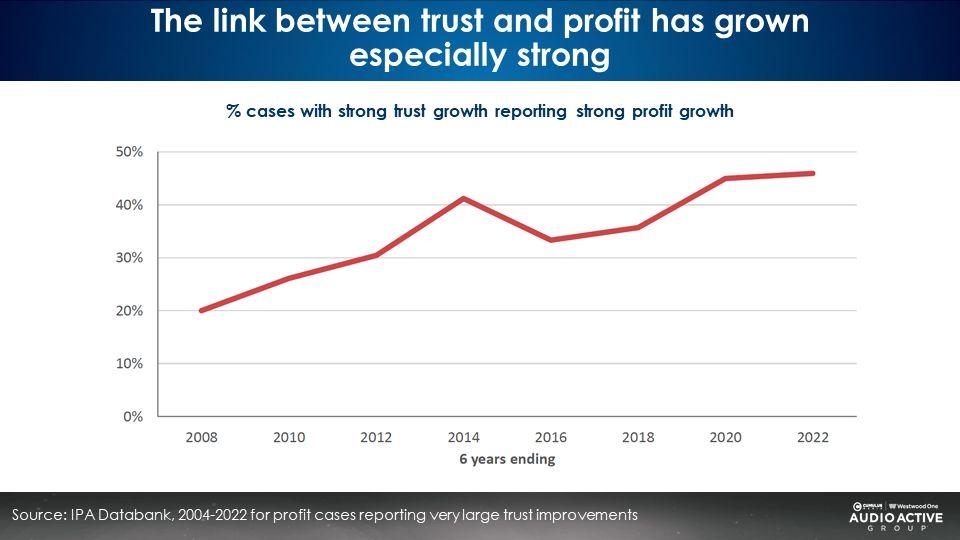

The link between trust and profit has surged over the last 15 years

Peter Field’s analysis of the IPA databank of marketing case studies reveals brands with strong trust growth report very strong profit growth.

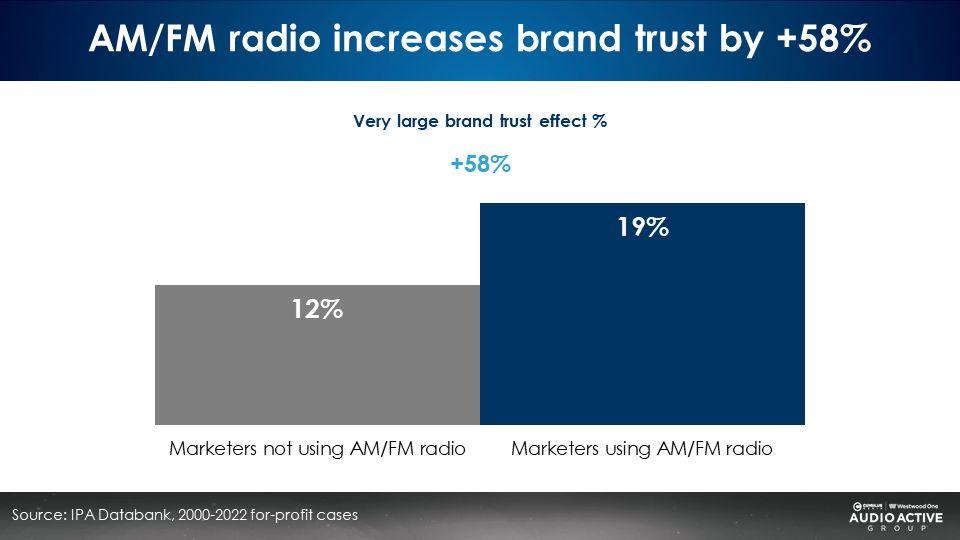

Adding AM/FM radio to the plan boosts brand trust by an astounding +58%

Putting AM/FM radio into the media plan grows trust, which generates profit growth.

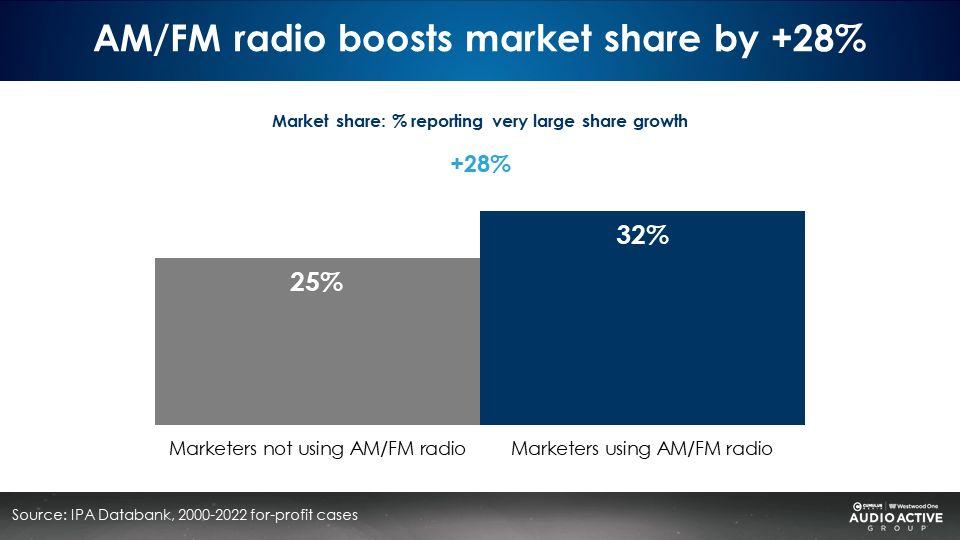

Media plans with AM/FM radio have +28% greater market share than brands that do not use AM/FM radio

From 2000 to 2022, brands in the IPA databank using AM/FM radio had a +28% greater market share (32%) compared to brands not using AM/FM radio (25%).

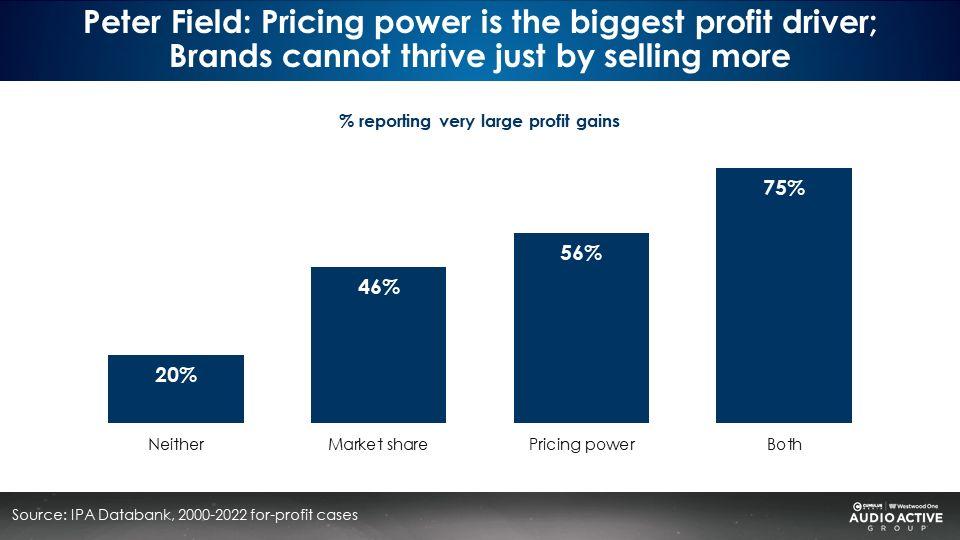

Pricing power is the biggest profit driver; Brands cannot thrive just by selling more

Peter Field’s analysis of the IPA databank reveals that pricing power is the biggest profit driver:

- 46% of brands with market share increases report large profit gains.

- 56% of marketers with pricing power have very large profit growth.

- 75% of brands with both market share gains and pricing power have very large profit growth.

Field notes businesses cannot thrive just by growing sales volume. Pricing power is a key profit accelerator.

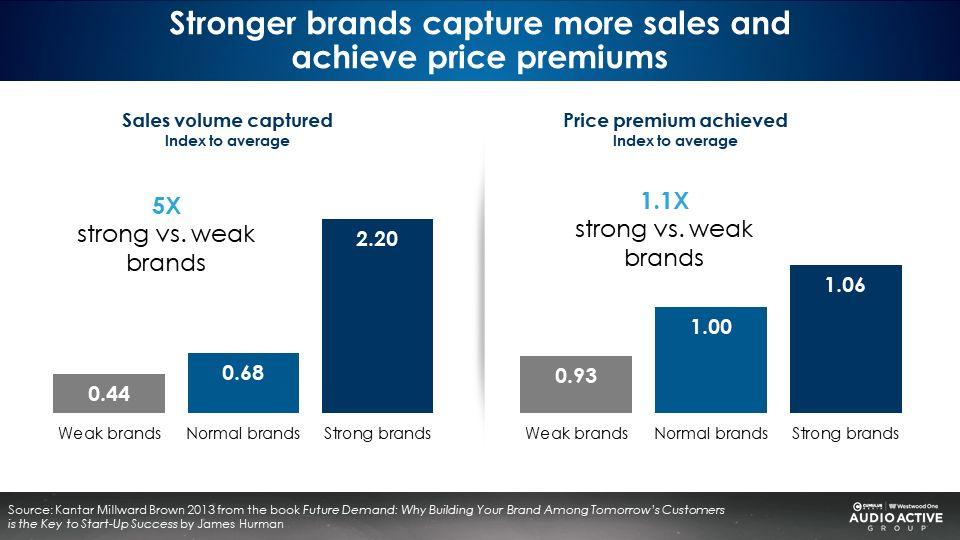

Kantar Millward Brown: Pricing power is the unforeseen benefit of using brand building ads to create future demand: Customers are willing to pay more for strong brands

Stores and businesses with strong brands generate better sales and profits. Kantar Millward Brown reports strong brands generate five times more sales volumes than weak brands.

More importantly, strong brands have more pricing power than weak brands. Pricing power generates greater profit.

Warren Buffett: “If you’ve got the power the raise prices, you’ve got a good business”

Warren Buffett has made a career of investing in companies with strong brands. Companies with strong brands recover faster from uncertain economies and have greater consumer purchase intent.

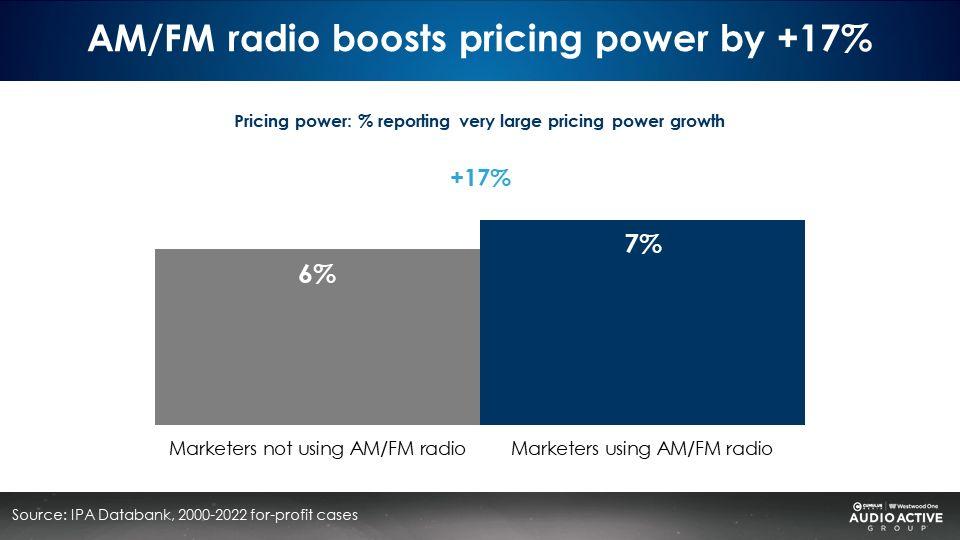

AM/FM radio improves brand pricing power by +17%

Compared to brands not using AM/FM radio, advertisers using AM/FM radio enjoy +17% greater pricing power, a key profit driver.

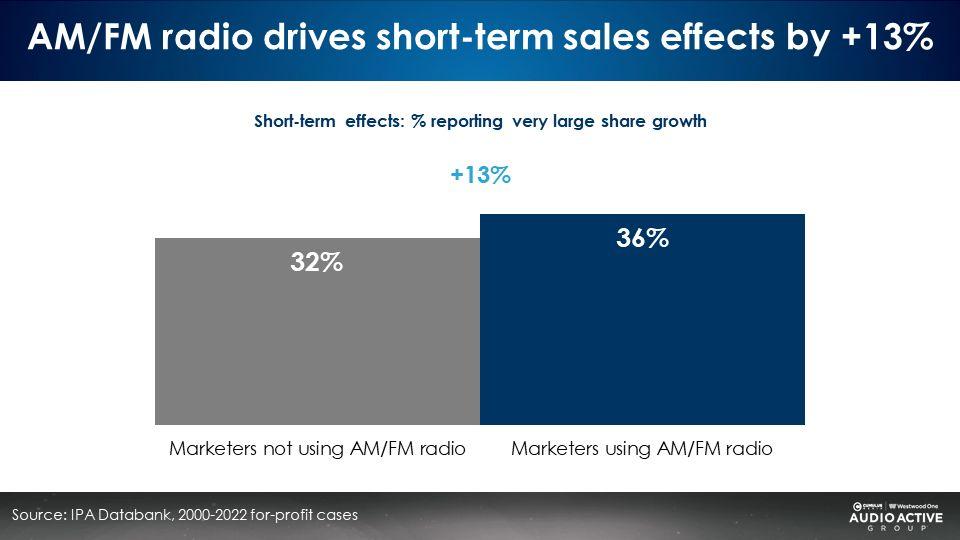

AM/FM radio grows short-term sales effects by +13%

The publication and major industry study Rethinking Brand for the Rise of Digital Commerce by the World Advertising Research Center (WARC) and James Hurman, Founding Partner, Previously Unavailable, defines short-term sales effect as “converting exist demand.”

Hurman says converting existing demand is, “Making sure we’re advertising to that relatively small group of consumers who are ready to buy, and capturing as large a share as possible of them for our product.” It is estimated only 1-5% of people are “in the market” at any one period of time.

Short-term sales via converting existing demand are most efficiently achieved by tightly targeting those “in the market” with rational messaging of product and price information that persuades them to choose one product over another.

Peter Field reports marketers using AM/FM radio experience +13% greater short-term sales effects compared to brands not using AM/FM radio.

Binet and Field: A simple math equation can predict if sales grow, fall, or remain stable

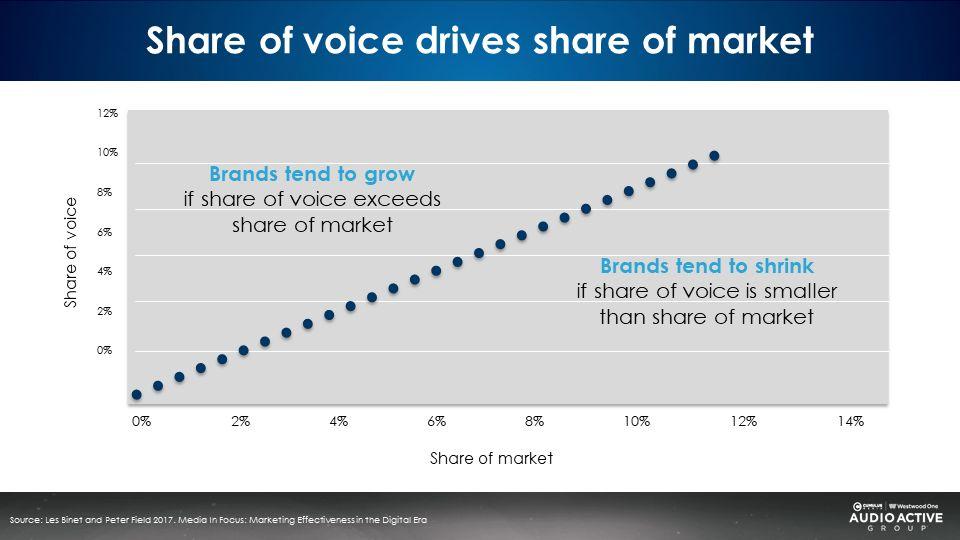

This chart below from Binet and Field gives a sense of the future growth of a business or brand. The chart visualizes the relationship between a brand’s “share of voice” and their market share.

Share of voice

The vertical axis (up/down) represents an advertiser’s “share of voice.” Share of voice is a marketer’s ad spend divided by category ad spend.

Say a furniture store spends $500,000 dollars a year on advertising in a town where there is $5 million dollars of furniture advertising.

Divide the store ad spend over category spend to determine share of voice. $500,000 divided by $5,000,000 equals a 10% share of voice. In essence, the furniture store represents 10% of furniture store advertising impressions in the market. Share of voice can also be determined by dividing your brand’s GRPs (gross rating points) over category GRPs.

Market share

Market share is a brand or retailer’s revenue divided by category sales.

Let’s say the furniture store generates $10 million dollars in sales in a town where there is $100 million dollars of total furniture sales. Divide the sales over total category sales to determine the market share.

$10 million divided by $100 million equals a 10% share of category spend. The furniture store has a ten share of furniture sales in the market.

Can your brand or store expect market share to maintain, grow, or shrink? Here’s how the relationship between share of voice and market share impacts future growth:

- If share of voice exceeds share of market, sales tend to grow.

- If share of voice is similar to share of market, sales tend to be stable.

- If share of voice is smaller than share of market, sales tend to shrink.

The “share of voice/market share” relationship explains why some businesses advertise just to see stable sales. “I advertise, why don’t my sales grow?” Brands whose share of voice is close to their market share are spending just enough to keep stable sales.

For every 10% of “extra share of voice” (ESOV) over a brand’s market share, a 0.5 increase in market share can be expected. If the furniture store increased ad spend to an 11% share of voice, they could expect their market share to grow by 0.5% to 10.5%.

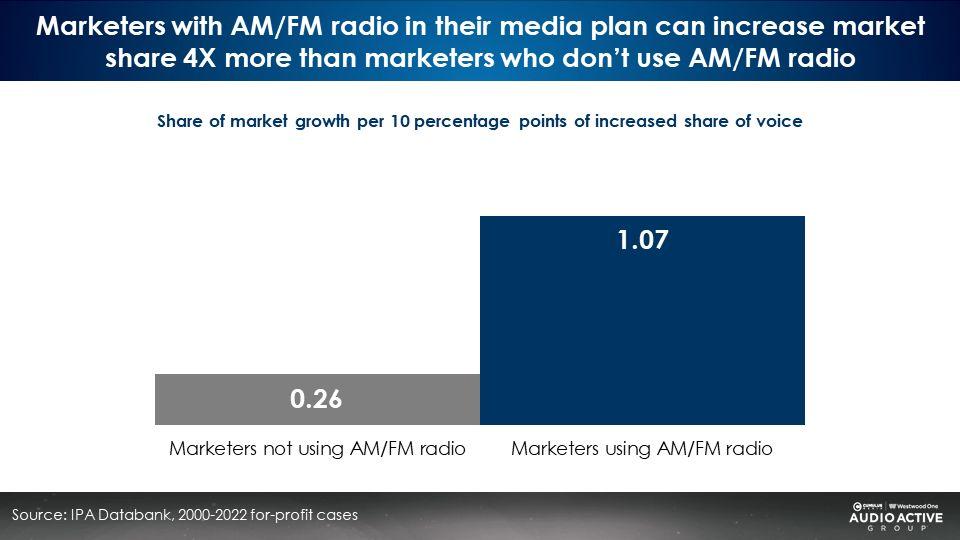

Brands using AM/FM radio find their share of voice impact is 4X more efficient compared to advertisers not using AM/FM radio

AM/FM radio is America’s number one mass media with stunningly affordable CPMs. Recently Media Dynamics reported that 2023/2024 Network TV Primetime CPMs soared +19% to $36.10, 7X greater than network radio CPMs. Putting AM/FM radio into a media plan lifts market share much higher than brands that do not use AM/FM radio.

Peter Field’s analysis of the IPA databank reveals non-AM/FM radio brands that increase their share of voice by 10% can expect a 0.26% increase in market share. Marketers with AM/FM radio in the media plan can expect a 1.07% increase in market share, a 4X difference!

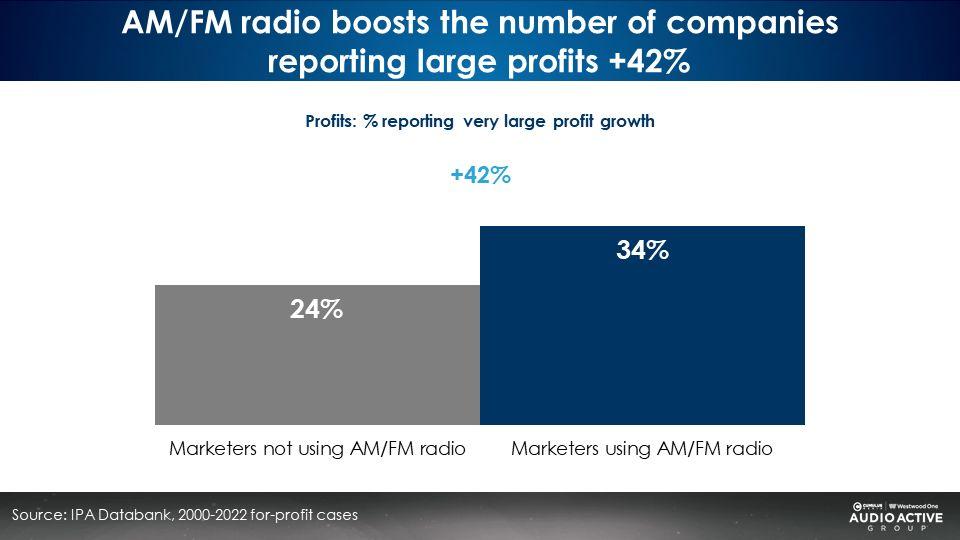

Advertisers using AM/FM radio have +42% greater profit than brands that do not use AM/FM radio

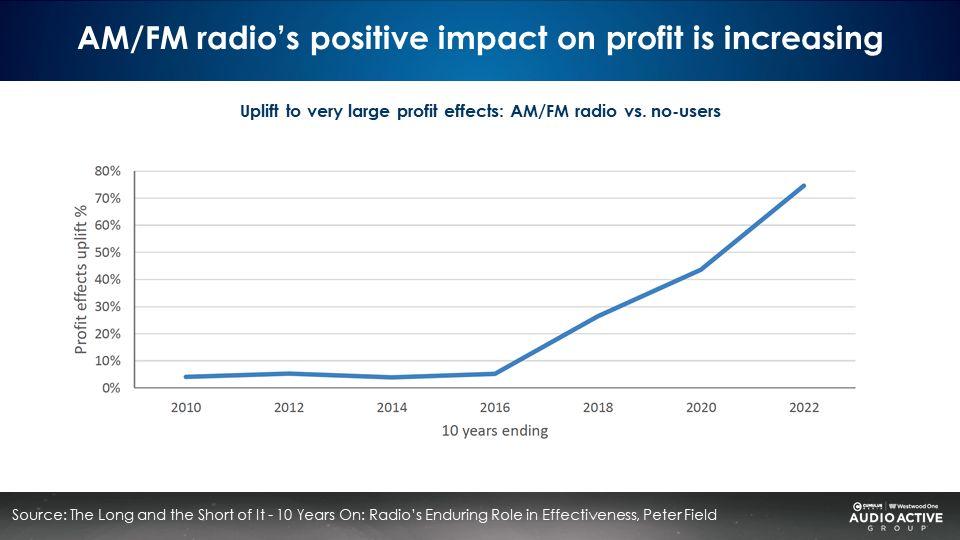

AM/FM radio’s impact on profit growth is increasing

Since 2016, Peter Field’s analysis of the IPA databank reveals the profit uplifts among marketers who use AM/FM radio versus those who do not have been growing steadily.

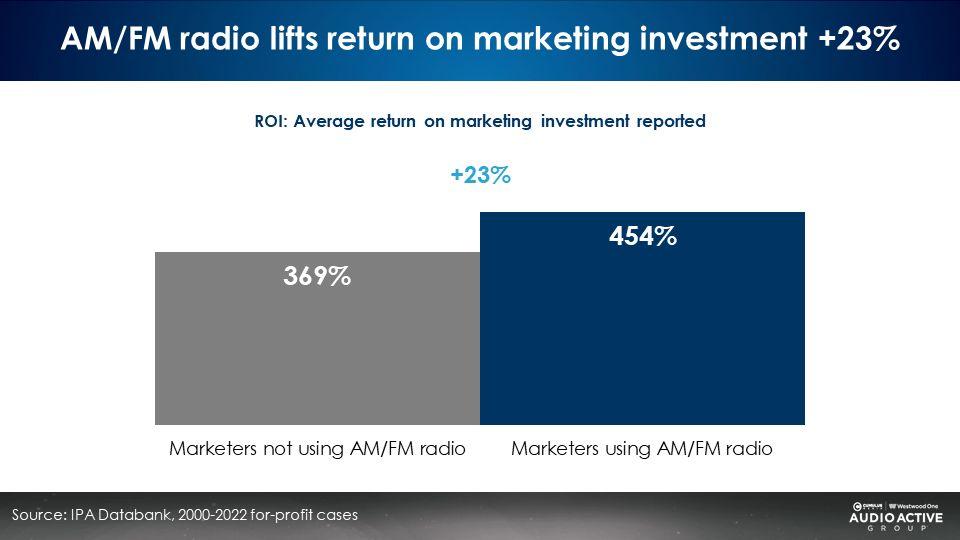

Brands using AM/FM radio experience +23% greater return on marketing spend

Compared to brands who don’t use AM/FM radio, AM/FM radio advertisers experience +23% greater return on advertising spend (ROI).

This new study makes a decisive business case for AM/FM radio advertising.

Key takeaways:

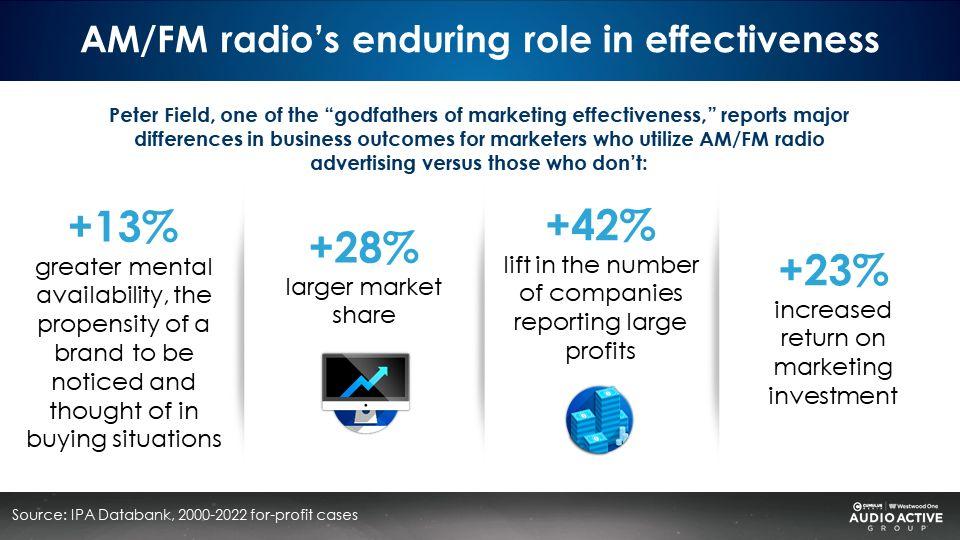

In one of the most significant studies ever conducted on the sales effect of AM/FM radio, Peter Field, one of the “godfathers of marketing effectiveness,” reveals major differences in business outcomes for marketers who utilize AM/FM radio versus those who don’t:

- +13% greater mental availability, the propensity of a brand to be noticed and thought of in buying situations

- +58% lift in brand trust, which is highly correlated to profit growth

- +28% larger market share

- +17% increase in pricing power

- +13% larger short-term sales effect

- 4X greater share of voice efficiency

- +42% increased profits, with AM/FM radio’s impact on profit growing

- +23% greater return on advertising spend

Click here to view a 16-minute video of the key findings.

Click here to download a PDF of the report Peter Field presented at the Radiocentre Ireland event.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.