AM/FM Radio And Podcasts Can Recapture Lost TV Reach Due To Writers/Actors Strike As 22% Of The Heavy Linear TV Audience Say They Will Watch Less TV This Fall

Click here to view a 9-minute video of the key findings.

Click here to download a PDF of the slides.

As the Writers Guild of America (WGA) and Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) strike in Hollywood continues well past the 100-day mark, there is a mixed outlook on a resolution.

Joe Mandese, Editor in Chief of widely read MediaPost, recently asked Zenith Media CEO Lauren Hanrahan, “What is the next most disruptive thing that will impact media planning and buying?” “The strike,” she replied. Hanrahan believes the strike’s impact “will probably be part of a more fundamental longer-term shift.”

To understand the degree to which Americans are aware of the Hollywood writers and actors strike and how media habits might shift as a result, the Cumulus Media | Westwood One Audio Active Group® retained MARU/Matchbox to conduct a nationally representative study of 1,003 Americans taking place August 25-28, 2023.

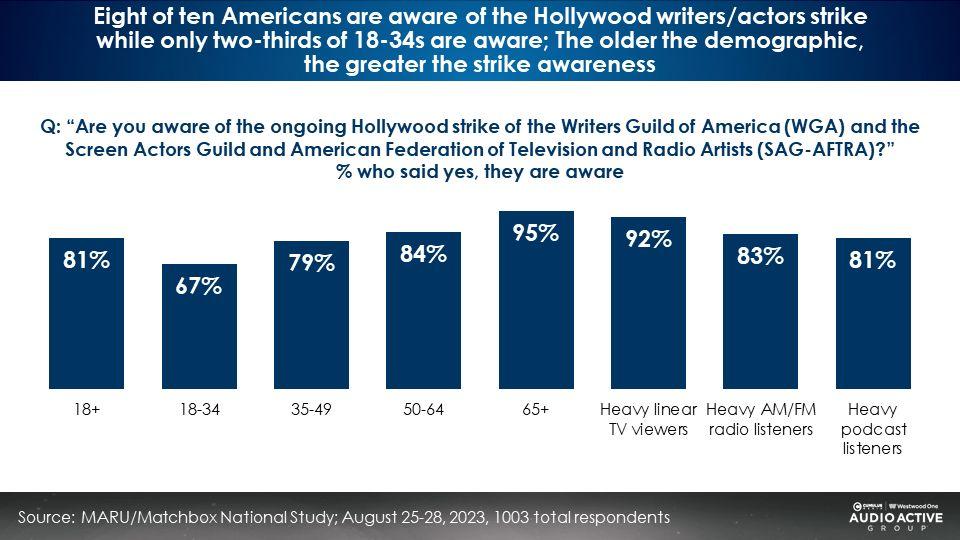

Eight of ten Americans are aware of the Hollywood writers/actors strike while only two-thirds of 18-34s are aware; The older the demographic, the greater the strike awareness

Nine out of ten heavy linear TV viewers (those who watch the most broadcast network and cable network programming) are aware of the strike. Virtually all Americans over the age of 65 are aware of the strike. Over 80% of the AM/FM radio and podcast audience are aware of the strike.

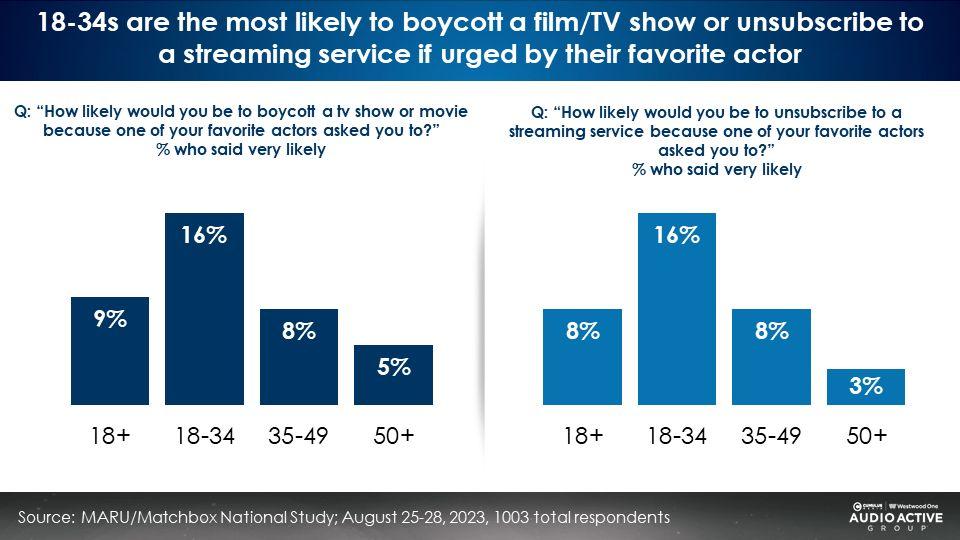

18-34s are most likely to boycott a film/TV show or unsubscribe to a streaming service if urged by their favorite actor

While 18-34s are the least likely to be aware of the writers and actors strike, they are more likely to respond to a request from their favorite actor for a show/movie boycott or cancellation of a streaming service.

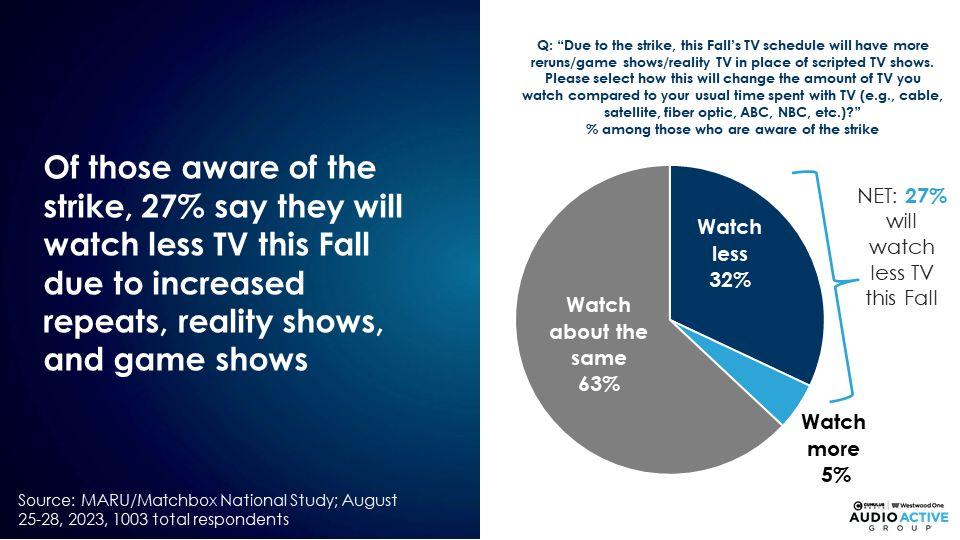

Of those aware of the strike, 27% say they will watch less TV this Fall due to increased repeats, reality shows, and game shows

Among those aware of the strike, 32% say they will watch less TV this Fall. 5% say they will watch more. Thus, the net of the two means 27% will watch less TV this Fall.

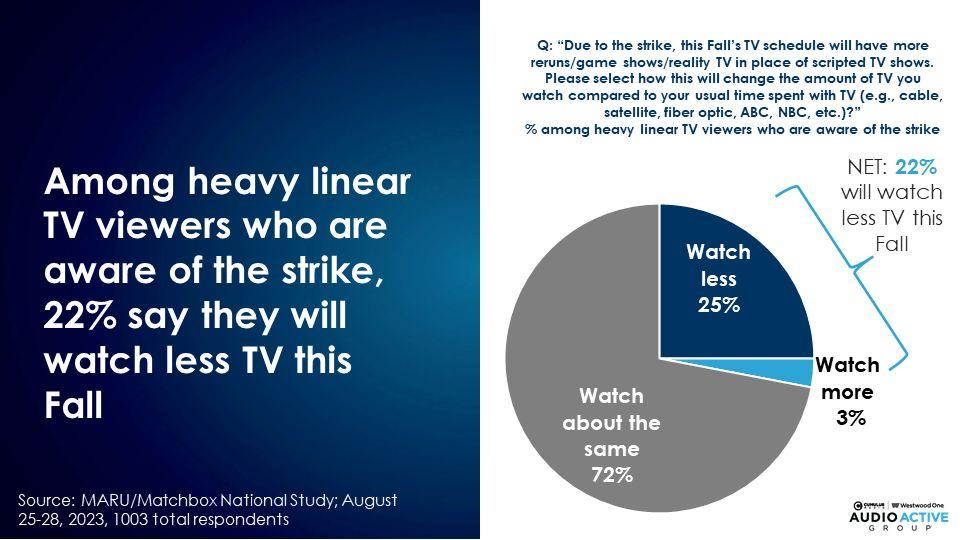

Among heavy linear TV viewers who are aware of the strike, 22% say they will watch less TV this Fall

Compared to the general population, heavy TV viewers who are aware of the strike are less likely to indicate a reduction in their Fall TV viewing due to programming shifts brought on by the Hollywood strike. 25% of heavy TV viewers say they will watch less and 3% say they will watch more for a net reduction of 22%. Still, one out of five heavy TV viewers say they will be watching less TV this Fall.

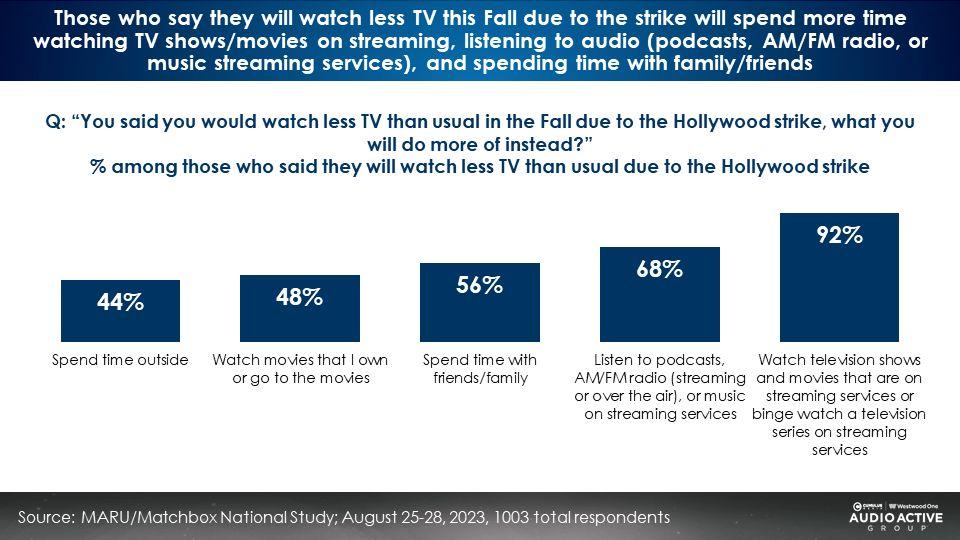

What will people do more of because of the strike? Watching TV shows and movies on streaming, listening to audio, and spending time with family and friends, according to those who say the strike will cause them to watch less TV this Fall

Among those who say they will be watching less TV this Fall due to the strike, 92% say they will “watch television shows and movies that are on streaming services” or “binge watch a television series on streaming services.” Next, 68% will spend more time with audio (podcasts, AM/FM radio, or audio streaming). 56% will spend more time with friends and family.

AM/FM radio makes your TV better: Replace lost TV reach with AM/FM radio

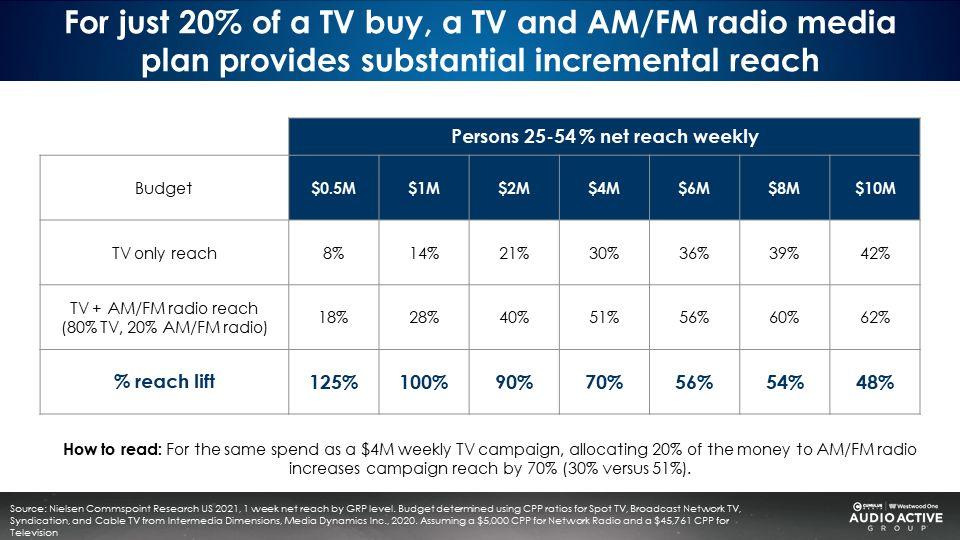

A media optimization analysis from Nielsen Media Impact, the media planning platform, reveals AM/FM radio can replace TV’s lost reach. Reallocating 20% of a TV ad budget can generate significant lift in reach.

No matter the size of a TV budget, shifting 20% of TV spend to AM/FM radio results in a massive increase in reach.

- Shifting 20% of a $500,000 network TV buy to AM/FM radio increases reach from 8% of persons 25-54 to 18%, more than doubling the reach with the same budget.

- Shifting 20% of a $2M network TV buy to AM/FM radio grows reach from 21% to 40%, a 2X increase in reach with the same budget.

- Moving 20% of an $8M network TV buy to AM/FM radio lifts reach from 39% to 60%, a +54% reach increase at the same budget.

Key takeaways:

- Eight of ten Americans are aware of the Hollywood writers/actors strike while only two-thirds of 18-34s are aware; The older the demographic, the greater the strike awareness

- 18-34s are most likely to boycott a film/TV show or unsubscribe to a streaming service if urged by their favorite actor

- Of those aware of the strike, 27% say they will watch less TV this Fall due to increased repeats, reality shows, and game shows

- Among heavy linear TV viewers who are aware of the strike, 22% say they will watch less TV this Fall

- Those who say they will watch less TV this Fall due to the strike will spend more time watching TV shows/movies on streaming, listening to audio (podcasts, AM/FM radio, or music streaming services), and spending time with family/friends/outdoors

- AM/FM radio makes your TV better: No matter the size of a TV budget, shifting 20% of TV spend to AM/FM radio results in a massive increase in reach

Click here to view a 9-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.