Pay TV Crisis: Reallocating TV Budgets To AM/FM Radio Can Recover Lost Audiences And Generate Significant Incremental Reach

Click here to view a 10-minute video of the key findings.

Click here to download a PDF of the slides.

Though the 11-day blackout of Disney cable networks and the ABC TV network from Charter/Spectrum cable that affected 22.2 million viewers has been resolved, pay TV’s woes and declines will continue.

Are we witnessing the meltdown of the pay TV business model?

The pay TV world has two major players: distributors and programmers. Distributors are the cable companies who provide TV services to consumers. Programmers are the media companies (cable networks and broadcast networks) who license content (sports rights) and produce the shows. For every home that takes a cable network, the cable company pays an affiliate fee to the programmer.

Life was good in the 1990s and 2000s. Pay TV penetration soared to 90% of American homes. Revenue exploded and the networks used their affiliate fee bounty to produce shows and to secure sports rights.

Then streaming video on demand (SVOD) players like Netflix came along and the media companies rushed to create their own streaming services. Cord cutting exploded and pay TV is now in less than half of U.S. homes. MoffettNathanson, one of the most respected and quoted media analysis firms, has identified two key trends that are causing a major crisis for the pay TV business model.

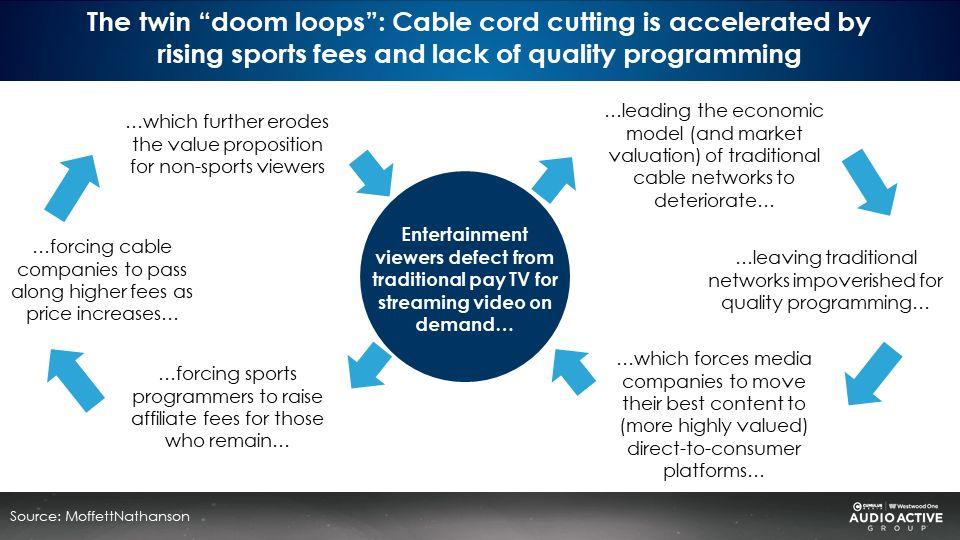

Pay TV twin “doom loops”: Sports fee inflation and the best shows are moving to streaming

MoffettNathanson has been warning that pay TV’s twin “doom loops” are bringing the industry to a breaking point. Media firms with sports rights keep raising the affiliate fees for cable distributors who pass these costs onto consumers. This causes entertainment viewers to defect from pay TV to streaming.

The erosion of the pay TV business model forces media companies to move their best shows to their streaming services rather than their linear networks. This in turn causes entertainment viewers to defect from traditional pay TV to streaming.

Cable TV ad impressions are evaporating quickly

It used to be the programmers held all the cards. No longer. Investors are now encouraging pay TV distributors to abandon offering TV services. Cable companies make little to no money offering TV channels. They make their money on broadband.

Amazingly, less than half of major cable companies’ customers take their video service. Only 47% of Comcast’s broadband customers take their video service. Only 46% of Charter/Spectrum’s broadband customers take its TV service. Only 15% of Cable One’s broadband customers take TV service and their profits have soared to record levels.

Besides becoming more profitable, there is another benefit for cable operators to drop video, says MoffettNathanson: “Dropping video would free up a huge amount of additional capacity for broadband, which would, in turn, mean a huge jump in broadband speeds.”

For advertisers, it means the next several years will see stunning erosion in cable audiences locally and nationally. Auto dealers who have relied heavily on spot cable (as have the auto brands) will need another media platform to build their brand and drive sales effect.

MoffettNathanson observes, “It is no small irony that just as it is becoming clear that SVOD (or AVOD, or any hybrid) isn’t ever going to be as good a business as the old linear pay TV industry used to be, it is becoming clearer than ever that there is no going back. The lifeboats have already been burned.”

What about TV advertisers? Campaign deliveries were negatively impacted

While the Disney/Spectrum outcome has been resolved, TV campaigns were being impacted. There will be more carriage disputes which will continue to erode cable audiences for advertisers.

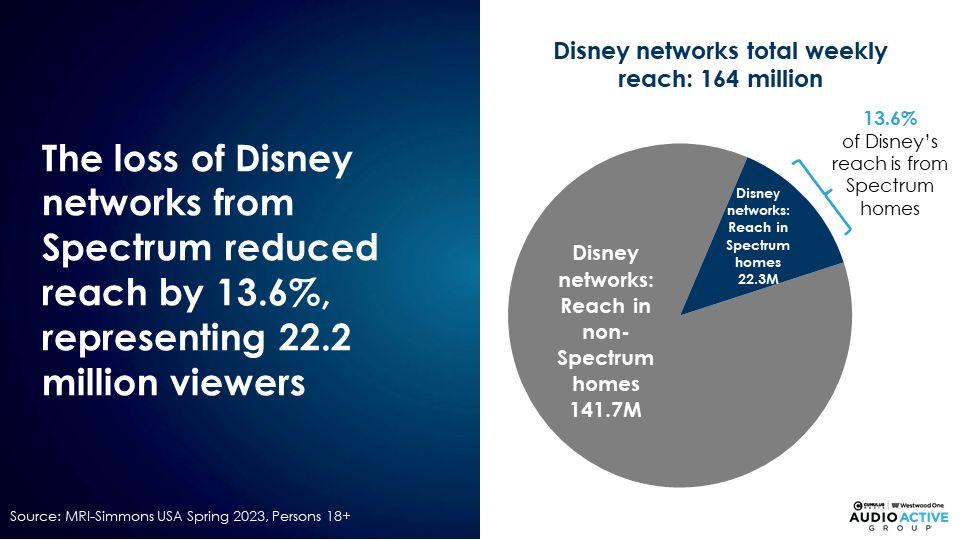

For a national advertiser, the loss of Disney networks from Spectrum reduced reach by -13.6%, representing 22.3 million viewers, according to MRI-Simmons.

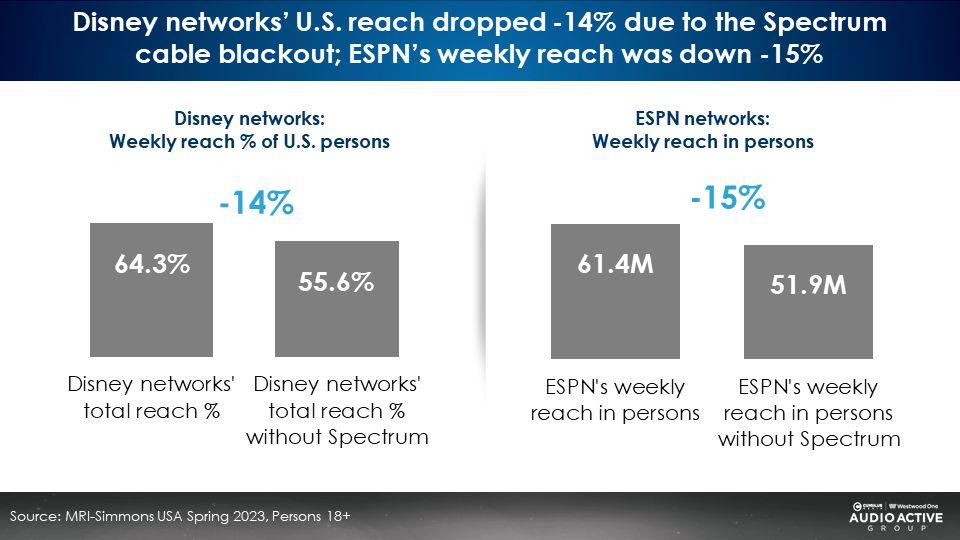

Disney networks’ U.S. reach dropped -14% and ESPN eroded by -15% due to Spectrum blackout

The impact for local advertisers was even more significant

While audience delivery erosion in the mid-teens is not insignificant, local advertisers experienced more significant audience reductions in their TV media plans. A Nielsen Scarborough analysis reveals there are 42 DMA markets with an over 5% audience loss due to the Spectrum/Disney stalemate:

| DMA market | Disney owned cable networks & ABC-TV reach: Watched last 7 days | Lost reach: Spectrum subscribers who viewed Disney owned cable networks or ABC-TV O&Os in last 7 days | Reach loss % |

| Honolulu DMA | 631,065 | 362,801 | 57.5% |

| Raleigh/Durham DMA | 1,245,661 | 559,296 | 44.9% |

| Tampa/St. Petersburg DMA | 2,540,444 | 997,111 | 39.2% |

| Los Angeles DMA | 6,033,042 | 2,306,075 | 38.2% |

| Albany/Schenectady/Troy DMA | 786,529 | 290,301 | 36.9% |

| Syracuse DMA | 458,245 | 157,596 | 34.4% |

| Buffalo DMA | 773,695 | 261,747 | 33.8% |

| Rochester DMA | 584,119 | 190,500 | 32.6% |

| Greensboro/High Point/Winston-Salem DMA | 838,306 | 272,657 | 32.5% |

| Dayton DMA | 591,787 | 191,153 | 32.3% |

| Orlando/Daytona Beach/Melbourne DMA | 2,261,418 | 634,331 | 28.1% |

| Cleveland/Akron DMA | 1,945,051 | 526,799 | 27.1% |

| Columbus DMA | 1,342,313 | 350,283 | 26.1% |

| Charlotte DMA | 1,713,850 | 440,054 | 25.7% |

| Milwaukee DMA | 1,285,801 | 320,400 | 24.9% |

| St. Louis DMA | 1,545,381 | 366,097 | 23.7% |

| Bakersfield DMA | 362,985 | 82,895 | 22.8% |

| Cincinnati DMA | 1,259,195 | 278,879 | 22.1% |

| Greenville/Spartanburg/Asheville/Anderson DMA | 1,135,576 | 248,446 | 21.9% |

| San Antonio DMA | 1,467,086 | 304,406 | 20.7% |

| Flint/Saginaw/Bay City DMA | 560,676 | 104,413 | 18.6% |

| Harlingen/Weslaco/Brownsville/McAllen DMA | 532,179 | 95,986 | 18.0% |

| Birmingham DMA | 1,062,227 | 186,598 | 17.6% |

| Green Bay/Appleton DMA | 672,589 | 118,130 | 17.6% |

| Louisville DMA | 925,135 | 161,408 | 17.4% |

| Lexington DMA | 654,735 | 110,193 | 16.8% |

| Kansas City DMA | 1,310,238 | 214,899 | 16.4% |

| Austin DMA | 1,137,992 | 179,861 | 15.8% |

| New York DMA | 7,303,953 | 1,108,183 | 15.2% |

| Toledo DMA | 602,203 | 84,135 | 14.0% |

| Dallas/Fort Worth DMA | 3,864,782 | 518,848 | 13.4% |

| Knoxville DMA | 750,137 | 89,495 | 11.9% |

| Grand Rapids/Kalamazoo/Battle Creek DMA | 903,747 | 106,265 | 11.8% |

| Chattanooga DMA | 500,599 | 52,162 | 10.4% |

| El Paso DMA | 515,310 | 52,194 | 10.1% |

| Nashville DMA | 1,501,662 | 100,346 | 6.7% |

| Minneapolis/St. Paul DMA | 2,419,325 | 149,106 | 6.2% |

| New Orleans DMA | 874,187 | 52,783 | 6.0% |

| Charleston/Huntington DMA | 580,717 | 34,599 | 6.0% |

| San Diego DMA | 1,259,932 | 73,753 | 5.9% |

| Indianapolis DMA | 1,356,743 | 75,939 | 5.6% |

| Atlanta DMA | 3,614,414 | 187,947 | 5.2% |

- 10 DMAs had audience losses north of 30%

- 20 DMAs had audience losses of 20% or more

- 35 DMAs had audience losses of 10% or greater

ABC owned and operated TV station reach eroded by -10.2%

Due to the Spectrum blackout, Nielsen Scarborough reports ABC O&O weekly reach dropped from 27.5 million to 24.7 million, a -10.2% decrease. In markets with an ABC O&O, the combination of the cable audience losses with the ABC broadcast reach loss is significant.

AM/FM radio to the rescue: AM/FM radio can recover lost audiences and dramatically expand reach

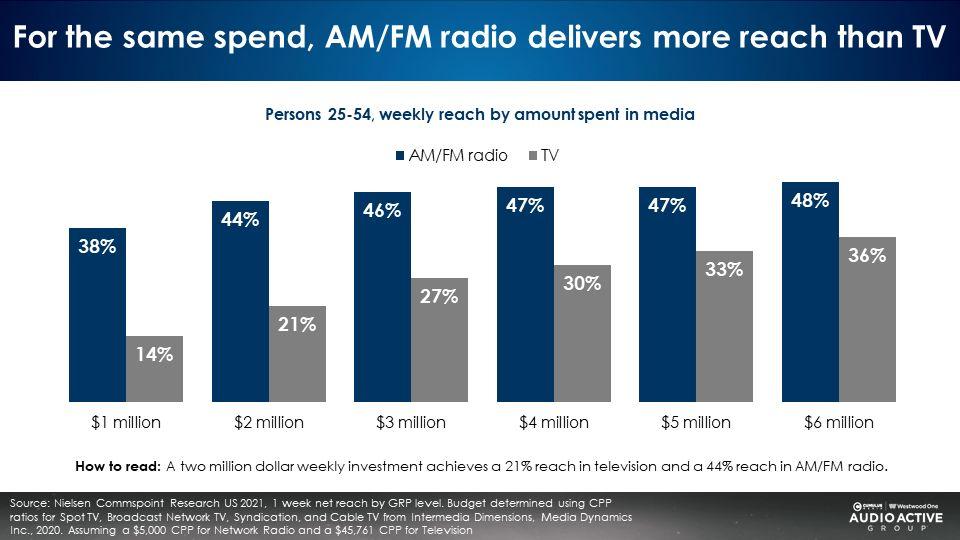

Instead of taking Disney/ABC makegoods, advertisers should get a refund and invest in AM/FM radio. Nielsen Commspoint, the media planning system, reports investments in AM/FM radio generate far more reach than the same spend in TV:

A one million dollar national TV buy reaches 14% of persons 25-54. The same one million dollars in AM/FM radio reaches almost three times as many people – 38% of 25-54s! At every spend level, AM/FM radio investments reach far more Americans than TV.

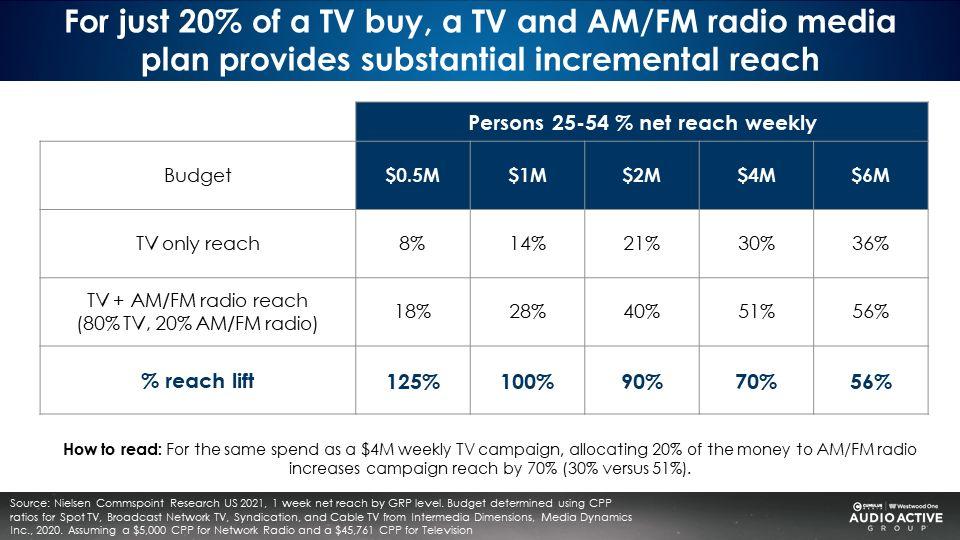

Shifting 20% of a TV budget to AM/FM radio can double reach

The Nielsen Commspoint media planning platform reveals reallocating 20% of a TV media plan to AM/FM radio causes reach to double. Yes, you read that right. Moving 20% of the media plan generates 2X the reach at the same budget:

Shifting 20% of a $500,000 TV budget to AM/FM radio causes a +125% reach lift (8% reach to an 18% reach of 25-54s). Reallocating 20% of a two million dollar TV plan to AM/FM radio increases campaign reach from 21% to 40%, a nearly 2X lift in campaign reach.

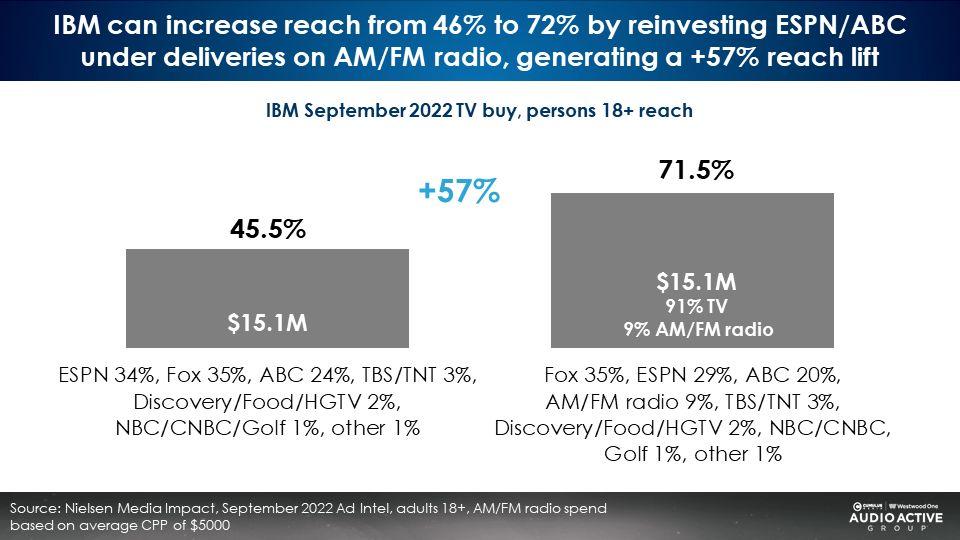

Case study: IBM’s buy can be enhanced by shifting the ESPN/ABC lost GRPs to AM/FM radio

In September 2022, IBM spent $15.1 million dollars on a network TV plan where the majority of the investment (58%) was run on ESPN/ABC. If the same media plan was activated this September, 25 GRPs from ESPN/ABC would be lost due to the Spectrum/Disney blackout.

Instead of getting makegoods worth $1,328,000, IBM would be better served taking that as a refund and investing in AM/FM radio. Allocating a modest 9% of the total plan to AM/FM radio would generate an outsized impact on reach.

The original IBM plan generated a reach of 45.5% of Americans in September. Shifting the lost ESPN/ABC deliveries into AM/FM radio would increase reach from 44.5% to an astonishing 71.5%. Shifting just 9% of the plan to AM/FM radio increases reach by +57% for the same budget!

Marketers: AM/FM radio is your solution to the ongoing pay TV crisis

Even with this current Disney/Spectrum crisis behind us, more turmoil will occur. Writers/actors strike anyone? The twin “doom loops” of ever-increasing sports fees and eroding programming quality will power the relentless erosion of the pay TV universe.

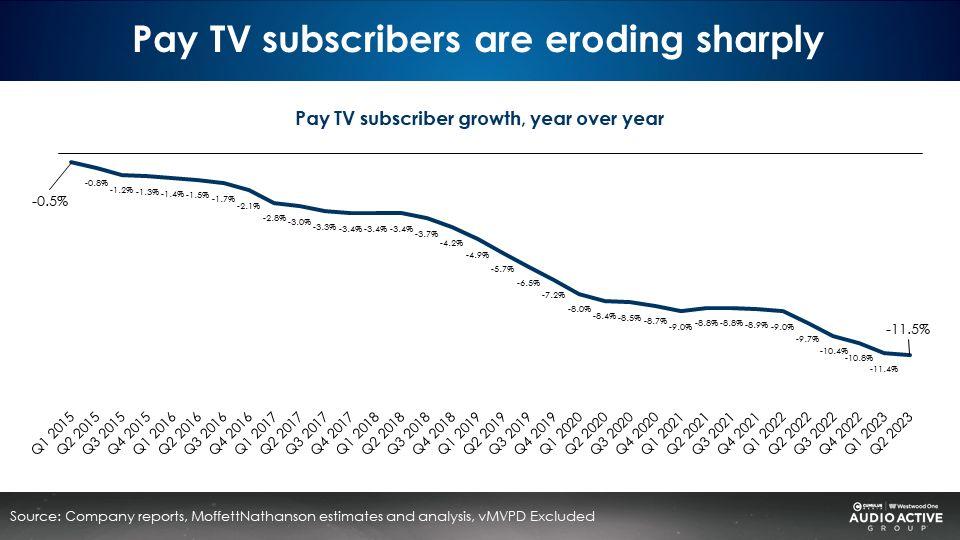

Connected TV and over-the-top TV cannot solve all of linear TV’s woes, especially at a $30 CPM which eats up budgets for only modest reach growth. Linear TV reach will keep eroding. According to MoffettNathanson, pay TV is eroding sharply, losing -11.5% of subscribers year over year in Q2 2023.

Shifting 10%-20% of media plans to AM/FM radio is an excellent hedge against the audience erosion of pay TV and a solution to generate extraordinary reach in media plans of any size.

The pay TV boat is sinking. As MoffettNathanson reports, the lifeboats have already been burned. AM/FM radio can rescue TV advertisers’ media plans, replace lost TV audiences, and supplement reach to impressive levels.

Key takeaways:

- Disney networks’ U.S. reach dropped -14% and ESPN eroded by -15% due to Spectrum blackout

- AM/FM radio to the rescue: AM/FM radio can recover lost audiences and dramatically expand reach

- Shifting 20% of a TV budget to AM/FM radio can double reach

- Case study: IBM’s TV buy can be enhanced by shifting 9% of the budget to AM/FM radio; IBM’s reach would surge from 46% to 72%, a +57% increase for the same investment

Click here to view a 10-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.