Lumen: Audio Ads Outperform Video For Attention And Brand Recall, Dentsu Study Reveals

Click here to download slides from the Lumen AM/FM Radio and Podcast Attention Study from Dentsu.

Click here to view a 19-minute video of the key findings.

“Audio Ads Outperform Video for Attention and Brand Recall,” was the head snapper of a headline in last week’s Advertising Age. Dentsu, one of the world’s largest media agencies, released a historic, first-ever study of media attentiveness that compared podcasts and AM/FM radio ads with all manner of visual ads. The Advertising Research Foundation defines advertising attentiveness as “the degree to which those exposed to the advertising are focused on it.”

There were three key findings:

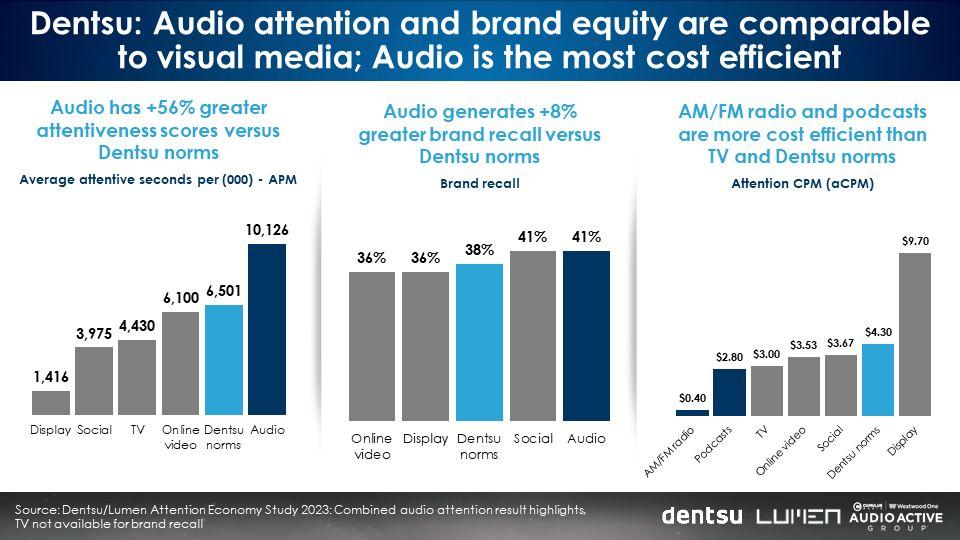

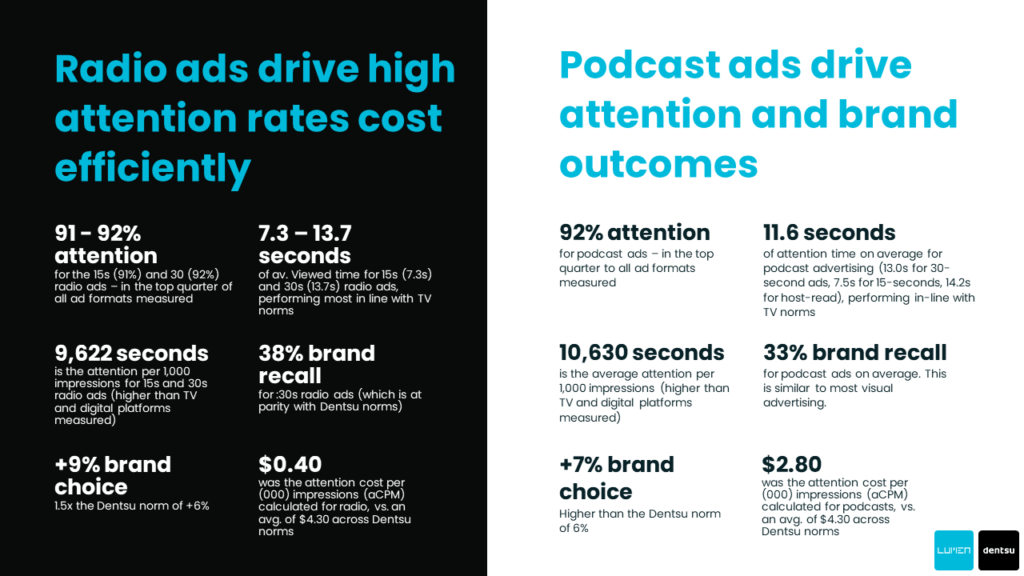

- Audio has +56% greater attentiveness scores versus Dentsu norms, +128% stronger than TV.

- Audio generates +8% higher brand recall versus Dentsu norms, +14% greater than online video and display.

- AM/FM radio is eight times more cost effective than TV and eleven times more cost efficient than Dentsu’s “attention cost per thousand” media benchmark. Podcasts are +43% more cost efficient than Dentsu’s “attention CPM” norm.

Three implications:

- The Dentsu/Lumen study puts a stake through the heart of the myth that “sight, sound and motion” ads are somehow superior to audio ads: The study proves that audio outperforms visual ads on the top jobs of advertising: creating memories, growing brand recall and increasing brand choice.

- Podcasts, perceived to be “expensive,” are actually remarkably cost effective on an “attention CPM” basis: Podcasts’ $25 media CPM becomes a mere $2.80 attention CPM, well below the Dentsu $4.30 average. Display media, perceived as cost effective, actually has a very expensive attention CPM ($9.70).

- AM/FM radio should be in every media plan: It outperforms visual media on the business outcomes of brand recall and brand choice while having a stunningly low attention CPM of 40 cents.

The Association of National Advertisers reveals there are three stages to what they define as the Attention Pathway:

- “Get Noticed – advertising requires an environment that fosters attention. This is the job of a media placement. How well it gets that job done is a good indicator of its quality: the best quality placements create the greatest potential for attracting attention.

- Hold Attention – it’s vital to keep the viewer focused on the ad. In some circumstances, this can be measured using duration. This requires a stable media placement and interesting creative.

- Impact Memory – with attention now assured, the creative must deliver a brand message that affects the short- or long-term memory of the person paying attention to the ad.”

The landmark Dentsu report conducted by Lumen, one of the leaders in attentiveness measurement, is the latest in a series of studies that have documented the surprising strength of audio.

IAB Concentration and Content Value Study: Podcasts lead

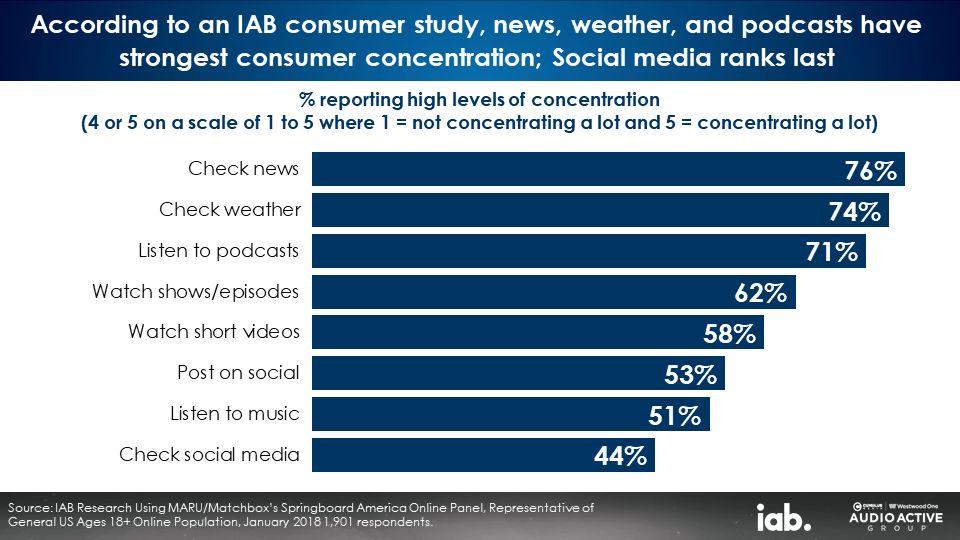

In 2018, the Interactive Advertising Bureau (the IAB) published a content concentration and content value study. Consumers evaluated media content on a one to five scale to indicate their degree of concentration. One represented “not concentrating a lot” and five represented “concentrating a lot.”

News, weather, and podcasts scored the greatest concentration (a four or a five). Podcasts trumped TV and online video and dramatically outperformed social media.

MARU/Matchbox Media Attentiveness Study: Podcasts and AM/FM radio lead audio platforms

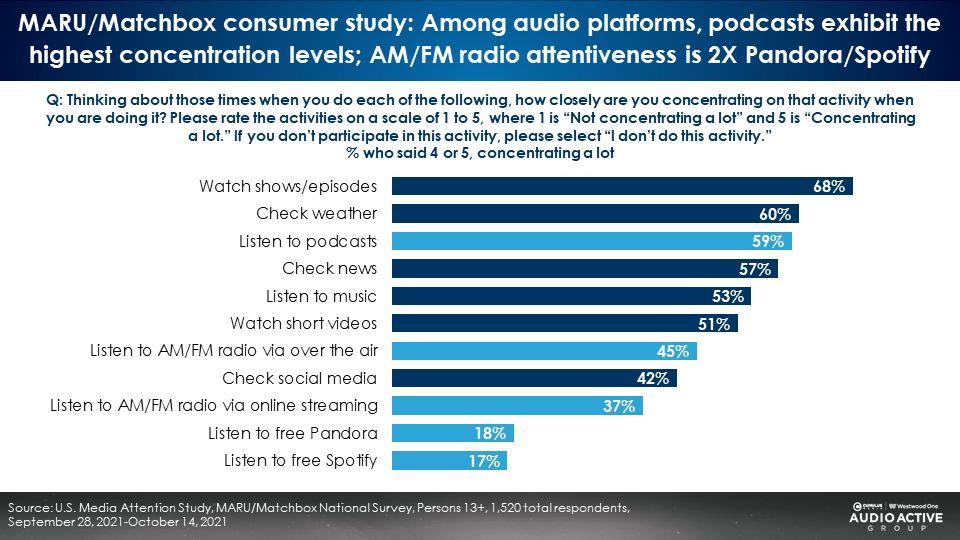

In 2021, the Cumulus Media | Westwood One Audio Active Group® retained MARU/Matchbox to conduct an in-depth study of media concentration. The study replicated IAB’s content concentration measurement including a greater breadth of media platforms. Among audio platforms, podcasts exhibited the highest concentration levels.

Consumer concentration for AM/FM radio was two times that of ad-supported Spotify and ad-supported Pandora. Consumer concentration to AM/FM radio streaming was also double that of Spotify and Pandora.

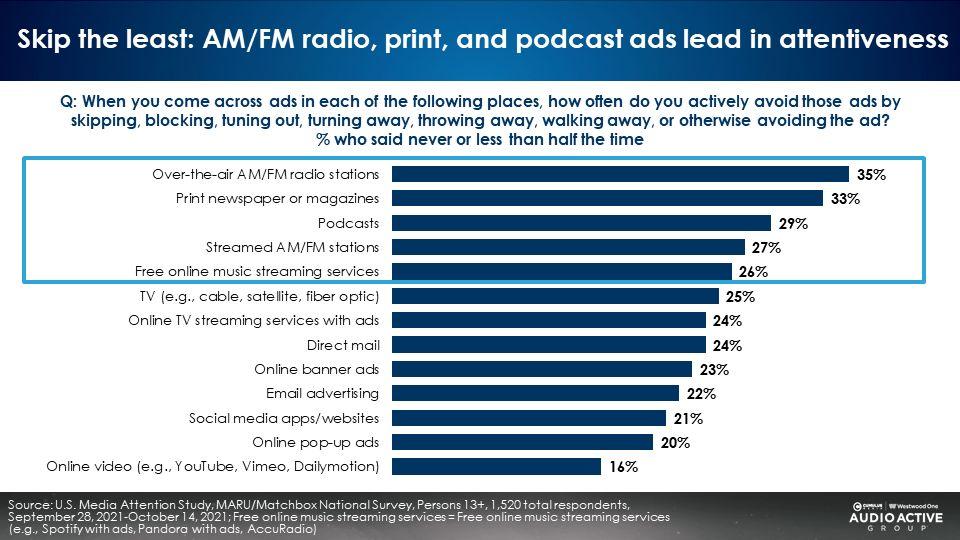

Ads skipped the least: AM/FM radio, print, and podcast ads lead in attentiveness

Of all advertising, MARU/Matchbox reports AM/FM radio ads, print, podcasts, and AM/FM radio streaming ads lead for being noticed, holding attention, and being skipped the least. Digital ad formats such as intrusive pop ups, social media, banner ads, and online video experience high levels of ad skipping.

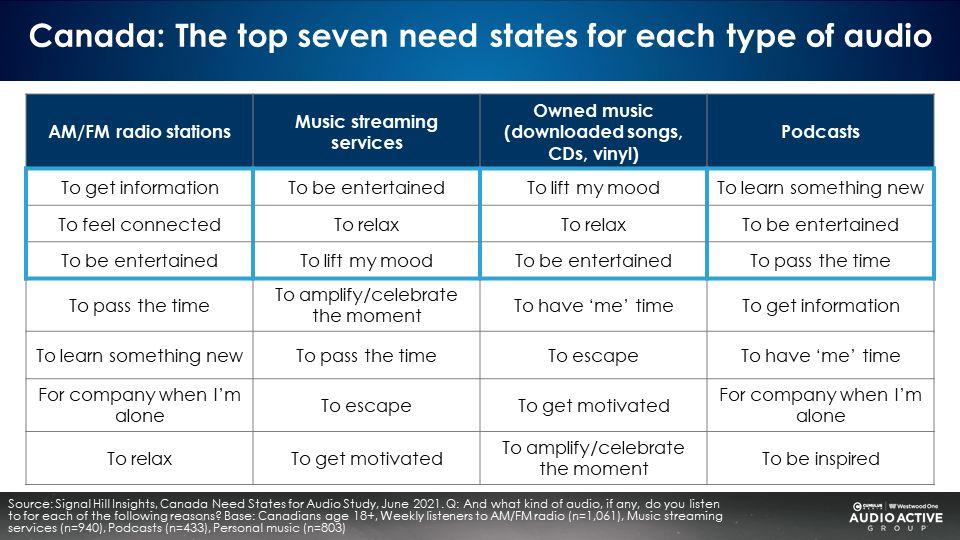

Signal Hill Insights audio need states: Advertising works well on AM/FM radio and podcasts since listeners are learning, getting information, and feeling connected

Signal Hill Insights conducted a study in 2021 of Canadian listeners to measure the key benefits audio provides. The findings revealed:

- Music streaming entertains, relaxes, and lifts moods.

- AM/FM radio provides information, connection, and entertainment.

- Podcasts are about learning, entertainment, and passing the time.

Advertising works so much better in AM/FM radio and podcasts because consumers use them to learn, to be connected, and to get information.

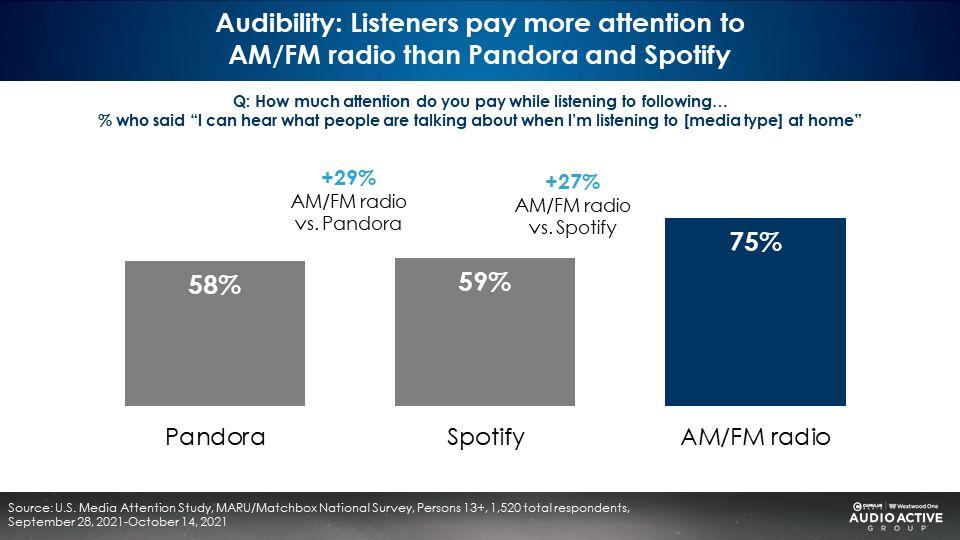

Audibility: Ads are more effective on AM/FM radio since listeners can hear the voices more clearly on AM/FM radio versus Pandora and Spotify

There is a simple reason advertising is so much more effective on AM/FM radio than on Spotify and Pandora – listeners are more likely to hear the ads. MARU/Matchbox asked consumers the degree to which, “[They] can hear what people are talking about when [they’re] listening to Pandora, Spotify, and AM/FM radio.”

According to listeners, AM/FM radio is +27% more audible than Spotify and +29% more audible than Pandora. Ads work better when people can hear them!

The “background music” vibe of Pandora and Spotify means ads are harder to hear. The foreground nature of AM/FM radio (with DJs, pop culture information, interviews, listeners phone calls, news, weather, sports, etc.) make AM/FM radio content more foreground. Ads are noticed more in an environment where there is more spoken word content that is entertaining, informative, and builds human connections.

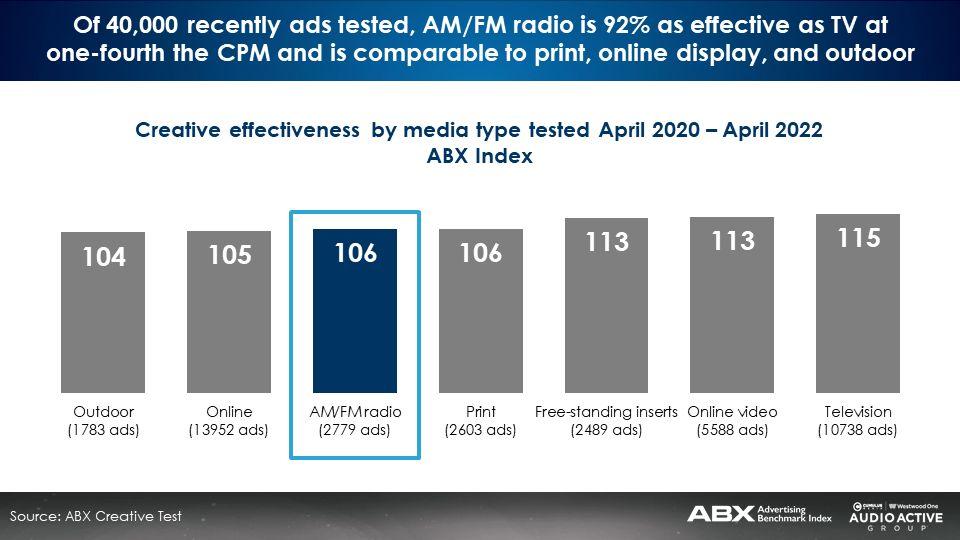

Massive ABX creative effectiveness study of TV And AM/FM radio ads reveals “sight, sound, and motion” superiority is a myth

In 2022, ABX, a leading advertising creative testing firm, released the largest ever creative effectiveness study comparing audio ads versus video ads. ABX examined two years’ worth of recent testing, totaling 40,000 ads and including 10,738 TV ads and 2,779 AM/FM radio ads. ABX’s findings explode the myth that the “sight, sound and motion” of video ads are dramatically more powerful that audio ads.

ABX: AM/FM radio creative effectiveness is 92% of TV at one-fourth of the CPM

If “sight, sound, and motion” are so impactful, one would think the TV ad creative effectiveness would be double that of AM/FM radio. In reality, TV advertising effectiveness is only 8% better than AM/FM radio at 4X the CPM.

The findings are clear. “Sight, sound, and motion” do not represent significantly greater creative effectiveness.

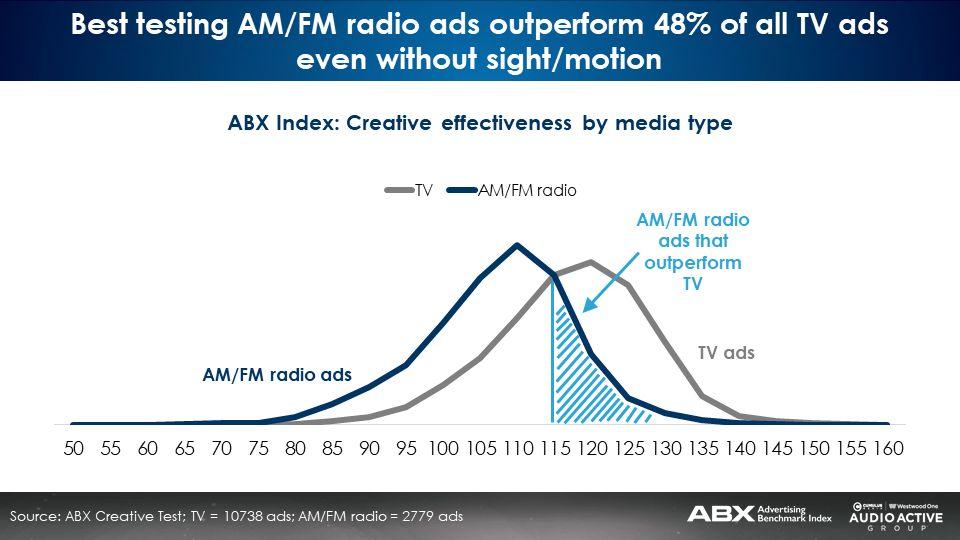

The best testing AM/FM radio ads outperform nearly half of all TV ads

Remarkably, ABX found that higher scoring AM/FM radio ads actually outperformed 48% of TV executions. As the total scores of the TV and AM/FM radio creative tests are so similar, it is not surprising AM/FM radio ads can have greater creative effectiveness than TV ads.

Gary Getto, President of ABX, says, “Moving some TV funds to AM/FM radio produces significantly higher reach. Often the excuse for not doing this is the need for sight, sound, and motion that TV provides and, in many cases, the lack of confidence in AM/FM radio creative’s ability to move the needle. But extensive ABX data shows that AM/FM radio can be nearly as effective as television when best practices in audio creative are followed.”

Dentsu’s Attention Economy: An industry first now introduces audio measurement

Last week’s study is the latest to be released by Dentsu’s Attention Economy which is celebrating its fifth anniversary this year since launching in 2018. The Attention Economy was the industry’s first attention-focused study and is the world’s largest in scale and scope of its kind. Dentsu’s program has defined the true value of attention across channels, platforms, and formats and revolutionized the way the advertising industry plans, measures, and buys media.

How the Lumen study was conducted

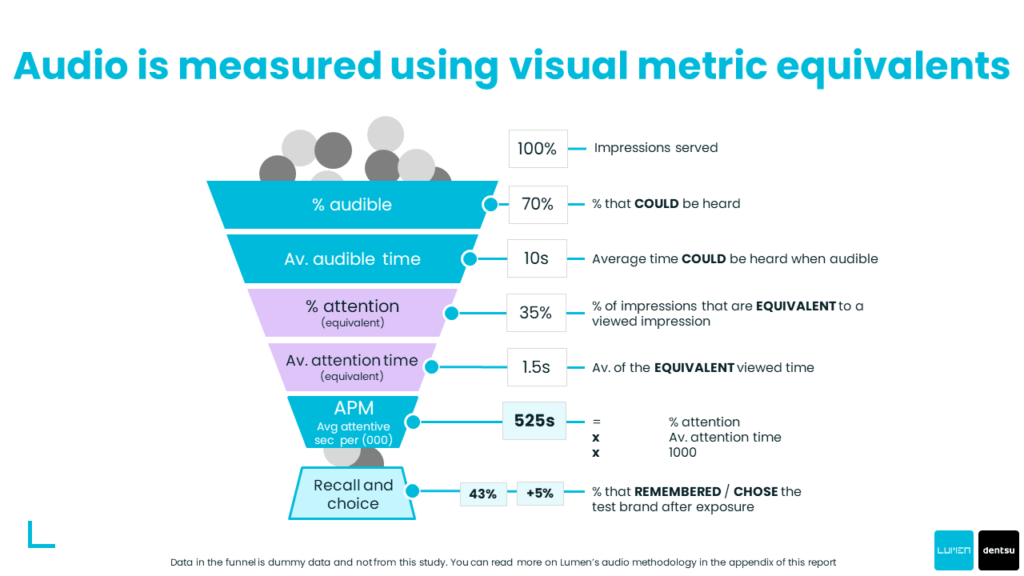

Expanding Dentsu’s Attention Economy research into audio advertising for the first time, the media agency network worked with research partner Lumen to devise a methodology to measure attention in audio that is equivalent with measurement across visual media destinations.

To conduct the study, 1,700 respondents were exposed to listening environments similar to their native audio experiences (e.g., selecting a podcast, AM/FM radio station or genre of music on a streaming service). Post-listening, they were administered Dentsu’s Attention Economy Survey to gauge ad recall and brand choice uplift compared to a similarly recruited control group. Lumen modeled an attention score which is equivalent to that based on visual attention using the factors collected (including passively collected audio listening data, survey results, and type of ad exposure).

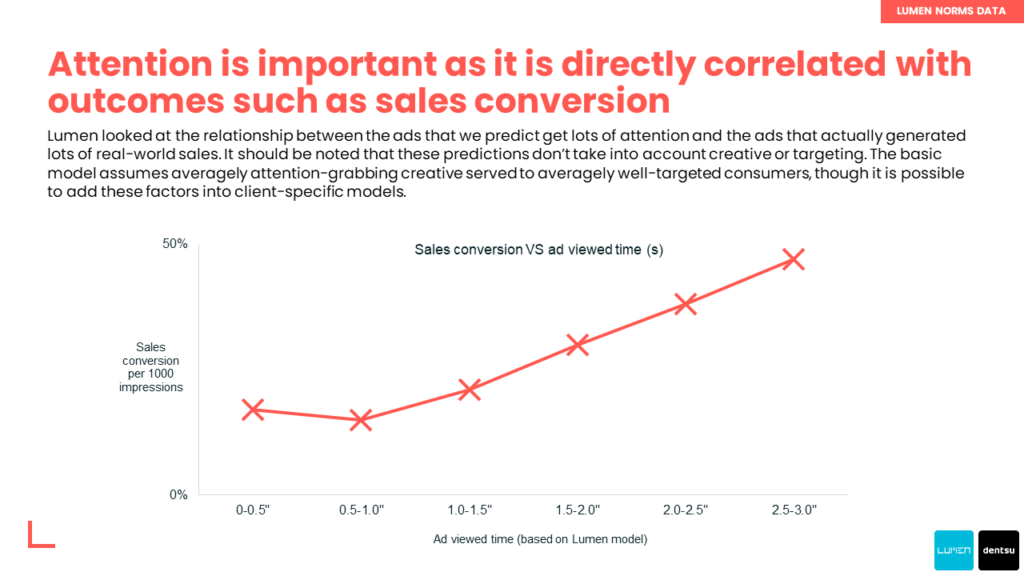

Attention is important: The greater the time duration that an ad is heard and seen, the greater the sales conversion

When consumers are “eyes on” to visual ads and “ears on” to audio ads, sales increase as time spent with the ad grows. As “eyes on” time with visual ads exceeds two seconds, sales soar.

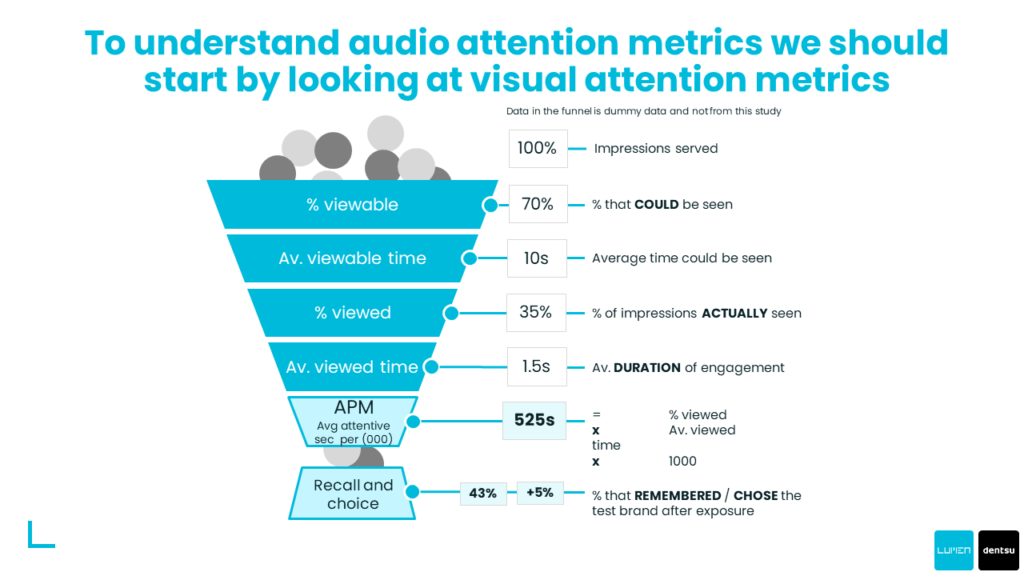

How Lumen measures the attentiveness of visual media

Lumen’s visual attention attentiveness uses eye tracking technology to measure the proportion of visual ads that are actually seen. Lumen reports an “attention cost per thousand” based on the impressions that are actually seen. Lumen then measures which ads are remembered and the degree to which the advertised brand is considered a good choice.

How Lumen measured audio attentiveness: Consumers were exposed to the actual experience of listening to a podcast and a radio station

For the AM/FM radio test, Lumen created an AM/FM radio station player for desktop and mobile in which respondents could listen to an AM/FM radio station programming format of their choice from a variety of seven different choices.

During each AM/FM radio station sample that lasted about an hour, there were three ad breaks each comprised of five advertisers. Participants were able to increase or decrease the volume until muted.

For the podcast study, Lumen created a podcast player for desktop and mobile in which respondents could listen to a podcast of their choice from a library of 20 representing a range of genres.

During each podcast there were three ad breaks with each break comprised of 3-4 advertisers. The ad breaks were served as pre-roll, mid-roll, and post-roll. The podcast player had controls to fast forward 15-seconds and to increase or decrease the volume until muted.

Lumen measured audio attentiveness using their visual metric equivalents including calculating the attention cost per thousand (aCPM) as well as measuring advertising recall and brand choice.

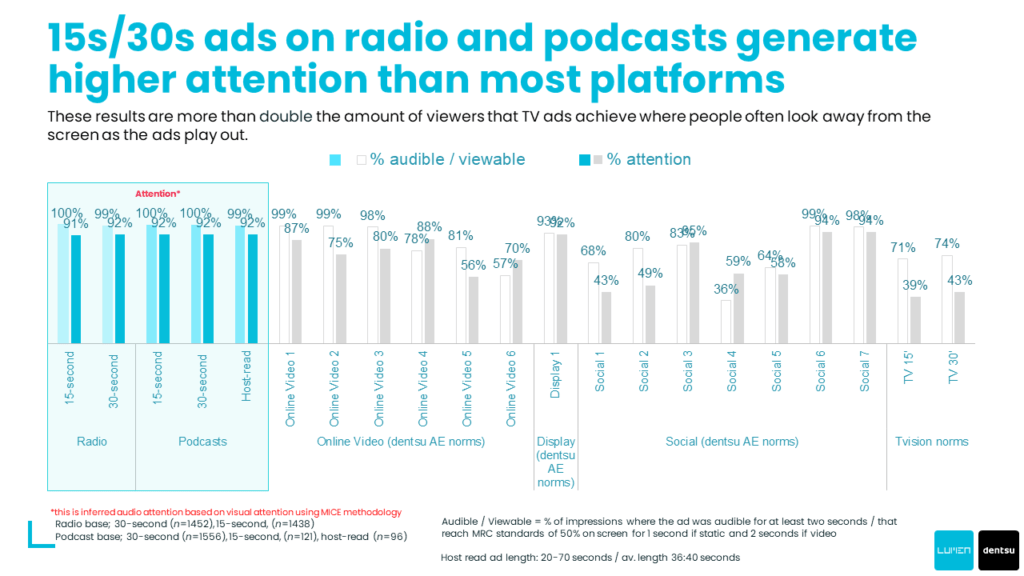

AM/FM radio and podcast ads have the highest attentiveness of all media formats, surpassing online display, online video, social, and TV

Erwin Ephron, the father of modern media planning, famously said, “You can look away but you cannot shut your ears.” Lumen calculates what percentage of an ad duration has the consumers’ attention (visual media are the grey bars below).

About 40% of TV ad durations have “eyes on” the screen. The proportion of social ad formats that have “eyes on” attention ranges from a low of 43% to a high of 94%. Online video “eyes on” attention ranges from a low of 56% to a high of 88%.

Podcast and AM/FM radio ads (blue bars below) experience “ears on” attentiveness of 92%, greater than most ad formats.

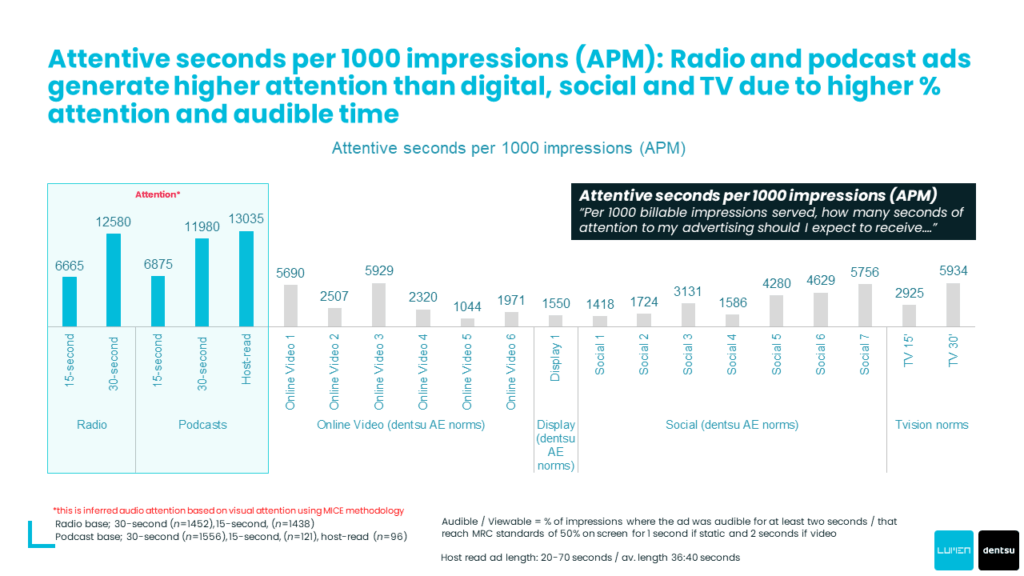

Attention seconds per 1000 impressions: Podcast and AM/FM radio ads generate the highest attentive seconds, greater than digital, social, and TV, due to a greater proportion of attention and audibility

Lumen then quantifies attentive seconds per one thousand impressions. This answers the question, “How many attentive seconds are generated for every 1000 impressions advertisers pay for?”

It is not enough to know how many impressions were generated. What moves the needle for advertisers is the amount of attentive seconds generated by their ads.

Stunningly, audio ads generate a massive amount of attentiveness seconds for every 1000 ad impressions. Podcast and AM/FM radio attentive seconds tower over online video, online display ads, social formats, and TV.

Audio ads have +56% greater attentiveness scores versus Dentsu norms and are +128% stronger than TV.

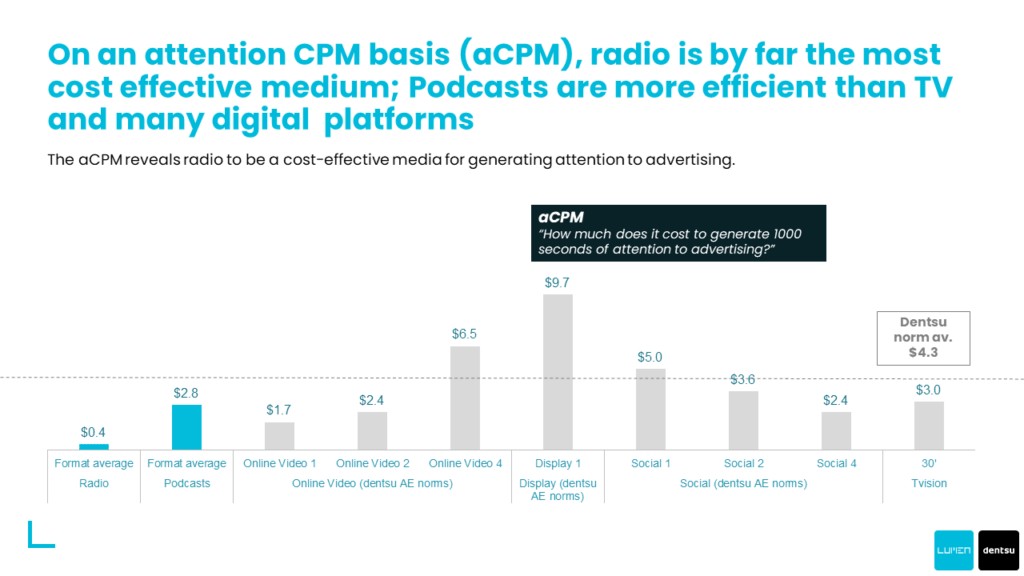

Attention cost per thousand: Podcasts are more efficient than TV and many digital platforms; AM/FM radio is by far the most cost effective medium

Lumen calculates an “attention cost per thousand” (aCPM) by dividing media costs into attentiveness seconds/impressions.

The most expensive attention CPM is online display at a $9.70 aCPM. The average Dentsu attention CPM across all media is $4.30.

At a $2.80 attention CPM, podcasts are more cost effective than the Dentsu aCPM media average of $4.30 and television’s $3.00.

For marketers who feel the podcast media CPM of $25 is pricey, this study will reset those perceptions

Podcasts, perceived to be “expensive,” are actually remarkably cost effective on an “attention CPM” basis. While the average media CPM of podcasts is about $25, Lumen reveals the podcast attention CPM is only $2.80, a bargain relative to other media.

AM/FM radio is extraordinarily cost effective

At an attention CPM of 40 cents, AM/FM radio is eight times more cost effective than TV and eleven times more cost efficient than Dentsu’s “attention cost per thousand” media benchmark.

Nielsen’s just released Q1 2023 Total Audience Report reveals AM/FM radio is America’s number one mass reach media. This massive reach, combined with Lumen’s strong business outcomes for brand recall and brand choice with a stunningly cost effective attention CPM, means AM/FM radio should be in every marketer’s media plan.

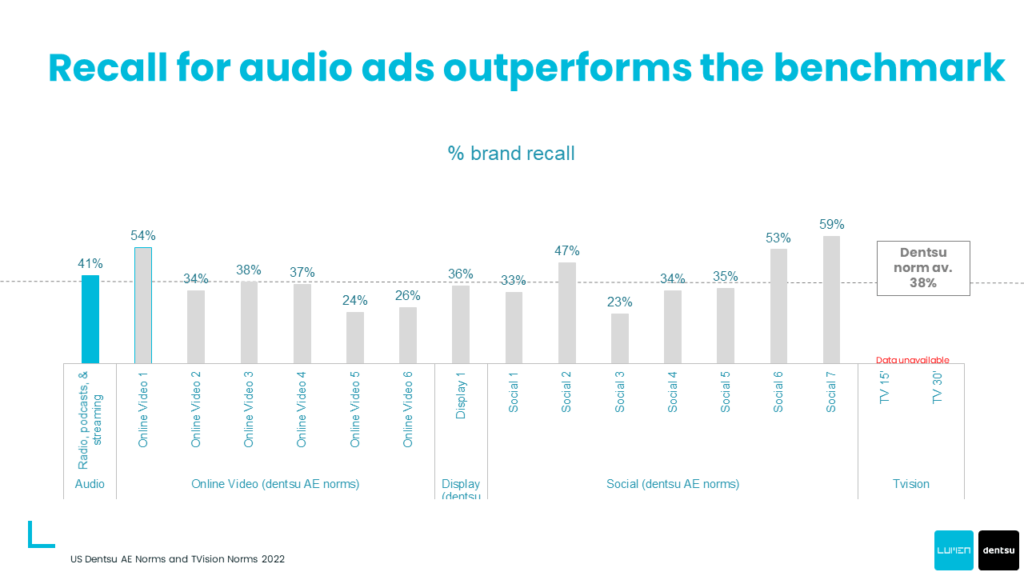

Audio generates +8% greater average brand recall versus Dentsu norms (38%)

Brand recall is expressed as the percentage of people who correctly identified the brand post exposure. Lumen presents respondents with a choice of ten brands from the same category, one of which is a test brand, and tells them to select which brands they remember. If they do not remember seeing a brand from that category, they can select ‘none of these.’

Lumen found that audio’s average brand recall (41%) was +8% greater than Dentsu norms (38%). Audio also beat display (36%) and the online video for brand recall.

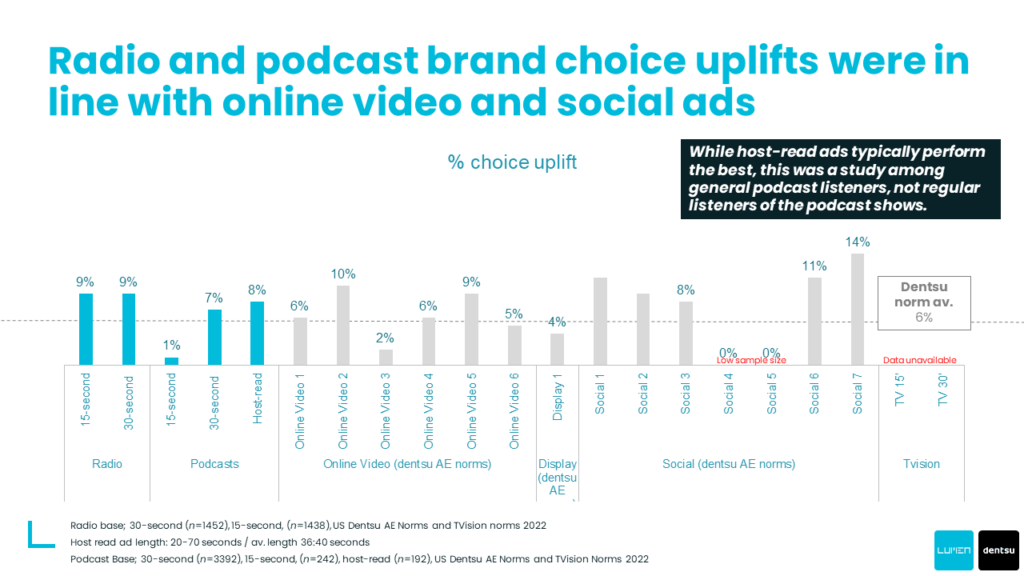

Brand choice: Podcast and AM/FM radio brand choice uplifts exceed Dentsu norms and are comparable with online video and social ads

Brand choice is expressed as a percentage point increase in the likelihood of choosing the brand as a result of ad exposure. Lumen presents respondents with a choice of five brands from the same category, one of which is a test brand, and told that if all things were equal, including price and convenience, which brand would they choose.

An unexposed control group is asked exactly the same question. The ‘choice uplift’ is the difference between the percentage who chose the brand after ad exposure and the expected level of choice based on the baselines from the control group.

Podcast and AM/FM radio brand choice uplifts exceed Dentsu norms and are comparable with online video and social ads.

Dentsu/Lumen Attentiveness Study key findings: Podcast and AM/FM radio ads outperform visual ads cost effectively

Key findings:

- Over the last five years, a series of studies from the IAB, MARU/Matchbox, Signal Hill Insights, and ABX reveal audio platforms and ad formats lead in consumer concentration with the lowest ad skipping

- Massive ABX creative effectiveness study of TV and AM/FM radio ads reveals “sight, sound, and motion” superiority is a myth: AM/FM radio creative effectiveness is 92% of TV at one-fourth of the CPM

- Attention is important: The greater the time duration that an ad is heard and seen, the greater the sales conversion

- AM/FM radio and podcast ads have the highest attentiveness of all media formats, surpassing online display, online video, social, and TV

- Attention cost per thousand: Podcasts are more efficient than TV and many digital platforms; AM/FM radio is by far the most cost effective medium

- AM/FM radio is extraordinarily cost effective

- Audio generates +8% greater average brand recall versus Dentsu norms (38%)

- Brand choice: Podcast and AM/FM radio brand choice uplifts exceed Dentsu norms and are comparable with online video and social ads

Three implications:

- The Dentsu/Lumen study puts a stake through the heart of the myth that “sight, sound and motion” ads are somehow superior to audio ads: The study proves that audio outperforms visual ads on the top jobs of advertising: creating memories, growing brand recall and increasing brand choice.

- Podcasts, perceived to be “expensive,” are actually remarkably cost effective on an “attention CPM” basis: Podcasts’ $25 media CPM becomes a mere $2.80 attention CPM, well below the Dentsu $4.30 average. Display media, perceived as cost effective, actually has a very expensive attention CPM ($9.70).

- AM/FM radio should be in every media plan: It outperforms visual media on the business outcomes of brand recall and brand choice while having a stunningly low attention CPM of 40 cents.

Click here to view a 19-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.