Audio Is The Missing Movie Marketing Ingredient: New Study Reveals Audio Listeners Are More Likely To See Summer Releases

Click here to view a 12-minute video of the key findings.

The summer movie season is off to a fast start with better-than-expected box office results for Disney’s Guardians of the Galaxy Vol. 3 in addition to a strong showing for Universal’s The Super Mario Bros. Movie.

According to Yahoo, “Dergarabedian called out upcoming films like Pixar’s “Elemental,” Disney’s “The Little Mermaid,” Universal’s “Oppenheimer,” and Warner Bros. “Barbie” as just some of the many films that will drive box office dollars.” Dergarabedian continued, “This is just a bevy of riches on the way at the multiplex,” he said.

Dergarabedian notes 2023 will have 30 more wide-release films slated for release this year compared to 2022.

New study: Heavy audio listeners are more aware of upcoming summer 2023 blockbusters compared to heavy social media and TV viewers

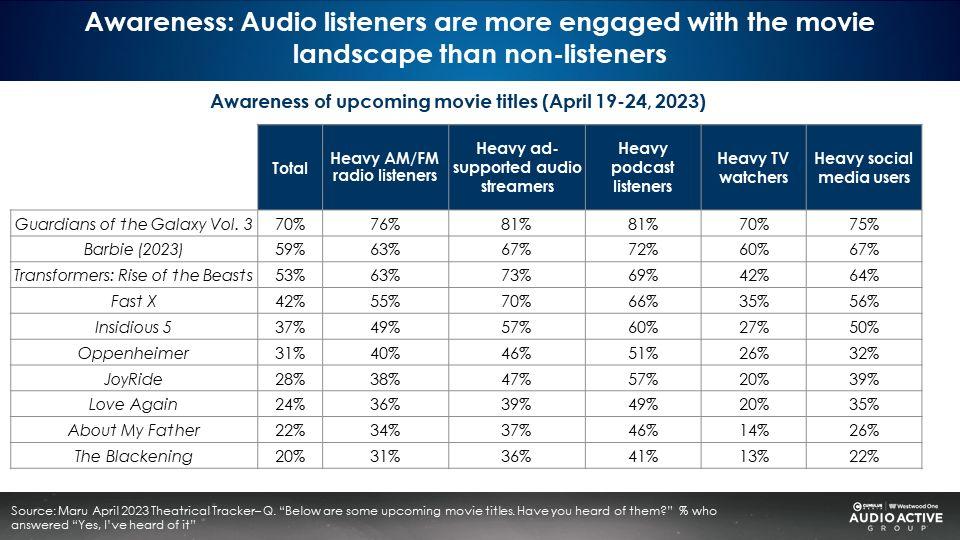

A just completed theatrical film awareness and interest tracking study conducted April 19-24, 2023 among 1,020 respondents by Maru reveals heavy audio listeners have the greatest familiarity with upcoming summer movie releases. Maru tested ten major films for awareness and desire to see.

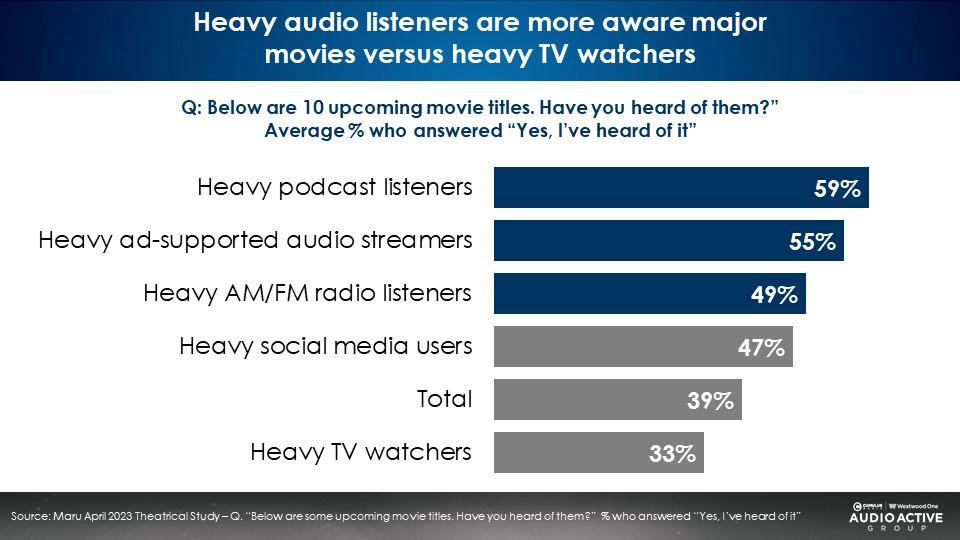

The ten films have an average awareness of 39% among all Americans.

Only 33% of heavy TV viewers are aware of the ten upcoming summer film releases. Among heavy social media users, the films have an average awareness of 47%.

Awareness of the ten films is greatest among heavy podcast listeners (59%), followed by heavy ad-supported audio streamers (55%) and heavy AM/FM radio listeners (49%).

While TV receives the largest share of movie marketing budgets, title awareness is lowest among TV viewers

The upcoming release of Fast X, the tenth installment of the Fast and Furious franchise, has very high familiarity among audio streamers (70%) followed by podcast listeners (66%), social media users (56%), and AM/FM radio listeners (55%). Very few TV viewers (35%) are aware of the upcoming Fast X release.

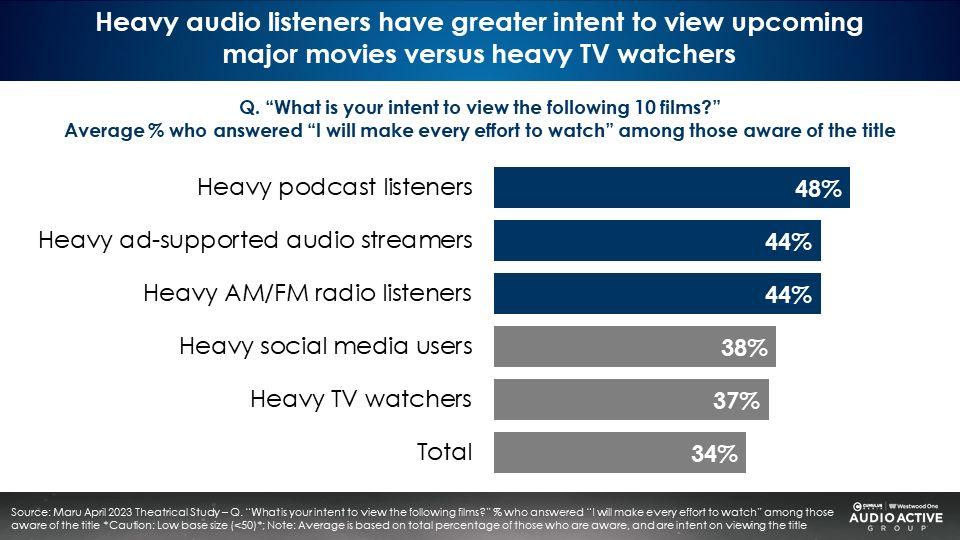

Audio listeners have the greatest likelihood to watch summer 2023 blockbusters compared to social media users and TV viewers

Of the ten upcoming summer releases, 48% of podcast listeners say they will “make every effort to watch” the average title. 44% of audio streamers and AM/FM radio listeners intend to see the ten films. Fewer social media users (38%) and TV viewers (37%) indicate viewing intention of the ten films.

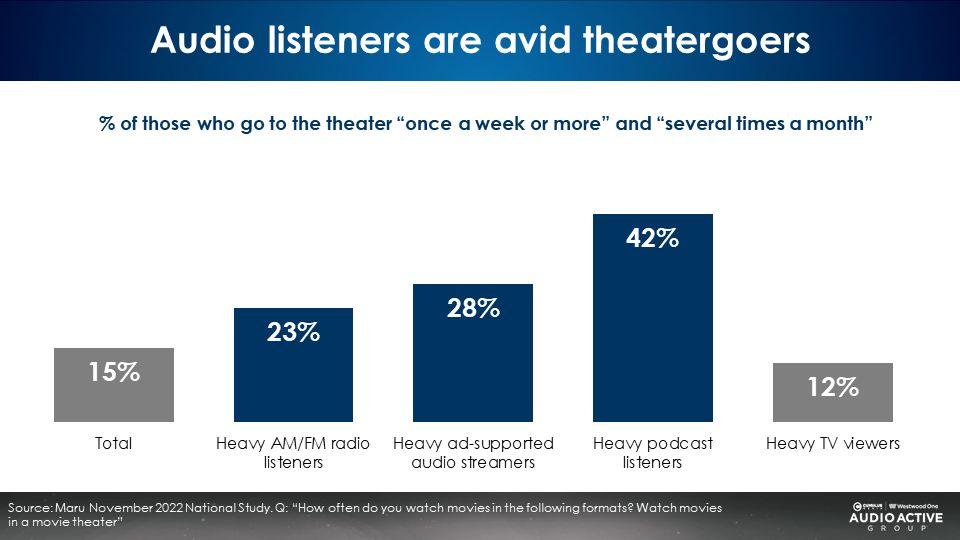

All audio platforms over-index on frequent moviegoing

The first wave of the Maru theatrical study was conducted November 4-14, 2022 among 1,020 respondents. According to the November data, while 15% of the U.S. go to the movie theater weekly/monthly, a much larger proportion of audio listeners are in the heavy moviegoer segment. Interestingly, TV viewers under-index on frequent moviegoing.

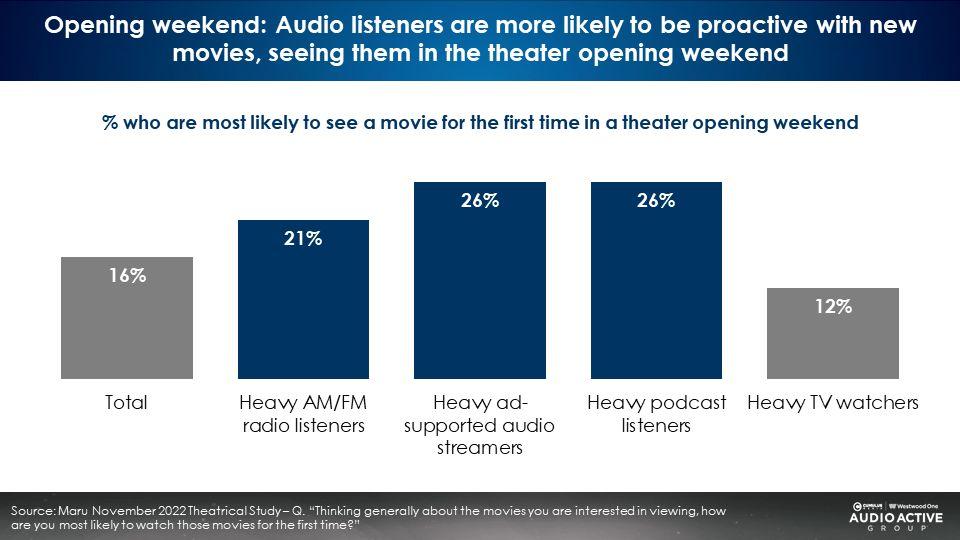

Opening weekend: Ad-supported audio listeners are more likely to see films in the first weekend

TV viewers are less likely to be opening weekend moviegoers.

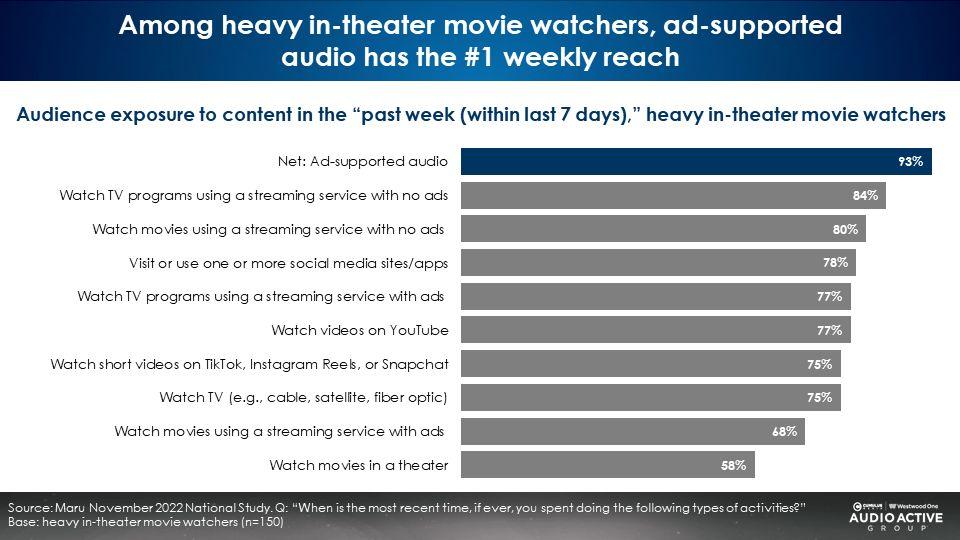

Audio is the dominant ad-supported platform among moviegoers

Maru examined the weekly media habits of heavy moviegoers, the 15% of the U.S. who goes to the movies once a week or more or a few times a month. Ad-supported audio (AM/FM radio, podcasts, and streaming) has the largest weekly reach (93%) among heavy moviegoers. Ad-supported audio reaches heavy moviegoers not reached on other media platforms.

The next two largest media platforms among heavy moviegoers are both subscription streaming, which do not accept ads. 78% of heavy moviegoers are reached by social media. 75% to 77% of heavy moviegoers are reached by video platforms such as linear TV, YouTube, TikTok, and ad-supported video streaming.

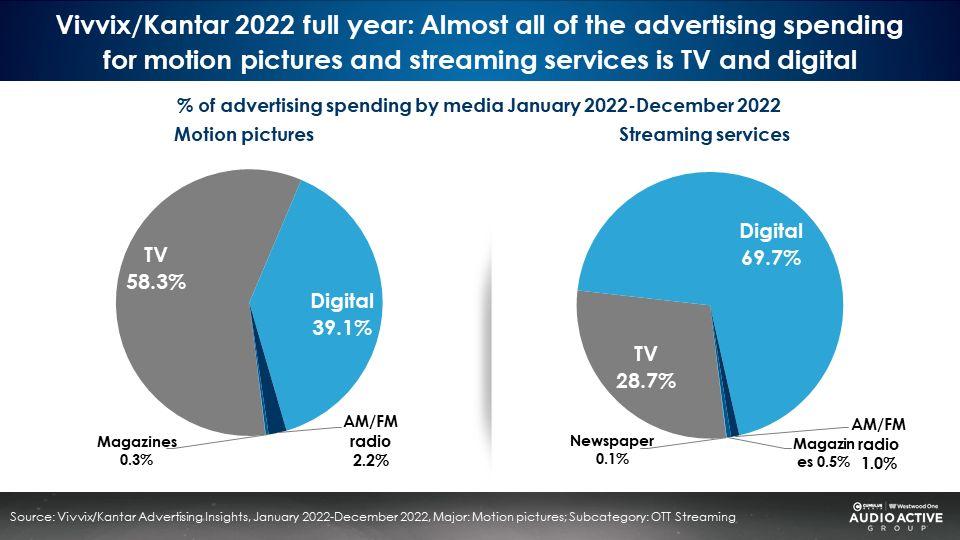

Vivvix/Kantar: The vast majority of movie ad spend occurs via TV and digital; Only a tiny amount is spent on audio

58% of theatrical release ad budgets are devoted to TV, 39% to digital, and only 2% to AM/FM radio. Video streaming services spend 70% of their ad budgets on digital and 29% on TV. Only 1% of video streaming service marketing occurs via AM/FM radio.

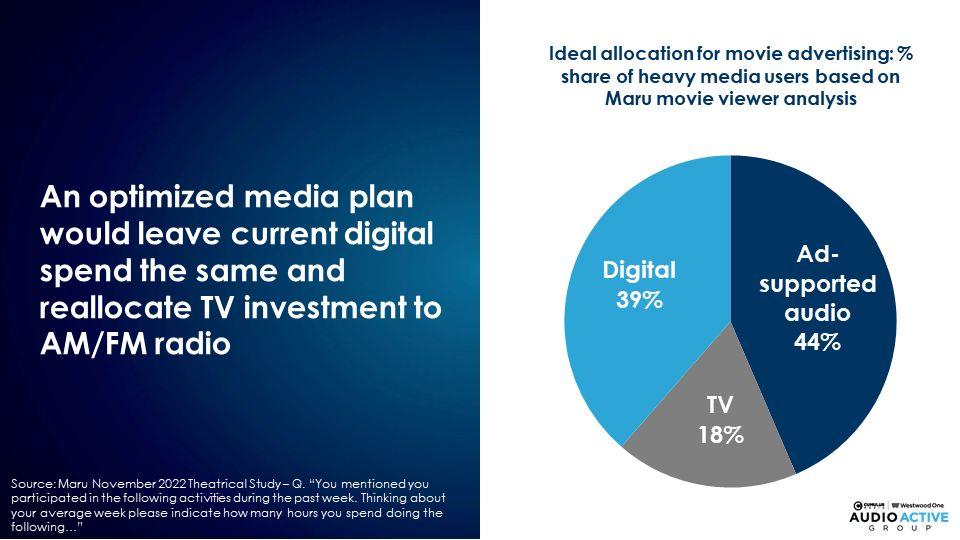

Maru: Ad-supported audio should represent 44% of movie marketing investments

Maru determined an optimized media allocation based on the actual proportion of media audiences who go to the movies. This ideal media allocation maintains digital’s share of spend at 39%, with 44% allocated to audio and 18% to linear television.

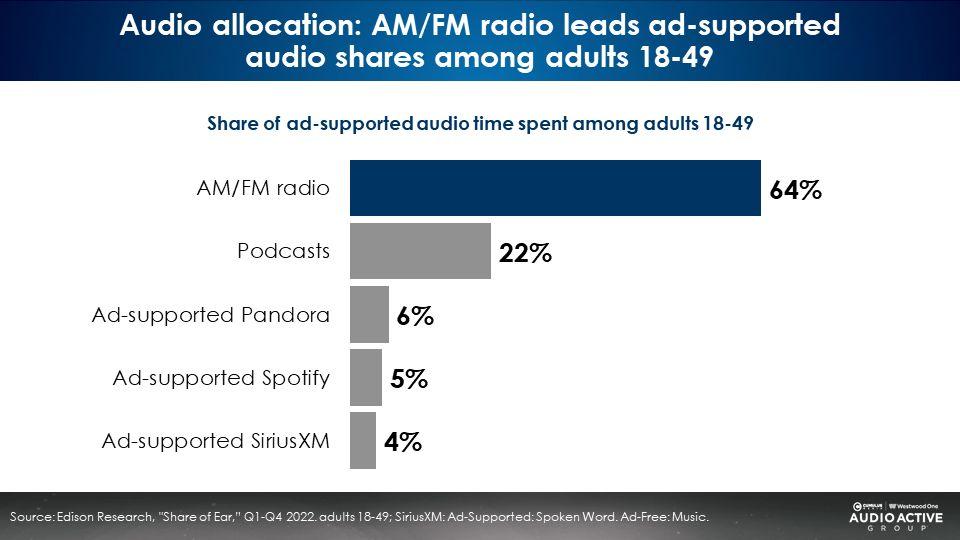

The optimized audio movie marketing plan allocation consists of 64% AM/FM radio, 22% podcasts, 11% Spotify/Pandora, and 4% SiriusXM

The gold standard audio planning tool offered by Nielsen is Edison Research’s “Share of Ear,” the most utilized and respected audio time use study. Among 18-49s, AM/FM radio has a 64% share of ad-supported audio time spent, followed by podcasts (22%), Spotify/Pandora (11%), and SiriusXM (4%).

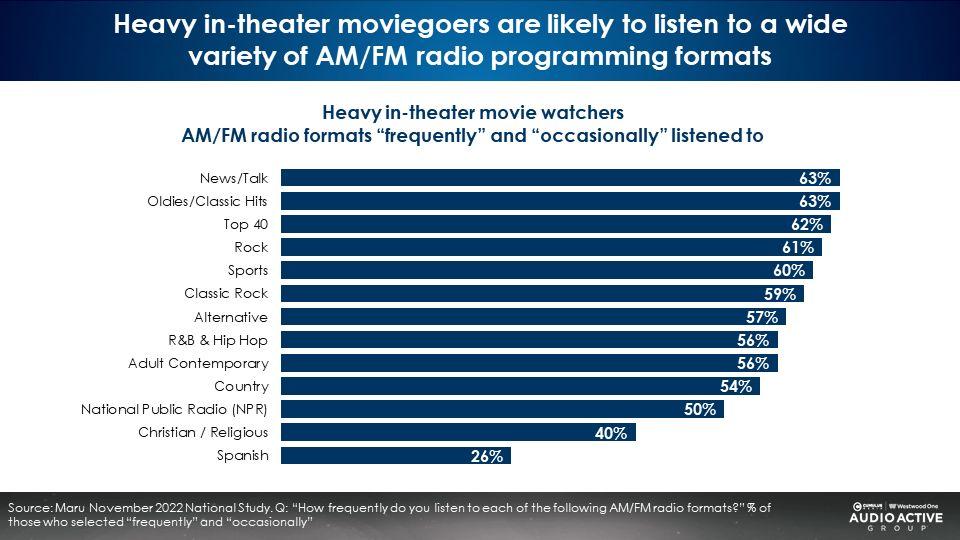

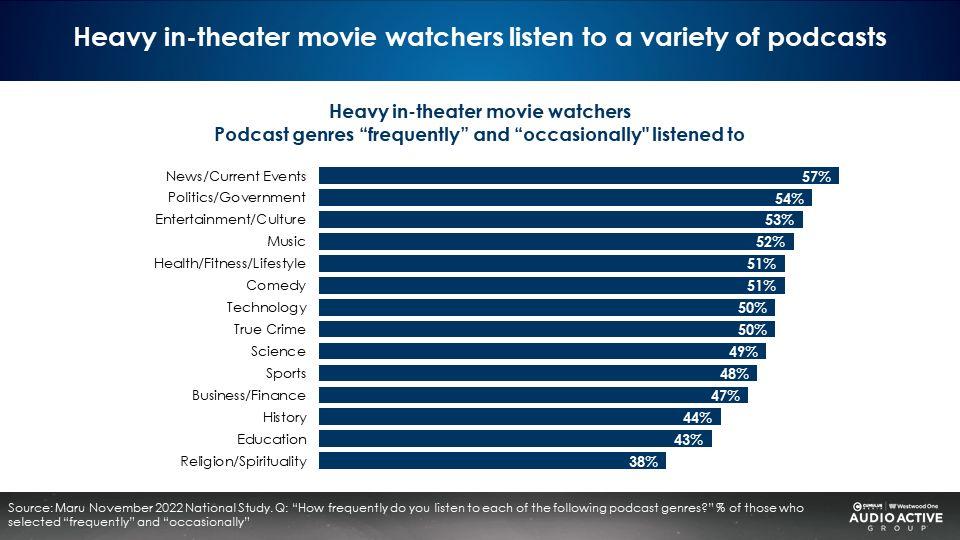

Heavy moviegoers listen to a wide variety of AM/FM radio programming formats and podcast genres

Since reach is the foundation of media effectiveness, the ideal audio movie buy spans a wide variety of programming genres and content. Erwin Ephron, the father of modern media planning advises, “Remind the many – don’t lecture the few.”

There is a diverse and broad array of AM/FM radio programming formats listened to among heavy moviegoers. Similarly, there is a long list of podcast genres with strong reach among heavy moviegoers.

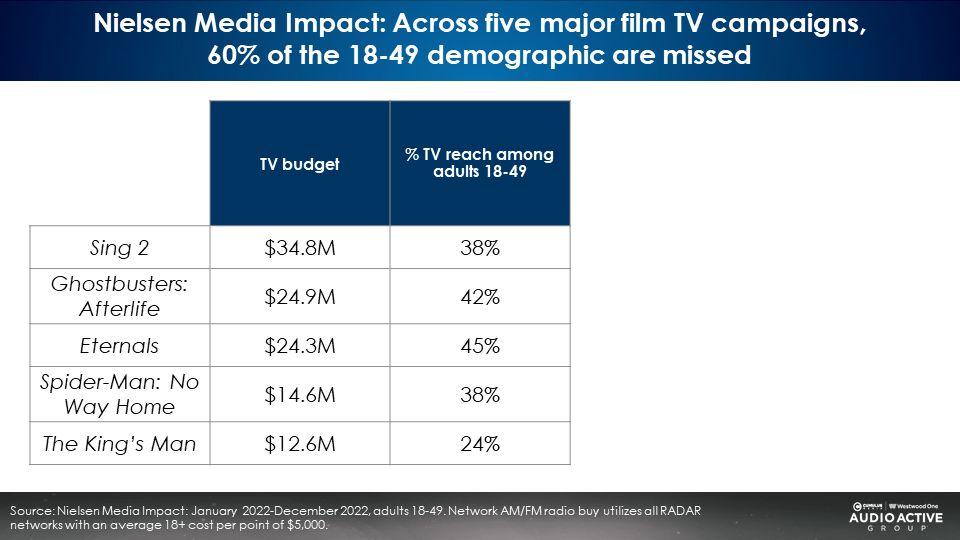

60% of American 18-49s will never see a movie ad on broadcast/cable TV due to the collapse of U.S. linear television viewing

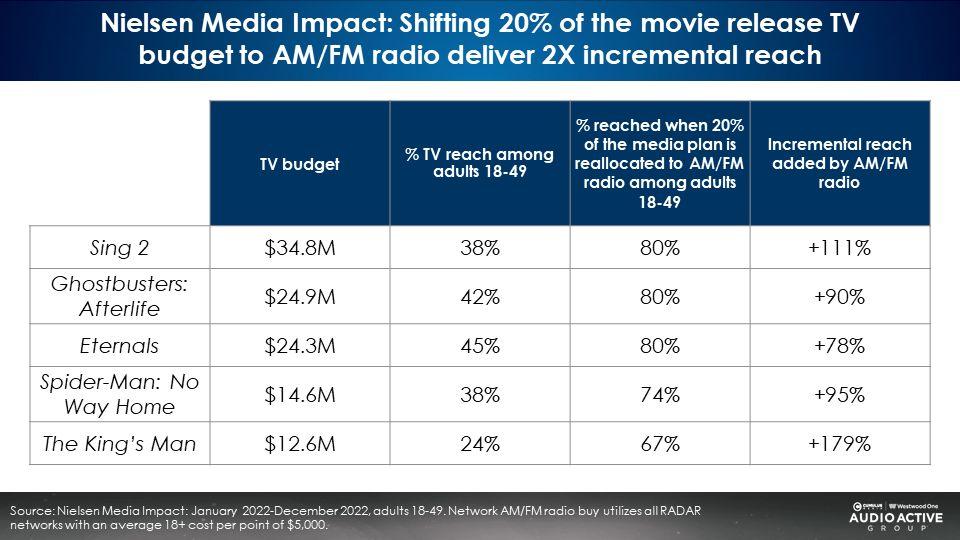

A Nielsen analysis of five major film TV campaigns reveals 60% of the 18-49 demographic are missed. The $24.3 million-dollar TV campaign for Marvel’s Eternals reached only 45% of the 18-49 demographic. The $34.8 million-dollar TV campaign for Sing 2 missed 62% of U.S. 18-49s.

AM/FM radio to the rescue: Reallocating 20% of the linear TV investment to AM/FM radio cause campaign reach to double, according to Nielsen Media Impact

According to Nielsen’s Q3 2022 Total Audience Report, AM/FM beats TV in weekly reach by a sizable margin (83% to 59%). In addition, Nielsen reports AM/FM radio beats TV in 18-49 average audience. AM/FM radio’s audience advantage means shifting 20% of the TV investment to AM/FM radio generates a massive increase in reach.

The Sing 2 campaign would see the reach soar from 38% of 18-49s to 80%, a 2X increase. Shifting 20% of the Eternals linear TV campaign to AM/FM radio would cause campaign reach to surge from 45% to 80%, an astonishing +78% lift in incremental reach.

Key findings:

- Heavy audio listeners are more aware of upcoming summer 2023 film release titles and have a higher likelihood to watch these movies compared to social media users and TV viewers.

- While audio listeners are big moviegoers, there is a missed opportunity in advertising movies on these platforms. Shifting 20% of linear TV film marketing budgets to AM/FM radio causes campaign reach to double.

- Audio is the dominant ad-supported reach platform among moviegoers.

- While the vast majority of theatrical ad budgets are devoted to linear TV, TV viewers show very low interest in going to the movies and exceptionally low awareness of upcoming movie titles.

Recommendations:

- Audio should represent 44% of film marketing budgets based on the Maru analysis of media habits among movie viewers. A Vivvix/Kantar analysis of current spend reveals audio is underutilized.

- The addition of AM/FM radio generates significant incremental reach lift to the campaign. Shifting 20% of linear TV spend to AM/FM radio generates a 2X increase in campaign reach.

- The ideal audio allocation for movie media plans is 64% AM/FM radio, 22% podcasts, 11% Spotify/Pandora, and 4% SiriusXM, based on Edison’s “Share of Ear” study of 18-49 ad-supported audio shares.

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.