New Study: How Ad-Supported Audio Can Power Movie Marketing

Click here to view a 17-minute video of the key findings.

Analysts predict a strong summer for the movie industry with twice as many films with $100M+ budgets set to release. Creating awareness and interest for movie releases is getting more challenging.

Not as many people are aware of upcoming movie releases

Market research firms that track film title familiarity and interest report awareness of new titles is below historical norms. While movie marketing has diversified its media mix, it’s harder to create familiarity of theatrical releases.

To understand the moviegoing patterns and media habits of theatergoers, the Cumulus Media | Westwood One Audio Active Group® commissioned Maru to field a national study of 1,010 consumers aged 18+ in November of 2022. Here are the key findings:

Audio is the dominant ad-supported platform among moviegoers

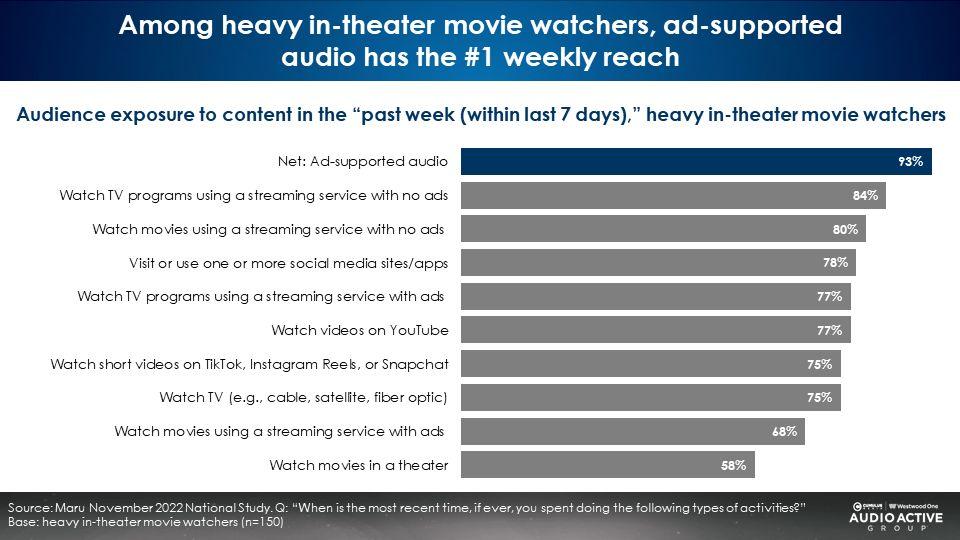

Maru examined the weekly media habits of heavy moviegoers, the 15% of the U.S. who goes to the movies once a week or more or a few times a month. Ad-supported audio (AM/FM radio, podcasts, and streaming) has the largest weekly reach (93%) among heavy moviegoers. Ad-supported audio reaches heavy moviegoers not reached on other media platforms.

The next two largest media platforms, both subscription streaming, do not accept ads. 78% of heavy moviegoers are reached by social media. 75% to 77% of heavy moviegoers are reached by video platforms such as linear TV, YouTube, TikTok, and ad-supported video streaming.

All audio platforms over-index on frequent moviegoing

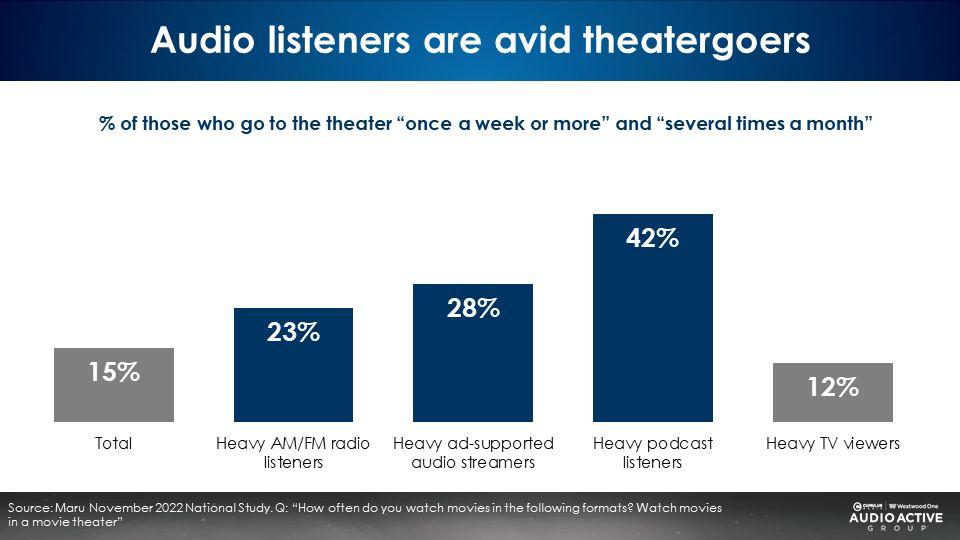

While 15% of the U.S. go to the movie theater weekly/monthly, a much larger proportion of audio listeners are in the heavy moviegoer segment. Interestingly, TV viewers under-index on frequent moviegoing.

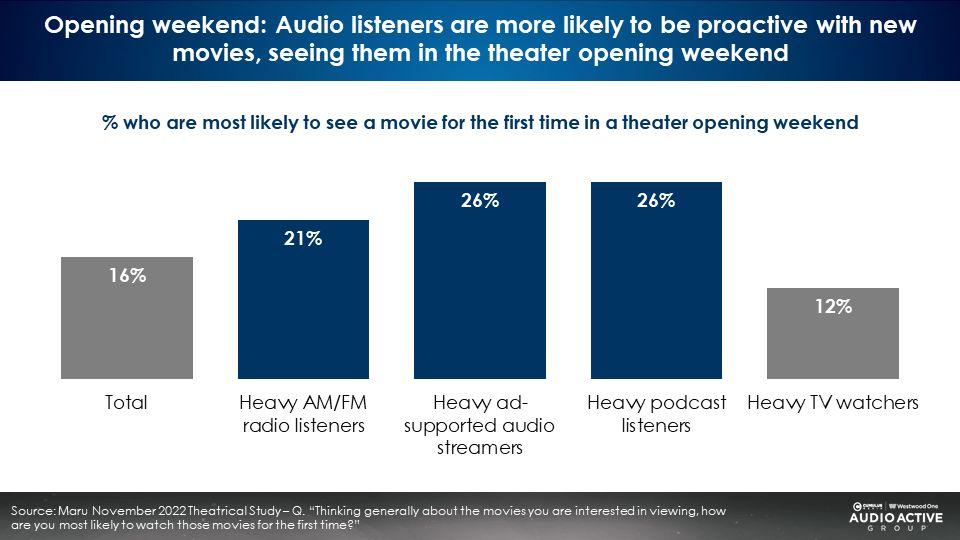

Opening weekend: Ad-supported audio listeners are more likely to see films in the first weekend

TV viewers are less likely to be opening weekend moviegoers.

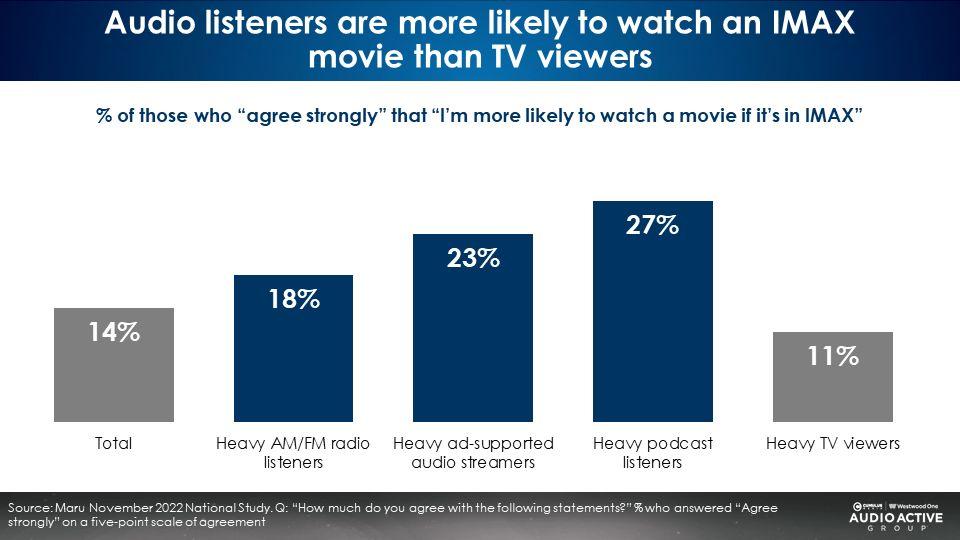

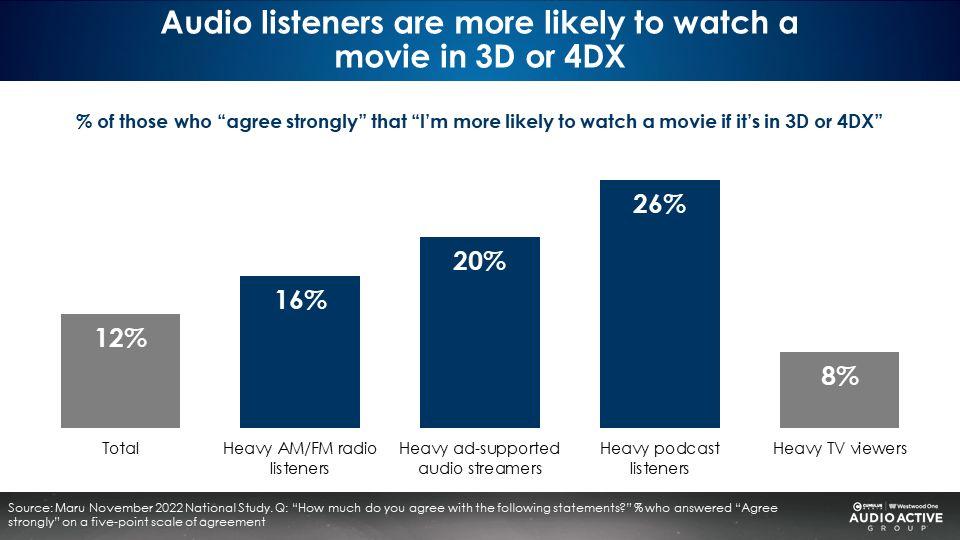

IMAX, 3D, and 4DX formats: Audio listeners are more likely to see films in high-profit, advanced formats

TV viewers are much less likely to see films in advanced formats.

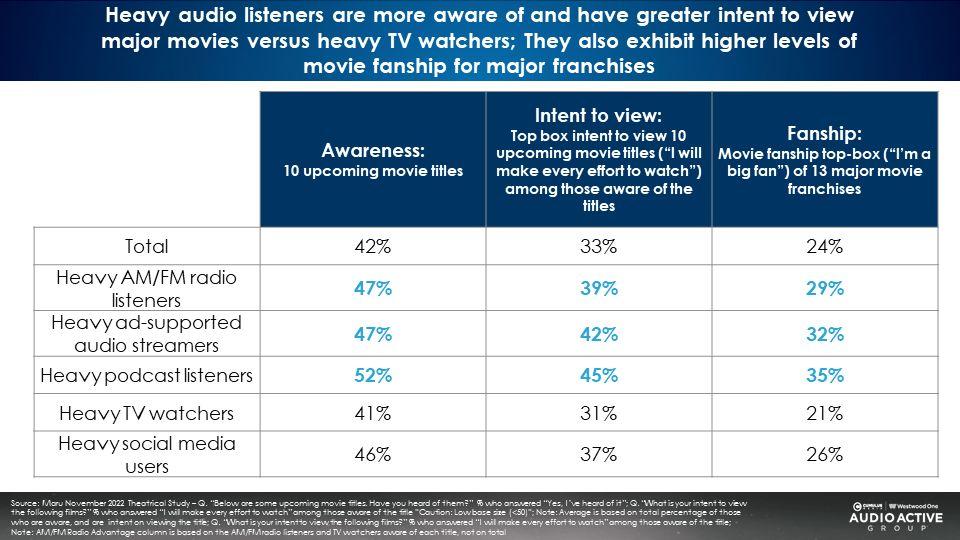

Heavy audio listeners are more aware of and have greater intent to view major movies versus heavy TV watchers; Heavy audio listeners also exhibit higher levels of movie fanship for major franchises

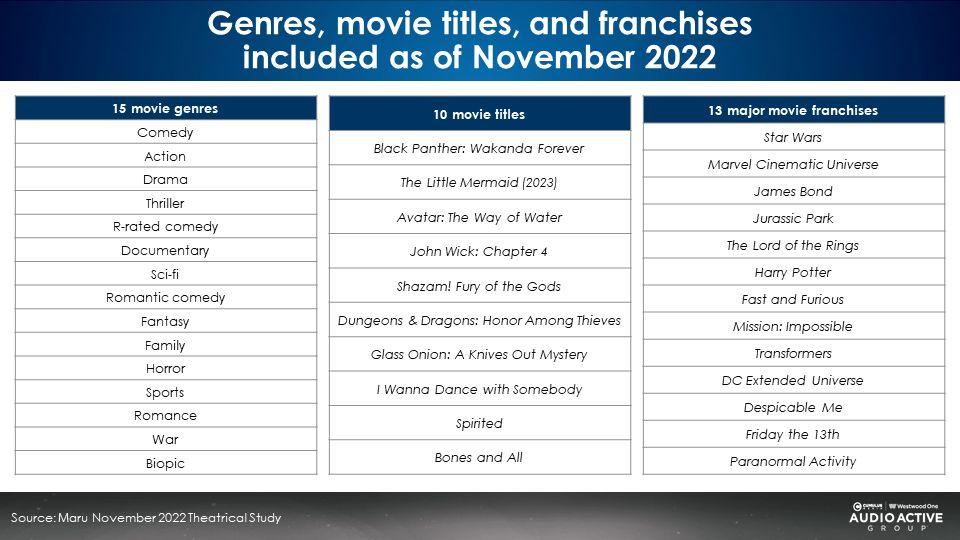

Maru tested the appeal and interest in fifteen movie genres, ten upcoming movie titles, and thirteen major movie franchises.

Given the vast quantities of film marketing lavished on linear TV, one would expect very high levels of movie title awareness and strong intent to view movies in the theater. Oddly, average awareness for ten major upcoming movie releases among heavy TV viewers (41%) is at the U.S. average (42%). Equally odd, average intent to view among heavy TV viewers (31%) is lower than the U.S. average (33%).

How is it that linear TV viewers who are exposed to massive amounts of movie advertising have just average awareness of upcoming movies and low desire to see films at the theater?

Heavy TV viewers show much less interest than the average in thirteen major movie franchises. These thirteen major film franchises represent a majority of theatrical revenues and a significant amount of linear TV ad spending. Only 21% of heavy TV viewers say they are “big fans” of major movie franchises compared to 24% for average Americans.

In contrast, audio listeners show greater passion and engagement for movies versus the U.S. average and TV and social audiences. The degree of title awareness, intention to view, and fanship for movie franchises are far stronger among audio audiences.

While audio listeners are big moviegoers, there is a missed opportunity in advertising movies on audio platforms

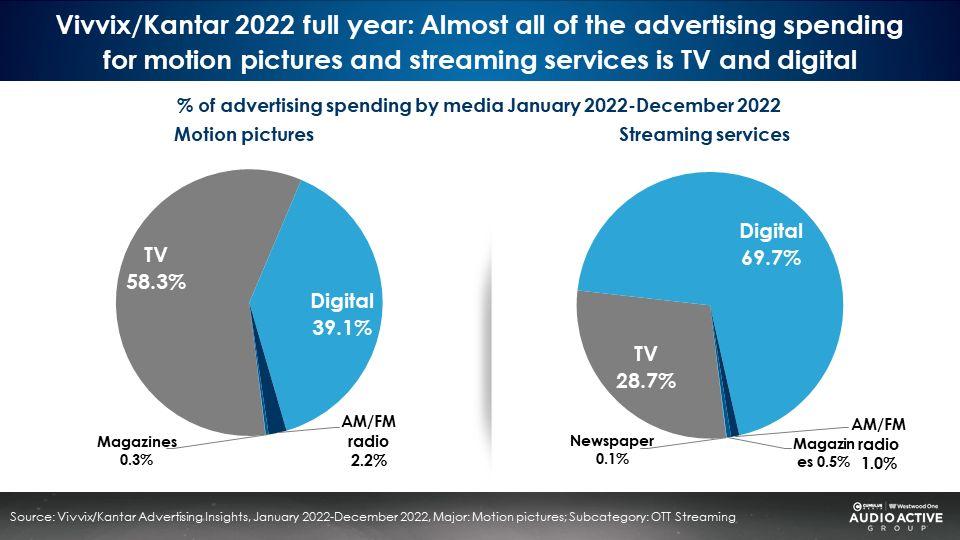

A Vivvix/Kantar analysis of theatrical film and streaming movie marketing expenditures reveals the media plans are devoted entirely to linear television and digital platforms.

Theatrical release marketing consists of a 60/40 split for TV and digital. Streaming movie marketing consists of a 70/30 split of digital and TV. Audio represents less than 1% of movie marketing budgets.

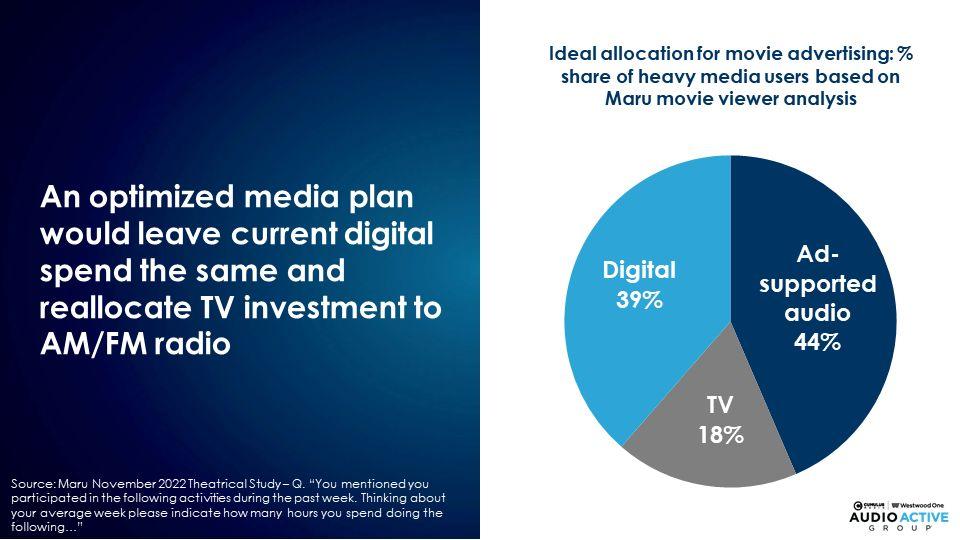

Maru: Ad-supported audio should represent 44% of movie marketing investments

Maru determined an optimized media allocation based on the actual proportion of media audiences who go to the movies. This ideal media allocation maintains digital’s share of spend at 39%, with 44% allocated to audio and 18% to linear television.

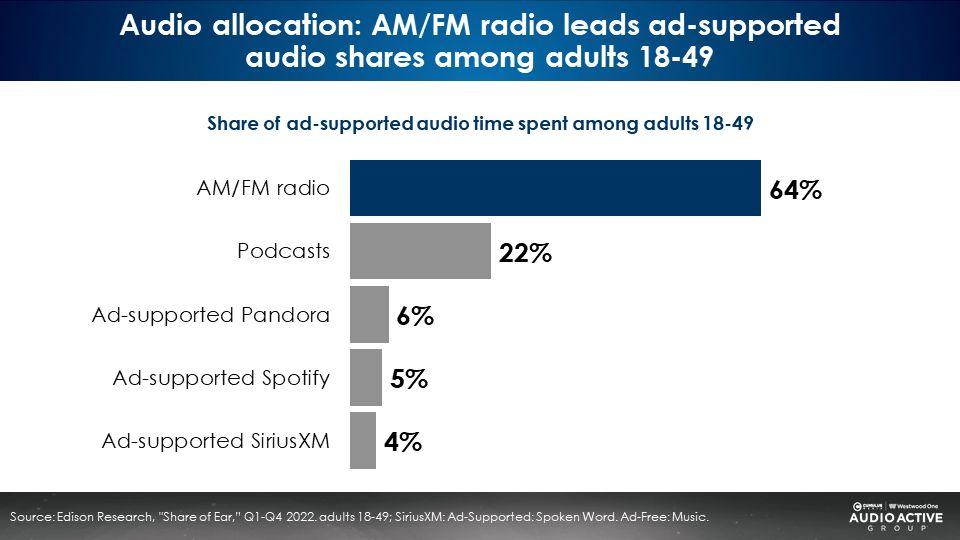

The optimized audio movie marketing plan allocation consists of 64% AM/FM radio, 22% podcasts, 11% Spotify/Pandora, and 4% SiriusXM

The gold standard audio planning tool offered by Nielsen is Edison Research’s “Share of Ear,” the most utilized and respected audio time use study. Among 18-49s, AM/FM radio has a 64% share of ad-supported audio time spent, followed by podcasts (22%), Spotify/Pandora (11%), and SiriusXM (4%).

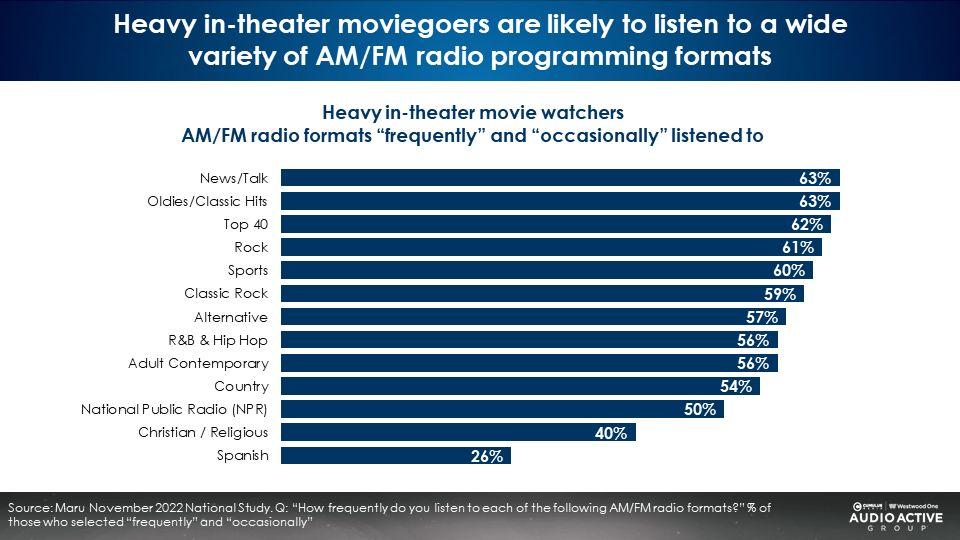

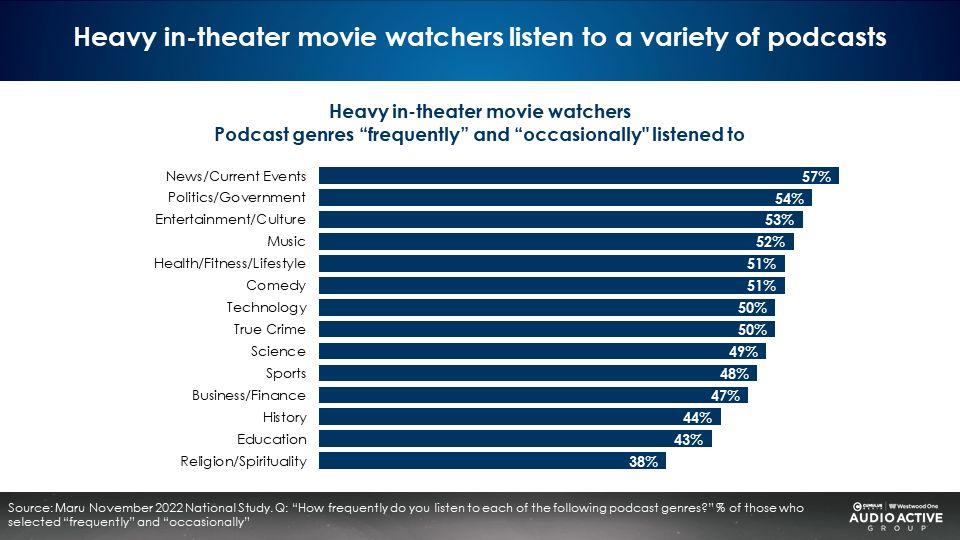

Heavy moviegoers listen to a wide variety of AM/FM radio programming formats and podcast genres

Since reach is the foundation of media effectiveness, the ideal audio movie buy spans a wide variety of programming genres and content. Erwin Ephron, the father of modern media planning advises, “Remind the many – don’t lecture the few.”

There is a diverse and broad array of AM/FM radio programming formats listened to among heavy moviegoers. Similarly, there is a long list of podcast genres with strong reach among heavy moviegoers.

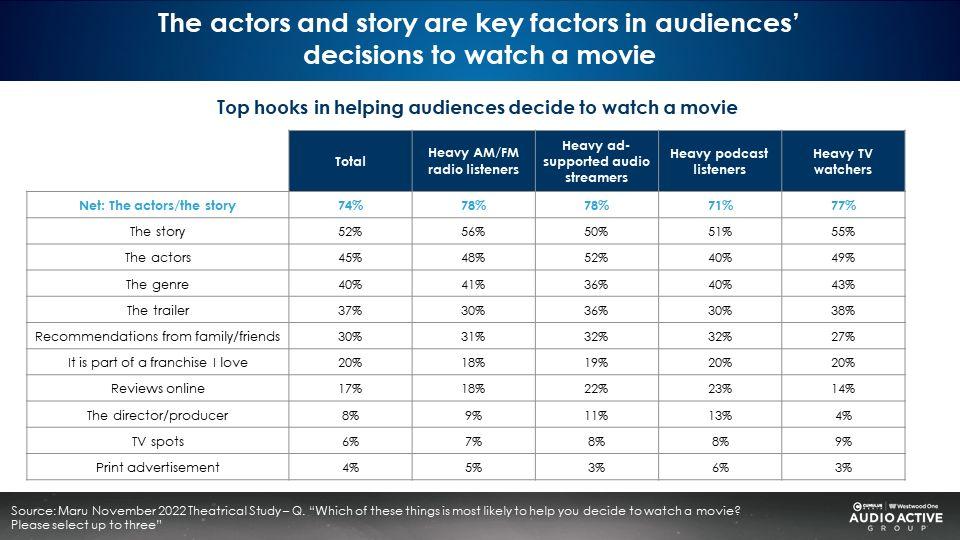

Audio creative best practice: Actors and story are key factors in audience decisions to watch a movie

Maru probed consumers on the top hooks in helping audiences decide to attend a movie. While TV ads tend to create a mood and show thrilling action scenes, Maru found audio audiences prefer to understand the plot, story, and actors.

Given this finding, it is not recommended to use the audio track from a TV ad for the audio creative. Most likely, the TV audio track is too noisy, confusing, and lacking the information (story/actors) that audio listeners seek about a title.

Over half of the U.S. will never see a movie ad on linear TV due to the collapse of U.S. linear television viewing

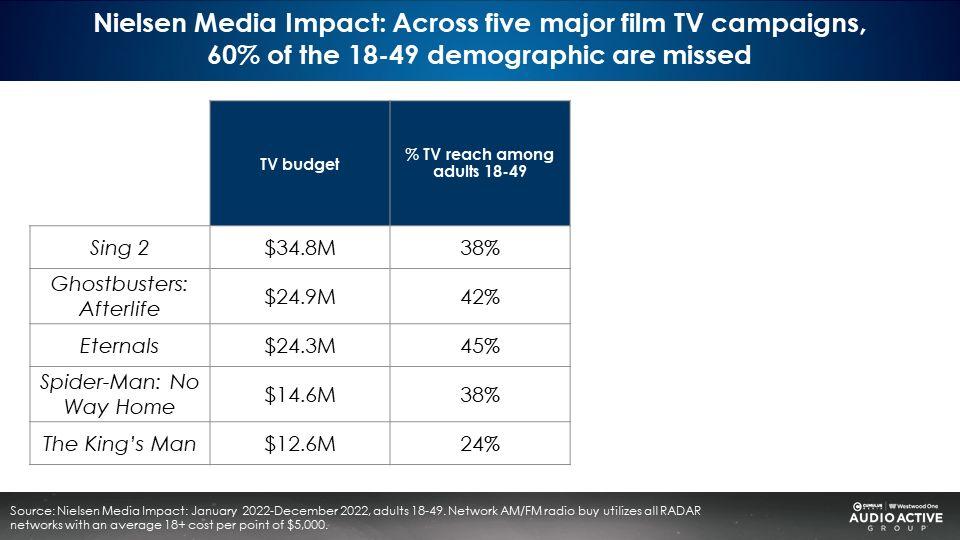

Just last week, Ad Age reported that linear weekly television reach has sunk to only 59% of U.S. 18-49s. It’s not surprising that linear TV campaigns for films only reach 40% of the 18-49 moviegoing demographic.

A Nielsen analysis of five major film TV campaigns reveals 60% of the 18-49 demographic are missed. The $24.3 million-dollar TV campaign for Marvel’s Eternals reached only 45% of the 18-49 demographic. The $34.8 million-dollar TV campaign for Sing 2 missed 62% of U.S. 18-49s.

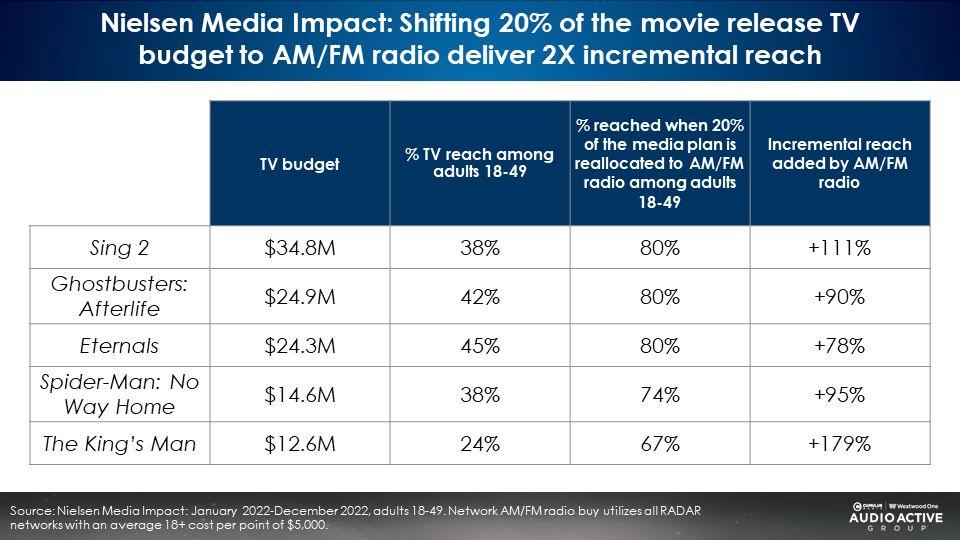

AM/FM radio to the rescue: Reallocating 20% of the linear TV investment to AM/FM radio cause campaign reach to double, according to Nielsen Media Impact

According to Nielsen Media Impact, the media planning and optimization platform, reallocating a mere 20% of the linear TV budget to AM/FM radio generates astonishing lifts in incremental reach.

The Sing 2 campaign would see the reach soar from 38% of 18-49s to 80%, a 2X increase. Shifting 20% of the Eternals linear TV campaign to AM/FM radio would cause campaign reach to surge from 45% to 80%, an astonishing +78% lift in incremental reach.

Key findings:

- Audio is the dominant ad-supported reach platform among moviegoers.

- Heavy audio listeners are more likely to watch movies in the theater, especially opening weekend, using profitable formats such as IMAX, 3D, and 4DX.

- Heavy audio listeners are more aware of upcoming film release titles, have a higher likelihood to watch these movies, and exhibit strong fanship for major movie franchises.

- While audio listeners are big moviegoers, there is a missed opportunity in advertising movies on these platforms. Shifting 20% of linear TV film marketing budgets to AM/FM radio causes campaign reach to double.

- A movie’s story and actors primarily pull audio listeners into watching a film, more so than the mood driven/action scene approach of traditional TV ads.

Recommendations:

- Audio should represent 44% of film marketing budgets based on the Maru analysis of media habits among movie viewers. A Vivvix/Kantar analysis of current spend reveals audio is underutilized. The addition of AM/FM radio generates significant incremental reach lift to the campaign. Shifting 20% of linear TV spend to AM/FM radio generates a 2X increase in campaign reach.

- The ideal audio allocation for movie media plans is 64% AM/FM radio, 22% podcasts, 11% Spotify/Pandora, and 4% Sirius/XM, based on Edison’s “Share of Ear” study of 18-49 ad-supported audio shares.

- Audio ads should be unique marketing assets that should not simply use the audio track of the TV ad. Repurposing the audio from TV ads will not be as successful as developing distinctive audio creative executions.

- While video ads focus on creating atmosphere and mood, audio ads should focus on laying out the movie narrative and highlighting the actors. Capitalize on cast appeal and experiment with voiceovers from A-list actors to speak directly to listeners.

Click here to view a 17-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.