AM/FM Radio Is The Reach Accelerator For Video And Digital: Amplify Your Media Plan With Network Radio

Click here to view an 11-minute video of the key findings.

Each quarter, MoffettNathanson, the leading Wall Street media analyst firm, issues their “Cord-Cutting Monitor.” The detailed report studies the free fall of pay TV.

The Q3 2022 analysis was bluntly titled, “Can Linear Be Saved?” The news for pay TV was not good:

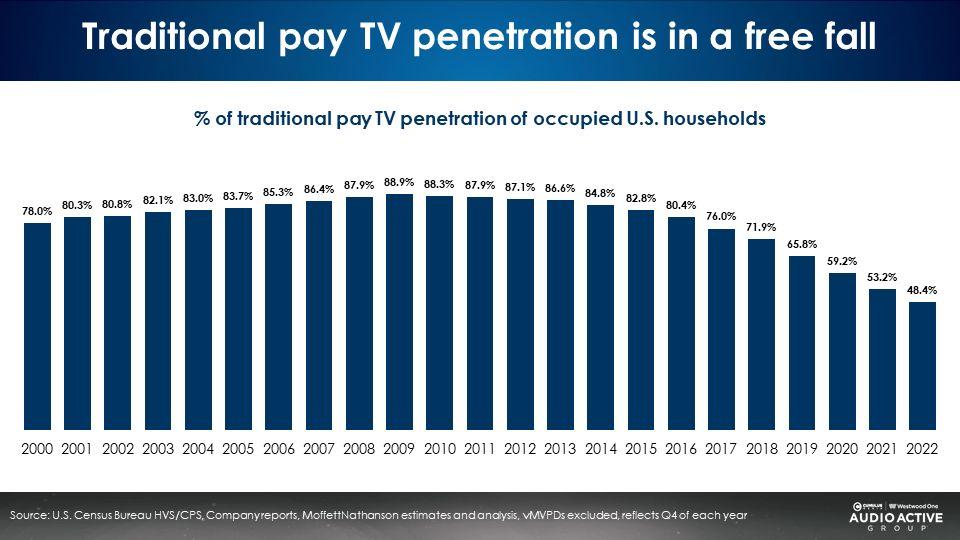

- “Rates of decline for … Pay TV accelerated to near all-time-worsts.”

- “Taken together, the declines at Cable and Satellite have left penetration of traditionally-distributed video … as a percentage of occupied households at 48%, the lowest level in thirty-five years.”

- “Among traditional distributors, both Cable and Satellite, video is increasingly viewed to be a lost cause.”

- “There is a growing sense among cable operators that wireless is now strategically more critical to their future than video.”

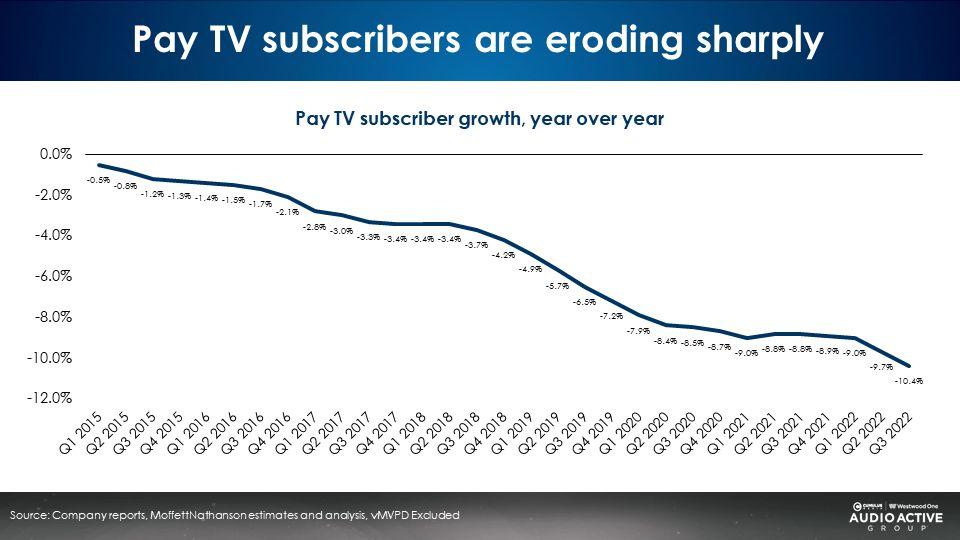

The rate of cable erosion is stunning

From 2020 to 2021, cable subscriptions eroded -8% each quarter. 2022 was even worse. Q1 2022 saw a -9% drop, Q2 -9.7%, and Q3 2022 saw a double-digit reduction of -10.4%.

U.S. pay TV penetration peaked at 88.9% in 2009. By 2016 it had dropped to 80.4%. Then the bottom fell out. By 2022, pay TV penetration plunged to 48.4%.

MoffettNathanson estimates there are 55 million homes outside the cable network ecosystem. Half of America’s homes will not see traditional cable network ads.

All-time lows: Only half of cable subscribers take video service

Once upon a time, cable companies distributed TV. Now these firms focus on broadband and wireless phone service. Cable television? Not so much.

Video attach rates, the percentage of customer relationships that include video, have dropped to 55% or lower for all operators. Only 50% of Comcast customers take video. Just 49% of Charter’s subscribers take video. Cable One’s video attachment rate is only 19%.

Where can advertisers replace lost TV audiences?

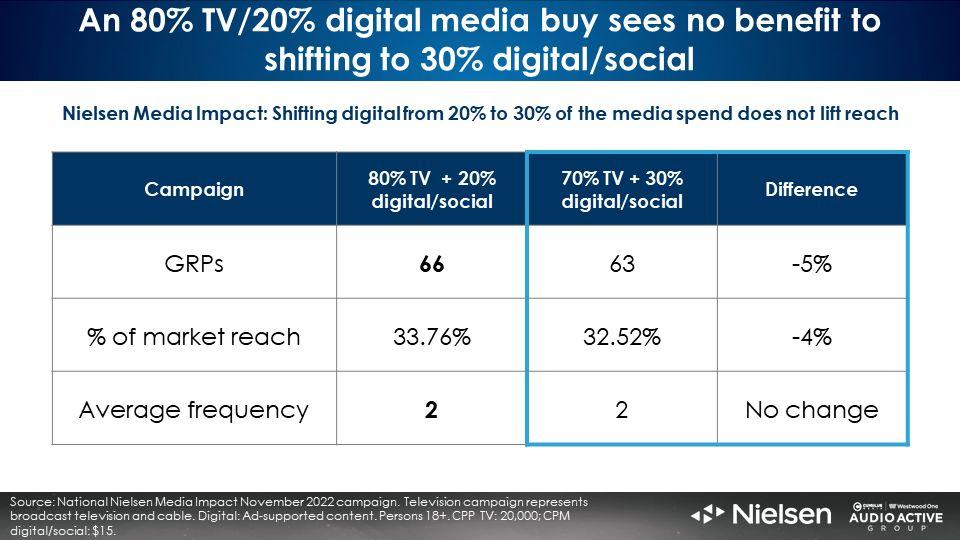

One approach is to shift more media budgets to digital and social. An analysis from the media optimization platform Nielsen Media Impact reveals such a shift does not grow incremental reach.

The base media plan above consists of a mix of 80% TV and 20% digital/social. Shifting 10% of the media plan from TV to digital and social results in a decline in reach. Another approach is to shift money out of linear TV to connected TV (CTV) or ad-supported over-the-top video streaming services.

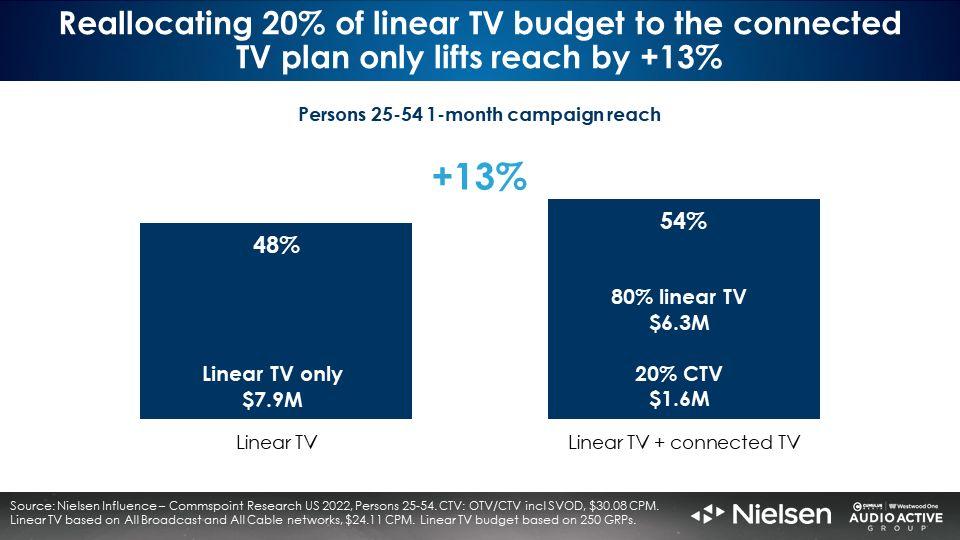

CTV cannot replace all linear TV losses: A 20% addition of connected TV weight only results in a +13% reach lift

A Nielsen Commspoint analysis reveals a 20% addition of CTV media weight to a linear TV buy results only in a +13% increase in reach. CPMs for connected TV are pricey.

Media cost per thousands (CPMs) for linear television run between $10 and $15. The average CPM for YouTube videos runs at $20 to $25. Connected TV CPMs can range from $35 to an eye-popping $65.

Surprise: Network radio is the media plan reach accelerator

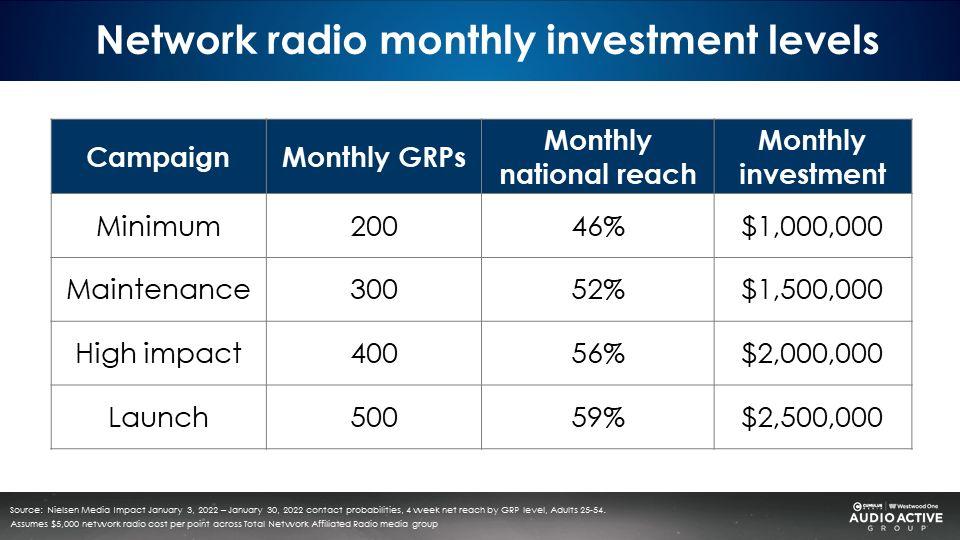

Network radio is an affordable option that generates significant levels of monthly reach. Consider four monthly network radio investment levels:

In network radio:

- 200 monthly GRPs generate 46% reach

- 300 monthly GRPs generate 52% reach

- 400 monthly GRPs generate 56% reach

- 500 monthly GRPs generate 59% reach

Network radio generates more impact than TV/digital

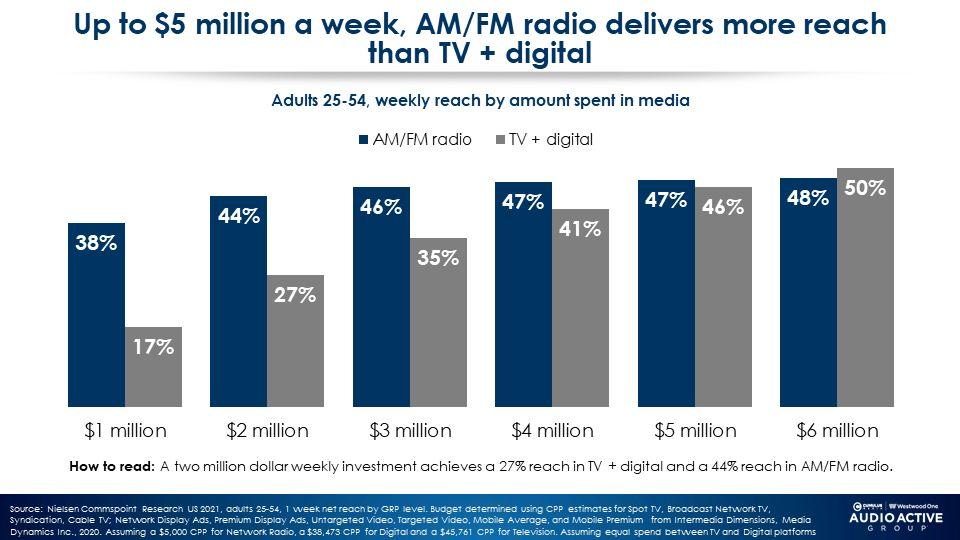

According to the Nielsen Commspoint media planning tool, network radio generates greater reach for the same investment than TV and digital.

A $2 million dollar investment in network radio generates a weekly national reach of 44%, +63% greater than the same investment in digital and TV (27%).

Adding network radio into any media plan generates an outsized lift in incremental reach

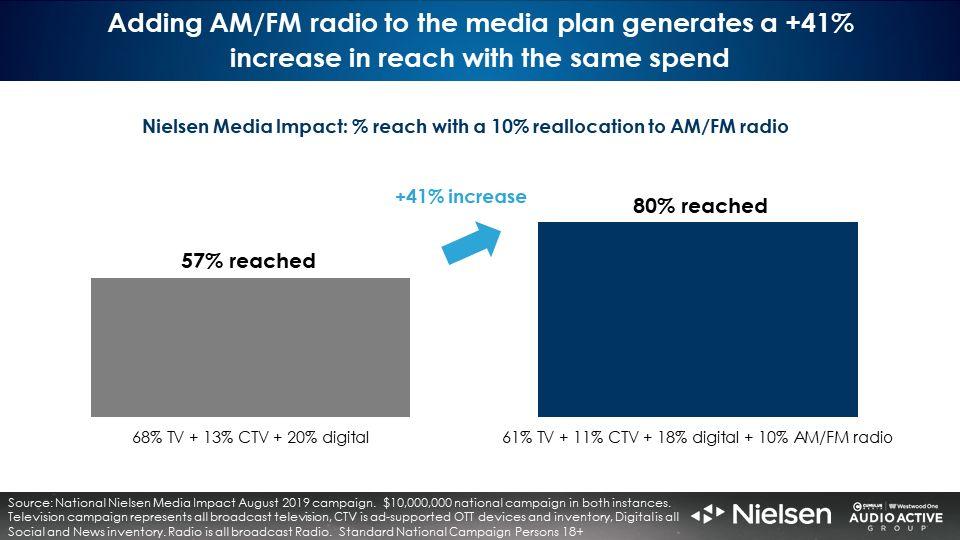

Consider a media plan that consists of 68% linear TV, 13% CTV, and 20% digital. Per Nielsen Media Impact, this buy achieves a national reach of 57%.

When the same spend includes a 10% allocation for network radio, reach soars from 57% to 80%, an astonishing +41% reach increase at the same budget!

No matter the budget size: AM/FM radio makes your TV and digital plan better

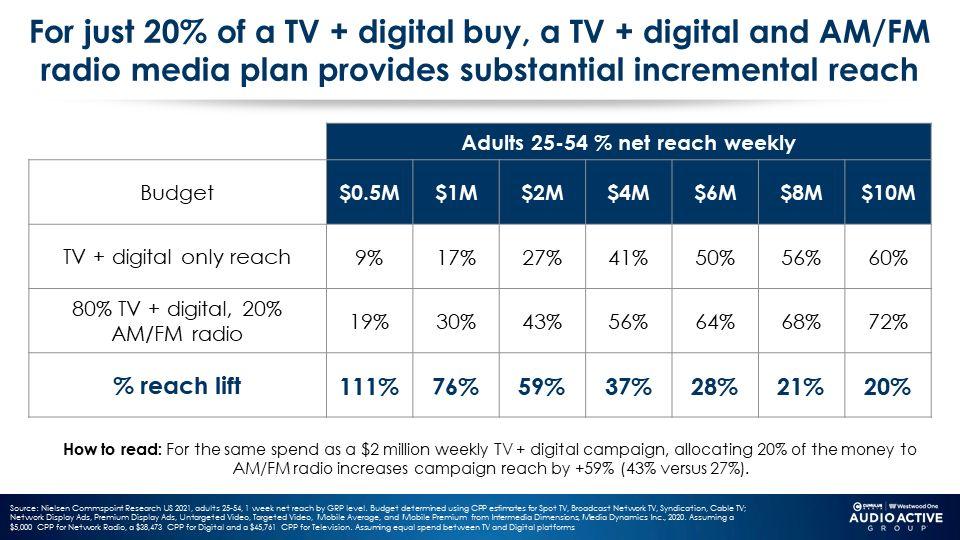

At a wide variety of investment levels, shifting 20% of the TV/digital budget to AM/FM radio generates outsized increases in campaign reach at the same spend.

- A half a million dollars of weekly digital/TV reaches 9% of Americans. Shifting 20% over to AM/FM radio causes reach to more than double to 19%, at the same budget.

- A $2 million dollar weekly digital/TV media plan reaches 27% of America. Shifting 20% over to AM/FM radio causes reach to jump to 43%.

How can network radio generate a lift in your media plan?

Ask your Westwood One sales representative. Via the Nielsen Media Impact optimization platform, the reach of any TV buy can be determined. Then NMI’s share shift function reveals how the addition of network radio to the plan with no increase in budget can generate a significant lift in incremental reach.

Give it a try! It will surprise you. Tell us your brand and we’ll run the Nielsen Media Impact share shift report for you. Email us at RadioIncrementalReach@westwoodone.com.

Key takeaways:

- Cord cutting is a key contributor to the erosion of TV audiences; Only half of U.S. homes have pay TV

- Connected TV cannot replace all linear TV losses: A 20% addition of CTV weight to a TV buy only results in a +13% reach lift

- Network radio is the media plan reach accelerator: Shifting 20% of TV/digital weight to network radio generates significant increase in campaign reach

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.