Perception vs. Reality: Eight Things Brands Have Completely Wrong About AM/FM Radio

Click here to view a 17-minute video of the key findings.

Click here to download a PDF of the full deck.

The perception of media audiences is skewed by prevalent myths in the ad community. Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, puts it best: “Why do people think that nobody listens to radio anymore? Because there is a narrative that new media kills old media, so nobody bothers to look at evidence that doesn’t fit the narrative.”

Let’s challenge the narrative and look at some evidence. Using data from research leaders Nielsen, Maru/Blue, and Edison Research, we disprove eight of the biggest perceptions brands hold about AM/FM radio.

Here are the realities of consumer media behaviors:

Perception #1: “Due to the pandemic, no one is listening to AM/FM radio.”

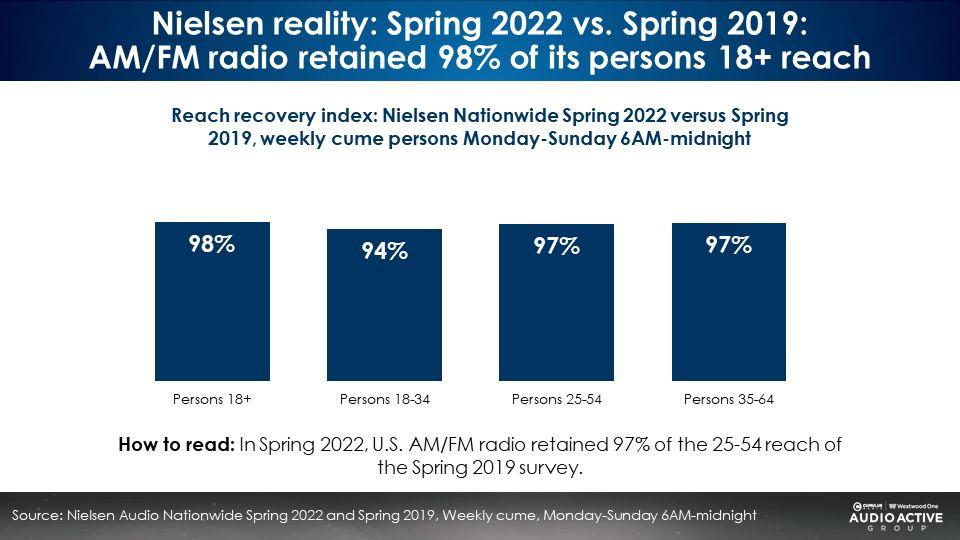

According to the latest Nielsen Spring 2022 Nationwide Report, AM/FM radio has retained 98% of its persons 18+ reach from the Spring 2019 survey. Nielsen’s Nationwide study aggregates total American AM/FM radio listening from all 253 Nielsen local markets and all U.S. DMA markets.

In Spring 2022, persons 18-34 weekly reach was 94% of what it was in Spring 2019. Persons 25-54 weekly reach was 97% of what it was in Spring 2019. Persons 35-64 weekly reach was 97% what it was in Spring 2019.

Perception #2: “Due to the pandemic, everyone’s working at home and no one is commuting.”

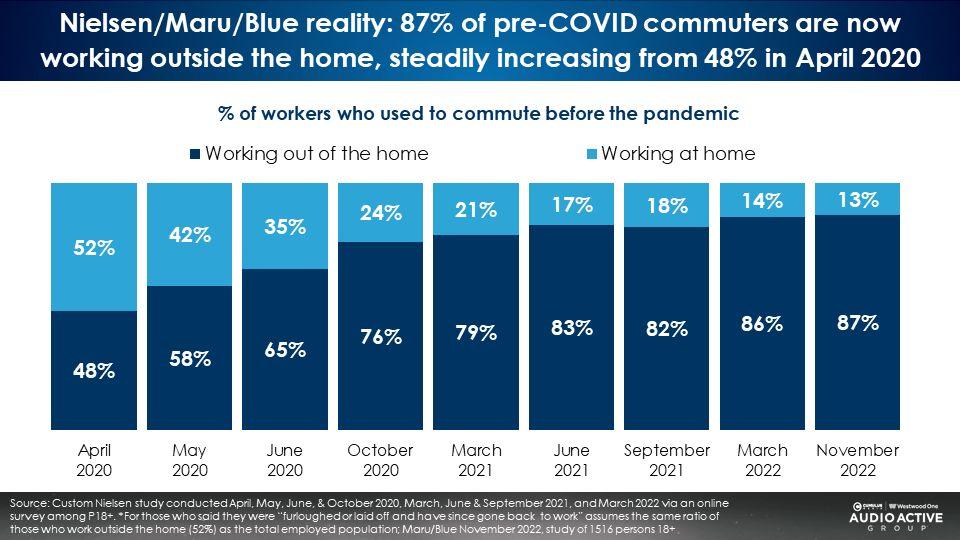

In reality, commuting has bounced back. According to a November 2022 Maru/Blue study, most of pre-COVID commuters are now working outside the home (87%). This is compared to only 48% of pre-COVID commuters who were working outside the home in April 2020, according to a custom Nielsen study.

Perception #3: “AM/FM radio has very low reach.”

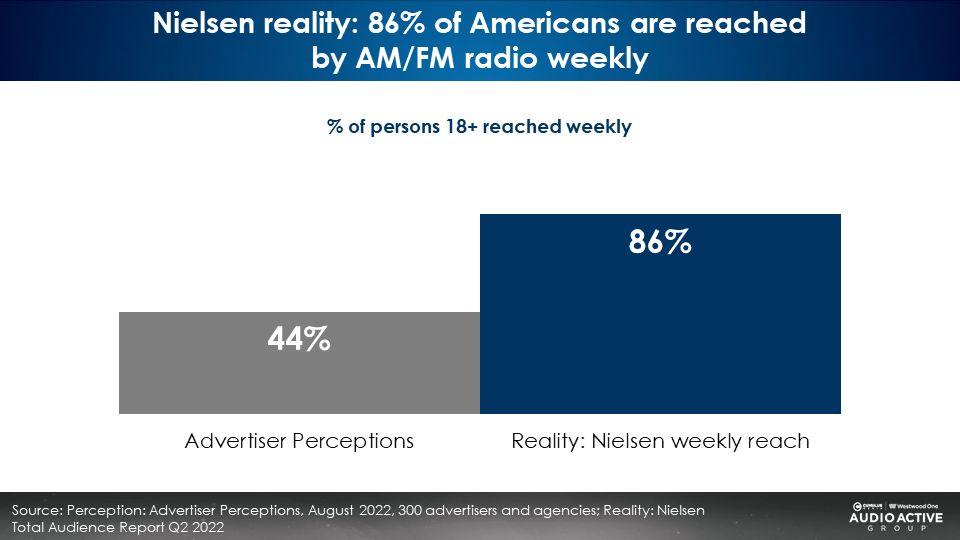

The reality is AM/FM radio has massive reach. An August 2022 study by Advertiser Perceptions found marketers and agencies believe AM/FM radio’s weekly reach is 44%. A massive miss. In reality, 86% of all Americans are reached by AM/FM radio on a weekly basis, according to Nielsen’s Q2 2022 Total Audience Report.

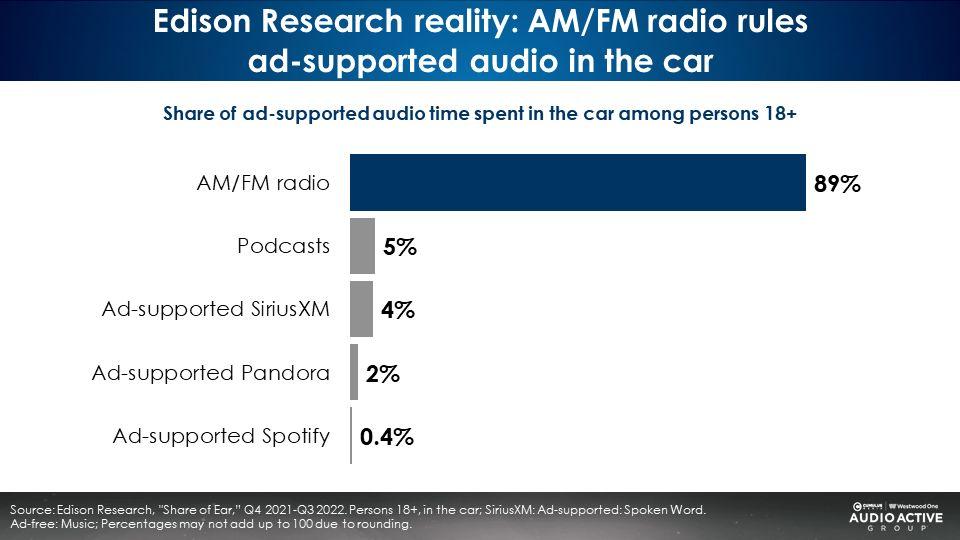

Perception #4: “Audience shares to Pandora/Spotify are nearly equal to AM/FM radio.”

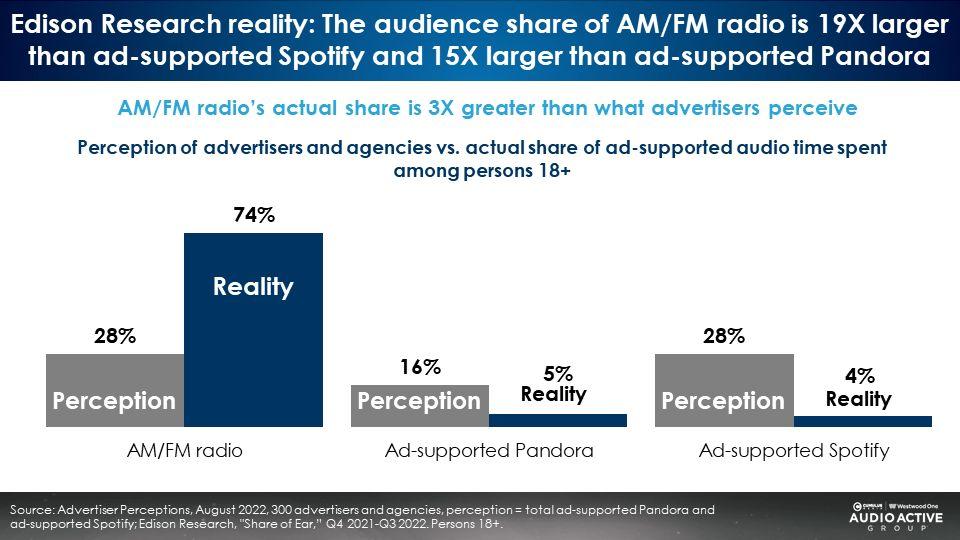

Edison Research reports AM/FM radio is nineteen times larger than ad-supported Spotify and fifteen times that of ad-supported Pandora.

Marketers and agencies told Advertiser Perceptions they feel audience shares of AM/FM radio are pretty similar to Pandora and Spotify. The buzz is wrong. The share of time spent listening to AM/FM radio dominates the two streaming audio services.

Perception #5: “In the world of the connected car, the number one thing people do in their vehicles is stream online radio on their smartphones.”

AM/FM radio still rules the road. Among ad-supported audio, AM/FM radio has a dominating 89% share of in-car time spent.

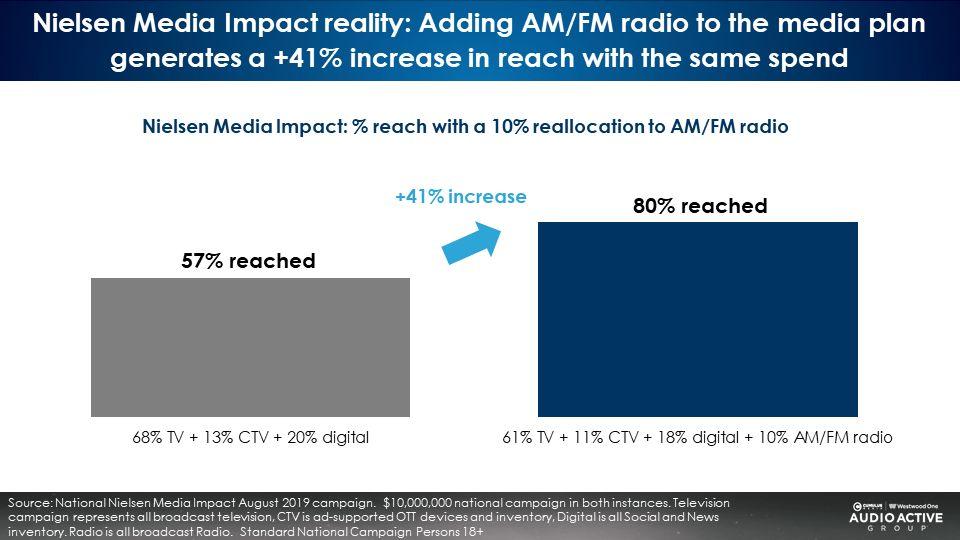

Perception #6: “Today’s optimal media plan: Put all of your money into TV and digital.”

Adding AM/FM radio to the TV and digital plan generates incremental reach for the same spend. While TV and digital are mass reach media that will deliver audiences, AM/FM radio is a powerful tool for marketers and agencies.

To illustrate, here is a case study with two approaches analyzed by Nielsen Media Impact, the media planning and optimization platform. The media plan on the left represents a typical mix of 68% linear TV, 20% digital, and 13% connected TV. That plan achieves a 57% reach.

The media plan on the right, with the exact same budget, keeps linear TV, digital, and connected TV in the plan and allocates 10% of spend to AM/FM radio. This plan generates an astounding 80% reach. The same budget yields much bigger reach. Putting AM/FM radio into the plan at a modest 10% allocation lifts reach by an impressive +41%.

Perception #7: “I would love to consider audio. However, there’s a total lack of ROI and sales lift evidence for AM/FM radio.”

Since 2013, Nielsen has conducted over a dozen return on investment studies across a variety of consumer categories that prove that AM/FM radio generates significant positive return on advertising spend.

Nielsen has found time and time again that AM/FM radio delivers impressive ROI. For example, for every $1 invested in an auto aftermarket AM/FM radio campaign, there is a $21 sales return. The Nielsen ROI data showcases AM/FM radio’s proven track record as a sales driver.

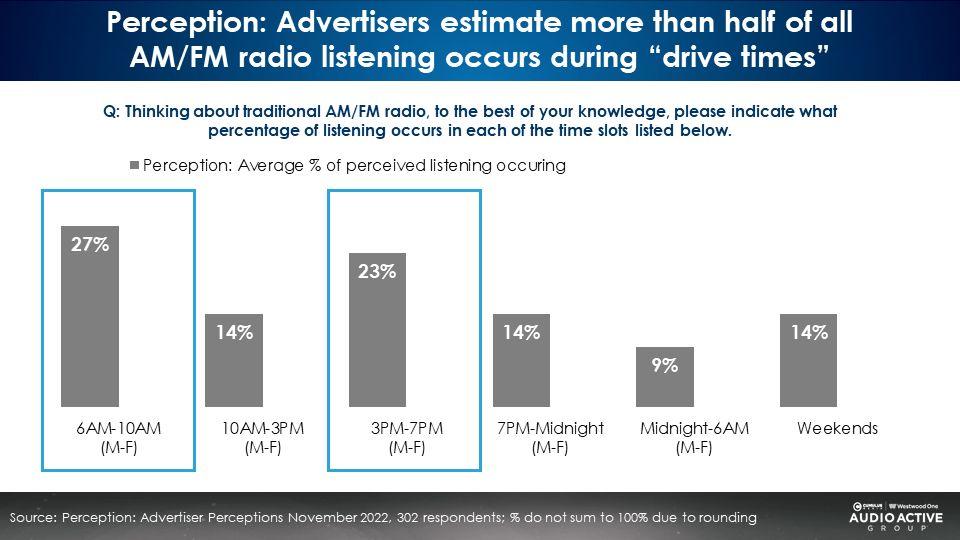

Perception #8: “AM/FM radio listening only happens during drive times.”

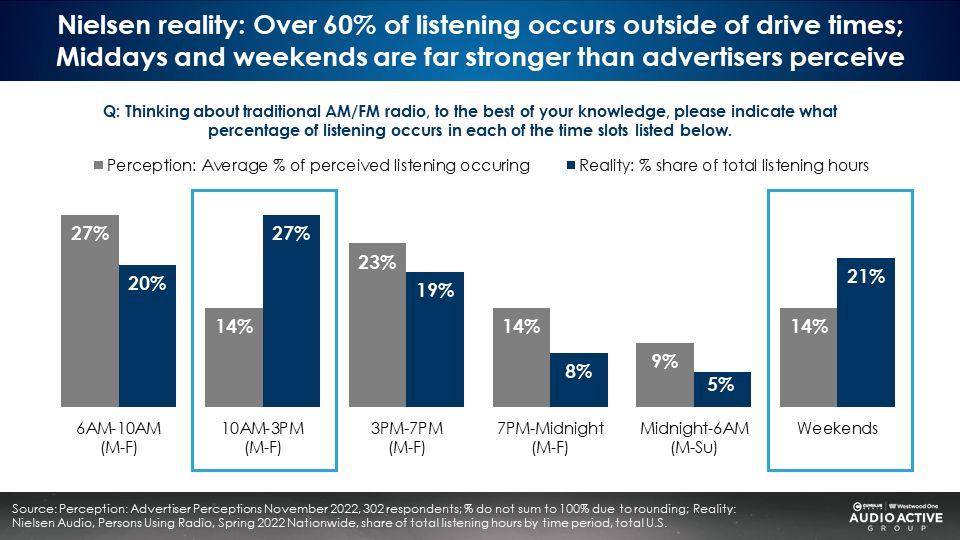

Over 60% of total American AM/FM radio listening occurs outside of drive times. Many Americans listen to AM/FM radio during middays and weekends.

When thinking about AM/FM radio, Advertiser Perceptions reports marketers and agencies believe 27% of listening occurs during weekday morning drive, 6AM-10AM, followed by Monday-Friday afternoon drive, 3PM-7PM, at 23%. Middays, 10AM-3PM, were third at 14%, narrowly inching out nighttime and weekends.

Nielsen Audio shows there is a stark difference in perceived and actual AM/FM radio listening. The highest share of time spent among Americans occurs during middays, Monday-Friday, 10AM-3PM (27%).

There is also a major disconnect about weekend listening. Advertisers perceive only 14% of all listening occurs during the weekend. The Nielsen reality is 22%, 2 points greater than morning drive.

The prevailing narrative is wrong. Know the realities:

- AM/FM radio has retained 98% of its persons 18+ reach and 97% of its reach among persons 25-54.

- Per a Maru/Blue survey, 87% of pre-COVID commuters are now working outside the home.

- 86% of Americans are reached by AM/FM radio weekly.

- The audience share of AM/FM radio is nineteen times larger than Spotify and fifteen times larger than Pandora.

- AM/FM radio rules ad-supported audio in the car.

- Adding AM/FM radio to the media plan generates a +41% increase in reach with the same spend.

- AM/FM radio delivers excellent ROI across various categories.

- Over 60% of listening occurs outside of drive times. Middays and weekends are far stronger than advertisers perceive.

Click here to view a 17-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.