Two Case Studies: AM/FM Radio And Podcasts Work For Pet Supplies Retailers

Click here to view a 9-minute video of the key findings.

The pet category is one of the most heavily advertised. Kantar and Magellan report in the one-year span from October 2021 to September 2022, pet supplies retailers spent over $545 million on advertising. However, only 4% of total pet category media budgets were allocated to audio. 34% of total pet category media spend went to TV.

The Cumulus Media | Westwood One Audio Active Group® commissioned a series of Signal Hill Insights studies to measure the impact of two pet retailer campaigns. One was for a retailer’s network radio campaign and one was for a podcast campaign. Both studies revealed AM/FM radio and podcast advertising can generate a significant brand lift and sales effect.

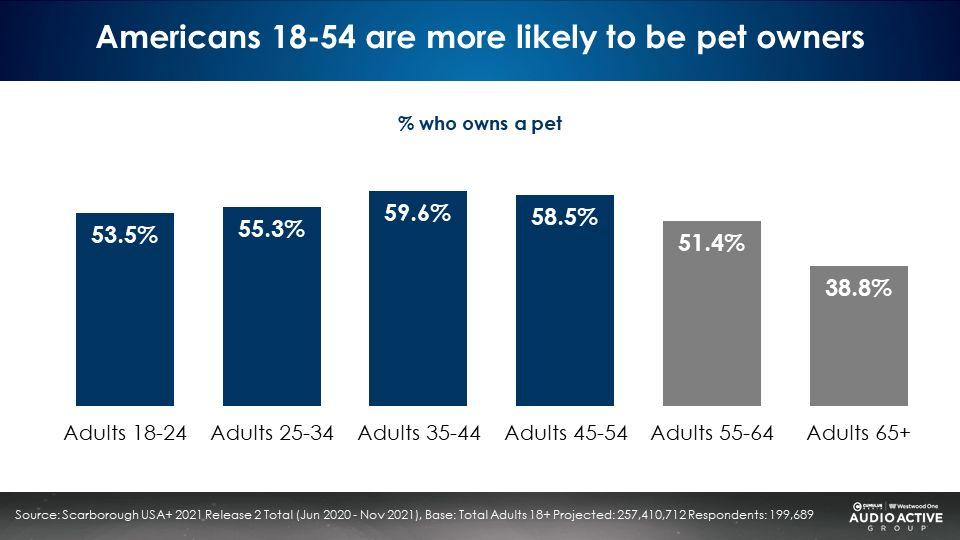

Pet ownership is greatest among 25-54s and declines sharply over the age of 55

Nielsen Scarborough reveals over half of adults 25-54 own a pet. Pet ownership is highest among 35-54s, where nearly six out of ten own a pet. After the age of 55, pet ownership drops significantly. Only 39% of adults 65+ own a pet.

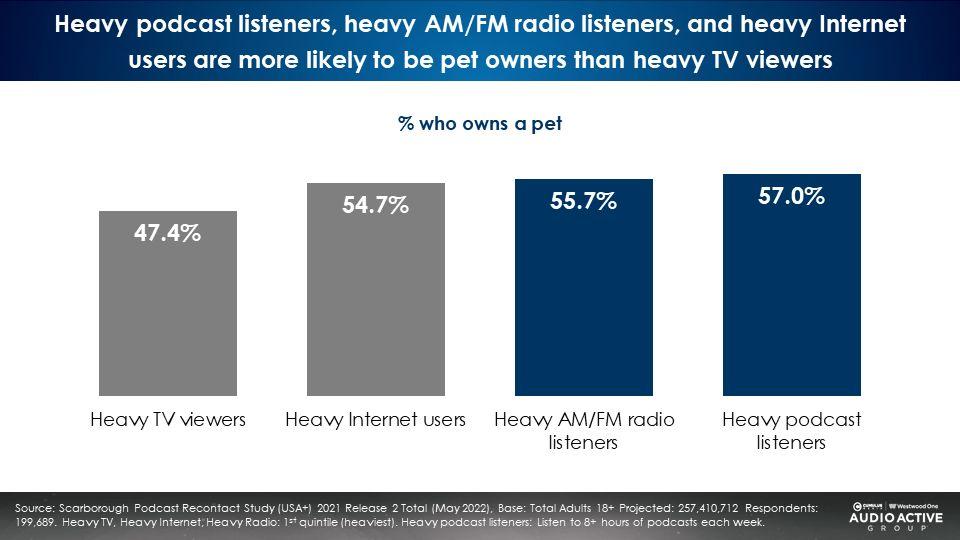

Heavy AM/FM radio listeners are +18% more likely than TV viewers to be pet owners, revealing pet category media plans are underweight on AM/FM radio and overspent on TV

Since TV audiences skew so old, it is not surprising that TV audiences under index for pet ownership. Heavy podcast listeners, heavy AM/FM radio listeners, and heavy Internet users are far more likely to be pet owners.

AM/FM radio listeners are 18% more likely than TV viewers to own a pet. Podcast listeners are 20% more likely than TV viewers to be pet owners.

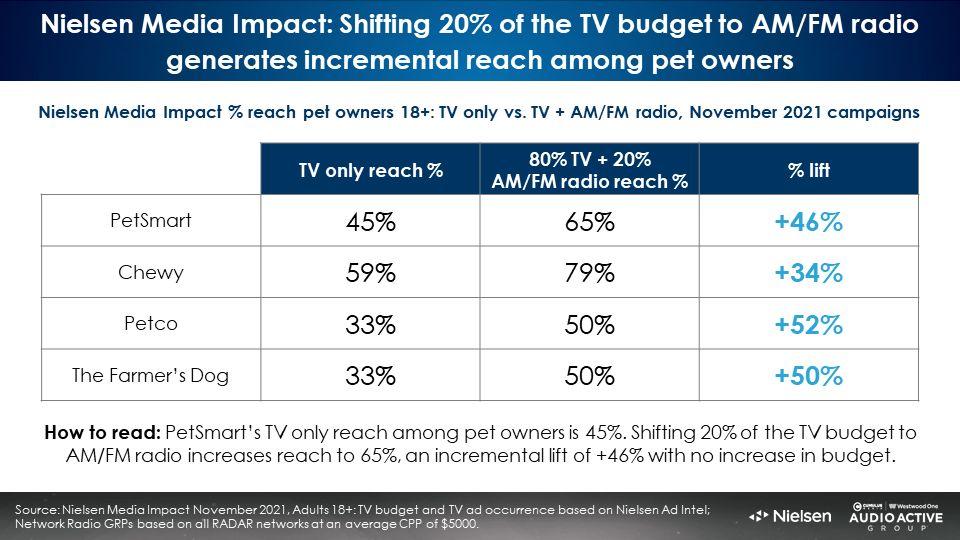

Nielsen Media Impact: Adding AM/FM radio to pet brand TV media plans generates a massive lift in campaign reach

Since AM/FM radio is America’s number one mass reach media, adding AM/FM radio to the TV plan causes outsized incremental reach lift.

A Nielsen Media Impact analysis found heavy spending pet brands such as Chewy and PetSmart achieve 59% and 45% in monthly reach of pet owners. Shifting 20% of the TV plan to AM/FM radio results in a +34% increase in Chewy’s pet owner reach and a +46% lift in PetSmart’s reach.

Nielsen Media Impact reveals an AM/FM radio reallocation analysis for Petco and The Farmer’s Dog results in +50% reach increases. Shifting 20% of Petco’s TV budget to AM/FM radio causes monthly reach to grow from 33% to 50%. A 20% reallocation of The Farmer’s Dog TV spend lifts pet owner reach from 33% to 50%.

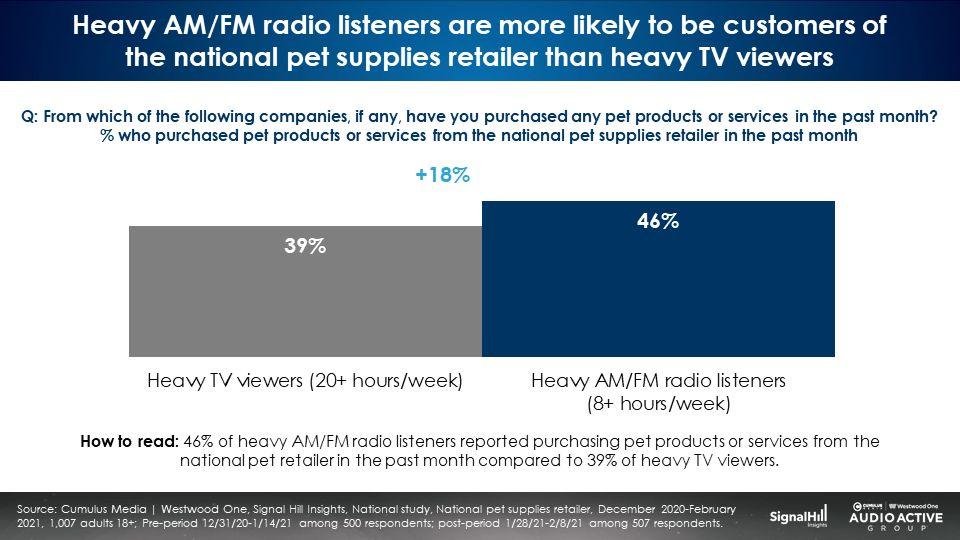

AM/FM radio listeners are far more likely to be customers of the national pet chain retailer according to a Signal Hill Insights campaign effect study

A major national retailer executed an aggressive one-month network radio campaign. Signal Hill Insights fielded a nationally representative pre/post campaign effect study. The sample consisted of 1,007 Americans aged 18+ who had a pet in their household or planned to get one in the next 6 months.

Right off the bat, AM/FM radio’s advantage over TV became apparent. 46% of AM/FM radio listeners were customers of the national pet retailer compared to only 39% of TV viewers. AM/FM radio listeners are +18% more likely than TV viewers to be customers of the pet retailer.

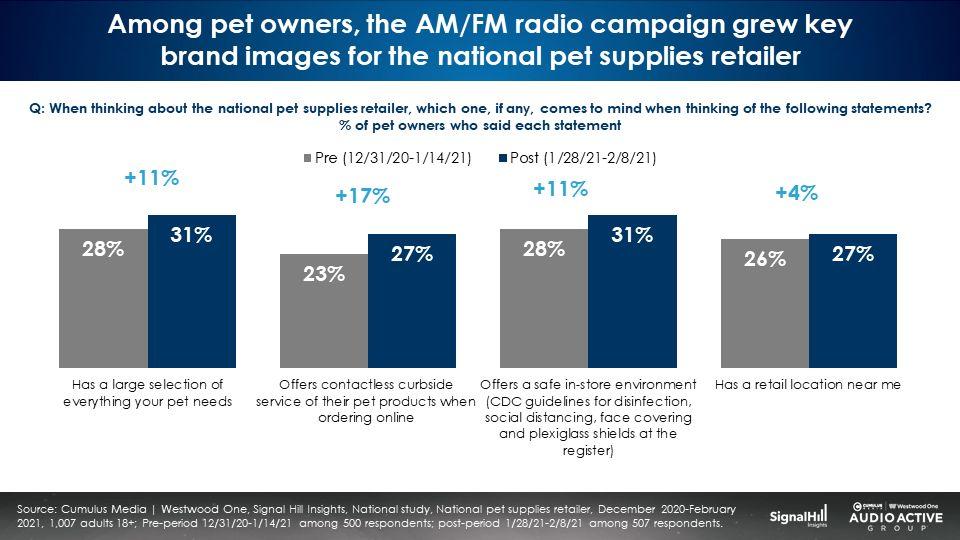

Brand lift: Key perceptions in the campaign saw growth

Comparing perceptions associated with the retailer before and after the campaign saw lifts of +4% to +17%.

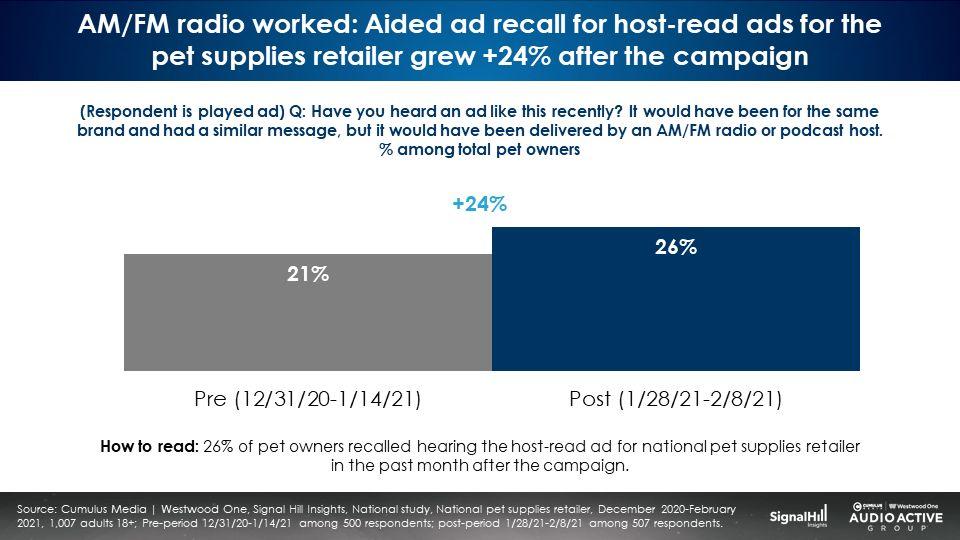

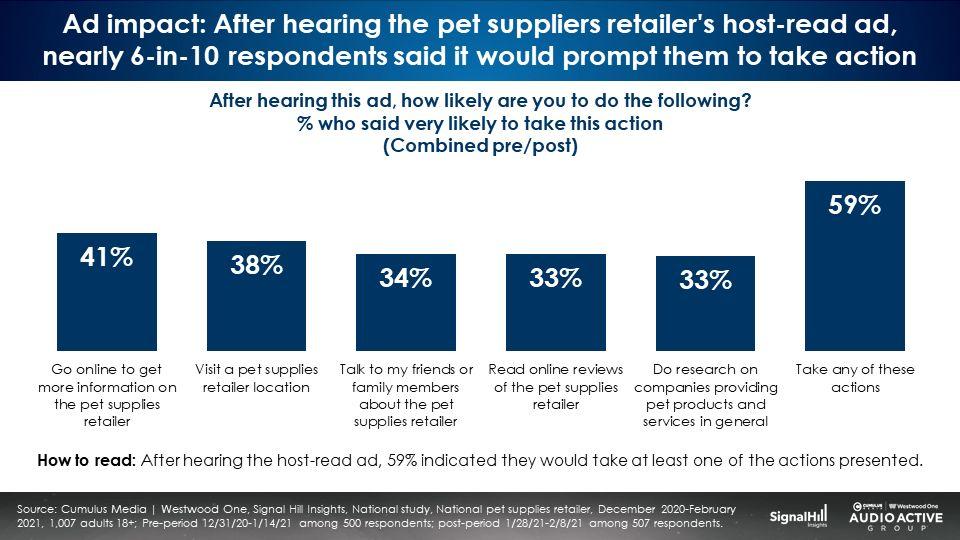

AM/FM radio worked: Advertising recall grew +24% and 6 in 10 said they would take an action based on the campaign

Consumers were played the AM/FM radio ad and asked if they recalled hearing the ad. In the one-month period, aided ad recall grew from 21% to 26%, a +24% increase.

After hearing the ad, 59% said they would take some form of action including visiting the retail website and store locations.

Signal Hill Insights podcast brand effect study: Significant impact up and down the purchase funnel

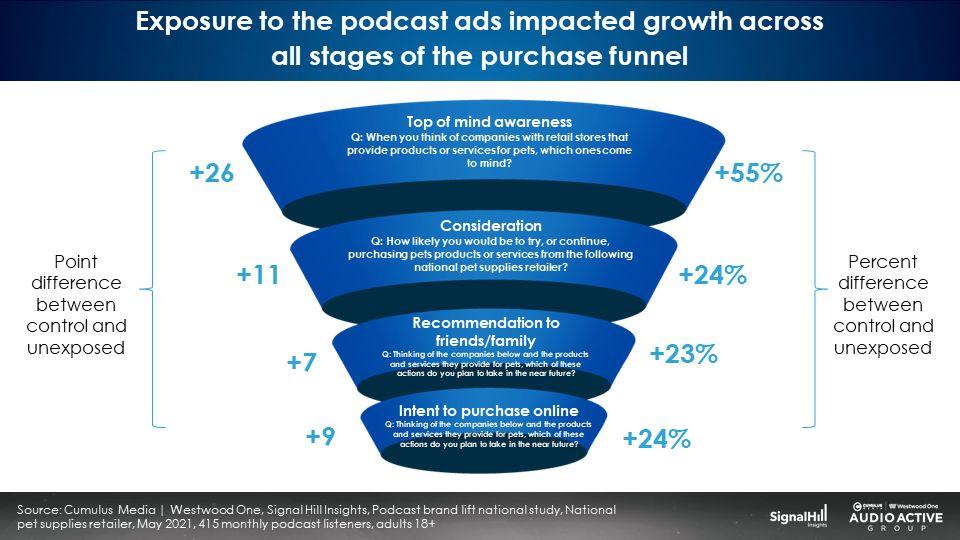

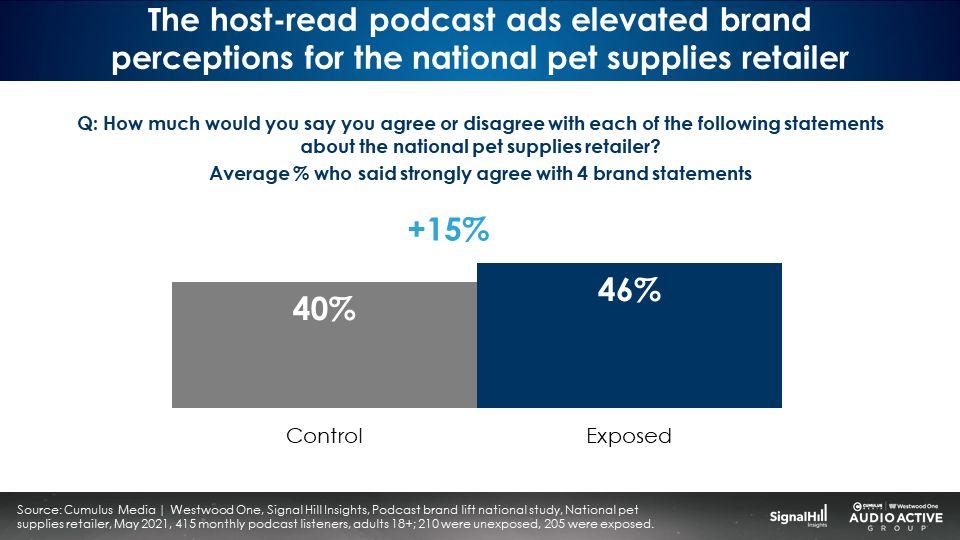

The national pet retailer conducted a campaign which consisted of host-read ads across the Cumulus Podcast Network and covered a wide range of podcast genres.

Signal Hill Insights conducted an online survey among those unexposed to the campaign and those who were exposed. The survey sample consisted of 415 monthly podcast listeners aged 18+ with an interest in at least one of the podcast genres offered and had a pet in their household or planned to get one in the next 6 months.

The podcast campaign generated significant impact:

- Top of mind awareness grew +55%

- Brand consideration increased +24%

- Brand recommendation improved +23%

- Online purchase intent was up +24%

The podcast campaign generated a +15% growth in average brand perceptions

Key takeaways:

- Pet ownership is greatest among 25-54s and declines sharply over the age of 55

- Heavy AM/FM radio listeners are +18% more likely than TV viewers to be pet owners, revealing pet category media plans are underweight on AM/FM radio and overspent on TV

- Nielsen Media Impact: Adding AM/FM radio to pet brand TV media plans generates a massive lift in campaign reach

- AM/FM radio worked: Key brand perceptions grew, advertising recall grew +24%, and 6 in 10 said they would take an action based on the campaign

- Signal Hill Insights podcast brand effect study: Significant impact up and down the purchase funnel

- The podcast campaign generated a +15% growth in average brand perceptions

Click here to view a 9-minute video the key findings.

Pierre Bouvard is the Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.