Passive Job Seekers Outnumber Active Job Seekers Two To One; Companies Can Reach Them And Hiring Managers With Audio, The Soundtrack Of The American Worker

Click here to view a 12-minute video of the key findings.

To analyze the national employment ecosystem and profile job seekers and hiring decision makers, the Cumulus Media | Westwood One Audio Active Group® commissioned MARU/Matchbox to field a study in July 2022. 1,000 respondents were surveyed to explore the labor market. These findings were compared to similar studies conducted in February 2021 and April 2018.

Here are the key findings:

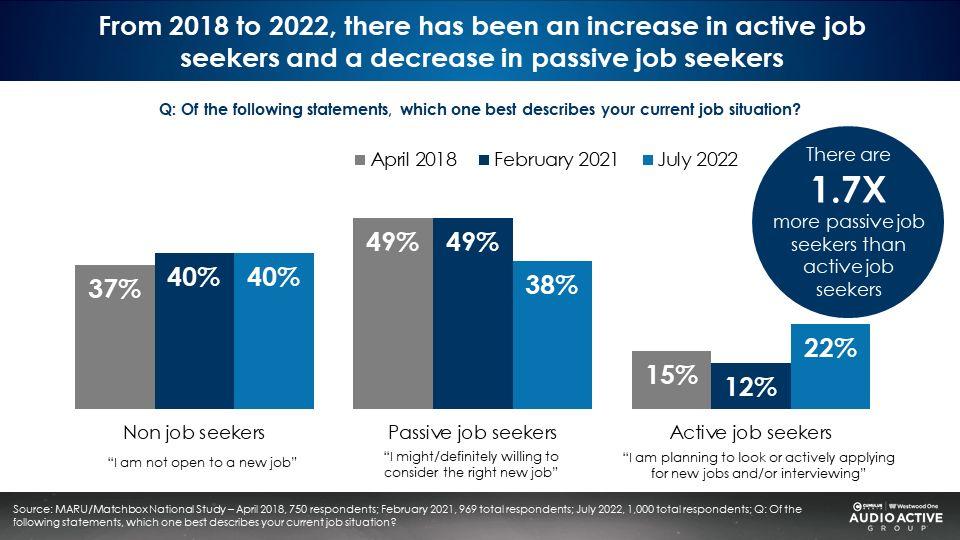

Passive job seekers are the #1 source of new workers in America and outnumber active job seekers two to one

As the name implies, passive job seekers represent the 38% of Americans who are not actively looking for a new job: “I might consider the right new job” or “I am definitely willing to consider a new job.” There are two times more passive job seekers than active job seekers (38% versus 22%). As such, it is crucial that companies tailor their messaging and media plans to attract passive candidates.

Since 2021, the number of active job seekers has reached a four-year high. Over one out of five Americans say they are “actively applying for new jobs/interviewing or planning to look.”

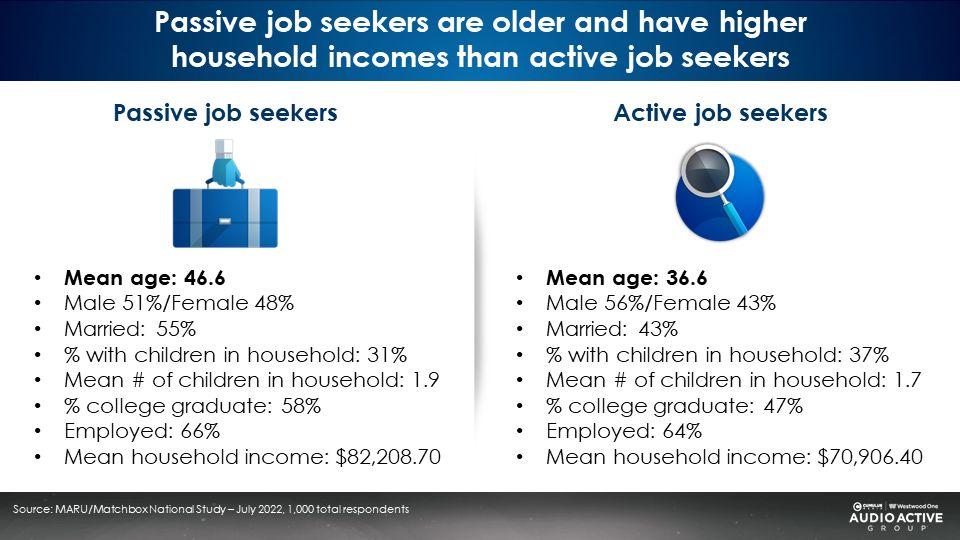

Active job seekers are ten years younger than passive job seekers, lean male, and are more likely to have kids

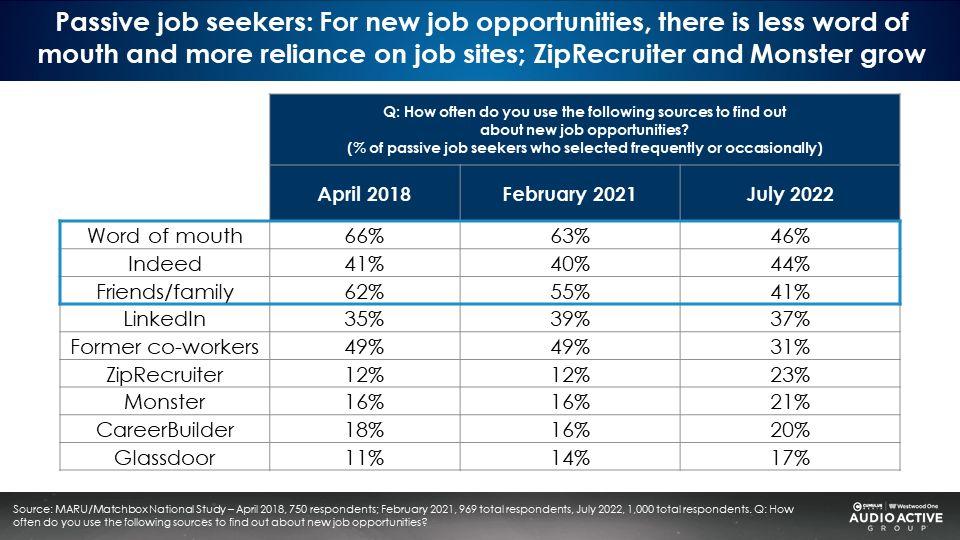

Passive job seekers are less likely to use online job sites

They don’t call them “passive” job seekers for nothing! Less than half of passive job seekers use Indeed, LinkedIn, ZipRecruiter, and Glassdoor.

Companies who solely rely on online job sites to recruit new hires are missing out on a gigantic portion of the candidate pool that is twice as large as active job seekers. Adding over-the-air AM/FM radio, AM/FM radio streaming, and podcasts to the recruitment media plan can help secure these hard-to-reach candidates.

This year, passive job seekers are less likely to use word of mouth or friends and family to learn about new job opportunities. Passive job seekers now show greater usage of job sites such as ZipRecruiter, Monster, and Glassdoor. All three firms have been aggressive advertisers on AM/FM radio and podcasts.

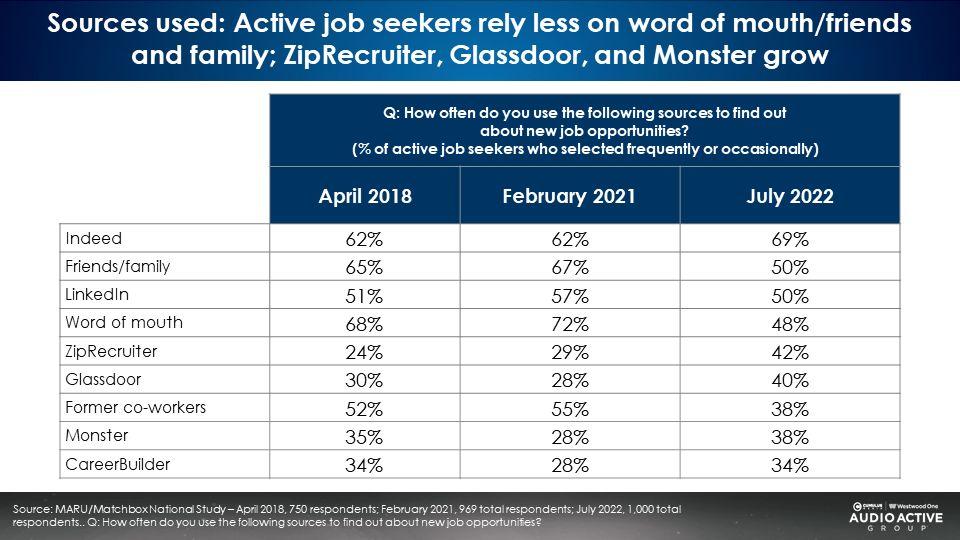

Active job seekers rely less on word of mouth and friends; Indeed and LinkedIn are the most used while ZipRecruiter, Glassdoor, and Monster grow

As seen with passive job seekers, this year there is less reliance on word of mouth and friends and family. Usage of job sites has expanded. ZipRecruiter and Monster show significant growth with two out of five active job seekers using their platforms.

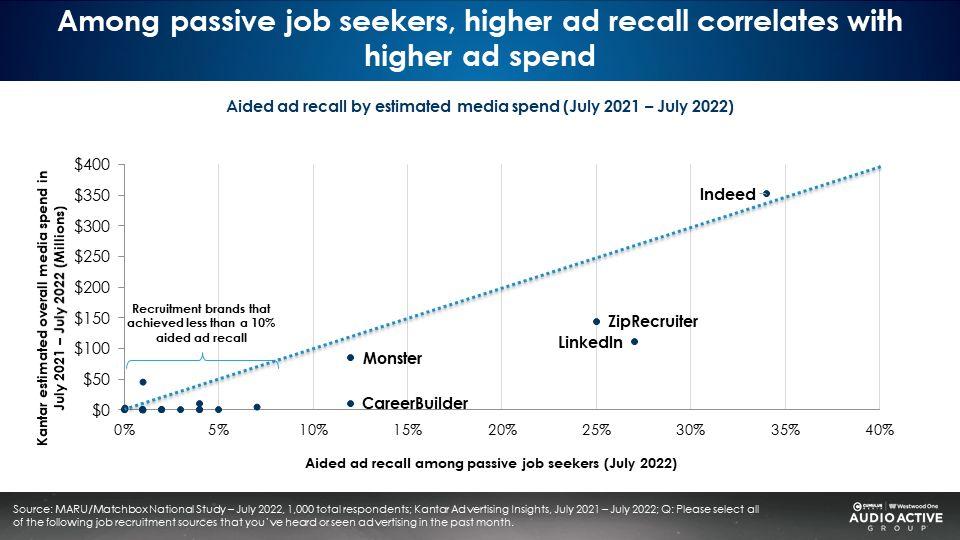

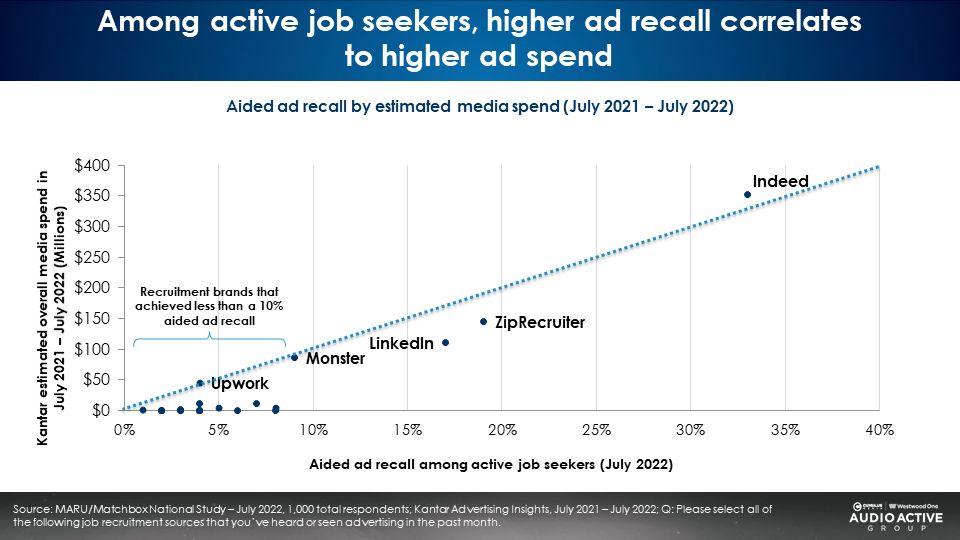

Advertising works: There is a direct relationship between advertising spend and advertising recall

Comparing total media spend as measured by Kantar and advertising recall from the July 2022 MARU/Matchbox national study reveals the greater the ad spend, the greater the advertising recall among both passive and active job seekers.

Among both active and passive job seekers, Indeed, consistently a leading user of network radio, enjoys strong advertising recall, followed by ZipRecruiter, LinkedIn, and Monster. Among active job seekers, there is a straight line relationship between media spend and advertising recall.

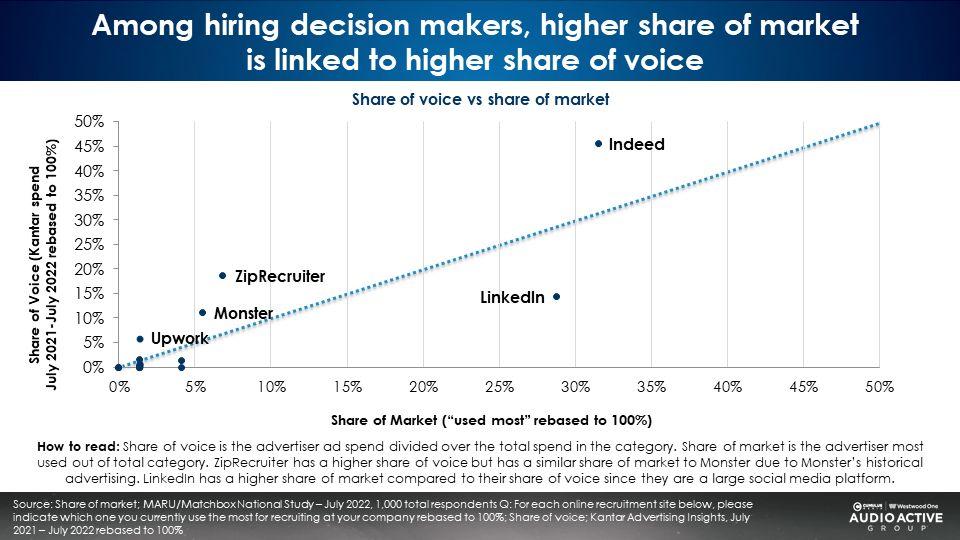

How advertising works: The relationship between market share and share of voice

A useful marketing exercise compares share of voice to a business’ market share.

Share of voice: Ad budgets as a percentage of category ad spend

To understand a brand or business’ growth trajectory, first determine “share of voice.”

Share of voice is the ad spend divided by category ad spend. Say a furniture store spends $500,000 dollars a year on advertising in a town where there is $5 million dollars of furniture advertising.

Divide the store ad spend over category spend to determine share of voice. $500,000 divided by $5,000,000 equals a 10% share of voice. In essence, the furniture store’s advertising represents 10% of the total furniture store advertising impressions in the market.

Share of market: Revenues as a percentage of category revenues

Market share is a brand or retailer’s revenue divided by category sales.

For example, a furniture store generates $10 million dollars in sales in a town where there is $100 million dollars of total furniture sales. Divide company sales over total category sales to determine the market share.

$10 million divided by $100 million equals a 10% share of category spend. The store gets a ten share of furniture sales in the market.

Compare share of voice to share of sales

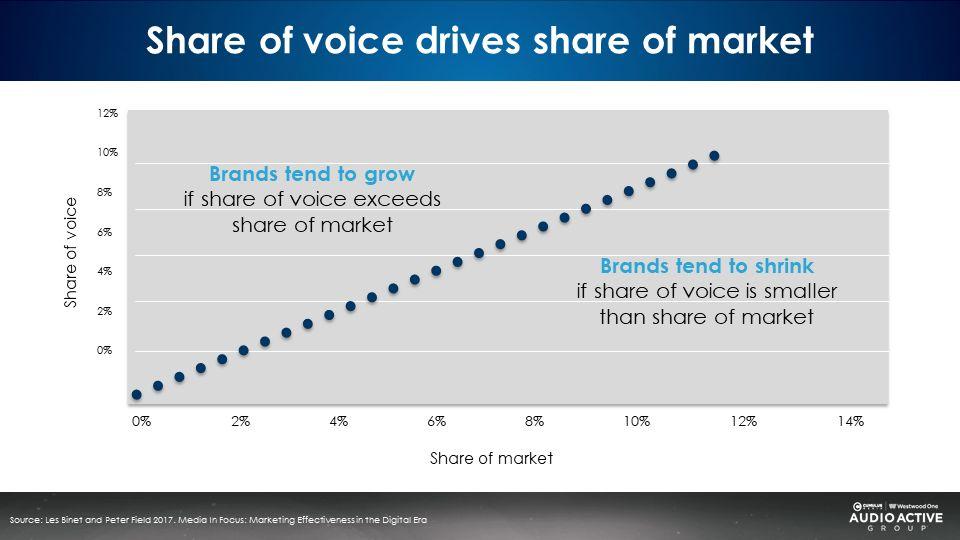

Les Binet and Peter Field, the legendary “godfathers of marketing effectiveness,” use the share of voice/share of market visual to predict future growth of a business or brand.

- If share of voice exceeds share of market, sales tend to grow.

- If share of voice is similar to share of market, sales tend to be stable.

- If share of voice is smaller than share of market, sales tend to shrink.

Job recruitment sites: Share of voice and market share

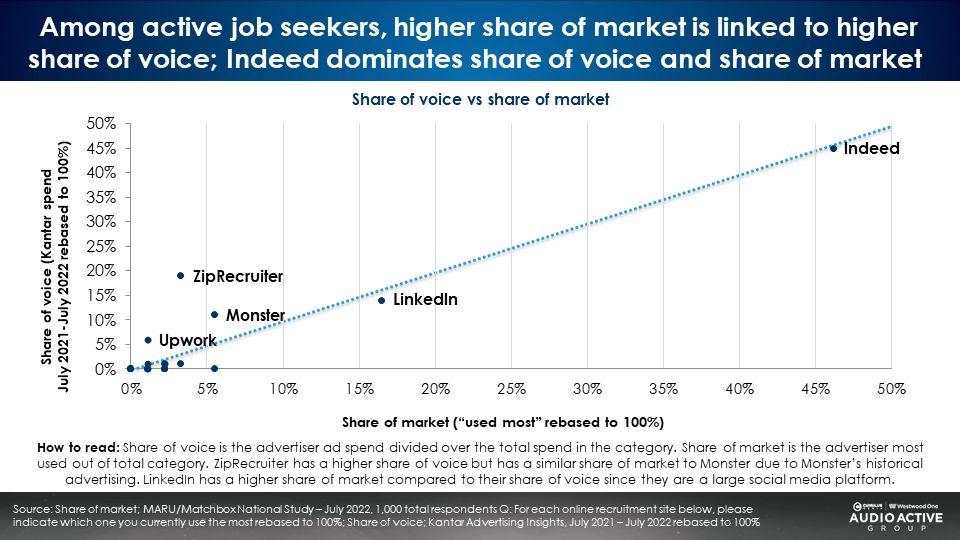

Using total media spend data from Kantar (including all media, digital, TV, and audio), share of voice was determined for each job site by dividing brand ad spend over total job site category spend. Market share was determined using the “most used” job site response from the July 2022 MARU/Matchbox study among active job seekers.

There is the 45-degree Binet and Field relationship between job site share of voice and market share. Indeed has an outsized share of voice matched by their significant “used most” market share.

ZipRecruiter, and Monster to a lesser extent, have greater share of voice than their current market share, which predicts future growth for both brands.

LinkedIn has a slightly lower share of voice than their current market share would predict. The fact that LinkedIn doubles as a business networking job site provides earned market perceptions which benefit the brand.

Among hiring decision makers, Indeed and ZipRecruiter have extra share of voice, which predicts future growth

The MARU/Matchbox study examined hiring decision makers who include anyone who has influence in the recruiting process, has hiring responsibilities, or are HR personnel.

LinkedIn’s lower paid media share of voice compared to their market share reflects a marketplace halo as a business networking social media site. Among hiring managers, LinkedIn and ZipRecruiter have “extra share of voice,” which suggests future brand growth.

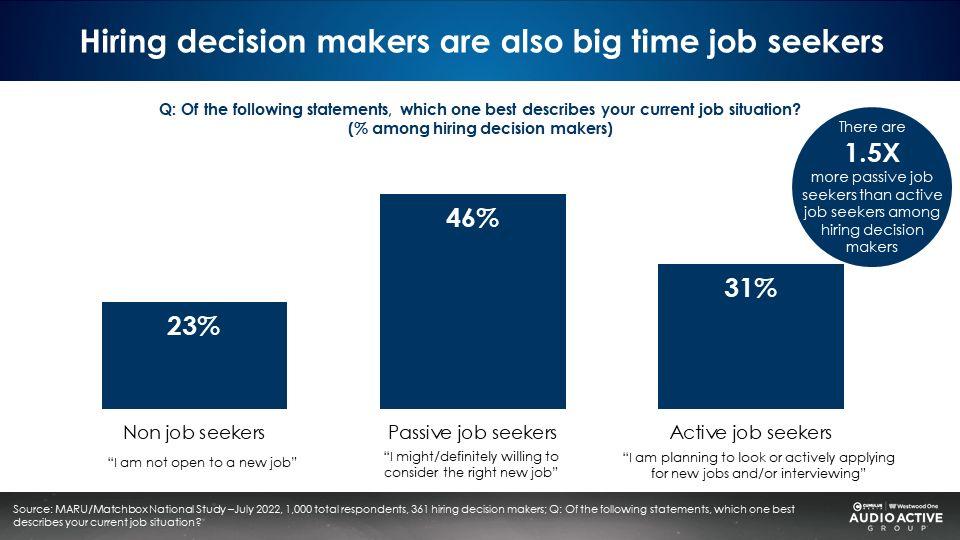

Hiring decision makers are more likely to be passive and active job seekers

The very people who have hiring responsibilities are more likely to be passive or active job seekers! Hiring decision makers are more likely to be passive job seekers (46%) versus the market overall (38%). Interestingly, hiring decision makers are much more likely to be actively looking for a new job (31%) compared to the average (22%).

How to reach job seekers and hiring decision makers with audio

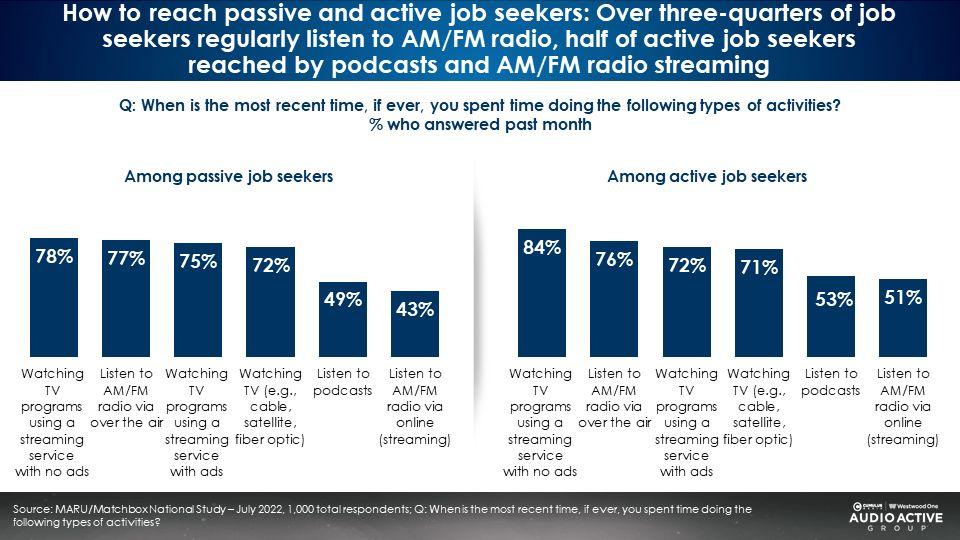

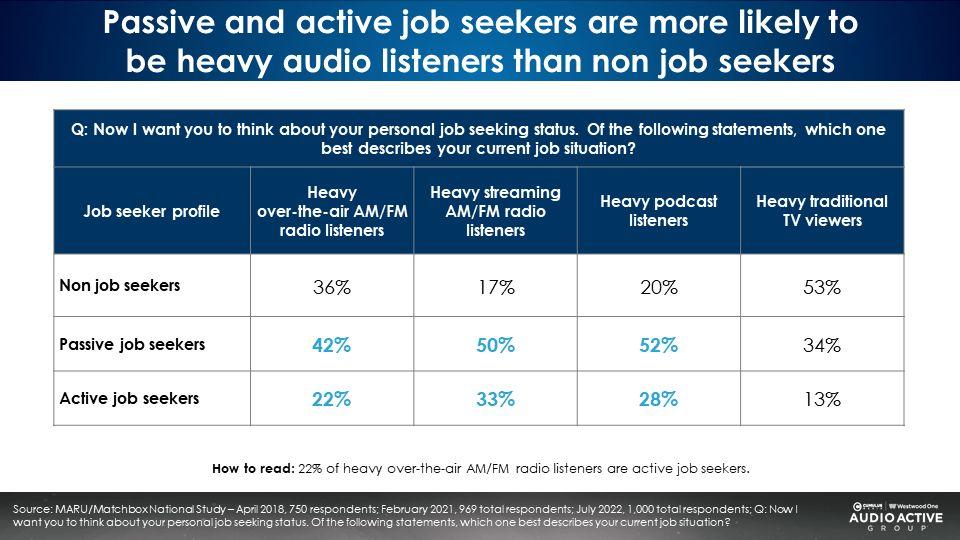

Over 75% of job seekers can be reached by AM/FM radio. Half can be reached with AM/FM radio streaming and podcasts.

While podcasts and AM/FM radio streaming have lower reach, they over index for job seekers, especially passive job seekers. Heavy TV viewers who tend to be retired have a much lower proportion of job seekers.

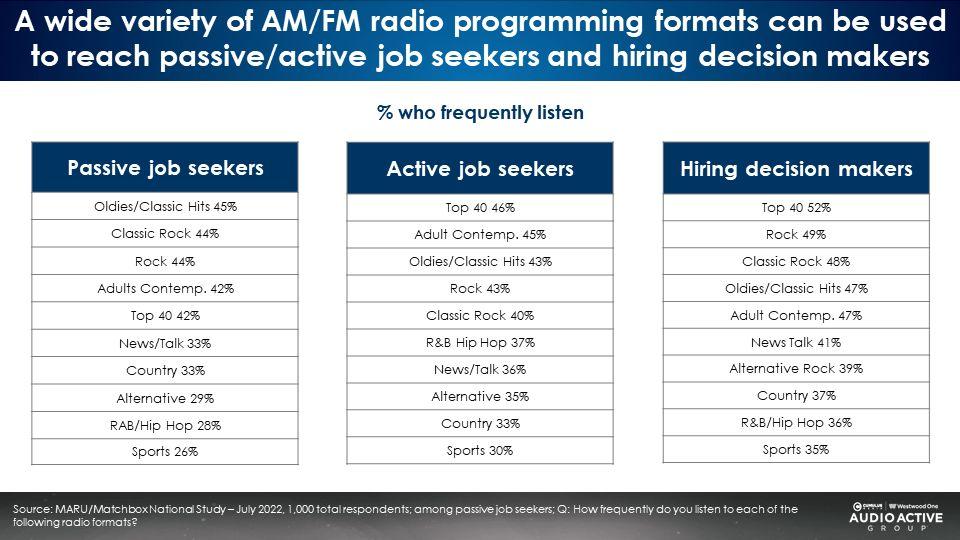

A wide variety of AM/FM radio programming formats can be used to reach hiring decision makers and job seekers

The younger skew of active job seekers is evidenced by larger audiences for more contemporary music formats. Various flavors of Rock, Classic Rock, Oldies, and Classic Hits perform well across the board with job seekers and hiring managers.

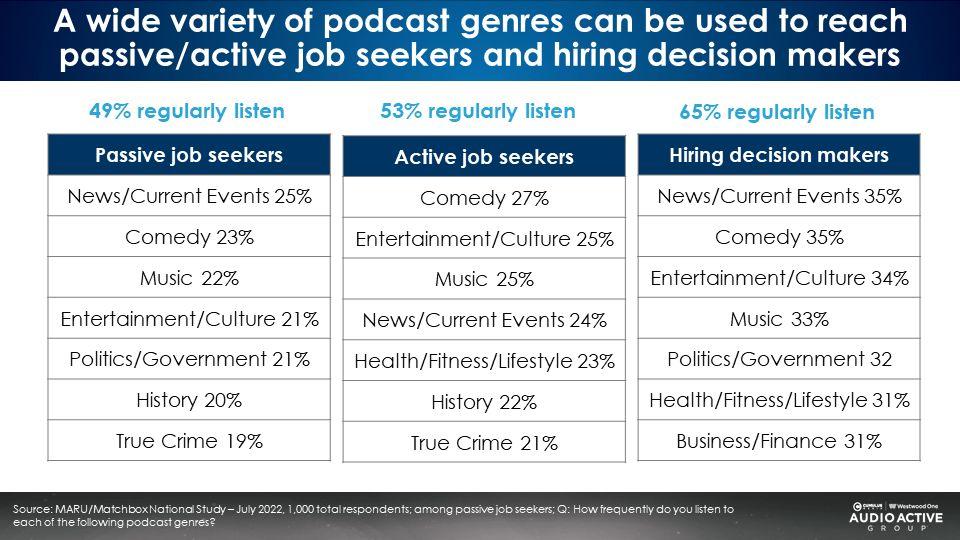

A wide variety of podcast genres reach job seekers and hiring managers

Hiring decision makers are big users of podcasts. They are 30% more likely to be regular listeners to podcasts (65%) versus the market overall (50%).

Key findings:

- Passive job seekers outnumber active job seekers, but active job seekers are growing: The optimal source to fill positions are passive job seekers who outnumber active job seekers 2:1. Active job seekers have surged from 12% to 22% of the American population.

- LinkedIn and Indeed are the recruitment category leaders for job seekers: Among active and passive job seekers, LinkedIn and Indeed frequently rose to the top in key brand metrics such as awareness and aided ad recall.

- ZipRecruiter and Monster are growing: ZipRecruiter has grown in frequent use for active job seekers from 24% in April 2018 to 42% in July 2022. Monster has grown in frequent use for active job users from 35% in April 2018 to 38% in July 2022.

- Audio is an ideal advertising environment for recruitment brands and companies hiring new employees: Over-the-air AM/FM radio reaches nearly 80% of active and passive job seekers. Both heavy streaming AM/FM radio listeners and heavy podcast listeners exhibit strong reach for active and passive job seekers. Hiring managers are significant users of podcasts.

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is the Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.