“Share Of Ear” Q2 2022: A Five-Year Look Back Reveals Podcast Shares Have Tripled And AM/FM Streaming Has Doubled In Share, Beating Pandora Two To One

Click here to view a 12-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of American audio time use. Edison Research surveys 4,000 Americans to measure daily reach and time spent for all forms of audio.

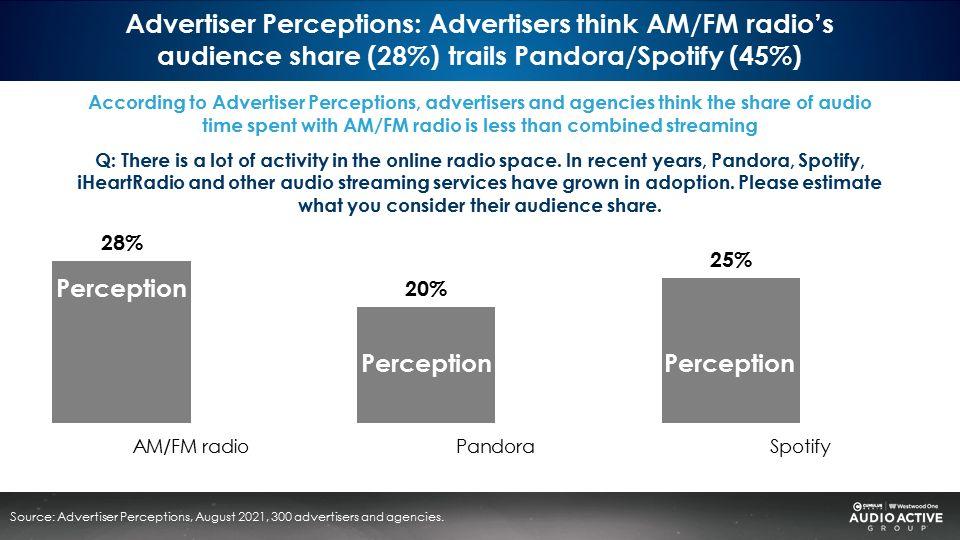

Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

The just released Q2 2022 report reveals a yawning gap in agency/marketer perceptions of audio audiences. A study of 300 media agencies and marketers conducted in August 2021 by Advertiser Perceptions, the gold standard measurement firm of advertiser sentiment, found the perceived share of Pandora/Spotify is a combined 45% share, much greater than the perceived share of AM/FM radio (28%).

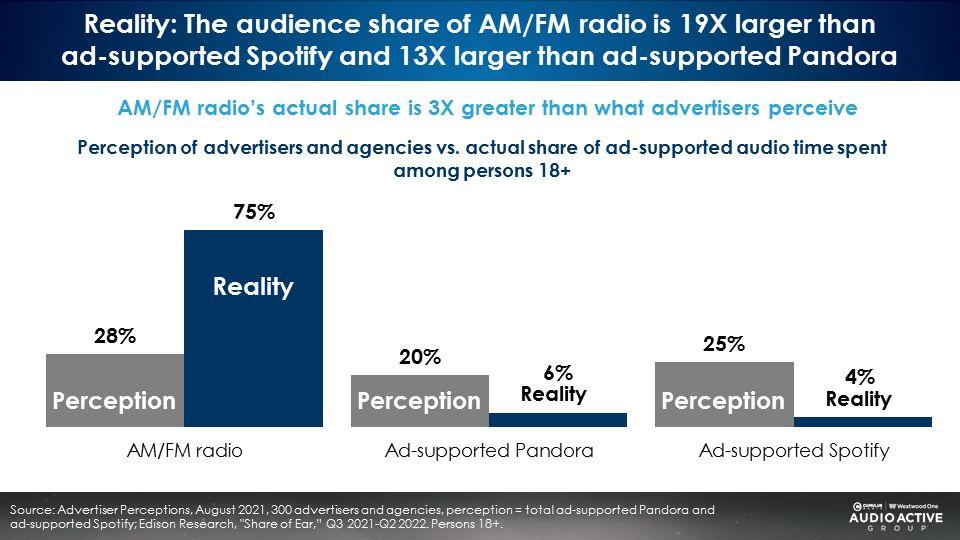

What are the actual shares? The “Share of Ear” reality is quite different!

AM/FM radio’s actual share is three times larger than advertisers perceive. According to the Q2 2022 “Share of Ear,” AM/FM radio’s persons 18+ share of ad-supported audio (75%) is 13 times larger than Pandora (6%) and 19 times greater than Spotify (4%).

“Share of Ear” data proves that advertisers are not taking the “me” out of media

Mark Ritson, the renowned Marketing Professor, describes this phenomenon: “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data.”

Perception is shaded by personal experience. For marketers and agencies, this creates a major disconnect with reality. Media decision makers need to take the “me” out of media.

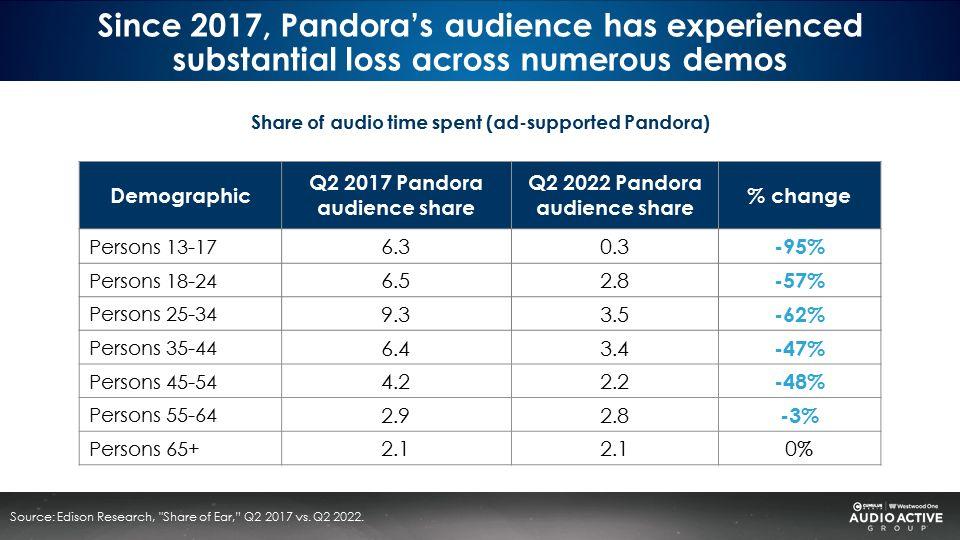

Pandora’s stunning audience erosion is another reason for the disconnect between advertiser perceptions and actual audio shares

Pandora’s shares used to be a lot larger than they are today. Compared to five years ago, Pandora audience shares have suffered devastating losses.

Compared to Q2 2017, Pandora’s current Q2 2022 audience shares are down 60%-95% among persons 13-34 and have plummeted 47%-48% among persons 35-54. Once upon a time Pandora had modest audiences. No longer. Advertiser perceptions of Pandora’s audience have not caught up to current realities.

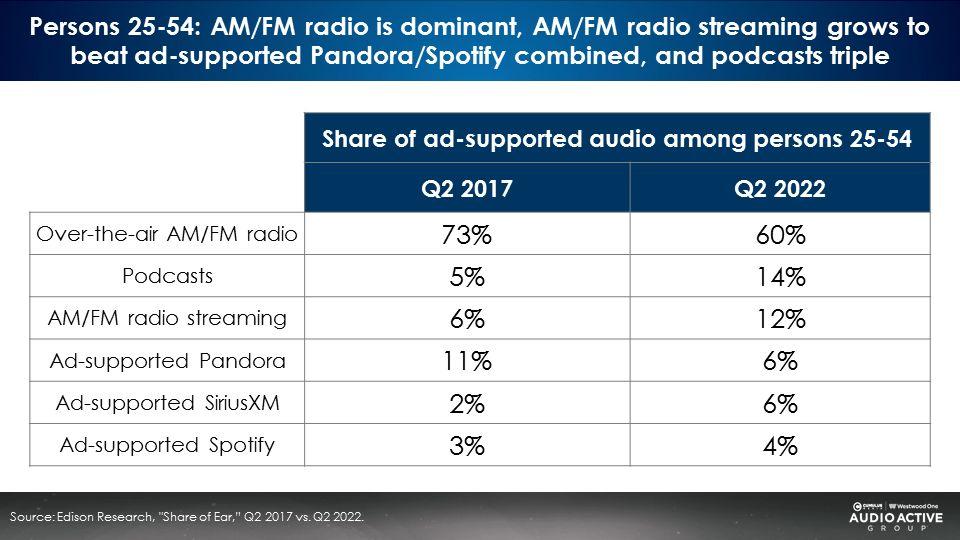

2017 versus 2022: Podcasts triple and AM/FM radio streaming doubles in share, beating Pandora two to one

A comparison of persons 25-54 ad-supported audio shares from Q2 2017 to Q2 2022 reveals surprising trends:

- Podcast shares have nearly tripled from 5% in 2017 to 14% today. Podcasts are the fastest growing audio platform. Number two is AM/FM radio streaming.

- AM/FM radio streaming shares have doubled from a 6% share in 2017 to a 12% share today.

- AM/FM streaming now beats Pandora two to one (12% to 6%). The roles have reversed. Back in 2017, it was Pandora that beat AM/FM radio streaming by nearly two to one in share (11% to 6%).

- Spotify shares are small and stagnant.

- AM/FM radio’s total share (over-the-air plus streaming) is dominant at a 72%, slightly down from 2017 (79%).

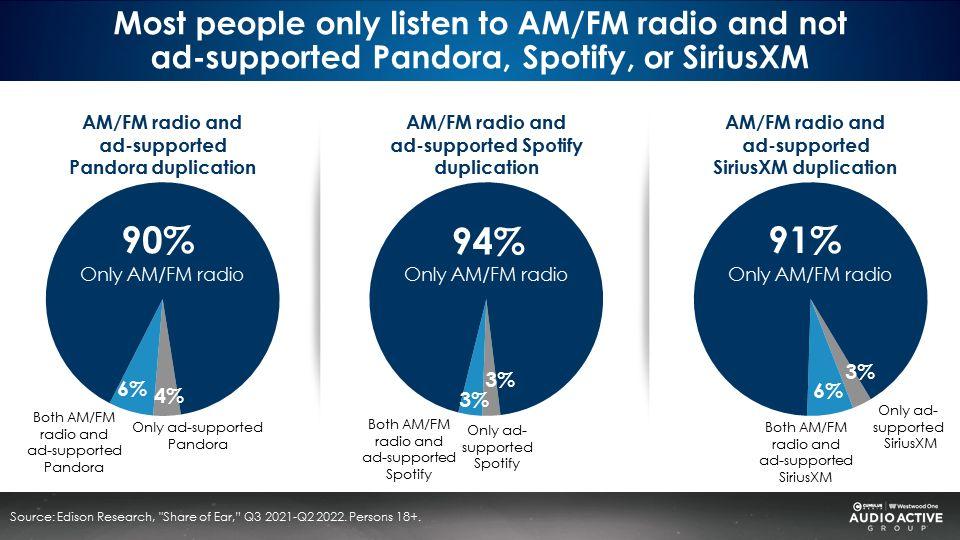

In a typical day, most Americans only listen to AM/FM radio while few listen to Pandora, Spotify, or SiriusXM

- 90% only listen to AM/FM radio and do not listen to ad-supported Pandora.

- 94% only listen to AM/FM radio and do not listen to ad-supported Spotify.

- 91% only listen to AM/FM radio and do not listen to ad-supported SiriusXM.

There are few exclusive listeners of Spotify, Pandora, or SiriusXM. Only 3%-4% of daily listeners only listen to Pandora, Spotify, or SiriusXM and do not listen to AM/FM radio. On the other hand, a strong AM/FM radio schedule will reach half to two-thirds of Pandora, Spotify, and SiriusXM audiences at no extra cost.

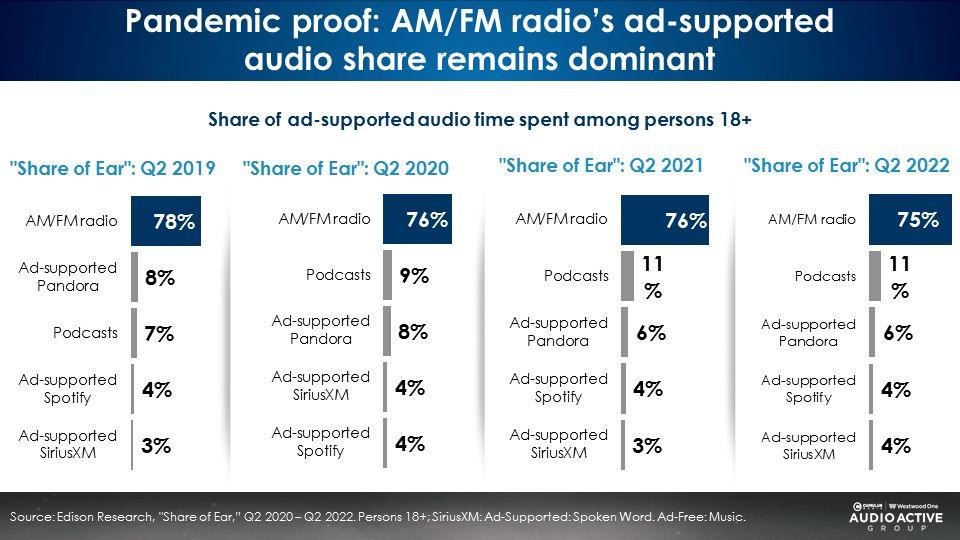

Audio shares are pandemic proof revealing little change before, during, and after the pandemic

Many have wondered if the pandemic shifted audio usage patterns. Overall, ad-supported shares are remarkably consistent from Q2 2019 to Q2 2022. AM/FM radio is stable and dominant. Podcasts are up. Pandora is down. For the most part, a very stable trend.

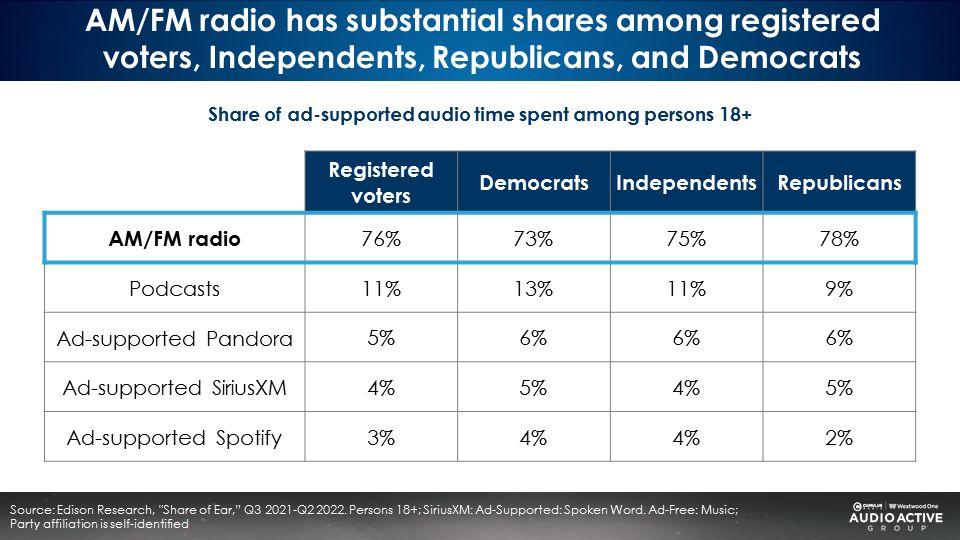

For political campaigns, AM/FM radio is the best audio platform to reach voters

Among registered voters and across the entire political spectrum, AM/FM radio is the dominant ad-supported option with shares in the mid-70s, according to the Q2 2022 “Share of Ear.” Podcast shares surpass the combination of ad-supported Spotify and Pandora.

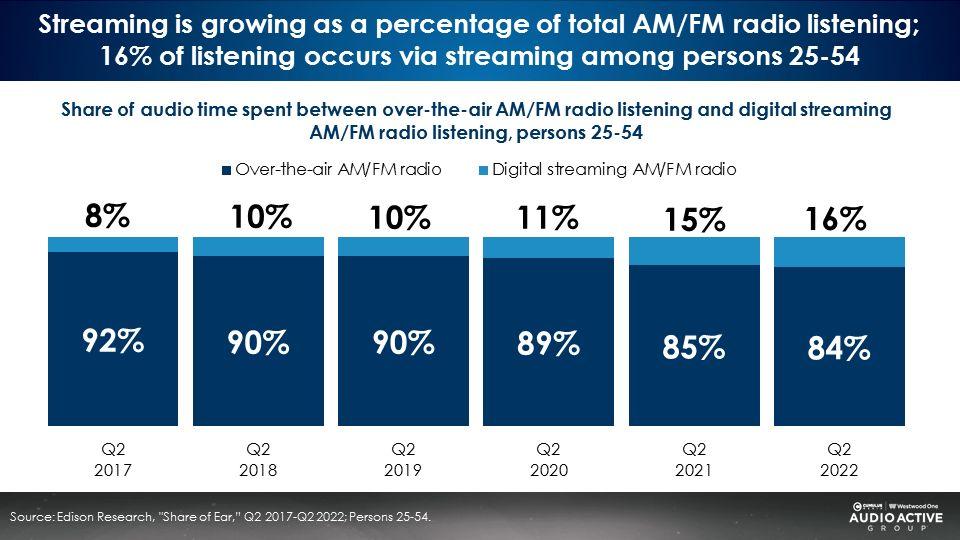

AM/FM radio streaming hits a record high representing 16% of all AM/FM radio listening

Among 25-54s, AM/FM radio streaming now accounts for 16% of total AM/FM radio listening. The share of total AM/FM radio listening occurring via the stream has doubled in the last five years (8% to 16%).

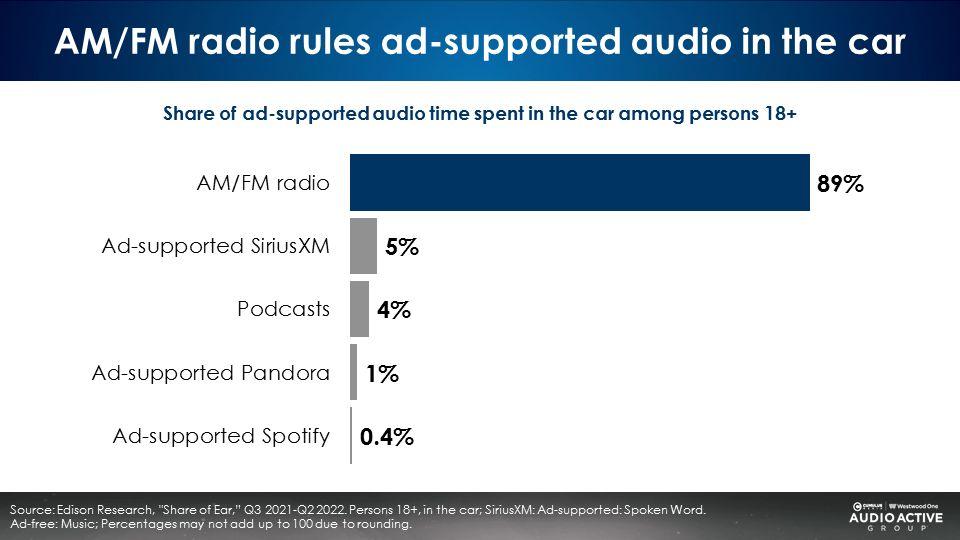

AM/FM radio is the “queen of the road” with a stunning 89% share of ad-supported audio in the car

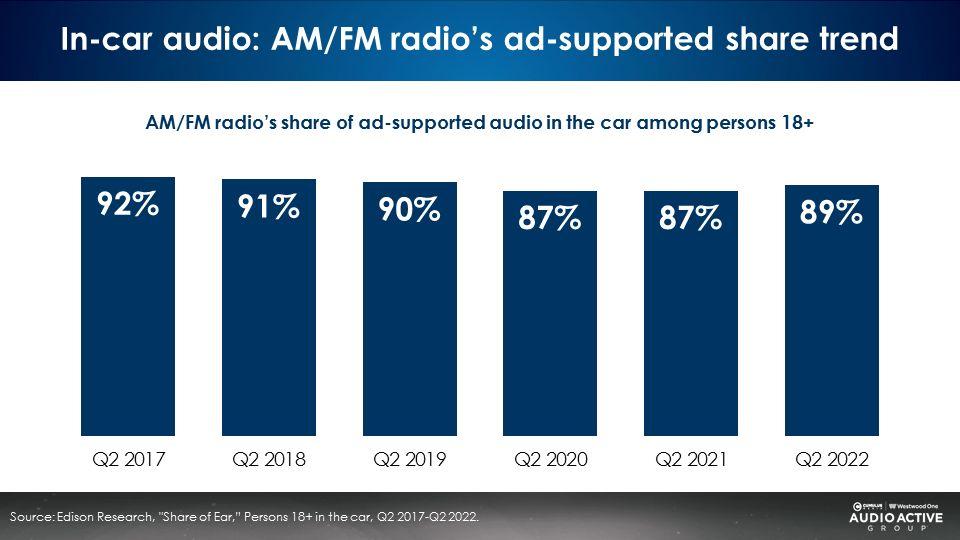

AM/FM radio’s dominant in-car ad-supported shares have been rock steady over the past six years

Key takeaways:

- Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

- “Share of Ear” data proves that advertisers are not taking the “me” out of media

- Pandora’s stunning audience erosion is another reason for the disconnect between advertiser perceptions and actual audio shares

- 2017 versus 2022: Podcasts triple and AM/FM radio streaming doubles in share, beating Pandora two to one

- In a typical day, most Americans only listen to AM/FM radio while few listen to Pandora, Spotify, or SiriusXM

- Audio shares are pandemic proof revealing little change before, during, and after the pandemic

- For political campaigns, AM/FM radio is the best audio platform to reach voters

- AM/FM radio streaming hits a record high representing 16% of all AM/FM radio listening

- AM/FM radio is the “queen of the road” with a stunning 89% share of ad-supported audio in the car

- AM/FM radio’s dominant in-car ad-supported shares have been rock steady over the past six years

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.