New Studies: AM/FM Radio Is Ideal For Tax Preparation Services As AM/FM Radio Listeners Spend More Than TV Viewers; AM/FM Radio Campaigns Generate Massive Surge In Site Traffic

Click here to view a 12-minute video of the key findings.

Two new studies measuring national AM/FM radio campaigns for the recently completed 2022 tax season reveal AM/FM radio is the ideal media platform for tax preparation services and generates significant impact.

Signal Hill Insights tax preparation services brand study

The Cumulus Media | Westwood One Audio Active Group® commissioned Signal Hill Insights to conduct a MARU/Matchbox national brand study of 1,000 Americans 18+. The study was conducted April 19-22, 2022, immediately following the deadline for filing tax returns for the 2021 tax year. Comparisons were made with a similar study conducted in September 2020, three months after the July 2020 filing deadline.

LeadsRx site and search attribution study

The Cumulus Media | Westwood One Audio Active Group® also partnered with LeadsRx to study how AM/FM radio impacted a tax preparation service’s brand search and site traffic during their Q1 2022 AM/FM radio campaign. The study took place January 10 through March 6, 2022.

The AM/FM radio campaign occurrence data of all ads run was obtained from Media Monitors. Advertising occurrences in each market were matched to minute-level geo-fenced website data to determine lift in online behavior to specific touchpoints as a result of the campaign.

The AM/FM radio campaign featured pre-recorded 30-second ads. The study examined site attribution for all AM/FM radio ads run during the campaign regardless of media vendor. Nielsen Audio audience estimates were used to provide impressions based on adults 18+ from all AM/FM radio ad occurrences campaigns.

Here are the key findings:

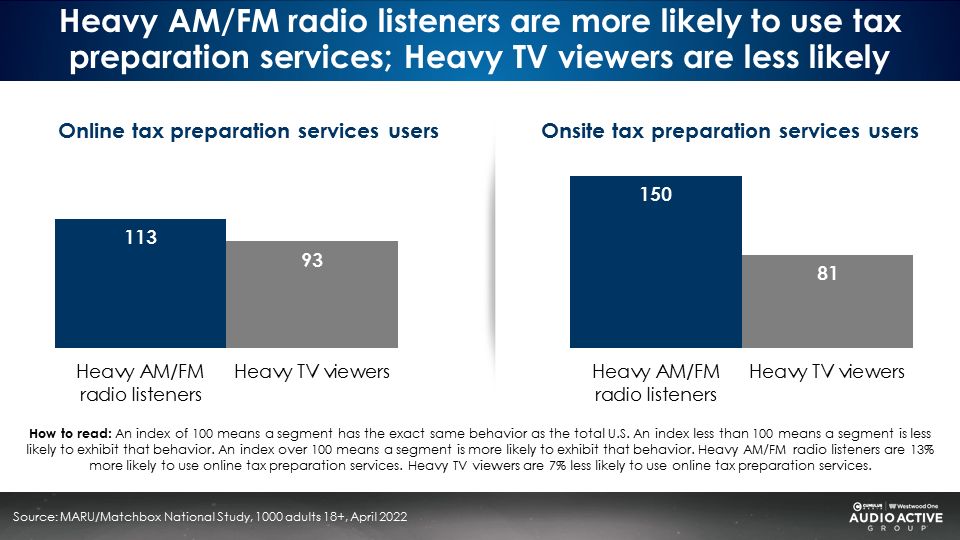

Compared to heavy TV viewers, heavy AM/FM radio listeners are more likely to use tax preparation services (onsite or online) and spend more than TV viewers

Since AM/FM radio listeners are bigger category users and spend more, AM/FM radio advertising can build stronger awareness, consideration, and sales effect for tax preparation services.

Compared to TV, AM/FM radio listeners are 22% more likely to use online tax preparation services (AM/FM radio’s 113 index versus TV’s 93 index).

AM/FM radio listeners are 85% more likely to use onsite tax preparation services compared to TV viewers (AM/FM radio’s 150 index versus TV’s 81 index).

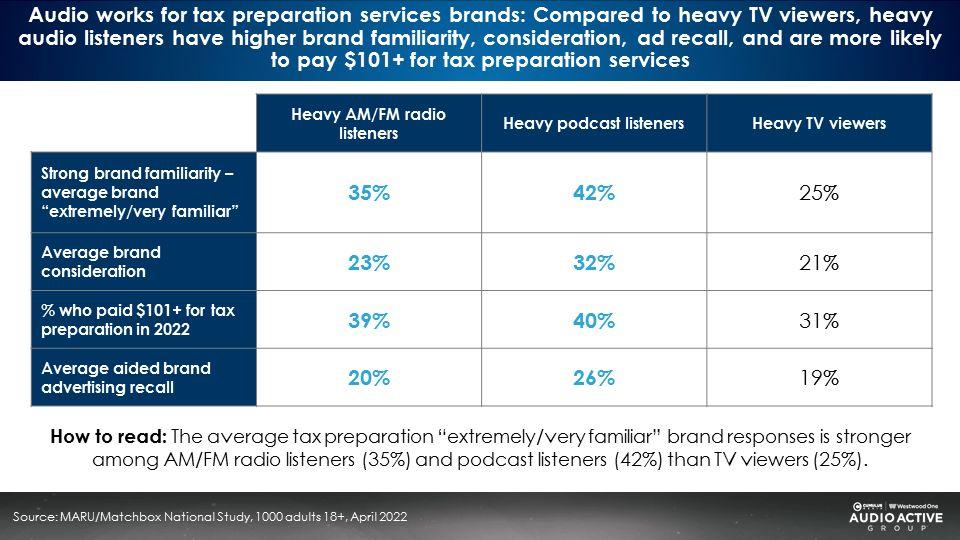

Compared to TV viewers, audio listeners have higher brand familiarity, consideration, and advertising recall with tax preparation services

- Among heavy TV viewers, the average tax preparation brand familiarity is 25%, much lower than among heavy podcast listeners (42%) and heavy AM/FM radio listeners (35%).

- Brand consideration is weaker among heavy TV viewers (21%) than among podcast listeners (32%) and heavy AM/FM radio listeners (23%).

- Tax preparation advertising recall is greater among audio listeners than among TV viewers.

Despite all the money tax preparation brands spend on TV, it is astonishing how low brand awareness, brand consideration, and ad recall is among TV viewers. No matter how much money is spent on TV, the results will disappoint because TV viewers have such little interest and engagement with tax preparation services.

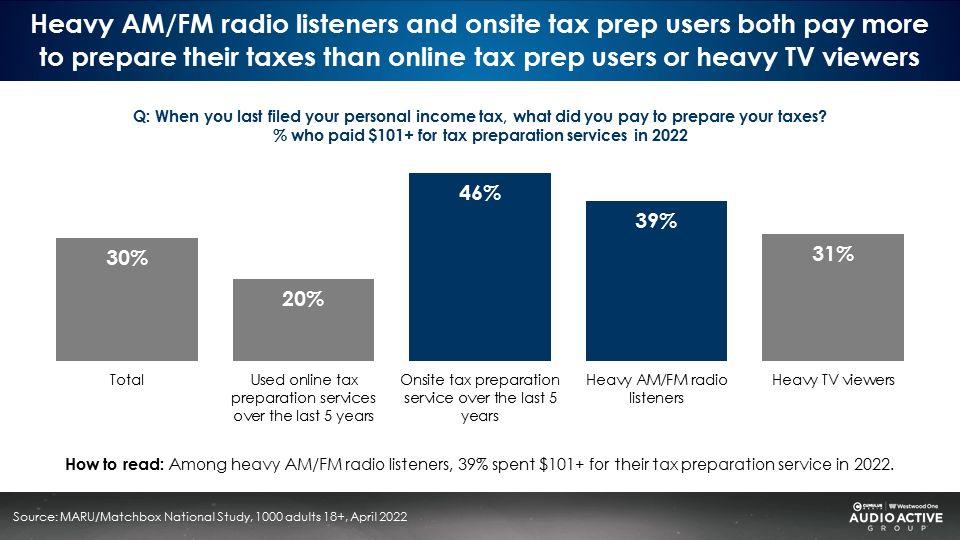

Compared to the TV audience, AM/FM radio listeners spend more to submit their taxes

AM/FM radio listeners are 26% more likely than TV viewers to have paid $101+ to prepare their taxes in the past tax season (39% heavy AM/FM radio listeners versus 31% heavy TV viewers).

Be known before you are needed: Familiarity drives brand consideration

Hurman explains:

“Create Future Demand – advertising to that much larger group of consumers who are not in the market, who are not ready to buy now, but will be in the future, and making them feel familiar with and positively toward us, so that they gravitate to us when they enter the category.

Creating Future Demand is most efficiently achieved by targeting very broad audiences of ‘all category buyers’ with emotional messaging that is designed to stand out and be enjoyed by consumers, creating positive memories of our brand that will influence future purchase decisions.”

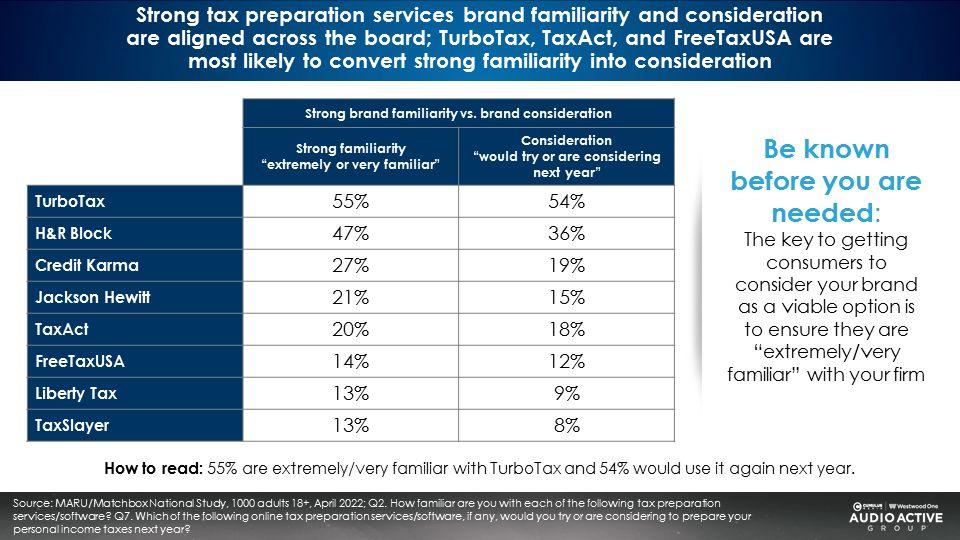

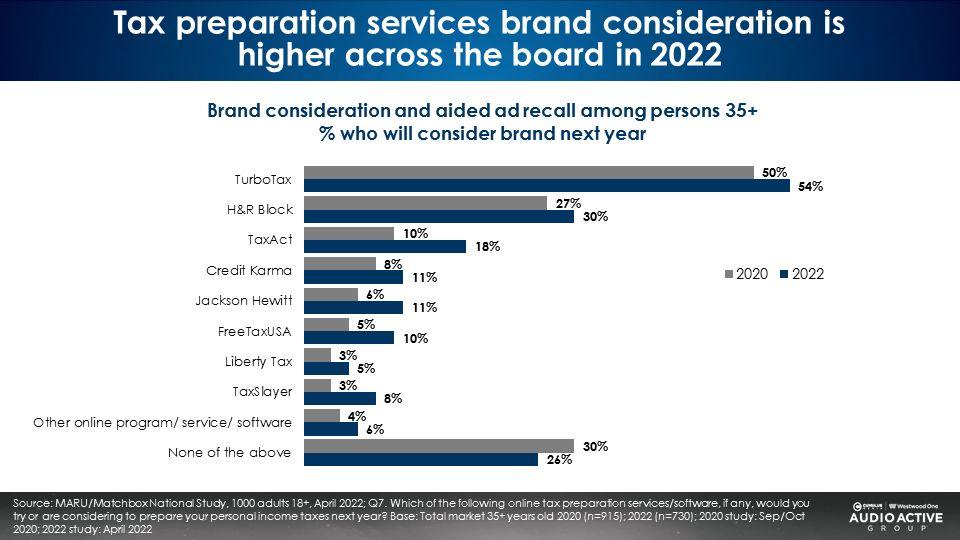

The Signal Hill Insights study revealed the size of brand familiarity for tax preparation services was very close to the magnitude of the brand consideration. Thus, 55% of Americans say they are “extremely or very familiar” with TurboTax and 54% “would try or are considering” TurboTax next year.

The greater the brand familiarity, the more people would consider using that brand. The key to getting prospects to consider your brand as a viable option is to ensure people are “extremely or very familiar” with your brand.

That’s the job of advertising – to create future demand for your brand. As advertising expert and author Spike Santee says, advertisers need to “be known before you’re needed.”

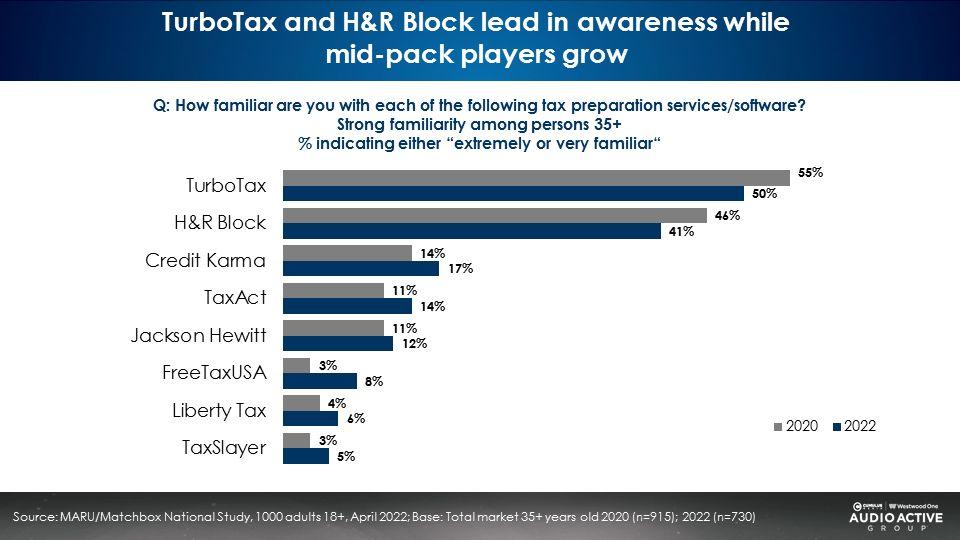

TurboTax and H&R Block lead in awareness while mid-pack players grow

Versus 2020, Credit Karma, TaxAct, Jackson Hewitt, FreeTaxUSA, Liberty Tax, and TaxSlayer saw familiarity growth.

Brand consideration grows for mid-pack tax preparation services

Consumers were asked, “Which of the following tax preparation services or software, if any, would you try or are considering to prepare your personal income taxes next year?” Fueled by familiarity growth, brand consideration for most brands outside the top two grew more.

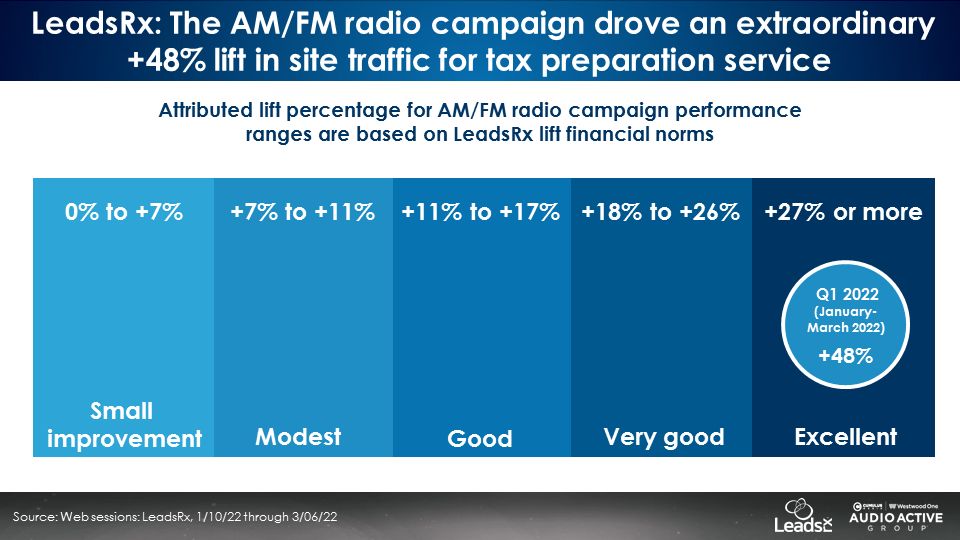

LeadsRx: The AM/FM radio campaign drove an extraordinary +48% increase in site traffic for a tax preparation services brand

LeadsRx considers site traffic increases of +27% or greater as “excellent.” A Q1 2022 national AM/FM radio campaign for a tax preparation services brand generated an eye-popping +48% increase in site traffic.

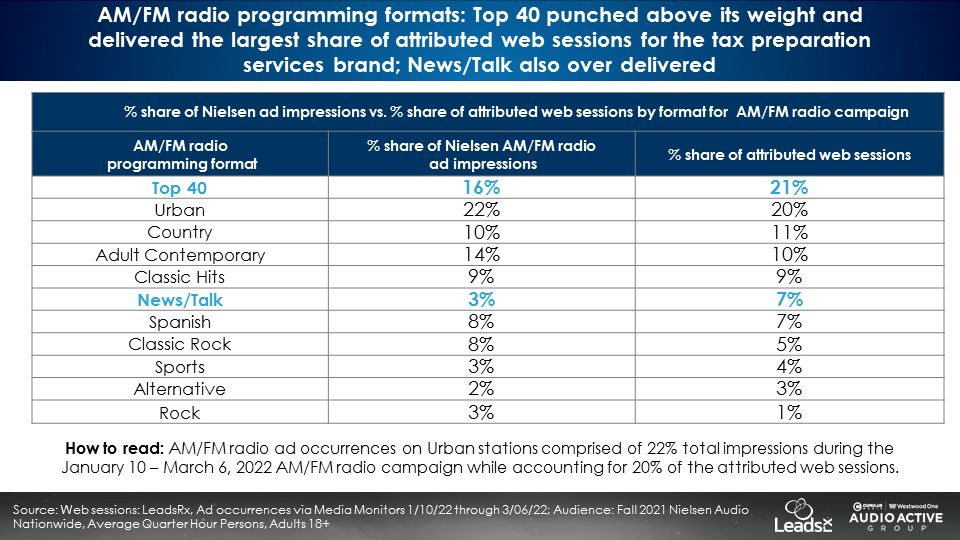

A wide variety of AM/FM radio programming formats generated attributed web sessions for the tax preparation brand

The smartest AM/FM radio buy utilizes a wide and diverse mix of AM/FM radio programming formats. Since reach is the most important media sales driver, using a wide array of formats is the best way to optimize for reach.

LeadsRx found the share of attributed web sessions lined up nicely with the shares of campaign impressions by AM/FM radio format. Top 40 and News/Talk over delivered web sessions.

Key takeaways:

- Compared to heavy TV viewers, heavy AM/FM radio listeners are more likely to use tax preparation services (onsite or online) and spend more than TV viewers. Since AM/FM radio listeners are bigger category users and spend more, AM/FM radio advertising can build stronger awareness, consideration, and sales effect.

- TurboTax and H&R Block continue to be the dominant players but here come the challengers. Jackson Hewitt, TaxAct, Credit Karma, and Liberty Tax have grown brand equity (awareness, consideration, and ad recall).

- “Be known before you are needed”: Strong familiarity (“extremely/very familiar”) drives brand consideration. Familiarity and consideration are aligned across the board.

- Audio works for tax preparation services brands. Compared to heavy TV viewers, heavy audio listeners have higher brand familiarity, consideration, ad recall, and are more likely to pay $101+ for tax preparation services.

- AM/FM radio drove an astonishing +48% site traffic lift for tax preparation services as measured by LeadsRx.

- Search and site traffic by programming format mirrored media weight. The composition of search and site traffic by AM/FM radio programming format was generally similar to format media allocations. Both Top 40 and News/Talk delivered a greater share of site traffic lift versus their share of impressions.

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.