New Online Sports Betting Study: AM/FM Radio Listeners Show Significantly More Interest and Engagement Than TV Viewers

Click here to view a 13-minute video of the key findings.

The Cumulus Media | Westwood One Audio Active Group® commissioned MARU/Matchbox to conduct a national brand awareness study of online sports betting brands. 1,252 adults 21+ were surveyed in February 2022. 483 respondents were from states that have legalized sports betting and 769 respondents were from states that have not. The findings were compared to prior studies that were conducted in April and October 2021.

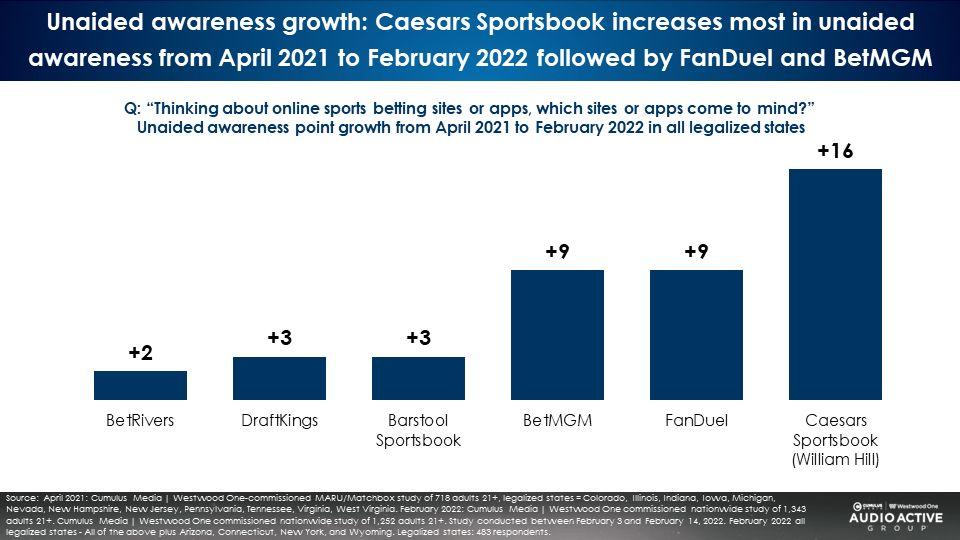

Powered by their iconic “Caesar character,” Caesars Sportsbook soars in awareness; FanDuel and BetMGM also show growth

On an unaided basis, consumers were asked the name of all the online sports betting brands they could think of.

The online sports betting brands that saw the largest unaided awareness growth in states with legalized betting were most major casino brands or existing fantasy sports platforms. Fueled by a major promotional push with their funny and entertaining “Caesar character,” Caesars Sportsbook grew dramatically with a 16-point increase in unaided awareness from April 2021 to February 2022.

FanDuel and BetMGM each saw their unaided awareness grow by nine points. DraftKings and Barstool Sportsbook increased by three points and BetRivers grew by two points.

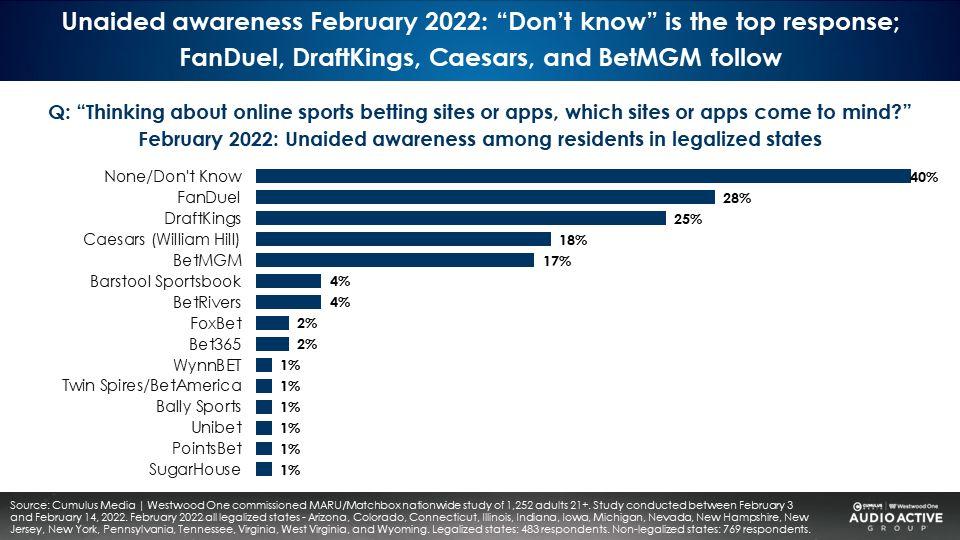

Perceptions are like glaciers – slow to form and slow to melt. Despite all of the marketing activity in the category, “don’t know” is the leading awareness brand response among consumers in legalized states. Next are FanDuel (28%) and DraftKings (25%), followed by Caesars (18%) and BetMGM (17%).

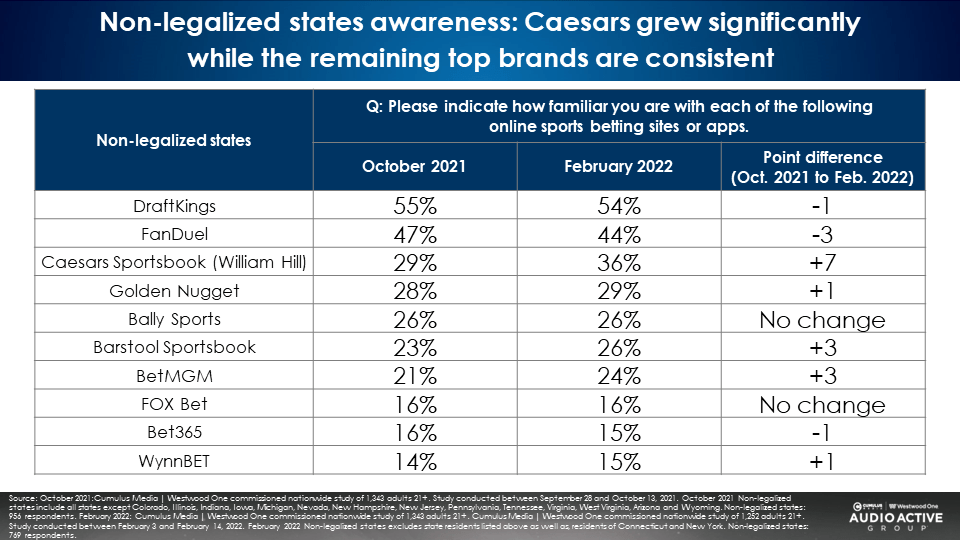

In non-legalized states, the same five online sports betting brands top the awareness rankings

The job of advertising is to help brands “become known, before they are needed.” As such, it is important to study brand equity in the rest of the country where sports betting has yet to be legalized.

In areas of the country where online sports betting has not yet been legalized, total aided brand awareness levels are weaker by as much as 20% to 30%. The aided awareness rank position is very similar.

DraftKings and FanDuel are in the top tier of aided brand awareness. In the second tier are Caesars Sportsbook, Golden Nugget, and Bally Sports. The third tier consists of Barstool Sportsbook and BetMGM. Caesars shows the strongest increase with a 7-point growth in aided awareness in non-legalized states.

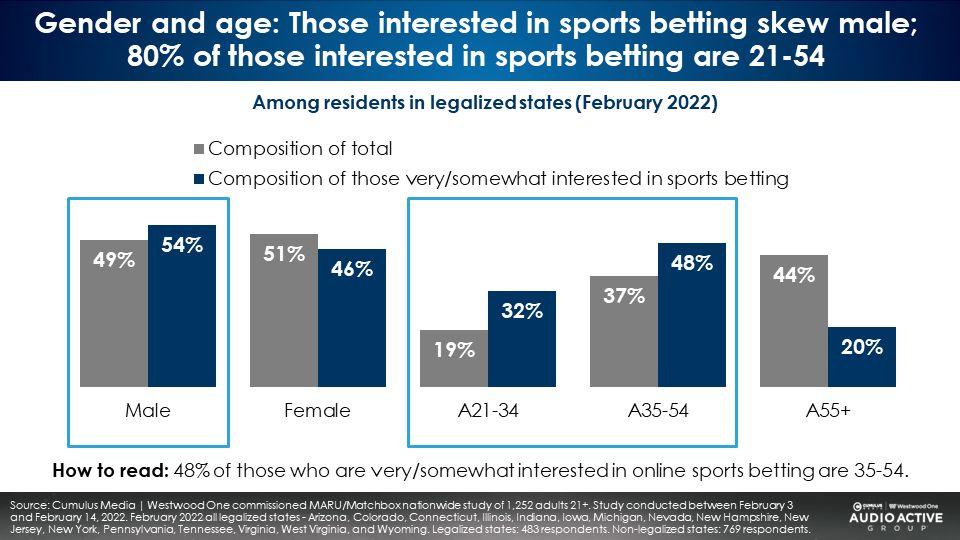

The most important online sports betting target demographic are adults 35-54 followed by adults 21-34

Nearly half of those most interested in online sports betting are adults 35-54 (48%) followed by adults 21-34 (32%). 80% of the online sports betting category are adults 21-54.

The proportion of those over the age of 55 who are interested in online sports betting is still small but is growing. A year ago, only 13% of those interested in online sports betting were 55+. Today it is 20%.

Women are becoming more interested in online sports betting

A year ago, those interested in online sports betting skewed male (65%) versus female (35%). Today, the gender profile of those interested is more evenly distributed by gender (men 54% vs. women 46%).

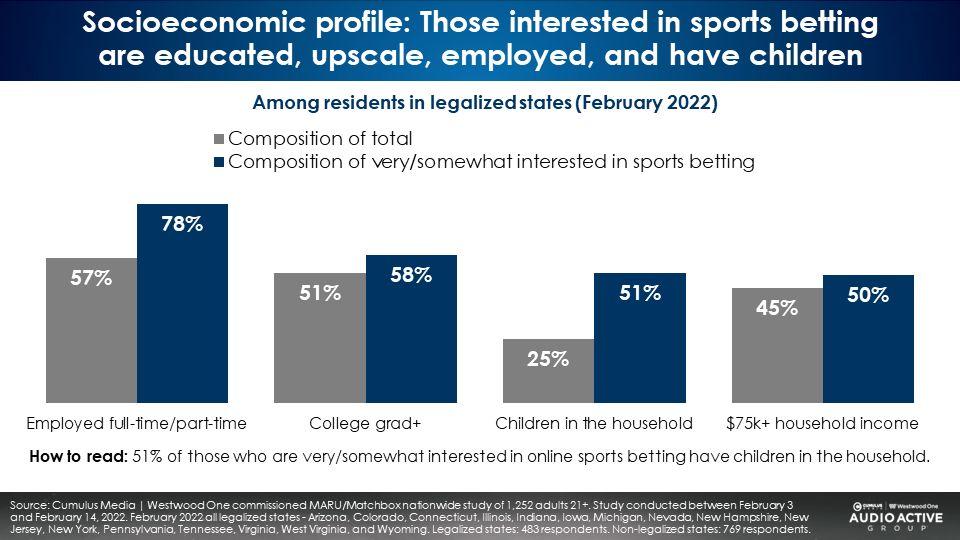

Those interested in online sports betting are married, educated, employed, upscale, and have children

This is not the stereotype of single 18-34 Millennials. These are full-time employed adults with kids. Given that the core demo of online sports betting is 35-54, the “married with kids and a job” profile makes perfect sense.

Compared to TV viewers, AM/FM radio listeners have far more experience with and interest in online sports betting and greater awareness of online sports betting brands

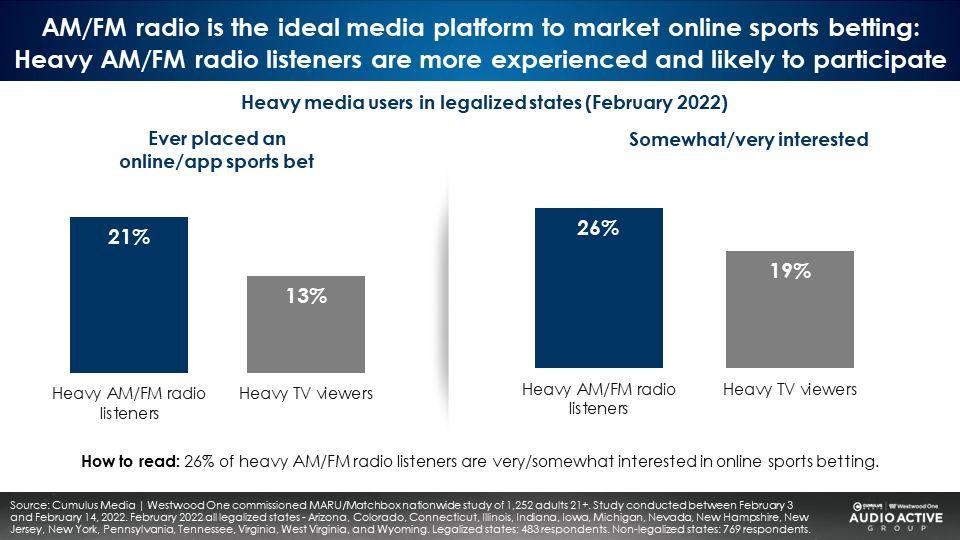

Across states with legalized sports betting, MARU/Matchbox finds more online sports betting engagement among AM/FM radio listeners:

- More AM/FM radio listeners (21%) have ever placed an online sports bet versus TV viewers (13%).

- More AM/FM radio listeners (26%) say they are very/somewhat interested in online sports betting versus TV viewers (19%).

- More AM/FM radio listeners can name an online sports betting brand compared to TV viewers. This is shocking considering that the vast majority of online sports brand advertising runs on TV. For every dollar spent on AM/FM radio, twenty-four dollars are spent on TV, according to Kantar.

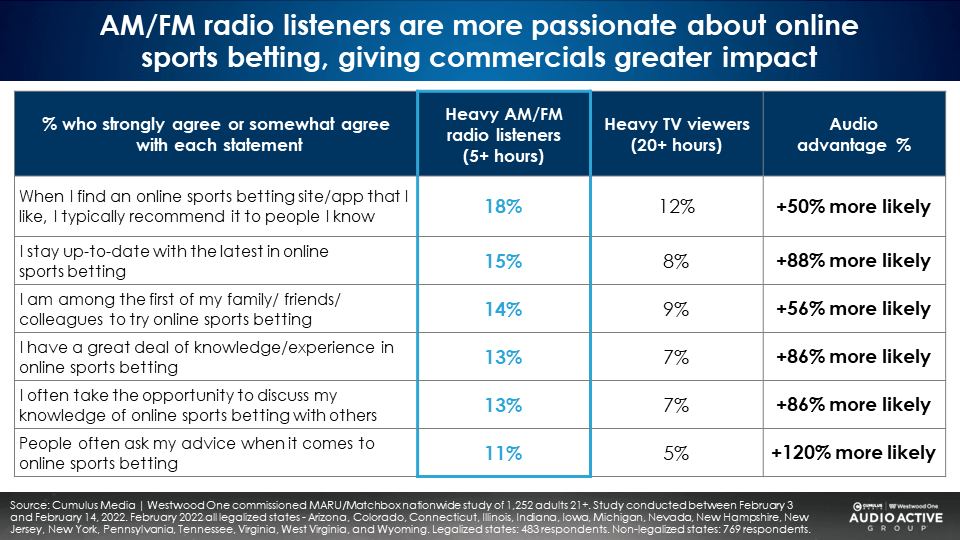

Compared to TV viewers, AM/FM radio listeners are far more engaged with online sports betting

Across six different measures of online sports betting passion, AM/FM radio listeners are twice as engaged as TV viewers.

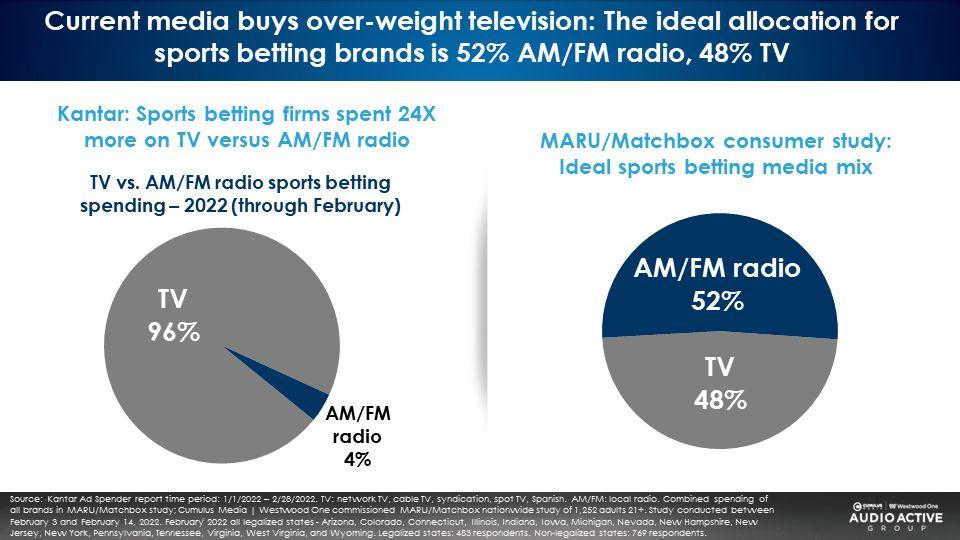

Based on media habits of online sports betting intenders, the ideal media allocation is 52% AM/FM radio and 48% TV

A comparison of Kantar Media spend and the MARU/Matchbox study reveals the current TV buys are massively overspent as TV viewers show less interest in online sports betting. It is a major miscalculation for current online sports betting media plans to have so little weight allocated to AM/FM radio.

Kantar Media spending reveals 96% of online sports betting AM/FM radio/TV spend goes to TV. Only 4% goes to AM/FM radio. The MARU/Matchbox analysis of media use among online sports betting intenders reveals the optimal allocation is 52% AM/FM radio and 48% TV.

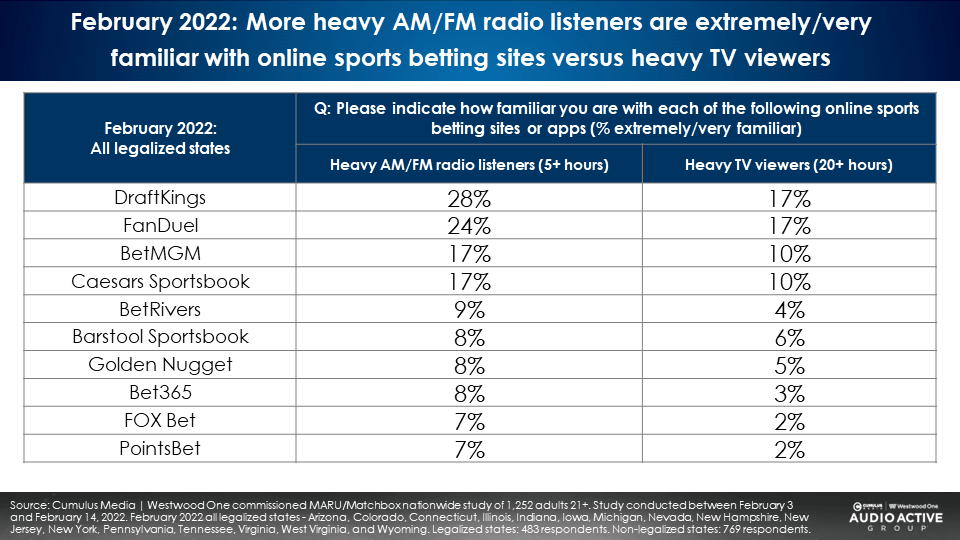

Compared to TV viewers, AM/FM radio listeners are more aware of online sports brands

Despite the fact that most advertising for online sports betting runs on TV, AM/FM radio listeners are more aware of sports betting brands in legalized states. Why? Compared to older TV viewers, AM/FM radio listeners are more engaged, interested, and more likely to participate in online sports betting.

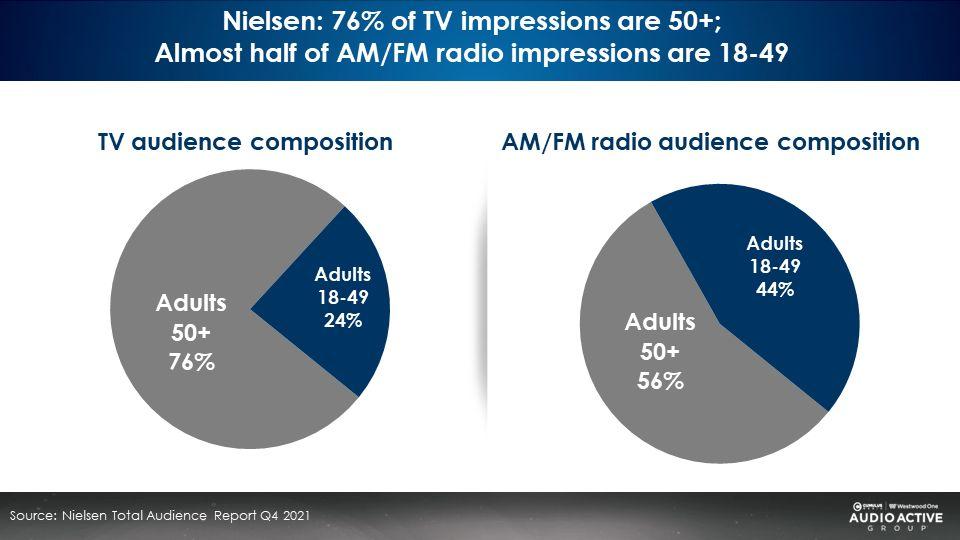

TV is not an ideal platform to market online sports betting as the vast majority of those interested in sports betting are under the age of 50; Most TV viewers are 50+

80% of those most interested in online sports betting are adults 21-54. Per Nielsen, only 24% of linear TV audiences are under the age of 50. In contrast, 44% of AM/FM radio listeners are under the age of 50.

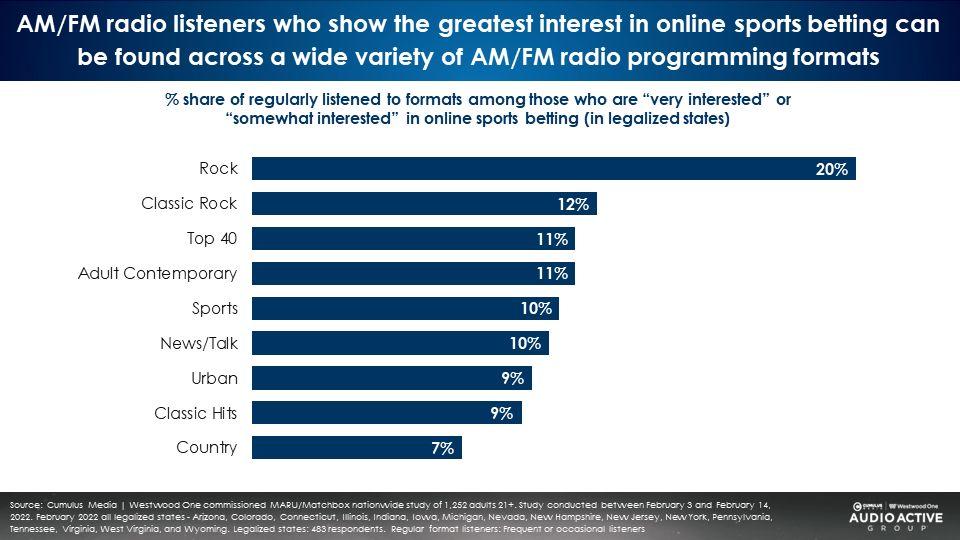

AM/FM radio listeners who show the greatest interest in online sports betting can be found across a wide variety of AM/FM radio programming formats

The Rock programming format has a 20% share of those most engaged with online sports betting. After that, each format has between 7% to 12% of the in-market consumers. It would be a mistake for a brand to place a lot of their money into Sports Talk as 90% of online sports betting intenders are found outside the Sports radio format.

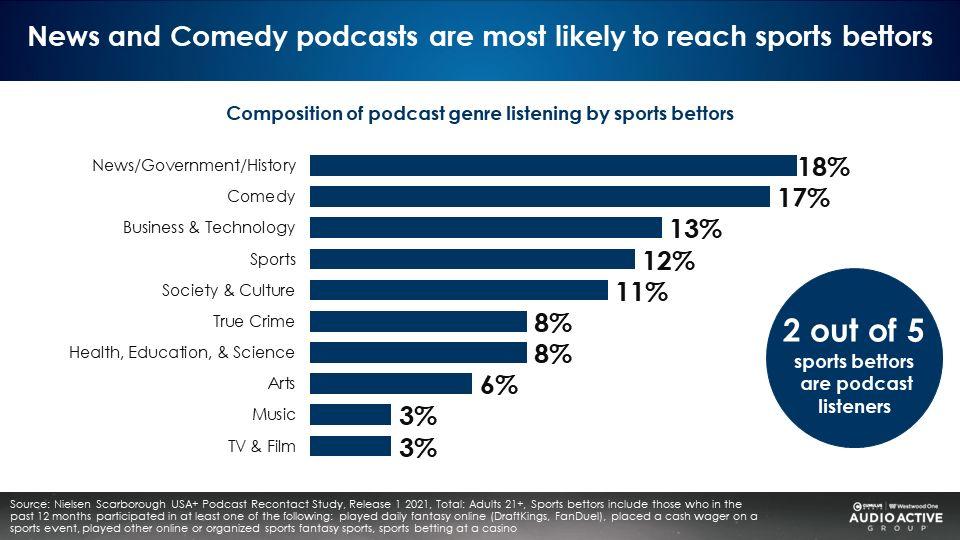

Podcast listeners are 64% more likely to be sports bettors; Online sports betting intenders can be found across a wide variety of podcast genres

Nielsen Scarborough reports that 18% of podcast listeners are online sports bettors, 64% greater than the total U.S. (11%). Nielsen reveals that sports bettors listen to a broad and diverse set of podcast genres.

Key takeaways and recommendations:

- The ideal target for online sports betting are adults 35-54 who are married, have kids, and work full time. Nearly half of those most interested in online sports betting are adults 35-54 (48%). Women are becoming more interested in online sports betting. The gender profile of those interested is more evenly distributed (men 54% vs. women 46%).

- Based on media habits of online sports betting intenders, the optimal media allocation is 52% AM/FM radio and 48% TV. Compared to TV viewers, AM/FM radio listeners have far more experience with online sports betting, greater interest, greater awareness of, and greater engagement with online sports betting brands.

- The audio sports betting media plan should contain a wide array of AM/FM radio programming formats and podcast genres. Those interested in online sports betting listen to a broad array of podcast genres and AM/FM radio programming formats beyond just Sports programming. Audio media plans that focus mostly on spoken word (News/Talk and Sports) will miss the majority of those who are engaged with online sports betting. Based on AM/FM radio programming format preferences among those interested in online sports betting, the ideal allocation is 20% of impressions to Rock and then 10% each to the rest of the formats (Classic Rock, News/Talk, Sports, Classic Hits/Oldies, Country, Top 40, Urban, and Adult Contemporary).

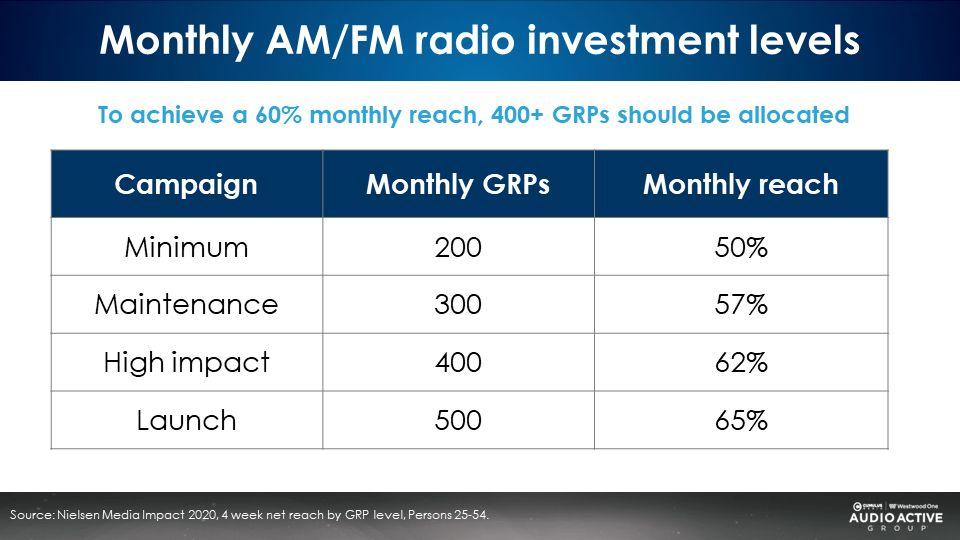

- Audio media plans should emphasize reach over frequency and increase weight to reach 60% of the market. Recent monthly AM/FM radio plans are only reaching 38% of the market. Brands should seek to reach at least 60% of the market each month. Here are the monthly AM/FM radio GRP investment levels and the market reach achieved:

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.