How Auto Dealer Advertising Works And The Looming Disappearance Of TV Audiences

Click here to view a 19-minute video of the key findings.

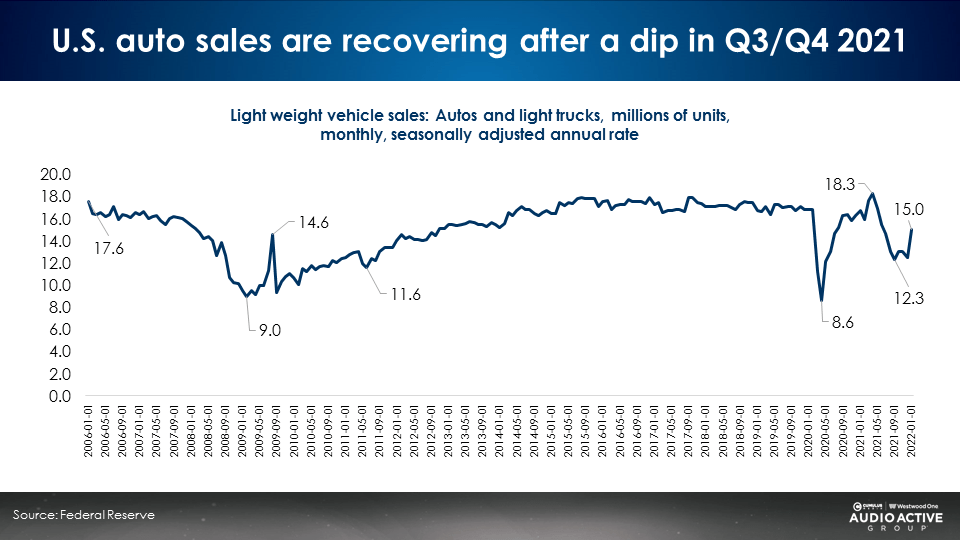

As the U.S. continues its emergence from the pandemic, the Federal Reserve finds auto sales are recovering. In January of this year, the seasonally adjusted annual rate (SAAR) was 15 million vehicles, up from a dip in Q3 and Q4 2021. Cox Automotive forecasts a total of 16 million vehicles sold for 2022. Americans are spending and the time for auto dealers to advertise is now.

But how long does it take for advertising to work? If a dealership runs ads this month, how long will it take to see the impact?

Many auto dealers feel the vast majority of this month’s advertising impacts this month. When confronted by a lack of auto inventory, many dealers pulled back on advertising. They reasoned, “Why advertise when I don’t have the inventory?” The implication is, “Every dollar I spend this month will bring people to my dealer just this month.”

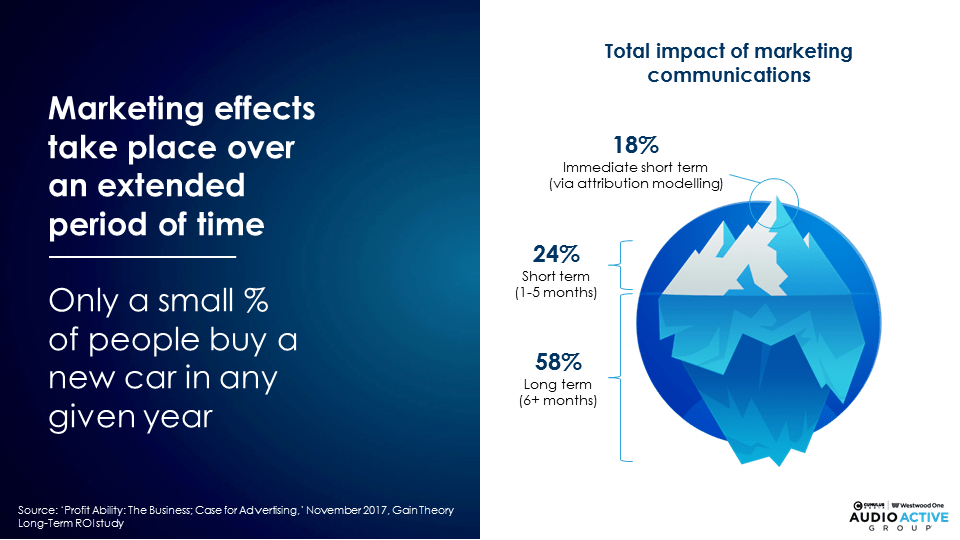

How long does it take for advertising to work? Surprisingly, quite a bit of time: 58% of this month’s advertising impacts in 6+ months

There are a number of major firms that study how advertising works and what generates results. These marketing effectiveness measurement firms are called “marketing mix modelers.” They examine all marketing investments and the impact on sales.

A firm called Gain Theory conducted a major report called Profit Ability: The Business Case For Advertising. One of the most significant findings was how long it takes for spending today to create impact. There are three numbers to remember: 18, 24, and 58.

- 18% of current marketing investments impact this month, measured via attribution modeling.

- 24% of this month’s advertising impact occurs in one to five months.

- 58% of this month’s advertising impact occurs in six months and beyond.

Most of the advertising occurring this month will impact six months, a year, or longer down the line. Why?

Not everybody reached is in the market this month. If 12% of U.S. households purchase a new vehicle in a typical year, only 1% will purchase this month.

Advertising is like taking care of a lawn. Most of the benefits of fertilizer and watering take place over an extended period of time, just like advertising.

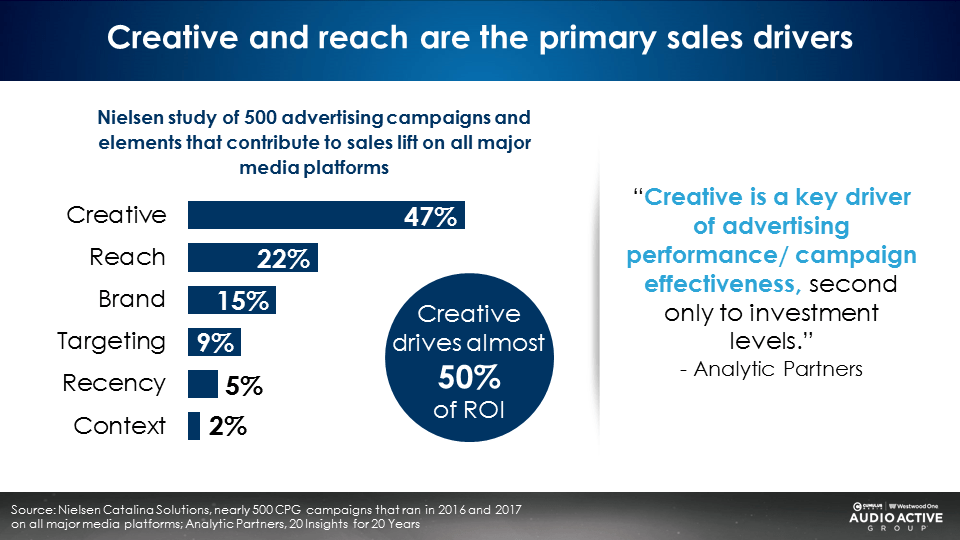

The “water and fertilizer” of advertising are creative and reach. These two major sales drivers have the biggest impact on success.

Creative and reach are the two biggest sales drivers

A major Nielsen sales effect study of 500 campaigns revealed half of all sales effect has to do with creative. 22% is due to reach. So creative and reach generate 69% of sales. Interestingly, despite all of the excitement and interest in targeting, it only contributes 9% of sales lift. Reach trumps targeting 2.1:1 (22% versus 9%).

Five question auto dealers should ask about their advertising creative:

- Are my ads memorable and do they make my dealership easy to recall?

- Do my ads create strong awareness and consideration?

- Are my ads just about price or do they create positive feelings and associations about my dealership?

- Do consumers feel my broad reach ads are interesting and enjoyable?

- Do people feel my targeted ads are relevant and useful?

The looming disappearance of TV audiences: Midterm elections and advertising-free streaming

Spending for each election cycle keeps setting records. The upcoming midterm spending forecasts are massive.

A Nielsen analysis finds one of every three ads on local TV are political in the run-up to an election. This means dealers will be shut out of local video platforms like local cable, broadcast TV, YouTube, and connected TV.

On top of the political cycles, Nielsen reports significant erosion in the supply of GRPs as audiences abandon linear TV for advertising-free video streaming.

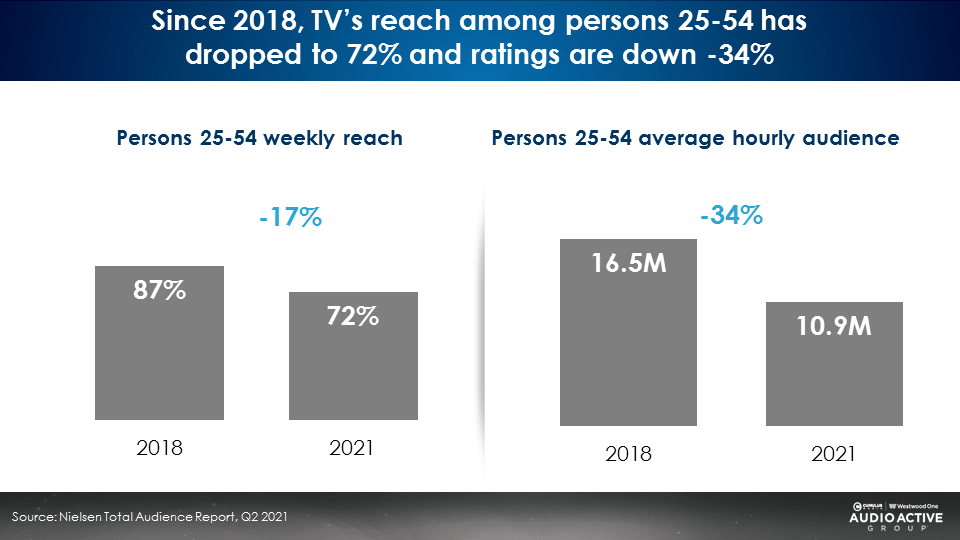

Nielsen: Since 2018, TV reach has dropped to 72% and ratings are down -34%

Nielsen’s Total Audience Report reveals:

- Over one-fourth of persons 25-54 are not reached by linear TV in a typical week.

- One-third of persons 18-49 do not watch linear TV.

- GRPs and impressions among persons 25-54 are down -34% since 2018.

Cord cutting is a major driver of TV’s audience collapse

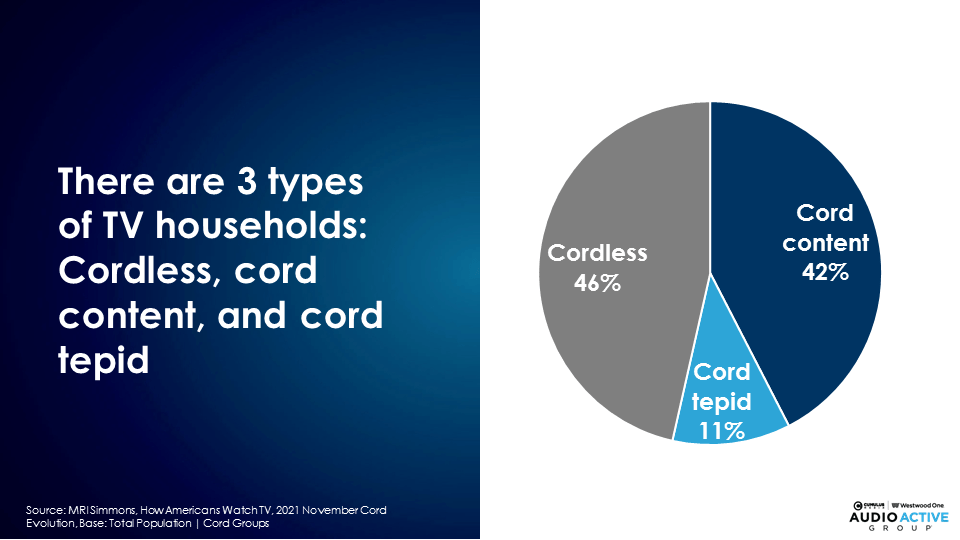

The MRI Simmons How Americans Watch TV report reveals 46% of the U.S. have cut the cord. Another 11% are “cord tepid,” meaning they have cut back on their cable TV package or are contemplating “cord shaving.” Only 42% of Americans are “cord content.”

Streaming is now “TV”: Half of Americans say streaming has replaced traditional TV

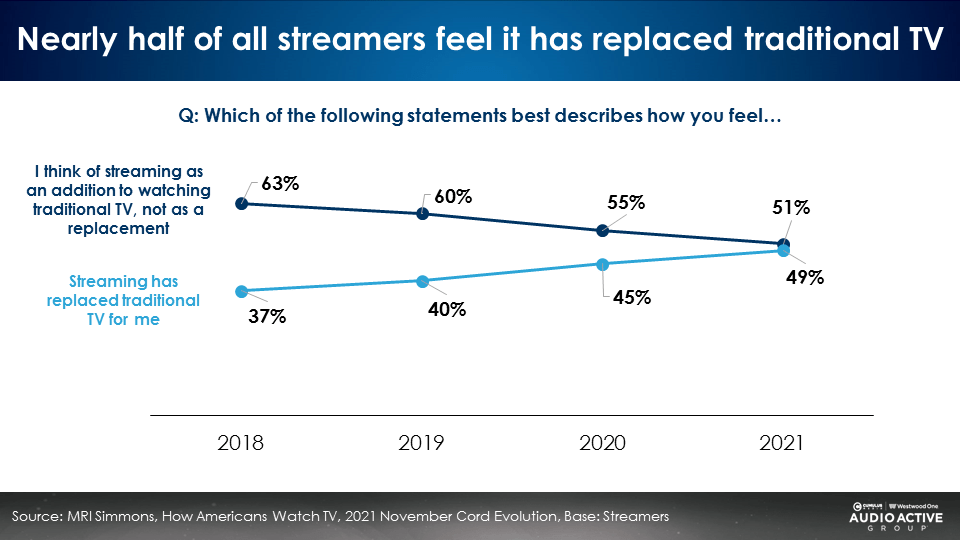

MRI Simmons finds a major shift has occurred in the American mindset about streaming. Once thought of as an “add on” to regular TV, streaming is increasingly seen as America’s primary television platform.

From 2018 to 2021, the number of video streamers who say “streaming has replaced traditional TV” has surged from 37% to 49%. The number of Americans who stream who perceive “streaming as an addition to TV rather than a replacement” dropped from 63% in 2018 to 51% in 2021.

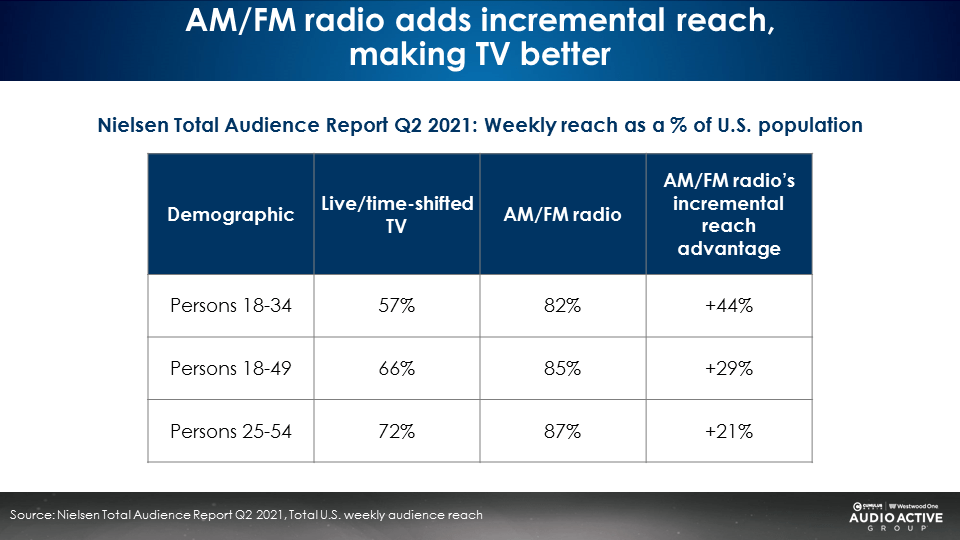

AM/FM radio adds incremental reach, making TV better

According to the latest Nielsen Total Audience Report, AM/FM radio outreaches live and time-shifted TV across every major demographic.

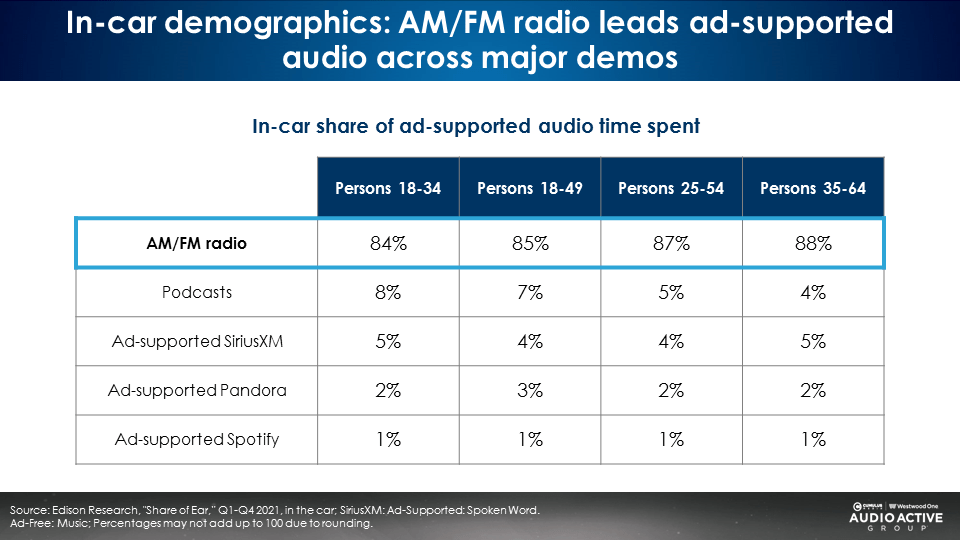

When it comes to ad-supported audio in the car, AM/FM radio is the “queen of the road” with shares in the mid to upper 80s across every buying demographic

The best place to get consumers thinking about their vehicle or an auto purchase is while they are in their car! AM/FM radio is the “queen of the road,” dominating the dashboard with massive in-car shares of ad-supported audio, according to the just-released Q4 2021 “Share of Ear” study from Edison Research.

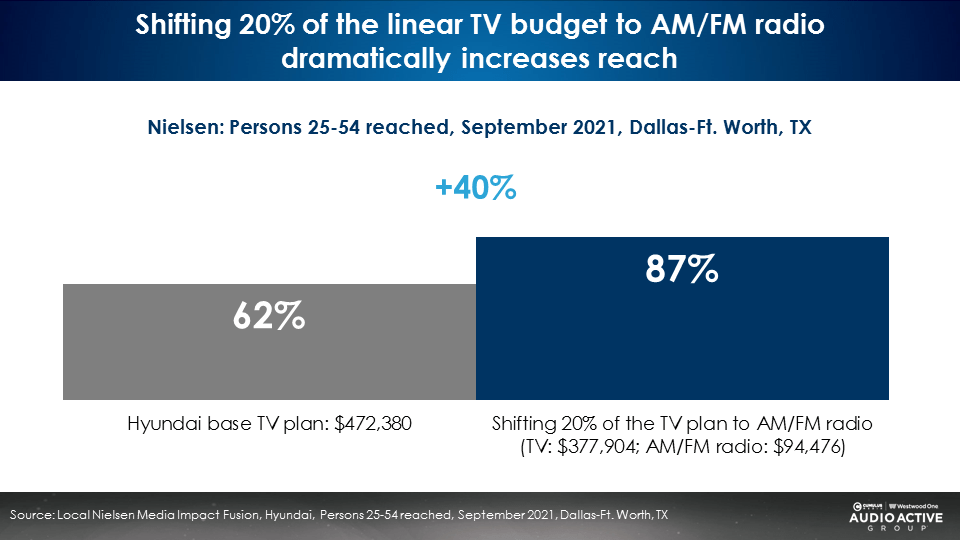

Nielsen Media Impact: A Hyundai buy could grow its reach +40% with the addition of AM/FM radio

Recently, Nielsen added AM/FM radio into its media optimization platform called Nielsen Media Local Impact. The software allows dealers to create scenarios to enhance their buys.

In September 2021, Hyundai spent $427,380 in local TV and cable in Dallas. Their TV campaign reached 62% of persons 25-54.

Shifting 20% of the TV budget over to AM/FM radio causes reach to soar from 62% to 87%, a +40% increase in monthly reach with the same budget!

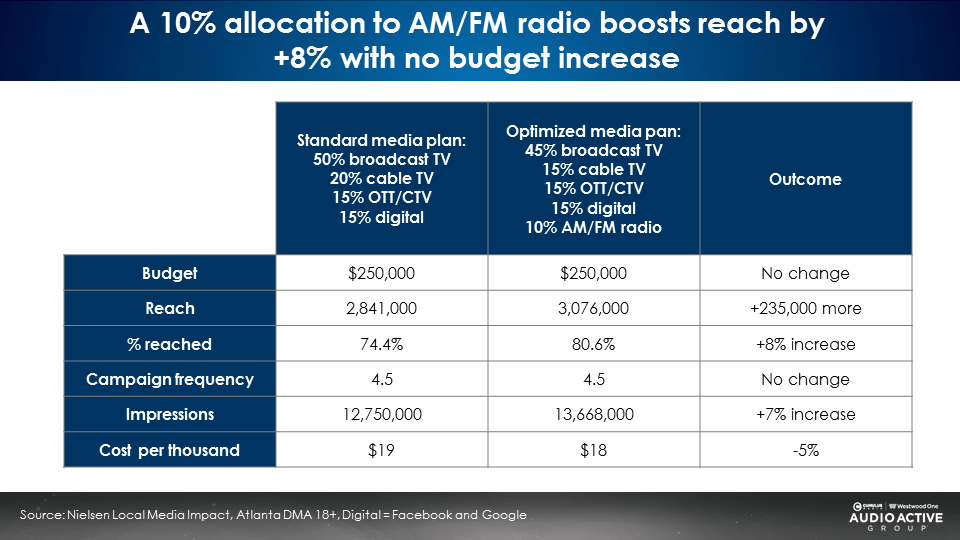

Nielsen Media Impact: Putting AM/FM radio into the plan causes reach to surge at no additional cost

Given that reach is the number one media sales driver, dealer ad campaigns must be optimized for the largest possible reach. Nielsen compared two media plans using Nielsen Media Local Impact.

The first plan consisted of a standard $250,000 campaign with the following allocations:

- 50% broadcast TV

- 20% cable TV

- 15% OTT/CTV

- 15% digital

The second plan, optimized for greater reach with the same budget, had the following allocations:

- 45% broadcast TV

- 15% cable TV

- 15% OTT/CTV

- 15% digital

- 10% AM/FM radio

Introducing a 10% allocation for AM/FM radio causes reach to grow by 235,000 persons, an +8% increase. Impressions were up +7% while frequency was stable and CPMs were more efficient.

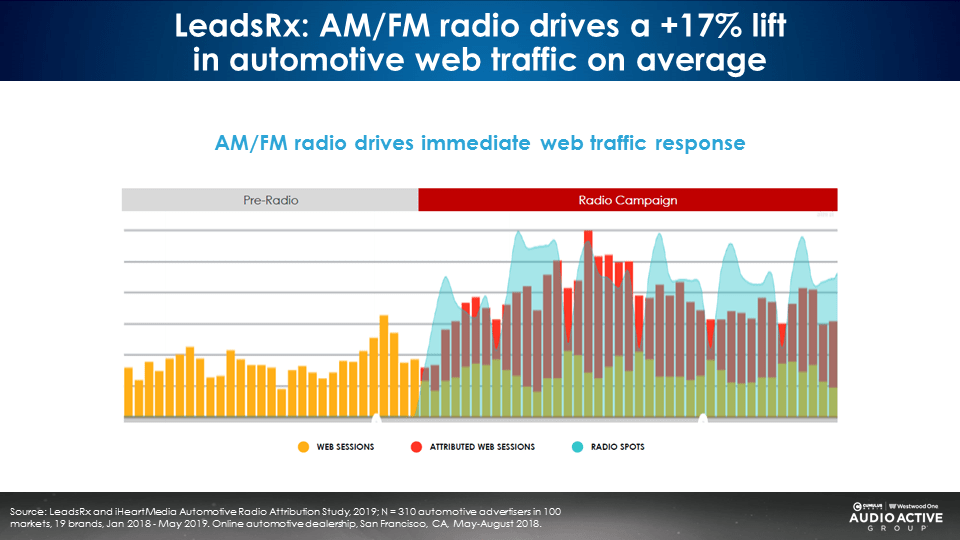

Proving impact: AM/FM radio campaigns generate significant auto dealer website traffic

What hard evidence exists to prove AM/FM radio advertising can deliver traffic to auto dealer websites? Enter LeadsRx, a leading multi-touch attribution measurement firm that works for hundreds of advertisers and agencies to quantify advertising impact on search and site advertising.

On behalf of iHeartMedia, LeadsRx conducted the world’s largest study of media impact on auto website traffic. Website traffic was measured from 310 auto dealers covering 19 vehicle brands in 100 markets for a 17-month period. A total of 1.8 million AM/FM radio commercials were studied to develop auto dealer best practices for AM/FM radio advertising.

LeadsRx found that on average, AM/FM radio is responsible for a +17% lift in automotive dealer web traffic. Most of this traffic comes from new consumers.

59% of web visits attributable to AM/FM radio advertising originate from new shoppers. The red bars below represent auto dealer web sessions attributed to AM/FM radio.

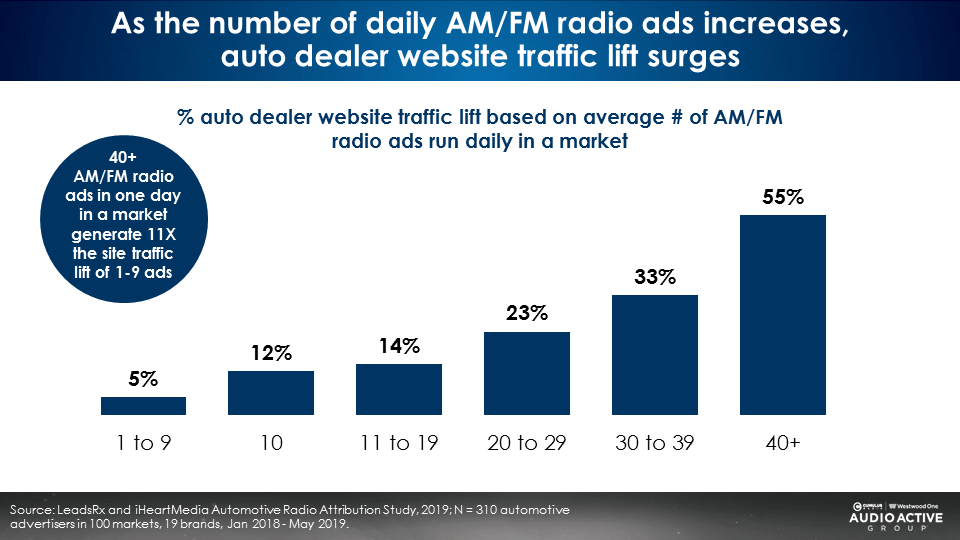

LeadsRx attribution data finds that media weight is important. As the number of daily AM/FM radio ads increases in the overall market, auto dealer website traffic surges.

- 1 to 9 ads a day aired in the market generated a +5% lift in auto dealer website traffic.

- 20 to 29 daily ads resulted in a +23% increase in auto dealer website traffic.

- 40+ daily AM/FM radio ads in the market caused a massive +55% increase in auto dealer website traffic.

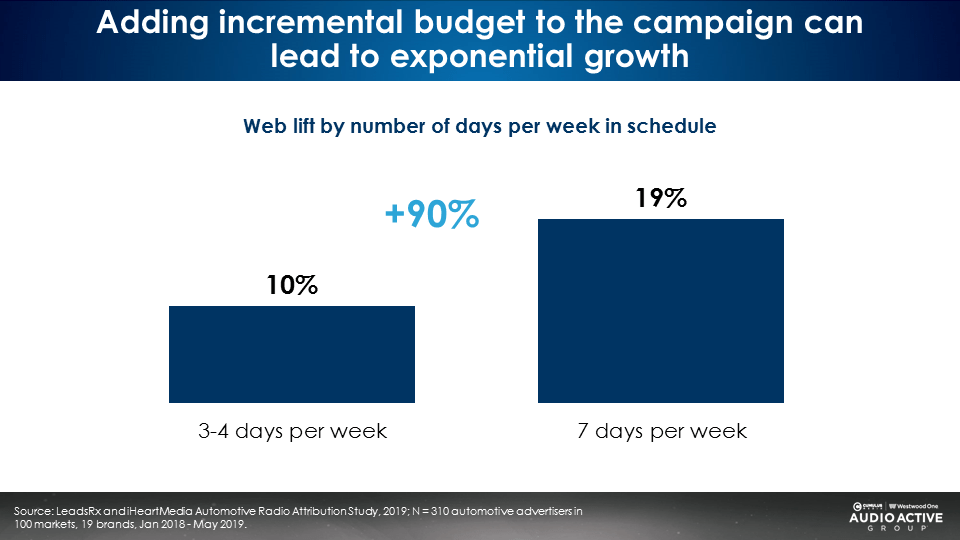

Expanding a buy from three days to seven days a week causes auto dealer web traffic to nearly double.

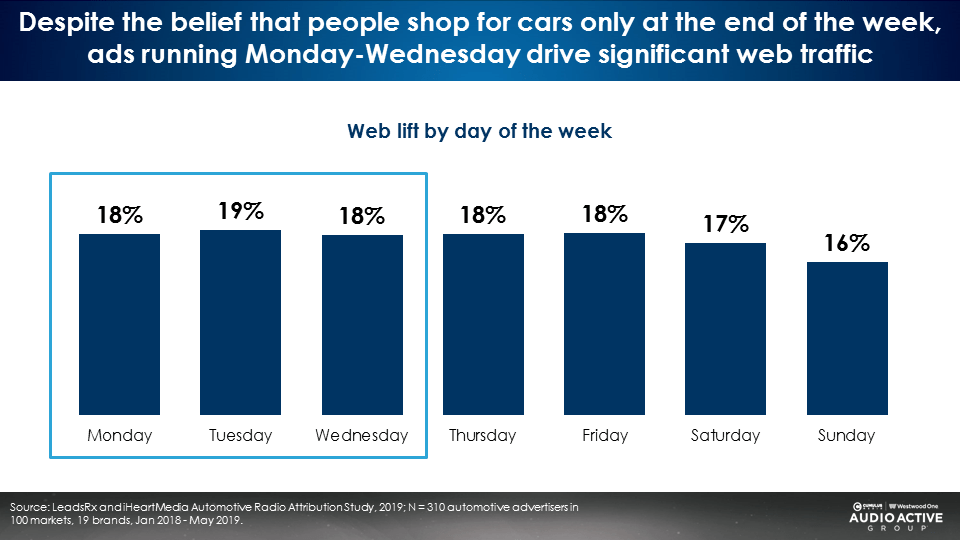

The myth that auto dealer ads should be run mostly towards the end of the week was shattered. LeadsRx found very strong web lift throughout the week, especially Monday through Wednesday.

The LeadsRx study issued the following recommendations:

- Run many ads: As the number of daily AM/FM radio ads increases, auto dealer website traffic lift surges.

- Advertise all days of the week: Despite the belief that people shop for cars only at the end of the week, ads running Monday through Wednesday drive significant web traffic.

- Advertise on all dayparts: Car shopping aligns with 6AM-7PM, AM/FM radio prime time.

- Use on-air personality endorsements: Campaigns that include AM/FM radio personalities generate an average of 2X greater response than campaigns that include produced/pre-recorded ads.

- Leverage multiple ad lengths: Campaigns with multiple ad lengths outperform single ad length campaigns by over 2X.

Key takeaways:

- Nielsen: Since 2018, TV reach has dropped to 72% and ratings are down -34%

- Cord cutting is a major driver of TV’s audience collapse

- Streaming is now “TV”: Half of Americans say streaming has replaced traditional TV

- When it comes to ad-supported audio in the car, AM/FM radio is the “queen of the road” with shares in the mid to upper 80s across every buying demographic

- Nielsen Media Impact: A Hyundai buy could grow its reach +40% with the addition of AM/FM radio

- Nielsen Media Impact: Putting AM/FM radio into the plan causes reach to surge at no additional cost

- LeadsRx: AM/FM radio campaigns generate significant auto dealer website traffic

Click here to view a 19-minute video of the key findings.

Download your copy of the Marketing Strategies and Attribution Insights for Auto Dealers deck

Pierre Bouvard is Chief Insights Officer at Cumulus Media | Westwood One and President of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.