PlaceIQ: Get Ready For A Massive Retail Foot Traffic Surge By Late February/Early March

Click here to view a 7-minute video of the key findings.

PlaceIQ, the leader in geo-location and consumer foot traffic measurement, issued a report last week predicting a surge in retail foot traffic and consumer shopping by late February/early March. PlaceIQ ingests and processes data from hundreds of millions of mobile devices, observing consumer visits to car dealerships, casual restaurants, malls, entertainment venues, fast food restaurants, and all sorts of retail locations.

The “Second Reemergence” in February 2021 occurred because COVID case counts dropped sharply

A year ago, PlaceIQ noticed something startling in their foot traffic data. “Around February 20th, it appears someone fired a starter pistol loud enough for most of the US to hear it. Overall device activity shot up so quickly.” After investigating, they concluded, “It wasn’t a mirage, foot traffic was shattering trends.” Visits to restaurants and stores had exploded.

What caused this significant uptick in retail foot traffic in February 2021? A sharp drop in COVID case counts. According to PlaceIQ’s analysis, COVID cases were declining coming into 2021, “bottoming out around February 20th. Almost precisely when mall and restaurant traffic takes off. Traffic was also up across the board, from big box stores to bars.”

The “Third Reemergence” is coming fast

Daily COVID infections soared in the U.S. beginning on December 23, 2021 and peaked on January 14, 2022. Beginning on January 23, 2022, COVID infection rates began a precipitous drop. According to The New York Times, COVID infection rates are down -57% over the last two weeks.

Google Trends: Consumer search volumes for “COVID” are down sharply in tandem with infection rates

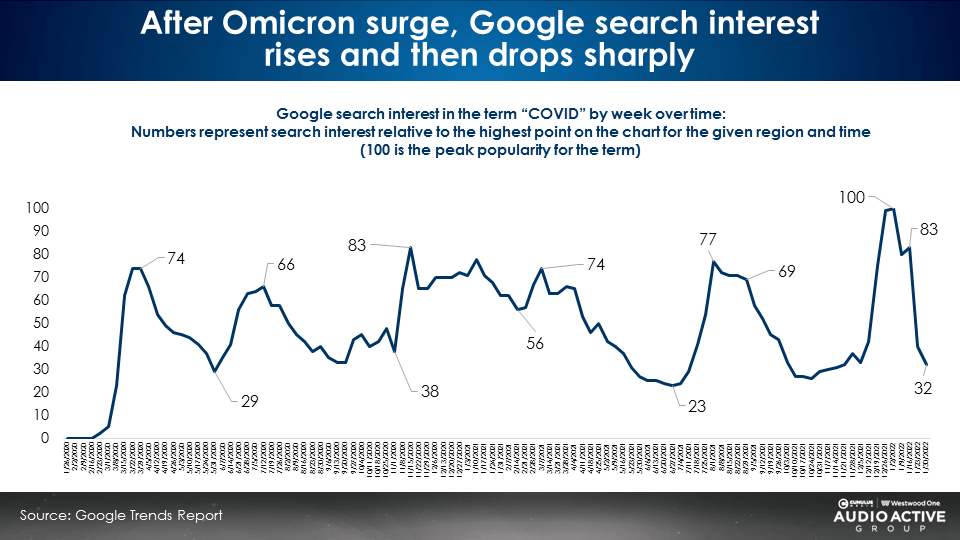

Google Trends are one of the most powerful and no cost methods of determining consumer interest. The act of searching on a term is hard evidence of consumer engagement and interest.

Input a search term into Google Trends, like COVID or a brand/category, and a report will track consumer interest over time. The period with the largest search activity is set at a 100 index and all other periods are compared to that high point.

According to the 23-month Google Trends Report, December 2021 searches for the term “COVID” exploded to two-year highs. Notice the sharp drop in search volumes in the last two weeks.

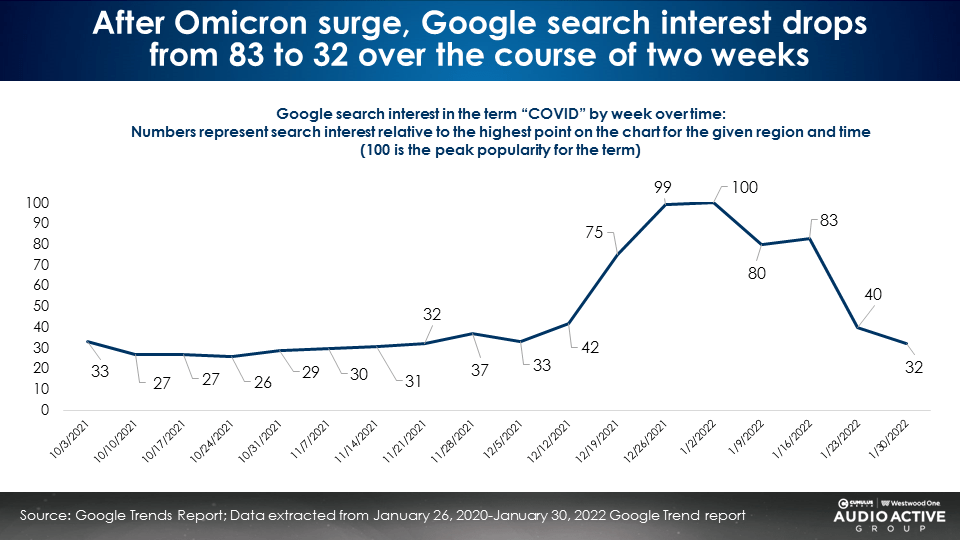

This four-month view below of Google Search trends for “COVID” clearly depicts the sharp rise due to the Omicron variant. “COVID” search volumes have collapsed from an 83 index to a 32 index from mid to late January 2022.

At present, search volumes for “COVID” are off 70% from recent highs. This is the most significant consumer concern drop in the two-year history of “COVID” Google search trends.

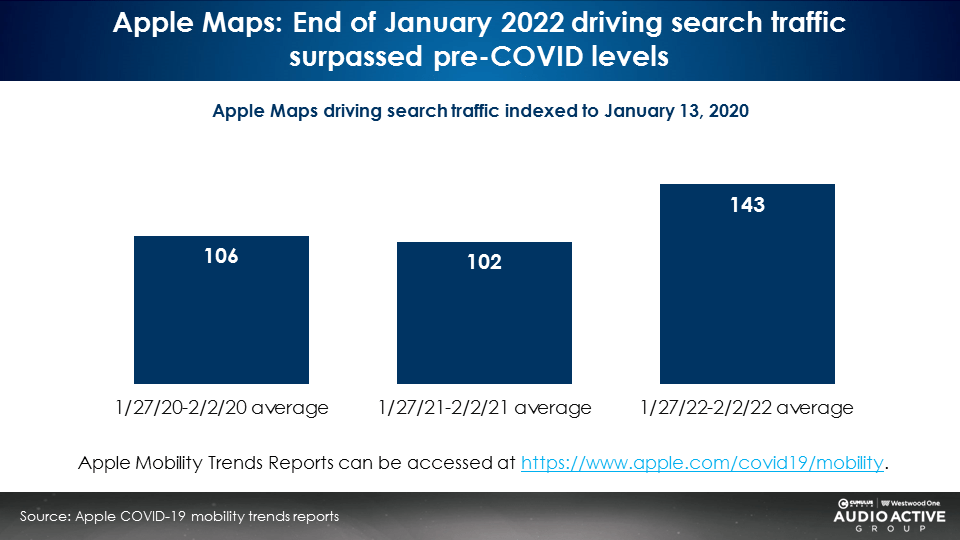

Apple Maps: U.S. driving volumes now exceed pre-pandemic levels

Since the onset of the pandemic, Apple Maps has depicted search volumes for driving, walking, and public transit trips for cities and many countries. These travel search volumes are indexed to the pre-COVID data of January 13, 2020. Click here to trend your city, state, or country.

The most recent week of U.S. driving search data (January 27, 2022 through February 2, 2022) reveals +40% growth over the 2021 and even surpasses the pre-pandemic week in 2020.

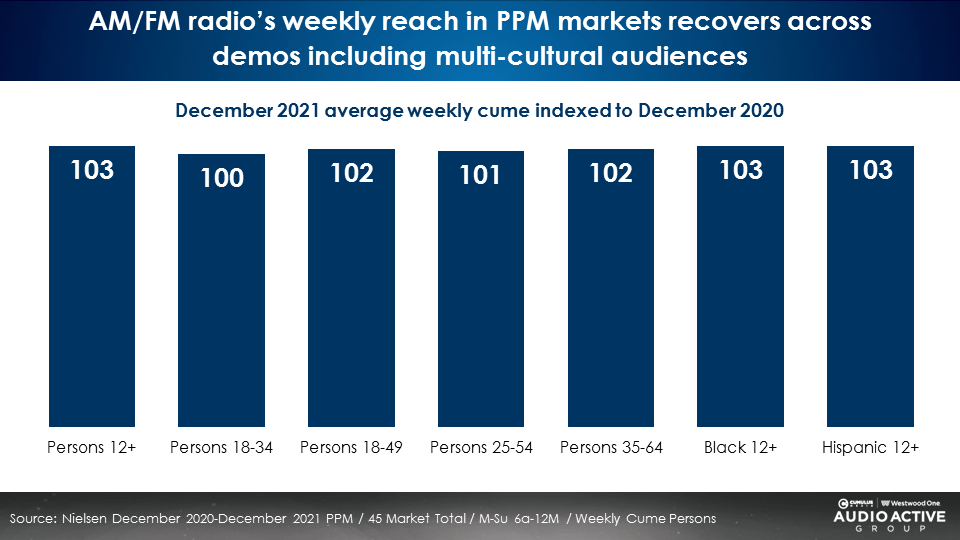

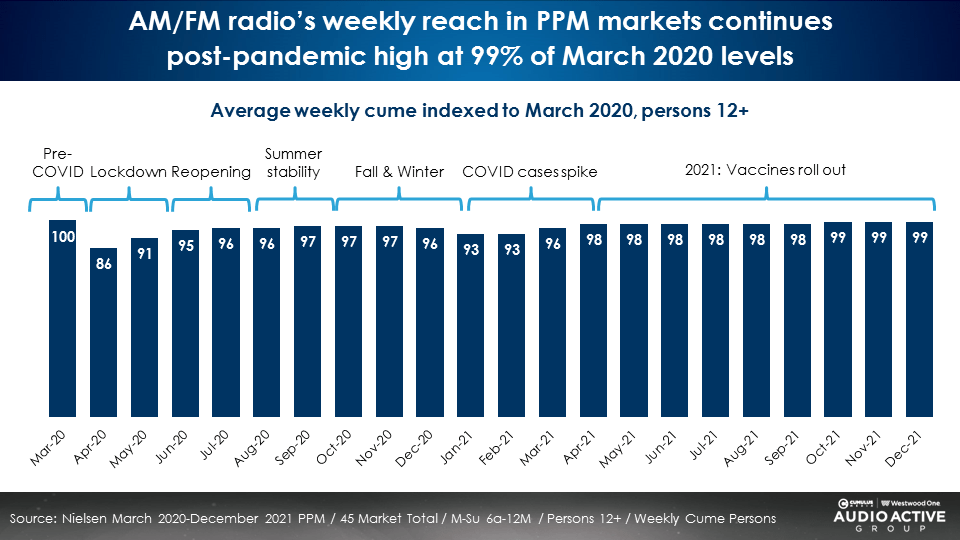

Nielsen: AM/FM radio listening recovery continues as December Portable People Meter listening was up +3% over the prior year

The strong recovery in miles traveled and driving has powered AM/FM radio listening recovery. Since the onset of the pandemic, Nielsen has reported listening in their PPM and diary markets benchmarked against March 2020. AM/FM radio’s December 2021 reach was +3% greater than December 2020.

The December 2021 48 PPM markets reveal AM/FM radio’s reach is 99% of March 2020 volumes. The trend of AM/FM radio listening recovery mirrors the driving trends from Apple Maps.

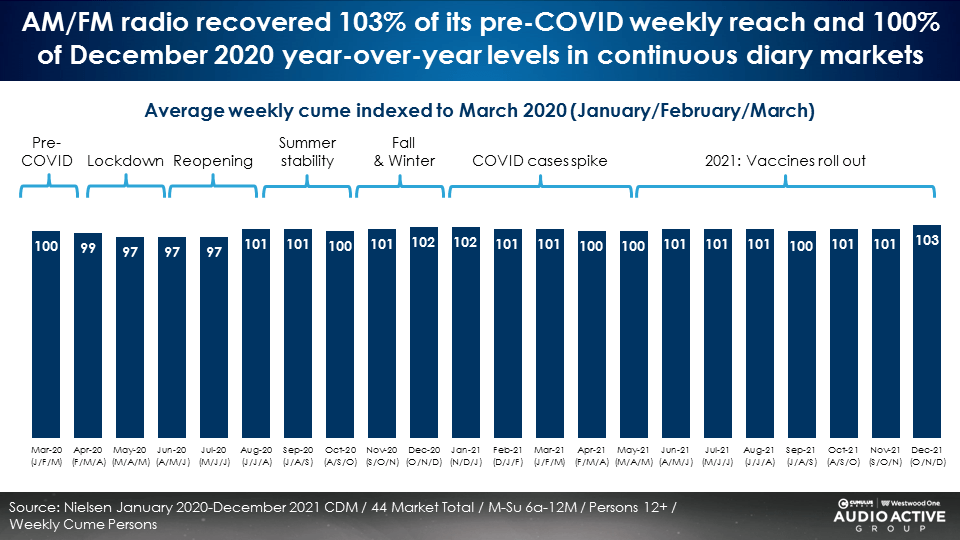

Nielsen: Diary market audiences were not impacted by COVID as listening has been rock steady

The just-released October-November-December 2021 diary market audience data represents the 21th month of rock steady listening levels. Miles traveled data from Geopath, the audience measurement service of outdoor advertising, reveals the reduction in driving in 2020 occurred mostly in the largest markets where the Portable People Meter is utilized.

Outside the top 50 markets, Geopath has shown very strong miles traveled, reflected in Nielsen’s stable diary market listening trends.

PlaceIQ: “I would be readying my business for a pop in post-curve traffic by late February or early March”

PlaceIQ expects the first explosion in foot traffic in a few weeks will be casual restaurants and shopping malls as they are most reactive to changes in traffic. “In the short term we’re looking at a uniformly tired population who is likely ready to bolt out the door once the all clear is sounded for this wave. Just like last year,” PlaceIQ concludes. “We strongly suggest you make preparations to capture and ride this wave of enthusiasm.”

Key takeaways:

- Google Trends: COVID concerns experience the largest drop in the two-year history of the pandemic

- Apple Maps: Driving search volumes for late January 2022 surge past pre-COVID levels

- Nielsen: AM/FM radio listening recovery continues as December 2021 Portable People Meter listening was up +3% over the prior year

- Nielsen: Diary market audiences were not impacted by COVID as listening has been rock steady

- PlaceIQ: Get ready for a massive retail foot traffic surge by late February/early March

Click here to view a 7-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.