Nielsen: 5 Things Advertisers Need To Know About The Latest COVID Consumer Tracking Study

Click here to view an 11-minute video of the key findings.

Nielsen held a client webinar this week to reveal the findings of their seventh COVID consumer tracking study since the start of the pandemic. 1,022 Americans 18+ were surveyed this September 2021.

5 things advertisers need to know about Nielsen’s very encouraging findings:

- The time to advertise is now as marketers need to capitalize on the positive consumer outlook: Consumer spending is steady despite the Delta variant. 86% say they are spending the same or more. More than eight in ten say their household finances will improve or remain the same in the coming months.

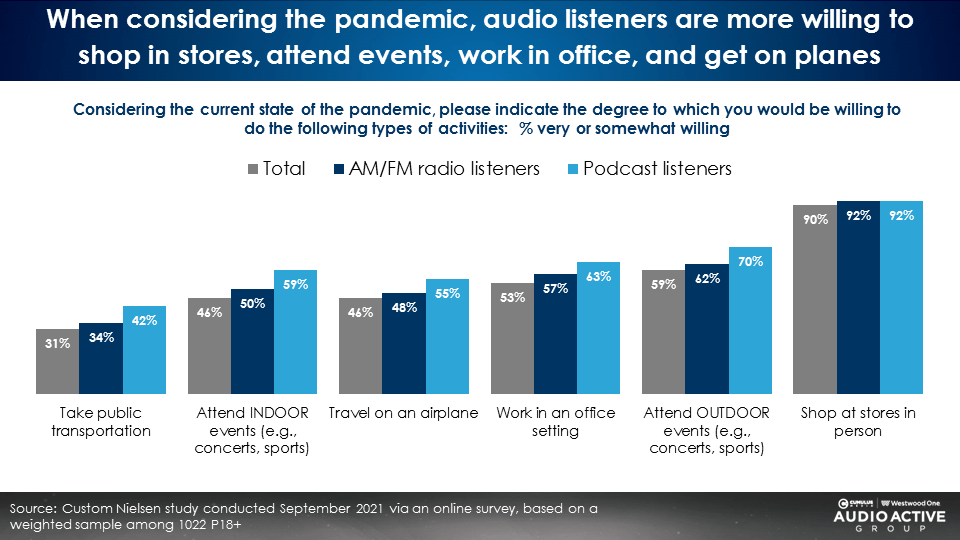

- Advertise on audio to reach those most likely to spend: AM/FM radio and podcast listeners are more likely to shop in stores, attend events, work in an office, and travel.

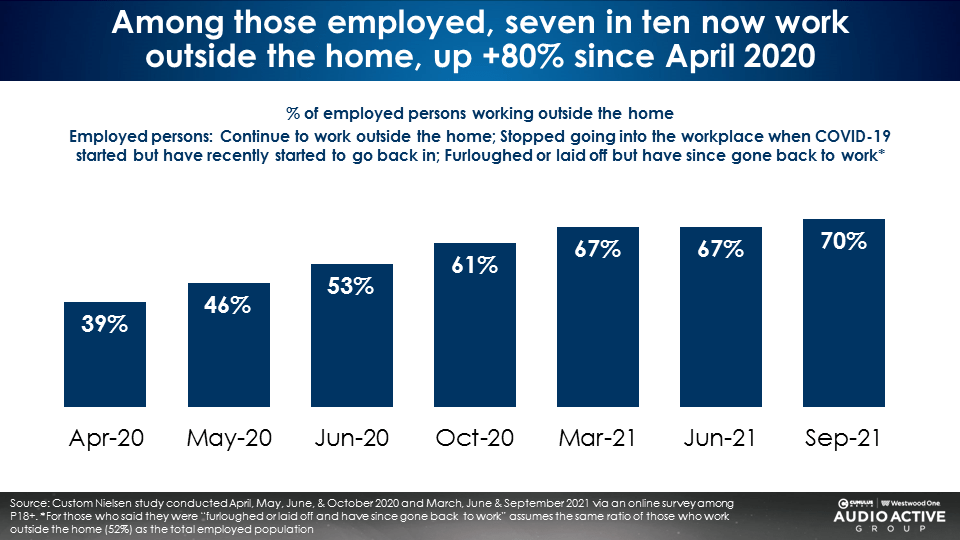

- Among those who are employed, 70% now work outside the home: Those commuting to work have grown across six prior studies. Time spent in the car has surged, especially among heavy AM/FM radio listeners.

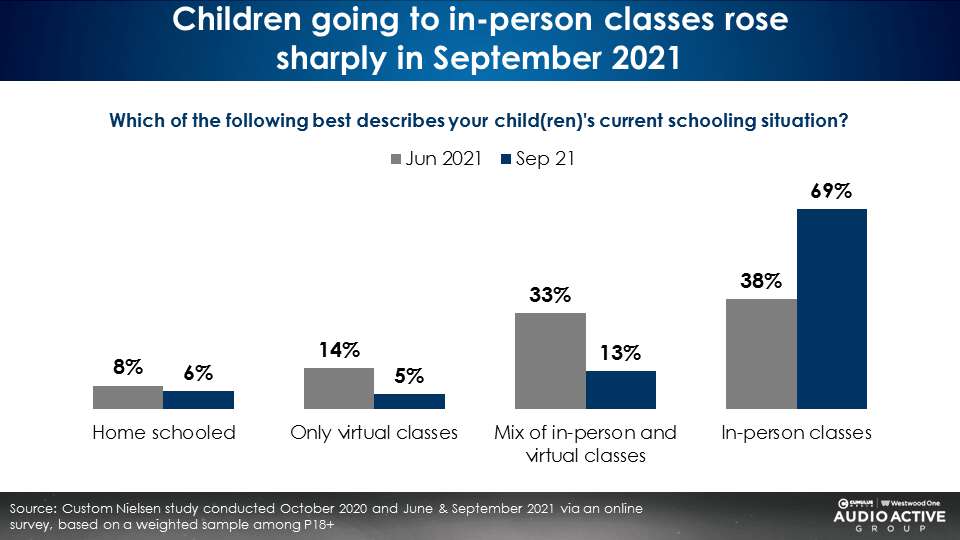

- There was a sharp increase in children attending school in person in September 2021: Those attending in-person classes jumped from 38% in June 2021 to 69% in September 2021. Most are being driven to school with AM/FM radio on.

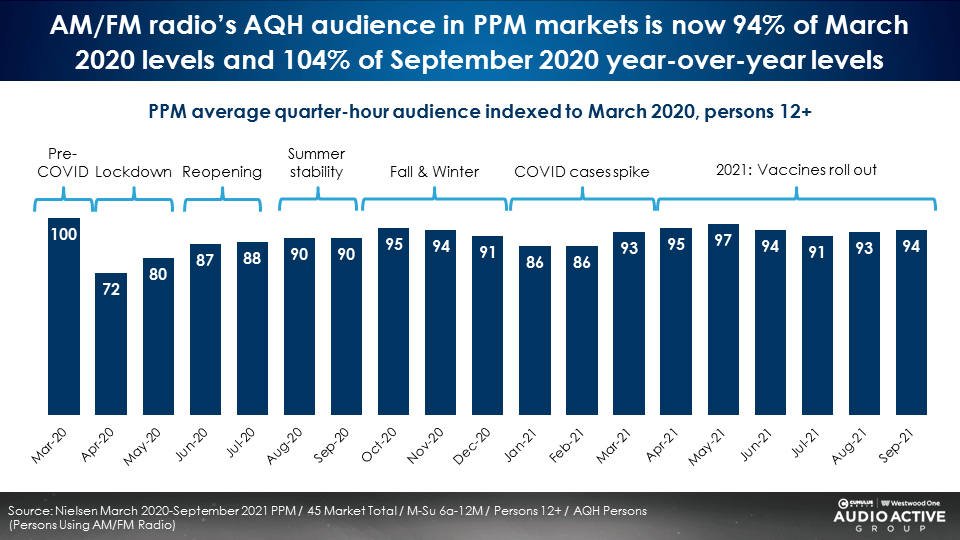

- AM/FM radio continues to be the soundtrack of American recovery as September listening reached a record high: Morning drive audiences were up especially among women and teens powered by the return to work and school.

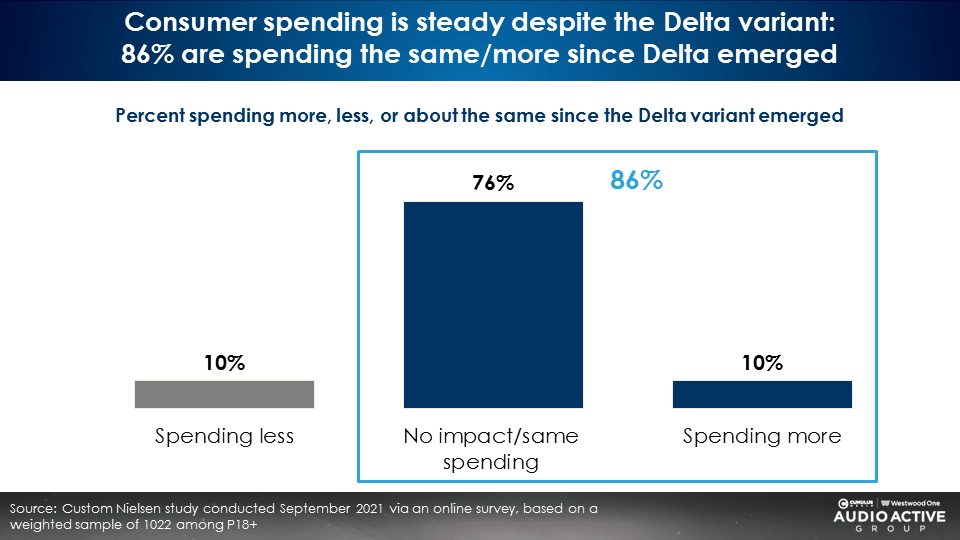

Consumer spending is steady despite the Delta variant

86% of consumers say they are spending the same or more since the Delta variant emerged.

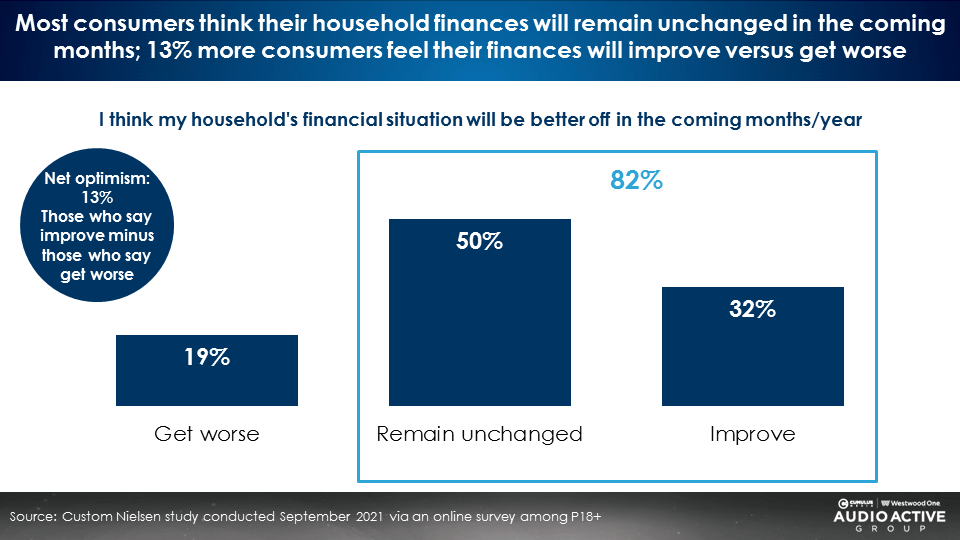

Eight in ten say their household finances will remain unchanged or improve in the coming months

The net optimism outlook reveals 13% more Americans say their finances will improve (32%) versus worsen (19%).

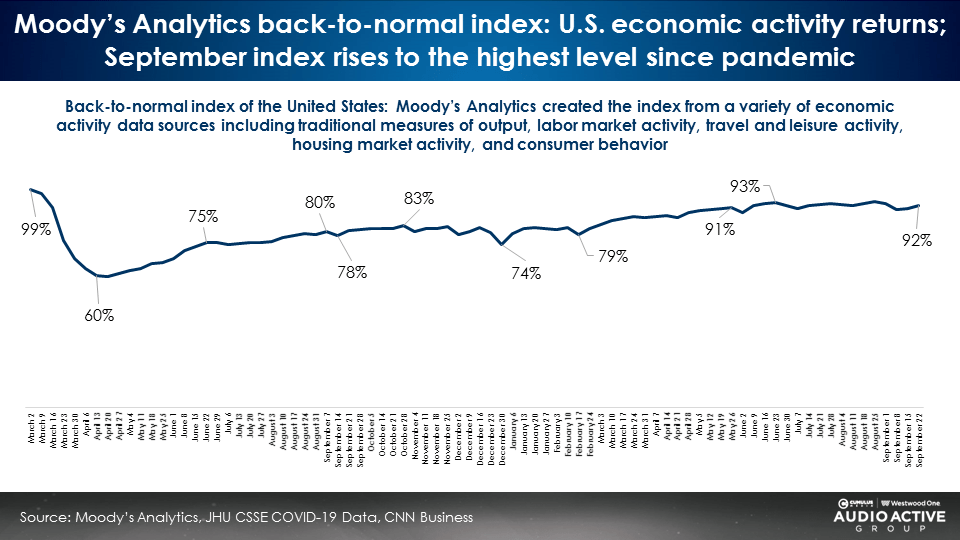

Moody’s Analytics back-to-normal index rises to the highest point since the pandemic

Moody’s Analytics created the back-to-normal index from a variety of economic activity data sources including measures of output, labor market activity, travel and leisure activity, housing market activity, and consumer behavior. At the depth of the Spring 2020 lockdown, the index sunk to a low of 60. Throughout 2021, the Moody’s back-to-normal index has been steadily rising and at the end of September, recovered into the low 90s.

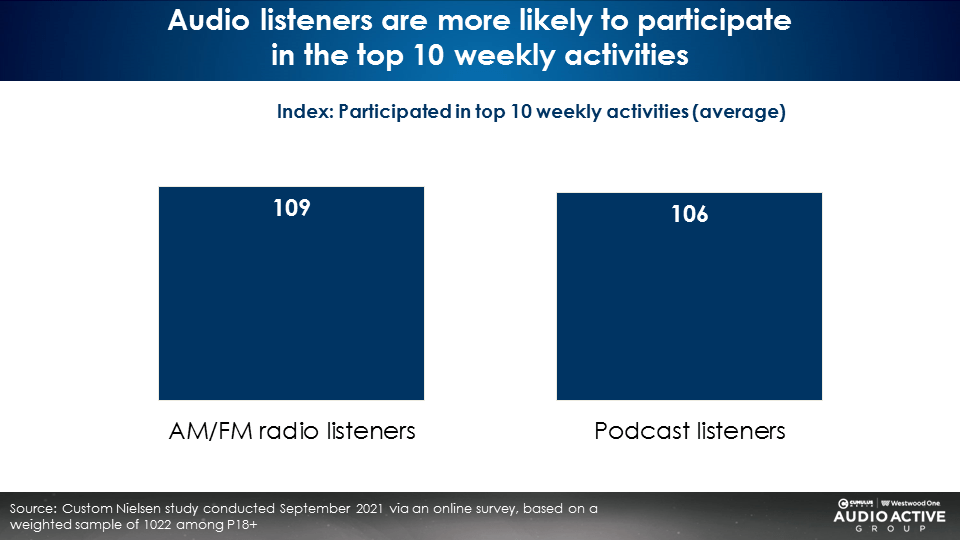

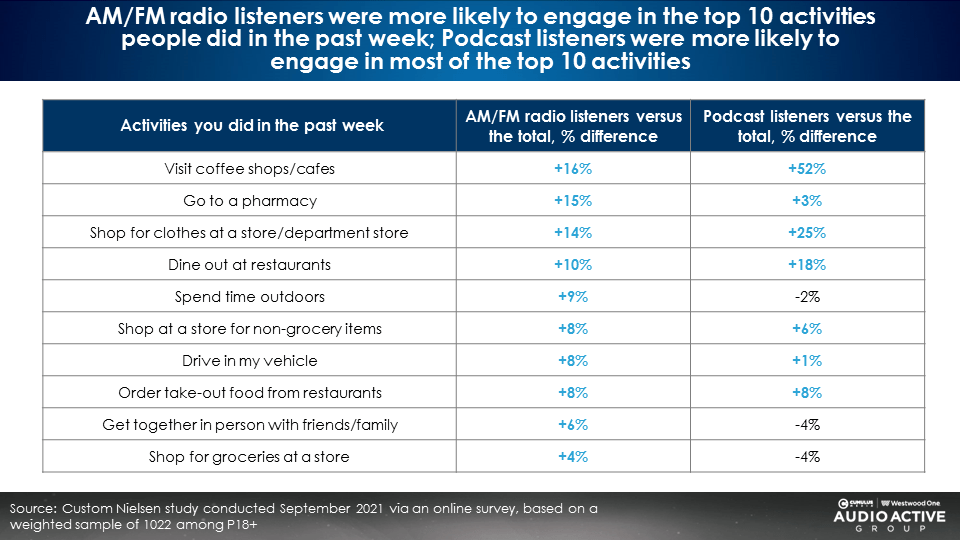

Audio listeners are more likely to participate in weekly activities

AM/FM radio listeners are +9% more likely and podcast listeners are +6% more likely to have participated in ten weekly activities out of the home.

Audio listeners are more willing to shop in stores, attend events, work in an office, and travel

AM/FM radio listeners and podcast listeners are “ready to go” and vote with their wallets.

70% of workers are now working outside the home

Nielsen’s consumer tracking study has shown continued recovery of the great American commute. Geopath and Apple Maps reveal U.S. miles traveled and car trips now exceed pre-pandemic volumes.

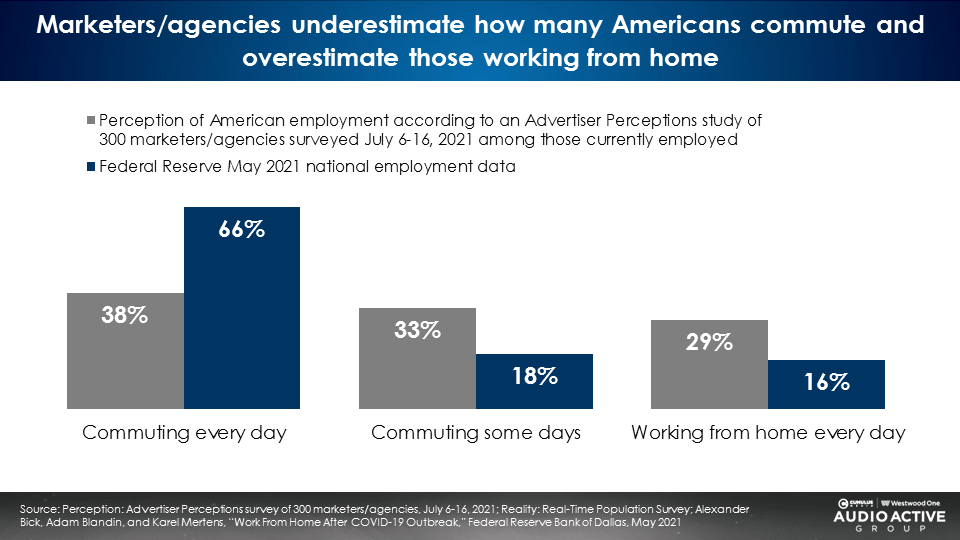

U.S. Federal Reserve: 66% of workers are now commuting every day and 18% are commuting some days

Nielsen’s September study of worker commuting patterns is validated by the Federal Reserve recent worker study. The Federal Reserve reported 66% of workers commuted every day and 18% commuted some days. 16% were working from home every day.

The Federal Reserve data reveals agency and marketer perceptions about the current state of American commuting patterns are way off the mark. In July 2021, Advertiser Perceptions, the leader in researching advertiser and agency sentiment, fielded a study of 300 media decision makers. They asked, “What percentage of American workers are either working from home daily, commuting some days, or commuting every day?”

The chart below depicts advertiser/agency perceptions in grey compared to the actual Federal Reserve commuting data in blue.

- Marketers and agencies dramatically underestimate the number of Americans who are commuting to work each day: Per the U.S. Federal Reserve, 66% of U.S. workers are commuting every day. Marketers and agencies think only 38% are commuting daily. Actual U.S. daily commutes are double the advertiser perception.

- Marketers and agencies overestimate the number of Americans who are working from home: Per the U.S. Federal Reserve, 16% of workers are working from home daily. Marketers and agencies think the percentage of those working from home is 29%.

There was a sharp increase in children attending school in person in September 2021

Those attending in-person classes jumped from 38% in June 2021 to 69% in September 2021.

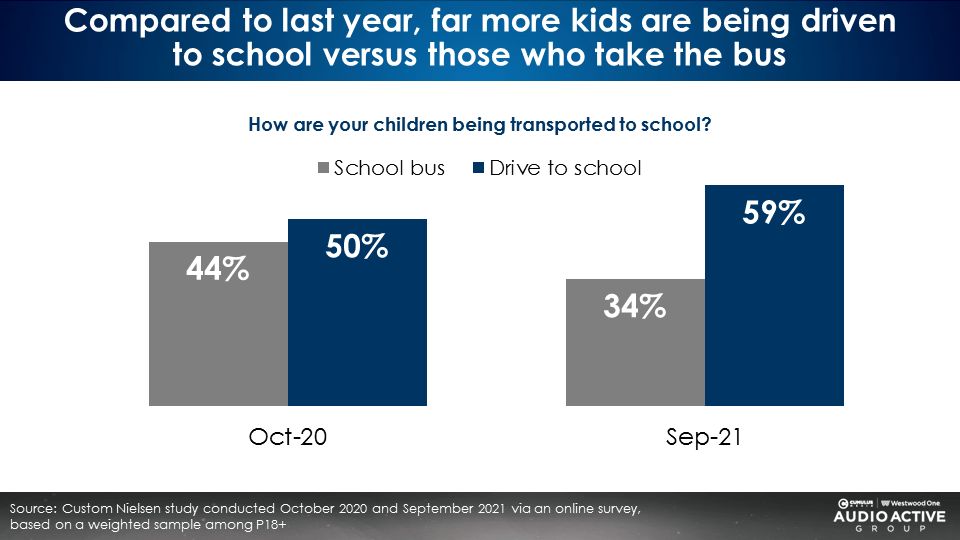

More children are being driven to school versus taking the bus

Versus a year ago, the proportion of kids being driven to school has increased from 50% to 59%. Fewer are taking the bus (44% in October 2020 versus 34% in September 2021).

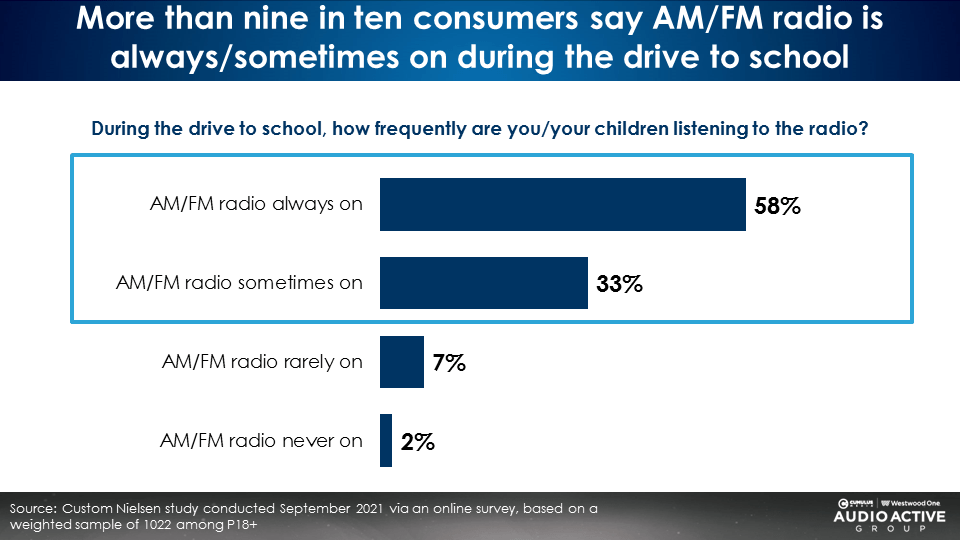

Nine in ten say AM/FM radio is on during the drive to school

AM/FM radio continues to be the soundtrack of American recovery as September listening reached a record high

Since the onset of the pandemic, Nielsen has reported listening in their PPM and diary markets benchmarked against pre-COVID.

The just-released 48 Portable People Meter markets reveal September 2021 AQH listening has recovered 94% of March 2020 volumes and was up +4% versus September 2020. AM/FM radio listening recovery mirrors the driving trend increases from both Geopath and Apple Maps.

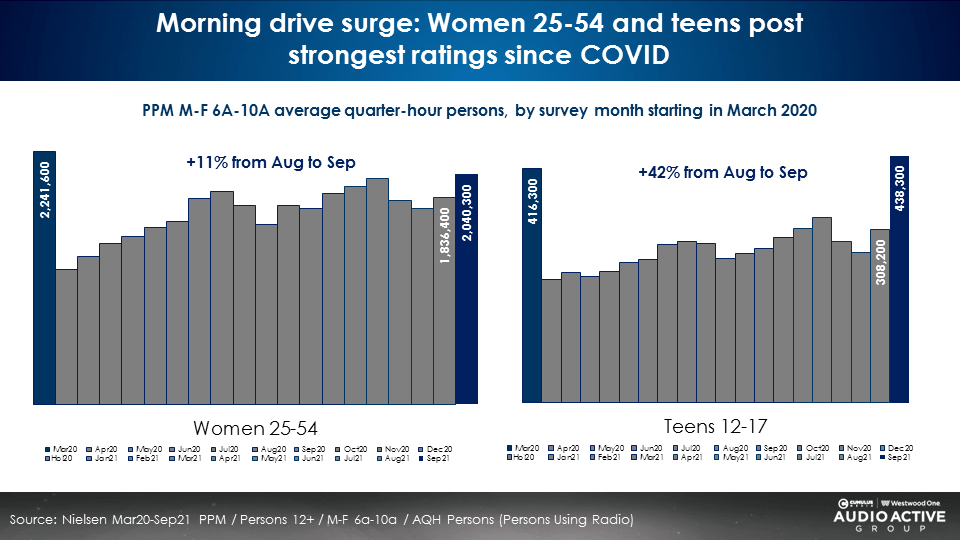

Morning drive surge: Women 25-54 and teens post strongest ratings since the pandemic

The growth of back to work and kids back in school powered significant morning drive audience recovery. In the Portable People Meter markets, women 25-54 and teens had their strongest ratings performance since the pandemic.

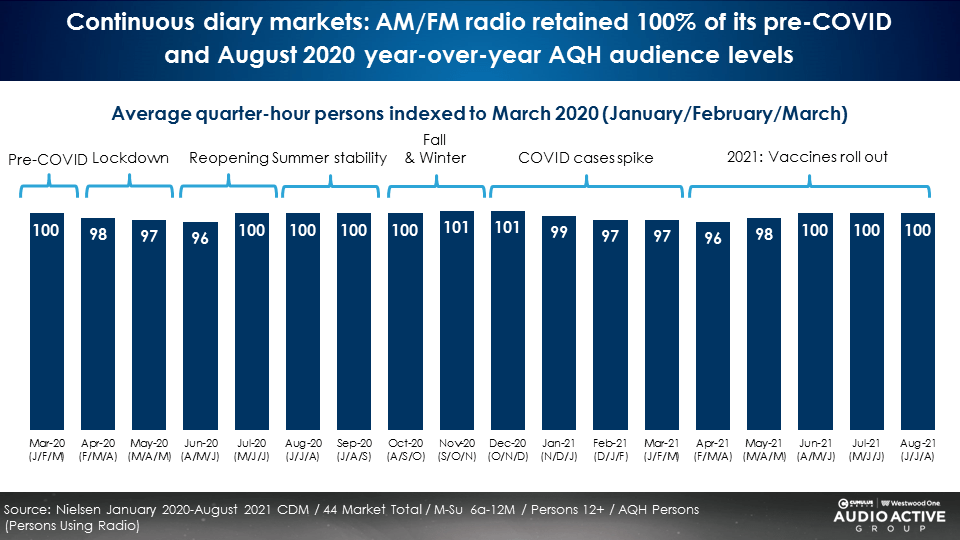

Diary market audiences were not impacted by COVID as listening has been rock steady

The just-released June-July-August diary market audience data represents the 17th month of rock steady average quarter-hour listening levels. Outside the top 50 markets, Geopath has shown very strong miles traveled, reflected in Nielsen’s stable diary market listening trends.

Key takeaways:

- The time to advertise is now as marketers need to capitalize on the positive consumer outlook: Consumer spending is steady despite the Delta variant. 86% say they are spending the same or more. More than eight in ten say their household finances will improve or remain the same in the coming months.

- Advertise on audio to reach those most likely to spend: AM/FM radio and podcast listeners are more likely to shop in stores, attend events, work in an office, and travel.

- Among those who are employed, 70% now work outside the home: Those commuting to work have grown across six prior studies. Time spent in the car has surged, especially among heavy AM/FM radio listeners.

- There was a sharp increase in children attending school in person in September 2021: Those attending in-person classes jumped from 38% in June 2021 to 69% in September 2021. Most are being driven to school with AM/FM radio on.

- AM/FM radio continues to be the soundtrack of American recovery as September listening reached a record high: Morning drive audiences were up especially among women and teens powered by the return to work and school.

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the Insights team at CorpMarketing@westwoodone.com.