Sports Betting Big Bang: New Study Reveals AM/FM Radio Listeners Show Significantly More Interest And Engagement In Online Sports Betting Than TV Viewers

This past February, a MARU/Matchbox study commissioned by CUMULUS MEDIA | Westwood One in Michigan found AM/FM radio is the ideal platform for online sports betting sites to build their brands and business. Compared to TV viewers, AM/FM radio listeners were far more engaged with online sports betting, were much more likely to have placed online bets, and showed far more interest in online sports betting brands.

To get a broader national perspective of the emerging online sports betting market, CUMULUS MEDIA | Westwood One commissioned a second study in April across the twelve states where online sports wagering is fully legalized. MARU/Matchbox surveyed 718 adults over the age of 21 in Colorado, Illinois, Indiana, Iowa, Michigan, Nevada, New Hampshire, New Jersey, Pennsylvania, Tennessee, Virginia, and West Virginia.f

Here are the key findings:

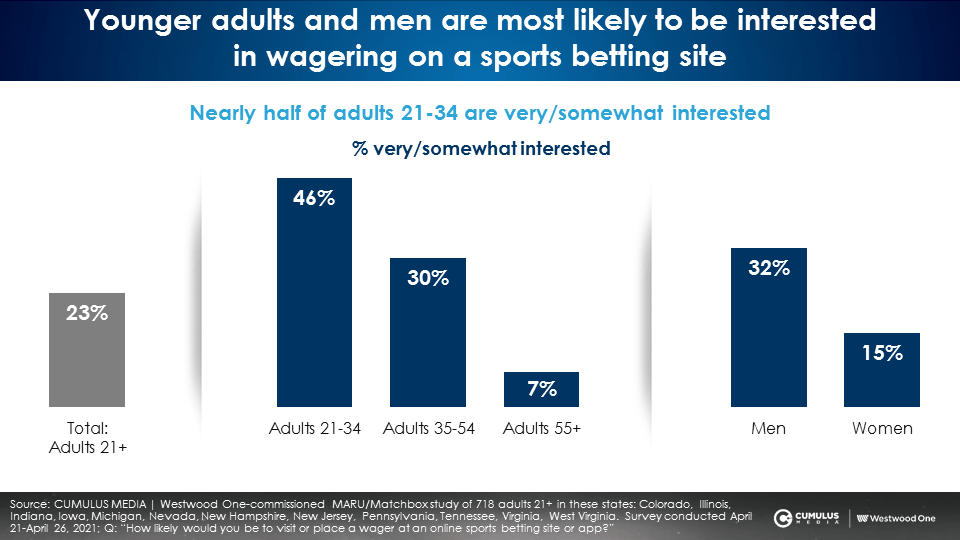

In states with legalized sports betting, younger adults and men are the most likely to be interested in wagering on sports betting sites

Across the twelve states, 71% of adults 21+ are aware that sports betting has been legalized in their state. When asked how likely they would be to visit or place a wager at an online sports betting site or app, 23% of adults 21+ say they are very or somewhat interested in online sports betting.

Nearly half of adults 21-34 say they would be interested. Among adults 35-54, interest drops to 30%. Over the age of 55, there is very little interest in online sports betting.

There are twice as many men (32%) versus women (15%) who say they would be very/somewhat interested in online sports betting.

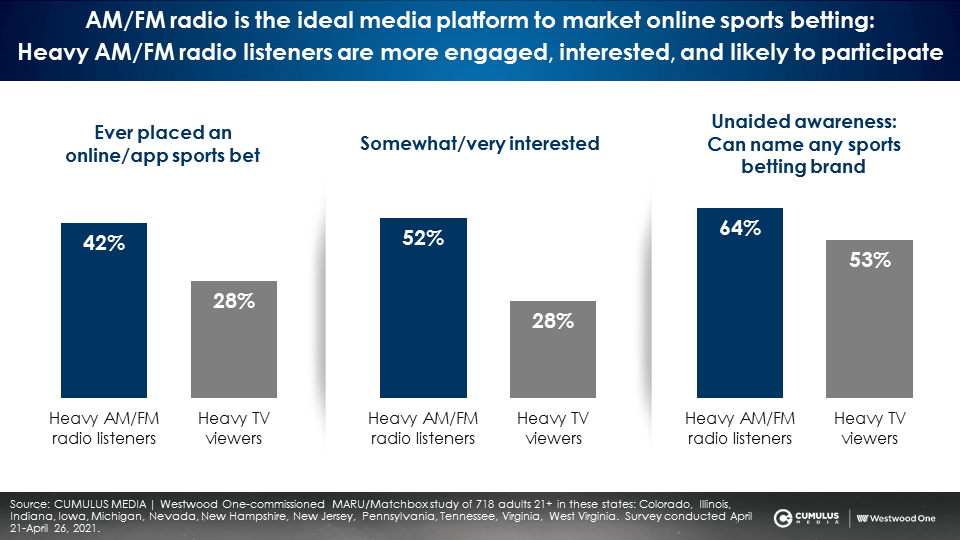

Compared to TV viewers, AM/FM radio listeners have far more experience with sports betting, greater interest, and greater awareness of online sports betting brands

Across the twelve states with legalized sports betting, MARU/Matchbox found more online sports betting engagement among AM/FM radio listeners. Demography plays a role here.

Online sports betting skews young. Linear TV leans quite old with the majority of the audience over the age of 50. AM/FM radio’s much younger age profile means it has a much larger concentration of those interested in online sports betting.

- More AM/FM radio listeners (42%) have ever placed an online sports bet versus TV viewers (28%).

- Nearly twice as many AM/FM radio listeners (52%) say they are very/somewhat interested in online sports betting versus TV viewers (28%).

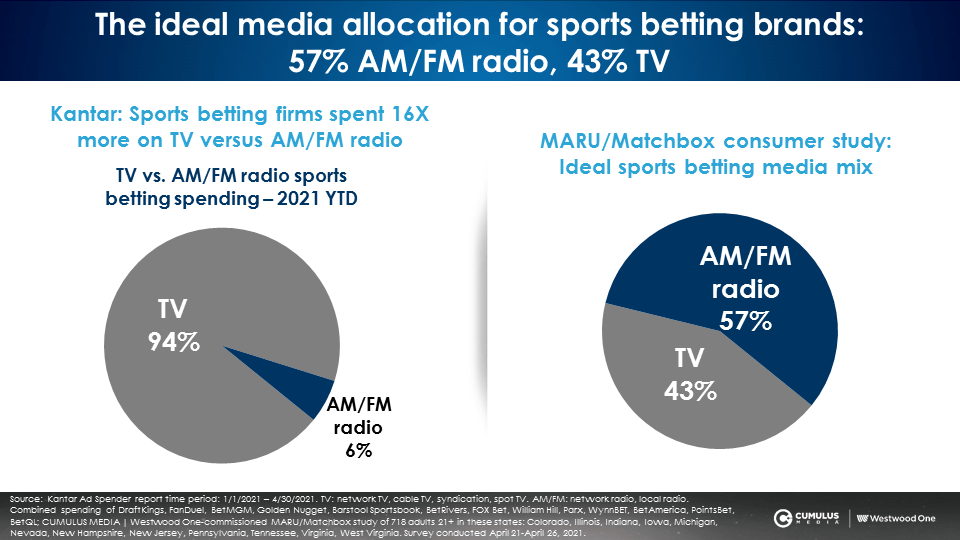

- More AM/FM radio listeners (64%) can name an online sports betting brand compared to TV viewers (53%). This is shocking considering that the vast majority of online sports brand advertising runs on TV. For every dollar spent on AM/FM radio, sixteen dollars are spent on TV, according to Kantar.

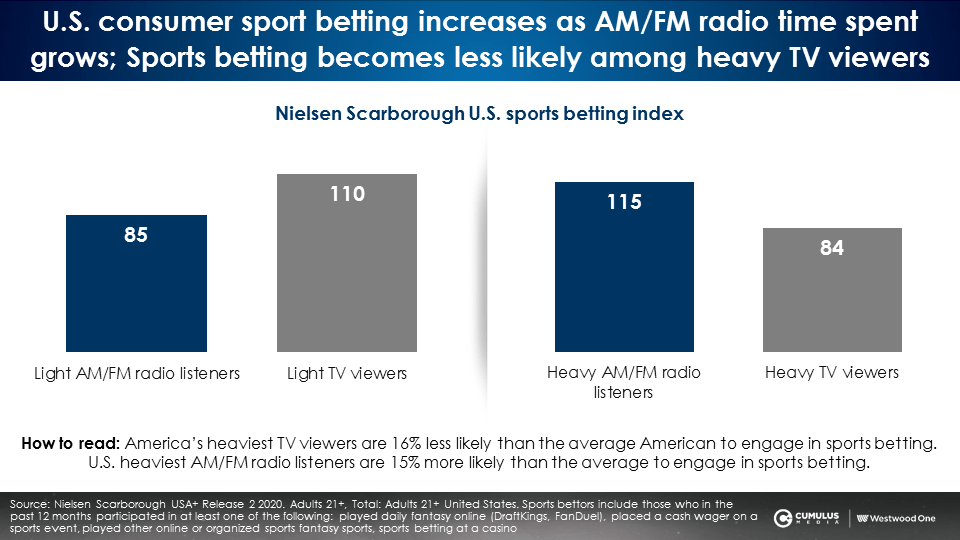

Nielsen Scarborough: Those engaged with sports betting are very light TV viewers, making linear TV a very expensive media option; AM/FM radio is far more effective at reaching the online sports bettor

It is challenging to reach sports bettors on linear TV as they spend so little time with the medium. The greater the time spent with TV, the lower the interest in sports betting.

AM/FM radio is the opposite. As AM/FM radio time spent listening grows, so does sports betting behavior.

A TV campaign will generate massive impressions among those who have no interest in online sports betting. AM/FM radio campaigns will generate a greater proportion of impressions with those inclined to online sports betting.

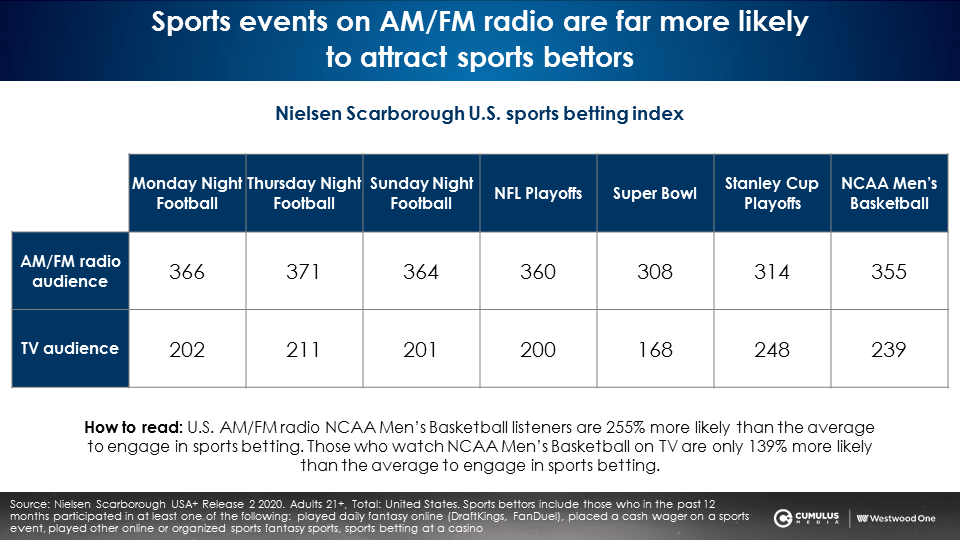

AM/FM radio play-by-play sports broadcasts have a much greater sports betting propensity compared to the same broadcasts on television

Nielsen Scarborough finds AM/FM radio sports play-by-play broadcasts are almost twice as likely to attract sports bettors compared to the same broadcast on television. This is because those who listen to play-by-play sports broadcasts on AM/FM radio are more informed sports fans than casual TV viewers to the same events.

Ideal media allocation mix for online sports betting brands: 57% AM/FM radio, 43% TV

The overwhelming evidence of this study reveals AM/FM radio listeners are more likely to be responsive to online sports betting advertising. Simply put, AM/FM radio listeners are far more likely to use online sports betting compared to TV viewers.

- AM/FM radio listeners are +50% more likely to have ever placed an online sports bet

- AM/FM radio listeners are +85% more likely to be interested in online sports betting

- Among those interested in sports betting, 40% are heavy AM/FM radio listeners and 30% are heavy TV viewers, a relationship that converts to a ratio of 57% AM/FM radio and 43% TV

Given this level of engagement, the ideal media allocation for this category is 57% AM/FM radio and 43% TV. According to Kantar, January through April 2021 spending in the online sports betting category skews 94% television and only 6% AM/FM radio. This is a massive misalignment.

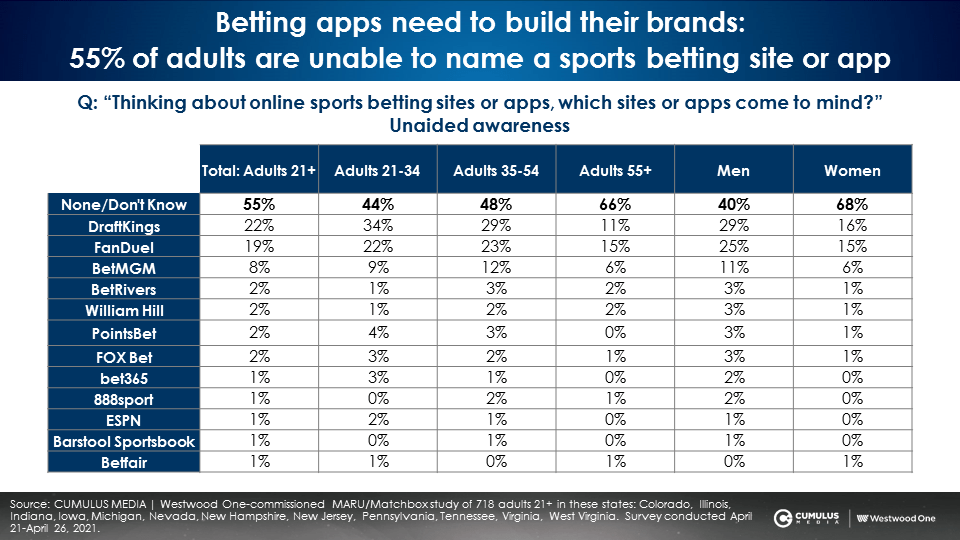

Unaided awareness: At the dawn of the online sports betting era, half cannot name a sports betting site or app

When asked unaided to name online sports betting sites or apps, 55% of those in the twelve states cannot name a brand. DraftKings and FanDuel generate the strongest unaided awareness based on their historical fantasy sports marketing.

Unaided awareness is the most important brand equity measure to build. It is also the most expensive and time consuming to achieve. However, it is crucial to “be known, before you are needed.”

Les Binet and Sarah Carter, marketing effectiveness authorities and authors of the book, How Not To Plan: 66 Ways To Screw It Up, conclude:

“The single most important factor driving brand preference is ‘mental availability’: how well known a brand is, and how easily it comes to mind. Brands with low mental availability tend to struggle, rejected in favour of more familiar rivals. Or not considered in the first place. Brands with high mental availability don’t have to push so hard to sell, so tend to have higher market shares and better margins.”

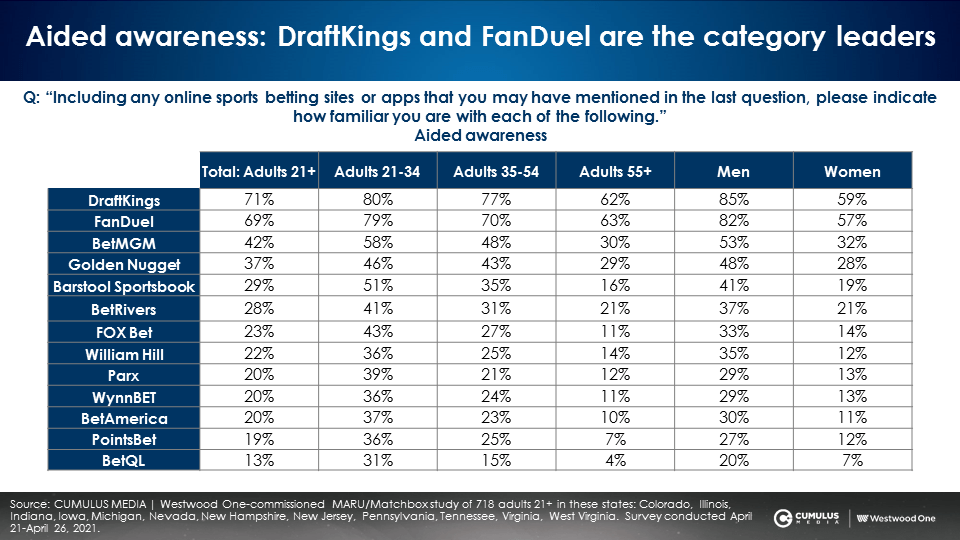

Aided awareness: 70% are aware of FanDuel and DraftKings, four out of ten are familiar with BetMGM and Golden Nugget, and eight brands have aided awareness ranging from 19% to 29%

Consumers were provided with a list of online gaming brands and asked if they were either “extremely familiar,” “very familiar,” “somewhat familiar,” or “heard of, only know the name.” Those four responses combined constitute aided awareness.

DraftKings (71%) and FanDuel (69%) have the highest levels of awareness. Four out of ten are familiar with BetMGM and Golden Nugget. Eight brands have aided awareness ranging from 19% to 29%.

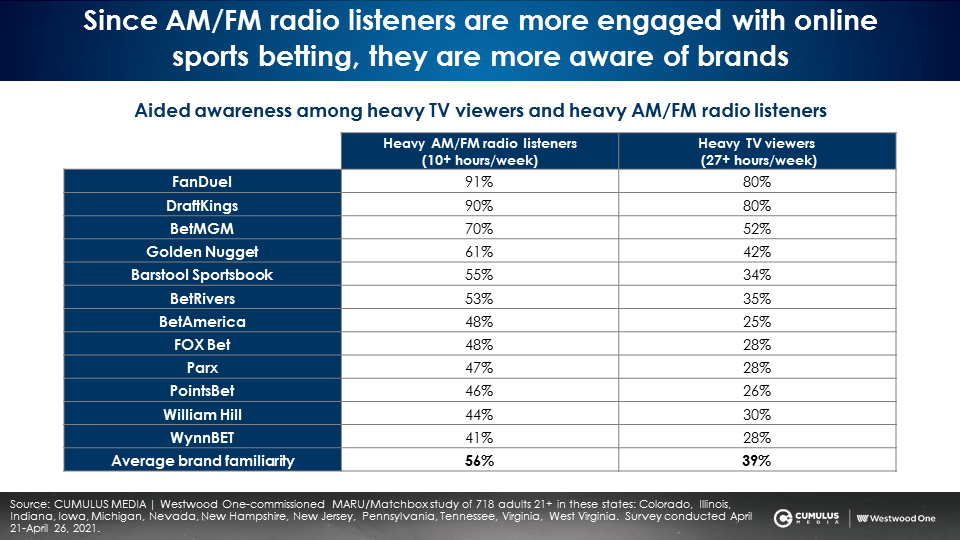

AM/FM radio listeners have +44% greater aided familiarity for online sports betting brands compared to TV viewers despite all the money showered on TV

Among heavy AM/FM radio listeners, the average aided brand familiarity for the twelve online sports betting brands is 56%, compared to only 39% among heavy TV viewers. AM/FM radio listeners are +44% more familiar with online sports betting firms than TV viewers, despite the fact that most online sports betting media plans favor TV.

Strongly familiar aided awareness: Among adults 21-34, eleven brands have awareness between 22% and 29%

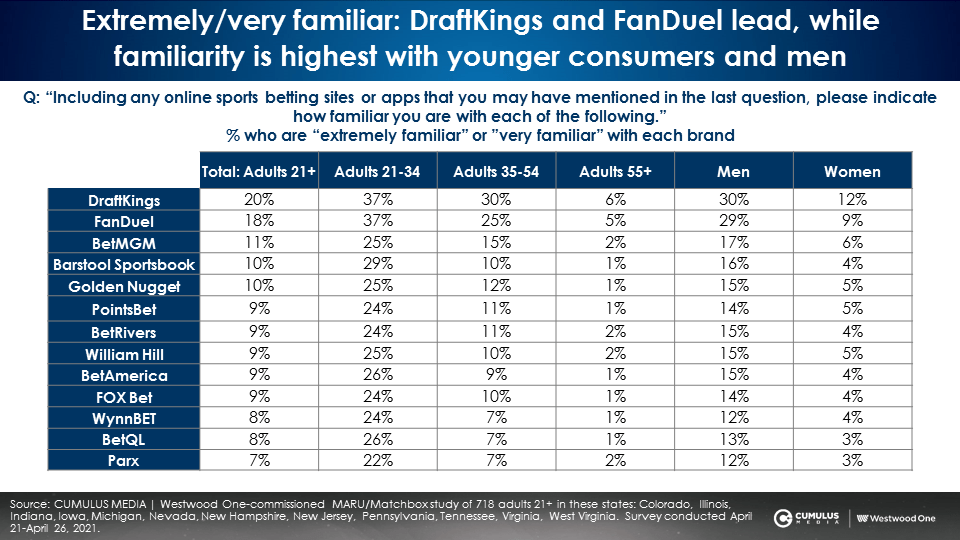

Now we focus on the strongest level of aided awareness (extremely or very familiar). Again, DraftKings and FanDuel exhibit the strongest familiarity, followed by BetMGM, Barstool Sportsbook and Golden Nugget. Eight brands have strong familiarity scores between 7% and 9%.

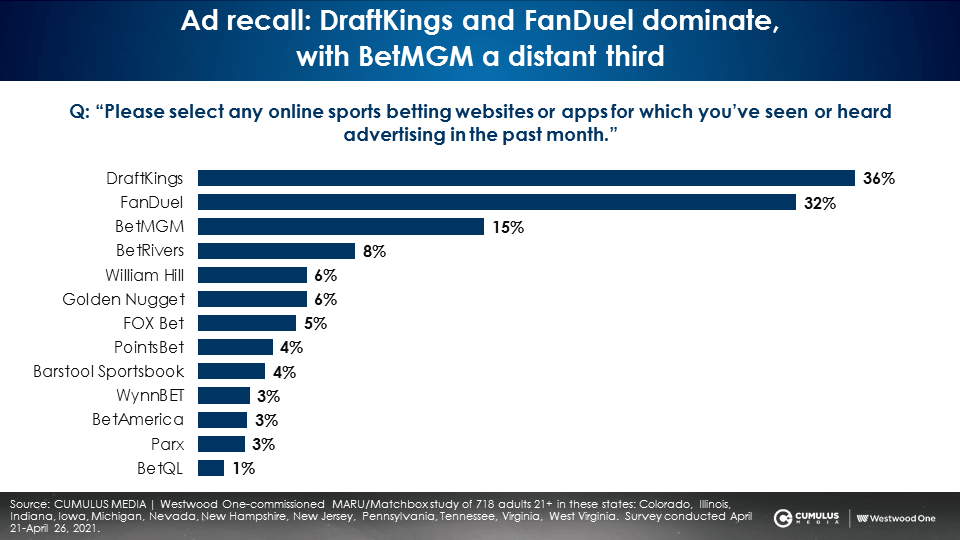

Advertising recall: DraftKings and FanDuel lead, BetMGM is in distant third, and BetRivers is fourth

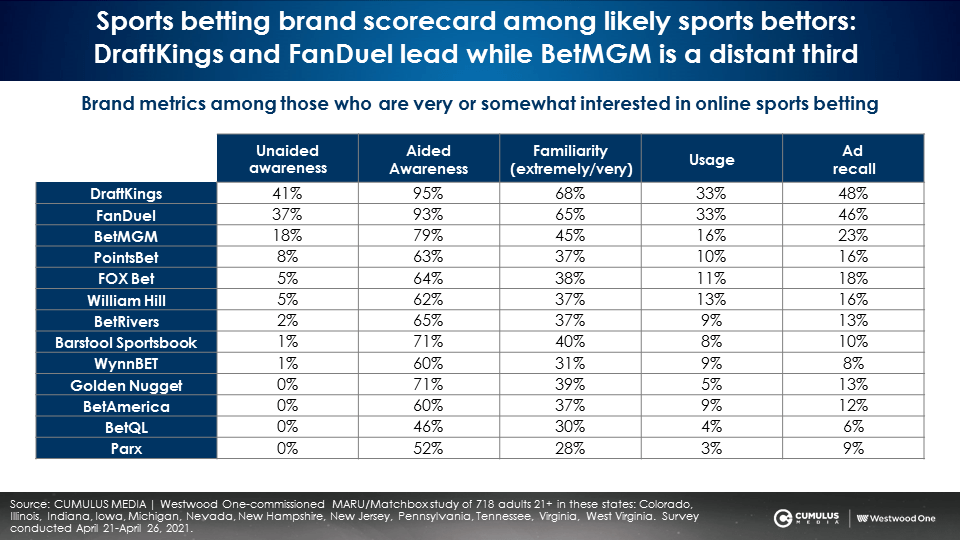

Brand scorecard: Among those interested in online sports betting, DraftKings and FanDuel tie for the lead, BetMGM places next, and a large group of brands occupy the next tier

The table below depicts the key measures of brand equity among the 23% of the twelve-state population who say they are very or somewhat interested in online sports betting. The previous brand equity measures in this report were reported based upon the entire adult 21+ population in the twelve states.

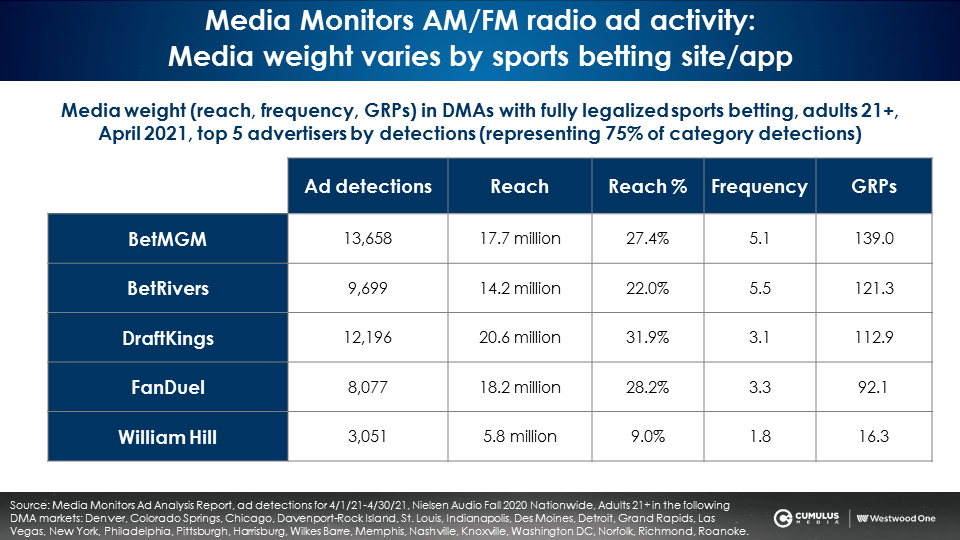

Media Monitors/Nielsen: BetMGM leads with AM/FM radio advertising weight, followed by BetRivers, DraftKings, and FanDuel

BetMGM’s third place showing in advertising recall could be fueled by their strong use of AM/FM radio. In Media Monitors measured markets in the twelve states that have legalized sports betting, BetMGM ran the most Gross Rating Points (139) of AM/FM radio in April 2021.

GRPs are the sum of all rating points in an advertising schedule. Following BetGM were BetRivers (121), DraftKings (113), and FanDuel (92). William Hill ran a very modest schedule of 16 GRPs.

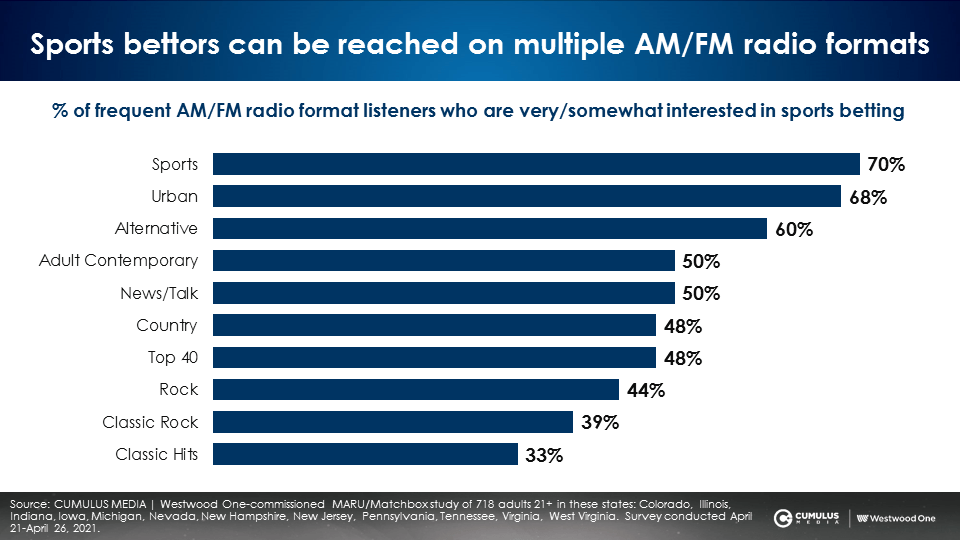

Among AM/FM radio programming format listeners, Sports, Urban, Alternative Rock, Adult Contemporary, News/Talk, Country, Top 40, and Rock fans show the greatest interest in sports betting

While is makes perfect sense that a majority of Sports radio fans would be interested in sports betting, it is intriguing that such a large proportion of Urban radio listeners would have such a strong affinity for online sports betting. It is also important to note a large variety of AM/FM radio format listeners show interest in online sports betting.

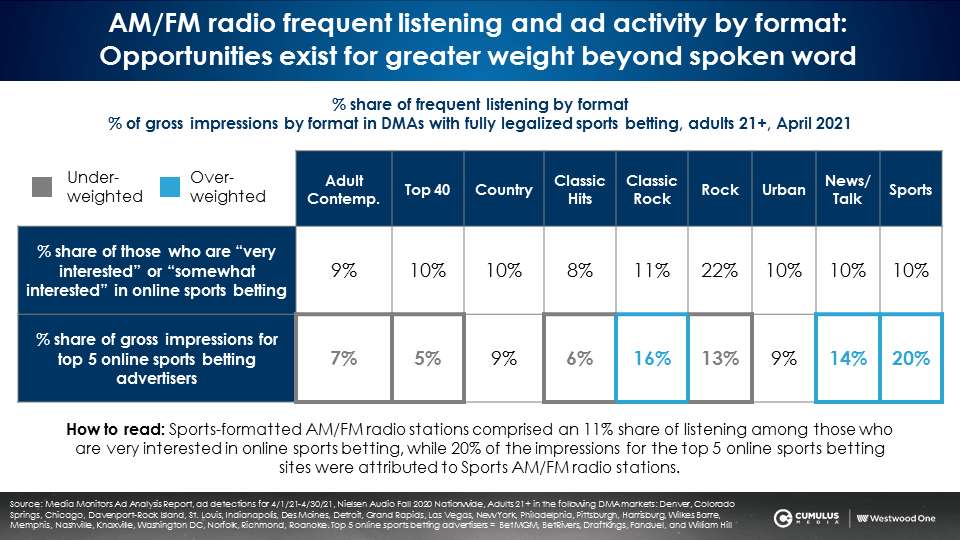

Online sports betting AM/FM radio buys are under-weighted on Rock, Top 40, Adult Contemporary, and Classic Hits/Oldies; AM/FM radio programming formats that are over-weighted include Sports, News/Talk, and Classic Rock

The table below details AM/FM radio programming format shares among those who are “very interested” or “somewhat interested” in online sports betting. The last line indicates the share of AM/FM radio gross impressions of the top five spending online sports betting brands in April 2021.

While the Rock format represents 20% of those highly interested in online sports betting, the Rock format only received 10% of the AM/FM radio ad impressions. The Rock format is under-weighted and under-utilized for this category. Adult Contemporary, Classic Hits/Oldies, and Top 40 are also under-utilized.

Some formats are over-weighted in AM/FM radio campaigns. The Sports format represents 11% of those who are interested in online sports betting but received 20% of the online sports betting impressions. In addition, News/Talk and Classic Rock are over-utilized.

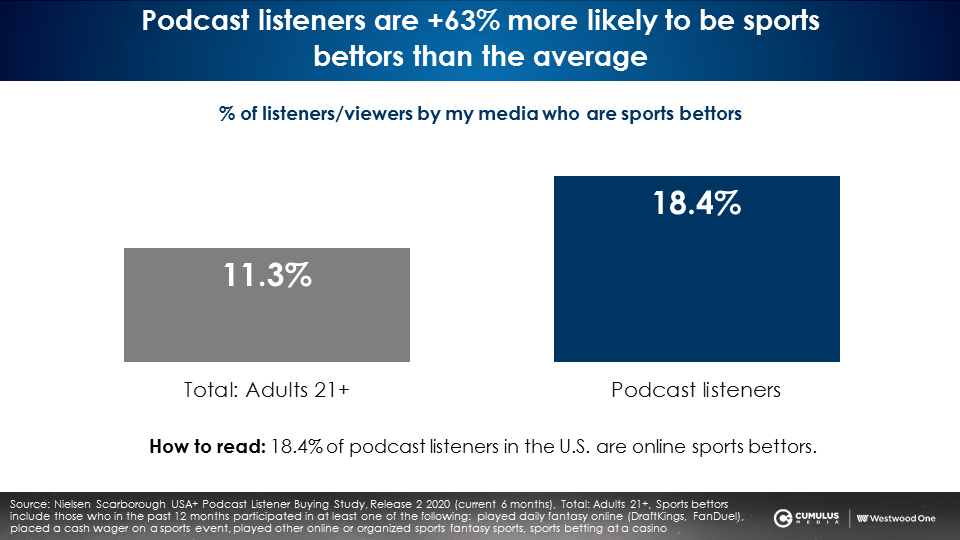

Podcasts represent a strong media platform for online sports betting brands as podcast listeners are +63% more likely to be sports bettors

According to Nielsen Scarborough’s Podcast Buying Power Study, the podcast audience is +63% more likely to be sports bettors versus the general population. However, podcasts do not have the massive reach of AM/FM radio. AM/FM radio reaches 86% of sports bettors. Podcasts offer another strong opportunity for online sports betting brands as 39% of sports bettors are reached by podcasts.

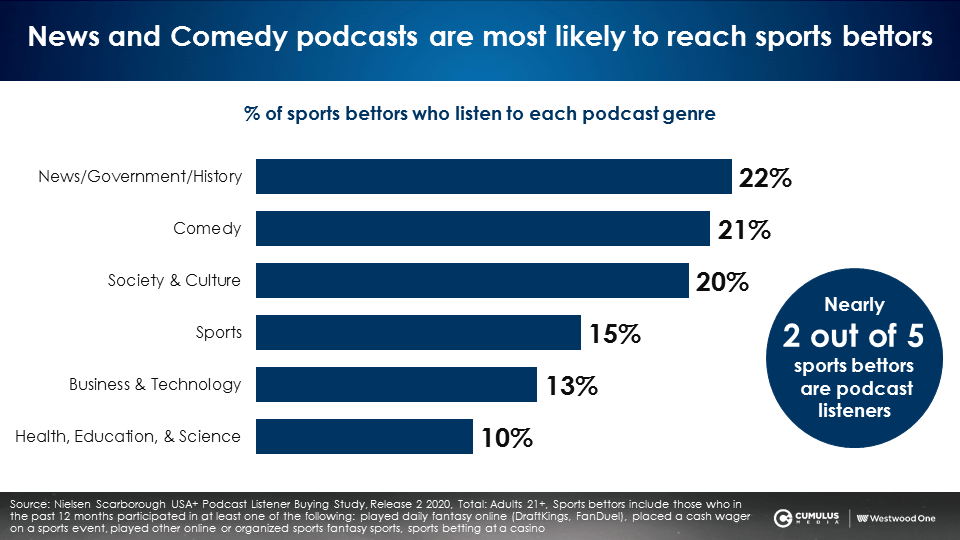

Sports bettors listen most to News/Government/History, Comedy, and Society and Culture podcasts

Online sports betting brands should consider running ads far beyond just Sports podcasts. A number of podcast genres outside of Sports attract larger audiences of sport bettors: News/Government/History, Comedy, and Society and Culture. Sports is fourth, followed by Business/Technology, and Health/Education and Science.

Key takeaways and recommendations:

- AM/FM radio should be the centerpiece of the online sport betting media plan: Compared to TV viewers, AM/FM radio listeners have far more experience with online sports betting, greater interest, greater awareness of, and greater engagement with online sports betting brands. The ideal media allocation is 43% TV and 57% AM/FM radio.

- The audio sports betting media plan should contain a wide array of podcast genres and AM/FM radio programming formats: Those interested in online sports betting listen to a broad array of podcast genres and AM/FM radio programming formats beyond just Sports programming. Audio media plans that focus mostly on spoken word (News/Talk and Sports) will miss a large number of those who are engaged with online sports betting. Based on AM/FM radio programming format preferences among those interested in online sports betting, the ideal allocation is 20% of impressions to Rock and then 10% each to the rest of the formats (Classic Rock, News/Talk, Sports, Classic Hits/Oldies, Country, Top 40, Urban, and Adult Contemporary).

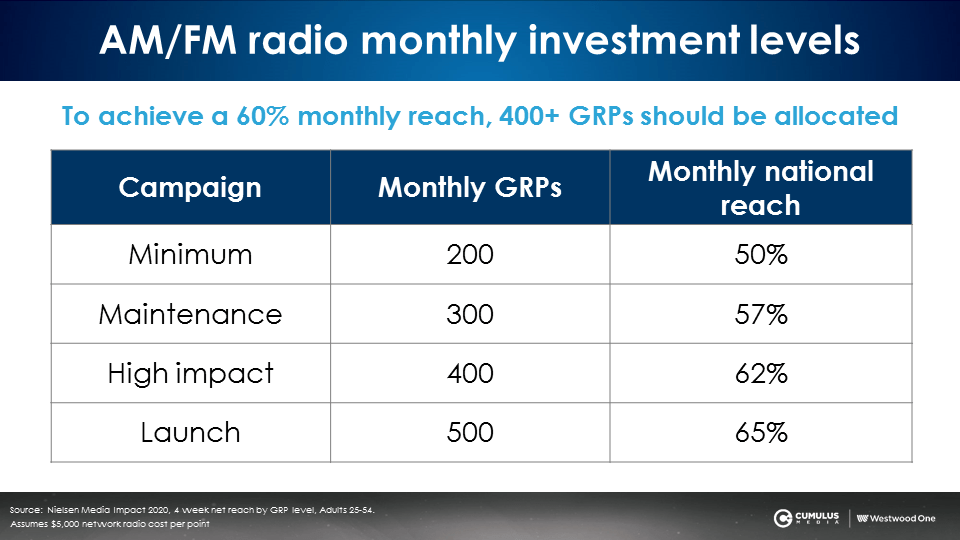

- Audio media plans should emphasize reach over frequency and increase weight to reach 60% of the market: The largest current monthly AM/FM radio plans are only reaching 28% of the market. Brands should seek to reach at least 60% of the market each month. Here are the monthly AM/FM radio GRP investment levels and the market reach achieved:

Click here to view a 14-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.