Nielsen: 5 “Back To Normal” Findings Advertisers Need To Know From Latest Wave Of Consumer Study

Nielsen held a client webinar this week to reveal the findings of their sixth COVID consumer tracking study since the pandemic. 1,000 Americans 18+ were surveyed this June 2021. Nielsen’s findings are validated by just-released June data from Apple Maps, GeoPath, Google Trends, and Moody’s Analytics.

5 things advertisers need to know about Nielsen’s very encouraging findings:

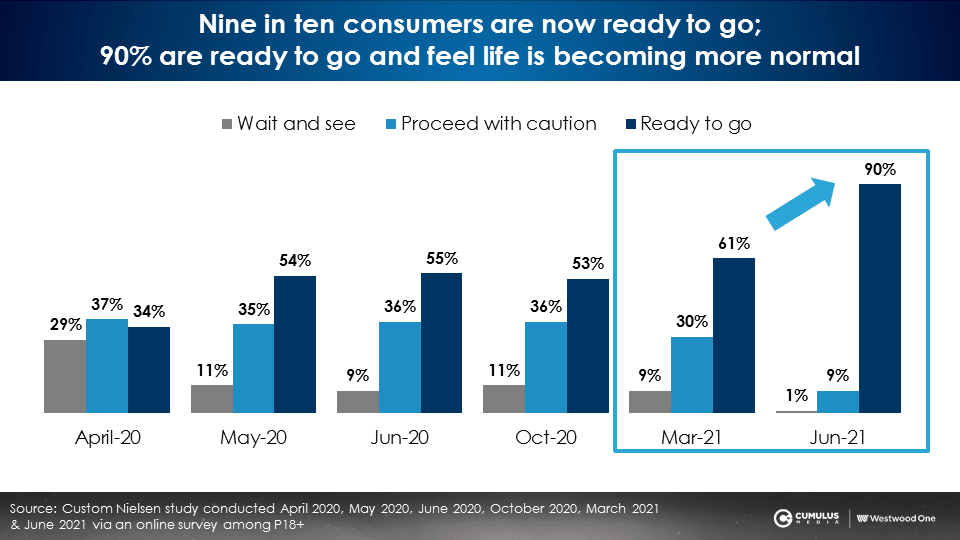

- It is time to advertise: The three-month period from March 2021 to June 2021 saw an extraordinary jump in consumer confidence pointing to things getting back to normal. The “ready to go” segment only grew six points from June 2020 to March 2021. From March 2021 to June 2021, the optimistic “ready to go” consumer segment grew an astounding 29 points.

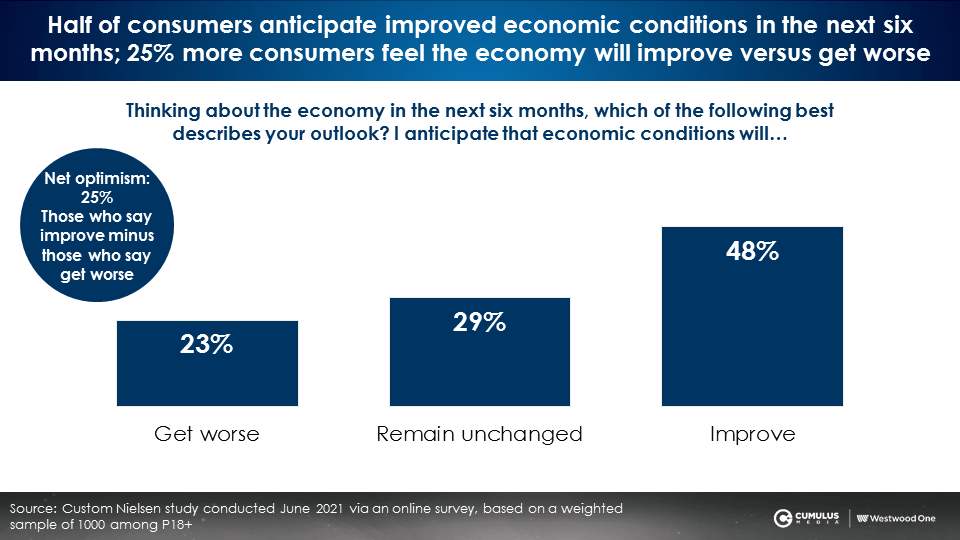

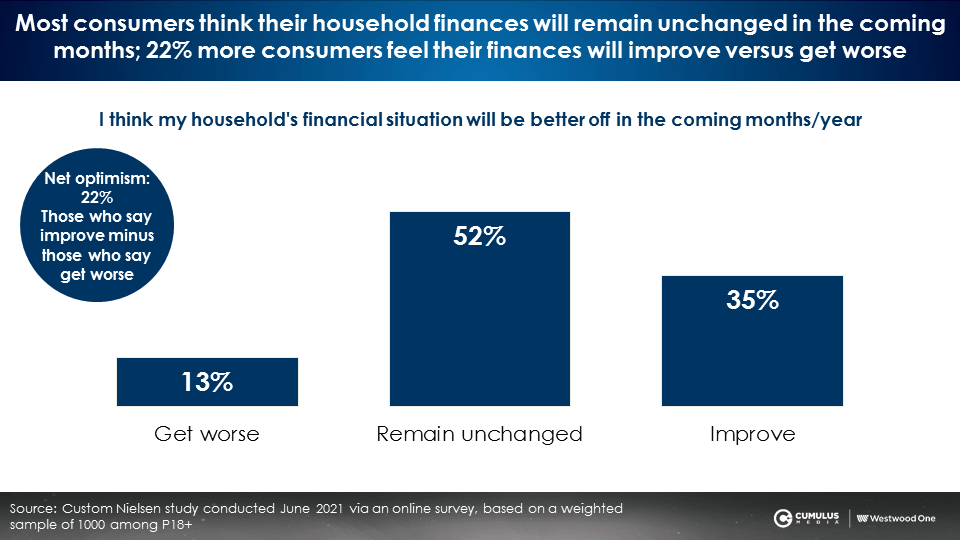

- Brands need to capitalize on this positive consumer outlook: On the economy, 25% more consumers feel things will improve versus get worse (48% improve versus 23% get worse). Nearly the same percentage more (22%) say their household finances will improve versus get worse (35% improve versus 13% get worse).

- Americans are back in their cars and listening to AM/FM radio: The majority of workers are commuting. Families are driving their kids to school. Time spent listening to AM/FM radio is up.

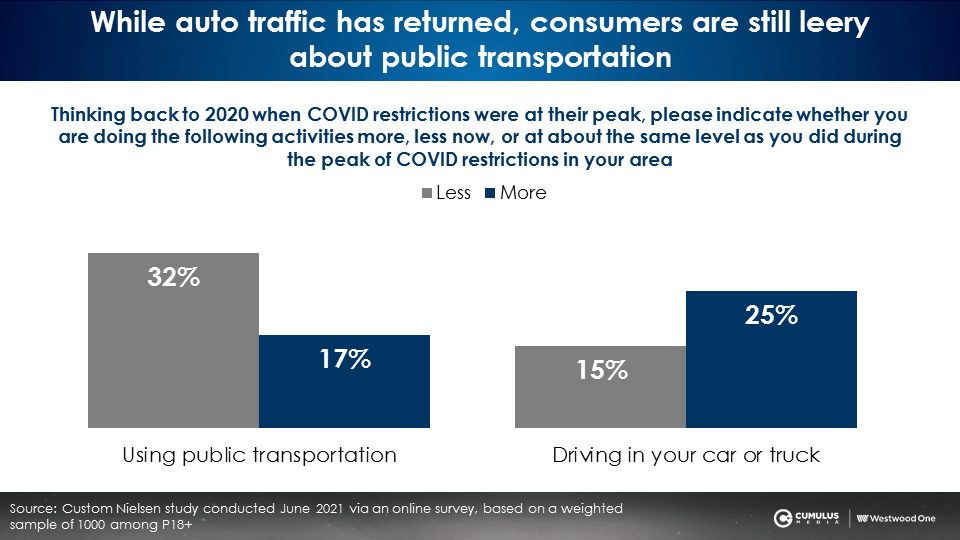

- Commuters are still leery about public transportation, a positive for AM/FM radio: 32% of consumers say they will spend less time on public transport versus 17% who will spend more time.

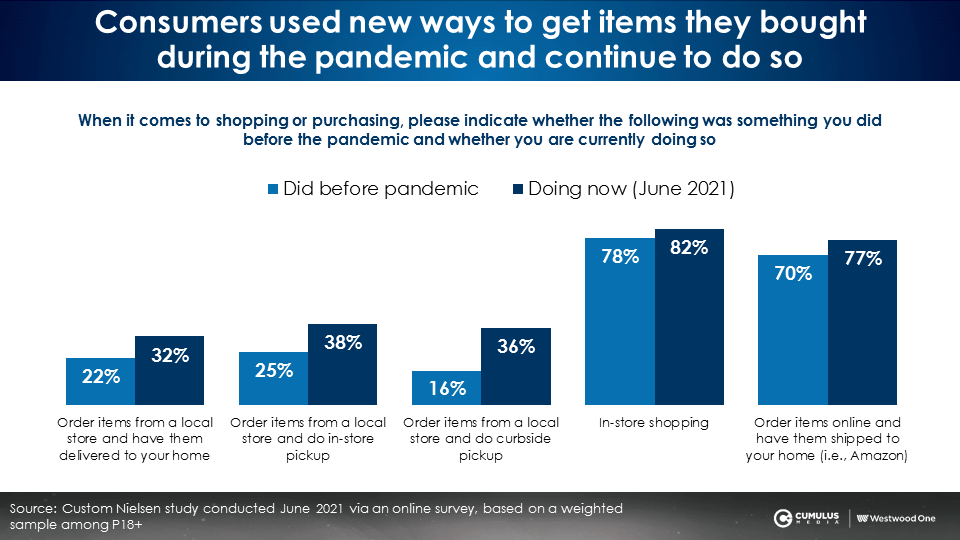

- Retailers need to continue to invest in ecommerce and ensure their AM/FM radio ads drive to web as shopping will be omni-channel: While stores are open, the convenience of hybrid shopping approaches remain: buy online and in-store or curbside pickup.

Here is a deeper dive:

At the start of the COVID consumer tracking study in April 2020, Nielsen assigned Americans into three segments based on their return to normal outlook:

- The most pessimistic group was called “wait and see”

- The in-the-middle segment was dubbed “proceed with caution”

- The most optimistic group was “ready to go”

After experiencing a 20-point jump from April to May 2020, the “ready to go” segment stabilized around 55% to 61% over the next eleven months into March 2021. The last three months have seen an explosive 29-point increase from March 2021 to June 2021. Nine in ten consumers now feel life is becoming more normal.

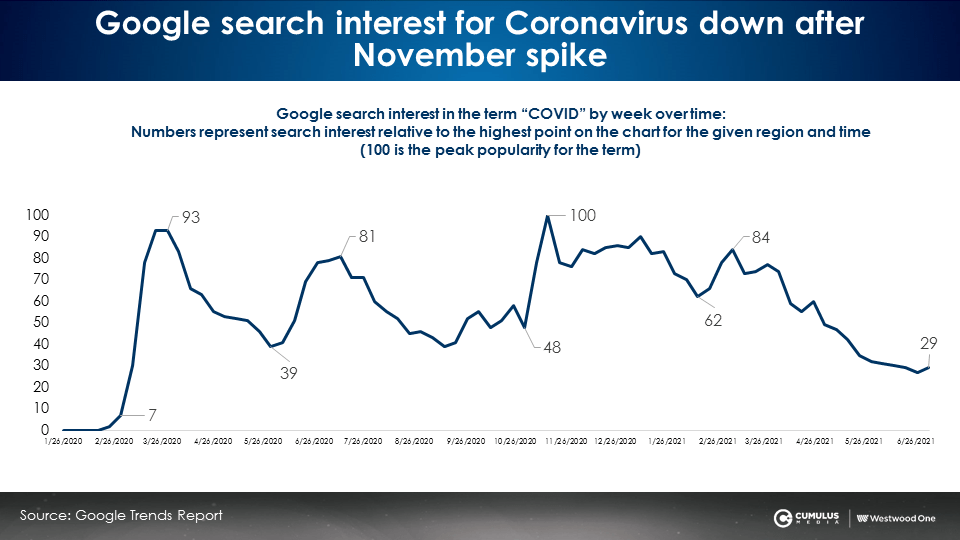

COVID concern is subsiding according to Google search trends

Nielsen’s Spring surge in “back to normal” consumer sentiment is mirrored by plunging Google search trends on the pandemic. In late June 2021, Google search trends for the term “COVID” neared their lowest level since the pandemic, 71% below the November peak.

Google search trends are a powerful source of consumer interest data. We are now at reduced COVID interest levels not seen since last February when the world was just beginning to learn about the COVID virus.

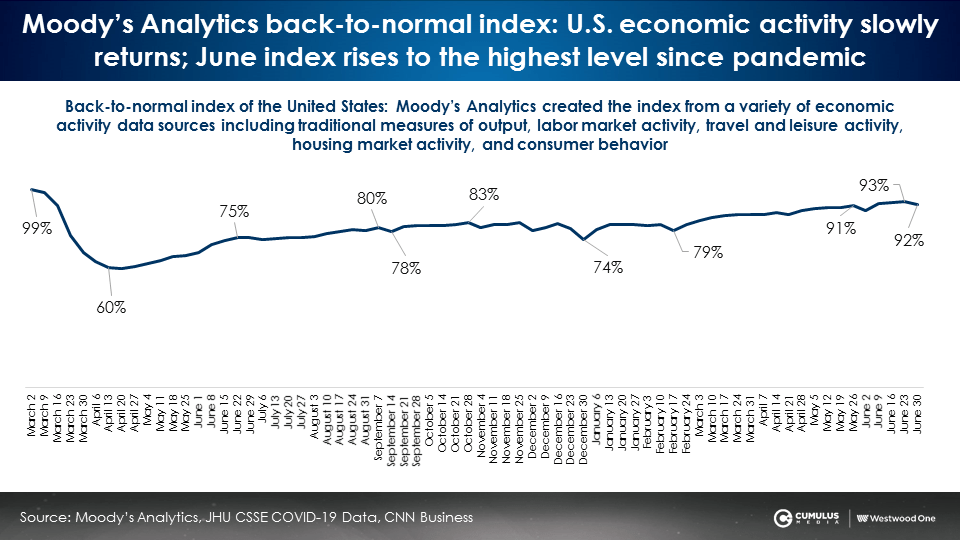

Moody’s Analytics back-to-normal index rises to the highest point since the pandemic

Moody’s Analytics created the back-to-normal index from a variety of economic activity data sources including measures of output, labor market activity, travel and leisure activity, housing market activity, and consumer behavior. At the depth of the Spring 2020 lockdown, the index sunk to a low of 60. Throughout 2021, the Moody’s back-to-normal index has been steadily rising and at the end of June, recovered into the low 90s.

Nielsen’s June 2021 study reveals a very positive consumer outlook on the economy. Nearly half say they expect economic conditions to improve. 25% more consumers feel the economy will improve versus get worse.

Nielsen finds nearly the same proportion (22%) of consumers say their household finances will improve versus worsen. Overall, half they their household finances will remain unchanged.

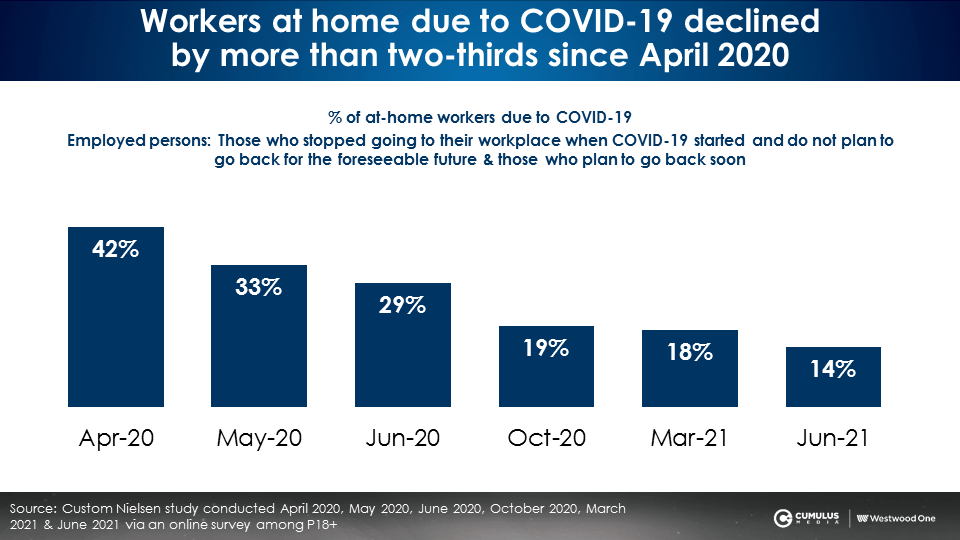

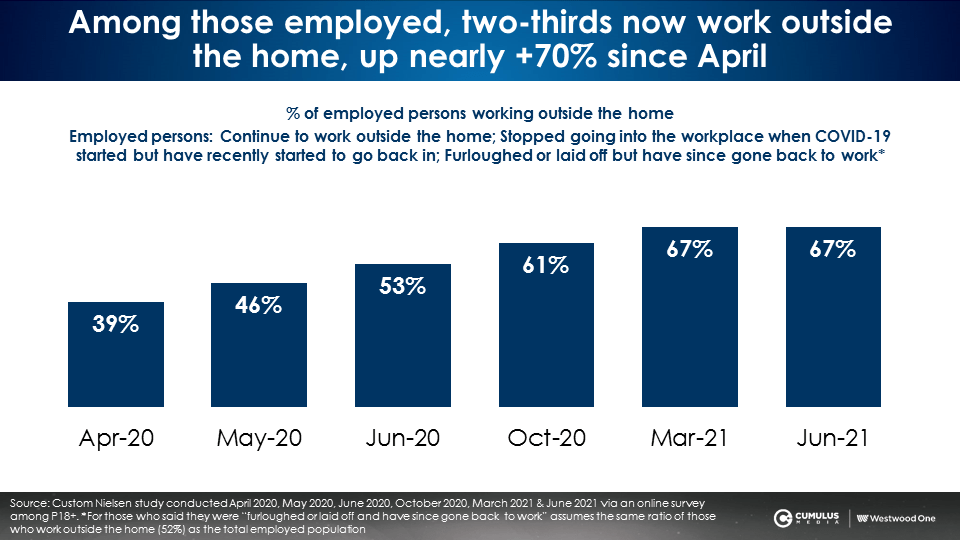

Nielsen: Those working from home dwindle to only 14% as two-thirds of workers are now commuting

U.S. Federal Reserve: 66% of workers are now commuting every day and 18% are commuting some days

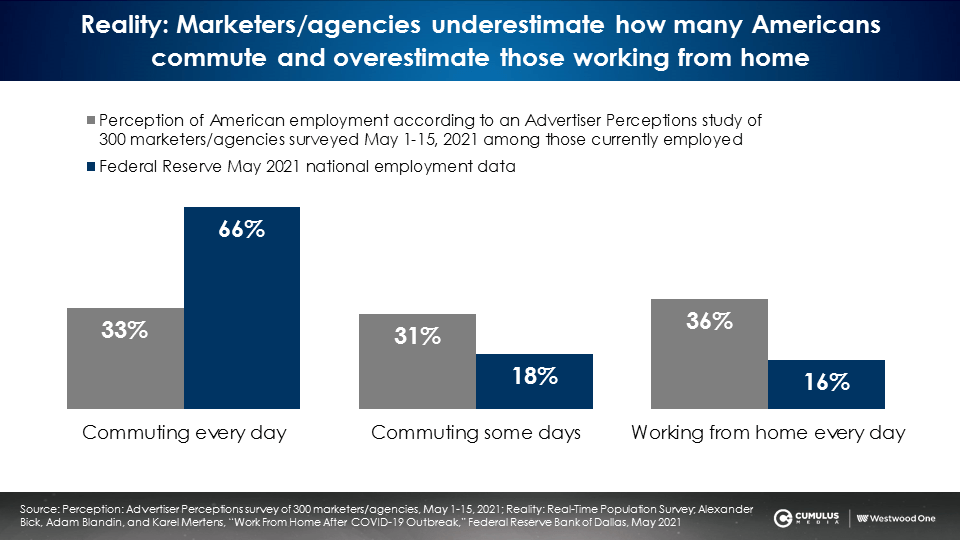

Nielsen’s June study of worker commuting patterns is validated by the Federal Reserve May 2021 worker study. The Federal Reserve reported 66% of workers commuted every day and 18% commuted some days. 16% were working from home every day.

The Federal Reserve data reveals agency and marketer perceptions about the current state of American commuting patterns are way off the mark. In May 2021, Advertiser Perceptions, the leader in researching advertiser and agency sentiment, fielded a study of 300 media decision makers. They asked, “What percentage of American workers are either working from home daily, commuting some days, or commuting every day?”

The chart below depicts advertiser/agency perceptions in grey compared to the actual Federal Reserve commuting data in blue.

- Marketers and agencies dramatically underestimate the number of Americans who are commuting to work each day: Per the U.S. Federal Reserve, 66% of U.S. workers are commuting every day. Marketers and agencies think only 33% are commuting daily. Actual U.S. daily commutes are double the advertiser perception.

- Marketers and agencies overestimate the number of Americans who are working from home: Per the U.S. Federal Reserve, 16% of workers are working from home daily. Marketers and agencies think the percentage of those working from home is 36%.

- Marketers and agencies overestimate the number of Americans who are commuting some days: The Federal Reserve says 18% of workers are commuting some days. Marketers and agencies perceive 31% of workers are commuting some days.

What is behind AM/FM radio’s audience growth? Consumer movement is up

Americans are getting out of the house and on the move. A recently released consumer tracking study from GroupM’s Mindshare found 34% of Americans plan to spend more time outside and 21% plan to spend less time online during 2021. “[These findings] bode well for media consumed out-of-home, especially outdoor, place-based media and radio,” according to MediaPost’s Joe Mandese.

Consumers spending time outdoors plus growth in vehicular traffic and miles traveled mean increases in AM/FM radio time spent. With an 87% share of ad-supported audio in the car, AM/FM radio is the queen of the road.

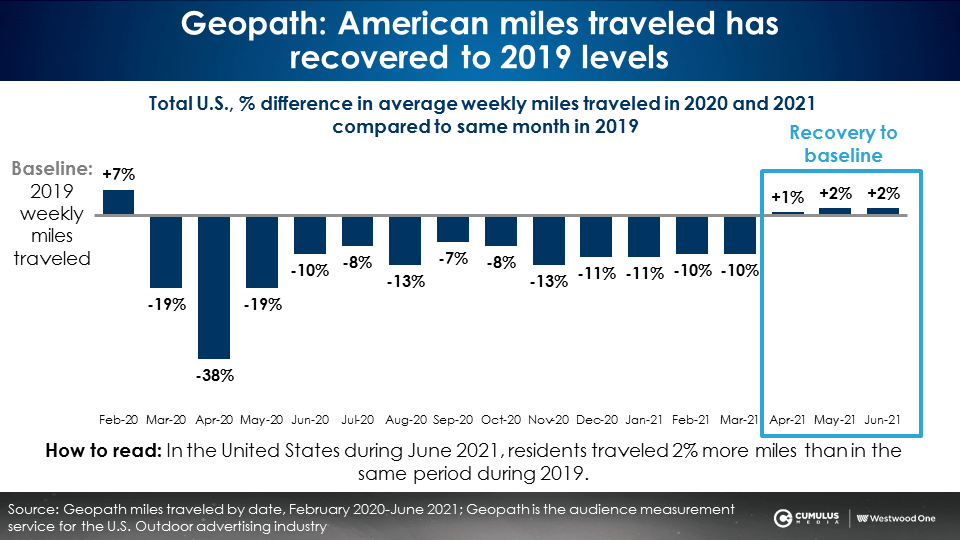

Geopath, the Nielsen of the outdoor advertiser industry, reports June 2021 miles traveled has recovered to the 2019 baseline. Miles traveled over the last six months lagged about -10% below historical norms. April, May, and June 2021 saw a sharp recovery to 2019 levels.

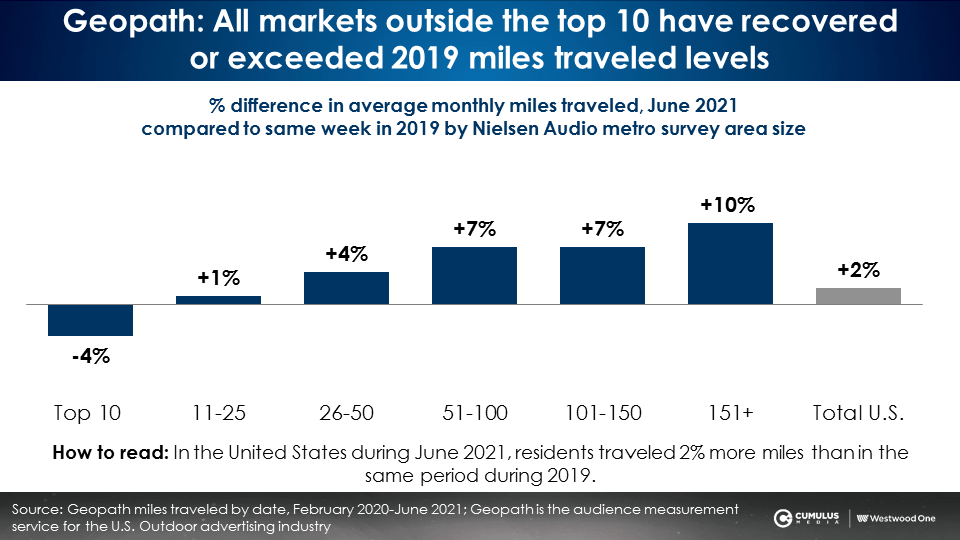

Geopath data reveals miles traveled in markets ranked 11th and smaller are up versus 2019. The smaller the market, the larger the miles traveled increase versus 2019. Only the top ten markets continue to slightly lag 2019 vehicular miles traveled volumes (-4%).

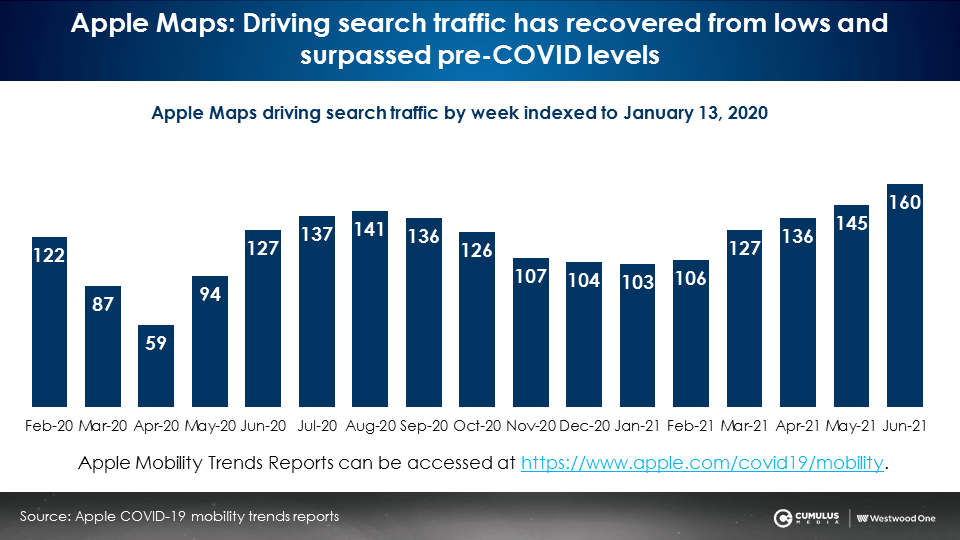

Apple Maps has been tracking automotive trip search requests over the last year. In June 2021, Apple Maps car trip search requests were +60% greater than before the pandemic, marking their highest levels in the last two years.

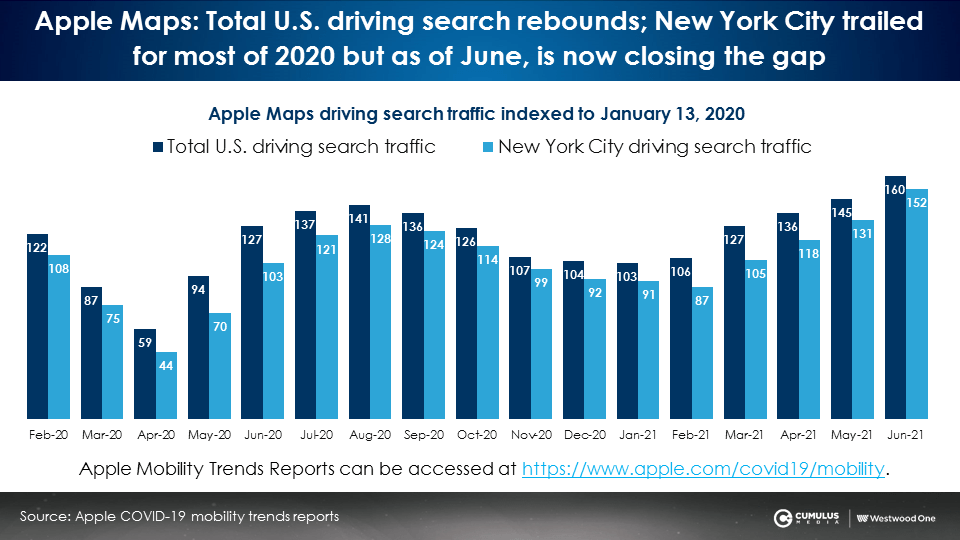

In New York City, the capital of media planning and buying, vehicular traffic has rebounded strongly, per Apple Maps car trip search requests. New York City car trip search volumes nearly match the U.S. recovery after lagging behind the country over the past year.

Nielsen: While auto traffic has returned, consumers are still leery about public transportation

While Americans are happy to drive in their vehicle, many still show reluctance about using public transportation. Those who say they will use public transportation less outnumber those who say they will use it more.

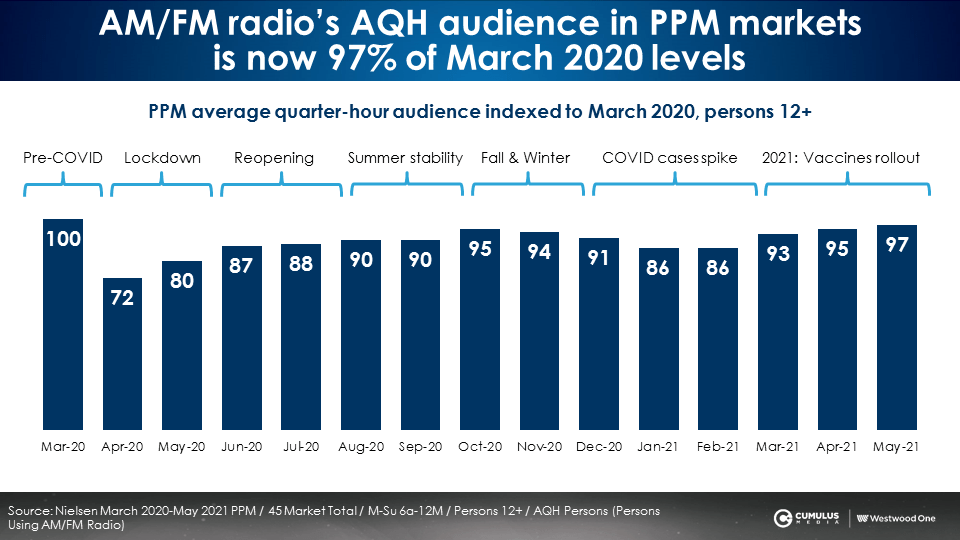

As America gets back on the road and in their cars, AM/FM radio listening has soared +13% since the beginning of this year

AM/FM radio’s average quarter-hour audience in PPM markets is now 97% of pre-COVID listening levels. May 2021 AQH is up +13% since January 2021.

Nielsen: AM/FM radio is the soundtrack of America’s recovery

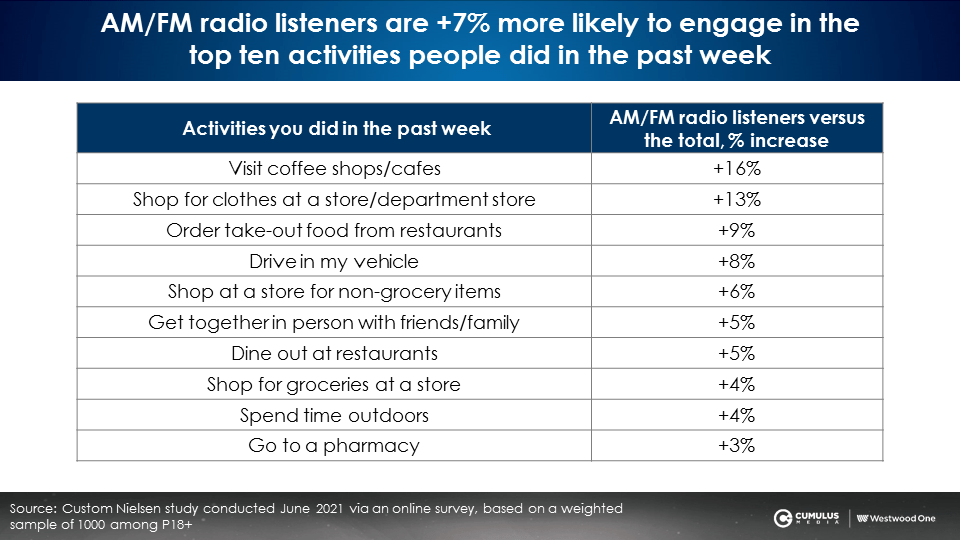

In each of the prior five studies, Nielsen found that AM/FM radio listeners were more likely to appear in the “ready to go” consumer confidence segment and make purchase decisions. This study is no different.

Across a wide variety of popular activities, Nielsen’s June study found heavy AM/FM radio listeners are more likely than the average to shop and engage with people. This is why Nielsen declares AM/FM radio to be the soundtrack of America’s recovery.

Brands need to ensure their omni-channel capabilities are featured in their AM/FM radio copy as the pandemic created new online shopping habits that remain

Consumers report they are continuing to exhibit a number of online-based shopping behaviors they adopted during the pandemic.

Key takeaways:

- It is time to advertise: The three-month period from March 2021 to June 2021 saw an extraordinary jump in consumer confidence pointing to things getting back to normal. The “ready to go” segment only grew six points from June 2020 to March 2021. From March 2021 to June 2021, it grew an astounding 29 points.

- Brands need to capitalize on this positive consumer outlook: On the economy, 25% more consumers feel things will improve versus get worse (48% improve versus 23% get worse). Nearly the same percentage more (22%) say their household finances will improve versus get worse (35% improve versus 13% get worse).

- Americans are back in their cars and listening to AM/FM radio: The majority of workers are commuting. Families are driving their kids to school. Time spent listening to AM/FM radio is up.

- Commuters are still leery about public transportation, a positive for AM/FM radio: 32% of consumers say they will spend less time on public transport versus 17% who will spend more time.

- Retailers need to continue to invest in ecommerce and ensure their AM/FM radio ads drive to web as shopping will be omni-channel: While stores are open, the convenience of hybrid shopping approaches remain: buy online and in-store or curbside pickup.

Click here to view a 10-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.