Auto Insurers: Increase Spend On AM/FM Radio To Drive Incremental Reach, Search, And Site Traffic

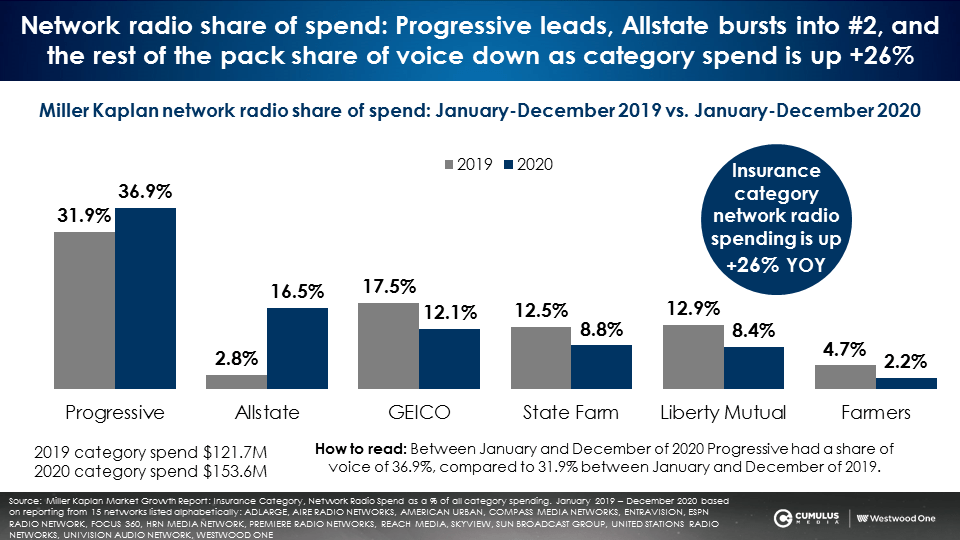

Auto insurers, always strong users of AM/FM radio, increased their AM/FM radio commitment in 2020 despite the pandemic. Last year, the insurance category increased network radio spend by +26% versus 2019, according to Miller Kaplan.

Progressive grew its share of voice leadership from 32% to 37% while Allstate made a strong return to AM/FM radio, leaping into second place. The remaining brands maintained investment levels but saw their share of voice drop due to increased category spend.

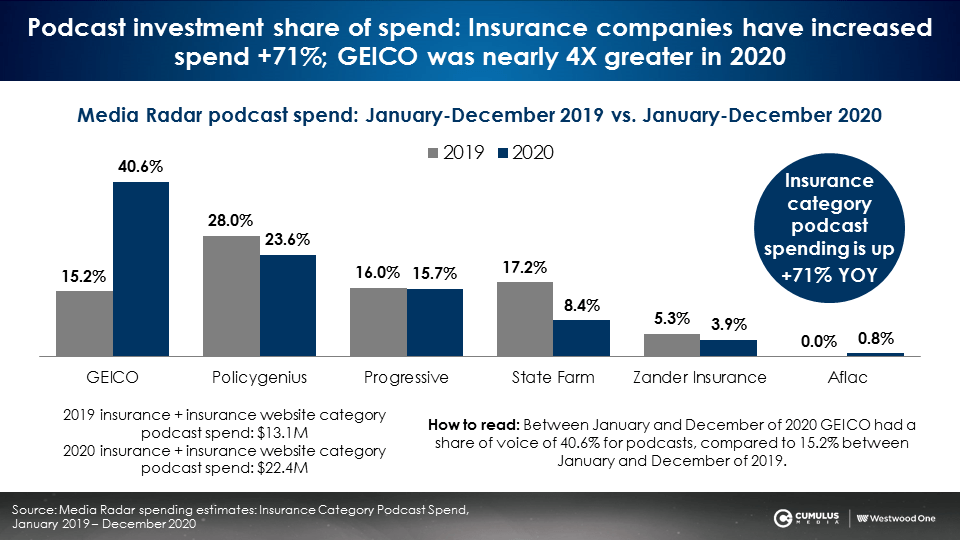

While insurance spend in network radio grew +26% in 2020, podcast spend almost doubled. According to Media Radar, a firm that tracks podcast ad occurrences, 2020’s podcast spend in the insurance category was up +71% in 2020 over the prior year.

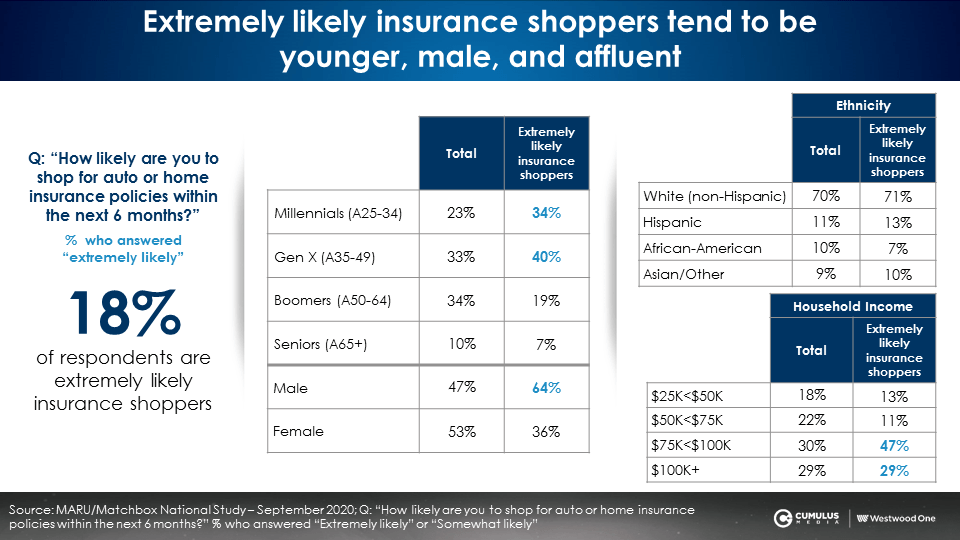

In-market insurance shoppers: Younger, male, and affluent

A September 2020 MARU/Matchbox study found 18% of Americans reported they were “extremely likely” to shop for insurance policies in the next six months. The profile of the in-market insurance shopper skews male, has a $75K+ income, and is young, with 74% falling in the 25-49 age bracket.

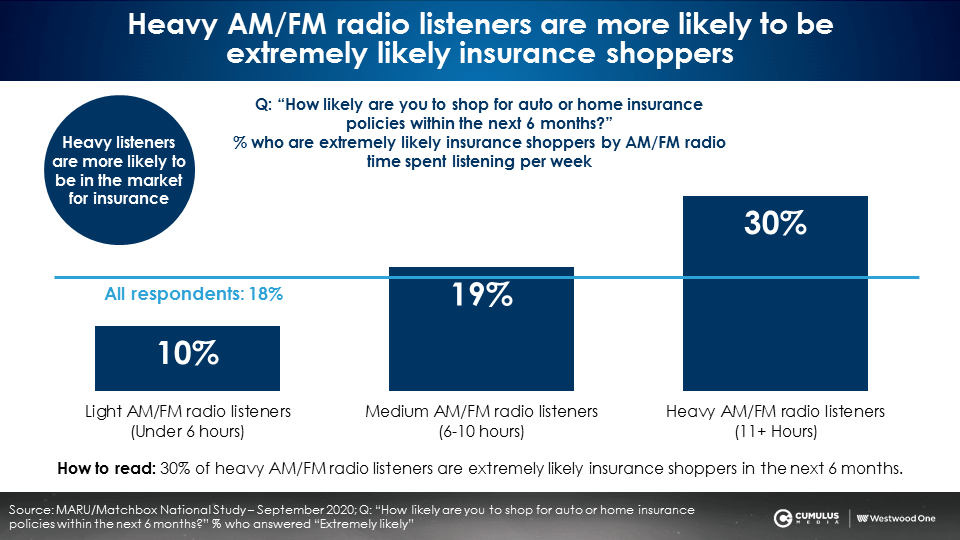

AM/FM radio is the ideal medium for insurance brands: The greater the time spent with AM/FM radio, the more likely listeners are in the market for insurance

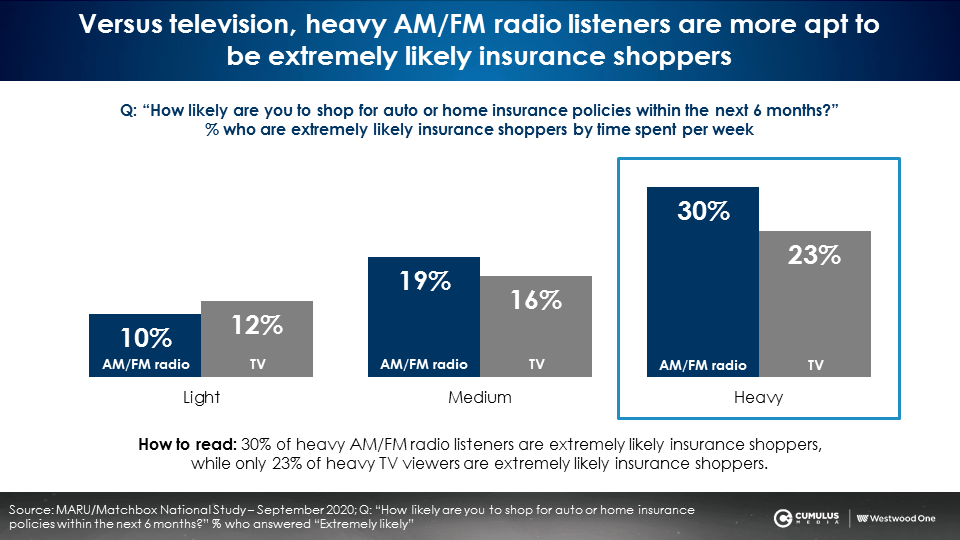

Nielsen Scarborough reports 90% of those who will switch their auto insurance provider in the next year are reached by AM/FM radio. The MARU/Matchbox study revealed that while 18% of total consumers indicated they were “extremely likely” to be in the market for insurance, a whopping 30% of heavy AM/FM radio listeners indicate they are in market.

Heavy AM/FM radio listeners are +67% more likely than the average to be in the market for insurance. No wonder insurance brands are upping their spend on audio.

Versus heavy TV viewers, heavy AM/FM radio listeners are +30% more likely to be in market for insurance

23% of heavy TV viewers are extremely likely to shop for insurance in the next 6 months compared to 30% for heavy AM/FM radio listeners. Running the same impressions on TV and AM/FM radio will yield +30% more in-market consumers on AM/FM radio.

Nielsen Media Impact: AM/FM radio generates a +39% increase in incremental reach among adults 25-34 for five major insurance brands

Life’s major milestones typically occur between the ages of 25 and 34: first car, first house, marriage, and first child. Insurance firms need to create awareness, interest, and favorability for their brand with this demographic so they get into the consideration set of consumers.

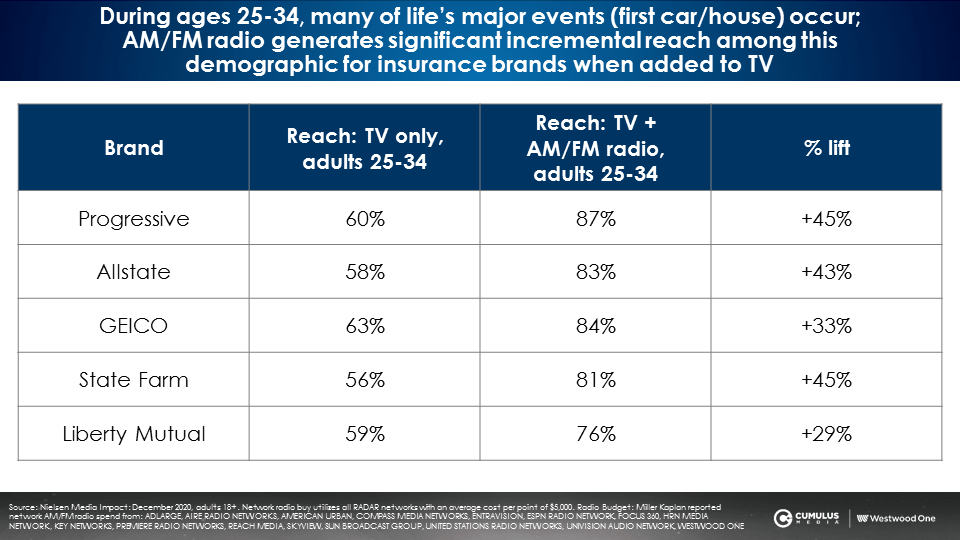

The table below depicts the reach among adults 25-34 of five major insurance brands’ December 2020 television campaigns. The next column reveals the net reach of each brand’s TV and AM/FM radio campaign. Any duplication between the TV and AM/FM radio reach is eliminated. The last column represents the increase in incremental reach generated by AM/FM radio.

As an example, Allstate’s TV campaign last December generated a 58% reach among adults 25-34. The addition of Allstate’s AM/FM radio campaign to their TV buy generated an 83% net reach. AM/FM radio grew Allstate’s adult 25-34 reach by +43%.

AM/FM radio makes your TV better. The average insurance brand experiences a +39% increase in adult 25-34 reach thanks to their AM/FM radio campaign.

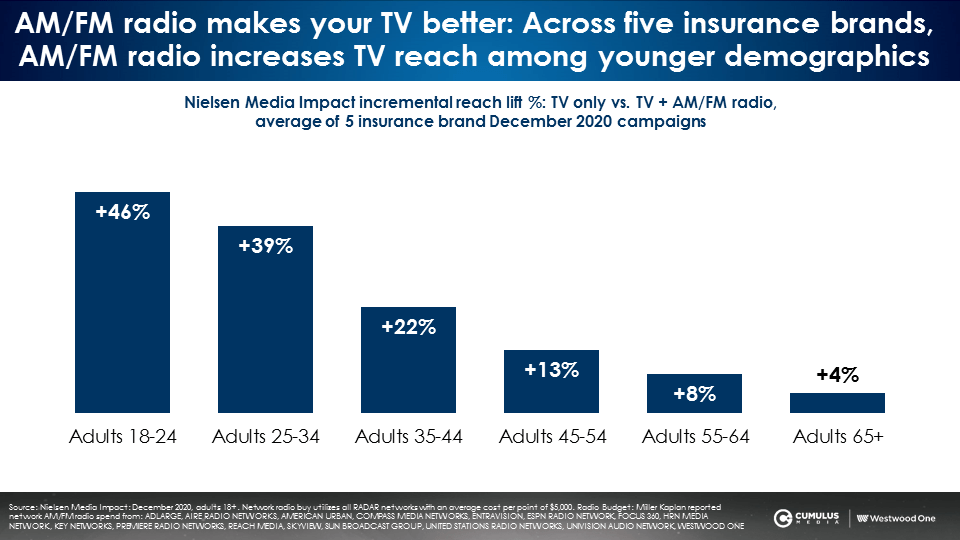

The younger the demographic, the greater the increase in incremental reach generated by AM/FM radio

Among adults 35-44, AM/FM radio generates a +22% average increase in reach as an overlay to the TV plans of five major insurance brands. Adult 25-34 reach grows +39%. Among adults 18-24, AM/FM radio lifts incremental reach by +46%.

AM/FM radio complements and supplements TV among adults 18-34. According to Nielsen’s Q4 2020 Total Audience Report, the weekly reach of live and time-shifted TV is only 62%. Two out of five adults 18-34 are not reached by linear television weekly. In contrast, Nielsen reports 84% of adults 18-34 are reached weekly by AM/FM radio.

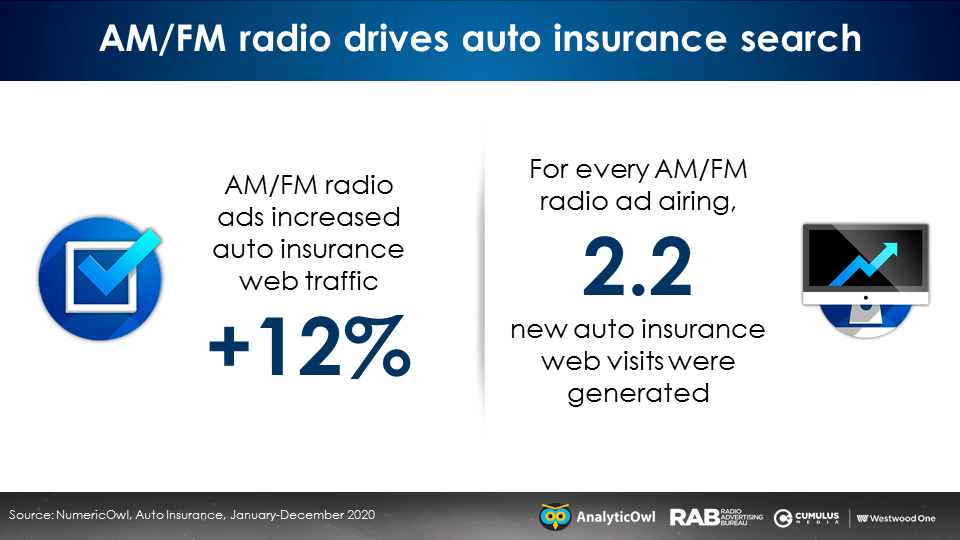

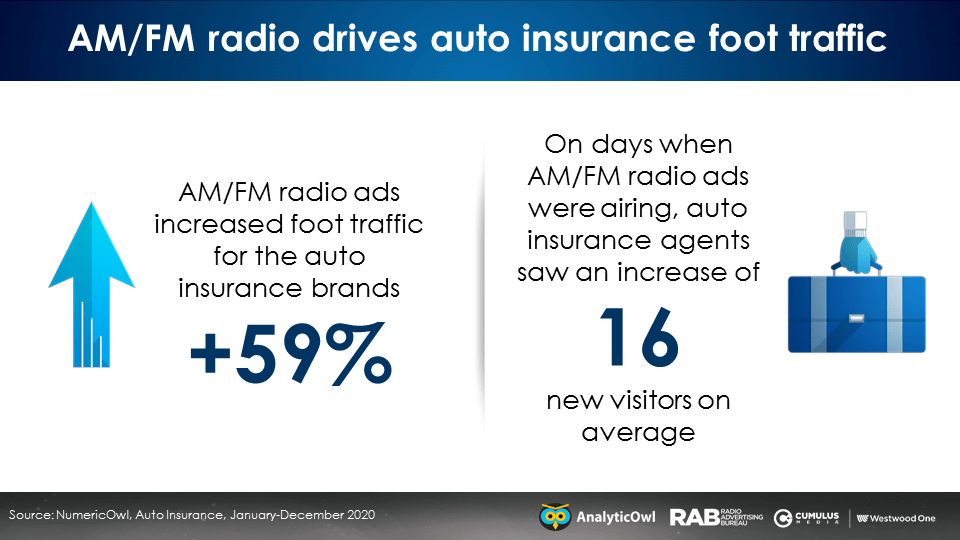

AnalyticOwl: AM/FM radio advertising generates a +12% increase in web traffic and a +59% increase in retail visits for auto insurance brands

The Radio Advertising Bureau conducted an analysis of AnalyticOwl’s attribution measurement of 35,700 auto insurance ads than ran throughout 2020. AnalyticOwl connects AM/FM radio ad occurrences to insurance website search and site traffic.

The analysis found that AM/FM radio advertising drives auto insurance web activity, generating a +12% increase in web traffic and a +59% increase in retail visits for auto insurance brands.

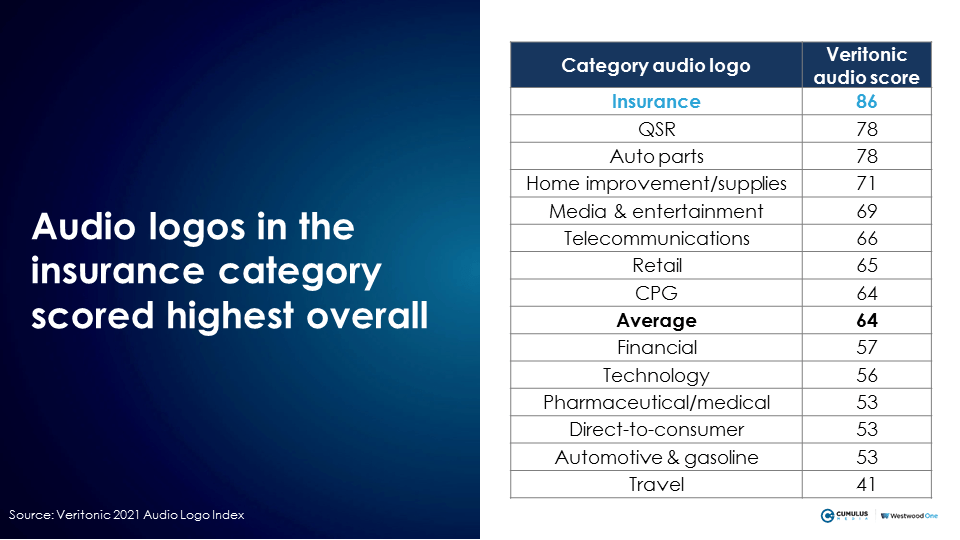

Veritonic: Audio logo testing reveals insurance brands have some of the top scoring sonic brands

Veritonic, the audio intelligence platform, specializes in testing audio creative. Each year, Veritonic tests hundreds of audio logos with 3,700 consumers in the U.S. and the U.K. They publish their findings in their Audio Logo Index.

The sonic brands of insurance firms generate the strongest creative performance of all categories.

Veritonic audio logo best practices: Have melody and say the name of the brand

Veritonic has found that audio logos with melody perform far better in memorability. Not surprisingly, audio logos that say the name of the brand, rather than just music notes, also perform exceptionally better. Audio logos with both melody and the brand name knock it out the park in effectiveness.

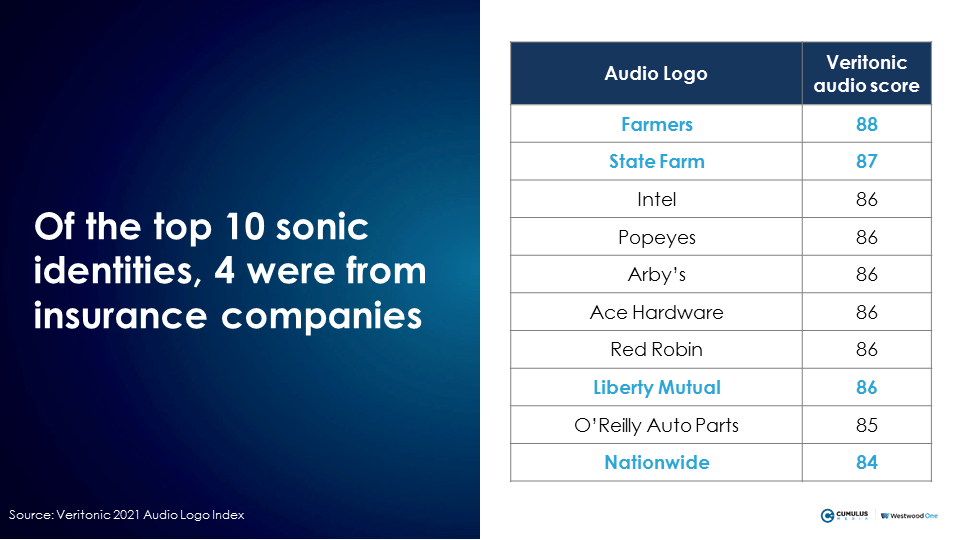

Four of the top ten tested audio logos are from insurance brands. As you read each brand, the audio logo starts playing in your head:

- Farmers: “We are Farmers…bum-ba-dum-bum, bum bum bum.”

- State Farm: “Like a good neighbor, State Farm is there.”

- Liberty Mutual: “Liberty, Liberty, Liberty, Liberty!”

- Nationwide: “Nationwide is on your side.”

Insurance brand best practice: Brand early and often

Insurance brands have mastered one of the most crucial audio creative best practices: brand early and often. They have learned the power of placing their brand name within the first three seconds of the ad and frequently throughout.

According to a study conducted by CUMULUS MEDIA | Westwood One with Veritonic, insurance brands with “enhanced branding” that included saying the same of the brand earlier performed better than the prior creative. Overall, the total average score of enhanced ads was +9% greater than the prior ads.

Key takeaways:

- Heavy AM/FM radio listeners are more likely to be in-market insurance shoppers.

- AM/FM radio reaches auto insurance shoppers: AM/FM radio reaches 90% of adults 18+ who plan to change their auto insurance provider within the year.

- AM/FM radio drives auto insurance search: AM/FM radio ads increased auto insurance web traffic +12%, according AnalyticOwl.

- AM/FM radio drives auto insurance foot traffic: AM/FM radio ads increased foot traffic for the auto insurance brands +59%, according to AnalyticOwl.

- Nielsen Media Impact: AM/FM radio generates significant incremental reach lift especially in younger demographics.

- Veritonic 2021 Audio Logo Index: Farmers, State Farm, and Liberty Mutual’s audio logos all had almost perfect recall scores due to consistent use in the market, mentioning the brand name, and melody.

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.