Edison Research’s Q1 2021 “Share of Ear” Report: AM/FM Radio Adds Significant Audience To Pandora/Spotify, Reaches Consumers On The Path To Purchase, And Is The Most Listened To Ad-Supported Audio On Smart Speakers

The recently released Q1 2021 edition of Edison Research’s “Share of Ear,” the gold standard audio time use study, contains five interesting findings.

1. Adding AM/FM radio to Pandora or Spotify generates a massive increase in reach.

Some advertisers make a buy on Spotify and Pandora and declare, “The audio box is checked.” Not so fast.

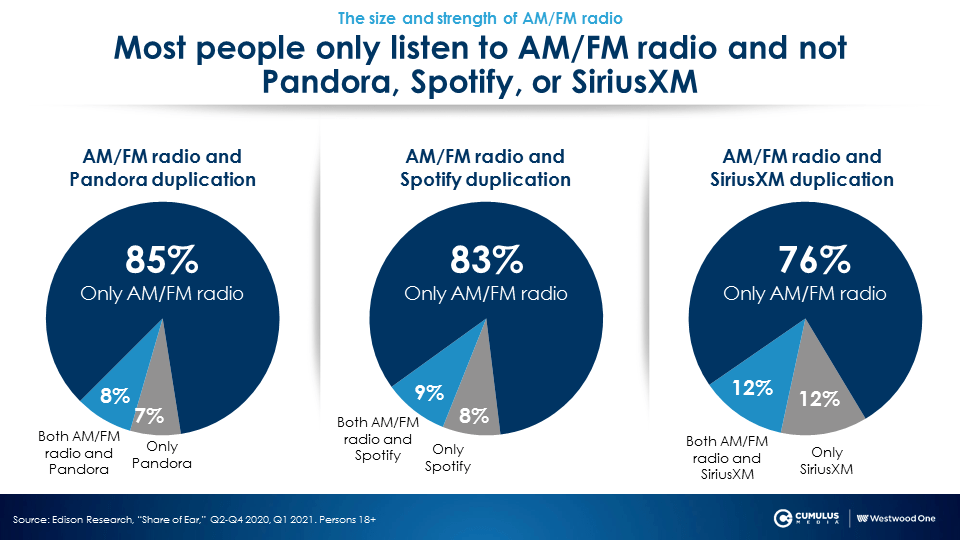

This duplication analysis reveals that more people listen to AM/FM radio and not Pandora, Spotify, or SiriusXM.

- Of the combined AM/FM radio and Pandora audience, in a typical day, 85% listens to AM/FM radio and never listens to Pandora. Over half of Pandora’s audience also listens to AM/FM radio. Thus, an ad buy on AM/FM radio reaches half of Pandora’s audience for no extra cost.

- Of the combined AM/FM radio and Spotify audience, 83% listens to AM/FM and does not listen to Spotify. Over half of Spotify’s audience also listens to AM/FM radio. An ad buy on AM/FM radio has the added bonus of delivering half of Spotify’s audience for free.

- Of the combined AM/FM radio and SiriusXM audience, 76% listens to AM/FM radio and does not listen to SiriusXM. Half of SiriusXM’s audience also listens to AM/FM radio. Buy AM/FM radio and get half of SiriusXM’s audience at no extra charge.

Since Pandora and Spotify audiences are so small, it is very difficult to build reach on their platforms. Even as investment is increased, reach growth flatlines on Pandora and Spotify. Meanwhile, as AM/FM radio investment is increased, reach grows and grows.

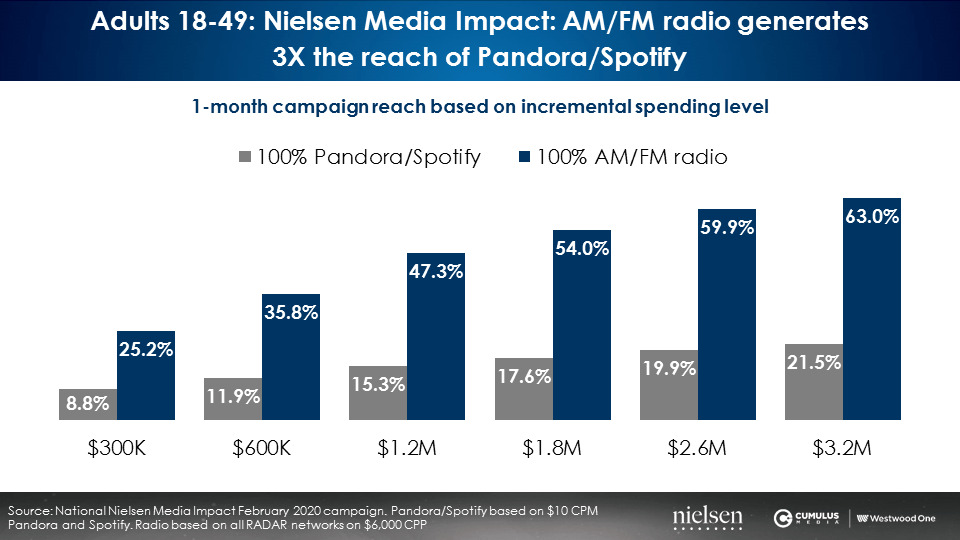

Nielsen Media Impact, the media planning and optimization platform, reports that increased investment on Pandora and Spotify yields very little reach growth (in grey below). The same investment levels on AM/FM radio generates triple the reach (blue bars below) with reach that keeps growing.

A $300,000 buy on Pandora and Spotify reaches 9% of U.S. persons 18-49. The same buy on AM/FM radio reaches three times as many people (25%).

Adding another $300,000 to Pandora and Spotify only generates three more reach points (11.9% versus 8.8%). The addition of $300,000 to AM/FM radio increases reach by 11 points.

An increase in spend on AM/FM radio results in a significant increase in reach. Increased investment on Pandora/Spotify generates little if any incremental reach.

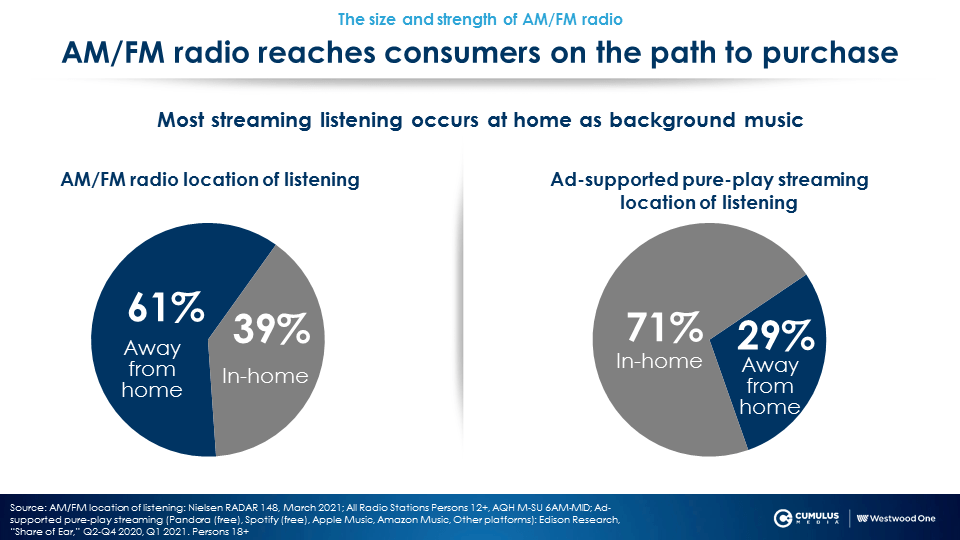

2. Most Spotify/Pandora listening occurs at home while the majority of AM/FM radio listening occurs away from home.

Years ago, people had a “box of music” at home filled with CDs and albums that played softly as background music. Today, it is Pandora and Spotify that softly plays at home in the background in the other room.

“Share of Ear” reveals 71% of time spent with Pandora and Spotify occurs at home. Conversely, according to Nielsen, most AM/FM radio listening occurs away from home in the car and at work.

Pandora and Spotify are “chill out,” lean back audio platforms in the other room. AM/FM radio is a lean-in entertainment and information service that is the soundtrack of the American worker.

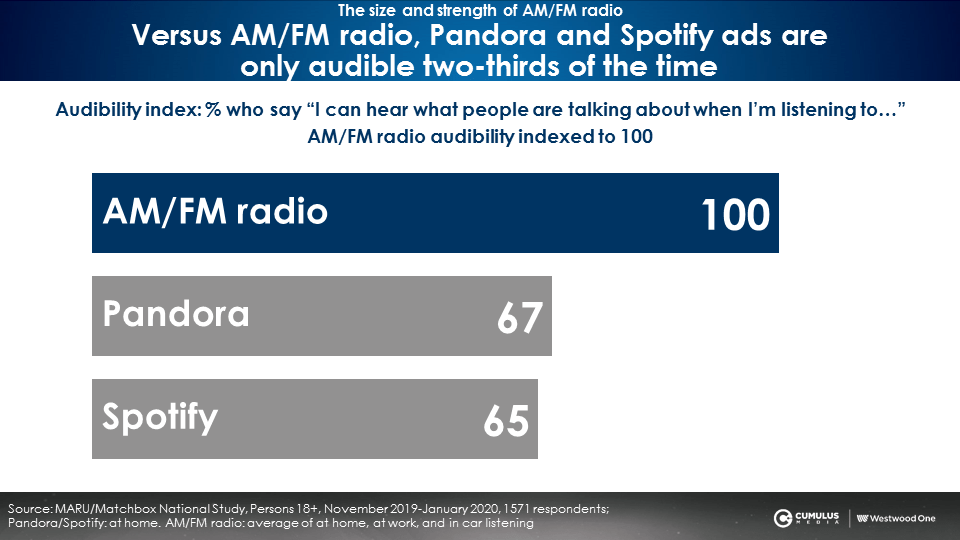

A MARU/Matchbox study of 1,571 listeners found a major difference between the audibility of AM/FM radio and Pandora/Spotify. When asked if they “could hear what people were talking about” on Pandora and Spotify, only about half of respondents reported being able to hear speaking. Pandora and Spotify have only two-thirds of the attention and audibility of AM/FM radio.

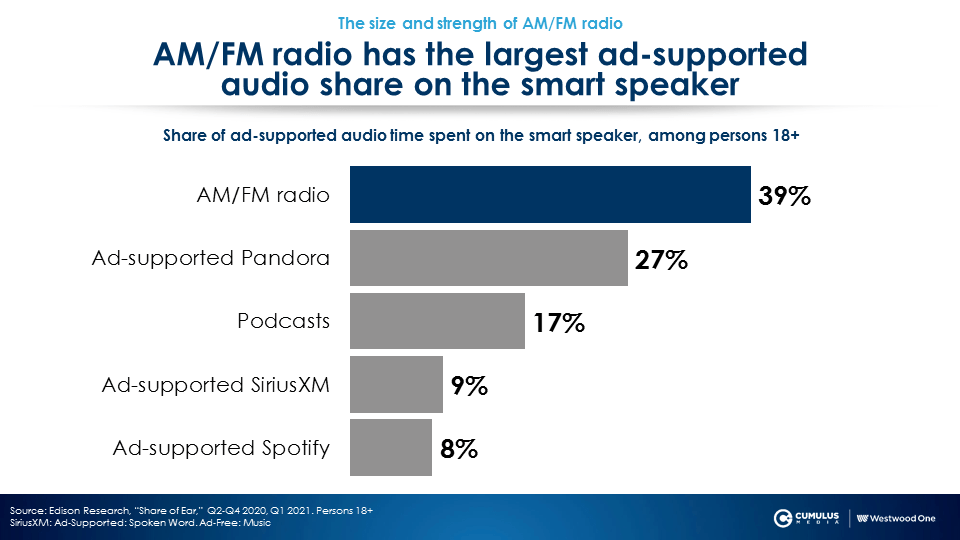

3. AM/FM radio is the most listened to ad-supported platform on smart speakers, a consistent trend over the last several years.

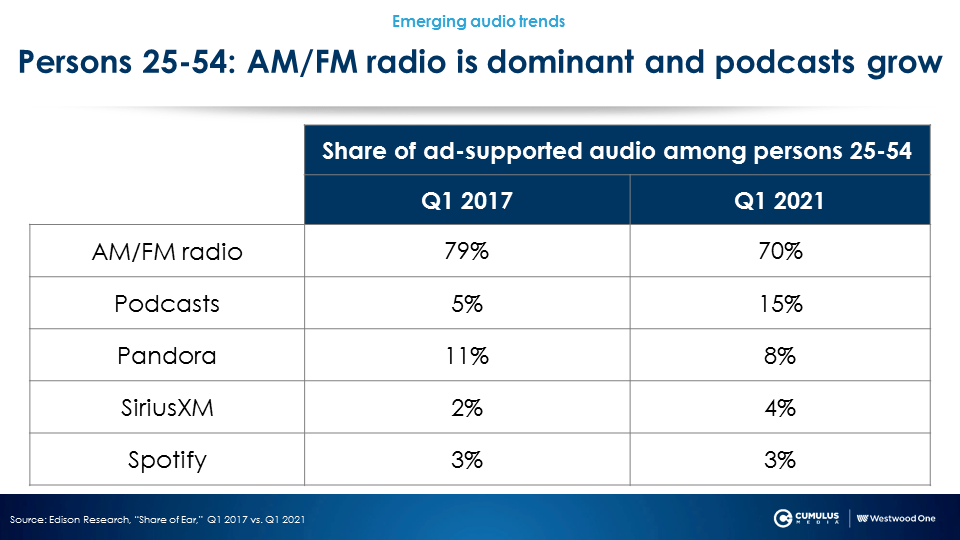

4. Podcasting’s audience trajectory continues to soar while AM/FM radio remains the undisputed leader in ad-supported audio.

Since 2017, podcasting’s audience share has tripled. Spotify, a tiny player at a 3 share, is flat. SiriusXM’s two share point gain is washed out by Pandora’s three share point loss. All of the growth in ad-supported audio is coming from podcasting.

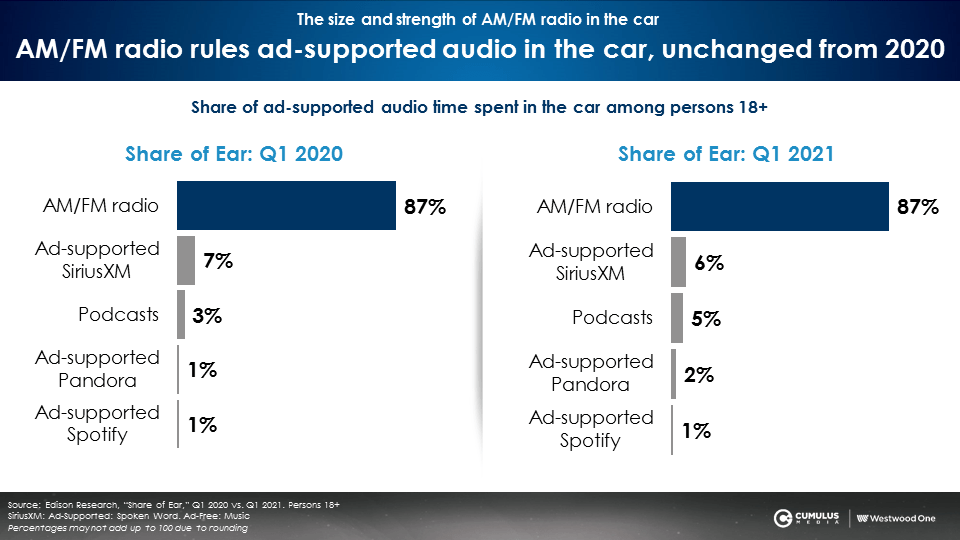

5. As America gets back on the road, AM/FM radio’s in-car share of ad-supported audio remains at a dominant 87%.

AM/FM radio’s near 90% share of in-car ad-supported audio has not moved from a year ago. AM/FM radio is the smart choice to reach hundreds of millions of Americans on the path to purchase.

Key takeaways:

- Adding AM/FM radio to Pandora or Spotify generates a massive increase in reach.

- Most Spotify/Pandora listening occurs at home while the majority of AM/FM radio listening occurs away from home.

- AM/FM radio is the most listened to ad-supported platform on smart speakers, a consistent trend over the last several years.

- Podcasting’s audience trajectory continues to soar while AM/FM radio remains the undisputed leader in ad-supported audio.

- As America gets back on the road, AM/FM radio’s in-car share of ad-supported audio remains at a dominant 87%.

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.