With America Back On The Move And Vehicular Traffic Up, AM/FM Radio’s Surge In Listening Can Help Businesses Recover

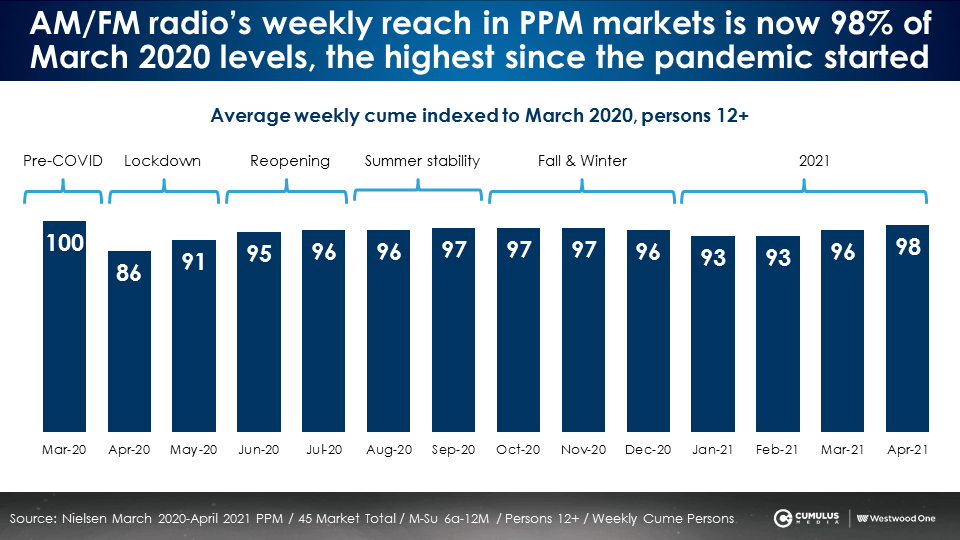

Last week, Nielsen released the April Portable People Meter data for the top 48 markets in the U.S. It was a record breaker.

In PPM markets, AM/FM radio’s audience reach for April 2021 was the highest since the pandemic started, notching a 98% recovery index versus March 2020.

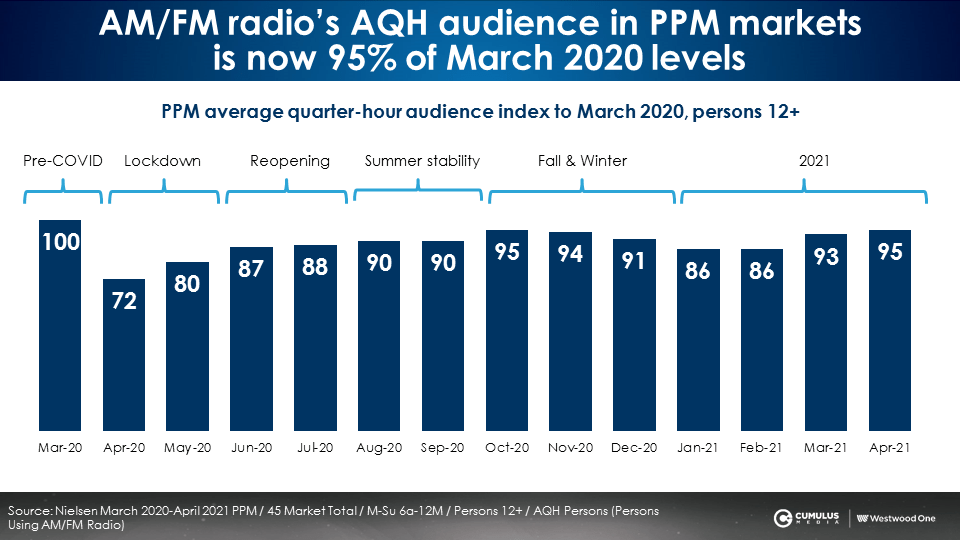

AM/FM radio’s average quarter-hour audience in the PPM markets grew to the highest point since the pandemic began at a 95% recovery index versus March 2020. Since the beginning of 2021, AM/FM radio’s AQH is up 10%.

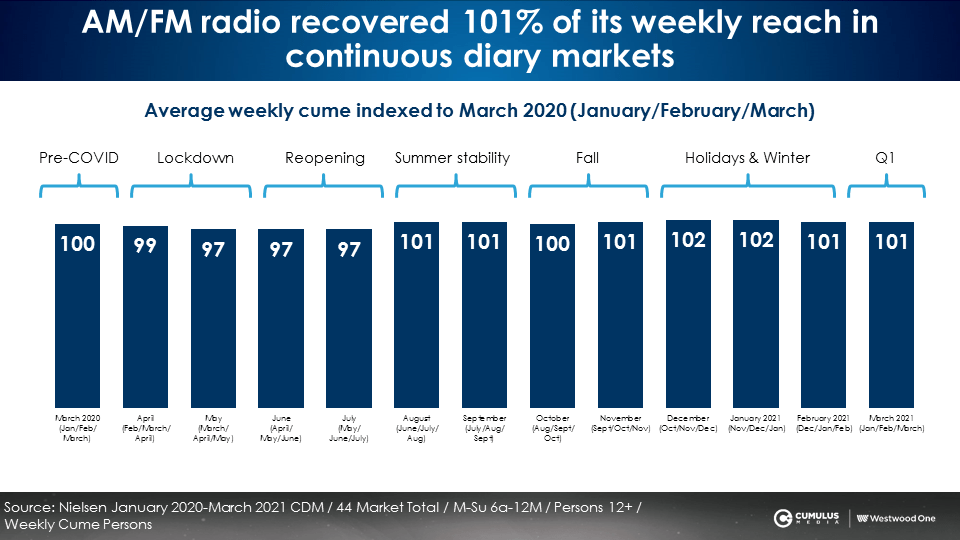

In markets outside the top 50 measured by the personal diary, Nielsen reports that AM/FM radio audiences are incredibly stable having experienced very slight reach losses in Spring 2020, which immediately recovered. January-February-March 2021 AM/FM radio reach in the diary markets is identical to the same period a year ago.

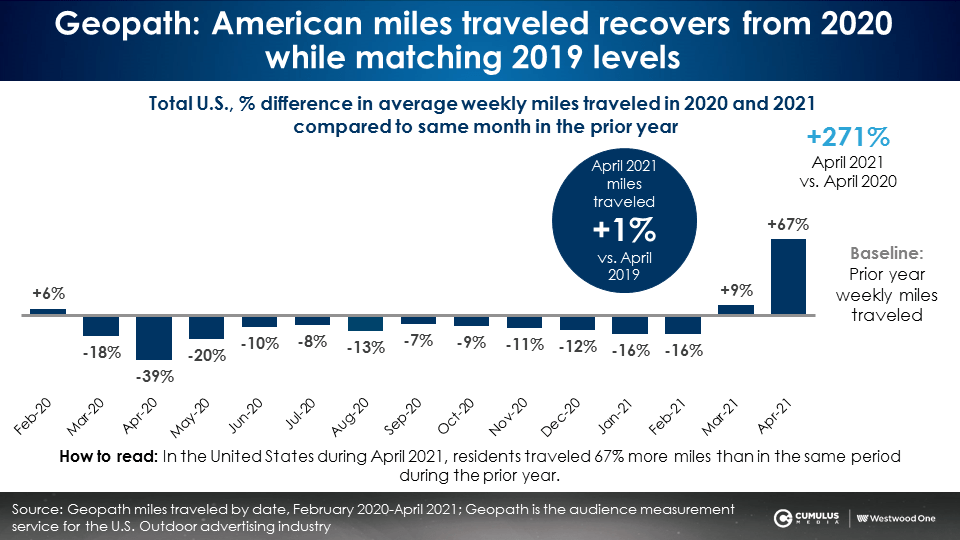

What is behind AM/FM radio’s audience growth? Consumer movement is up

With an 88% share of ad-supported audio in the car, AM/FM is the queen of the road. Growth in vehicular traffic and miles traveled means increases in AM/FM radio time spent.

Geopath, the Nielsen of the outdoor advertiser industry, reports April 2021 miles traveled surged +67% versus April 2020. Compared to April 2019, vehicular miles traveled completely recovered.

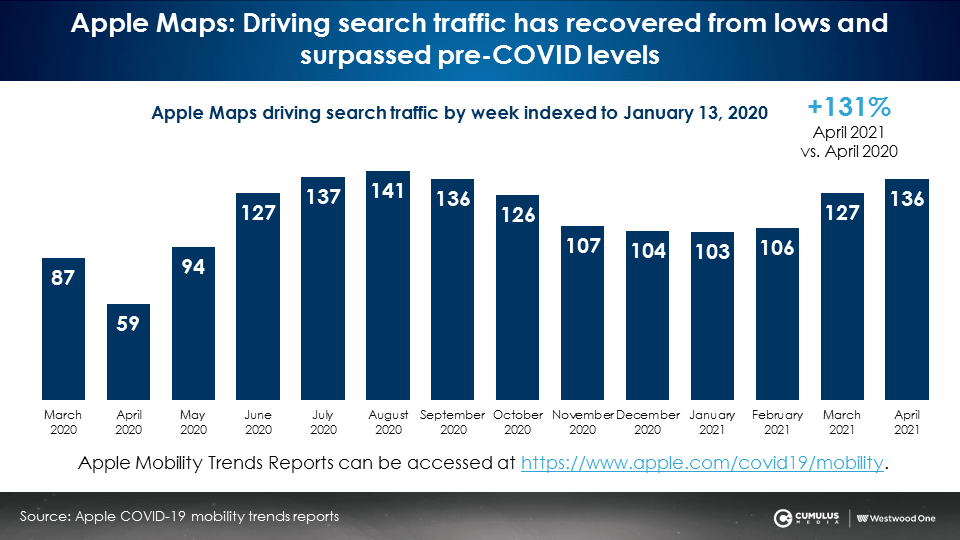

Apple Maps has been tracking automotive trip search requests over the last year. In April 2021, Apple Maps car trip search requests were +36% greater than before the pandemic, marking their highest levels since September 2020.

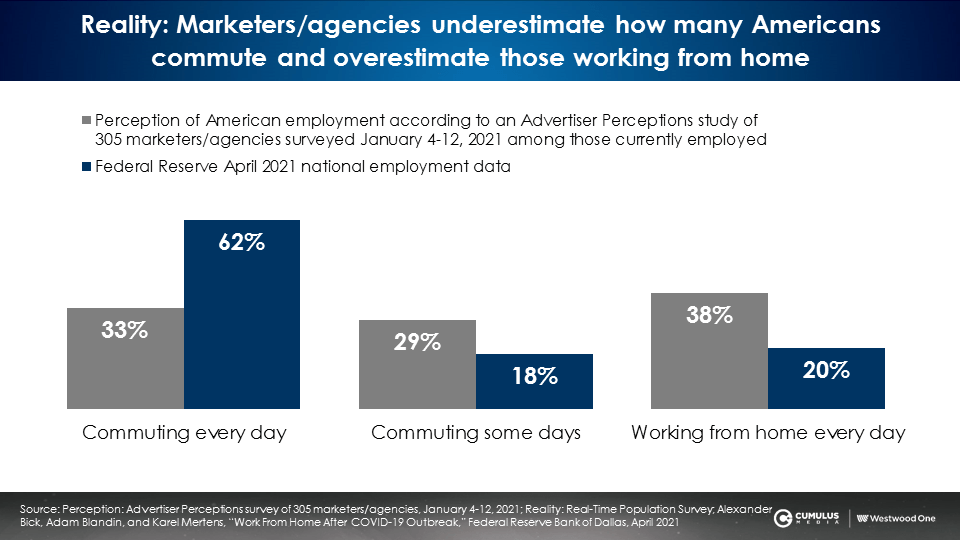

Back to the office: 62% of workers are now commuting full time and 18% are commuting some days

The Federal Reserve reports in April 2021, 62% of workers commuted full time and 18% commuted some days. 20% are working from home, 12 points greater than pre-pandemic.

The Federal Reserve data reveals agency and marketer perceptions about the current state of American commuting patterns are off the mark. In January 2021, Advertiser Perceptions, the leader in researching advertiser and agency sentiment, fielded a study of 300 media decision makers. They asked, “What percentage of American workers are either working from home daily, commuting some days, or commuting every day?”

The chart below depicts advertiser/agency perceptions in grey compared to the actual Federal Reserve commuting data in blue.

- Marketers and agencies dramatically underestimate the number of Americans who are commuting to work each day: Per the U.S. Federal Reserve, 62% of U.S. workers are commuting every day. Marketers and agencies think only 33% are commuting daily. Actual U.S. daily commutes are double the advertiser perception.

- Marketers and agencies overestimate the number of Americans who are working from home: Per the U.S. Federal Reserve, 20% of workers are working from home daily. Marketers and agencies think the percentage of those working from home is 38%.

- Marketers and agencies overestimate the number of Americans who are commuting some days: The Federal Reserve says 18% of workers are commuting some days. Marketers and agencies perceive 29% of workers are commuting some days.

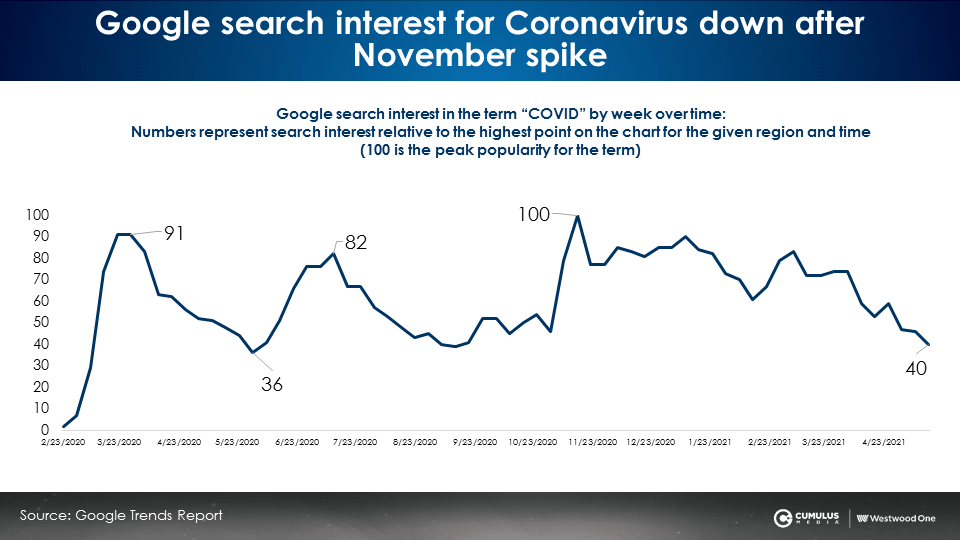

COVID concern is subsiding according to Google search trends

In early May 2021, Google search trends for the term “COVID” neared its lowest level since the pandemic, 60% below the November peak.

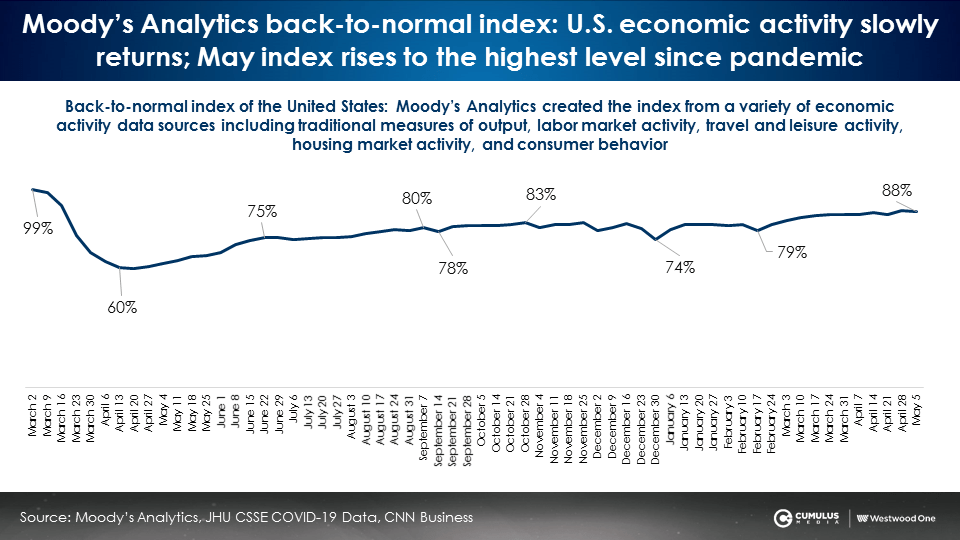

Moody’s Analytics back-to-normal index rises to the highest level since pandemic

Moody’s Analytics created the “back to normal” index from a variety of economic activity data sources including measures of output, labor market activity, travel and leisure activity, housing market activity, and consumer behavior. At the depth of the Spring 2020 lockdown, the index sunk to a low of 60. Throughout 2021, the Moody’s back-to-normal index has been steadily rising and is now at a high of 88.

How advertising can accelerate business recovery

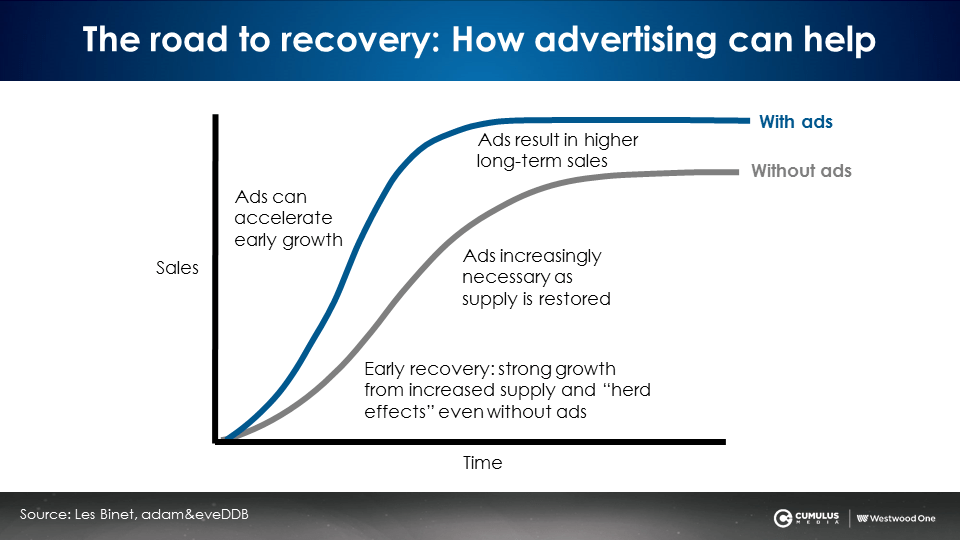

This fantastic visual below, created by adam&eveDDB London’s Les Binet, “the godfather of marketing effectiveness,” demonstrates how advertising can be the “recovery accelerator.”

The vertical axis represents sales and the horizontal axis depicts time. The grey line represents sales growth without advertising. The blue line presents sales growth with advertising.

Coming out of a recovery, business will grow from increased supply and consumer “herd mentality” even without advertising. However, as the economy recovers, businesses that advertise accelerate early growth. Businesses that continue to advertise generate stronger sales growth that converts into higher long-term sales.

AM/FM radio is the soundtrack of America’s recovery

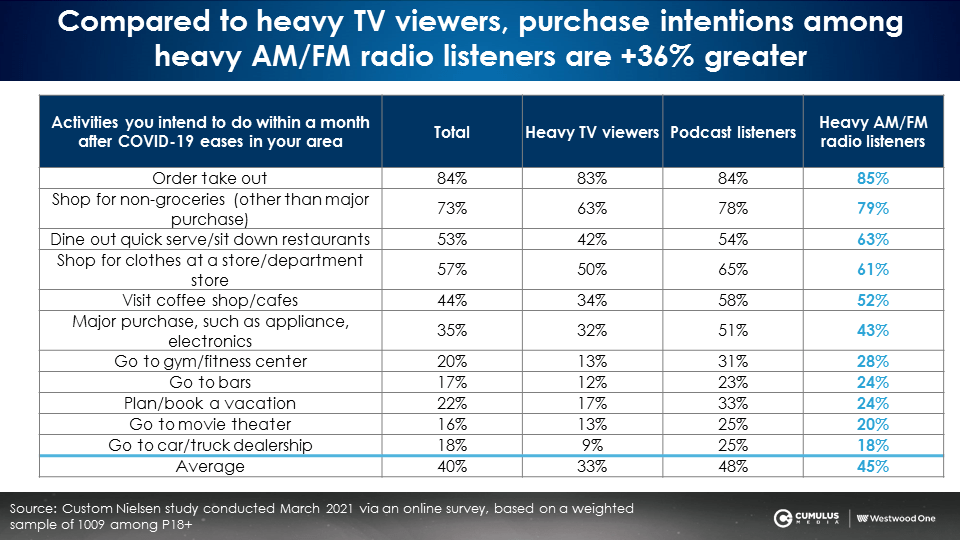

According to Nielsen’s recently released consumer purchase study, purchase intentions among AM/FM radio listeners are +36% greater than TV viewers. Across many different purchase categories, podcast listeners and AM/FM radio listeners show stronger purchase intentions than heavy TV viewers.

Charlie Rudd, Chief Executive Officer, Leo Burnett London, could have been thinking about AM/FM radio when he said:

Charlie Rudd, Chief Executive Officer, Leo Burnett London, could have been thinking about AM/FM radio when he said:

“We build businesses by creating large customer numbers keen to buy into what a brand offers. We mobilize and persuade large groups of people to act. It will be our contribution to rebuilding businesses and creating new jobs for many. … it will come from large broadly targeted brand marketing campaigns that empathize and inspire a nation yearning for recovery and positivity. It’s what we do best and it’s what [business] needs from us right now.”

Key takeaways:

- AM/FM radio’s audience reach for April 2021 was the highest since the pandemic started, notching a 98% recovery index versus March 2020

- AM/FM radio’s average quarter-hour audience in the PPM markets grew to the highest point since the pandemic began at a 95% recovery index versus March 2020

- Geopath reports April 2021 miles traveled surged +67% versus April 2020

- Apple Maps car trip search requests in April 2021 were +36% greater than before the pandemic, marking their highest levels since September 2020

- According to the Federal Reserve, 62% of workers are now commuting full time and 18% are commuting some days

- COVID concern is subsiding according to Google search trends

- Moody’s Analytics back-to-normal economic index rises to the highest level since pandemic

- Across many different purchase categories, podcast listeners and AM/FM radio listeners show stronger purchase intentions than heavy TV viewers

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.