Case Study: AM/FM Radio Powers A Streaming Video Subscription Service As Online Video Now Represents The Majority Of American TV Time Spent

A streaming video subscription brand recently utilized AM/FM radio to drive awareness and interest in their service. As part of the campaign, the streaming brand conducted a one-day takeover of 224 Cumulus Radio Station Group stations in 74 markets. CUMULUS MEDIA | Westwood One retained MARU/Matchbox to measure the impact of the campaign.

Goodbye cable and hello Netflix, Hulu, Amazon Prime, HBOMax, Peacock, Apple+, Disney+…

Media Analysts MoffettNathanson report that the proportion of American homes with cable has been plunging. 2009 was cable’s high-water mark when 89% of the U.S. had pay TV. Now, only 62% of U.S. households subscribe to pay TV.

No longer can advertisers consider cable as a mass reach option. Two of out five homes are now outside the pay TV ecosystem.

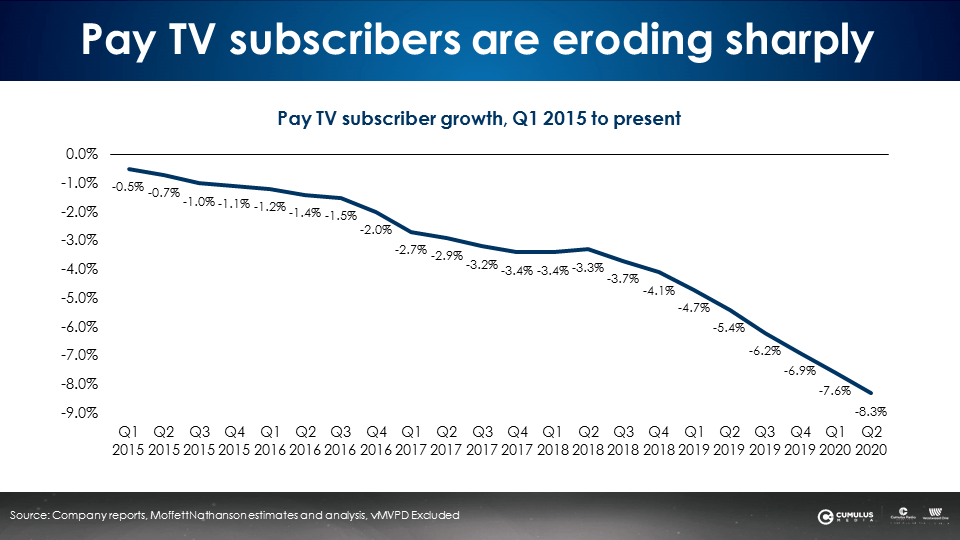

MoffettNathanson reports pay TV subscription losses are accelerating. Q2 2020 alone saw an -8.3% loss in cable subscribers.

Viewers say that online/streaming sources now consume most of their total time spent watching TV

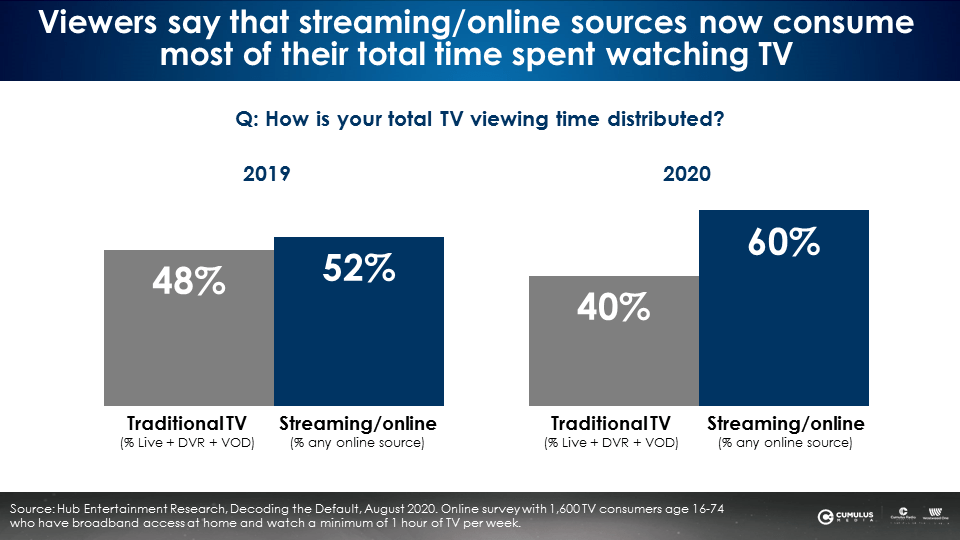

In August 2020, a Hub Entertainment Research study revealed that streaming video has overtaken traditional TV viewing. The study was conducted among persons 16-74 in homes with broadband who watch at least an hour of TV. When asked how their TV viewing time is distributed, Americans say 60% of their time goes to streaming/online and 40% of their time is spent with traditional TV via live viewing, DVR, or video on demand.

Much has changed over the last year. The share of time spent with streaming/online services has grown from 52% in 2019 to 60% this year. Traditional TV time spent as a share of total viewing has dropped from 48% last year to 40% in 2020.

The younger the viewer, the less likely that pay TV is a default viewing source

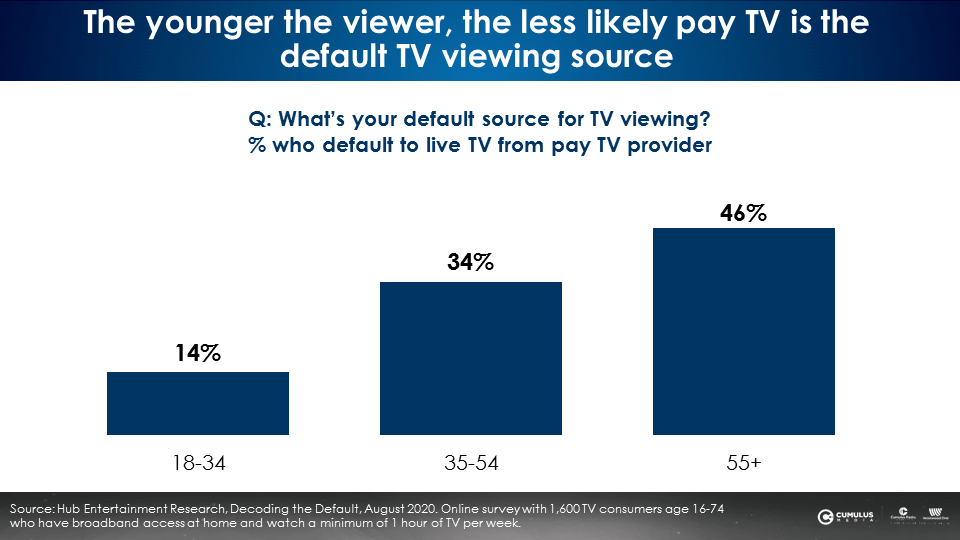

Why is it so hard to reach consumers under the age of 54 on ad-supported television? Only 14% of 18-34s say traditional TV is their default source for TV viewing, according to Hub Entertainment Research. Among 35-54s, only 34% say traditional TV is their default viewing source.

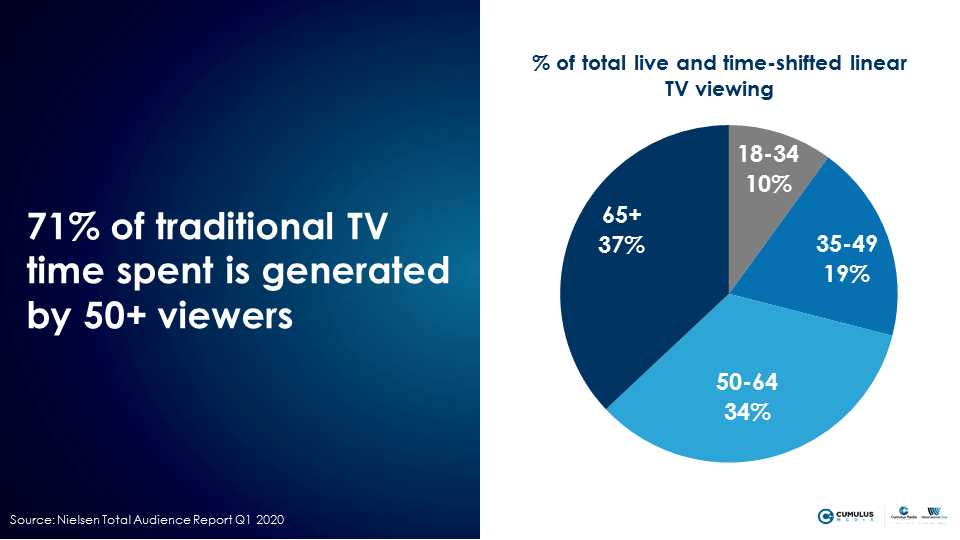

71% of traditional TV time spent is generated by 50+ viewers

Nielsen reports that people over the age of 50 generate a whopping 71% of linear TV time spent. Persons 18-49 represent only 29% of total live and time-shifted linear TV viewing, according to Nielsen’s just-released Q1 2020 Total Audience Report.

For advertisers, 71 cents of their TV ad dollar goes to persons 50+ while only 29 cents goes to persons 18-49.

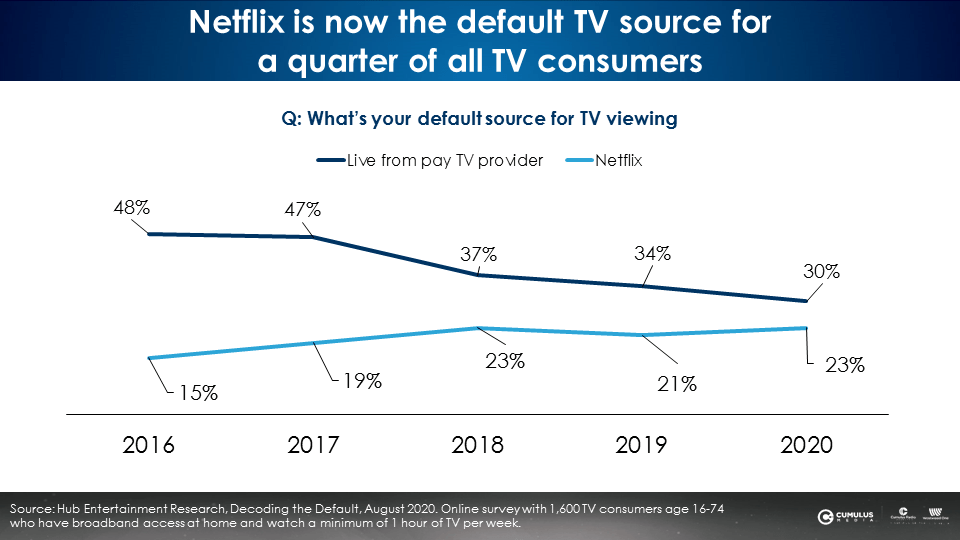

Netflix is now the default TV service for nearly a quarter of Americans

Hub Entertainment Research’s August 2020 study found 23% of viewers indicate Netflix is their default source for TV, only 7 points behind pay TV.

For media agencies and their brand clients, a quarter of Americans are now out of reach of TV advertising.

It is getting harder for video streaming services to reach their target on regular TV

The success of streaming services at capturing the lion’s share of TV time spent makes it harder for those very services to reach their target audiences on traditional TV. Ad-supported linear TV offers “sight, sound, and motion,” all perfect qualities for advertising a streaming video service. However, traditional TV does not have the reach it used to among the 18-54 target most likely to subscribe to a video streaming service.

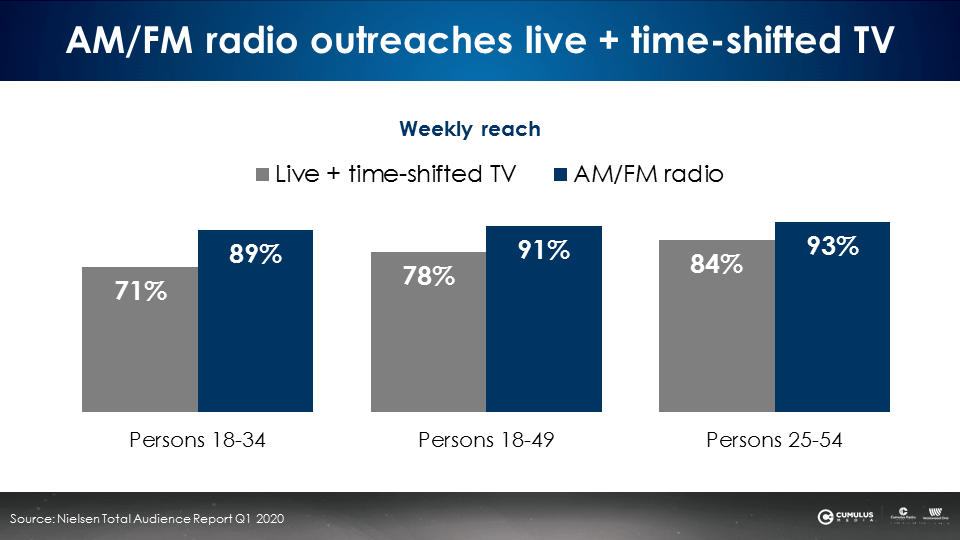

Nielsen’s Q1 2020 Total Audience Report reveals 29% of persons 18-34s are not reached by linear live and time-shifted TV in a typical week. 22% of persons 18-49s are not reached by linear TV.

How can advertisers insure their media plans reach audiences who fall outside the pay TV ecosystem and the large number of viewers who don’t ever watch linear traditional TV?

Just add AM/FM radio!

Per Nielsen’s Total Audience Report, AM/FM radio is America’s number one mass reach medium with a 90% reach of all demographics.

AM/FM radio is an ideal media platform for those in the market for a new online video subscription service

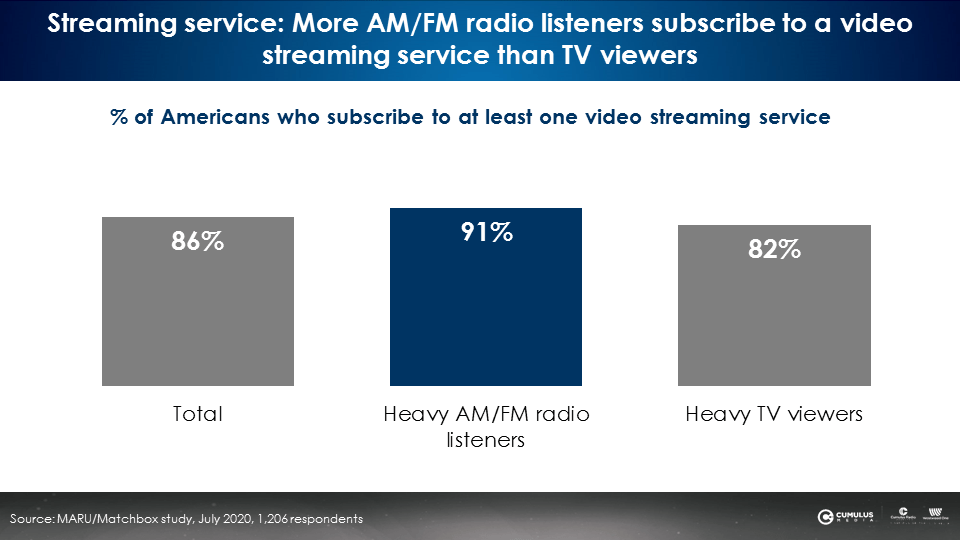

A national study of 1,206 consumers conducted by MARU/Matchbox in July 2020 commissioned by CUMULUS MEDIA | Westwood One revealed more heavy AM/FM radio listeners have a video streaming service than heavy TV viewers!

Versus TV, AM/FM radio is the better media platform to market video streaming subscription services. Given that heavy TV viewers spend most of their time with traditional linear television, it is not surprising that nearly one out of five of these older viewers do not yet subscribe to a video streaming service. In contrast, heavy AM/FM radio listeners are younger, more likely to work, and have kids with larger households. No wonder nine of ten AM/FM radio listeners subscribe to a video streaming service.

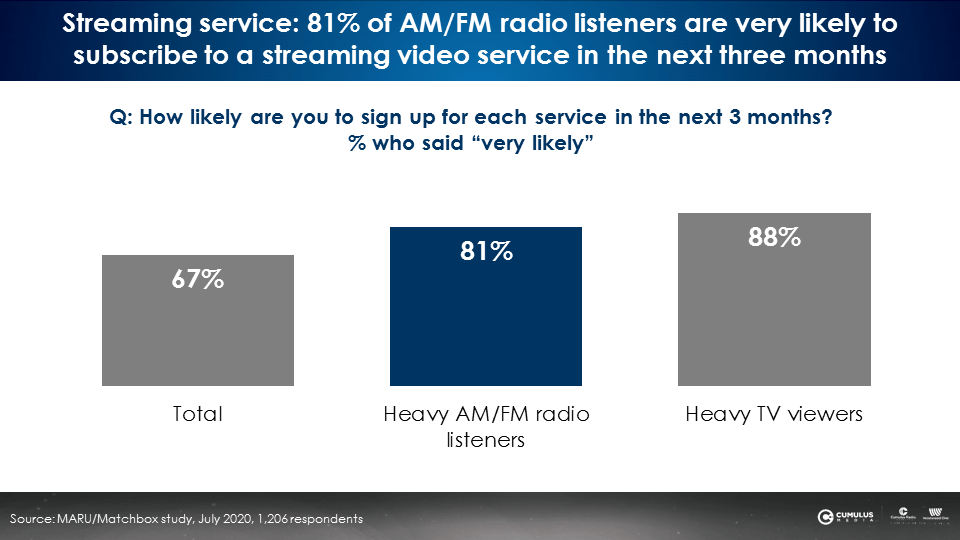

MARU/Matchbox also found heavy AM/FM radio listeners are comparable to heavy TV viewers in their interest in subscribing to new streaming video services.

Consumers were asked how likely they were to sign up for streaming services in the next three months. Two-thirds of Americans said they were “very likely” to sign up for a streaming service. An even greater proportion of heavy AM/FM radio listeners (81%) said they were “very likely” to sign up for a streaming service.

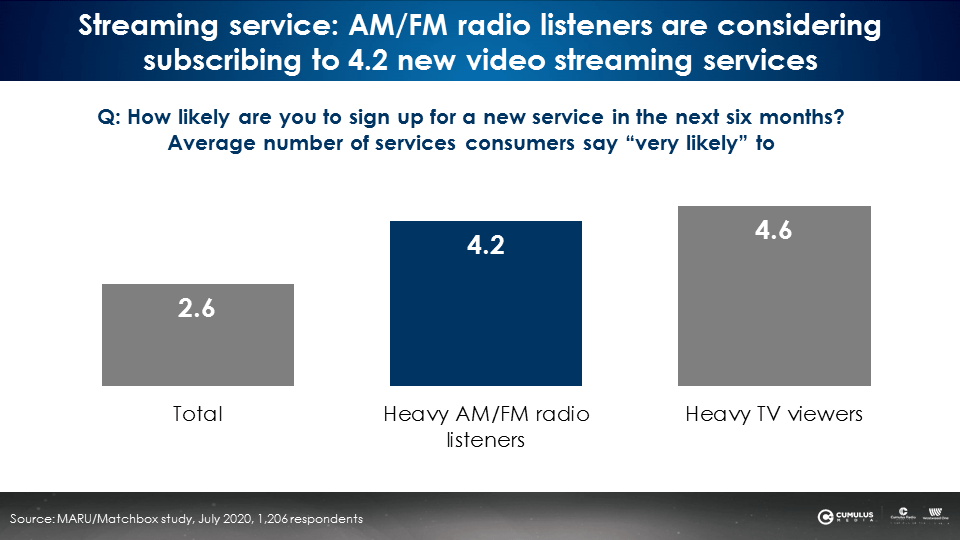

AM/FM radio listeners are considering subscribing to 4.2 video streaming services

AM/FM radio is an ideal platform to market video subscription streaming services. Overall, total U.S. consumers say they are considering subscribing to 2.6 different streaming services. In contrast, heavy AM/FM radio listeners are contemplating even more services, an average of 4.2 offerings.

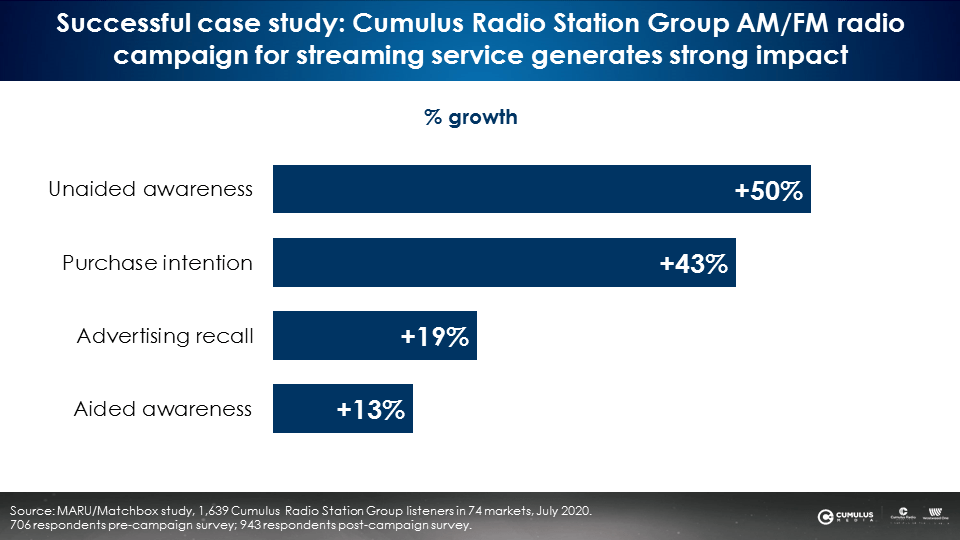

Successful case study: AM/FM radio generates significant brand equity lift and purchase intention for a video streaming service

Video streaming services are using AM/FM radio to build their brands and drive customer acquisition. In July 2020, a streaming video service launched a national AM/FM radio campaign that included a takeover of 224 Cumulus Radio Station Group stations in 74 markets. The “Impact PM Drive” campaign aired ads for the streaming service every hour in the same break in the first-in-pod position.

MARU/Matchbox conducted a campaign effect study before and after the takeover to measure impact on brand equity and purchase intention.

Overall, the event generated a +50% lift in unaided awareness, a +13% increase in aided awareness, a +19% growth in advertising recall, and an impressive +43% rise in likelihood to subscribe.

Key takeaways:

- Viewers say that online/streaming sources now consume most of their total time spent watching TV

- The younger the viewer, the less likely pay TV is the default viewing source

- 71% of traditional TV time spent is generated by 50+ viewers

- Netflix is now the default TV service for nearly a quarter of Americans

- It is getting harder for video streaming services to reach their target on regular TV

- AM/FM radio is an ideal media platform for those in the market for a new online video subscription service as AM/FM radio listeners are considering subscribing to 4.2 video streaming services

- More AM/FM radio listeners subscribe to a video streaming service than older, heavy TV viewers

- Successful case study: AM/FM radio generates significant brand equity lift and purchase intention for a video streaming service

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.