What Impact Has The Pandemic Had On Audio? Little, If Any, According To Edison Research’s Q2 2020 “Share Of Ear” Report

With the Coronavirus affecting so many industries since March, there was much media pundit anticipation surrounding the publication of the first post-pandemic “Share of Ear” report from Edison Research. What impact would COVID-19 have on audio listening?

The “Share of Ear” is a quarterly report released by Edison Research. It is the media industry’s gold standard for measuring how Americans consume audio each day. The report quantifies the reach and share of time spent with various audio platforms. Q2 2020 marks the first “Share of Ear” release since the pandemic began.

Here are the key takeaways from the latest Q2 2020 “Share of Ear” report:

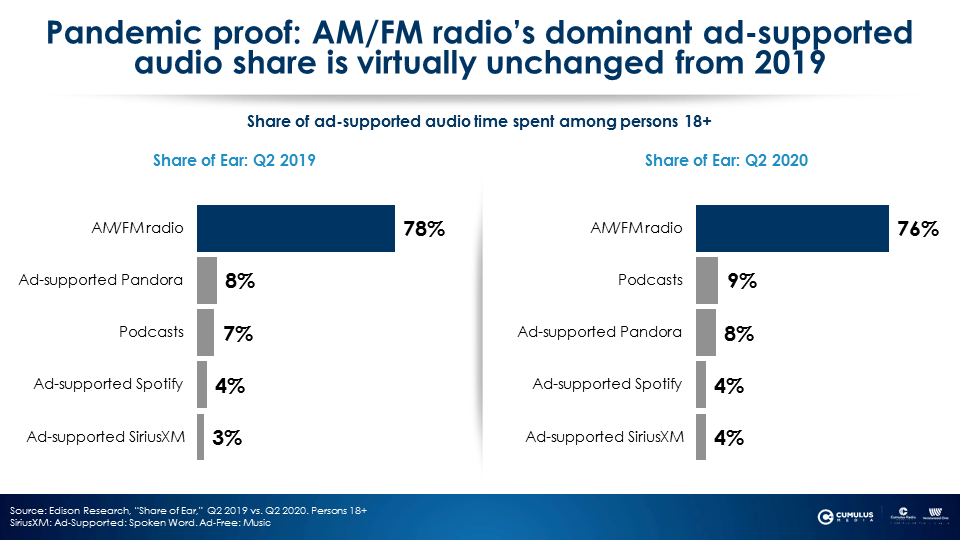

COVID-19 did not undermine AM/FM radio’s dominant share of ad-supported audio

In Q2 2020, COVID-19 did not upset AM/FM radio’s dominance of audio sources among Americans. Among persons 18+, AM/FM radio accounts for 76% of all ad-supported audio time spent. AM/FM radio has remained stable from the 78% ad-supported share reported in the Q2 2019 report.

Pandora and Spotify’s ad-supported shares are unchanged. AM/FM radio’s audience share is ten times bigger than Pandora and nineteen times bigger than Spotify. Podcasting’s share is up strongly to 9% from 7% last year.

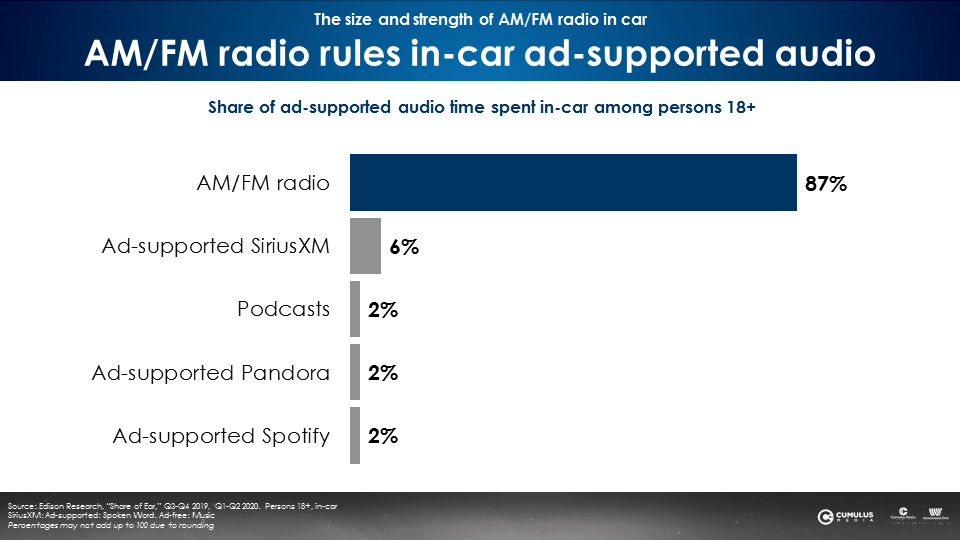

AM/FM radio continues to rule the road as Americans are back in their cars

In-car listening is one of the greatest drivers of overall AM/FM radio listening. When COVID-19 forced nearly everyone indoors due to shelter-in-place mandates, industry professionals feared the worst for AM/FM radio. However, Americans kept listening to AM/FM radio from their homes. On top of that, essential workers continued to listen to AM/FM radio during their commutes to their jobs.

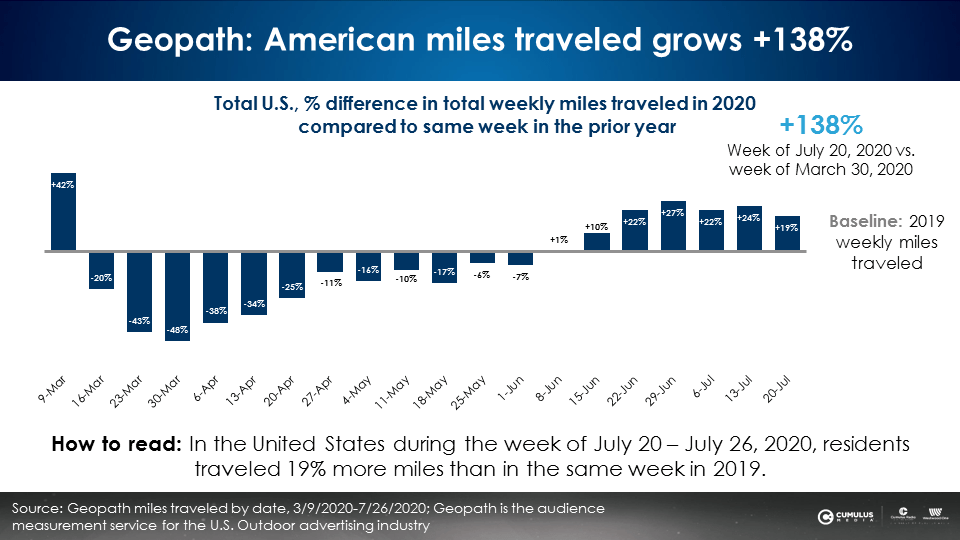

Americans are now back on the road

Geopath data shows weekly miles traveled compared to the same week in the prior year. Miles traveled dropped in March and April and then quickly recovered. In the most recent Geopath measurement week of July 20-26, U.S. miles traveled are +19% greater than the same week last year. Despite virus flare-ups, Americans are on the road and in their cars.

AM/FM radio did not lose its place as the #1 audio platform in the car. The Q2 2020 report shows AM/FM radio accounts for a whopping 87% of ad-supported time spent with audio in the car, confirming AM/FM radio’s resilience and dominance.

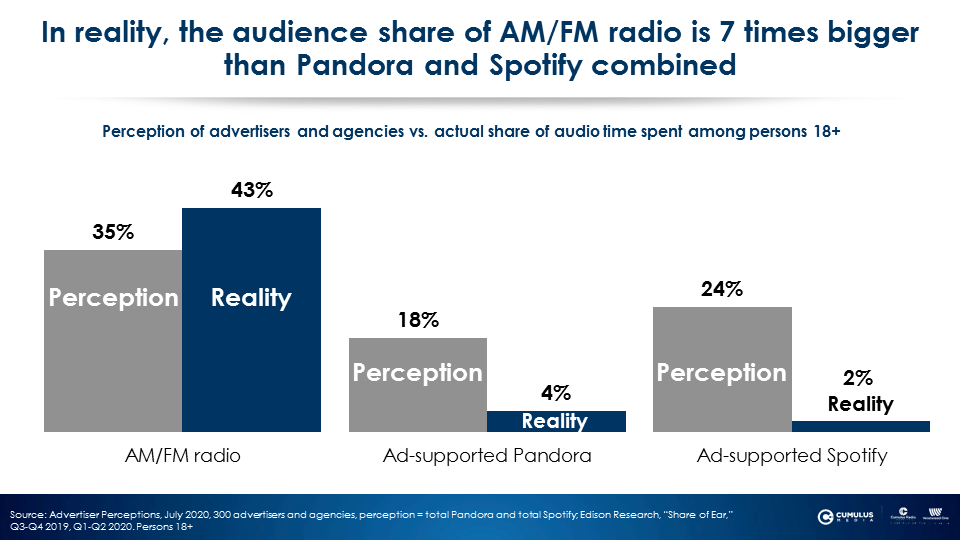

Perception versus reality: Pandora and Spotify still significantly trail AM/FM radio

Advertiser Perceptions is the leading measurement firm of advertiser and agency sentiment. They survey media professionals, agencies, marketers, and advertisers to quantify attitudes and perceptions of media.

When 300 media decision makers were asked in July 2020 to estimate the audience share of AM/FM radio, Pandora, and Spotify, what was the result? Brands and agencies perceived that the audience size of AM/FM radio was actually less than Pandora and Spotify combined (35% vs. 42%).

In reality, AM/FM radio is seven times bigger than ad-supported Pandora and Spotify combined (43% vs. 6%). Agencies and advertisers overestimate the audience share of Spotify by twelve times (24% vs. 2%) and Pandora by nearly five times (18% vs 4%). Meanwhile, they underestimate AM/FM radio’s share by 19% (35% vs 43%). Taking the “me” out of media is an important step for agency and advertising professionals as perception can cloud reality.

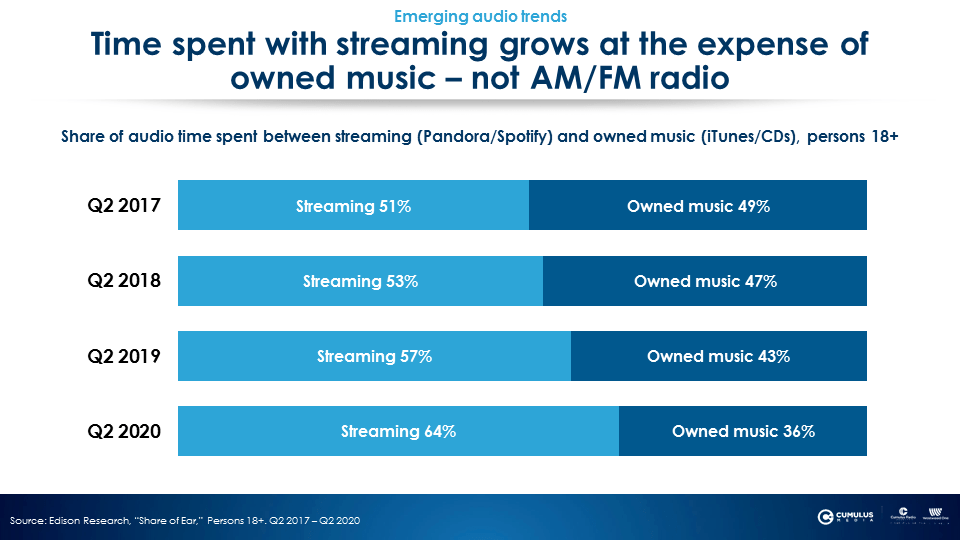

When it comes to entertainment, Americans are moving from ownership to rentals: Streaming audio growth comes at the expense of owned music, not AM/FM radio

The myth is that increased time spent with audio streaming comes at the expense of AM/FM radio. However, the real casualty is owned music like iTunes downloads and CDs. Over time, streaming audio has chipped away at the time Americans spend with their owned music.

In 2017, time spent was equally split between audio streaming and owned music. In Q2 2020, streaming audio accounted for almost two-thirds (64%) of the audio time spent between streaming audio and owned music.

Just as Americans used to buy movie DVDs and song downloads, consumers now “rent” content via Netflix and Spotify. Many Americans have shifted from owning entertainment to renting it.

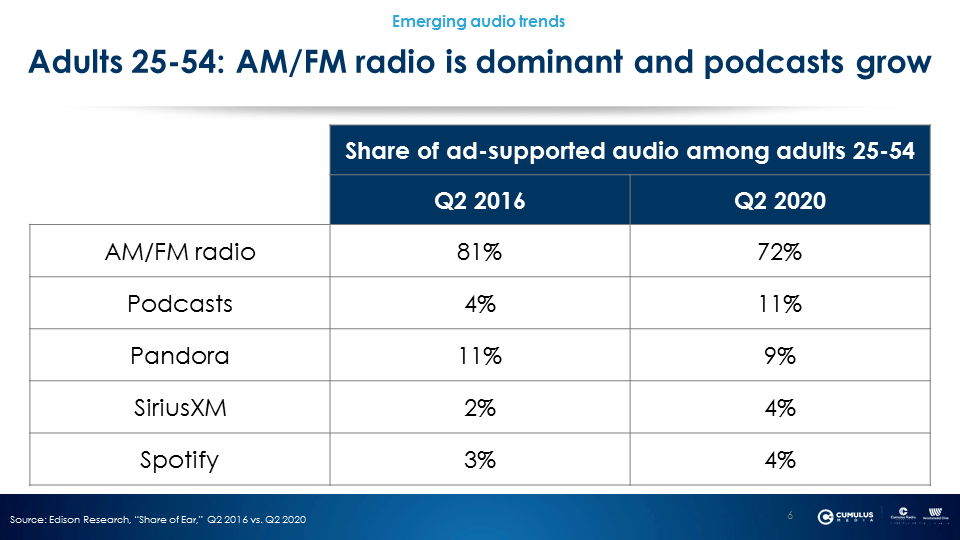

2016 versus 2020: Spotify/Pandora down, podcasts soar, AM/FM continues to dominate

Over the last four years, an examination of ad-supported audio audience shares among persons 25-54 reveals the combined shares of Spotify and Pandora dropped to 13% in Q2 2020, down from 14% in Q2 2016. Meanwhile, from Q2 2016 to Q2 2020, podcasts surpassed both streaming giants and even nearly tripled in share (4% to 11%). AM/FM remains the dominant player.

Key takeaways:

- COVID-19 did not undermine AM/FM radio’s dominant share of ad-supported audio

- AM/FM radio continues to rule the road as Americans are back in their cars

- Perception versus reality: Pandora and Spotify still significantly trail AM/FM radio

- When it comes to entertainment, Americans are moving from ownership to rentals: Streaming audio growth comes at the expense of owned music, not AM/FM radio

- 2016 versus 2020: Spotify/Pandora down, podcasts soar, AM/FM continues to dominate

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.