Nielsen: Listening Audiences Rebound As AM/FM Radio Becomes The Soundtrack Of America’s Reopening And Reemergence

Today Nielsen held a series of client webinars to review key insights from a brand new study of consumer COVID-19 sentiment and spending intentions. They also reviewed just-released audience data from the 45 Portable People Meter markets. The PPM data covered the period of March 27, 2020 through May 6, 2020. Nielsen reported a significant resurgence of U.S. AM/FM radio listening.

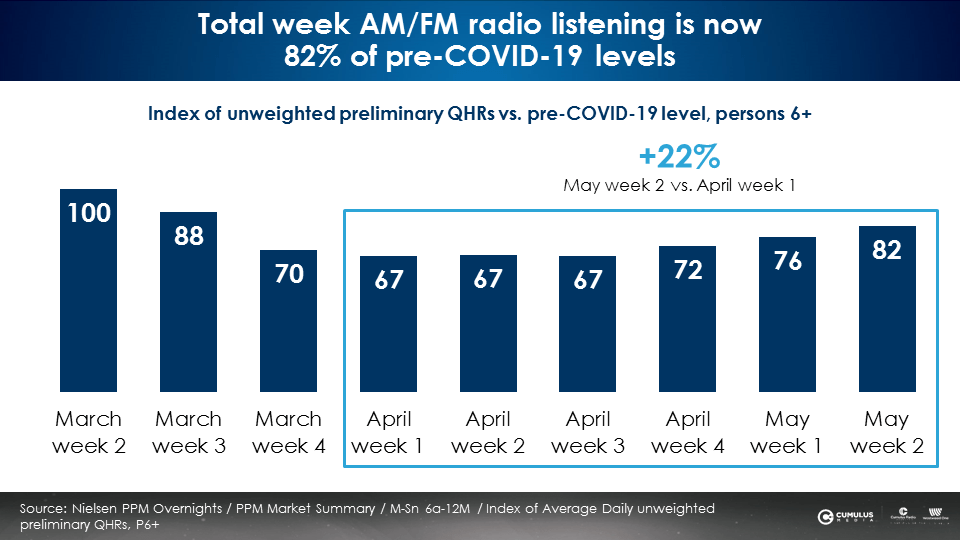

AM/FM radio listening levels recover to 82% of pre-COVID-19 levels

Nielsen presented an analysis of unweighted quarter-hour listening from their PPM overnight audience service for AM/FM radio programmers. They benchmarked pre-COVID-19 listening from the second week of March (March 5 to 11, 2020) at a 100 index. In the back half of March, AM/FM radio listening dropped as America began sheltering at home.

The four-week period from March week 4 to April week 4 (March 19 to April 15) was stable at 67-70% of pre-COVID-19 tuning volumes. The most recent three-week period of April week 4 to May week 2 (April 16 to May 6) saw a +22% increase in AM/FM radio audiences from April lows (67%). In the most recent week (May week 2: April 30 to May 6), AM/FM radio audiences returned to 82% of pre-COVID-19 listening levels.

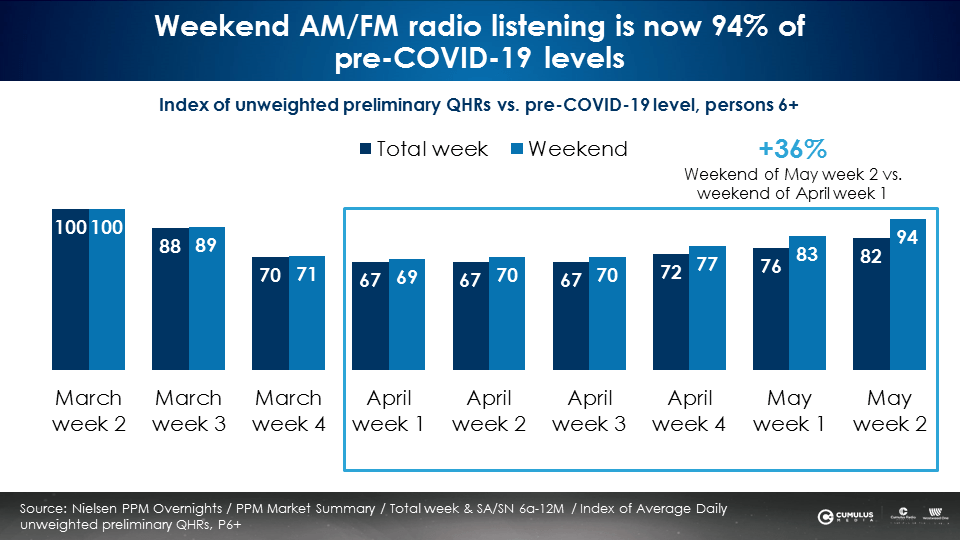

Weekend AM/FM radio listening levels recover to near pre-COVID-19 levels

A major finding from Nielsen’s Portable People Meter data is the significant resurgence of crucial weekend listening which occurs as Americans run errands and shop. The most recent weekend measured (May 2 and 3) had listening levels at 94% of pre-COVID-19 levels.

Listening during the most recent weekend has soared +36% from April lows. AM/FM radio listening is experiencing a “V-shaped” recovery. Two sources of consumer location data explain the surge in AM/FM radio listening.

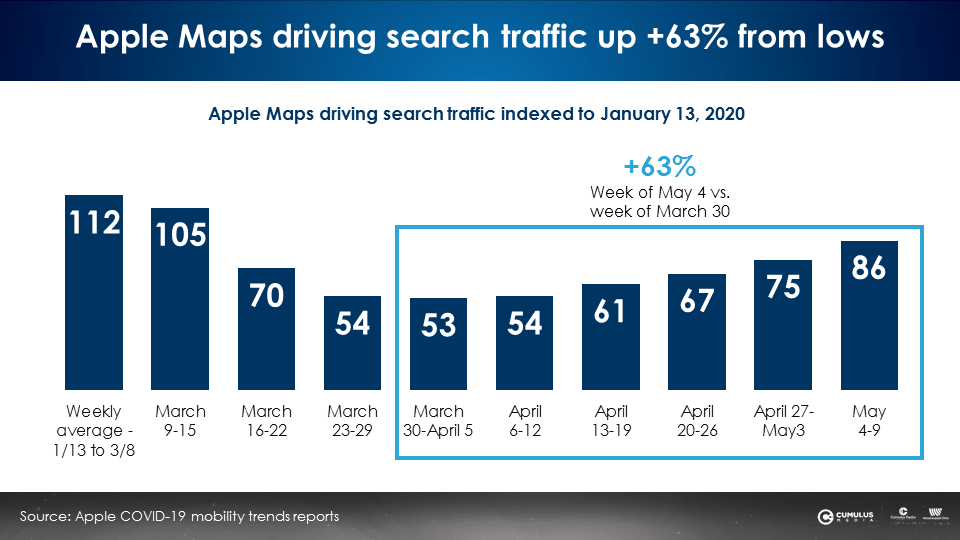

Apple Maps: Driving search traffic is up +63%

An innovative web-based application from Apple Maps allows you to enter any country or major city and see trends for driving, walking and transit search traffic. Current requests are compared to pre-COVID-19 norms from January 13, 2020. Apple Maps found that driving search requests dropped sharply in late March, bottomed out at half of normal levels, and have strongly recovered in the last four weeks.

In the most recent weeks, U.S. driving trip requests to Apple Maps are 86% of levels seen in mid-January. Driving trip requests are up +63%. Data from Geopath, the audience measurement service of outdoor advertising, shows a similar pattern.

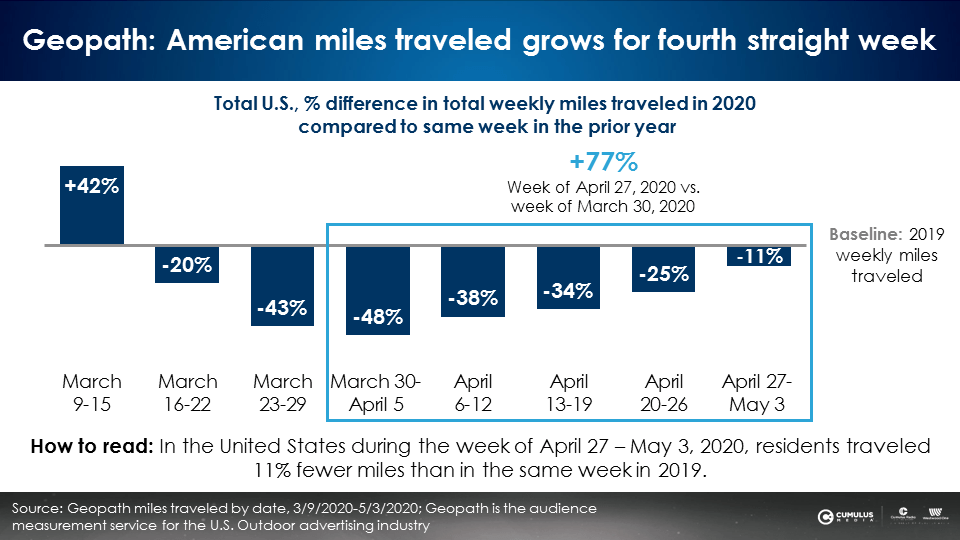

Geopath: Consumers are back on the road as miles traveled grows +77%

Geopath compared weekly U.S. miles traveled to the same week in the prior year. Geopath’s miles traveled data shows a similar pattern: a sharp drop in late March to a low in the first week of April. Since then, miles traveled has steadily recovered over the last four weeks. The most recent week (April 27 to May 3) reveals miles traveled is only -11% less than the same week last year.

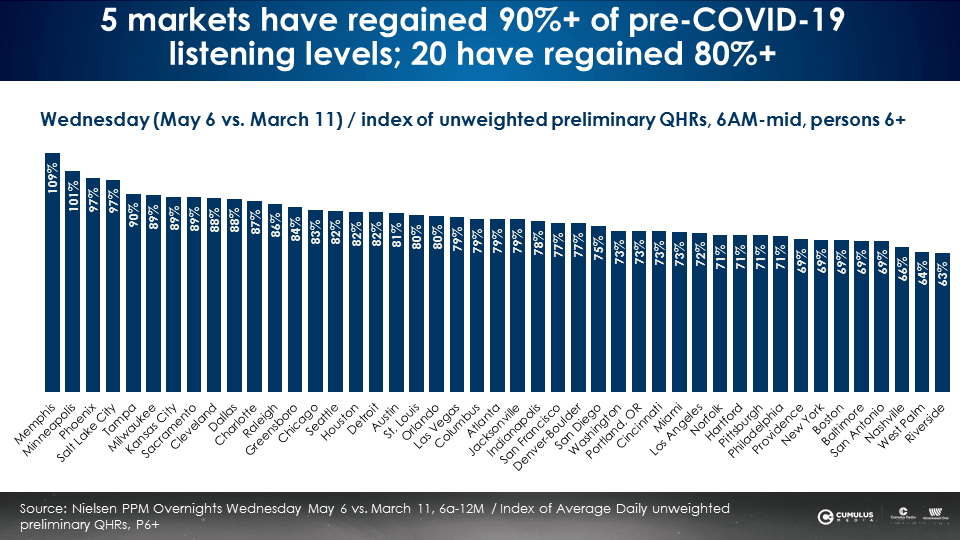

Nearly half of U.S. AM/FM radio market audiences have returned to 80% of prior listening levels

Nielsen compared listening from this past Wednesday, May 6 to Wednesday, March 11, a pre-COVID-19 day from nearly two months ago. Twenty AM/FM radio markets have listening volumes over 80% of pre-COVID-19 levels. Five markets are already at 90% of prior listening levels.

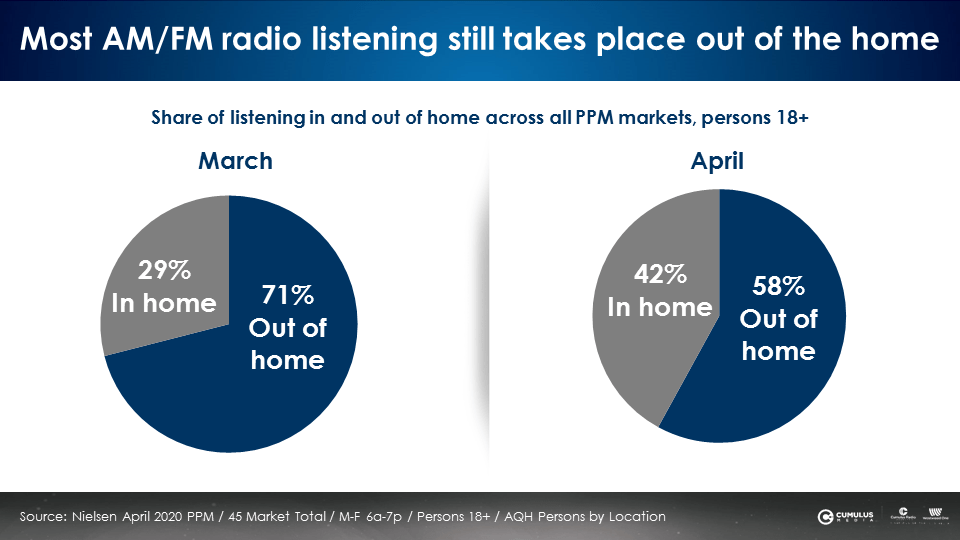

Out of home is still the number one location of AM/FM radio listening

Nielsen reports that through each week of the pandemic, the majority of AM/FM radio listening is still occurring away from home. A recent CUMULUS MEDIA | Westwood One consumer study revealed that 47% of Americans who normally work away from home were still commuting. The study found that among heavy AM/FM radio listeners that typically work out of home, 60% are continuing to commute to work.

Nielsen reports that 58% of all U.S. AM/FM radio listening in the April PPM survey was out of home, compared to 71% in March. In April, 27 of Nielsen’s 44 PPM markets had out-of-home listening volumes that were over 60% of total listening.

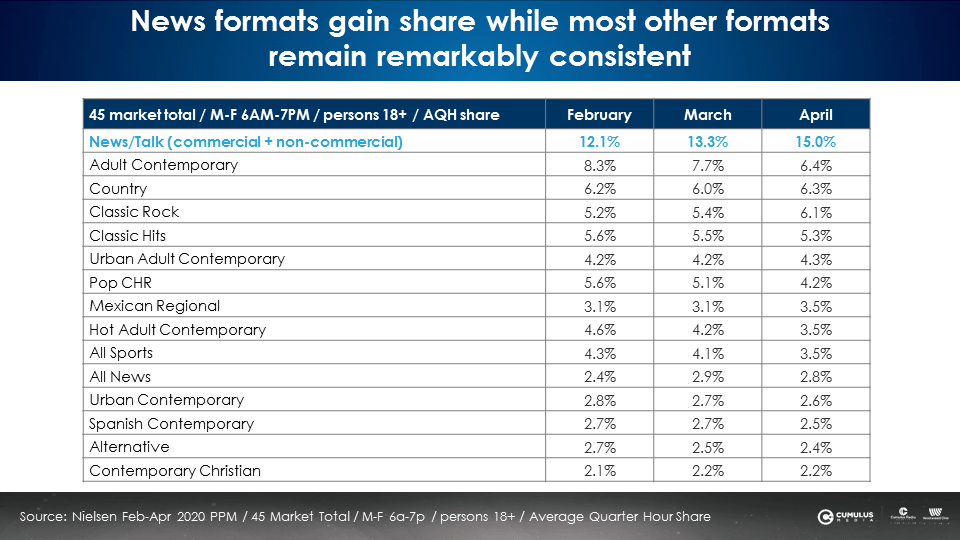

News formats gain share while most other formats remain remarkably consistent

The CUMULUS MEDIA | Westwood One study found that by a four to one margin, AM/FM radio listeners want near-normal programming on their favorite stations. As such, it is not surprising that format audience shares are so consistent.

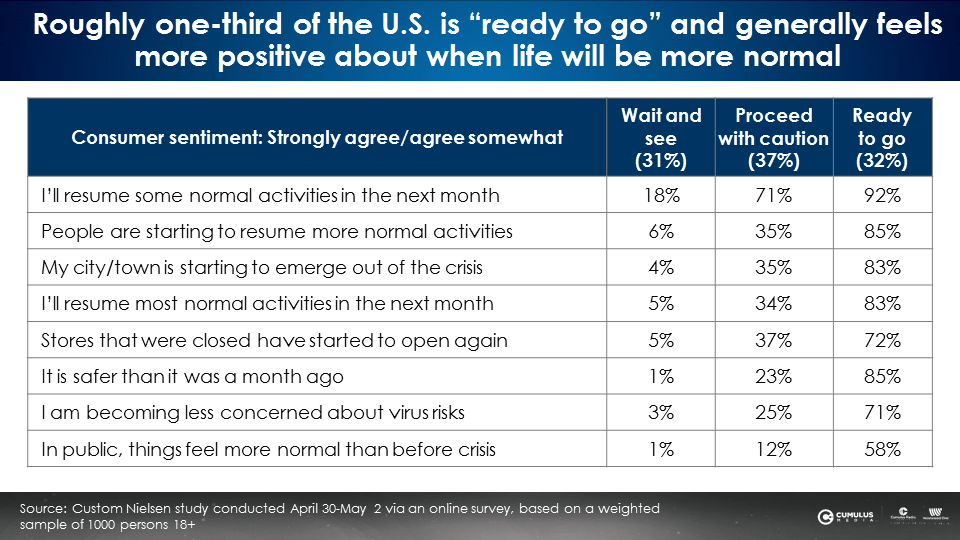

Nielsen COVID-19 Consumer Sentiment and Spending Intention Study

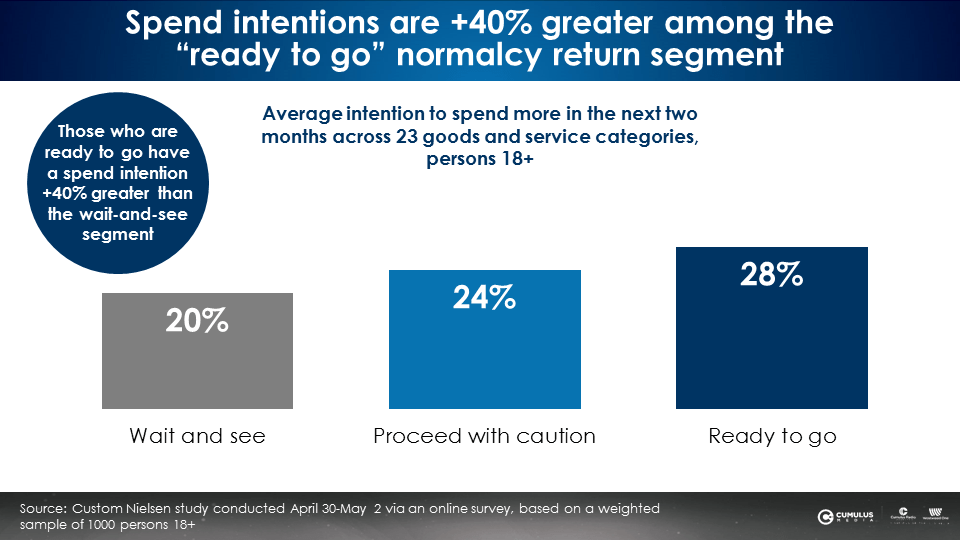

Within the last week (April 30 to May 2), Nielsen fielded a national study of 1,000 adults to probe the degree of consumer sentiment on COVID-19 and spending optimism. Nielsen identified three equal-sized consumer segments with varying degrees of post-COVID-19 normalcy.

The “wait and see” consumers are those do who do not feel things are normalizing or opening up. The “proceed with caution” consumers are those in the middle on opening up and resumption. The “ready to go” segment is most optimistic about a return to normalcy.

Consumer spending intentions increase with a greater sense of normalcy return

Nielsen asked consumers about their intention to resume spending more across 23 different categories of goods and services. The greater the sense of normalcy returning, the greater the spend intentions.

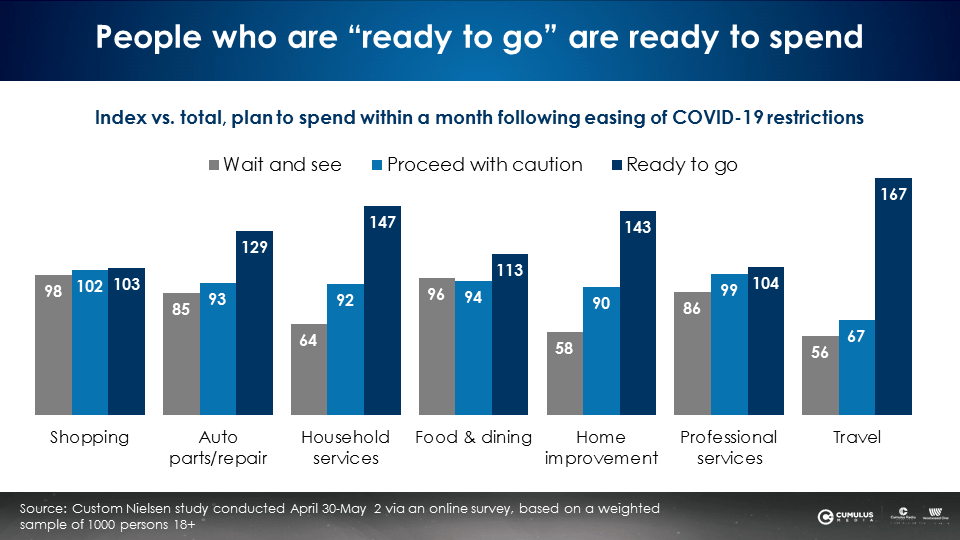

The “ready to go” segment says they will be spending quickly, meaning within a month. Across seven categories, the “ready to go” segment has exceptionally high spend intention indices for purchasing within a month. The “ready to go” segment is 29% more likely to spend in a month on auto parts and repair, 47% more likely to spend on household services, and 43% more likely to spend on home improvement.

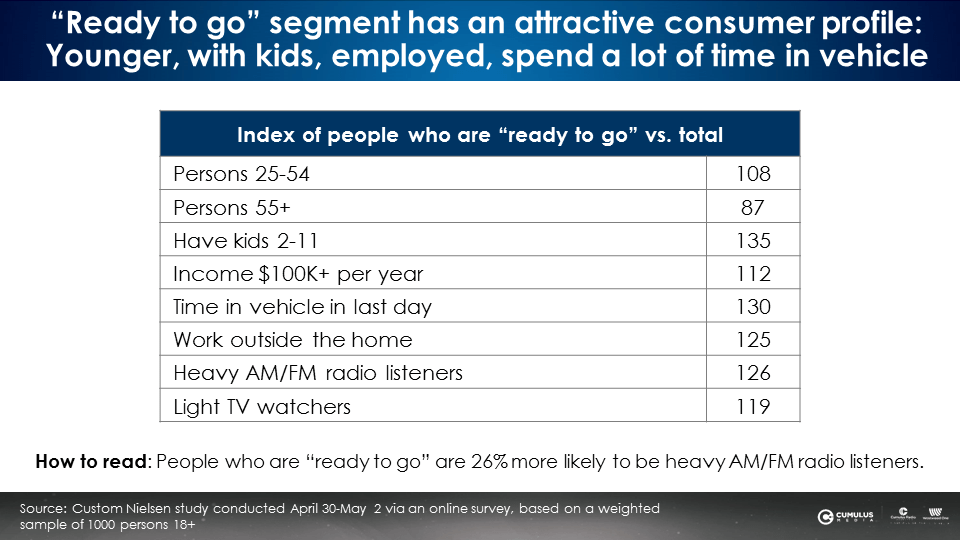

“Ready to go” profile: Younger, employed, with kids, work outside the home, light TV viewers

AM/FM radio is the soundtrack of America’s reopening and reemergence

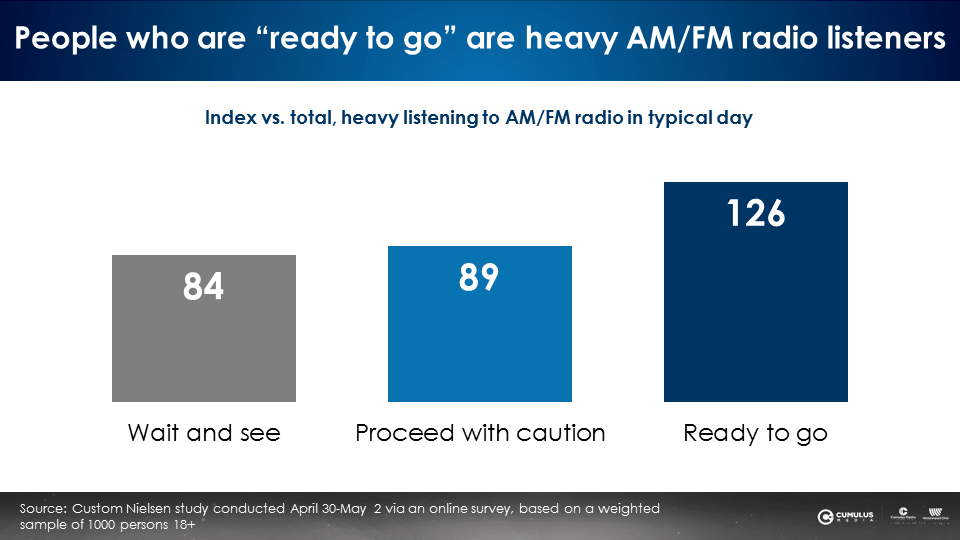

One of Nielsen’s major conclusions from their consumer study is that those with greater spending optimism are more likely to be heavy AM/FM radio listeners.

The one-third of the U.S. population in the “ready to go” consumer segment will be the engine of the American recovery. The “ready to go” consumers are 26% more likely to be heavy AM/FM radio listeners. Advertisers who seek to influence shoppers who are ready and willing to spend will find them listening to American AM/FM radio.

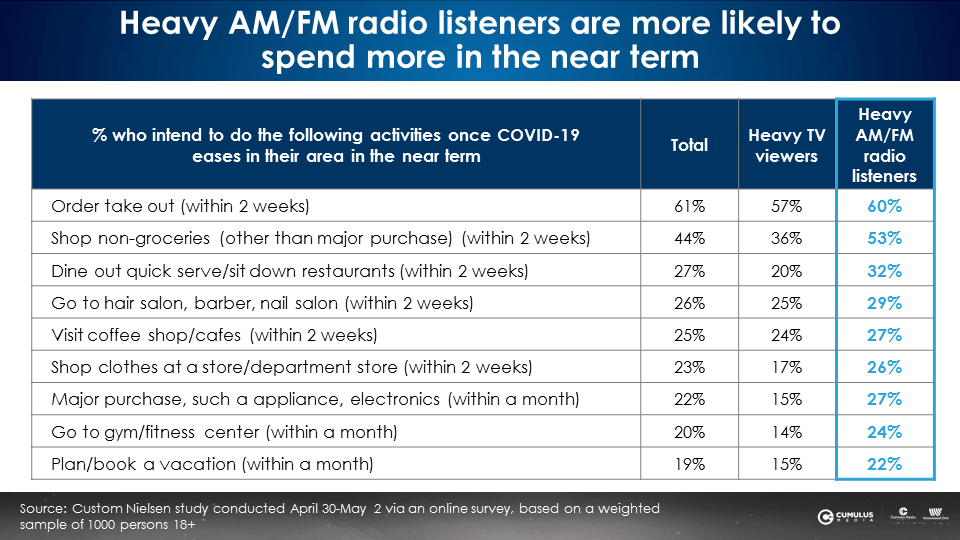

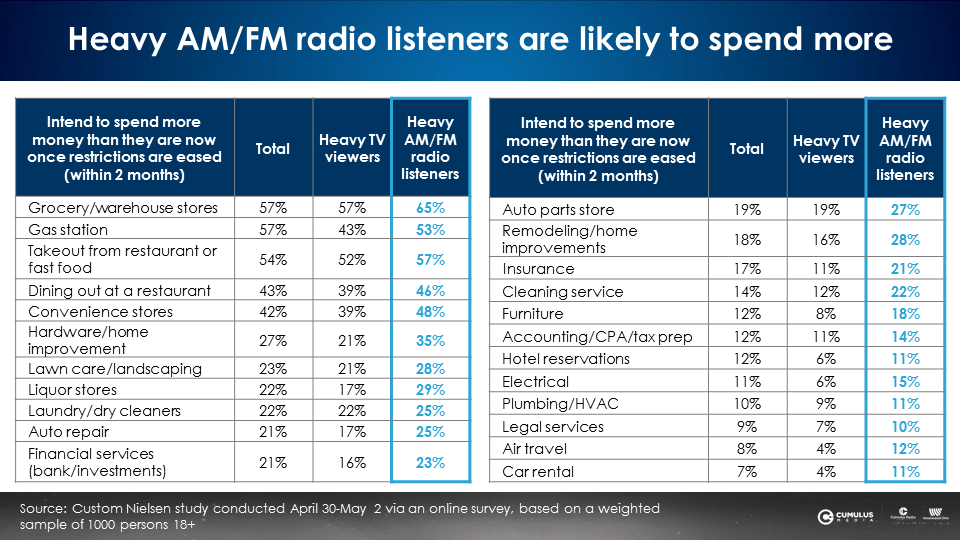

Heavy AM/FM radio listeners say they will spend more soon

Across various consumer categories, heavy AM/FM radio listeners are far more likely to indicate that they will be spending in the near term compared to heavy TV viewers.

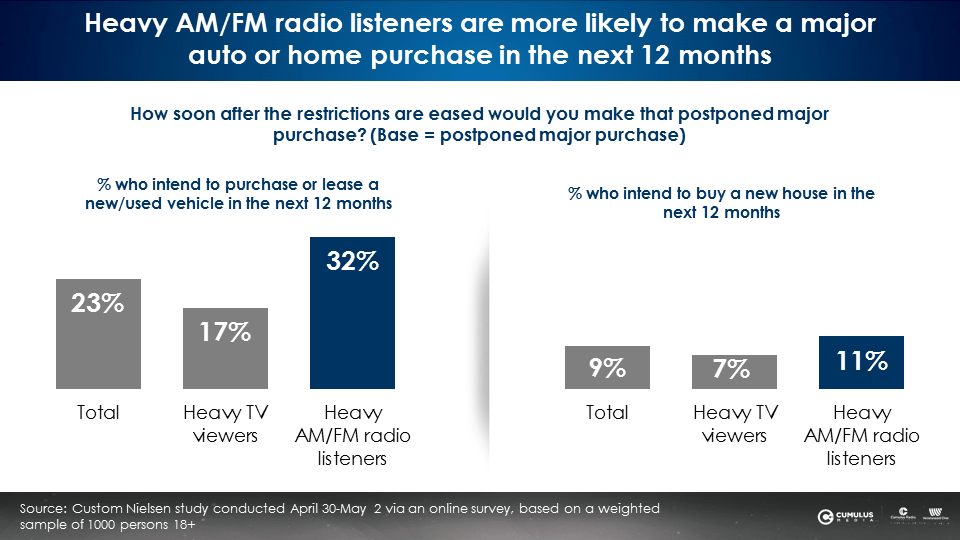

One-third of heavy AM/FM radio listeners say they will purchase a vehicle in the next year, a far greater proportion than the total U.S.

There is a growing number of optimistic Americans who feel life is returning to normal

These consumers are ready to be at the forefront of marketplace spending across dozens of categories. These “ready to go” high optimists (1/3 of population) and even broader moderate optimists (2/3 of population “ready to go” and “proceed with caution”) and their growing consumer confidence are key drivers of the countrywide momentum towards a more normal way of life and spending.

Key takeaways:

- AM/FM radio listening levels recover to 82% of pre-COVID-19 levels

- Weekend AM/FM radio listening levels recover to 94% of pre-COVID-19 levels

- Both Apple Maps and Geopath report significant growth in driving trips and miles traveled

- Out of home is still the number one location of AM/FM radio listening

- One-third of Americans fall into the optimistic “ready to go” consumer segment: They see signs of normalcy and are ready to spend and spend quickly

- The “ready to go” consumers have jobs, kids, skew younger, are light TV viewers, and heavy AM/FM radio listeners

- Across 23 different service and product categories, heavy AM/FM radio listeners are much more likely to say they will spend more soon

- One-third of heavy AM/FM radio listeners say they will purchase a vehicle, a much greater proportion than average

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.