AM/FM Radio and Podcasts: ideal media platforms for cellular service providers

The “Big 3” cellular service providers (Verizon, T-Mobile and AT&T), represent the majority of industry revenues and rely on AM/FM Radio to build their brands and drive subscriber acquisition.

Key findings:

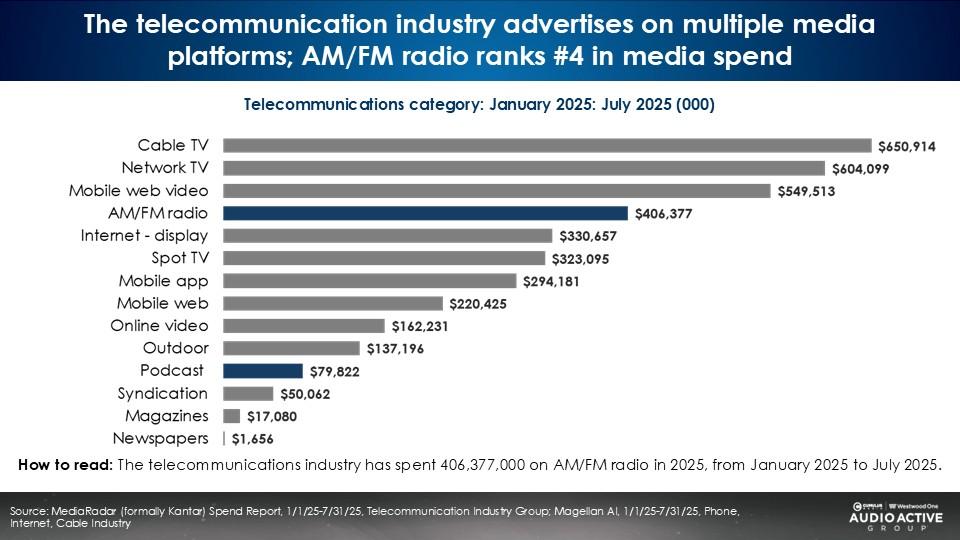

- AM/FM Radio is the fourth most utilized media platform among cellular service providers.

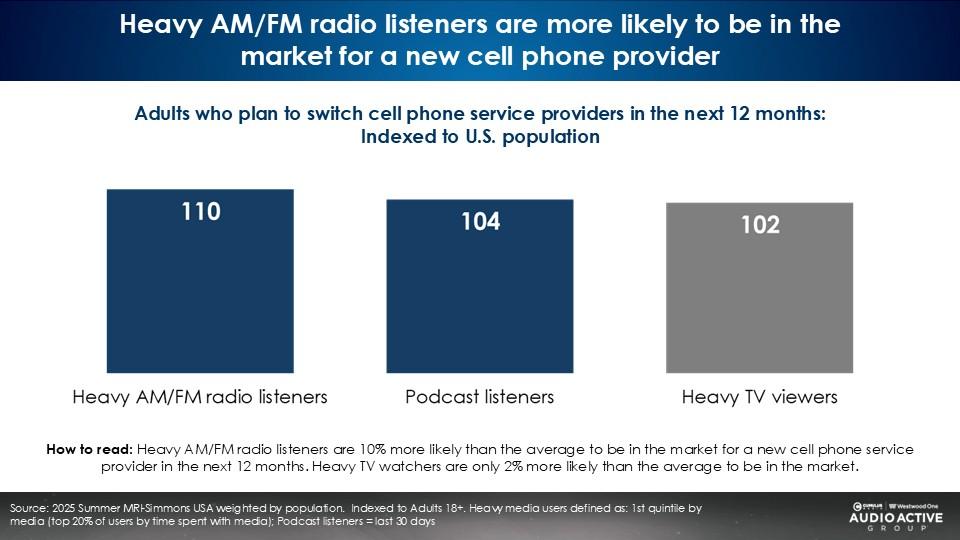

- Heavy audio listeners over index for being in market for a new cellular service.

- Audio consumers closely mirror the profile in those that intend to switch cellular firms. In contrast, the heavy TV viewer profile looks nothing like in-market consumers.

- ROI case study: AM/FM Radio generated $14 of incremental cellular brand sales for every dollar of AM/FM radio advertising.

- Despite spending significantly more on linear TV, a Harris Poll Brand Tracker study reveals a cellular brand has much stronger brand equity among audio listening segments than heavy TV viewers.

- Reallocating 20% of Verizon’s TV media plan to AM/FM Radio generates a 16% lift in incremental reach

MediaRadar reports AM/FM Radio ranks fourth in telecom media spend in the first half of 2025

While telecom brands spend 3X on TV versus AM/FM Radio, brand equity is actually stronger among audio consumers.

Heavy audio users are also more likely to be in market for a new cellular service.

MRI Simmons: audio consumers are more likely to be in the market for a new cellular service provider than heavy TV viewers

Compared to TV viewers, heavy AM/FM Radio listeners are 8% more likely to be in the market for a new cellular provider than heavy TV viewers (110 index for AM/FM Radio versus 102 index for heavy TV viewers).

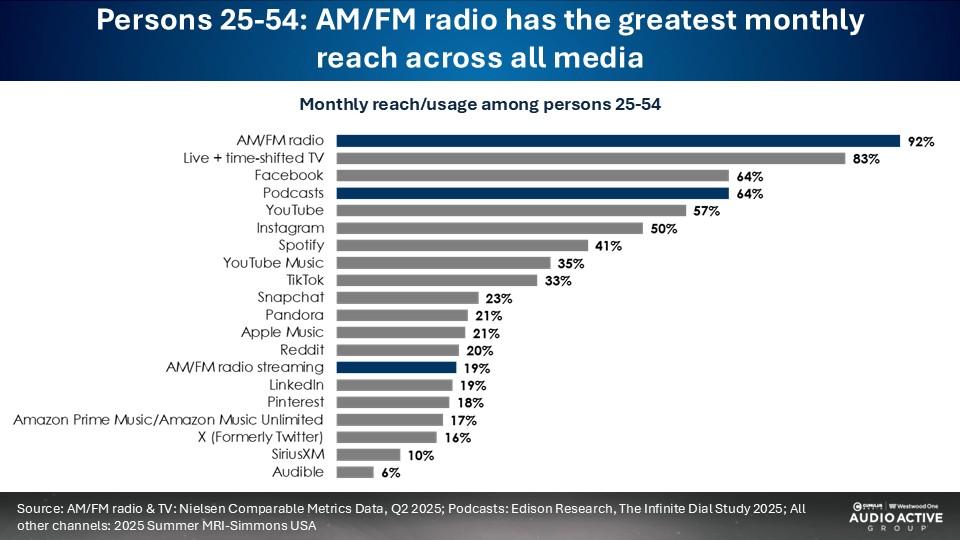

AM/FM Radio massive reach is a key factor in its prominence in cellular provider media plans. In a typical month, AM/FM Radio has the greatest 25-54 monthly reach of all media.

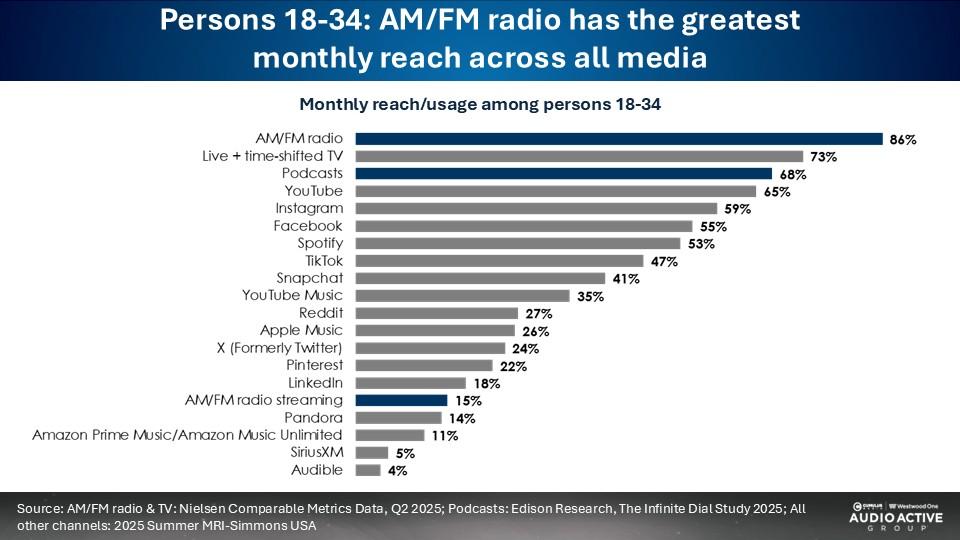

Surprisingly, AM/FM Radio leads all media in 18-34 monthly reach.

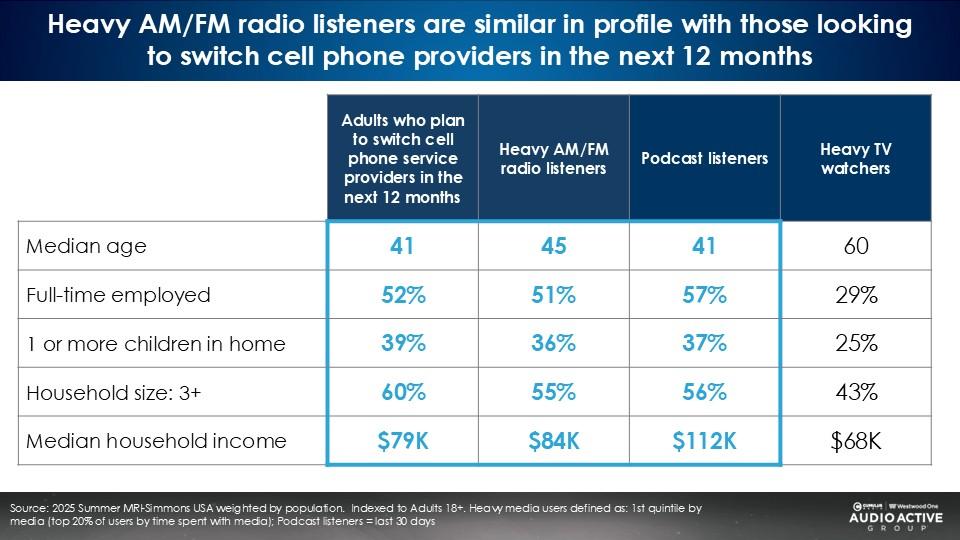

Audio consumers closely mirror the profile in those that intend to switch cellular firms in the next year. Podcast audience and heavy AM/FM Radio listeners match the in-market segment across age, employment, presence of children, household size and income. In contrast, the heavy TV viewer profile looks nothing like consumers who plan to switch cell phone services in the next year.

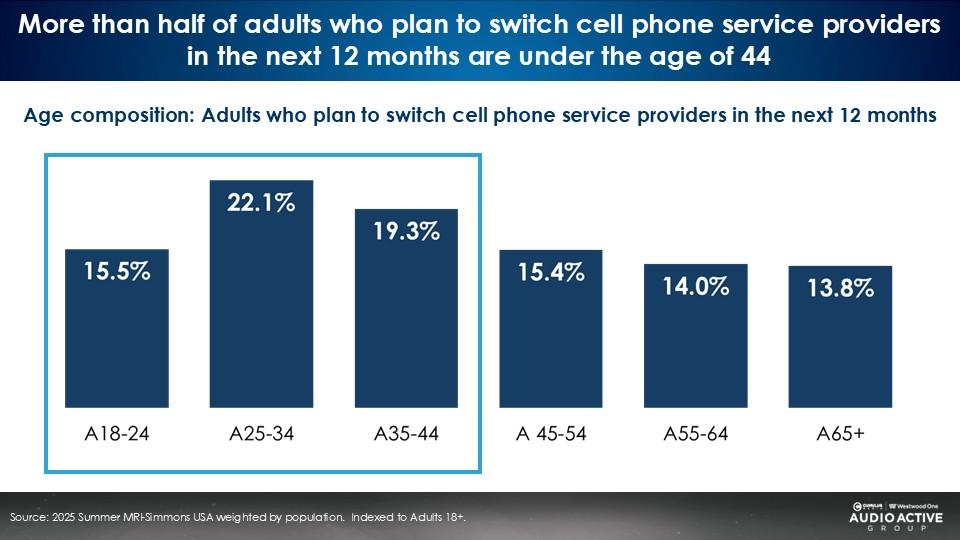

Cell phone switcher intenders skew towards 18-44s

57% of those who intend to switch cellular carriers in the next year are 18-44.

ROI case study: Radio generated $14 of incremental cellular brand sales for every dollar of AM/FM radio advertising

Nielsen matched radio ad occurrences for a cell service brand from their portable people meters to credit and debit expenditures. The study found in one quarter, a $15M AM/FM radio advertising investment generated $209 million of incremental sales. Dividing the $209 million of incremental sales generated by the $15M radio investment yields $14 return on ad spend.

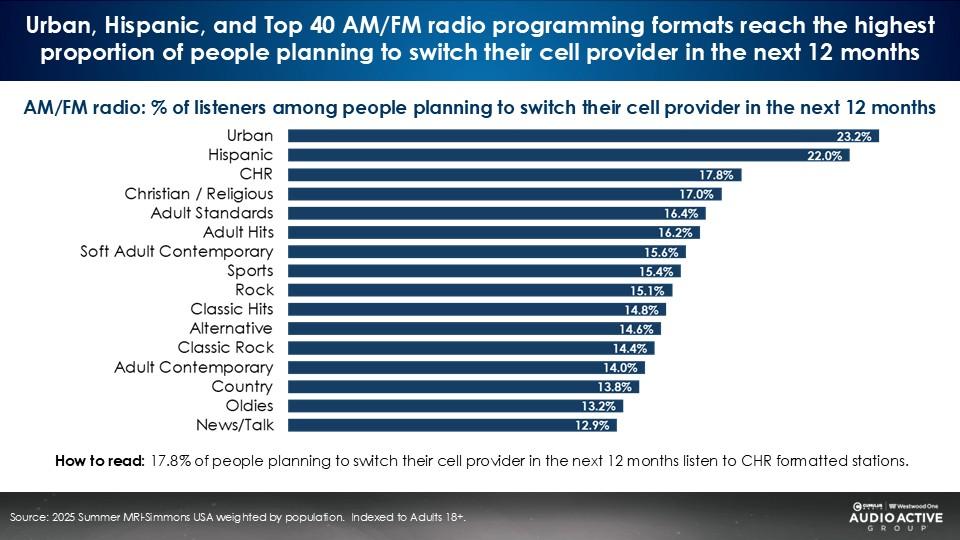

A diverse array of audio content is in the market for a new cellular service

Urban, Hispanic, Top 40/CHR, Christian, Adults Standards, Adult Hits and Soft AC are radio programming formats with large proportions of those who will switch cell providers.

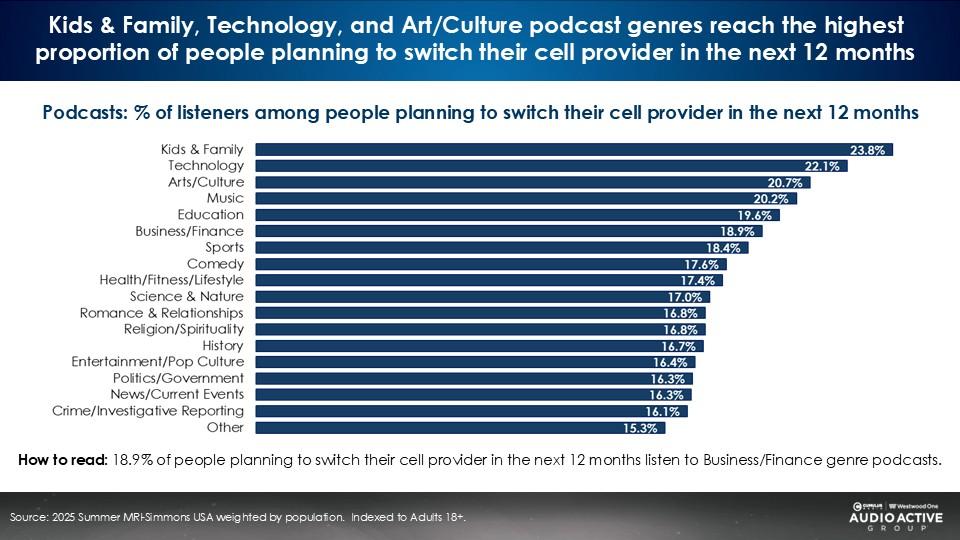

A wide variety of podcast genres have strong composition of in-market cellular service shoppers.

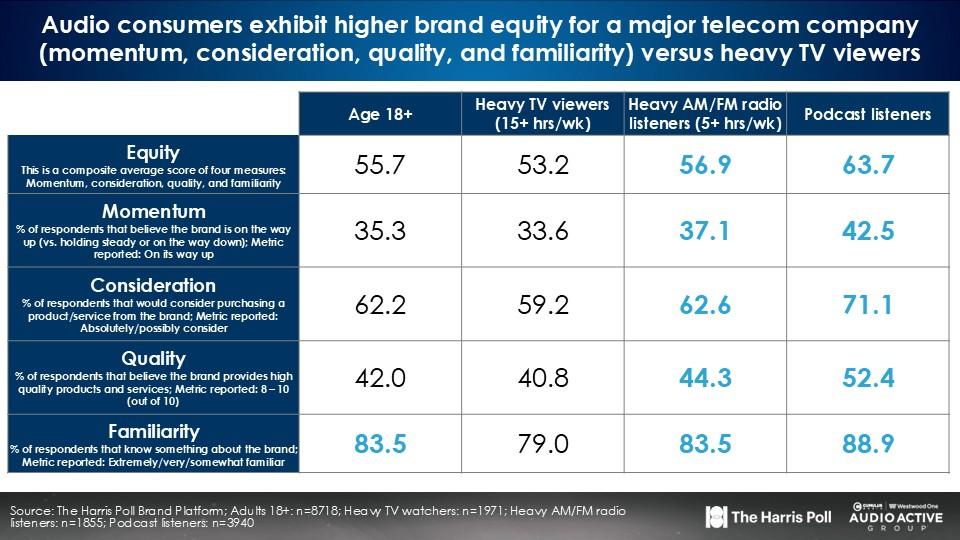

Harris Poll Brand Tracker: A Cellular brand has much stronger brand equity among audio listening segments versus heavy TV viewers

A recent Harris Poll Brand Tracker study of 8,913 respondents of a major cellular brand revealed key measures of brand equity (momentum, consideration, quality and familiarity) are much stronger among audio listening segments compared to heavy TV viewers.

Despite much stronger investment in TV platforms, the cellular marketer brand strength is weaker among heavy TV viewers than the total U.S. This is odd considering the size of the linear TV spend for the brand.

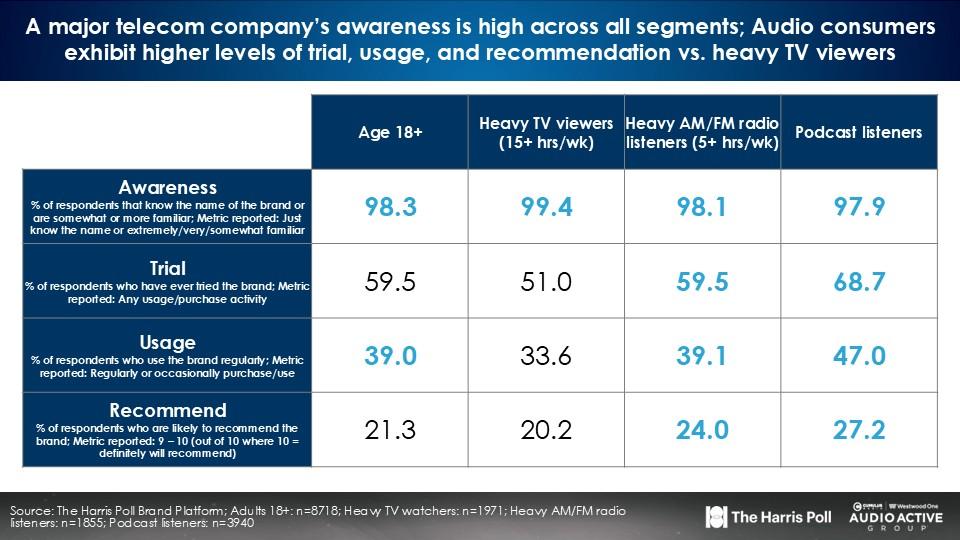

Why is the cell service brand trial, usage, and brand recommendation lower among heavy TV viewers than in the total U.S.?

These Harris Pol Brand Tracker findings are bizarre given the size of the linear TV budget.

A possible explanation is that heavy TV viewers are not really interested in the cellular service category or the brand. In that case, no matter how much TV budget is spent, the consumer has little interest, and the ads go “in one ear and out the other.”

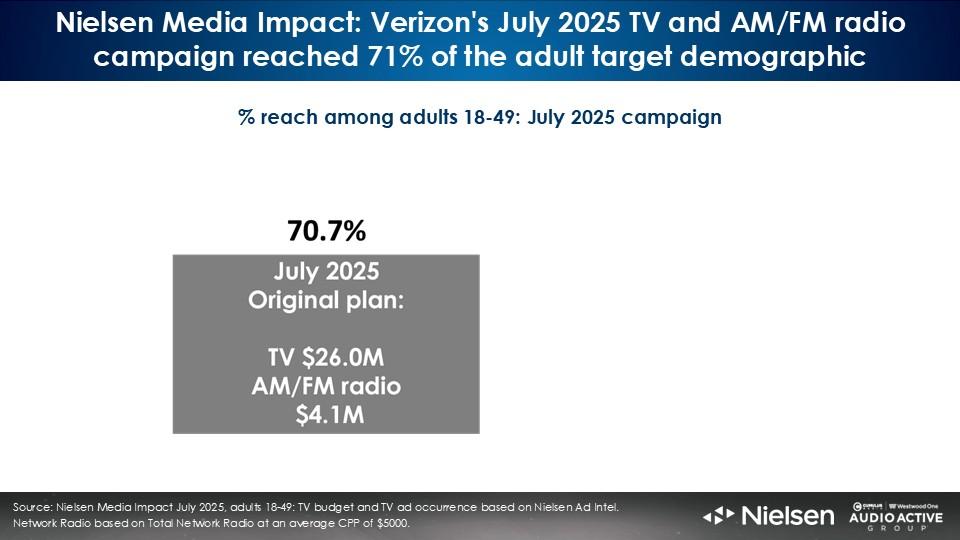

Verizon: how radio elevates the media plan

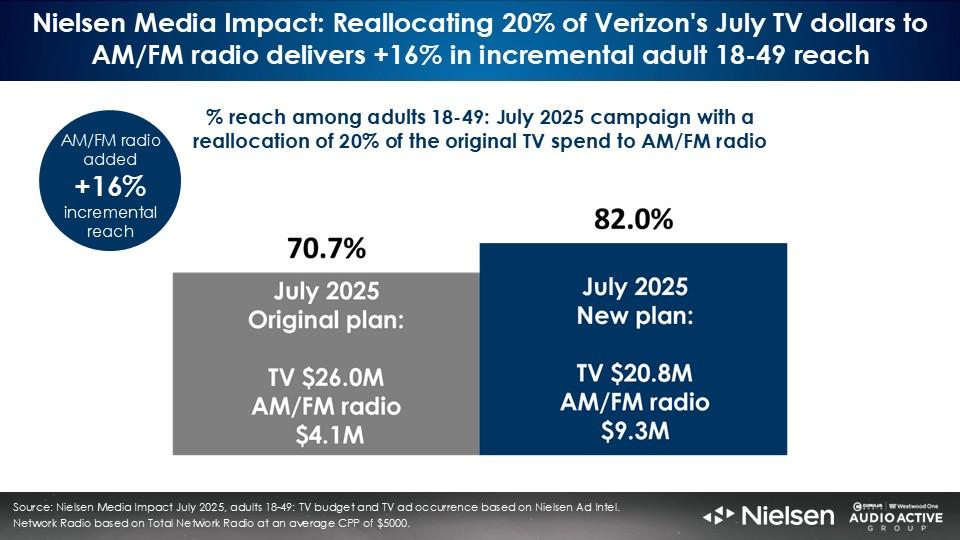

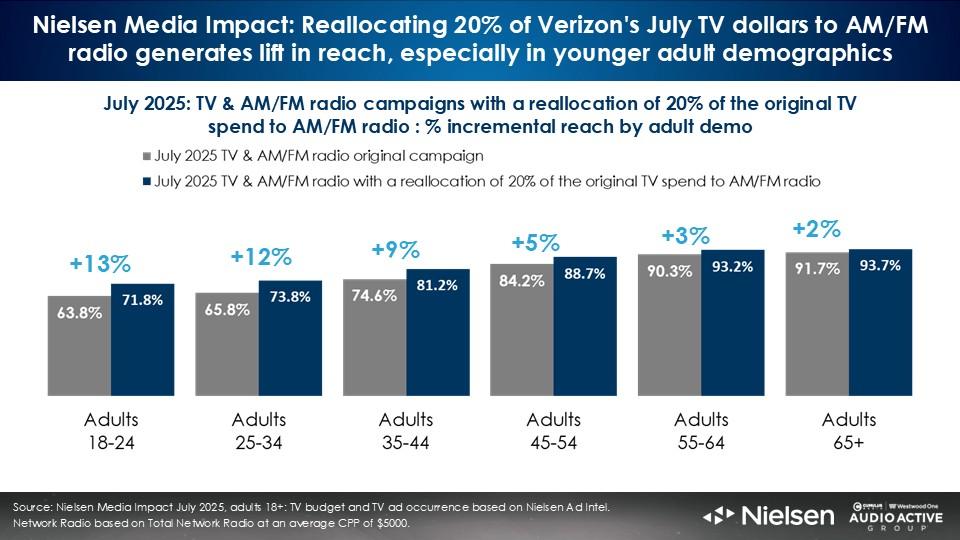

Via Nielsen Media Impact, the media planning and optimization platform, we learn that Verizon’s radio and linear TV campaign from a recent month reached 71% of U.S. persons 18-49. How can Verizon’s media plan be optimized?

Shifting 20% of Verizon’s linear TV monthly investment to AM/FM Radio increases monthly reach from 71% to 82%, an increase of 16%.

The 20% reallocation to AM/FM Radio generates strong reach lift among younger demographics who are more likely to be in the market for new cellular provider.

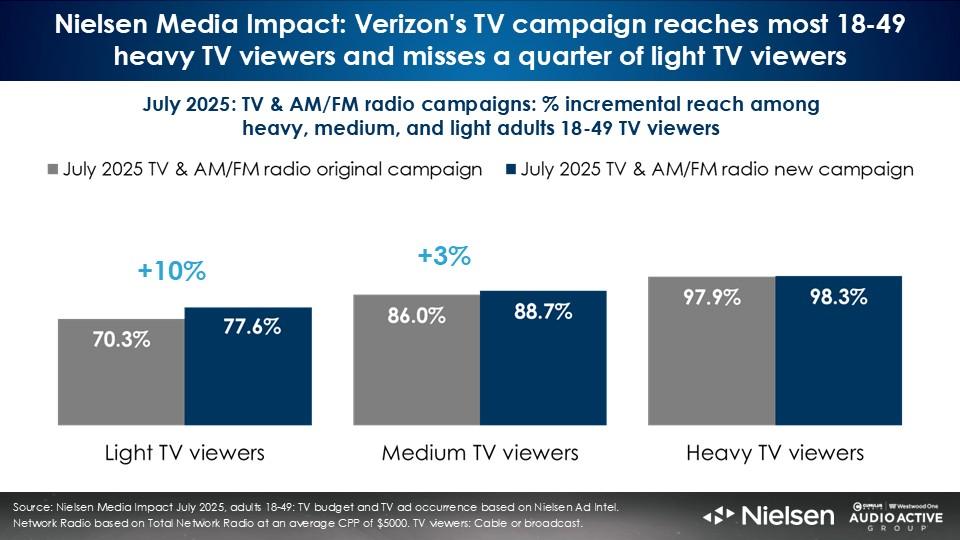

Radio’s superpower: generating incremental reach among light TV viewers

Shifting 20% of Verizon’s linear TV spend to AM/FM Radio generates the strongest incremental reach lift among light TV viewers who have little exposure to Verizon’s TV campaign.

Key findings:

- AM/FM Radio is the fourth most utilized media platform among cellular service providers.

- Heavy audio listeners over index for being in market for a new cellular service

- Audio consumers closely mirror the profile in those that intend to switch cellular firms. In contrast, the heavy TV viewer profile looks nothing like in-market consumers.

- ROI case study: Radio generated $14 of incremental cellular brand sales for every dollar of AM/FM radio advertising

- Despite spending significantly more on linear TV, a Harris Poll Brand Tracker study reveals a cellular brand has much stronger brand equity among audio listening segments than heavy TV viewers

- Reallocating 20% of Verizon’s TV media plan to AM/FM Radio generates a 16% lift in incremental reach