Nielsen Spring 2025 Total U.S. AM/FM Radio Audiences Up +6%; Weekends Grow +9%

Click here to download a PDF of the slides.

Network radio advertisers transact on Nielsen’s national audience service called “Nielsen Nationwide.” Nielsen has just released the Spring 2025 (April-May-June) Nationwide study of total listening in the United States.

Nielsen Nationwide aggregates listening from all counties including all Portable People Meter markets and all diary markets. Listening has grown across all demographics and time periods versus the Fall 2024 Nationwide report.

Key findings:

- Among persons 25-54, total U.S. AM/FM radio AQH has grown +6%, powered by a +19% increase in the Portable People Meter markets.

- Weekends and nights have the greatest growth compared to Fall 2024.

- Versus Fall 2024, Spring 2025 total U.S. audience growth is greater among men versus women and has increased in older demographics.

- Total U.S. Spring 2025 audience growth is up significantly among college graduates and upscale $75K+ income Americans.

- Spring 2025 format shares are remarkably stable.

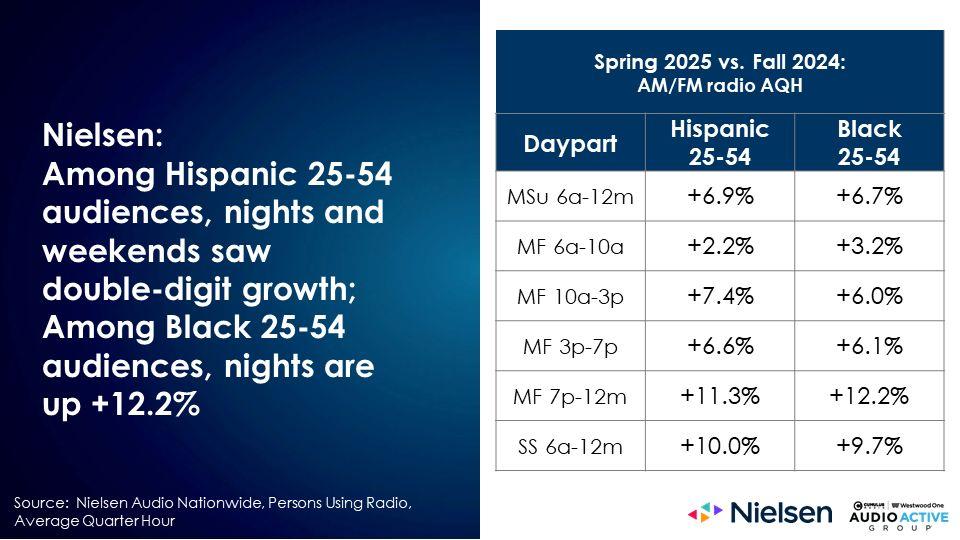

- Among Hispanic 25-54 audiences, nights and weekends saw double-digit growth; Among Black 25-54 audiences, nights are up +12.2%.

- Top market indices improve by three to five points.

Nielsen’s Portable People Meter modernization

The PPM audience growth is due to Nielsen’s three-minute qualifier modernization, which provides a significantly more comprehensive and realistic definition of AM/FM radio’s audience and their listening behavior.

Nielsen found 23% of PPM listening occasions were three or four minutes. Under the old five-minute listening qualifier rule, none of this tuning would have received listening credit. Effective with the January 2025 PPM survey, Nielsen began crediting tuning occasions that are three minutes or greater.

Westwood One’s legendary VP of Research Scott Anekstein conducted an analysis of the Spring 2025 Nationwide data, which aggregates all average quarter-hour audiences from all American counties in the United States. Scott compared the Spring 2025 Nationwide data with Fall 2024 (October-November-December) Nationwide report.

Here are Scott’s key findings:

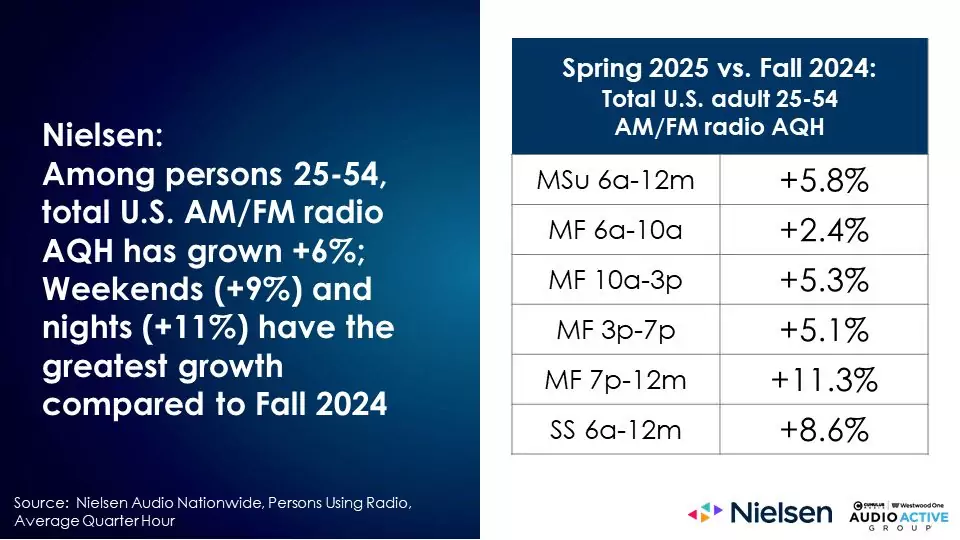

Among persons 25-54, total U.S. AM/FM radio AQH has grown +6%; Weekends (+9%) and nights (+11%) have the greatest growth compared to Fall 2024

Comparing Fall 2024 Nationwide report to Spring 2025 persons 25-54 reveals growth in all dayparts.

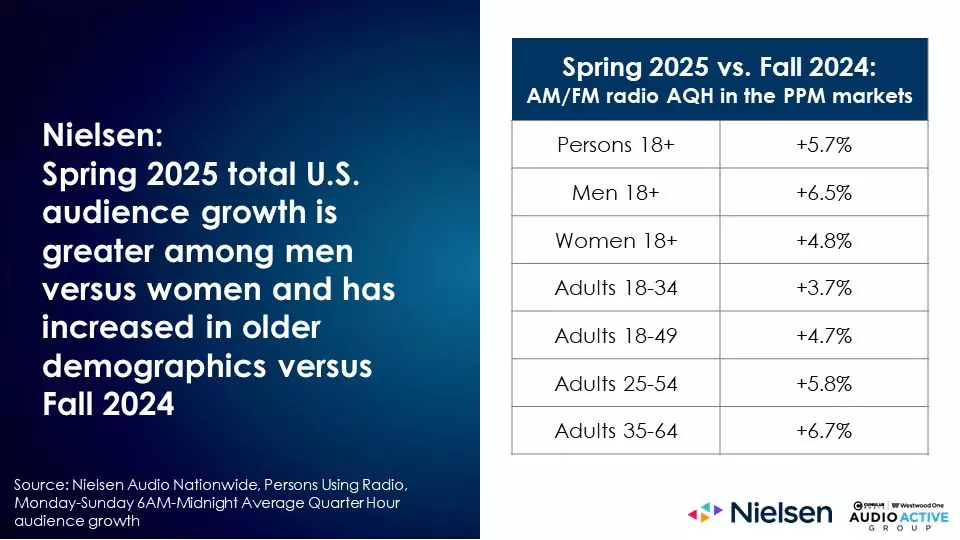

Spring 2025 total U.S. audience growth is greater among men versus women and has increased in older demographics versus Fall 2024

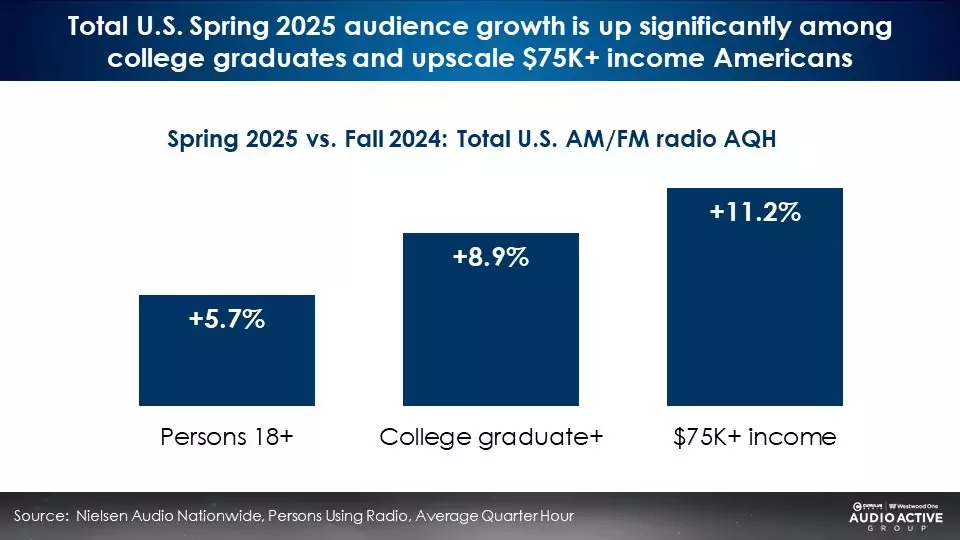

Total U.S. Spring 2025 audience growth is up significantly among college graduates and upscale $75K+ income Americans

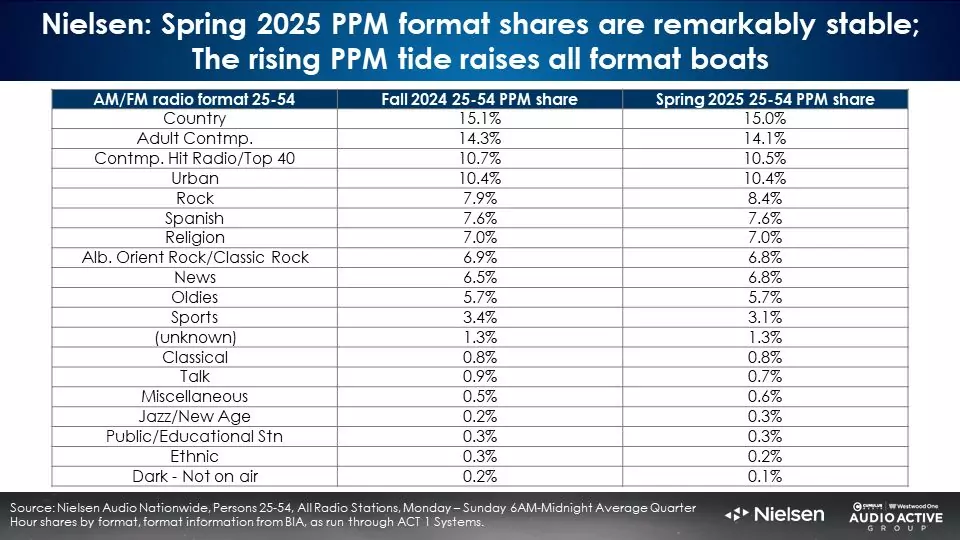

Total U.S. Spring 2025 format shares are remarkably stable as total radio AQH grows

Among Hispanic 25-54 audiences, nights and weekends saw double-digit growth; Among Black 25-54 audiences, nights are up +12.2%

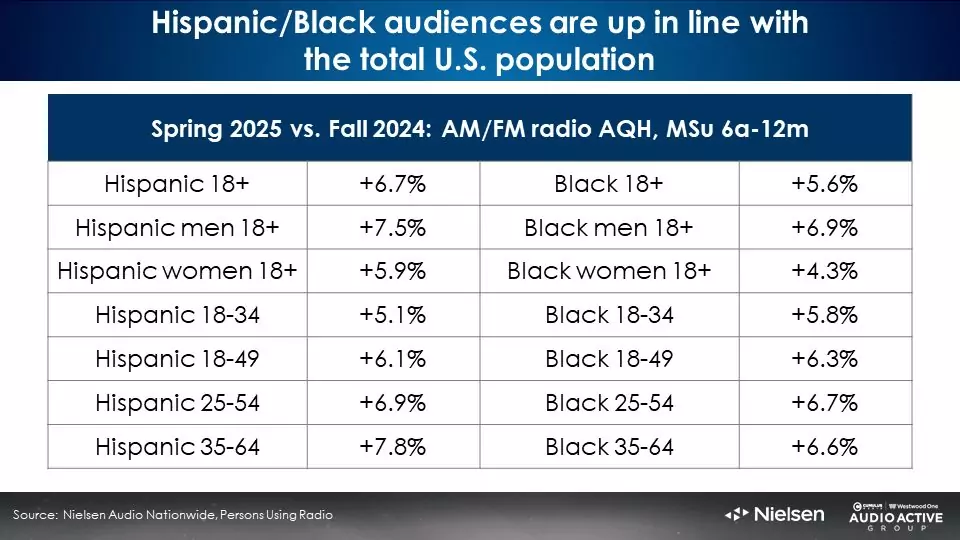

Hispanic/Black audiences are up in line with the total U.S. population

For national marketers, top market indices increase because of the PPM three-minute listening qualification

The growth in PPM audiences increases top market indices for all U.S. network radio audiences.

Network radio advertisers often assess the proportion of impressions that are generated by the largest markets. PPM markets have always had lower listening levels than diary markets due to the more exact nature of the Portable People Meter listening capture.

Previously, 25-54 listening levels in the top 50 markets were -19% lower than the total U.S. This is due to the fact the PPM method represents the vast majority of AM/FM radio listening in the top 50 markets.

With the introduction of the 3-minute qualifier in the PPM markets, top 50 market listening levels are now -16% lower than the total U.S.

Four implications of PPM listening increases

1. The trend of AM/FM radio surpassing TV in ratings will accelerate: Over the last five years, AM/FM radio has overtaken linear TV in ratings. Based on TV and AM/FM radio audience forecasts, 2026 will see AM/FM radio likely overtake linear TV in the all-important 25-54 demographic and widen its ratings lead over TV among 18-49s.

2. 2025 post-buy analyses will overachieve 2024 media plans: In PPM markets, expect increases in audience deliveries based on prior year schedules. For local buys, outcomes will vary by demographic, markets utilized, and AM/FM radio programming format mix.

For total U.S. media plans using Nielsen’s Nationwide survey, deliveries will grow by low/mid-single digits. Differences will result due to the mix of diary versus PPM market composition in network lineups as well as AM/FM radio programming format mix.

3. AM/FM radio, already America’s number one mass reach media, will experience reach growth in advertising schedules: With PPM now reporting higher AM/FM radio reach levels, campaign reach will experience growth. Since reach is the foundation of advertising effectiveness, this is a positive for AM/FM radio’s performance in media mix modeling analysis.

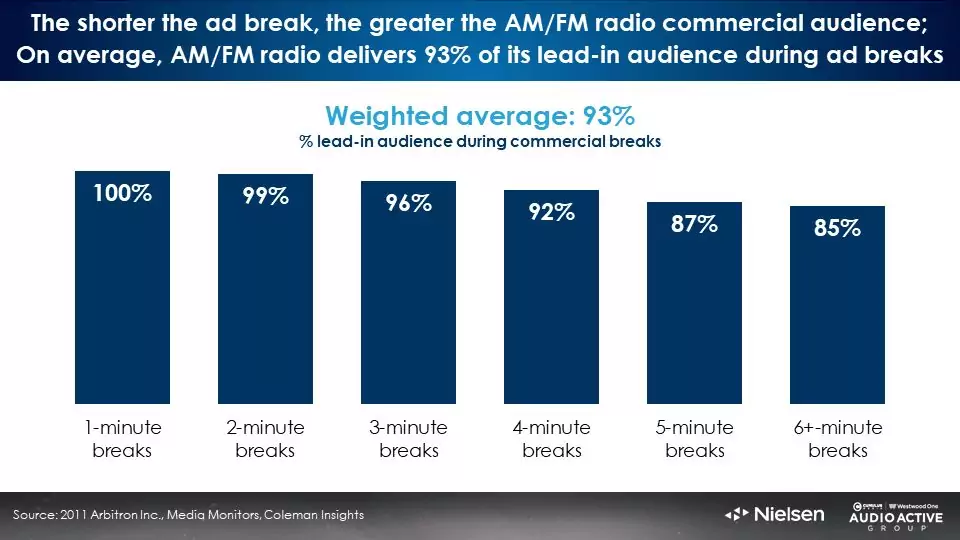

4. With a three-minute quarter hour qualification, stations can create more breaks of shorter duration, which will significantly benefit advertisers. AM/FM radio ads will be more effective as stations increase the number of commercial breaks with shorter durations. Since the introduction of the Portable Meter, most AM/FM radio stations schedule their two commercial breaks around 15 and 45 minutes past the hour. This strategy was designed to maximize five-minute listening durations.

A massive Portable People Meter study of 17,896,325 unique commercial breaks involving 61,902,473 minutes of advertising conducted by Nielsen, Media Monitors, and Coleman Research reveals the shorter the ad break, the greater the audience retention.

Two-minute ad breaks retain 99% of the lead-in audience. Six-minute ad breaks retain 85% of the lead in audience.

Creating more ad breaks of shorter duration generates larger commercial audiences. Advertisers stand out more in shorter breaks. Growing audience deliveries for AM/FM radio ads improve AM/FM radio’s performance in media mix modeling and marketing effectiveness studies.

Key findings:

- Among persons 25-54, total U.S. AM/FM radio AQH has grown +6%, powered by a +19% increase in the Portable People Meter markets.

- Weekends and nights have the greatest growth compared to Fall 2024.

- Versus Fall 2024, Spring 2025 total U.S. audience growth is greater among men versus women and has increased in older demographics.

- Total U.S. Spring 2025 audience growth is up significantly among college graduates and upscale $75K+ income Americans.

- Spring 2025 format shares are remarkably stable.

- Among Hispanic 25-54 audiences, nights and weekends saw double-digit growth; Among Black 25-54 audiences, nights are up +12.2%.

- Top market indices improve by three to five points.

Four implications of PPM listening increases

- The trend of AM/FM radio surpassing TV in ratings will accelerate.

- 2025 post-buy analyses will overachieve 2024 media plans.

- AM/FM radio, already America’s number one mass reach media, will experience reach growth in advertising schedules.

- AM/FM radio ads will become more effective as stations increase the number of commercial breaks with shorter durations.

Download the slides:

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.