Why Media Monitors’ Massive Market Expansion Of AM/FM Radio Ad Occurrence Measurement Is A Breakthrough For AM/FM Radio Performance In Media Mix Modeling

Click here to view or download the slides.

Editor’s note: John Fix is responsible for returning Procter & Gamble into the world of audio advertising. Since his retirement from P&G, John has opened his consultancy and Westwood One is excited to be one of his early clients. At P&G, John was one of the first to be dedicated to media analytics, from planning to attribution. He was responsible for the analysis and selection of media measurement applications and planning tools. At one point, John led U.S. media mix modeling, multi-touch attribution, and market testing. In his years at P&G, they went from non-existent to first in radio over a 5-year period.

Last week, Media Monitors, the leading commercial ad occurrence measurement firm, made two historic announcements that will dramatically improve the quality of AM/FM radio ad deliveries needed for Media Mix Modeling and attribution measurement.

Media Monitors’ radio ad monitoring market coverage increases from 106 to 250

As you read this, Media Monitors is now capturing ad occurrences for national advertisers in 250 markets, an increase of 144 markets. This will significantly improve the national representation of as-run radio advertising occurrences. This market expansion:

- Represents a +20% increase in average quarter-hour audience from the prior Media Monitors footprint

- Generates a +22% lift in reach to the Media Monitors cume footprint

- The Media Monitors national coverage now represents 86% of U.S. AM/FM radio reach

The second major enhancement to the Media Monitors data is they are now keeping radio advertising audio files “forever.” Media Mix Modeling often requires submitting two years of weekly radio GRPs and impressions along with the creative metadata.

Often these historical occurrences files contain “blank ISCIs”. ISCIs are an ID number assigned to creative by agencies. Sometimes ISCIs are assigned by radio networks and radio publishers for custom talent reads and special creative.

By having the old audio files available, ads can receive proper creative descriptions. The specific brand or sub-brand being advertised can be verified. This removes a major pain point in submitting accurate radio delivery data to media mix modelers and attribution measurement firms.

What is Media Mix Modeling?

Media Mix Modeling (MMM) is a statistical analysis that helps advertisers understand how different marketing activities impact a company’s sales and return on investment (ROI). It measures the effectiveness of marketing efforts and media channels by analyzing historical data to determine which factors contribute to sales.

MMM requires very few inputs to create an answer. Any media channel can be input at a brand level with weekly planned Total Rating Point data and weekly spend estimates. Planned GRPs are not ideal and not recommended.

MMM planning, data collection, and data validation can occur over a four-month period. After that, the modeling process takes two months and the results inform media plans for the next year.

Increasingly, advertisers are conducting “always on” media mix modeling that requires a steady flow of audience deliveries as input. Advances in AI and technology are sharply reducing the price of media mix modeling. This will expand the use of MMM to regional and local advertisers.

The solution to the data problem: Use as-run deliveries, not planned weight

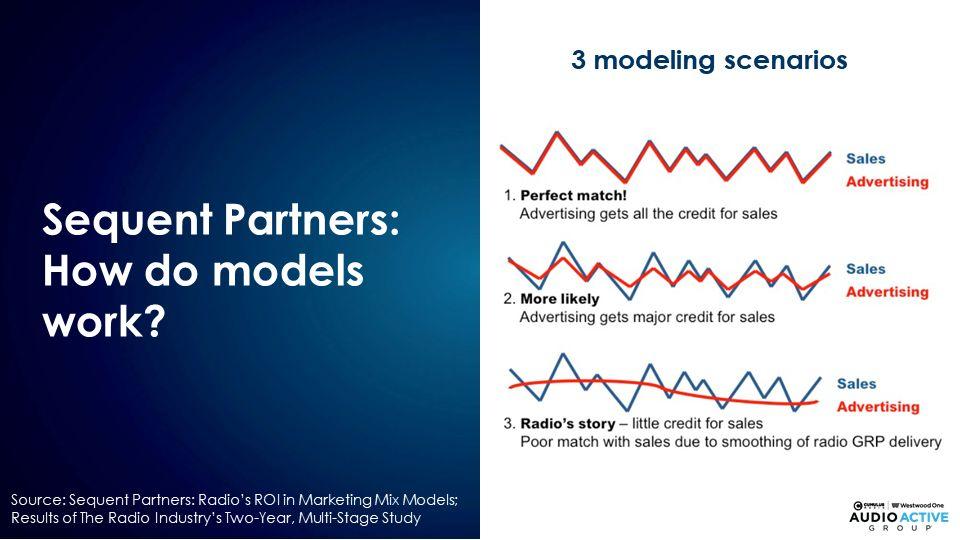

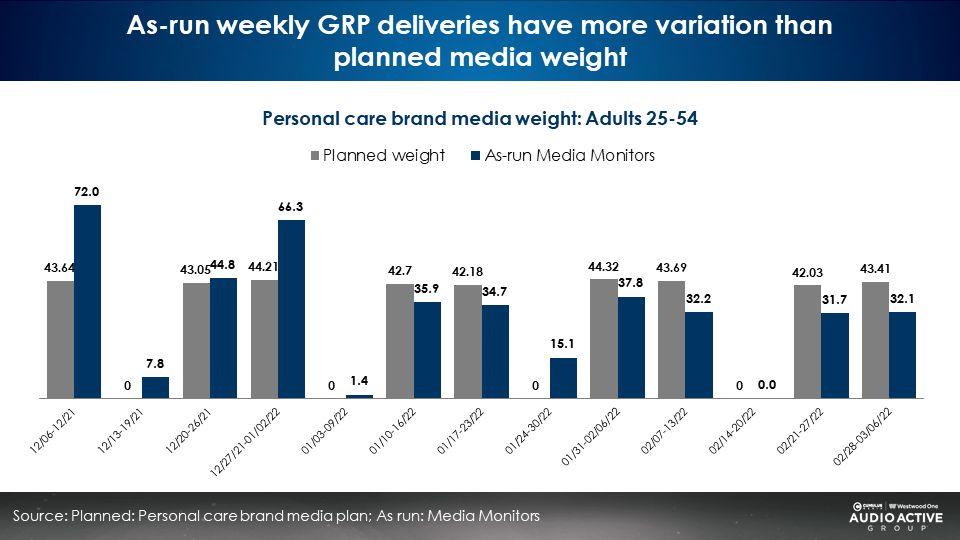

The easiest approach for an advertiser is to submit weekly planned GRP weight. As the visual below reveals, planned media weight is problematic. It creates a “smoothing effect,” which makes it difficult to correlate AM/FM radio ads with sales. The upshot? Audio gets little credit for sales.

A better approach is for the audio industry to provide as-run GRPs. In the chart below, the grey bars represent planned weekly GRPs. Notice how they never vary week to week with the exception of dark weeks.

Media Mix Models crave variation. Planned weight has little or no variation.

The blue bars represent as-run weekly GRPs pulled from Media Monitors. Media Monitors ad occurrences for the entire AM/FM radio investment over a two-year period are input into ACT1.

ACT1 is the software system that processes Nielsen Nationwide, the AM/FM radio ratings for the entire U.S. The as-run GRPs (the blue bars) show more variation, which is exactly what the models need.

ACT1 has modified its software to improve the process of producing AM/FM radio data inputs for Media Mix Modelers.

Best practices for MMM data inputs

In a Nielsen report titled Unlocking The Potential of Radio In Media Mix Modeling, Dave Hohman, EVP & GM Global Marketing Effectiveness at Nielsen’s Media Mix Modeling practice, recommends the following:

“Plan for Adequate GRPs: Allocate sufficient budget to radio and other audio channels. While the appropriate levels may vary by category

Use As-Run Data, Not Planned GRPs: Many marketers rely on planned GRPs, which can differ significantly from what is actually delivered. By using As-Run GRPs—actual media delivery—you’ll get a more accurate read of radio’s performance. Nielsen’s data consistently shows the importance of this distinction.

DMA-Level Delivery Matters: Radio’s effectiveness can vary across different markets, so it’s important to evaluate media delivery at the Designated Market Area (DMA) level. Actual delivery often deviates from planned delivery, and understanding these variations can provide valuable insights for optimizing your radio campaigns.

Analyze by Week: Timing is everything, especially for media like radio that may have seasonality or other timing-related nuances. Analyzing media delivery on a weekly basis—taking into account sales events, weather conditions, or special promotions—can help explain spikes or dips in performance. This granular level of analysis is crucial for understanding the true impact of your radio investments.”

Here are some other useful data inputs:

- Product hierarchy: Company, brand, sub-brand

- Creative campaign/strategy

- Target demo: What audience was the buy against

For assistance with data inputs for your Media Mix Modeling, reach out to your broadcast media partner.

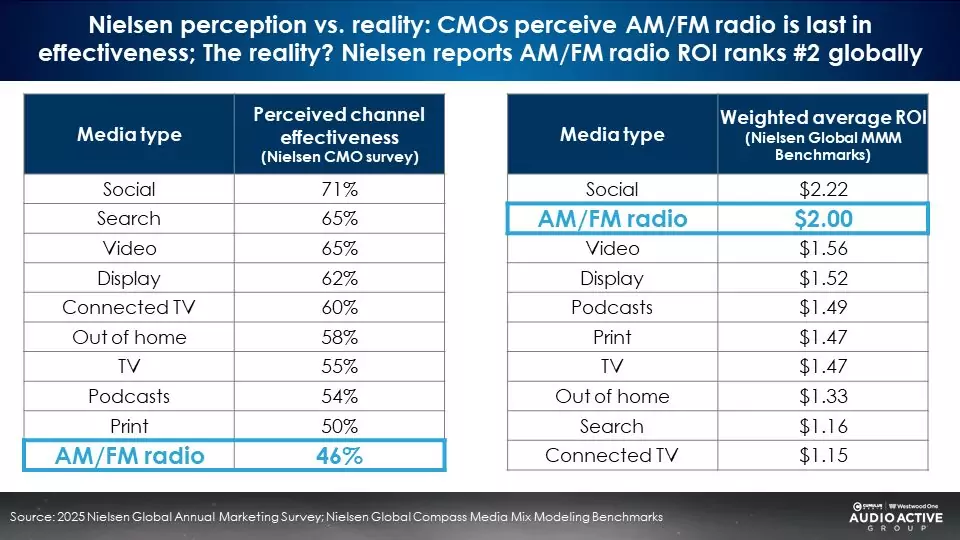

Perception vs. reality: Nielsen reports a massive marketer disconnect between the perceptions of AM/FM radio’s ROI and the reality from their Media Mix Modeling studies

A Nielsen global CMO survey reveals that AM/FM radio is perceived as having the lowest return on investment (ROI). The reality?

Nielsen’s global media mix modeling ROI benchmarks place AM/FM radio as number two!

Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, concludes, “Why do people think that nobody listens to radio anymore? Because there is a narrative that new media kills old media, so nobody bothers to look at evidence that doesn’t fit the narrative.”

Looking to elevate your media plan and drive business outcomes? Look no further than AM/FM radio and make sure you provide the media mix modeler actual as-run radio audience deliveries!

Key findings:

- Media Monitors’ radio ad monitoring market coverage increases from 106 to 250. This will significantly improve the national representation of as-run radio advertising occurrences.

- The second major enhancement to the Media Monitors data is they are now keeping radio advertising audio files “forever.” By having the old audio files available, ads can receive proper creative descriptions. The specific brand or sub-brand being advertised can be verified.

- The solution to the data problem: Use as-run deliveries, not planned weight. ACT1 has modified its software to improve the process of producing AM/FM radio data inputs for Media Mix Modelers.

- Perception vs. reality: Nielsen reports a massive marketer disconnect between the perceptions of AM/FM radio’s ROI and the reality from their Media Mix Modeling studies. Nielsen’s global media mix modeling ROI benchmarks place AM/FM radio as number two.

For more on media mix modeling insights, please consult several pieces I published in the last year:

- Think Media Mix Modeling Hates AM/FM Radio? Think Again! AM/FM Radio Is A Top ROI Generator According to 2,857 Nielsen MMM Studies

- Want to Get Mixed Media Modeling Right? Start with Your Data!

- Underspending Generates Weak ROI In Media Mix Modeling And The Benefits Of Moving To An Optimization Mindset Of “Did This Execution Of AM/FM Radio Work”

Download the slides:

John Fix can be reached at johnfixltd@gmail.com.