Audio, The Soundtrack Of The American Worker, Is The Ideal Platform For Reaching Passive And Active Job Seekers

Click here to view an 11-minute video of the key findings.

Click here to download a PDF of the slides.

To analyze national employment trends and profile job seekers and hiring decision makers, the Cumulus Media | Westwood One Audio Active Group® commissioned MARU/Matchbox to field a study in December 2024. 1,000 respondents were surveyed to explore the labor market.

These findings were compared to similar studies conducted over the last seven years in 2018, 2021 and 2022. This report will focus on job seekers. A subsequent study will examine hiring decision makers.

Key findings:

- Audio is an ideal advertising environment for recruitment brands and companies seeking to hire, especially among passive job seekers who are less likely to use job sites: Nine out of ten job seekers are reached by ad-supported audio. Over-the-air AM/FM radio reaches nearly 80% of active and passive job seekers. Six out of ten active job seekers are reached by podcasts.

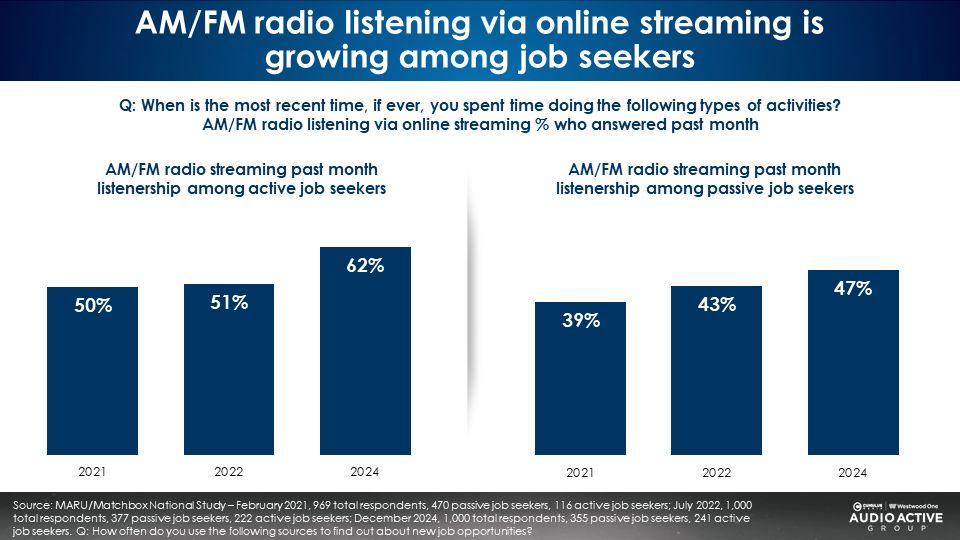

- AM/FM radio streaming’s audience growth has surged among job seekers: Since 2021, AM/FM radio streaming has soared in usage among both active and passive job seekers. Six out ten active job seekers are reached by AM/FM radio streaming.

- Passive job seekers outnumber active job seekers by +50%. Active job seekers are growing: The optimal source for filling positions are passive job seekers who outnumber active job seekers by +50%. Active job seekers have surged from 15% in 2018 to 24% currently.

- Advertising works: There is a very linear relationship between ad spend, share of voice, ad recall, and market share. The greater the ad spend, the greater the ad recall and market share.

- LinkedIn and Indeed are the recruitment category leaders for job seekers: Among active and passive job seekers, LinkedIn and Indeed frequently rose to the top in key brand metrics such as awareness and aided ad recall.

- ZipRecruiter is growing: ZipRecruiter has grown by 2X in frequent use among active job seekers (24% in 2018 to 47% in 2024).

Passive job seekers are the #1 source of new workers in America and outnumber active job seekers by +50%

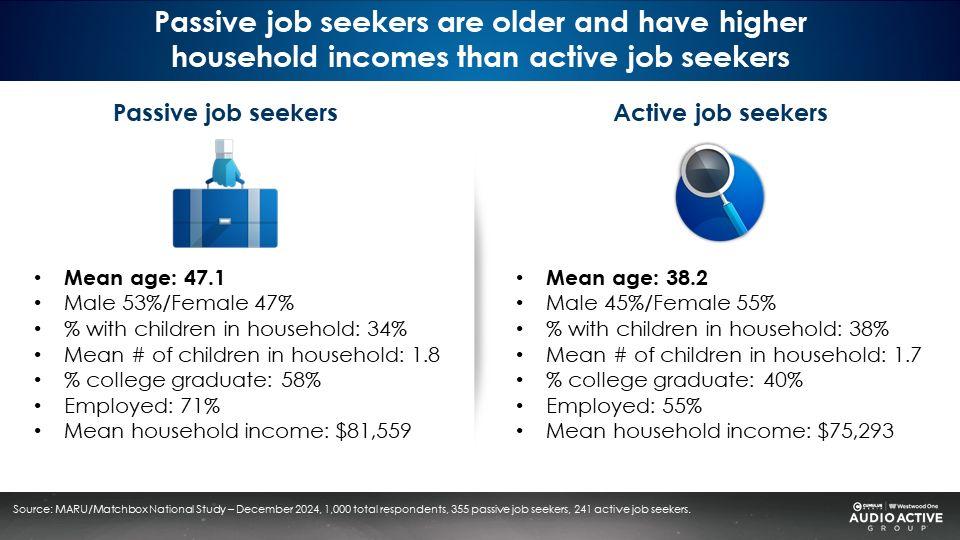

As the name implies, passive job seekers represent the 36% of Americans who are not actively looking for a new job: “I might consider the right new job” or “I am definitely willing to consider a new job.” There are +50% more passive job seekers than active job seekers (36% versus 24%). As such, it is crucial that companies tailor their messaging and media plans to attract passive candidates.

The number of active job seekers has reached a seven-year high. One out of four Americans say they are “actively applying for new jobs/interviewing or planning to look.”

Active job seekers are nine years younger than passive job seekers and lean female

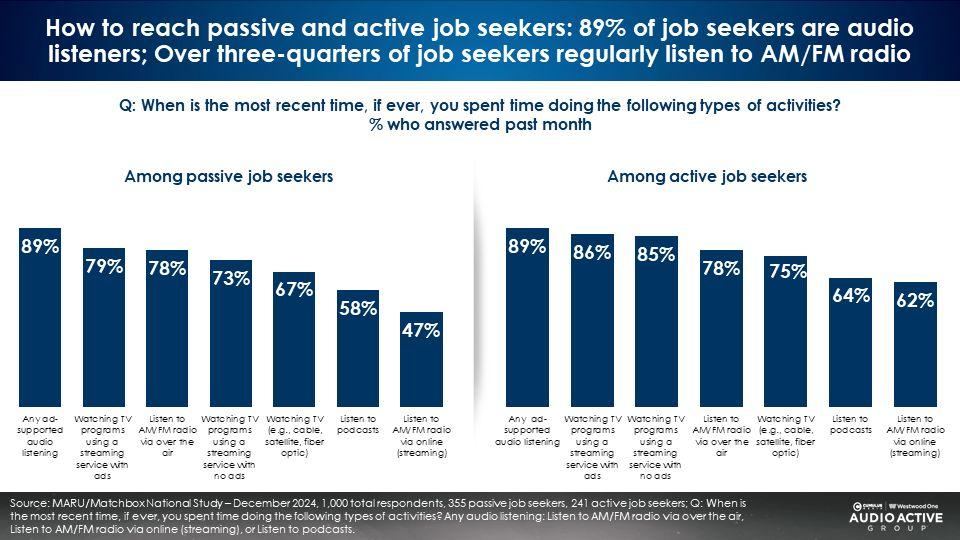

Ad-supported audio is the number one media platform to reach both passive and active job seekers

Nine out of ten job seekers are reached by ad-supported audio (AM/FM radio, streaming, and podcasts). Eight out of ten job seekers are reached by AM/FM radio and six out of ten are reached by podcasts.

AM/FM radio streaming is particularly effective at reaching active job seekers. 62% of active job seekers listen to AM/FM radio streaming.

AM/FM radio streaming is growing among job seekers

Since 2021, AM/FM radio streaming has surged in reach among active and passive job seekers.

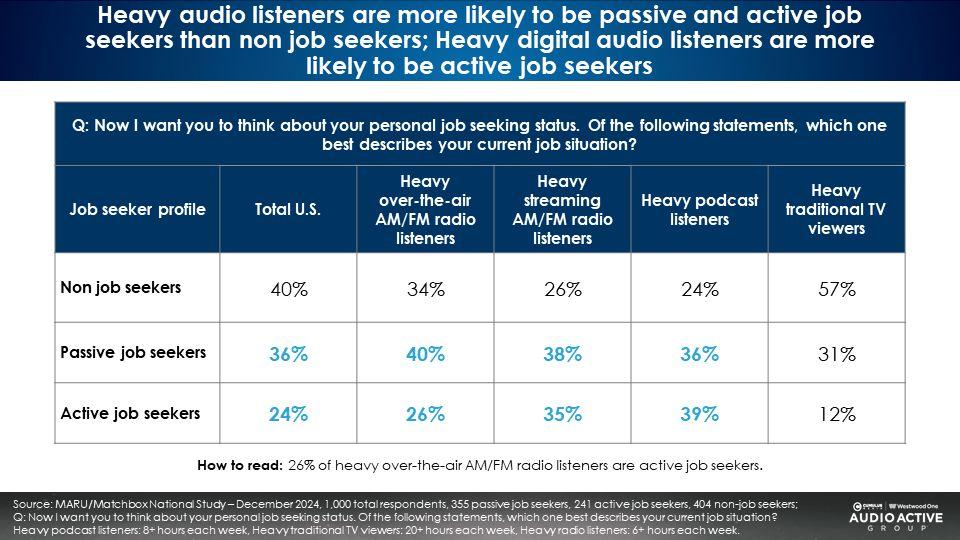

Heavy audio listeners are far more likely to be passive and active job seekers than non-job seekers; Heavy digital audio listeners (AM/FM radio streaming and podcasts) are much more likely to be active job seekers

In contrast, heavy TV viewers are far less likely to be job seekers.

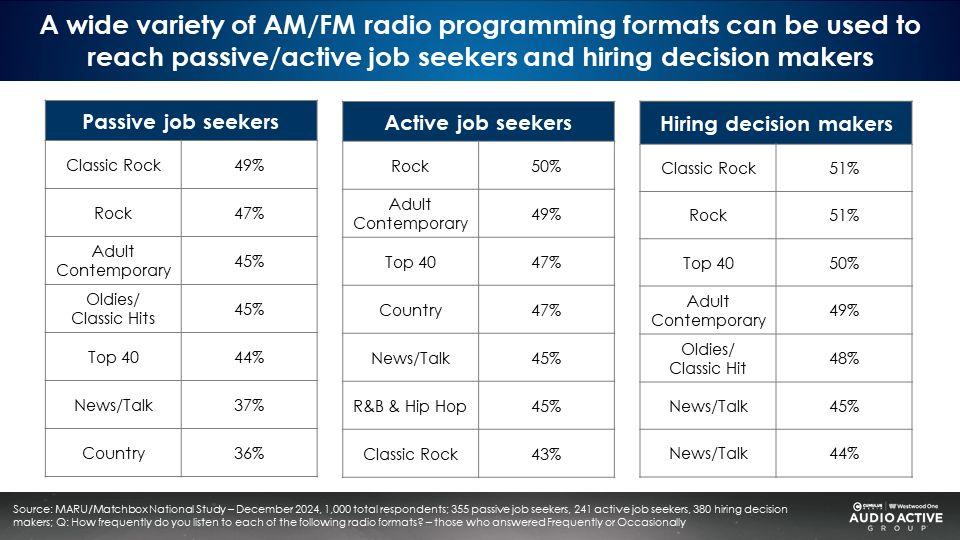

A wide variety of AM/FM radio programming formats reach job seekers

The younger skew of active job seekers is evidenced by larger audiences for more contemporary music formats like Top 40 and R&B/Hip Hop. The older skew of passive job seekers reveals stronger audience reach for gold-based programming formats such as Classic Rock and Oldies/Classic Hits.

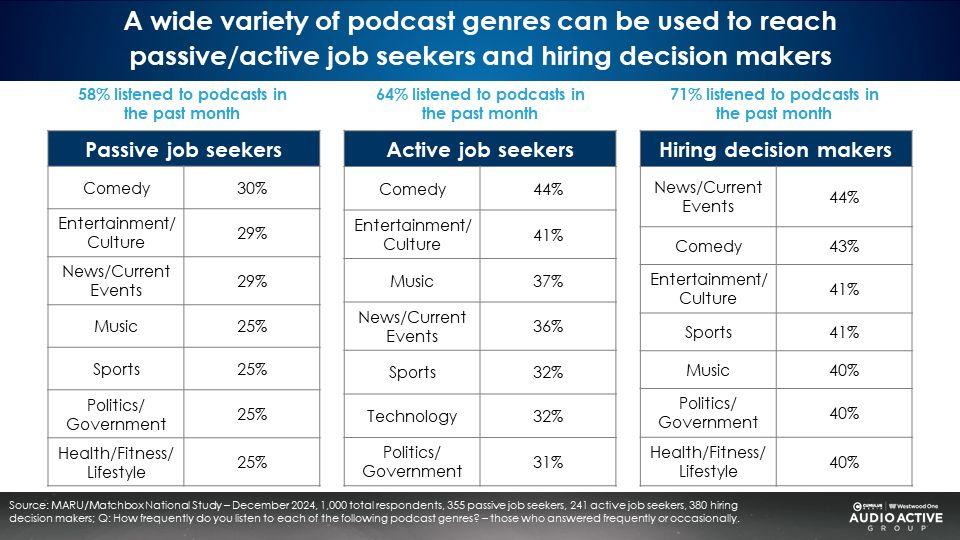

A wide variety of podcast genres reach job seekers

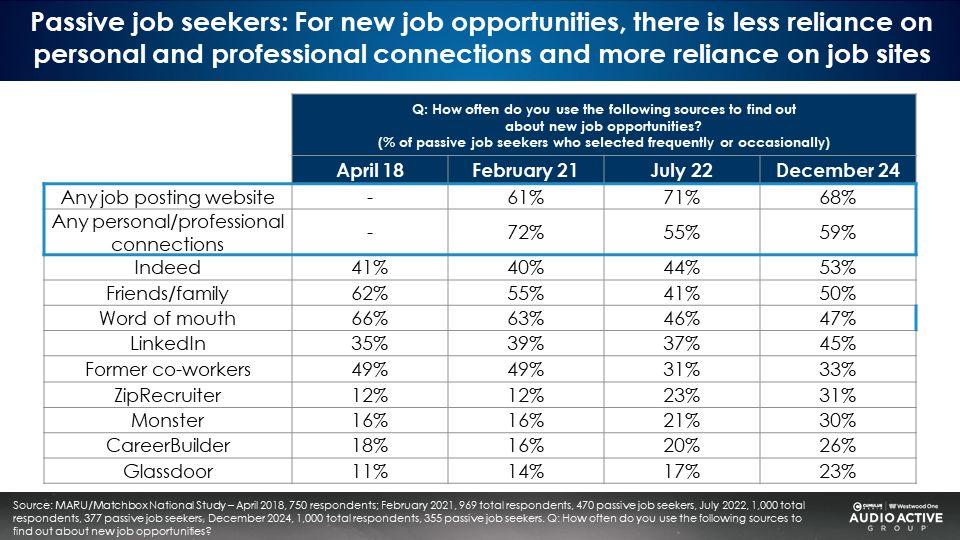

Passive job seekers are less likely to use online job sites

They don’t call them “passive” job seekers for nothing! While 90% of active job seekers are using job sites, only 68% of passive job seekers are using job sites frequently or occasionally.

Companies who solely rely on online job sites to recruit new hires are missing out on passive job seekers who outnumber active job seekers by +50%. Adding over-the-air AM/FM radio, AM/FM radio streaming, and podcasts to the recruitment media plan can help secure these hard to reach candidates.

Since 2021, passive job seekers are less likely to use word of mouth or friends and family to learn about new job opportunities. Currently, 59% of passive job seekers said they use personal or professional connections, down from 72% in 2021.

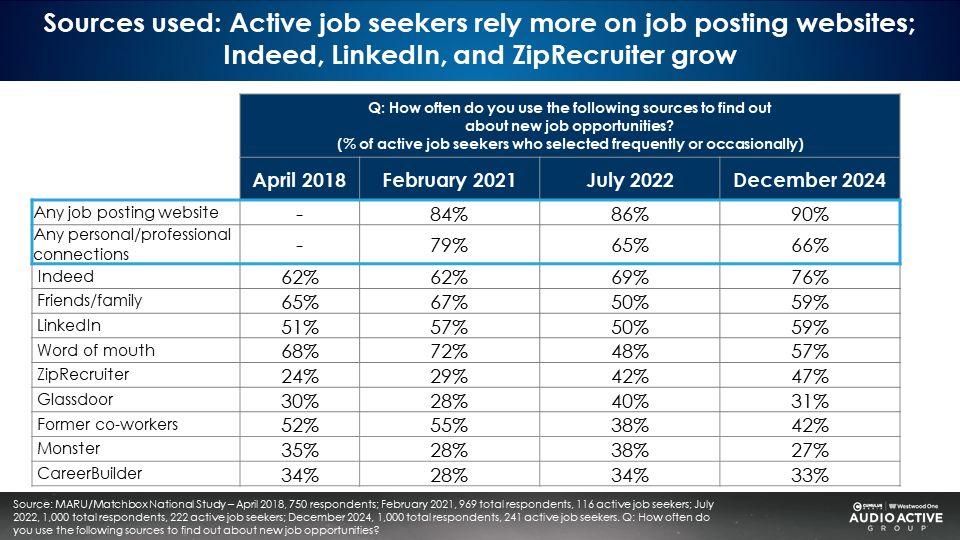

Active job seekers rely less on word of mouth and friends; Indeed and LinkedIn are the most used while ZipRecruiter grows and has doubled usage

As with passive job seekers, there is less reliance on word of mouth and friends and family. Nine of out ten active job seekers use job sites. 47% of active job seekers say they use ZipRecruiter, which is 2X their 2018 usage (24%).

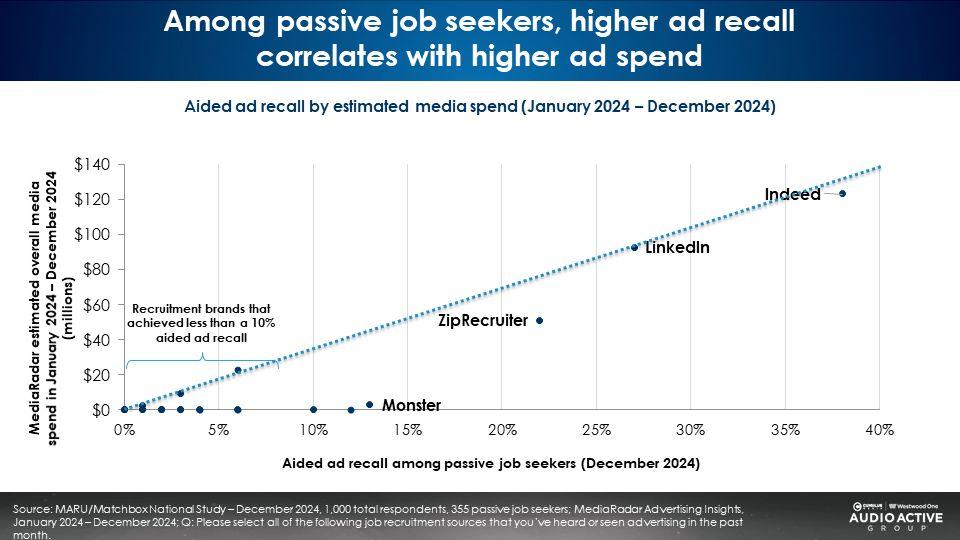

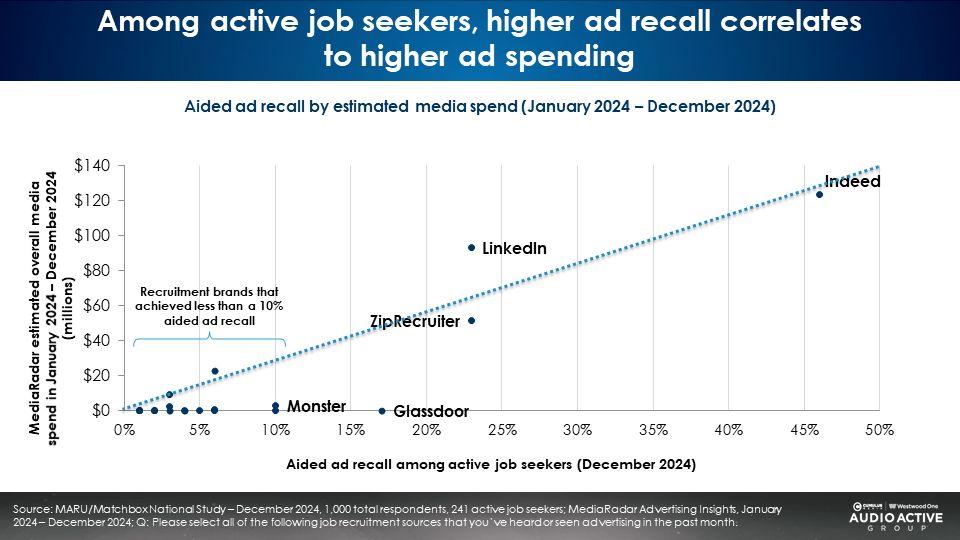

Advertising works: There is a direct relationship between advertising spend and advertising recall

Comparing 2024 total media spend measured by MediaRadar and advertising recall from the December 2024 MARU/Matchbox national study reveals a straight-line relationship. The greater the ad spend, the greater the advertising recall among both passive and active job seekers.

Among both active and passive job seekers, Indeed, consistently a leading user of network radio, enjoys strong advertising recall, followed by LinkedIn, and ZipRecruiter. Among active job seekers, there is also a strong relationship between media spend and advertising recall.

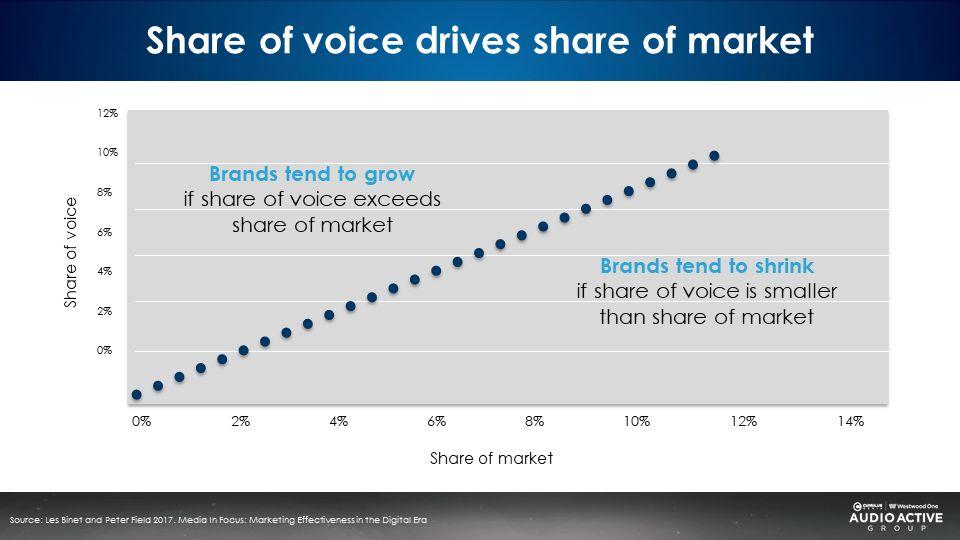

How advertising works: The relationship between market share and share of voice

A useful marketing exercise compares share of voice to a business’ market share. Les Binet and Peter Field, the legendary “godfathers of marketing effectiveness,” use the share of voice/share of market visual to predict future growth of a business or brand.

The up and down X axis represents share of voice which divides brand spend over category spend. The left to right Y axis represents market share for the brand (brand revenue divided by category revenue).

- If share of voice exceeds share of market, sales tend to grow.

- If share of voice is similar to share of market, sales tend to be stable.

- If share of voice is smaller than share of market, sales tend to shrink.

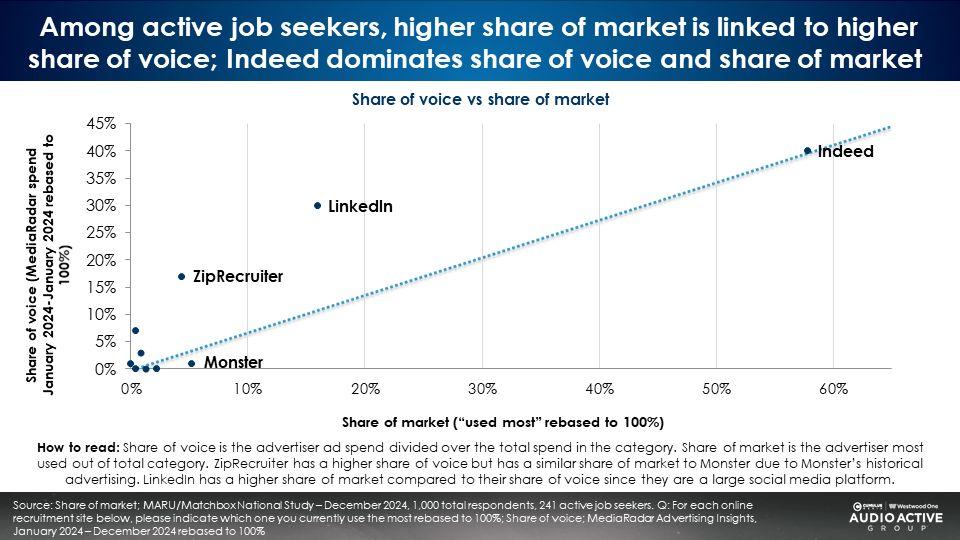

Job recruitment sites: Share of voice aligns with market share (“use most”)

Using total media spend data from MediaRadar (including all media, digital, TV, and audio), share of voice was determined for each job site by dividing brand ad spend over total job site category spend. Market share was determined using the “most used” job site response from the December 2024 MARU/Matchbox study among active job seekers.

There is the 45-degree Binet and Field relationship between job site share of voice and market share. Indeed has an outsized share of voice, which drives their significant “used most” market share.

LinkedIn and ZipRecruiter have greater share of voice than their current market share, which predicts future growth for both brands.

Key findings:

- Audio is an ideal advertising environment for recruitment brands and companies seeking to hire, especially among passive job seekers who are less likely to use job sites: Nine out of ten job seekers are reached by ad-supported audio. Over-the-air AM/FM radio reaches nearly 80% of active and passive job seekers. Six out of ten active job seekers are reached by podcasts.

- AM/FM radio streaming’s audience growth has surged among job seekers: Since 2021, AM/FM radio streaming has soared in usage among both active and passive job seekers. Six out ten active job seekers are reached by AM/FM radio streaming.

- Passive job seekers outnumber active job seekers by +50%. Active job seekers are growing: The optimal source for filling positions are passive job seekers who outnumber active job seekers by +50%. Active job seekers have surged from 15% in 2018 to 24% currently.

- Advertising works: There is a very linear relationship between ad spend, share of voice, ad recall, and market share. The greater the ad spend, the greater the ad recall and market share.

- LinkedIn and Indeed are the recruitment category leaders for job seekers: Among active and passive job seekers, LinkedIn and Indeed frequently rose to the top in key brand metrics such as awareness and aided ad recall.

- ZipRecruiter is growing: ZipRecruiter has grown by 2X in frequent use among active job seekers (24% in 2018 to 47% in 2024).

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.