Audio Remains The Primary Mode Of Podcast Consumption Despite Growing Video Options, According To Brand New Cumulus Media And Signal Hill Insights’ Podcast Download – Spring 2025 Report

Click here to download a PDF of the full report.

Podcasts are unique among other media platforms, offering flexible multimedia opportunities where consumers have the option to either watch or listen. While the video component is a growing option, audio remains the primary mode of consumption.

For the fourteenth edition of the Podcast Download series, Cumulus Media and Signal Hill Insights retained Quantilope to conduct an in-depth study of 603 weekly podcast consumers from April 21- 30th 2025. Since 2017, two studies are conducted annually. The Spring 2025 report highlights trends from prior studies and examines topics such as platform preference, content trends, advertiser usage of podcast advertising, and more.

Liz Mayer, Senior Insights Manager of the Cumulus Media | Westwood One Audio Active Group®, and Paul Riismandel, President of Signal Hill Insights, conducted an extensive analysis of the Podcast Download consumer study.

Key takeaways:

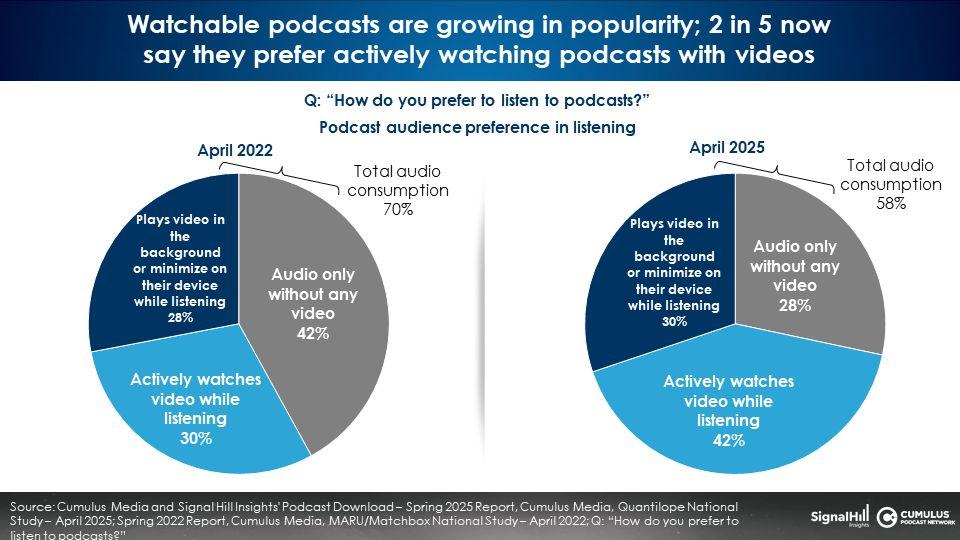

- Audio remains the primary mode of podcast consumption (58%) despite growing video options

- YouTube is the leading podcast platform, yet it is not a walled garden as consumers listen to podcasts across multiple platforms

- Driven by Podcast Newcomers, watchable podcasts have grown in popularity

- Podcast discovery: YouTube is the place to be found; 44% of new podcast audiences started listening on YouTube

- Downloads and listens underestimate the actual audience: The current download impression model fails to account for co-listening

- 75% of weekly podcast consumers will go back and consume episodes they’ve missed, while 70% of weekly podcast consumers consume episodes within 24 hours after release

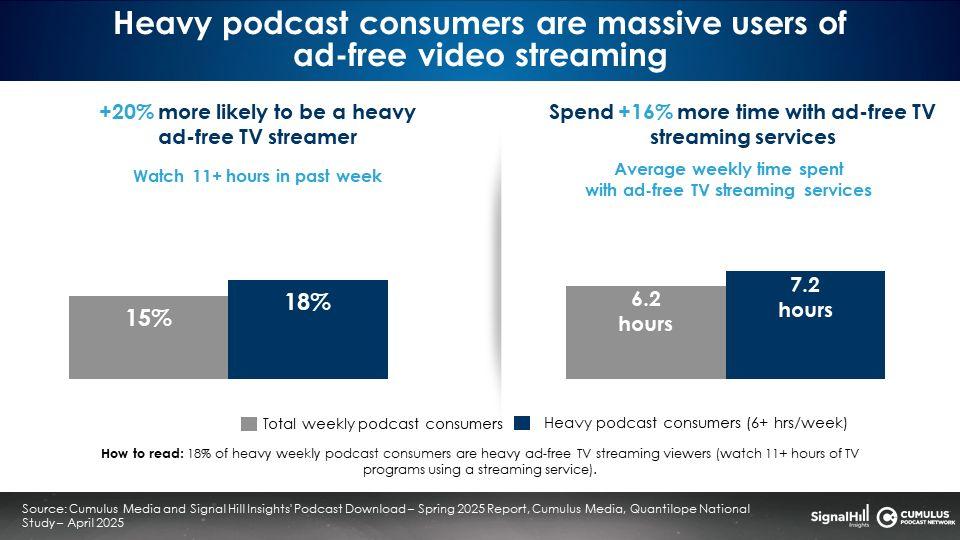

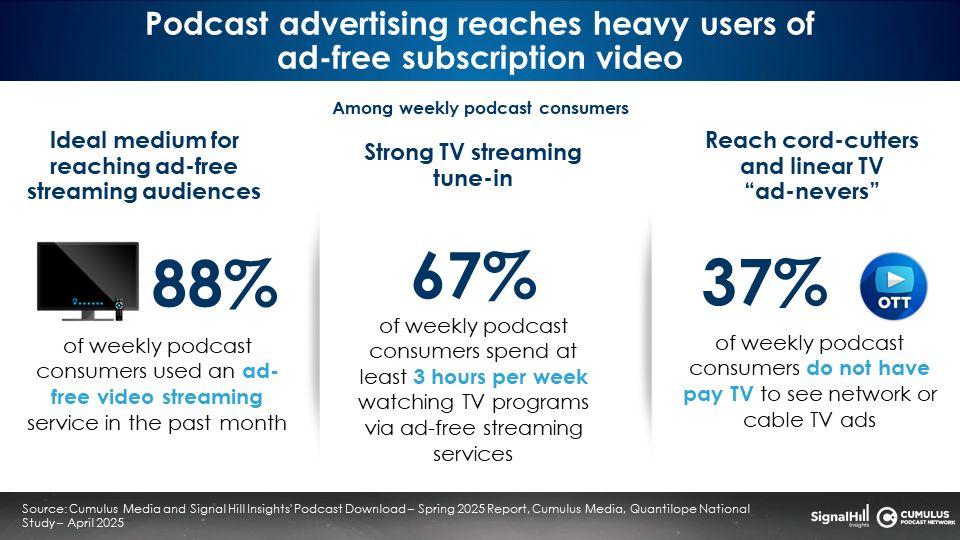

- Podcast advertising captures hard-to-reach, ad-free video streamers

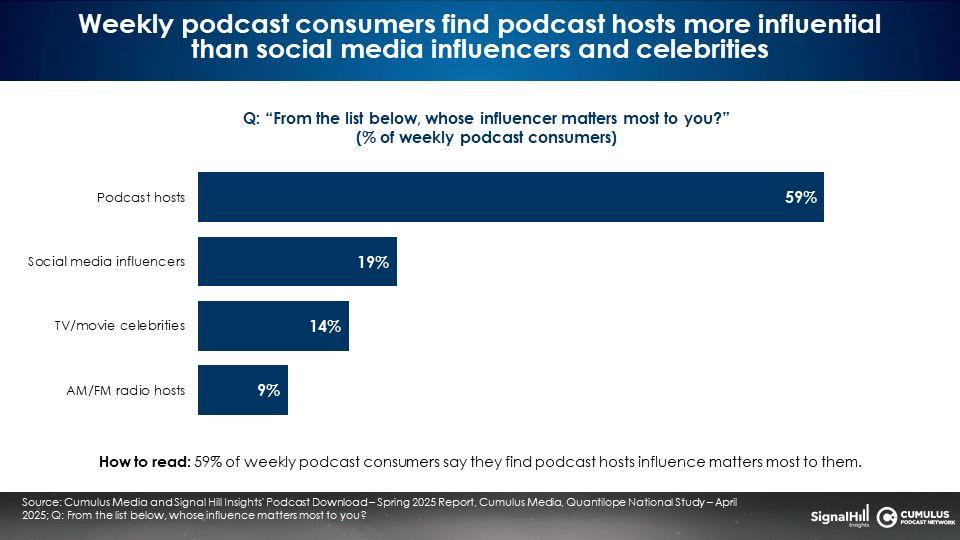

- Why podcast advertising works so well: Podcast hosts are 3X more influential than social media influencers

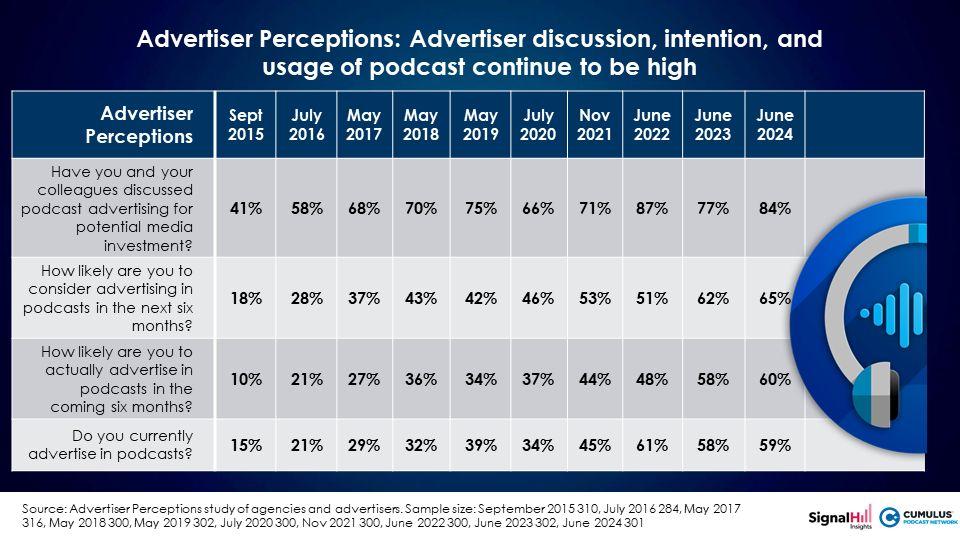

- Advertiser adoption of podcast ads continues to grow at a breakneck pace: Advertiser Perceptions reveals use of podcasts has jumped from 15% to 59% in the past decade

Audio remains the primary mode of podcast consumption (58%) despite growing video options

58% of weekly podcast consumers indicate audio is their primary mode of consumption. 28% say they listen via audio without any video. 30% report they listen while the video is minimized or plays in the background. 42% say they actively watch the podcast video.

From 2022 to 2025, the proportion who say they listen to podcasts without any video has dropped from 42% to 28%. Those who say they actively watch video while listening has grown from 30% to 42%.

YouTube is the leading podcast platform, yet it is not a walled garden as consumers listen to podcasts across multiple platforms

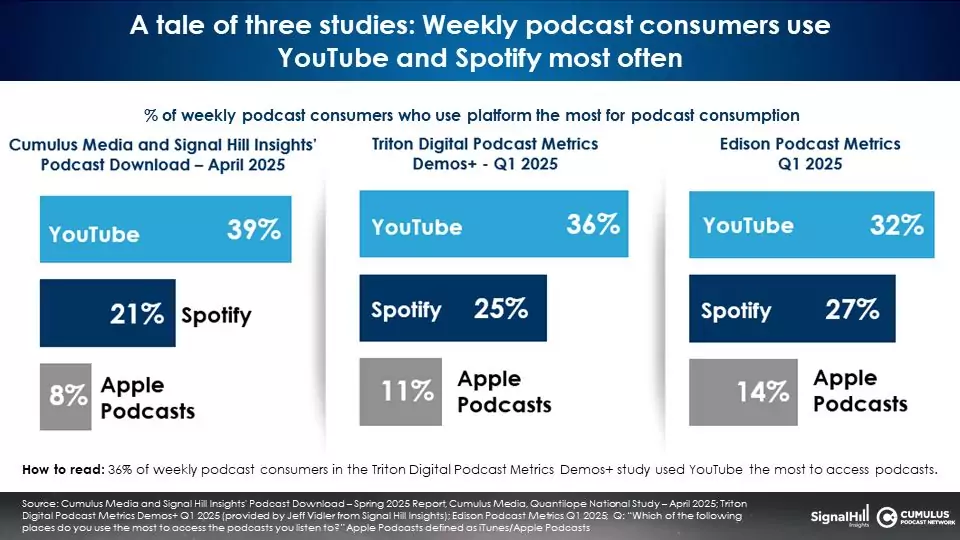

All the major podcast research leaders agree: YouTube is number one for podcast consumption. Edison, Triton, and Cumulus Media and Signal Hill Insights’ Podcast Download align.

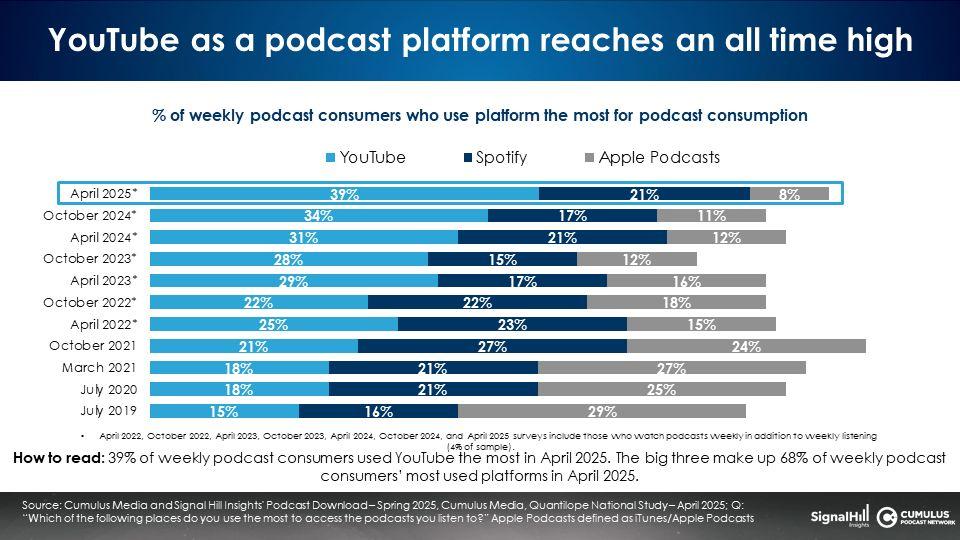

Since 2019, the proportion of weekly podcast consumers who say YouTube is the platform they use most has been steadily growing.

YouTube’s “listen most” response has soared two and a half times from 15% in July 2019 to 39% in Spring 2025. Over the same period, Spotify has held its own in the low 20s. Apple has experienced the greatest erosion, dropping from 29% “listen most” in 2019 to only 8% in Spring 2025. Currently, 68% of weekly podcast consumers use the “Big 3” platforms to listen/watch.

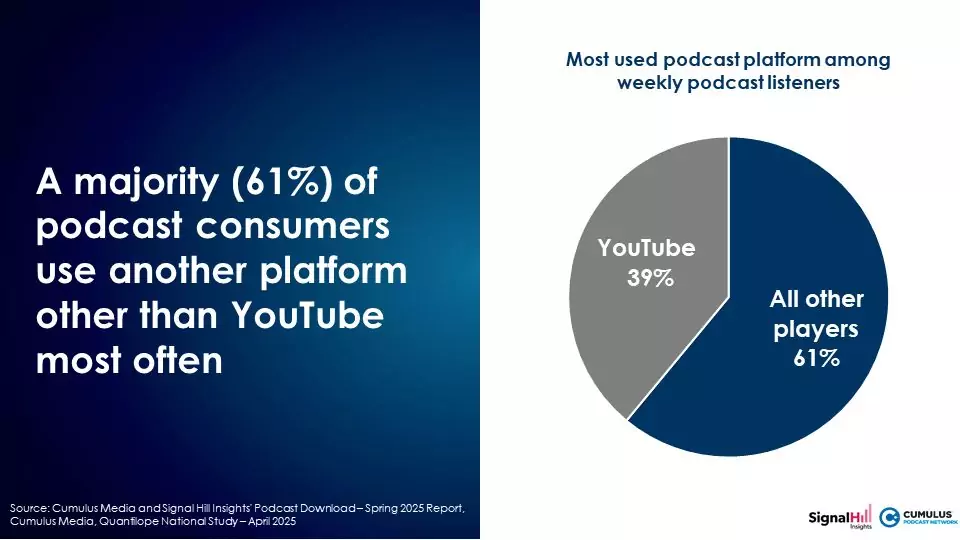

Still, YouTube’s “listen most” response does not represent the majority of consumption. “A majority – 61% – of podcast consumers use another platform other than YouTube most often. Just about half of that goes to Spotify (21%) and Apple Podcasts (8%) together. The remaining 32% is claimed by a long tail of apps and platforms, including iHeartRadio, Amazon Music, a podcast’s website, and many others.”

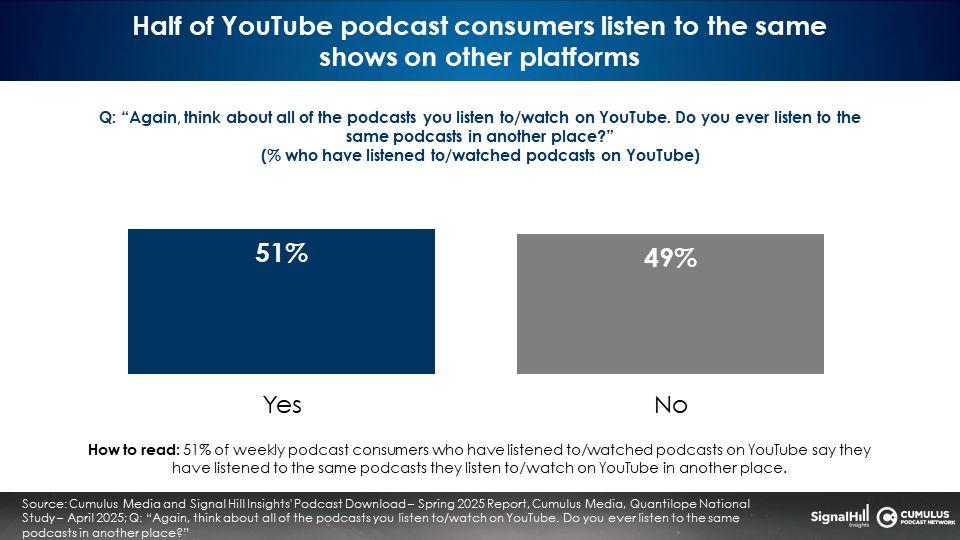

Despite YouTube’s strength as a podcast platform over half say they listen to/watch their YouTube shows on other platforms.

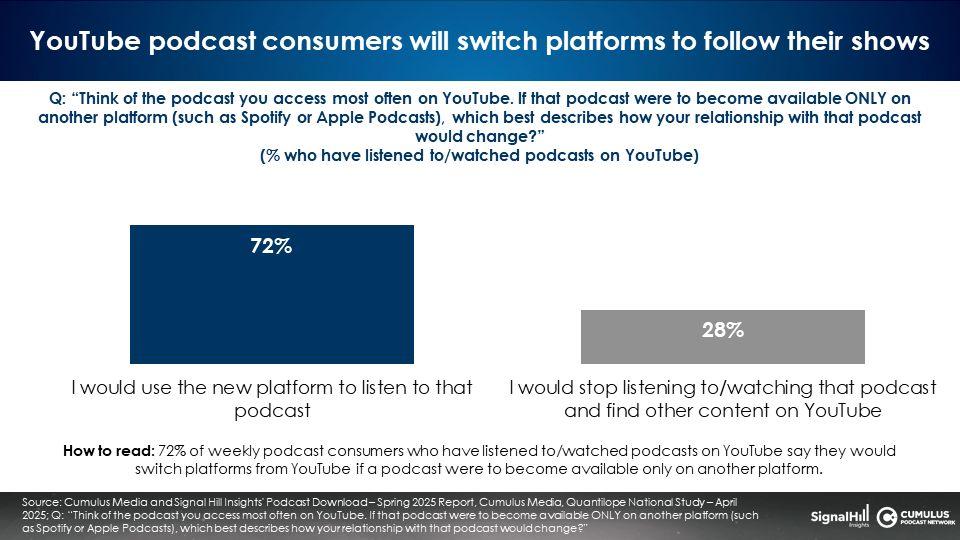

72% say they would consume podcasts on another platform if it became unavailable on YouTube.

In the world of video streaming, the platform is most often the exclusive place to watch the show. Ted Lasso is only available on Apple TV+. Jack Reacher is exclusive to Amazon Prime. Yellowstone can only be watched on Paramount+/CBS.

Every podcast can be consumed on any platform. Podcasts are unique among other media platforms, offering flexible multimedia opportunities and platforms where podcast consumers can watch or listen.

Driven by Podcast Newcomers, watchable podcasts have grown in popularity

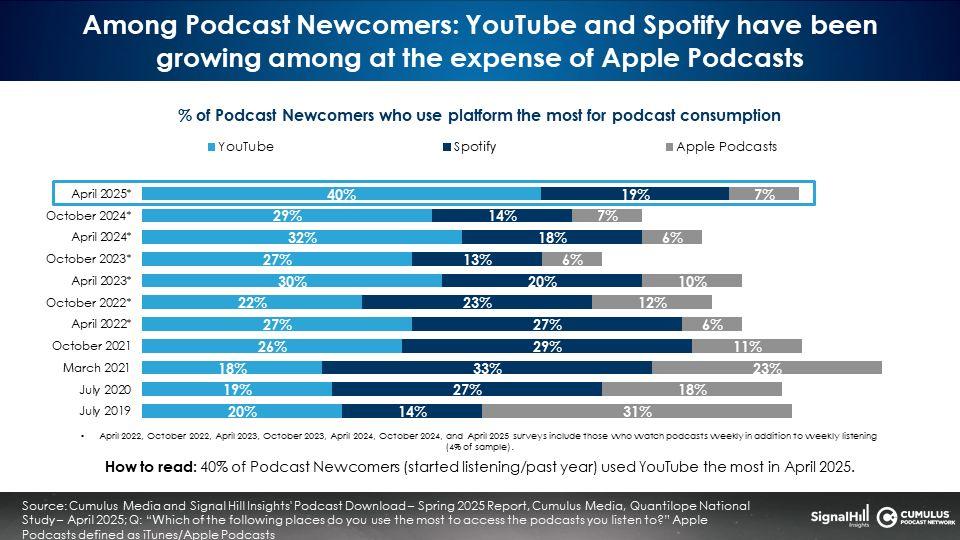

In 2019, Podcast Newcomers (those who started listening in the past year), said Apple was the place they consumed podcasts the most (31%). Flash forward to 2025 where a whopping 40% of Podcast Newcomers say they use YouTube the most for podcasts.

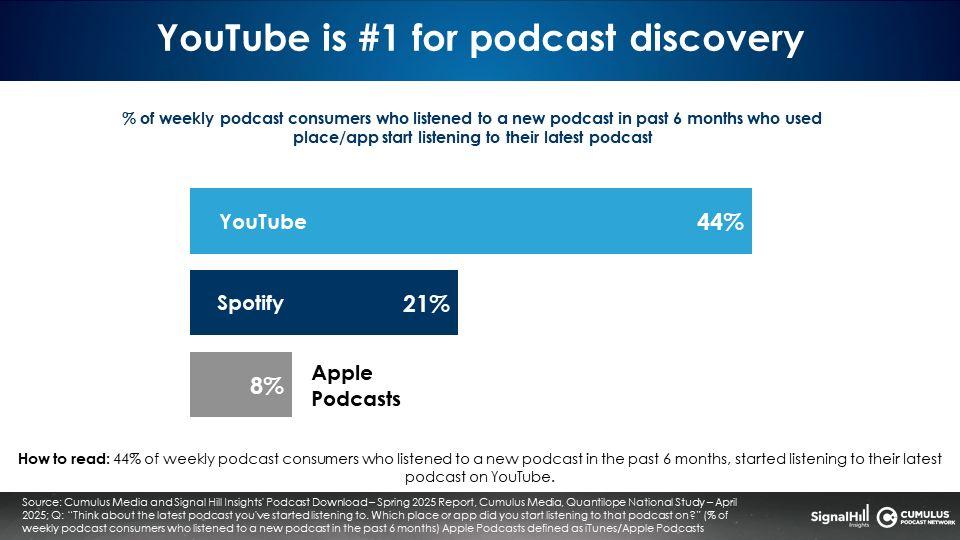

Podcast discovery: YouTube is the place to be found; 44% of new podcast audiences started listening on YouTube

44% of those who consumed a new podcast in the last six months say YouTube was the place/app they used. That’s 2X Spotify and 5X Apple.

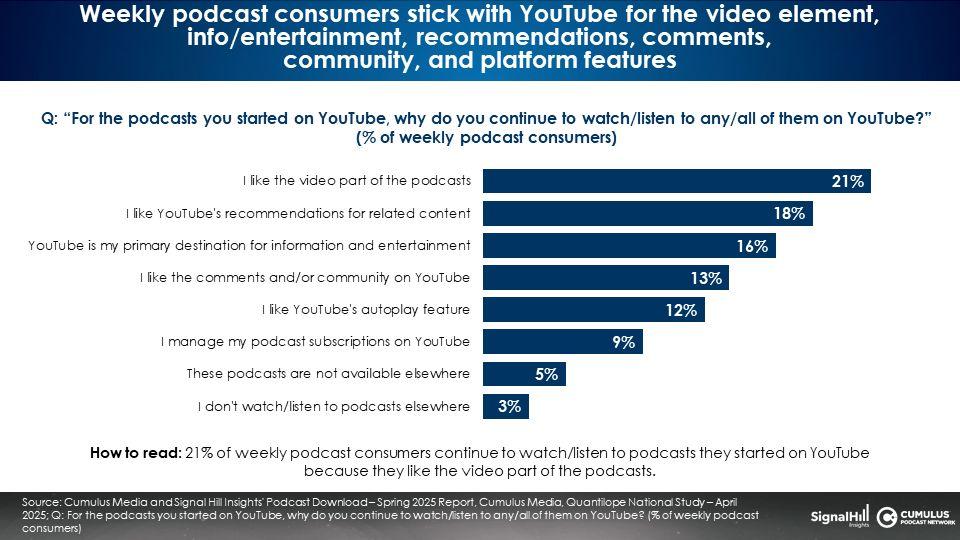

As the world’s entertainment search engine, YouTube’s features keep podcast audiences on the platform. Video, recommendations, comments, and autoplay are all cited as factors for utilizing YouTube for podcasts. A hefty proportion also indicate YouTube is already their primary entertainment and information destination.

Downloads and listens underestimate the actual audience: The current download impression model fails to account for co-listening

In television, there is a standard measurement called “VPVH – Viewers Per Viewing Household,” or the number of people watching per ad impression. The industry standard is 1.2. For every ad impression there are 1.2 people exposed to TV ads due to co-viewing. The TV measurement firm TVision reports that VPVHs for family friendly apps such as Netflix (1.4), Hulu (1.5), and Disney+ (1.7) are higher than the industry standard of 1.2.

In podcasting, “LPLH – Listeners Per Listening Household” measurements do not exist as part of standard audience services. In fact, the false assumption is all podcast listening is an entirely solo affair without any co-listening.

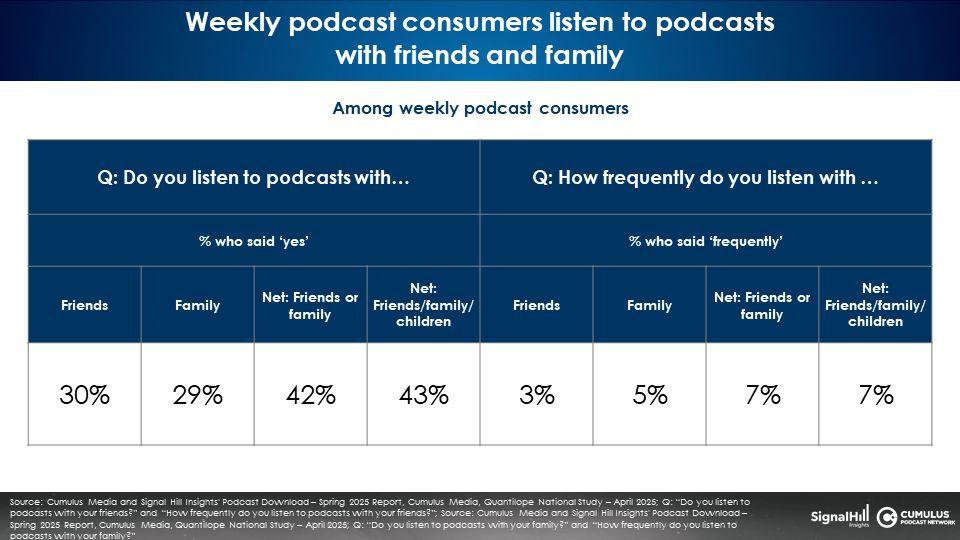

Podcast audiences are undercounted. 43% of podcast consumers indicate they have consumed podcasts with friends, family, and kids. 7% say they frequently listen with others. It is likely that podcasts’ “Listeners Per Listening Household” is at least 1.1, a 10% greater audience than listeners or downloads would suggest.

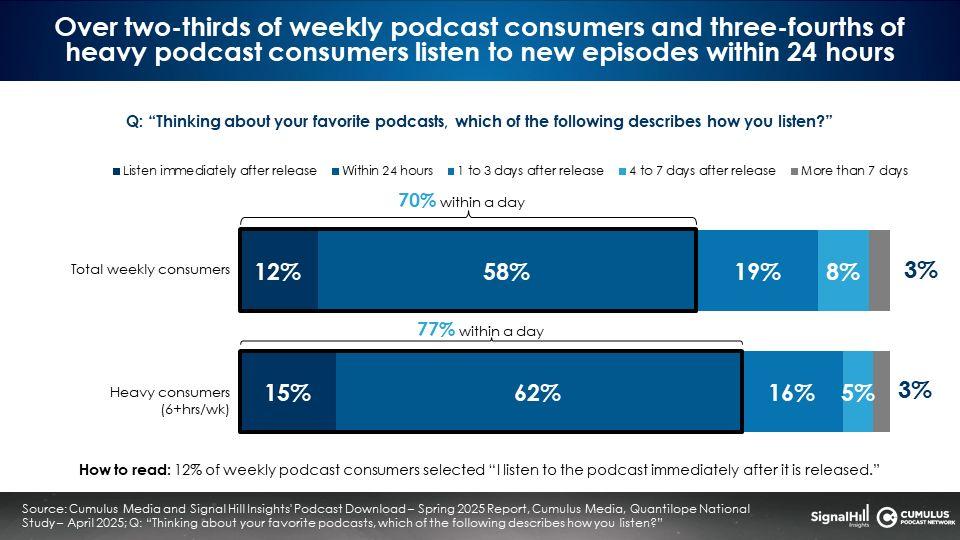

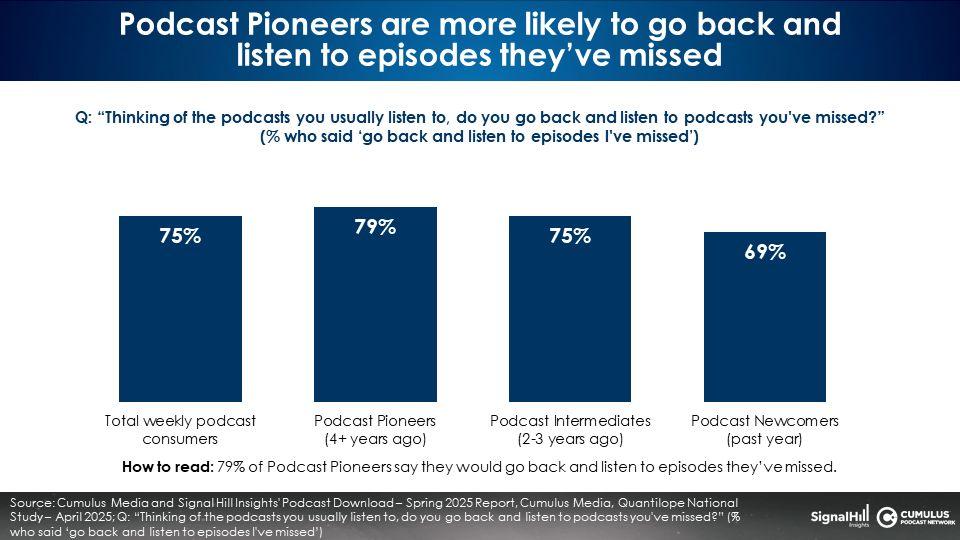

75% of weekly podcast consumers will go back and consume episodes they’ve missed, while 70% of weekly podcast consumers consume episodes within 24 hours after release

Podcast advertising captures hard-to-reach, ad-free video streamers

The podcast audience spends two-fifths of all their video viewing time with ad-free video streaming content. Podcast consumers significantly over-index on time spent with ad-free TV content.

Why podcast advertising works so well: Podcast hosts are 3X more influential than social media influencers

While social media influencers receive fleeting recognition and a few seconds of attention in a consumer’s social feeds, podcast consumers spend hours listening to their favorite hosts. It is not surprising that podcast hosts are three times more influential than social media influencers. These findings validate similar findings from a study from MAGNA, a major media agency, published in partnership with Vox Media.

Advertiser adoption of podcast ads continues to grow at a breakneck pace: Advertiser Perceptions reveals use of podcasts has jumped from 15% to 59% in the past decade

Key takeaways:

- Audio remains the primary mode of podcast consumption (58%) despite growing video options

- YouTube is the leading podcast platform, yet it is not a walled garden as consumers listen to podcasts across multiple platforms

- Driven by Podcast Newcomers, watchable podcasts have grown in popularity

- Podcast discovery: YouTube is the place to be found; 44% of new podcast audiences started listening on YouTube

- Downloads and listens underestimate the actual audience: The current download impression model fails to account for co-listening

- 75% of weekly podcast consumers will go back and consume episodes they’ve missed, while 70% of weekly podcast consumers consume episodes within 24 hours after release

- Podcast advertising captures hard-to-reach, ad-free video streamers

- Why podcast advertising works so well: Podcast hosts are 3X more influential than social media influencers

- Advertiser adoption of podcast ads continues to grow at a breakneck pace: Advertiser Perceptions reveals use of podcasts has jumped from 15% to 59% in the past decade

Recommendations

- Podcast studies should include podcast watchers: If you are running a study on podcasts but only including podcast listeners, you are missing around 4% of total podcast consumers.

- Create norms for co-listening: Current audience calculations based off downloads do not account for the percentage of podcast consumers who say they consume with others.

- Podcasters and publishers should contemplate the inclusion of video in their podcast planning: As podcast listening grows, it picks up new consumers who use YouTube as their one-stop entertainment/information destination. Spotify and Apple’s recently expanded access to video provides more choice for consumers. Even audio-only podcasts should consider video trailers as a tool to drive discovery to their audio feeds.

- Consider YouTube: Even audio-only podcasts should consider using YouTube as a distribution and discovery platform. People often use YouTube to listen while not actively watching the video portion. You don’t always need to post full episodes to reach audiences on YouTube.

- Advertisers can use podcasts to reclaim consumers lost to ad-free video streaming: As an on-demand medium, podcasts deliver heavy viewers of ad-free video streaming. 88% of weekly podcast consumers say they have watched an ad-free video streaming service in the past month.

Click here to download a PDF of the full report.

Liz Mayer is the Senior Insights Manager of the Cumulus Media | Westwood One Audio Active Group®.

Paul Riismandel is the President/CEO of Signal Hill Insights.

Contact the Insights team at CorpMarketing@westwoodone.com.