Perception Vs. Reality: Agencies And Advertisers Underestimate AM/FM Radio Shares And Overestimate Pandora And Spotify Audiences, According To Advertiser Perceptions And Edison’s Q1 2025 “Share Of Ear”

Click here to view an 11-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans annually to measure daily reach and time spent for all forms of audio. Advertiser Perceptions is the gold standard measurement of advertiser sentiment.

Here are the key findings from Edison’s Q1 2025 “Share of Ear” study:

- Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

- AM/FM radio dominates ad-supported audio share of time spent and has the largest audience share among frequent moviegoers and streaming movie viewers

- 2025 versus 2017: AM/FM radio is dominant, AM/FM radio streaming grows to beat ad-supported Pandora and Spotify, and podcasts grow by 5X

- AM/FM radio dominates listening in the car with an 85% share of ad-supported audio

- Spoken word audio audiences have surged since the pandemic as Personality/Talk Show shares have grown significantly

- Major change in podcast audience reach profile: In 2017, 18-24 was the largest age cell; Now podcasts’ strongest reach demos are 25-44

Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

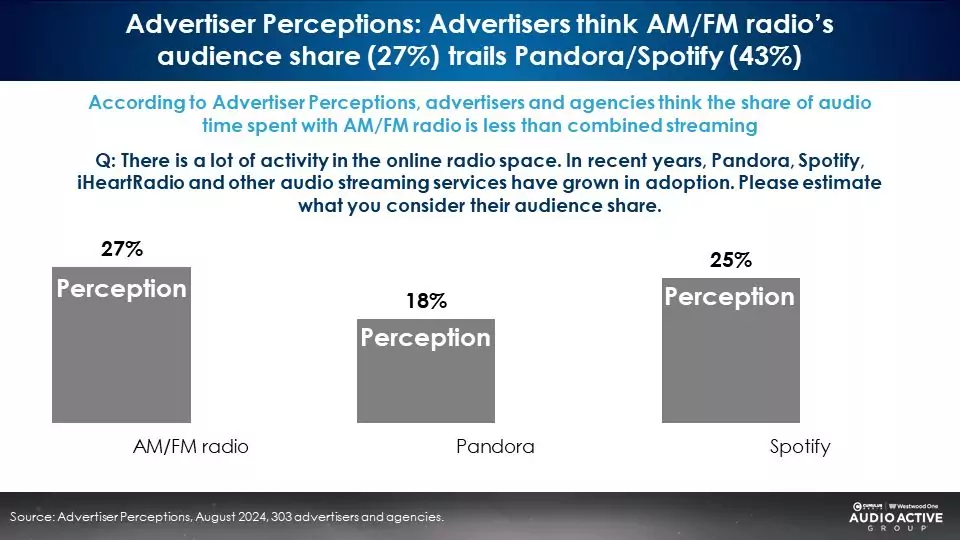

The Q1 2025 report reveals a yawning gap in agency/marketer perceptions of audio audiences. An Advertiser Perceptions study of 303 media agencies and marketers conducted in August 2024 found the perceived combined audience share of Pandora/Spotify is 43%, much greater than the perceived share of AM/FM radio (27%).

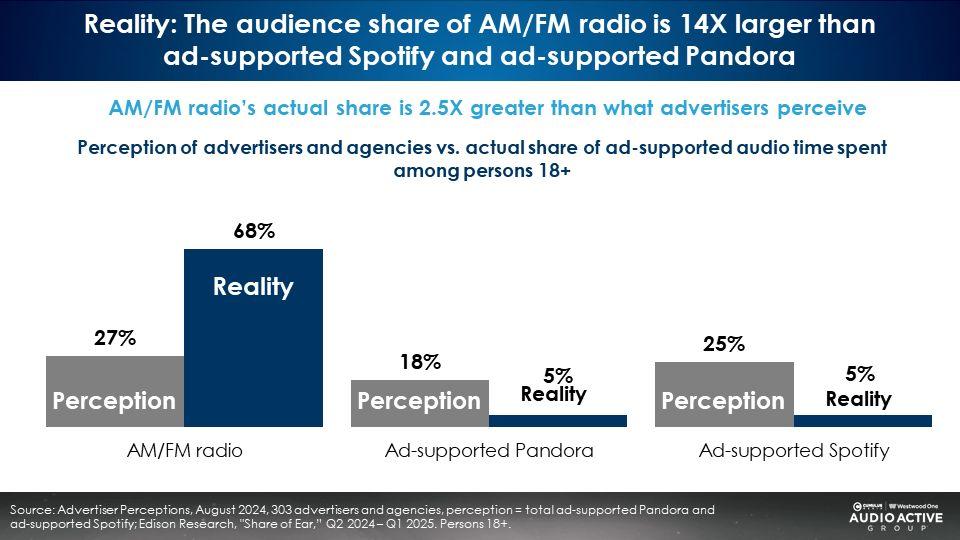

AM/FM radio’s actual share (68%) is 2.5 times larger than what advertisers perceive (27%).

Agencies and advertisers vastly overestimate Pandora and Spotify shares. According to the Q1 2025 “Share of Ear,” AM/FM radio’s persons 18+ share of ad-supported audio (68%) is 14 times larger than ad-supported Pandora (5%) and ad-supported Spotify (5%).

Ad community perceptions of media audiences are often completely opposite to reality. Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, puts it best: “Why do people think that nobody listens to radio anymore? Because there is a narrative that new media kills old media, so nobody bothers to look at evidence that doesn’t fit the narrative.”

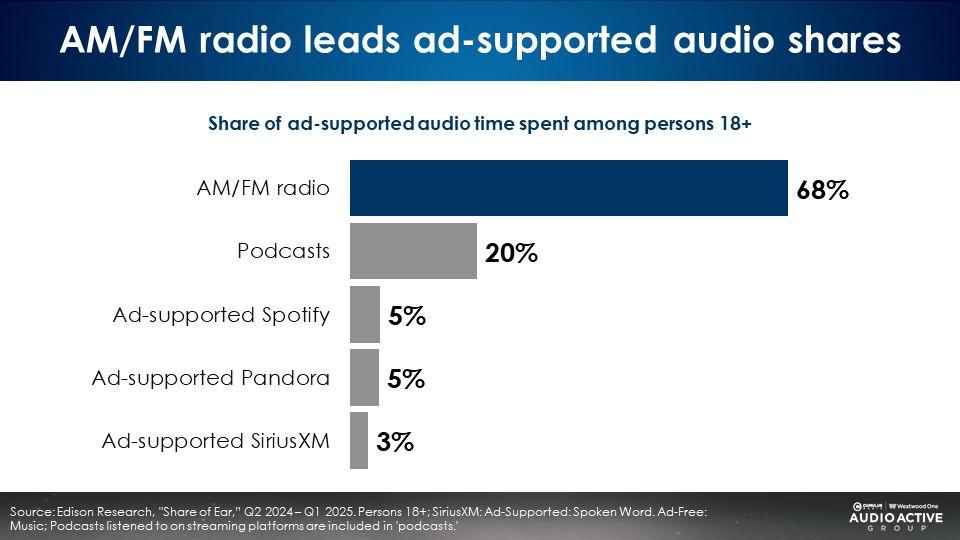

AM/FM radio dominates ad-supported audio share of time spent; Podcasts are a strong number two

AM/FM radio is the leader of ad-supported audio with a 68% share of ad-supported audio time spent among persons 18+. Podcasts take the second-place spot with a 20% share. Ad-supported Pandora (5%), ad-supported Spotify (5%), and ad-supported SiriusXM (3%) lag distantly.

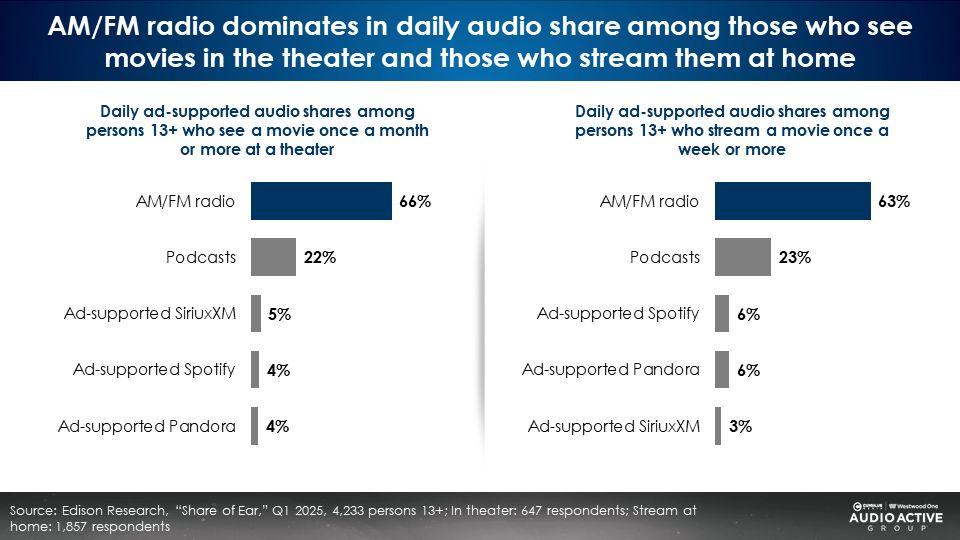

AM/FM radio has the dominant audience share among frequent movie goers and streaming movie viewers

With summer movie season in full swing, a series of recent studies reveal how AM/FM radio, podcasts, and streaming audio ads can launch movie theatrical releases and drive streaming video subscriptions.

New questions in Edison’s “Share of Ear” probe the listening habits of heavy moviegoers and frequent movie viewers on streaming services. Heavy movie viewers are big AM/FM radio listeners.

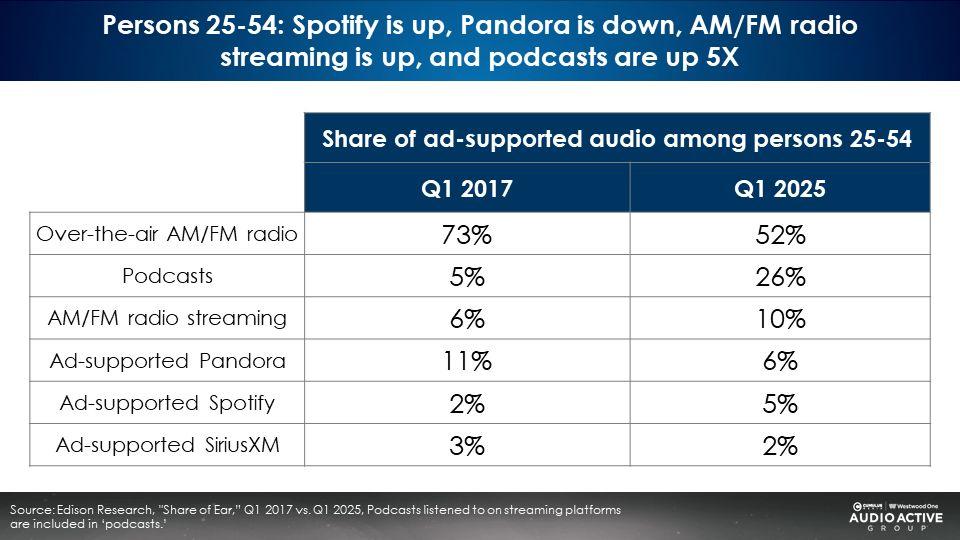

2025 versus 2017: AM/FM radio is dominant, AM/FM radio streaming grows to beat ad-supported Pandora and Spotify, and podcasts grow by 5X

Looking back over the last eight years, among persons 25-54, AM/FM radio streaming (10%) has grown to beat both ad-supported Pandora (6%) and ad-supported Spotify (5%). Podcasts have grown 5X from 5% to 26%. Pandora is down significantly (11% to 6%). Spotify is small and up slightly (2% to 5%).

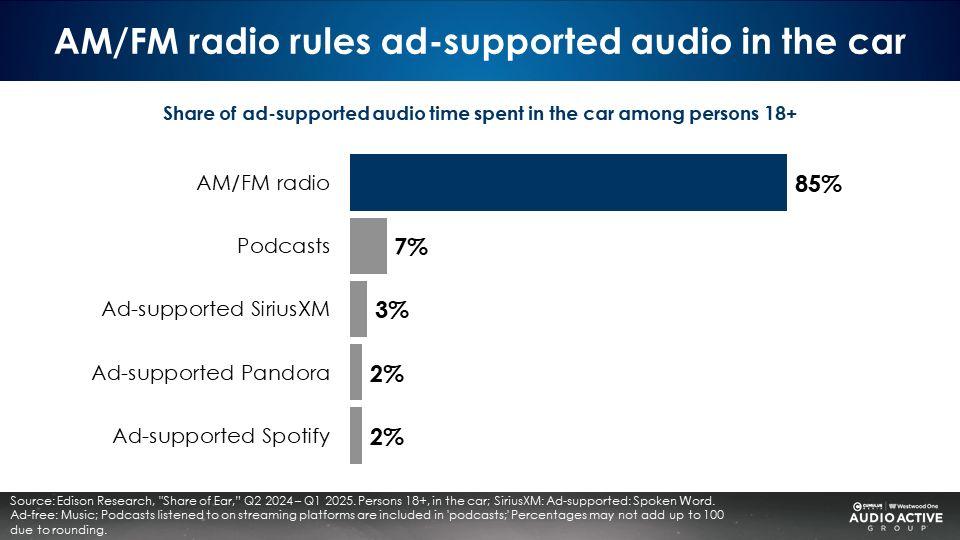

AM/FM radio dominates listening in the car with an 85% share of ad-supported audio

Out of all ad-supported audio in the car, AM/FM radio has an 85% share. Over the last decade, AM/FM radio’s share of ad-supported audio in the car has been steady in the mid to high 80s.

Podcasts have a 7% share of time spent listening in the car. Ad-supported Spotify represents a 2% share of ad-supported audio time spent in the car.

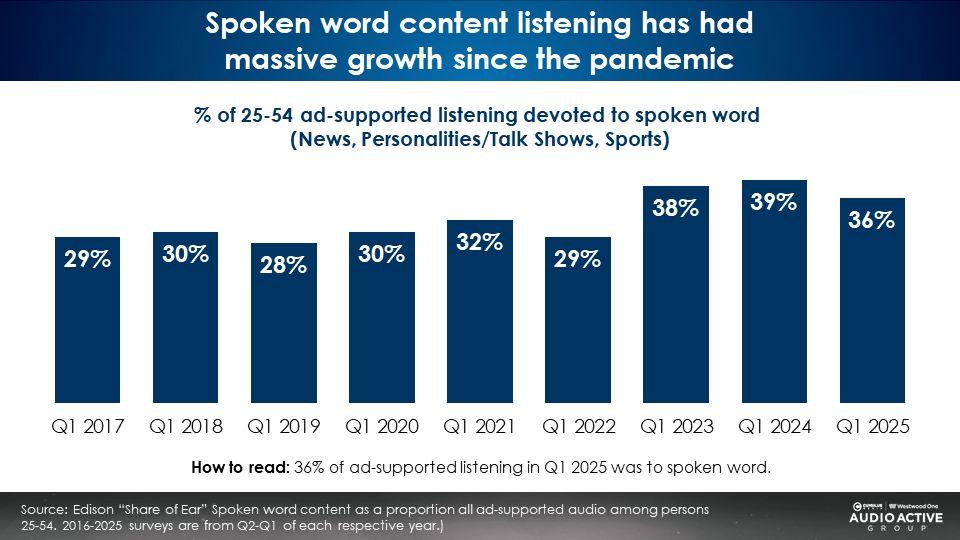

Spoken word audio shares have surged since the pandemic

Pre-pandemic, spoken word content (News, Sports, and Personalities/Talk Shows) represented a 29% share of all ad-supported listening. Over the last three years, spoken word has soared to a 37% share of ad-supported audio.

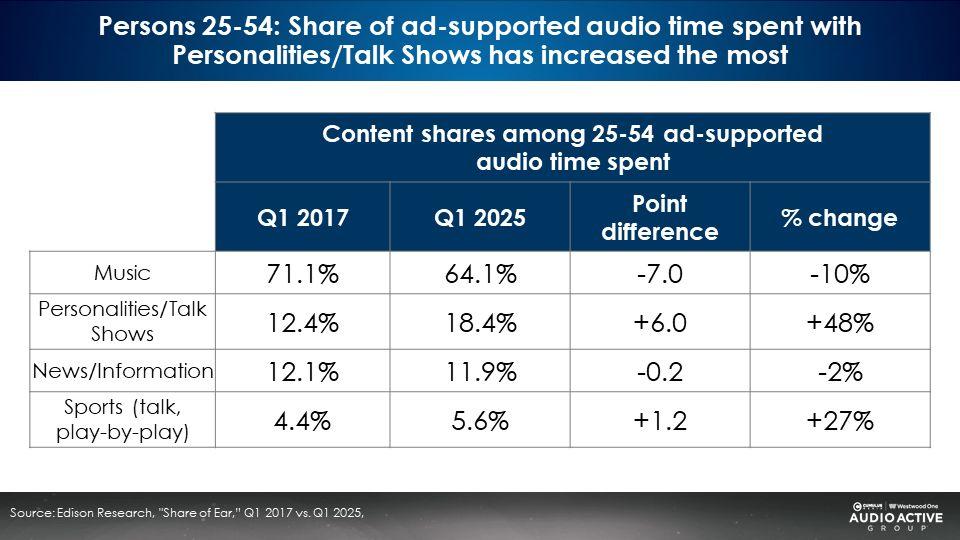

Since 2017, Personality/Talk Show shares have grown significantly

Since 2017, News is stable. Sports (talk shows and play-by-play broadcasts) is up slightly. Most of spoken word’s growth has come from Personality/Talk Shows, a.k.a. podcasts.

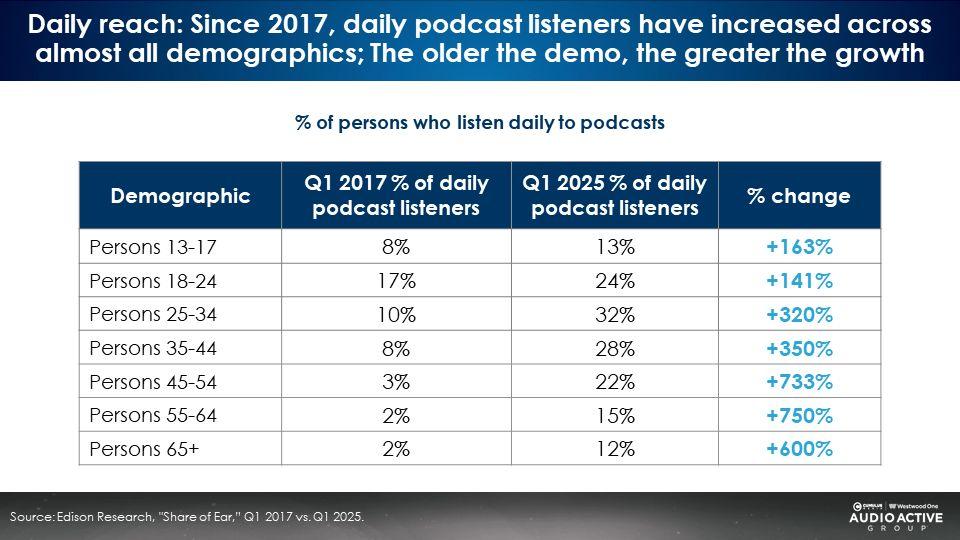

Major change in podcast audience profile: In 2017, 18-24 was the largest age cell; Now podcasts’ strongest reach demos are 25-44; 45-54 reach is almost as large as 18-24

The older the demo, the greater the reach growth. Since 2017, persons 45+ have experienced the greatest podcast reach growth.

Key findings:

- Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

- AM/FM radio dominates ad-supported audio share of time spent and has the largest audience share among frequent moviegoers and streaming movie viewers

- 2025 versus 2017: AM/FM radio is dominant, AM/FM radio streaming grows to beat ad-supported Pandora and Spotify, and podcasts grow by 5X

- AM/FM radio dominates listening in the car with an 85% share of ad-supported audio

- Spoken word audio audiences have surged since the pandemic as Personality/Talk Show shares have grown significantly

- Major change in podcast audience reach profile: In 2017, 18-24 was the largest age cell; Now podcasts’ strongest reach demos are 25-44

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.